Label Free Detection Market by Product & Service (Instruments, Consumables (Biosensor Chips, Microplates), Software), Technology (Surface Plasmon Resonance), Application (Hit Confirmation, Lead Generation), End User (Pharma, CROs) & Region – Global Forecast to 2028

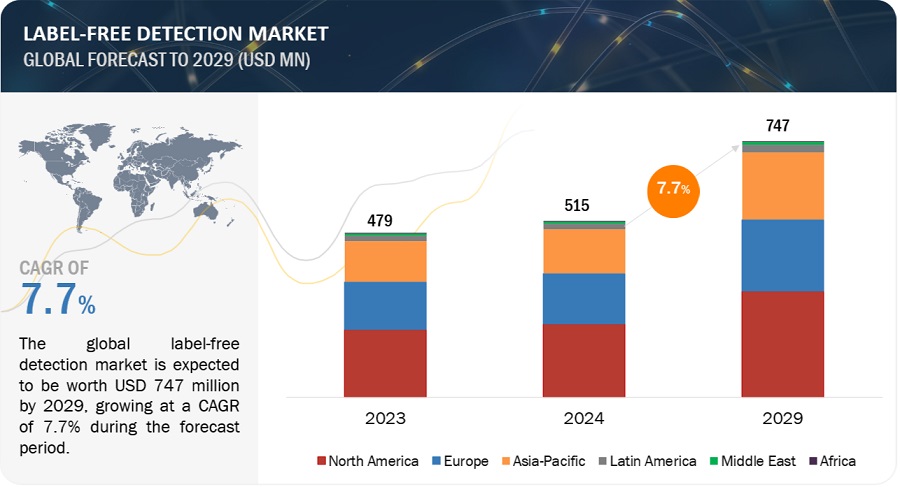

The global label free detection market in terms of revenue was estimated to be worth $570 million in 2023 and is poised to reach $863 million by 2028, growing at a CAGR of 8.7% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth of this market is majorly driven by the technological advancements in label-free detection market, growing number academic-industrial partnerships for drug discovery programs and high sensitivity of label-free technologies. On the other hand, high cost of instruments is a major factor restraining market growth to a certain extent.

Attractive Opportunities in Label-Free Detection Market

To know about the assumptions considered for the study, Request for Free Sample Report

Label Free Detection Market Dynamics

DRIVER: Technological advancements in label-free detection

Label-free methods are a relatively new technology in high-throughput screening and provide opportunities for investigating biomolecular interactions without using spatial interference or the auto-fluorescent or quenching effects of labels. Initially, low throughput was a challenge associated with label-free technologies. However, the introduction of SPR-based label-free systems with higher throughput has helped increase overall operational efficiency while providing the high-quality data needed to make informed decisions. For instance, in September 2021, TA Instrument Systems, a subsidiary of Waters Corporation, introduced the TMA 450RH and the Discovery SA. The TMA 450RH provides measurements of dimensional compatibility of materials under controlled temperature and humidity. The Discovery SA is used in pharmaceutical development to assess the impact of moisture in drug product processing and storage on crystalline structure, which is related to drug product efficacy.

RESTRAINT: High cost of instruments

Label-free detection instruments are priced at a premium due to their incorporation of advanced features and functionalities. For instance, a typical bio-layer interferometry system can cost anywhere between USD 50,000 to USD 300,000. Agilent's xCELLigence systems, available for academic and industrial use, fall within the price range of USD 50,000 to USD 500,000, depending on options like throughput. This puts these instruments out of reach for companies with limited R&D budgets, impeding market expansion. Academic research laboratories also face difficulties investing in such instruments due to financial constraints. Moreover, the high initial and ongoing costs, along with weekly maintenance expenses, associated with surface plasmon resonance (SPR) systems, confine label-free platforms to well-funded labs and academic core labs. The complexity of SPR platforms further renders them unsuitable for multi-user laboratories. On the other hand, pharmaceutical companies, with larger R&D budgets, represent the primary users of label-free detection instruments. However, their need for multiple instruments increases their capital expenditure. Consequently, the high cost of these instruments may curtail demand and limit overall market growth.

OPPORTUNITY: Growing life sciences research in emerging economies

The label-free detection market in Asia is experiencing significant growth, primarily propelled by the expanding economies of China and India, as well as increased investments in biotechnology and drug discovery. While most Asian countries currently lack established business models, they possess the scientific expertise necessary to foster robust local biotechnology industries. As a result, there is a growing trend of mergers, collaborations, and partnerships in these emerging countries. Many Asian economies have also modified to their regulations, policies, and guidelines to encourage investments, innovation, and commercialization, leading to a rise in research activities within the life science industry.

Over the years, China’s pharma industry has shifted from primarily focusing on manufacturing generics and copy-cat drugs to research & development of innovative treatments. Many pharma and biopharmaceutical companies, such as Lonza, AstraZeneca, GlaxoSmithKline, Sanofi, and Ferring Pharmaceuticals, have announced plans to invest in life science R&D activities in emerging markets in the coming years. These increasing investments will further boost R&D activities, which, in turn, will provide a range of growth opportunities for players in the market. For instance, in March 2022, Lonza AG, a pharmaceutical company, announced the completion of a laboratory expansion at its API manufacturing site in Nansha, China. The expansion focused on extending the capabilities and capacity of development laboratories and kilogram-scale cGMP manufacturing laboratories for the clinical supply of highly potent APIs (HPAPIs).

CHALLENGE: Sample complexity and interference

Many samples of interest, especially in biological and environmental sciences, are complex heterogenous mixtures containing multiple analytes, macromolecules, cells, or particles. Analyzing such mixtures with label-free techniques can be challenging due to their diverse components, varying concentrations, and potential interactions. The sample matrix, which refers to the composition and characteristics of the surrounding medium or biological fluid, can significantly influence label-free technologies such as SPR and DSC performance and accuracy. Interactions between the analyte of interest and the matrix components can lead to changes in signal intensity, nonspecific binding, or altered kinetics, affecting the accuracy and specificity of the analysis.

Additionally, background noise from impurities, scattering particles, or variations in the sample matrix can mask or interfere with the signals of interest, reducing the signal-to-noise ratio and affecting the detection sensitivity. Furthermore, nonspecific binding, cross-reactivity, and masking effects can affect the sensitivity and specificity of the measurements, leading to difficulties in data analysis and interpretation. It requires a comprehensive understanding of the sample characteristics, careful experimental design, optimization of sample preparation methods, selective surface modifications, reference and control experiments, advanced data analysis techniques, and validation & comparative studies to address the sample complexity and interference challenges. By addressing these challenges, label-free technologies can provide valuable insights into complex samples and enable accurate analysis in diverse research and application fields.

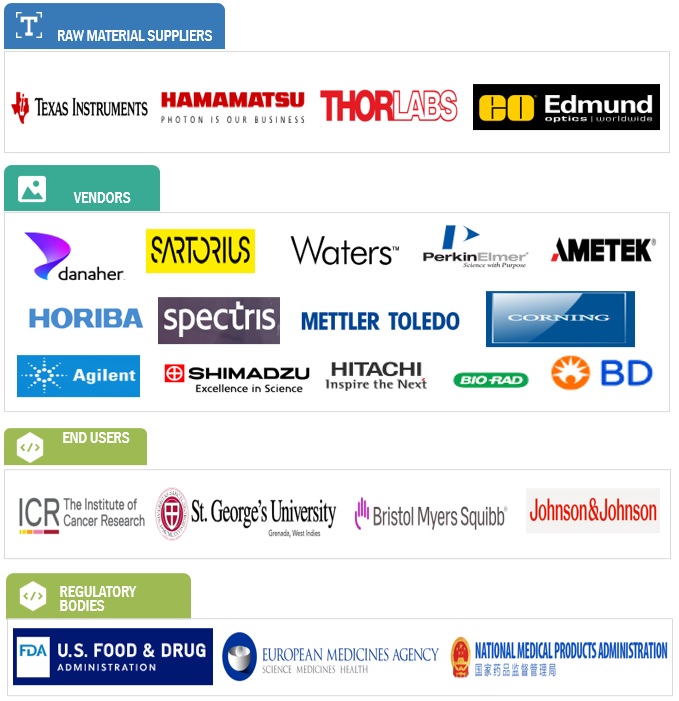

Label-free Detection Market Ecosystem

The label-free detection market is a complex ecosystem involving various stakeholders, including supply side i.e companies providing label-free detection products & services and demand side i.e. pharmaceutical & biotechnology companies, academic & research institutes, contract research organization and other end users such as food & beverages industry, agriculture and livestock, oil & gas industry, environmental monitoring industry, chemical industry, bioplastics, and Cosmeceuticals industries.

Several key companies provide products for label-free detection. For example, Danaher (US) is a leading provider of scientific products, including a range of solutions for label-free detection. They offer a comprehensive portfolio of instruments, consumables, and software & services. Their products, such as Biacore series of SPR instruments, consumables, and software, are widely used in the biotechnology industry. Other products providers include Sartorius AG (Germany), Waters Corporation (US), PerkinElmer Inc. (US), Ametek, Inc. (US), and others.

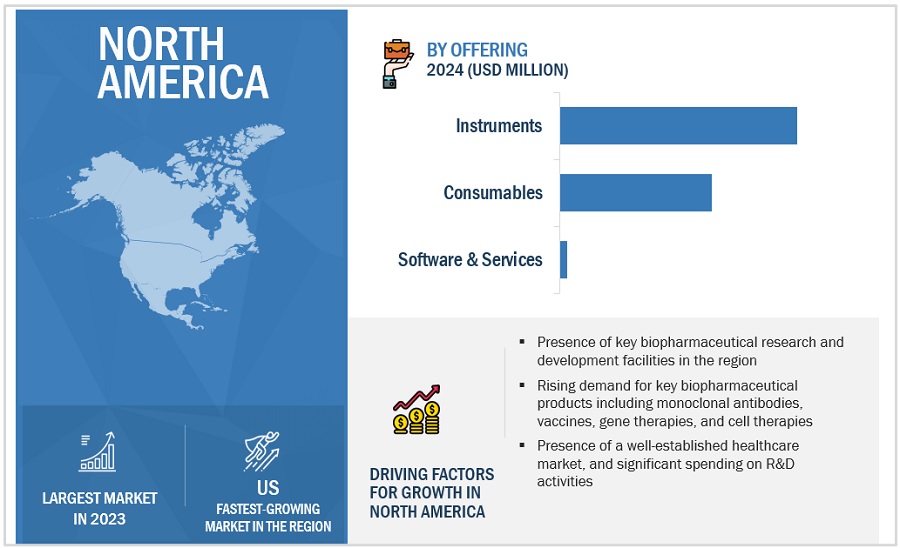

The instruments segment dominated label free detection industry by product & service:

The instruments segment held the largest share of the global label free detection market in 2022. The drug discovery industry is adopting label-free technologies for various molecular and cellular assays since it has become vital for drug discovery labs to identify lead failure earlier because of safety concerns. This creates demand for automated and easy-to-use bioanalytical systems, which is driving the growth of instrument segment. Furthermore, with the help of enhanced instrumentation, pharmaceutical and biotechnology companies can streamline and simplify laboratory workflows to improve productivity and reduce costs. Both biomolecular interactions and whole cells can be assayed using a variety of label-free instruments available today. Recent advances in label-free instruments offer improved costs, throughput, increased sensitivity, and sophisticated data analysis.

The binding kinetics segment dominated label free detection industry by application

The binding kinetics segment held the largest share of the global label free detection market in 2022. Growth in this segment is mainly driven by factors such as the increasing number of drug discovery research and development activities and increasing efforts to study biomolecular kinetics through label-free detection technologies. Binding kinetic studies measure drug residence time, which is important for predicting clinical outcomes of drugs. Binding kinetics help in understanding how fast a compound binds to its target and how fast it dissociates from it. It measures two things, the on-rate, and the off-rate. Measuring the on- and off-rate used to be a lengthy process. Modern biophysical techniques like SPR enable the direct measurement of on- and off-rates without using labels. SPR is the standard technique routinely used in laboratories for characterizing the affinity and kinetics of drugs binding to target proteins in vitro. It is applicable for a wide range of protein classes, particularly soluble proteins, including enzymes, kinases, and proteases. BLI is another alternative for profiling binding kinetics, mostly for antibodies.

Asia Pacific region of the label free detection industry is estimated to register the highest CAGR during the forecast period.

Asia Pacific offers lucrative growth potential for the label free detection market. This can be attributed to the increasing pharmaceutical R&D spending, the growing trend of outsourcing drug discovery services, growing life sciences research, and increasing government initiatives for healthcare research. One significant growth driver for the label-free detection market in the Asia Pacific region is the increasing investment in healthcare infrastructure and research & development (R&D) activities. Governments and private entities are allocating substantial funds and launching various research programs to enhance healthcare facilities and promote scientific advancements, including label-free detection technologies.

The Asia-Pacific Economic Cooperation (APEC) Life Sciences Innovation Forum (LSIF) and its Regulatory Harmonization Steering Committee (RHSC) adopted a strategic plan (Vision 2020: A Strategic Framework: Regulatory Convergence for Medical Products by 2020). This strategic plan provided the basic proposal and rationale for achieving regional regulatory convergence of medical product approval procedure. The forum’s vision is to accelerate regulatory convergence for medical products in the APEC region as much as possible by 2030 to protect people’s safety, make life-saving products available, save public resources, attract investments, mitigate corruption, and improve global standing in every APEC economy. Thus, favourable regulatory guidelines for product approval is expected to drive the market growth.

To know about the assumptions considered for the study, download the pdf brochure

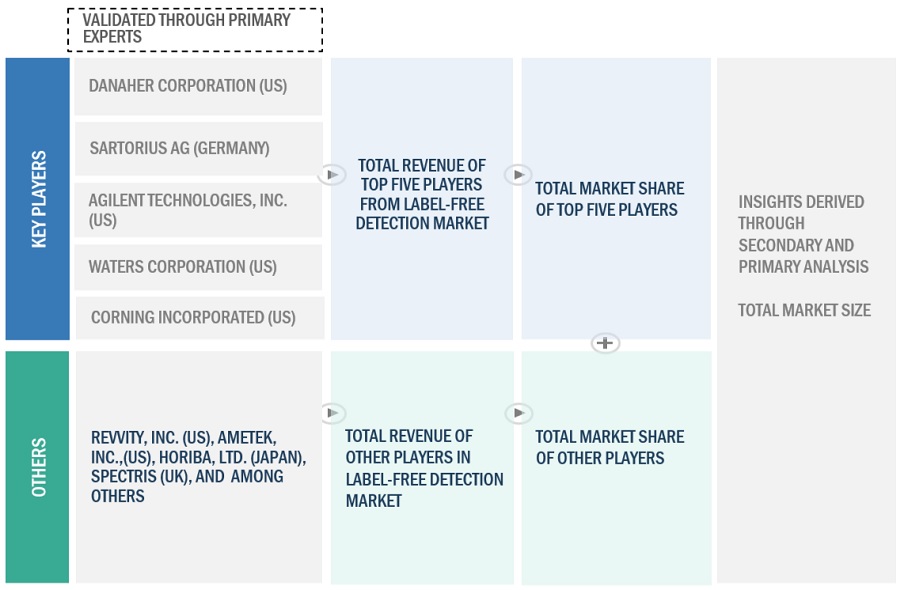

Key players in the label free detection market include Danaher (US), Sartorius AG (Germany), Waters Corporation (US), PerkinElmer, Inc. (US), AMETEK, Inc. (US), HORIBA, Ltd. (Japan), Spectris (UK), METTLER TOLEDO International Inc., (US), Agilent Technologies, Inc. (US), Shimadzu Corporation (Japan), Hitachi High-Tech Corporation (Japan), Attana AB (Sweden), Bruker (US), NanoTemper Technologies GmbH (Germany), Affinité Instruments (Canada), Biosensing Instrument (US), Unchained Labs (US), BioNavis Ltd. (Finland), Carterra, Inc. (US), Nicoya (Canada), BiOptix Analytical LLC (US), Plexera Bioscience (US), XanTec Bioanalytics GmbH (Germany), lino Biotech AG (Switzerland), and KEP Technologies (France).

Scope of the Label Free Detection Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$570 million |

|

Projected Revenue by 2028 |

$863 million |

|

Revenue Rate |

Poised to Grow at a CAGR of 8.7% |

|

Market Driver |

Technological advancements in label-free detection |

|

Market Opportunity |

Growing life sciences research in emerging economies |

This report categorizes the label free detection market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Instruments

-

Consumables

- Biosensor Chips

- Microplates

- Reagents & Kits

- Software and Service

By Technology

- Surface Plasmon Resonance

- Bio-Layer Interferometry

- Isothermal Titration Calorimetry

- Differential Scanning Calorimetry

- Other Technologies

By Application

- Binding Kinetics

- Binding Thermodynamics

- HIT Confirmation

- Lead Generation

- Endogenous Receptor Detection

- Other Applications

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organization

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Recent Developments of Label Free Detection Industry

- In April 2022, Sartorius launched the new Octet SF3, the first SPR system under the Sartorius Octet brand. Octet SF3 is a next-generation SPR instrument that offers robust, high-throughput, low maintenance characterization of biomolecular interactions.

- In February 2021, Creoptix, a subsidiary of Malvern Panalytical, launched WaveRAPID, a new and faster way of measuring kinetics to accelerate drug discovery.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global label free detection market?

The global label free detection market boasts a total revenue value of $863 million by 2028.

What is the estimated growth rate (CAGR) of the global label free detection market?

The global label free detection market has an estimated compound annual growth rate (CAGR) of 8.7% and a revenue size in the region of $570 million in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

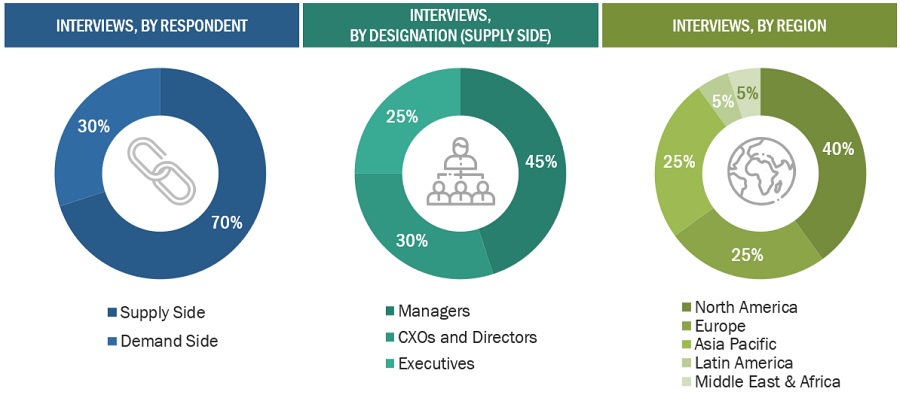

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global label-free detection market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as World Health Organization (WHO), the National Center for Biotechnology Information (NCBI), the National Institutes of Health (NIH), the US Food and Drug Administration (US FDA), the International Molecular Exchange Consortium (IMEx), the Biomolecular Interaction Network Database (BIND), the European Federation of Pharmaceutical Industries and Associations (EFPIA), the European Lead Factory (ELF), India Brand Equity Foundation (IBEF), the UK Research Partnership Investment Fund (UKRPIF), and Pharmaceutical Research and Manufacturers of America (PhRMA). Secondary sources also include corporate and regulatory filings, such as annual reports, SEC filings, investor presentations, and financial statements; business magazines & research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global label-free detection market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global label free detection market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as personnel from pharmaceutical and biopharmaceutical industries, CMOs and CROs, academic & research institutes, and experts from the supply side, such as C-level and D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. These interviews were conducted across four major regions, including the Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. Approximately 80% and 20% of the primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

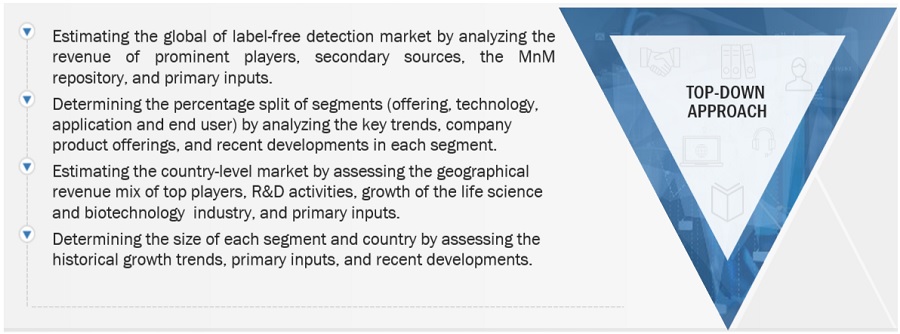

Market Size Estimation

The global size of the market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the label-free detection market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive primary and secondary research.

- The revenues generated from the label-free detection business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Label-free Detection Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Label free Detection Market: Top Down Approach

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

Label-free detection is gaining widespread acceptance as an important research and development tool in academic research institutes and biotechnology and pharmaceutical industries. It helps in the investigation of molecule-molecule interactions without using additional isotope or fluorescent labels that usually cause spatial interference or quenching.

Key Stakeholders

- Pharmaceutical and biotechnology research associations

- Label-free equipment manufacturers and vendors

- Research and consulting firms

- Pathologists and pathology laboratories

- Distributors of label-free detection equipment

- Research institutes

- Contract research organizations (CROs)

- Venture capitalists

- Government associations

Report Objectives

- To define, describe, and forecast the global Label free detection market based on product & service, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product & service portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographical Analysis

- Further breakdown of the Rest of Europe label free detection market, by country

- Further breakdown of the Rest of Asia Pacific label free detection market, by country

- Further breakdown of the Latin America and Middle East & Africa label free detection market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Segment Analysis

- Further breakdown of the disease indication area segment as per the service portfolio of prominent players operating in the market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Label Free Detection Market