Infrared Imaging Market Size, Share & Industry Growth Analysis Report by Technology (Cooled & Uncooled Infrared Imaging), Wavelength (Near, Shortwave, Mid-wave, & Long-wave Infrared), Application (Security & Surveillance, Monitoring & Inspection, Detection), Vertical - Global Forecast to 2028

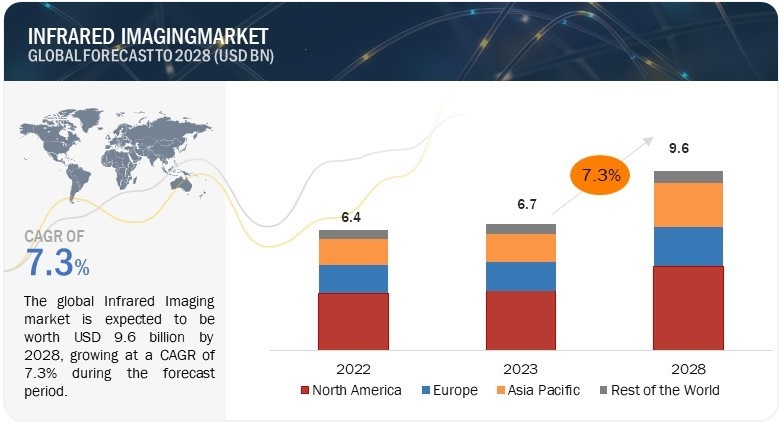

[218 Pages Report] The global infrared imaging market (IR camera market) size is estimated to be worth USD 6.7 billion in 2023 and is projected to reach USD 9.6 billion by 2028, at a CAGR of 7.3% during the forecast period. Increased adoption of infrared imaging products in security & surveillance application is one of the major drivers that fuels IR camera market growth.

Infrared Imaging Market Statistics Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Global Infrared Imaging Market Dynamics

Driver: Increasing use of infrared (IR) cameras in quality control and inspection application

The increasing use of infrared cameras in quality control and inspection applications has emerged as a significant trend in various industries. These highly advanced cameras enable businesses to enhance their quality control processes by providing non-destructive and non-contact testing capabilities. By capturing and analyzing thermal patterns, infrared cameras can identify anomalies, defects, or variations in temperature that may indicate potential issues with products or equipment. This technology allows for real-time monitoring, precise measurement, and efficient analysis, resulting in improved product quality, reduced waste, and enhanced overall operational efficiency.

Restraint: Limitations associated with image resolution and sensitivity of infrared (IR) cameras

The limited resolution and sensitivity lead to restrict the adoption of infrared imaging in certain high-precision applications and industries that demand exceptional image quality and detail. This leads to reliance on alternative imaging technologies or the need for supplementary methods to achieve the desired level of accuracy.

Opportunity: Emerging infrared imaging applications in automotive sector

Emerging infrared imaging applications in the automotive sector are driving innovation and transforming the driving experience. Infrared imaging technology offers advanced capabilities that enhance vehicle safety, convenience, and efficiency. One notable application is in driver monitoring systems, where infrared cameras can detect driver drowsiness or distraction by monitoring eye movements and alerting the driver in real time.

Challenge: High cost of infrared cameras to challenge adoption

The higher cost of a SWIR camera restricts its widespread adoption and impacts the overall infrared imaging market. While LWIR and MWIR cameras are also expensive, their price varies as per the application. For instance, infrared imaging cameras used for building inspection are usually less expensive than those used in research and development applications.

Infrared Imaging Market Ecosystem

The infrared imaging market is marked by the presence of a few tier-1 companies, such as Teledyne FLIR LLC (US), Fluke Corporation (US), Raytheon Technologies Corporation (US), Leonardo DRS (US), Axis Communications AB (Sweden), and many more. These companies have created a competitive ecosystem by investing in research and development activities to launch highly efficient and reliable infrared imaging offerings.

The market for uncooled infrared imaging by technology to hold largest market share during the forecast period

the expanding applications of uncooled infrared imaging in areas like automotive, security, and agriculture have fueled its growth. Also, the ease of use and the ability to capture thermal data in real-time without the need for cooling systems have made uncooled infrared imaging a preferred choice for many users.

Long-wave infrared by wavelength held the largest market share in 2023

LWIR cameras provide an extended wavelength range, enabling superior detection of small temperature differentials and enhancing image quality. This characteristic makes them highly suitable for critical applications like predictive maintenance, where identifying subtle temperature variations is essential. Moreover, LWIR cameras have experienced significant advancements in detector technology, resulting in heightened sensitivity and improved resolution.

Monitoring & Inspection by application to witness highest CAGR during forecast period

Infrared imaging facilitates non-destructive monitoring and inspection across industries by capturing thermal signatures. It assists in preventive maintenance, quality control, energy audits, building inspections, healthcare diagnostics, and agriculture, enabling the detection of anomalies, process optimization, and efficiency improvement.

Infrared Imaging Market Share

Asia Pacific held to register highest CAGR in the infrared imaging industry during forecast period

The Asia Pacific region is one of the key markets for infrared imaging market. The increasing adoption of thermal imaging technology across various sectors has driven the demand for infrared cameras and related products. Several companies in the region are actively involved in the development, production, and distribution of infrared imaging solutions. The technology continues to advance, and its applications are expanding to new areas, promoting safety, efficiency, and innovation in the region.

Infrared Imaging Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Infrared Imaging Companies - Key Market Players

The overall infrared imaging market is dominated by Teledyne FLIR LLC (US), Leonardo DRS (US), Axis Communications AB (Sweden), Zhejiang Dali Technology Co.,Ltd. (China), OPGAL Optronics Industries Ltd (Israel) L3Harris Technologies (US), Inc, Fluke Corporation (US), Raytheon Technologies Corporation (US), Xenics nv (Belgium), and Allied Vision Technologies GmbH (Germany). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the market.

Infrared Imaging Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 6.7 billion in 2023 |

| Projected Market Size | USD 9.6 billion by 2028 |

| Infrared Imaging Market Growth Rate | CAGR of 7.3% |

|

Infrared Imaging Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Technology, By Wavelength, By Application, By Vertical and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The major players in the infrared imaging market are Teledyne FLIR LLC (US), Fluke Corporation (US), Raytheon Technologies Corporation (US), Leonardo DRS (US), Axis Communications AB (Sweden), L3Harris Technologies (US), Inc, Xenics nv (Belgium), Zhejiang Dali Technology Co.,Ltd. (China), OPGAL Optronics Industries Ltd (Israel) and Allied Vision Technologies GmbH (Germany). |

Infrared Imaging Market Highlights

The study segments the infrared Imaging industry based on By Methodology, Device Type, Gas Analyzer Type, Industry and Region

|

Segment |

Subsegment |

|

By Technology |

|

|

By Wavelength |

|

|

By Application |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments in Infrared Imaging Industry

- In February 2023, Xenics nv (Belgium) launched Lynx R and XSL R series, expanding its linear SWIR camera portfolio. Linear SWIR cameras are available for demanding applications such as food sorting, machine vision, spectroscopy, optical fiber monitoring, semiconductor inspection, LIDAR sensing and spectral-domain optical coherence tomography.

- In April 2023, Raytheon Technologies (US) announced the launch of RAIVEN, an innovative tool that boosts the situational awareness capabilities of military & security personnel. Its primary purpose is to deliver real-time video streaming and advanced analytics in demanding environments, empowering users with enhanced insights and information..

- In June 2022, Teledyne FLIR LLC (US) and United States Coast Guard (USCG) signed a contract that to provide Maritime Forward Looking Infrared (MARFLIR) II sensors and SeaFLIR 280-HD surveillance systems. This contract strengthens Teledyne FLIR Defense's position as a trusted provider of cutting-edge imaging solutions for defense applications.

Frequently Asked Questions (FAQ):

What is the current size of the global infrared imaging market?

The infrared imaging market is estimated to be worth USD 6.7 billion in 2023 and is projected to reach USD 9.6 billion by 2028, growing at a CAGR of 7.3% during the forecast period.

Who are the winners in the global infrared imaging market?

Teledyne FLIR LLC (US), Axis Communications AB (Sweden), Fluke Corporation (US) are some of the global winners in infrared imaging market.

Which region is expected to hold the highest market share?

North America is expected to dominate the infrared imaging market during forecast period as region is home to many top market players such as Teledyne FLIR LLC (US), Fluke Corporation (US), L3Harris Technologies, Inc. (US), IRCameras LLC (US), OPGAL Optronics Industries Ltd. (US) and Leonardo DRS (US).

What are the major opportunities related to the infrared imaging market?

Emerging infrared imaging applications in automotive sector; Increase in application areas for infrared cameras; Penetration of infrared cameras in consumer electronics industry are major opportunities related to infrared imaging market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the infrared imaging market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

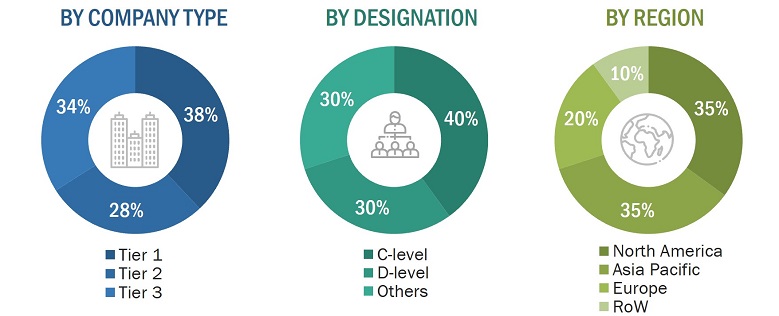

The research study involved 4 major activities in estimating the size of the infrared imaging market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research was mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, and regional outlook and developments from both market and technology perspectives.

Primary Research

In the primary research, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, equipment manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the infrared imaging market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used along with several data triangulation methods to estimate and forecast the overall market segments and subsegments listed in this report.

Estimating market size by bottom-up Approach (demand side)

The bottom-up approach has been used to arrive at the overall size of the infrared imaging market from the revenues of key players and their shares in the market. Key players have been identified on the basis of several parameters, such as product portfolio analysis, revenue, R&D expenditure, geographic presence, and recent activities. The overall market size has been calculated based on the revenues of the key players identified in the market.

Market Size Estimation Methodology-Bottom-up Approach

Data Triangulation

After arriving at the overall market size through the process explained earlier, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both the top-down and bottom-up approaches.

Market Definition

The infrared spectrum typically ranges from wavelengths of 0.7 μm to 1 mm. Imaging in this range requires infrared imaging cameras that can convert the radiation of objects in the infrared range to a measurable form. The capability of an infrared imaging camera depends on the type of components used. Lens and detector are the two most important components of an infrared imaging camera and account for a significant percentage of its total value. Indium gallium arsenide (InGaAs), microbolometer, and mercury cadmium telluride (HgCdTe) are some of the types of infrared detectors available in the infrared imaging market.

Key Stakeholders

- Infrared imaging product manufacturers

- Infrared imaging product traders/suppliers

- Raw material suppliers and distributors

- Research organizations and consulting companies

- Associations, organizations, forums, and alliances related to infrared technology

- Government bodies such as regulatory authorities and policy-makers

- Venture capitalists, private equity firms, and start-up companies

The main objectives of this study are as follows:

- To define, describe, and forecast the infrared imaging market, in terms of value, by of technology, wavelength, application, vertical, and region

- To provide the market size estimation for North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence market growth

- To provide a detailed overview of the infrared imaging value chain

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze key trends related to components, connectivity technologies, and applications that shape and influence the global infrared imaging market

- To profile key players and comprehensively analyze their ranking based on their revenues and core competencies

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

- To analyze competitive developments in the infrared imaging market, such as expansions, agreements, partnerships, contracts, product developments, and research and development (R&D) activities

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Infrared Imaging Market

Thermal hyperspectral imagers provide information that conventional spectral imagers cannot. A broader range of materials can be detected, mapped, and sorted by thermal hyperspectral imagers. We are planning to expand our offerings in this area so wanted to know if insights on thermal hyperspectral imaging present in the report.

I can see that the SWIR technology is witnessing significant growth in the infrared imaging market. We are planning include SWIR technology based products in our product portfolio, so would like to have an estimate of the SWIR market in China, and South Korea.

We are into the business of providing infrared cameras, and want to explore the market for infrared sensors. We are particularly interested in volume data of IR sensors, is it covered in the study?

LWIR and MWIR are the prominent technologies in the infrared market, while NIR and SWIR are the emerging ones. Can you tell me if the report analyzes the market between NIR, LWIR, MWIR, and SWIR technologies?

My company is engaged in providing hardware and software solutions for infrared camera. Our solutions are aimed at automated process monitoring application. Is the information on this application available in the report?