Laser Technology Market by Laser Type (Solid, Gas, Liquid), Configuration (Fixed, Moving, Hybrid), Application (Laser Processing, Optical Communication), Vertical (Telecommunications, Automotive, Medical, Industrial) and Region - Global Forecast to 2029

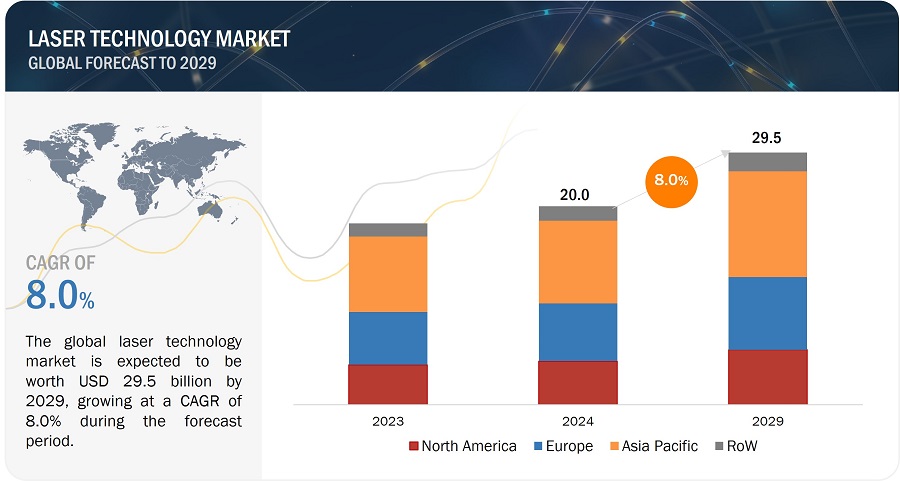

[259 Pages Report] The global laser technology market size is estimated to be valued at USD 20.0 billion in 2024 and is anticipated to reach USD 29.5 billion by 2029, at a CAGR of 8.0% during the forecast period. The market growth is ascribed to increasing demand for laser technology in healthcare vertical, better performance of laser-based techniques compared with conventional material processing methods, rising preference for laser-based material processing over traditional approaches, shift toward production of nanodevices and microdevices, growing adoption of smart manufacturing techniques.

Laser Technology Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Laser Technology Market Trends

Driver: Increasing demand for laser technology in healthcare vertical

The healthcare industry is witnessing a substantial surge in the demand for laser technology due to its diverse applications and transformative impact on medical practices. In the healthcare vertical, laser technology has significant applications in urology, dermatology, dentistry, and ophthalmology. Laser technology advances medical care by offering precise, effective, and minimally invasive solutions for diagnosis, treatment, and surgery across various medical specialties. Ongoing research and innovation in laser technology are expected to expand its applications further and improve healthcare outcomes in the future.As in February 2023, the newest laser therapy to remove blockages in heart blood vessel was introduced for the first time in Central India. laser therapy in which a catheter that emits high energy light is used to unblock arteries. It vapourizes blockages and clears vessels without hurting the walls of vessels.

Noninvasive methods of body contouring and fat reduction are gaining popularity. Transdermal focused ultrasound, monopolar radiofrequency (RF), high-intensity focused ultrasound (HIFU), and cry lipolysis are advanced techniques used for body contouring and fat reduction. Furthermore, fractionation treatments are leading to improvements in skin treatment procedures. Laser technology helps minimize bleeding and pain and leads to faster healing of human tissues. Hence, the increasing number of cosmetic laser surgeries and advancements in laser technology devices and ophthalmology lasers are fueling the demand for laser technology in the healthcare vertical.

Restraint: High deployment cost

The laser technology market faces challenge in the form of high deployment costs, which act as a barrier to widespread adoption across industries. The intricate nature of laser systems necessitates the use of specialized components, cutting-edge technologies, and strict safety measures, all of which contribute significantly to the overall deployment expenses. Research and development investments aimed at advancing laser technologies and ensuring compliance with safety standards further contribute to the high upfront costs. Quality assurance procedures, infrastructure requirements, and the need for customization to suit specific applications contribute to the overall financial commitment associated with deploying laser technology. The high deployment cost of lasers can be attributed to several factors, including the complexity of laser systems, the cost of materials and components, research and development expenses, and the specialized expertise required for design, manufacturing, and maintenance. Laser systems require specialized components such as diodes, optical elements, semiconductor materials, and control electronics. These components are often expensive to manufacture, and their high precision and quality contribute to the overall cost of laser systems.

The lack of trained personnel is another factor that is restraining the growth of the laser technology market. Skilled labor is essential for operating and maintaining laser systems, adding expenses related to hiring and training qualified professionals For instance, the operation of an excimer laser requires the presence of at least one trained personnel to ensure that the operator is aware of the protocols to be followed during the use of laser systems. The lack of trained staff could damage the materials involved in laser processing and lead to high time consumption.

Opportunity: Growing adoption of laser technology for optical communication

Optical communication uses light as a platform for transmission. Laser technology provides advantages over radio waves as light waves are packed tightly compared to sound waves. Laser fiber optics have many fibers wrapped inside a cable, in which each cable contains many laser beams. Every laser beam has the potential to carry billions of bits of data. Thus, laser technology can transfer more data per second with strong signal quality.

Laser technology enables high-speed data transmission in optical communication systems, supporting data rates ranging from gigabits per second (Gbps) to terabits per second (Tbps). High-speed laser-based communication systems are essential for meeting the increasing demand for bandwidth in modern telecommunications networks.

In the coming years, laser technology is expected to be widely used for optical communication as it can transmit multiple signals at a low loss and is monochromatic. Laser manufacturers focus on increasing the speed of lasers and decreasing the size of components to meet the demand for sophisticated optical communication applications.

Laser technology is emerging as a game-changer in satellite communications (SATCOM), enabling the creation of ultra-secure networks capable of transmitting vast amounts of data at unprecedented speeds via satellite networks and constellations. With ongoing advancements, the industry is poised for growth and collaboration, seizing the untapped potential of unconnected populations. The ability to handle the surging volume of data is a key advantage offered by laser communications, providing a significant value proposition. As in 2024 it is revealed by Breaking Defence that the project called Kepler is introduced which will bring Internet connectivity to space.

Challenge: Technical challenges associated to high-power lasers

The use of high-power lasers poses several challenges. High-power lasers, characterized by their output levels in the kilowatt (kW) to megawatt (MW) range, present several technical complexities that necessitate careful consideration in their design and operation. Enhancing the reliability and lifetime of lasers to meet the demands of industrial, medical, and aerospace applications is critical. Challenges pertaining to these applocations majorly include improving the stability of laser diodes, minimizing degradation mechanisms, and increasing component lifetimes under harsh operating conditions.High-power solid-state lasers exhibit strong thermal lensing, making achieving a high beam quality more challenging. Lasers with polarized output often compromise efficiency compared to lasers with depolarized output. Efficient heat removal and thermal management are issues that require additional measures to be resolved. High-power lasers also exhibit non-linear effects, such as Raman scattering, Brillouin scattering, and four-wave mixing.

The delivery and control of high-power laser beams poe challenges, demanding robust systems to ensure beam stability, pointing accuracy, and focus control over long distances.

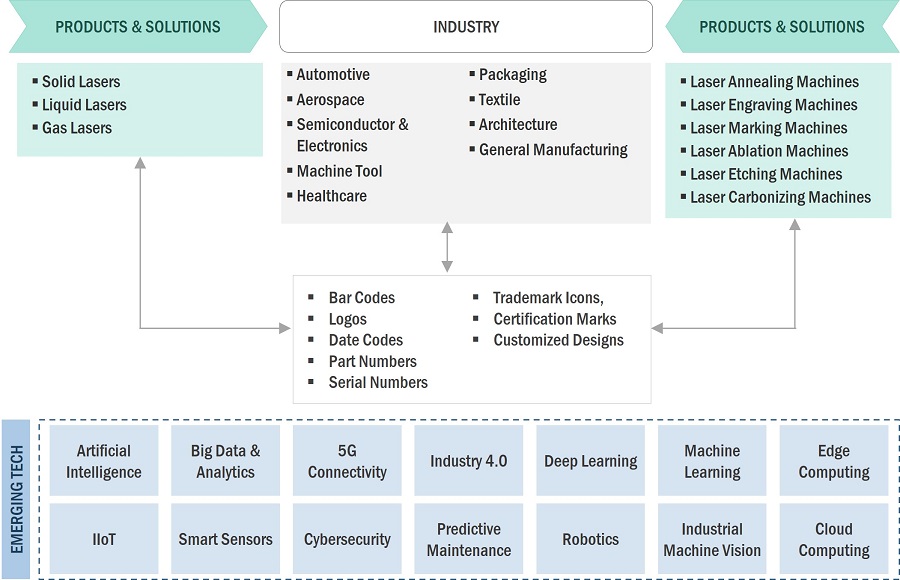

Market Ecosystem

The Solid laser type segment accounted for the largest share of the laser technology market in 2023.

Solid laser type segment accounted for the largest share of the laser technology market in 2023. Solid-state lasers lead the laser technology market owing to their adaptability, dependability, efficiency, compactness, and safety features. They serve diverse industries like manufacturing, healthcare, defense, communication, and entertainment. Technological advancements continually enhance their performance and affordability, making them economically advantageous. With their efficient energy conversion and extended operational lifespan, solid-state lasers are widely embraced across commercial and industrial sectors. In essence, their blend of performance, reliability, and cost-effectiveness cements their position as the preferred laser technology.

The hybrid configuration segment is expected hold the largest market share during the forecast period.

Hybrid configurations in laser technology dominate the laser processing market due to their versatility, optimized performance, flexibility, and potential synergistic effects. These systems provide a wider range of capabilities, meeting a variety of processing needs across sectors by combining several laser sources, such as fiber, CO2, and solid-state lasers. They improve performance for certain jobs, improve flexibility in response to changing needs, and can result in cost savings through equipment consolidation.

The laser processing application segment accounted for the largest share of the laser technology market in 2023.

The Laser processing encompasses a broad range of applications within laser technology, leveraging the unique properties of laser light for various industrial tasks. Laser technology offers unparalleled precision, speed, and versatility in tasks such as cutting, welding, marking, engraving, and drilling across various materials like metals, plastics, ceramics, and composites. Industries such as manufacturing, automotive, aerospace, electronics, healthcare, and consumer goods heavily rely on laser processing for its ability to deliver high-quality results with minimal material waste, reduced operational costs, and increased productivity.

Medical vertical will grow at the highest CAGR during the forecast period.

The laser technology plays a crucial role in medical procedures such as ophthalmology, dermatology, dentistry, and surgery due to its precision, minimally invasive nature, and ability to target specific tissues with high accuracy. As medical technologies progress, the market for medical lasers is expected to rise due to the growing need for laser-based procedures and treatments. Additionally, the aging population worldwide contributes to the rising demand for medical procedures, including those utilizing laser technology, to address age-related conditions such as vision impairments, skin disorders, and chronic diseases. Furthermore, continuous advancements in laser technology, including improved safety, efficacy, and accessibility of laser systems, make them more widely adopted in medical settings.

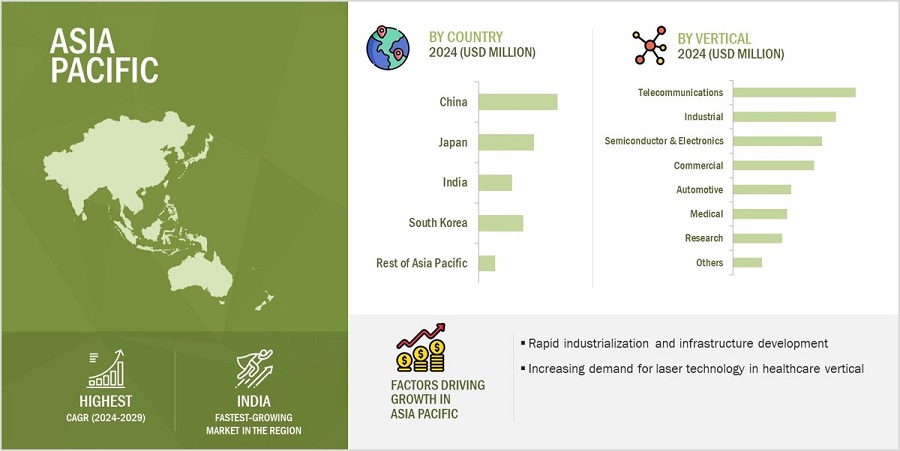

Asia Pacific holds the largest market share of the laser technology market throughout the forecast period.

Asia Pacific consists of – China, Japan, india, and South Korea. The region is home to some of the world's largest manufacturing hubs, including China, Japan, South Korea. These countries have a strong presence in industries such as automotive, electronics, semiconductors, and consumer goods, which are significant users of laser technology for applications like cutting, welding, marking, and engraving. Asia Pacific is experiencing rapid industrialization and urbanization, driving the demand for advanced manufacturing processes and technologies.

Laser Technology Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major companies in the laser technology companies are Coherent (US), TRUMPF (Germany), Han’s Laser Technology Industry Group Co., Ltd (China), IPG Photonics (US) and Jenoptik AG (Germany) and others. These companies have used both organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships to strengthen their position in the laser technology market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years Considered |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD million/billion) |

|

Segments Covered |

Type, Configuration, Application, Vertical, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Coherent (US), Trumpf (Germany), Han’s Laser Technology Industry Group Co., Ltd (China), IPG Photonics (US) and Jenoptik AG (Germany), A total of 25 players are covered. |

Laser Technology Market Highlights

In this report, the overall laser technology market has been segmented based on Type, Configuration, Application, Vertical, and Region.

|

Segment |

Subsegment |

|

By Type |

|

|

By Configuration |

|

|

By Application |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments

- In January 2024, Coherent Corp. introduced the OBIS 640 XT, a red laser module that matches the high output power, low noise, beam quality, and compact size of its existing portfolio of blue and green laser modules, which is a complete set. It also enables the high performance of SRM systems.

- In November 2023, IPG Photonics Corporation, a global leader in fiber laser technology, collaborated with Miller Electronics Mfg. LLC, a leading worldwide manufacturer of arc welding products, is in line with its commitment to innovation, quality, and reliability. The alliance will advance laser technologies for the handheld welding market and reshape the landscape of welding tools to provide welders with powerful, efficient, and precise solutions that meet the demands of modern welding applications. This collaboration will deliver dependable solutions that welders can rely on for their critical tasks.

- In October 2023, TRUMPF launched the TruMatic 5000 laser machine for fully automated laser-cutting, punching, and forming capabilities. This machine enables a fully automated flow of materials within the manufacturing cell, from loading and unloading the machine to removing finished parts.

Frequently Asked Questions (FAQs):

What will be the global laser technology market size in 2024?

The laser technology market is expected to be valued at USD 20.0 billion in 2024.

Who are the global laser technology market winners?

Companies such as Coherent, Trumpf, Han’s Laser Technology Industry Group Co., Ltd, IPG Photonics and Jenoptik AG fall under the winners’ category.

Which region is expected to hold the highest global laser technology market share?

Asia Pacific will dominate the global laser technology market in 2024.

What are the major drivers of the laser technology market?

Increasing demand for laser technology in healthcare vertical, better performance of laser-based techniques compared with conventional material processing methods, rising preference for laser-based material processing over traditional approaches, shift toward production of nanodevices and microdevices, growing adoption of smart manufacturing techniques.

What are the major strategies adopted by laser technology companies?

The companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

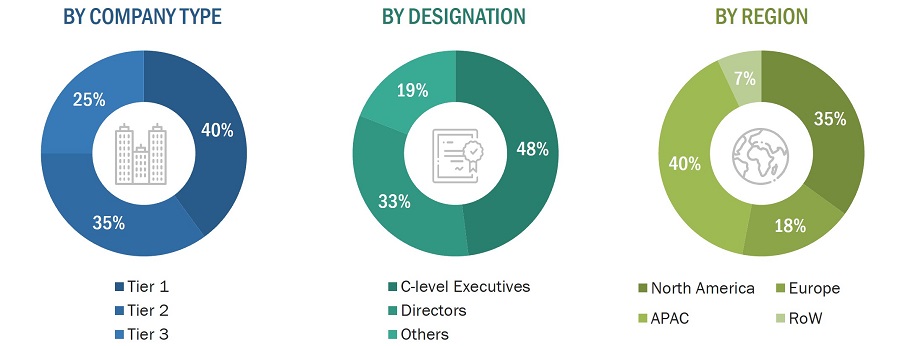

The study involves four major activities that estimate the size of the laser technology market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the laser technology market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research. The relevant data is collected from various secondary sources, it is analyzed to extract insights and information relevant to the market research objectives. This analysis has involved summarizing the data, identifying trends, and drawing conclusions based on the available information.

Primary Research

In the primary research process, numerous sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from laser technology providers, (such as Coherent, Trumpf, Han’s Laser Technology Industry Group Co., Ltd, IPG Photonics and Jenoptik AG) research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the laser technology market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

Laser stands for light amplification by stimulated emission of radiation (LASER). Laser technology-based devices generate a beam of light, which is coherent, monochromatic, and aligned. They generate light through optical amplification based on the stimulated emission of electromagnetic radiation. The wavelength of laser light is purer compared to other light sources. Unlike other light sources, all the photons that develop the laser beam have a fixed-phase relationship. The light beam generated from a laser source has low divergence. Laser technology-based systems find applications in optical communication, cutting, drilling, printing, and marking and engraving. The verticals that use laser technology include commercial, telecommunications, research, aerospace & defense, healthcare, automotive, semiconductor & electronics, industrial, and others (oil & gas, iron & steel, tobacco, glass, wood, retail, and plastics).

Stakeholders

- End users

- Government bodies, venture capitalists, and private equity firms

- Laser technology manufacturers

- Laser technology distributors

- Laser technology industry associations

- Professional service/solution providers

- Research institutions and organizations

- Standards organizations and regulatory authorities related to the laser technology market

- System integrators

- Technology consultants

The main objectives of this study are as follows:

- To define, describe, and project the size of the global laser technology market, in terms of value, segmented based on laser type, application, product, vertical and region

- To forecast the market size for various segments with respect to four main regions—North America, Europe, Asia Pacific, and Rest of the World (RoW)s

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To profile the key market players, and comprehensively analyze their market ranking and core competencies.

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, product launches, and research & development (R&D) activities, in the laser technology market

- To provide the leadership mapping based on company profiles and key player strategies such as product launches and development, collaborations, expansions, and acquisitions

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

- To provide ecosystem analysis, case study analysis, patent analysis, pricing analysis, Porter’s five forces analysis, key stakeholders & buying criteria, key conferences and events, and regulatory bodies, government agencies, and regulations pertaining to the market under study

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laser Technology Market

As a medium industry player, we would like to get informative data regarding the prospects of laser application in the future market so that we can reach to our fruitful planning on the purpose of the best sales of laser equipment.

I need to learn detailed laser market share from 2019 to 2025 to use in my thesis. I would be very happy especially if it's about diode lasers that is used to pump doped fiber lasers (between 808 nm and 1060 nm).

I would like the Epilog and Universal Laser Systems and Xenetech and Gravograph and Trotec financial pages.

I would like to research out the market size well to classify the technical addressable market and commercial addressable Market via our products.

We are interested in marketing single crystals for nonlinear optics in solid state lasers especially in the UV and deep UV.

Will increase in adoption of fiber laser will affect demand of CO2 laser?

Over the years, fiber laser have witnessed an increase in demand due to its low cost, high output power, and compact size. Will these fiber laser replace the prominent laser been used today including CO2 laser?

Looking for specific information on the number of YAG and other garnets used in the USA and globally.

There are several harmful effects of laser medical devices such as mild skin burns, tissue damage, photochemical effects and more. These effects depends upon various factors including exposure duration, beam energy, beam wavelength, and area of exposure. In what terms, harmful effects of laser during medical treatment or surgery will affect market growth?

Do government regulation affect adoption of lasers for food items?

Do you have more recent data than this report, and can you provide access to analyst who wrote it for a Q&A to dig deeper into specific sectors: we are particularly dealing at medical, surface treatment, YAG, fiber and ultrafast. The project has some urgency and your quick response would be appreciated.

Dot peen marking offers several advantages in terms of low-stress marking, adjustable marking length, ability to mark through any coating, and dot peen marking can be programmable for fully automated marking. How dot peen marking affect adoption of laser for marketing and engraving application?

Hi, I am an analyst at CCMP Capital. We are currently researching the laser market and found your report, “Laser Technology Market by Type, Application, and Geography - Trends & Forecast to 2013 - 2020” online. Do you have a sample of the report you could send us? We are in the initial stages of our research and want to get some preliminary understanding of the market before we proceed.

Recent trade war between China and the US have resulted in decreasing industrial output growth from several countries and global slowdown. According to an estimate, the trade war is expected to lower world's GDP by 1%. Up to what extent, US China trade war will affect laser market growth?

I am working on a research based on laser technologies. I am trying to have a better overview on the market share/growth and competition, present in the laser technologies sector.

I'm writing a BSc thesis about VECSEL lasers and I'm looking for a source to cite regarding the current size of the laser technology market.

Solid and fiber laser uses rare earth elements such as chromium, erbium, neodymium and others. Extraction of these rare earth materials can cause hazardous environment impacts. Also the raw supply can be monopolized by few countries. How government regulation regarding raw material mining and extraction for laser raw material will affect the market growth?

We are working on Indian laser development to judge whether we can have some corporation on the engineer or academic problems with India university or company.