Industrial PC Market by Type (Panel, Rack Mount, Embedded, and DIN Rail), Specification (Data Storage Medium, Maximum RAM Capacity, Display Type), Sales Channel (Direct, Indirect), Industry (Process, Discrete) and Region - Global Forecast to 2028

Updated on : October 30 , 2023

Updated on : April 24, 2023

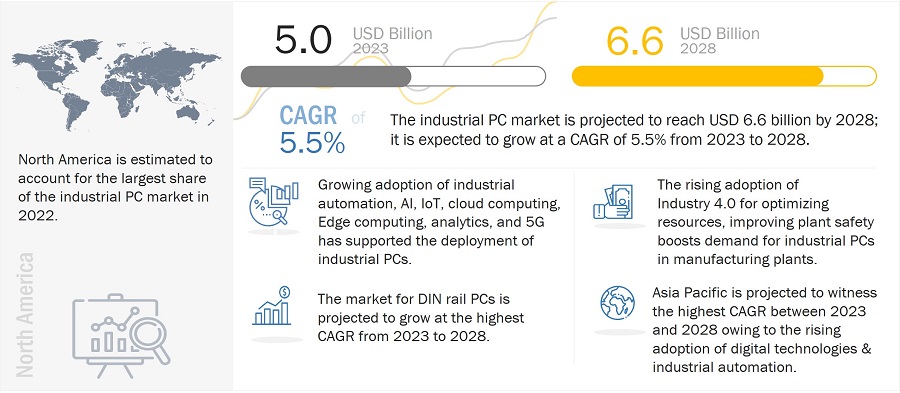

The industrial PC market size is expected to grow from USD 5.0 billion in 2023 to USD 6.6 billion by 2028, at a CAGR of 5.5%. The market growth is driven by factors including high demand for industrial IoT by manufacturing companies and steady move of manufacturing sector toward digitalization.

Additionally, increasing awareness of the benefits of effective IT infrastructure is expected to create growth opportunities during the forecast period. However, high initial investment and risk associated with integration of IPC are challenging the industrial PC industry growth.

Industrial PC Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increased awareness about resource optimization in manufacturing firms

Manufacturing companies are focusing on consolidating their production capacities to reduce costs and strengthen their competitive position by increasing efficiency. Industries such as oil & gas and metals & mining have lower profit margins than automotive and food & beverages, making it critical to optimize resources and reduce waste. A minor flaw in the production process in discrete industries could result in huge losses, causing manufacturers to recall their products or compensate by replacing the defective ones. Thus, manufacturing companies are adopting industrial PCs to automate their manufacturing processes to enhance productivity, improve accuracy, minimize operation costs, and achieve superior quality, uniformity, and safety. This increasing awareness of resource optimization in manufacturing industries is expected to drive the adoption of industrial PCs.

Restraint: Data privacy and cybersecurity concerns

The security system plays a vital role in the overall operation of any business, making it a major concern with increasing digitalization. Increasing data privacy and security concerns restrain the growth of industrial PC market. Today, most Industrial Control Systems Security (ICS) are integrated with commercially available software applications and internet enabled IPCs, providing many benefits and increasing system vulnerability. Sophisticated malware targeting ICS vulnerabilities is on the rise, posing a severe threat to industrial businesses and increasing cybersecurity concerns among users and suppliers. Thus, IPC manufacturers must address this issue through product services and collaboration with security specialists to ensure industry- and application-specific solutions.

Opportunity: Increasing awareness of benefits of effective IT infrastructure

Information availability and e-communication are the two most crucial factors in any manufacturing plant for smooth operations. Top quality IT networks and infrastructure can address manufacturing issues such as monitoring, resolution, economic performance assessment, self-adaptation, interpretation, and implementation, while poor IT ones can adversely affect the overall performance and productivity of manufacturing plants. Thus, manufacturing companies are focusing on increasing their investments in IT infrastructure, which is expected to create significant opportunities for the industrial PC market.

Challenge: Risks associated with integration of IPC

The use of industrial PCs in various industries such as oil & gas, chemical, energy & power and food & beverage are used to connect data, machines and people in real time to control manufacturing operation and to optimize resources and costs but with these advantages there are risk associated with integration of IPC. For instance, these industrial PCs are used in various industries to manage and control critical infrastructure such as power grids, process plants, water treatment plants, etc. and these devices are interconnected through internet. Hence, cyber-attack can exploit the vulnerability and increase the risk. Therefore, OEMs and end users should question their automation vendors about their future and total capabilities in terms of automation, not only IPC models.

The market for Panel IPC to hold largest market share from 2023 to 2028

Panel IPCs have compact chassis, high performance, enhanced flexibility, improved safety control, and user-friendly touchscreens. These IPCs are equipped with powerful processors to achieve high computing power; these PCs offer multiple expansion slots for add-on boards. Panel industrial PCs are easy to deploy for demanding applications across a wide range of industries. In addition, high infrastructure investments in the energy and power (E&P) sector, favorable government policies supporting the growth of manufacturing companies, and rapid industrialization are expected to propel the panel industrial PCs market.

Industrial PC market for process industries to exhibit high market share during the forecast period

The rising demand for cost effective products while reducing the manufacturing cost and increasing market share and strengthening their presence in various region companies are adopting IoT devices. IoT helps acquire and generate a high volume of manufacturing data, which requires equipment such as industrial PCs for data acquisition and process control applications. For instance, Exxon Mobil (US), under its digital initiative, is undertaking IoT projects to make its refineries more efficient, support production, and detect methane emissions from its operations. On the other hand, the industrial PC market in the developing economies of Asia Pacific is expected to gain traction in the near future due to the evolving manufacturing landscape in these countries.

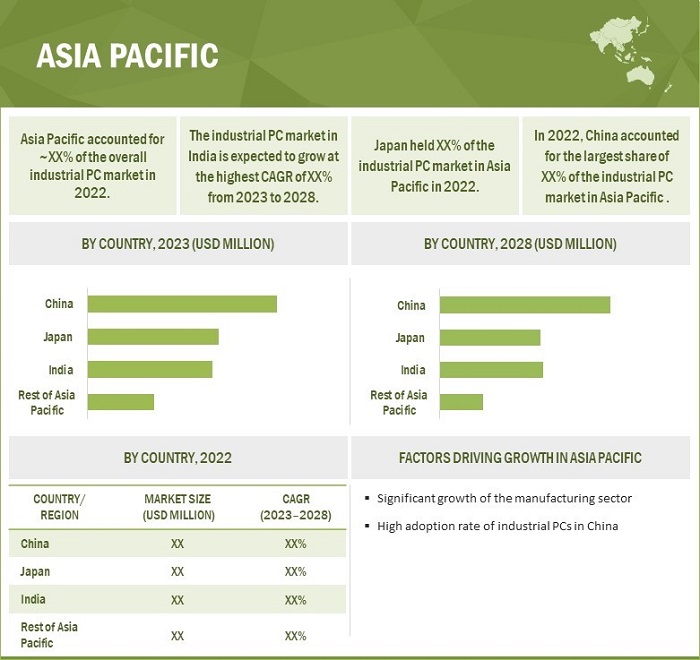

The industrial PC market in Asia Pacific to grow at highest CAGR during the forecast period

Asia Pacific is expected to grow with the highest CAGR during the forecast period. Rapid industrialization in Asia and consistent growth in industrial activities in the Pacific region are driving the development of the manufacturing sector in the Asia Pacific. Factors such as increasing investments in energy infrastructure for sustainable growth and favorable government policies related to foreign direct investment (FDI) encourage foreign players to enter the industrial PC market in the Asia Pacific. High-tech medical device manufacturing companies are actively focusing on geographical expansions in Asia Pacific due to the growing demand for healthcare services, increasing health concerns, and rising investments in industrial R&D. This is likely to fuel the growth of the industrial PC market in Asia Pacific during the forecast period.

DIN Rail IPC market to grow at highest CAGR during forecast period

DIN Rail IPCs are compact automation devices with high computing capabilities primarily used in the military, traffic, transportation, industrial, and medical sectors. The growing demand for automation and operational intelligence to optimize production and the increasing focus on improving asset and workforce management fueling the demand for DIN Rail IPCs in process and discrete industries. The US is the major contributor to the growth of the market in North America. The region witnesses the rapid adoption of advanced technologies in different manufacturing industries. Ever-evolving manufacturing operations demand compact automation devices with high computing capabilities. This, in turn, augments the use of DIN rail IPCs.

Industrial PC Market by Region

To know about the assumptions considered for the study, download the pdf brochure

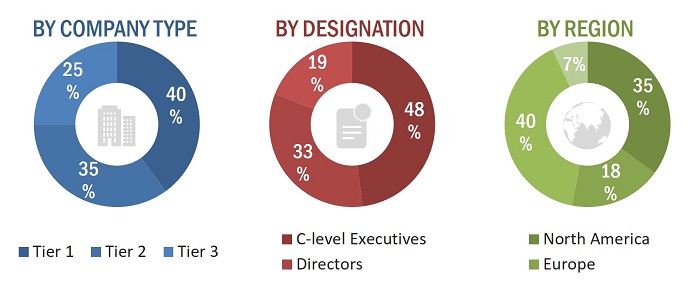

Profile break-up of primary participants for the report is given below:

- By Company Type – Tier 1 = 40%, Tier 2 = 35%, and Tier 3 = 25%

- By Designation – C-Level = 48%, Director Level = 33%, and Manager Level = 19%

- By Region – North America = 35%, Europe = 18%, Asia Pacific = 40%, and RoW = 7%

Key Market Players

As of 2022, Advantech Co., Ltd., (Taiwan), Beckhoff Automation (Germany), IEI Integration Corporation (Taiwan), Siemens (Germany), B&R Automation (Austria), Kontron (Germany), Avalue Technology Incorporation (Taiwan), DFI (Taiwan), NEXCOM International Co., Ltd., (Taiwan), and American Portwell Technology Inc. (US), Emerson Electric Co. (US), Mitsubishi Electric Corporation (Japan), OMRON Corporation (Japan), Panasonic Corporation (Japan), Rockwell automation (US), Schneider Electric (France), AAEON Technology Inc. (Taiwan), Acnodes Corporation (US), Aditech ICT Pvt. Ltd. (India), ADLINK Technology Inc. (Taiwan), Contec Co. Ltd. (Japan), Crystal Group Inc. (US), OnLogic Inc. (US), Protech Systems Co., Ltd., (Taiwan) and VarTech Systems (US) are some of the key players of industrial PC companies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for providing market size |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) in million/billion |

|

Segments covered |

Type, specification, operating temperature, sales channel, and end-user industry |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies covered |

Advantech Co., Ltd., (Taiwan), Beckhoff Automation (Germany), IEI Integration Corporation (Taiwan), Siemens (Germany), B&R Automation (Austria), Kontron (Germany), Avalue Technology Incorporation (Taiwan), DFI (Taiwan), NEXCOM International Co., Ltd., (Taiwan), and American Portwell Technology Inc. (US); are some of the key players in the vacuum valve market. A total of 25 players are covered. |

Industrial PC Market Highlights

The industrial PC market study has been segmented by type, by specification, operating temperature, sales channel, end-user industry, and region.

|

Segment |

Subsegment |

|

By Type: |

|

|

By Specification |

|

|

By Sales Channel |

|

|

By End-User Industry |

|

|

By Region |

|

Recent Developments

- In December 2022, Avalue Technology launched two new industrial-grade PCs, EMS-TGL and the EPC-TGU, based on AI. These PCs are equipped with 11th Gen Intel Tiger Lake UP3 microprocessor and dedicated GPU. These PCs are designed to be used for different applications. EMS-TGL is used for autonomous mobile robots (AMRs), whereas the EPC-TGU is for vision solutions.

- In November 2022, Beckhoff introduced the C6040-0090 to the C60xx ultra-compact industrial PC series with 12th-generation Intel Core Processors in SPS 2022. The industrial PC is ideal for applications including extensive axis control, complex HMI applications, machine learning and vision.

- In October 2022, Kontron launched the new MediView medical monitor and 23.8” variant of the MediClient Panel PC compliant with DIN EN 60601-1 for medical and healthcare applications in nurses’ stations, operating rooms, intensive care units, laboratories as well as pharmacies and clean rooms to maintain connectivity requirements and hygiene.

- In June 2022, Advantech launched the rugged and compact TPC-100W series, the latest generation of ARM-based touch PCs used in factory management for machine automation and web terminal application.

Frequently Asked Questions (FAQ):

Which are the major companies in the industrial PC market? What are their major strategies to strengthen their market presence?

The major companies in the industrial PC market are – Advantech Co., Ltd., (Taiwan), Beckhoff Automation (Germany), IEI Integration Corporation (Taiwan), Siemens (Germany), B&R Automation (Austria), Kontron (Germany), Avalue Technology Incorporation (Taiwan), DFI (Taiwan), NEXCOM International Co., Ltd., (Taiwan), and American Portwell Technology Inc. (US). The major strategies adopted by these players is product launches.

Which is the potential market for industrial PC in terms of the region?

The Asia Pacific region is expected to grow significantly due to the growing manufacturing activities of various industries, including semiconductors, consumer electronics, and automotive.

What are the opportunities for new market entrants?

There are moderate opportunities in the industrial PC market for start-up companies. These companies can provide industrial PC solutions to rapidly growing energy & power, automotive, and oil & gas industries. However, the presence of established players with broad product portfolios catered to different industries intensifies the market competition.

What are the drivers and opportunities for the industrial PC market?

Factors such as high demand for industrial IoT by manufacturing companies, steady move of manufacturing sector toward digitalization, increased awareness about resource optimization in manufacturing firms, and stringent regulatory requirements to ensure safety and security in production plants are among the driving factors of the industrial PC market. Moreover, growing deployment of smart manufacturing solutions and increasing awareness of benefits of effective IT infrastructure to create lucrative opportunities in the industrial PC market.

Who are the major consumers of industrial PC that are expected to drive the growth of the market in the next 5 years?

The major consumers for automotive, pharmaceutical, aerospace & defense, food & beverage, and medical devices industries are expected to have a significant share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involves major activities for estimating the current size of the industrial PC market. Exhaustive secondary research was carried out to collect information on the market. The next step involves the validation of these findings, assumptions, and sizing with industry experts, identified in the value chain, through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements, press releases); trade, business, and professional associations; white papers, industrial PC-related journals, and certified publications; articles by recognized authors; gold and silver standard websites; and directories.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various industry respondents from both supply and demand sides of the industrial PC market have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as to assess prospects.

Key players in the industrial PC market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as CEOs, directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

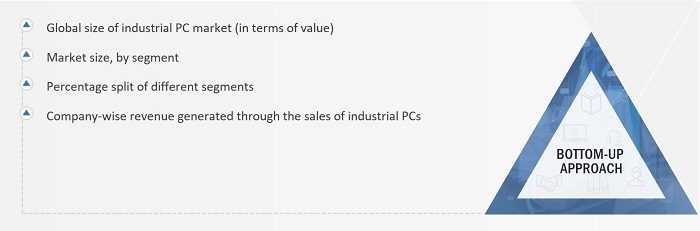

The bottom-up procedure has been employed to arrive at the overall size of the industrial PC market.

- Information related to revenues obtained from key manufacturers and providers of industrial PCs has been studied and analyzed to estimate the global size of the industrial PC market.

- The industrial PC market is expected to observe a linear growth trend during the forecast period owing to the fact that it is a mature market with a number of well-established players serving various verticals.

- Revenue, geographic presence, and key verticals, as well as different types of offerings of all identified players in the industrial PC market, have been studied to estimate and arrive at the percentage split of different segments of the market.

- All major players in each category (type and sales channel) of the industrial PC market have been identified through secondary research and duly verified through brief discussions with the industry experts.

- Multiple discussions with key opinion leaders (KOLs) of all major companies developing the industrial PC have been conducted to validate the market split based on type, sales channel, end-user industry, and region.

- Geographic splits have been estimated using secondary sources based on various factors, such as the number of players offering industrial PCs in a specific country or region and the type of industrial PCs offered by these players.

Market Size Estimation Methodology: Bottom-up Approach

The top-down approach has been used to estimate and validate the total size of the industrial PC market.

- Information related to revenues obtained from key manufacturers and providers of industrial PCs has been studied and analyzed to estimate the global size of the industrial PC market.

- The industrial PC market is expected to observe a linear growth trend during the forecast period owing to the fact that it is a mature market with a number of well-established players serving various verticals.

- Revenue, geographic presence, and key verticals, as well as different types of offerings of all identified players in the industrial PC market, have been studied to estimate and arrive at the percentage split of different segments of the market.

- All major players in each category (type and sales channel) of the industrial PC market have been identified through secondary research and duly verified through brief discussions with the industry experts.

- Multiple discussions with key opinion leaders (KOLs) of all major companies developing the industrial PC have been conducted to validate the market split based on type, sales channel, end-user industry, and region.

- Geographic splits have been estimated using secondary sources based on various factors, such as the number of players offering industrial PCs in a specific country or region and the type of industrial PCs offered by these players.

Market Size Estimation Methodology: Top-Down Approach

Data Triangulation

After arriving at the overall industrial PC market size through the estimation process, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Outlook And Growth Industrial PC and Industrial Computers Market

The Industrial PC and Industrial Computers market is expected to grow significantly in the coming years due to the increasing demand for automation in various industries. Industrial PCs and computers are used in manufacturing, automotive, aerospace, and other industrial sectors to improve efficiency, productivity, and accuracy in various processes.

One of the key factors driving the growth of the Industrial PC and Industrial Computers market is the increasing adoption of Industrial Internet of Things (IIoT) and Industry 4.0 initiatives. These technologies require advanced computing power, real-time data processing, and connectivity to enable automation and optimization of industrial processes.

The market for Industrial PCs and Industrial Computers is also being driven by the growing trend of digitization in various industries. The need for real-time data analysis, monitoring, and control is increasing, and Industrial PCs and computers provide the necessary computing power and capabilities for these applications.

The Asia-Pacific region is expected to be the largest market for Industrial PCs and Industrial Computers due to the growing industrialization and manufacturing activities in countries such as China, Japan, and India. The region is also witnessing an increasing adoption of IIoT and Industry 4.0 technologies, which is further driving the demand for Industrial PCs and computers.

How Industrial PC Market is Going To Impact In Industrial Computers?

The Industrial PC market is closely related to the Industrial Computers market, as Industrial PCs are a type of Industrial Computer. The growth of the Industrial PC market is expected to have a significant impact on the Industrial Computers market, as both are used in industrial applications to improve efficiency and productivity.

Industrial PCs are typically used in control and automation applications, where they provide real-time data processing, advanced computing power, and connectivity. They are also used in industrial environments where reliability, durability, and ruggedness are critical, such as in manufacturing plants, oil and gas refineries, and power plants.

The growth of the Industrial PC market is expected to lead to a corresponding growth in the demand for Industrial Computers, as the two are closely related. As Industrial PCs become more advanced, Industrial Computers are also expected to become more advanced to keep up with the increasing demands of industrial applications.

Some Futuristic Growth Use-cases Of Industrial Computers Market

The Industrial Computers market is expected to grow significantly in the coming years, driven by the increasing demand for automation and digitization in various industries. Here are some potential futuristic growth use-cases of Industrial Computers:

-

Smart Factories: Industrial Computers are expected to play a key role in the development of smart factories, which are highly automated and interconnected facilities that leverage advanced technologies such as IIoT, artificial intelligence, and robotics. Industrial Computers will be used to control and monitor various processes, and to collect and process data for real-time decision-making.

-

Autonomous Vehicles: Industrial Computers will be used in autonomous vehicles such as self-driving trucks, drones, and delivery robots. These vehicles will rely on advanced computing power and real-time data processing to navigate and make decisions, and Industrial Computers will provide the necessary computing capabilities for these applications.

-

Renewable Energy: Industrial Computers will play a critical role in the development and management of renewable energy systems such as wind farms, solar farms, and energy storage systems. They will be used to monitor and control various processes, and to collect and process data for real-time optimization and decision-making.

-

Healthcare: Industrial Computers will be used in various healthcare applications such as telemedicine, medical imaging, and robotic surgery. They will provide the necessary computing power and capabilities to process and analyze large amounts of medical data, and to control and monitor medical devices and equipment.

-

Smart Cities: Industrial Computers will be used in the development and management of smart cities, which are interconnected and automated urban environments. They will be used to control and monitor various systems such as traffic lights, public transportation, and energy management systems.

Industries That Will Be Impacted In The Future By Industrial

Industrial Computers will impact a wide range of industries in the future as they provide advanced computing capabilities and connectivity that are necessary for automation, digitization, and optimization of various industrial processes. Here are some of the industries that are expected to be impacted by Industrial Computers in the future:

-

Manufacturing: Industrial Computers are already widely used in manufacturing for process control and automation, and they will continue to play a key role in the development of smart factories, which rely on advanced computing power, connectivity, and real-time data processing to optimize production and increase efficiency.

-

Energy and Utilities: Industrial Computers will be used in the development and management of renewable energy systems, such as wind and solar farms, as well as in the control and monitoring of traditional power plants. They will also be used in the management of smart grids and energy storage systems.

-

Transportation: Industrial Computers will be used in various transportation applications, such as autonomous vehicles, rail control systems, and air traffic control systems. They will provide the necessary computing power and connectivity to enable real-time data processing and decision-making.

-

Healthcare: Industrial Computers will be used in various healthcare applications, such as medical imaging, robotic surgery, and patient monitoring. They will provide the necessary computing power and capabilities to process and analyze large amounts of medical data, and to control and monitor medical devices and equipment.

-

Agriculture: Industrial Computers will be used in precision agriculture applications, such as automated irrigation systems, robotic harvesting, and data-driven decision-making. They will enable farmers to optimize crop yields and reduce waste through real-time data processing and analysis.

-

Aerospace and Defense: Industrial Computers will be used in various aerospace and defense applications, such as flight control systems, unmanned aerial vehicles, and missile guidance systems. They will provide the necessary computing power and connectivity to enable real-time data processing and decision-making.

Growth Opportunities And Key Challenges For Industrial Computers In The Future

Growth Opportunities:

-

Digital Transformation: Industrial Computers are poised to benefit from the ongoing digital transformation of various industries, as they provide advanced computing capabilities and connectivity that are necessary for automation, digitization, and optimization of various industrial processes.

-

Smart Manufacturing: Industrial Computers will play a key role in the development of smart factories, which are highly automated and interconnected facilities that leverage advanced technologies such as IIoT, artificial intelligence, and robotics. Industrial Computers will be used to control and monitor various processes, and to collect and process data for real-time decision-making.

-

Emerging Technologies: Emerging technologies such as 5G, edge computing, and artificial intelligence will enable new use cases for Industrial Computers, such as real-time data processing and analysis, remote monitoring and control, and autonomous systems.

-

Industry 4.0: The Fourth Industrial Revolution or Industry 4.0 is driving the transformation of various industries, and Industrial Computers will be an essential component of this transformation, providing the computing power and connectivity necessary to enable smart, connected, and automated systems.

Key Challenges:

-

Cybersecurity: The increasing reliance on Industrial Computers and their interconnectedness make them vulnerable to cyberattacks. Therefore, cybersecurity will be a critical challenge for Industrial Computers in the future, and robust security measures will be necessary to protect these systems and the industrial processes they control.

-

Interoperability: The integration of various technologies and systems is essential for the development of smart factories and other advanced industrial applications. However, achieving interoperability between different systems and technologies is challenging and requires standardization and compatibility.

-

High Cost: Industrial Computers are typically more expensive than traditional computers, and this can be a barrier to adoption, particularly for small and medium-sized businesses. Therefore, reducing the cost of Industrial Computers will be necessary to increase their adoption.

-

Skill Gap: The adoption of Industrial Computers and other advanced technologies requires a highly skilled workforce. However, there is a significant skill gap in various industries, and training programs will be necessary to address this gap and to enable the adoption of these technologies.

The Objectives of the Study are as Follows:

- To describe and forecast the industrial PC market, in terms of value, by type, sales channel, end-user industry, and region

- To forecast the market size, in terms of value, by region—North America, Europe, the Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding market dynamics, namely, drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To provide a detailed overview of the value chain of the industrial PC ecosystem

- To analyze probable impact of recession on the market in future

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total industrial PC market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with a detailed competitive landscape for the market leaders.

- To analyze the major growth strategies such as product launches adopted by the key market players to enhance their position in the industrial PC market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the industrial PC market report.

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial PC Market

hello ,please provide details of industrial pc suitable for automated guided vehicle used in warehouse for material handling