M2M Satellite Communication Market by Offering (Hardware, Software Types, Services), Technology (Satellite Constellation (LEO, MEO, GEO), Data Transmission, VSAT, AIS), Vertical (Maritime, Military & Defense) and Region - Global Forecast to 2028

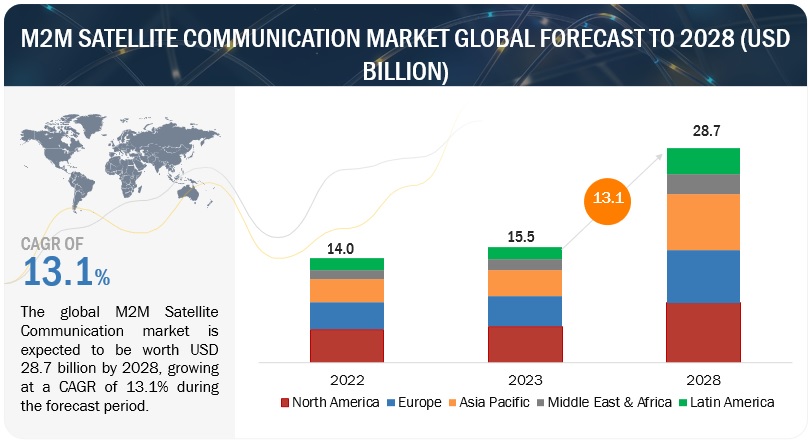

[403 Pages Report] The global market for the M2M satellite communication market is projected to grow from USD 15.5 billion in 2023 to USD 28.7 billion in 2028, at a CAGR of 13.1% during the forecast period. The increasing demand for ubiquitous and reliable connectivity in remote or challenging environments. Traditional terrestrial networks often face limitations in providing seamless communication in areas with limited infrastructure, such as rural or remote locations, oceans, and remote industrial sites. M2M satellite communication offers a solution by enabling devices and sensors to communicate efficiently over vast distances, regardless of geographical constraints.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

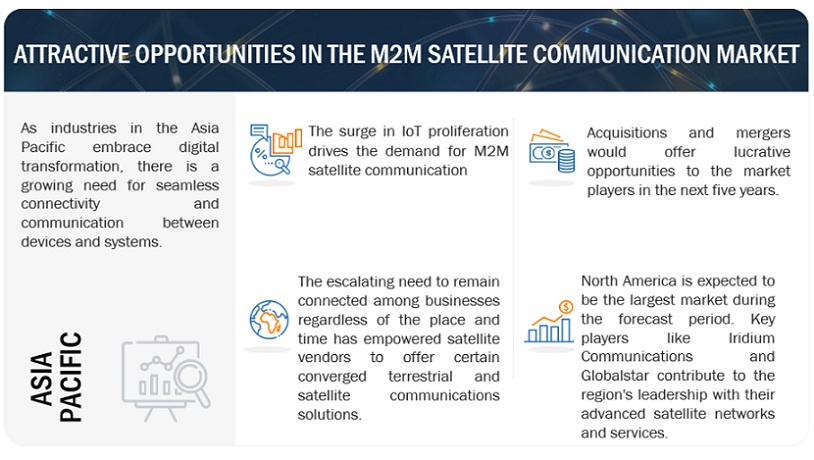

Driver: The surge in IoT proliferation drives the demand for M2M satellite communication

As the IoT ecosystem expands exponentially, the deployment of connected devices spans various sectors, ranging from agriculture and healthcare to transportation and manufacturing. A key challenge in this expansive landscape is ensuring connectivity and efficient communication, particularly in remote or isolated areas where traditional networks may be unreliable or absent. M2M satellite communication addresses this challenge by providing a reliable and ubiquitous communication infrastructure that enables seamless connectivity for IoT devices irrespective of their geographical location.

Restraint: Cost constraints hinder the widespread adoption of M2M satellite communication

The implementation and operation of satellite communication infrastructure involve substantial financial investments, encompassing satellite deployment, ground station construction, and ongoing maintenance. These costs can be particularly burdensome for smaller enterprises or organizations operating within budget constraints, limiting their ability to adopt M2M satellite communication solutions. Additionally, the expenses associated with satellite communication services, including bandwidth and subscription fees, can contribute to the overall economic challenge. The high initial investment and ongoing operational costs may deter some businesses from embracing M2M satellite communication, hindering its broader adoption and potentially limiting the accessibility of this technology for industries seeking cost-effective connectivity solutions.

Opportunity: To enhance global connectivity in remote areas

In regions where traditional terrestrial networks struggle to establish a reliable presence, M2M satellite communication emerges as a critical solution. Industries operating in remote and underserved areas, such as agriculture, mining, and maritime, stand to benefit significantly. M2M satellite communication enables these sectors to establish seamless and robust connections, facilitating real-time monitoring and management of assets in locations where network infrastructure is either limited or entirely absent. This opportunity is particularly crucial for applications like precision agriculture, where data-driven insights and control mechanisms are essential for optimizing crop yields.

Challenge: Interference and signal quality issues pose a challenge for M2M satellite communication

The transmission of data over satellite links is susceptible to various external factors that can compromise the integrity of the communication channel. Atmospheric conditions, electromagnetic interference, and competing signals can collectively contribute to signal degradation, impacting the reliability and accuracy of data transfer. In regions with challenging weather patterns or high levels of radio frequency interference, the potential for signal quality deterioration is amplified, posing a significant hurdle for M2M satellite communication systems. Maintaining consistent and high-quality signals is paramount, especially in applications where precision, reliability, and real-time responsiveness are critical, such as in remote sensing, telemetry, and other mission-critical operations.

M2M satellite communication Market Ecosystem

The M2M satellite communication market ecosystem is a dynamic landscape consisting of various key components, each playing a distinct role in advancing the field of M2M satellite communication. These components include M2M satellite communication hardware providers, software providers, service providers, and regulatory bodies.

By Vertical, the BFSI segment accounts for the largest market size during the forecast period.

The integration of satellite communication technology into vehicles has become increasingly prevalent, offering solutions that enhance safety, efficiency, and overall connectivity. In the automotive industry, M2M satellite communication is instrumental in providing real-time navigation, vehicle tracking, and telematics services. Fleet management systems leverage satellite connectivity for precise location tracking, route optimization, and monitoring of vehicle health. In the transportation sector, M2M satellite communication facilitates seamless communication between different modes of transport, improving overall logistics and supply chain management. Satellite communication supports connectivity in maritime and aviation industries, where terrestrial networks may be unreliable or unavailable over vast expanses of open water or airspace.

By Technology, the Very Small Aperture Terminals (VSATs) segment is projected to grow at the highest CAGR during the forecast period.

Very Small Aperture Terminals (VSATs) offer a reliable and scalable solution for connecting remote devices and locations. VSATs are satellite communication systems that utilize small antennas, typically ranging from 0.75 to 2.4 meters in diameter, to establish two-way satellite communication. In the M2M context, VSATs provide a crucial link between remote sensors, machines, or devices and centralized servers, enabling seamless data transmission. VSAT networks are highly adaptable, and their ability to provide reliable connectivity over large geographic areas makes them suitable for diverse M2M applications, including monitoring and control systems in agriculture, energy, and transportation. Additionally, VSAT systems support bidirectional communication, allowing M2M devices to both transmit data to the central server and receive commands or updates. This bidirectional capability is essential for applications like remote asset tracking, where real-time interactions and control are crucial.

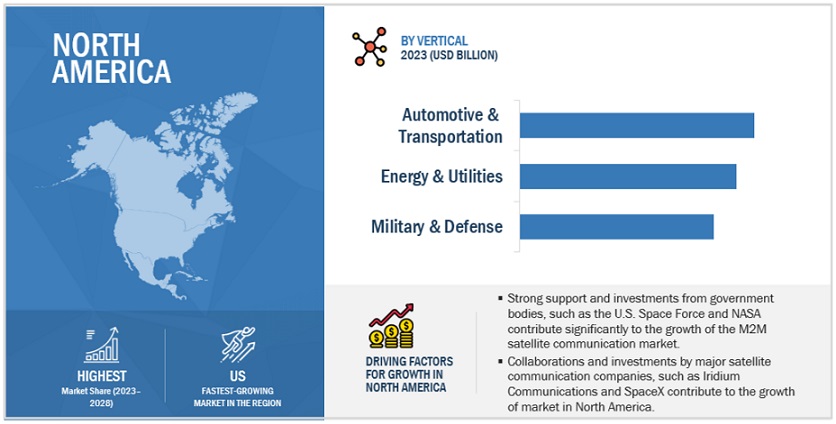

North America to account for the largest market size during the forecast period.

North America has witnessed significant growth in recent years, driven by the increasing adoption of IoT devices across various industries. The growing demand for real-time data transmission and communication in sectors such as agriculture, transportation, energy, and environmental monitoring. Several companies in North America are actively contributing to the development of M2M satellite communication solutions. Companies like Iridium Communications and Globalstar have expanded their satellite networks, offering enhanced coverage and reliability for M2M applications. Moreover, partnerships between satellite communication providers and IoT platform developers have facilitated the seamless integration of satellite connectivity into IoT ecosystems.

Key Market Players

The major M2M satellite communication hardware, software and service providers include Marlink (France), Viasat (US), Thales (France), ORBCOMM (US), Iridium Communications (US), Globalstar (US), Orange (France), EchoStar (US), Intelsat (US), Rogers Communications (Canada), SES (Luxembourg), Gilat (Israel), Telia (Sweden), Kore Wireless (US), Honeywell (US), Qualcomm (US), Telesat (Canada), Wireless Logic (England), Outerlink Global Solutions (US), Nupoint Systems (Canada), Businesscom Networks (US), Semtech (US), Yahsat (UAE). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the M2M satellite communication market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Billion |

|

Segments Covered |

Offering (Hardware, Software Type & Services) Technology (Satellite Constellation [Low-Earth Orbit, Medium-Earth Orbit, Geostationary-Earth Orbit]) Data Transmission, VSAT, AIS, Networking, Satellite Communication Protocols), Vertical, and Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America Middle East & Africa |

|

Companies covered |

Marlink (France), Viasat (US), Thales (France), ORBCOMM (US), Iridium Communications (US), Globalstar (US), Orange (France), EchoStar (US), Intelsat (US), Rogers Communications (Canada), SES (Luxembourg), Gilat (Israel), Telia (Sweden), Kore Wireless (US), Honeywell (US), Qualcomm (US), Telesat (Canada), Wireless Logic (England), Outerlink Global Solutions (US), Nupoint Systems (Canada), Businesscom Networks (US), Semtech (US), Yahsat (UAE). |

This research report categorizes the M2M satellite communication market based on offering (hardware, software type and services) technology, vertical, and region.

Offering:

-

Hardware

- Antennas

- Terminals

- Modems

- Other Hardware

-

Software Type

- Connectivity Management Platform

- Data Processing and Analytics Software

- Security and Encryption Software

- Remote Monitoring and Control Software

- Geospatial Analysis and Mapping Software

- Other Software Type

-

Services

- Data Services

- Voice Services

- Satellite Services

- Security Services

- Business Services

By Technology:

-

Satellite Constellation

- Low-Earth Orbit

- Medium-Earth Orbit

- Geostationary-Earth Orbit

- Data Transmission

- VSAT

- AIS

- Networking

- Satellite Communication Protocols

By Vertical:

- Mining

- Agriculture

- Energy and Utilities

-

Government and Public Sector

- Environmental Monitoring

- Disaster Management

- Smart Cities Management

- Automotive and Transportation

- Maritime

- Retail

- Military and Defense

- Manufacturing

- Healthcare

- Other Verticals (Education, IT/ITeS, Real Estate, Logistics and Construction)

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments:

- In November 2023, SWISSto12 and Thales collaborated to advance the development of Active Electronically Steerable Antennas (AESAs) catering to the Satcom-on-the-move market, particularly for airborne, land, and maritime vehicles. This collaboration involves integrating SWISSto12's innovative 3D-printed antenna apertures with Thales' cutting-edge solid-state beamformers.

- In October 2023, Viasat introduced upgraded business aviation in-flight broadband service options that align its Viasat Ka-band solution with the Jet ConneX solution from its recently acquired Inmarsat business. This integration aims to provide enhanced in-flight connectivity services for business aviation customers, combining the strengths of both Viasat and Inmarsat offerings to deliver a comprehensive and improved in-flight broadband experience.

- In July 2023, Thales entered exclusive negotiations to acquire Cobham Aerospace Communications for USD 1.1 billion. This move aligns with Thales' strategy to enhance its Avionics portfolio by gaining a leading position in safety cockpit communications.

- In May 2023, Viasat announced the acquisition of Inmarsat, marking a significant step that amplifies the company's scale and capabilities. This merger strengthens their position within the dynamic and competitive satellite communications industry, enabling them to leverage expanded scale and scope to drive further growth and innovation.

- In February 2023, Gilat unveiled the SkyEdge IV Taurus-M, a new satellite modem product tailored for military and government markets. This modem, backward compatible with SkyEdge II-c, safeguards the investments of customers who have previously embraced Gilat’s leading satellite network platform.

Frequently Asked Questions (FAQ):

What is M2M satellite communication?

M2M satellite communication involves the exchange of data between machines or devices through satellites. It enables real-time connectivity for remote and mobile applications, facilitating seamless communication in areas with limited terrestrial infrastructure.

Which region is expected to hold the highest share in the M2M satellite communication market?

North America dominates the M2M satellite communication market, holding the highest share due to extensive technological infrastructure, robust government initiatives, and widespread adoption across diverse industries, including defense, agriculture, and IoT applications. Key players like Iridium Communications and Globalstar contribute to the region's leadership with their advanced satellite networks and services.

Which are key end users adopting M2M satellite communication solutions and services?

Key end users adopting M2M satellite communication solutions and services include Mining, Agriculture, Energy & Utilities, Government & Public Sector (Environmental Monitoring, Disaster Management, Smart Cities Management), Automotive and Transportation, Maritime, Retail, Military and Defense, Manufacturing, Healthcare, Other Verticals (Education, IT/ITeS, Real Estate, Logistics and Construction)

Which are the key drivers supporting the market growth for M2M satellite communication?

The key drivers supporting the market growth for M2M satellite communication include the rising need for enriched data communication, the surge in IoT proliferation and The escalating demand for monitoring and remote management of connected devices.

Who are the key vendors in the market for M2M satellite communication?

The key vendors in the global M2M satellite communication market include Marlink (France), Viasat (US), Thales (France), ORBCOMM (US), Iridium Communications (US), Globalstar (US), Orange (France), EchoStar (US), Intelsat (US), Rogers Communications (Canada), SES (Luxembourg), Gilat (Israel), Telia (Sweden), Kore Wireless (US), Honeywell (US), Qualcomm (US), Telesat (Canada), Wireless Logic (England), Outerlink Global Solutions (US), Nupoint Systems (Canada), Businesscom Networks (US), Semtech (US), Yahsat (UAE). .

To know about the assumptions considered for the study, download the pdf brochure

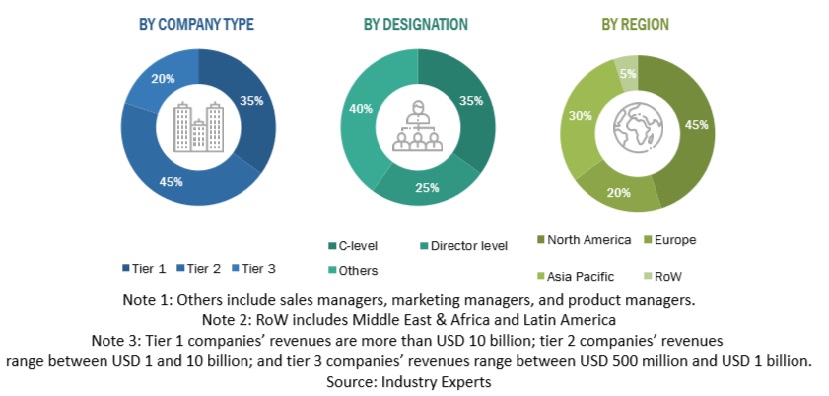

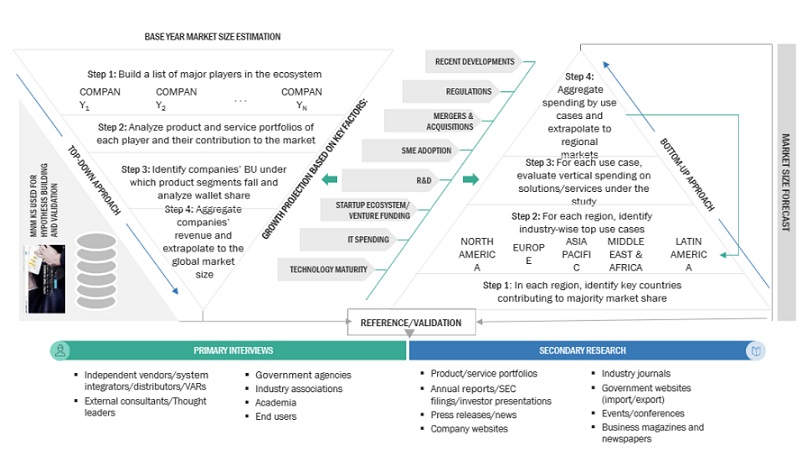

The research study for the M2M satellite communication market involved extensive secondary sources, directories, and several journals. Primary sources were mainly industry experts from the core and related industries, preferred M2M satellite communication software providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering M2M satellite communication hardware, software and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor websites. Additionally, M2M satellite communication spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on hardware, software, services, market classification, and segmentation according to offerings of major players, industry trends related to hardware, software, services, technology, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and M2M satellite communication expertise; related key executives from M2M satellite communication solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using M2M satellite communication, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of M2M satellite communication hardware, software and services, which would impact the overall M2M satellite communication market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the M2M satellite communication market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of solutions and services.

Market Size Estimation Methodology-Top-down Approach

In the top-down approach, an exhaustive list of all the vendors offering hardware, software type and services in the M2M satellite communication market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of hardware, software and services, technology, verticals, and regions. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology-Bottom-up Approach

In the bottom-up approach, the adoption rate of M2M satellite communication hardware, software and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of M2M satellite communication hardware, software and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the M2M satellite communication market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major M2M satellite communication solution providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall M2M satellite communication market size and segments’ size were determined and confirmed using the study.

Top-down and Bottom-up Approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Machine-to-machine (M2M) satellite communication refers to the exchange of data between devices or systems through satellites, enabling remote and real-time communication. This technology enables seamless connectivity for applications such as IoT, asset tracking, and monitoring in areas with limited terrestrial infrastructure.

Stakeholders

- Satellite Operators

- Satellite Service Providers

- Telecom Network Operators (TNOs)

- Terrestrial-based M2M Service Providers

- Satellite Equipment Manufacturers and Integrators

- M2M satellite communication vendors

- Business analysts

- Technology providers

- Internet Service Providers

- Value Added Service (VAS) Providers/Manufacturers

Report Objectives

- To define, describe, and predict the M2M satellite communication market by offering (hardware, software type and services), technology, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the market

- To analyze the impact of recession across all the regions across the M2M satellite communication market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American M2M satellite communication Market

- Further breakup of the European Market

- Further breakup of the Asia Pacific Market

- Further breakup of the Middle East & Africa Market

- Further breakup of the Latin American M2M satellite communication Market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in M2M Satellite Communication Market