Machine-to-machine (M2M) Connections Market by Technology (Wired, Wireless), End-user Industry (Automotive & Transportation, Utilities, Security & Surveillance, Healthcare, Retail, Consumer Electronics) and Region - Global Forecast to 2029

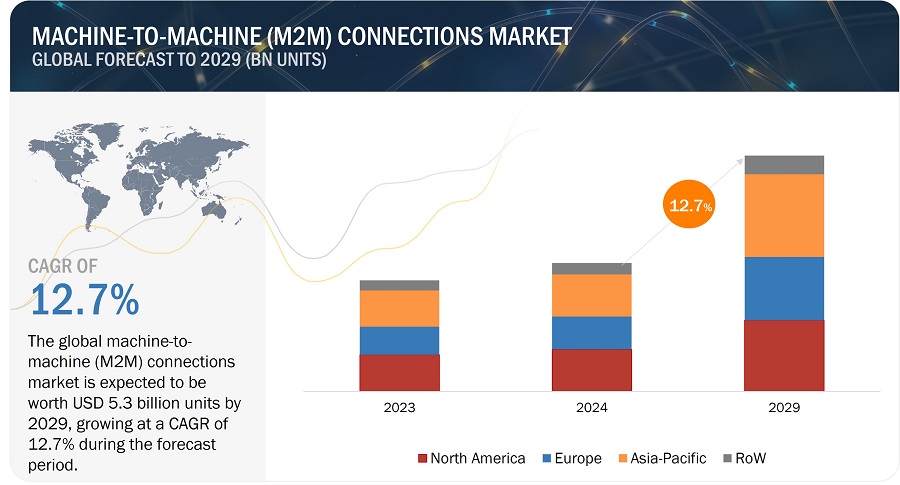

[226 Pages Report] According to MarketsandMarkets, the machine-to-machine (M2M) connections market is projected to grow from USD 2.9 billion units in 2024 to USD 5.3 billion units by 2029, registering a CAGR of 12.7% during the forecast period. The growing popularity of smart cities and connected cars, the development of wireless technologies such as 5G, NB-IoT, and LTE-M, and increasing penetration of machine-to-machine (M2M) connections in advanced & portable healthcare equipment are expected to propel the machine-to-machine (M2M) connections market in the next five years. However, a lack of standardization in connectivity protocols will likely pose challenges for industry players.

The objective of the report is to define, describe, and forecast the machine-to-machine (M2M) connections market based on technology, end-user industry, and region.

Machine-to-machine (M2M) Connections Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Machine-to-machine (M2M) connections market dynamics.

Driver: Growing popularity of smart cities and connected cars

The IoT infrastructure deployed by smart cities is required to handle devices and objects connected via different connectivity methods. Many cities are now seeking to expand the use of IoT to improve services such as waste management, water management and quality, and energy consumption in public buildings. The rising adoption of smart technologies in smart connected solutions has created new business opportunities for cellular M2M connections. IoT offers smart productive features and enhanced efficiency by providing connectivity among various household things using the Internet. Telecom service providers offer reliable connectivity solutions to various IoT applications. Cellular M2M communications play a critical role in the adoption and growth of distribution automation applications. It provides a reliable, easily available, and cost-effective network solution that enables enterprises to effectively support distribution automation applications. With improved penetration of cellular technologies such as 2G, 3 G, 4G/LTE, and 5G in technologically advancing countries, there is an increased need among end users to deploy distributed applications for improved load balancing, flexible pricing, and remote management. The adoption of autonomous driving is likely to increase in the coming years as driver assistance systems, such as adaptive cruise control, lane keep assist and parking assist, are likely to become more sophisticated. Many technology giants such as Google (US) and major car manufacturers such as Daimler (Germany), BMW (Germany), Volkswagen (Germany), Audi (Germany), Tesla (US), and Volvo (Sweden) are expected to launch fully automated cars by 2025. Therefore, the growth of the said market would further contribute to the growth opportunity for M2M technology-based solutions which form an integral component of self-driving cars.

Restraint: Lack of standardization in connectivity protocols

The growth of the M2M connections market largely depends on the development of specialized solutions for different application clusters such as security, transportation, healthcare, and automotive. These solutions need customizable hardware and software, which, in turn, entails higher costs for development, operation, and support. Due to the lack of standards, there is a demand for highly customer-specific applications that involve labor-intensive development by highly specialized integrators and developers. The low number of specialized developers and the high cost of employing them restrict the growth of this market.

Opportunities: Emergence of M2M devices in Telemedicine

Healthcare's M2M adoption, sometimes called telehealth/telemedicine, is the use of medical devices and communication technology together to monitor diseases and symptoms. Telemedicine in the M2M economy also enables continuous and remote patient monitoring, leading to better healthcare outcomes. Wearable devices equipped with M2M technology, such as smartwatches or fitness trackers, can collect real-time data on vital signs, sleep patterns, and physical activity. This information can be transmitted to healthcare providers, who can then analyze it to detect any abnormalities or trends. By monitoring patients remotely, healthcare professionals can identify potential issues early on and intervene proactively, ultimately improving patient care. The adoption of modern technologies, like telemedicine apps, virtual hospitals, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), is growing quickly. Applications built with machine learning algorithms can aid in the identification of rare diseases, cancer, and other chronic illnesses. Moreover, growing consumer demand for technologically sophisticated technologies that enable remote patient monitoring would support market expansion. For example, AMC Health and GE Healthcare inked a cooperative agreement in October 2022 to provide virtual care in home care settings.

Challenges: Privacy and security

M2M can be defined as a subset of Internet of Things (IoT), and it faces challenges similar to the latter. The privacy and security of data is one of the key challenges that IoT/M2M may face in the near future. As the number of M2M connections increases, the data generated by them would also increase, and organizations handling this data could gain more knowledge about the market position of different companies spread across end-user industries. Organizations handling the information generated by the M2M connections can misuse the data to determine respective companies’ business strategies and production schedules, or can hack and take control of the machines and shut them down. From an industry standpoint, this is a cause for major concern.

Market Map/Ecosystem

Machine-to-machine (M2M) connections Market: Key Trends.

The prominent players in the machine-to-machine (M2M) connections industry are AT&T Intellectual Property (US), Cisco Systems, Inc. (US), Huawei Technologies (China), NXP Semiconductors N.V. (Netherlands), Texas Instruments Incorporated (US), Intel Corporation (US), China Mobile International Limited (China), Thales (France), Vodafone Group Plc (UK), Murata Manufacturing Co., Ltd. (Japan), and U-Blox Holding AG (Switzerland), and among others. These companies boast mixing trends with a comprehensive product portfolio and strong geographic footprint.

Non-cellular wireless technology machine-to-machine (M2M) connections are expected to grow at the highest CARG in the machine-to-machine (M2M) connections market during the forecast period.

The non-cellular machine-to-machine (M2M) connections segment is expected to account for a significant share and grow at the highest CAGR during the forecast period. Non-cellular M2M connection technology encompasses a diverse range of solutions for machine-to-machine communication without relying on traditional cellular networks. These technologies offer alternative ways for devices to connect and exchange data, catering to various needs and application requirements. The cellular technologies covered in this section include Sigfox and LoRa.

The healthcare segment is expected to hold the second highest CAGR of the machine-to-machine (M2M) connections market during the forecast period.

The healthcare segment is expected to witness for the second highest CAGR during the forecast period. The rising use of M2M (Machine-to-Machine) devices in telemedicine is creating exciting opportunities for the M2M connections market. This trend involves seamless communication between medical devices and healthcare systems, enabling remote monitoring, data collection, and even automated interventions, which benefit both patients and healthcare providers. The adoption of modern technologies, like telemedicine apps, virtual hospitals, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), is growing quickly.

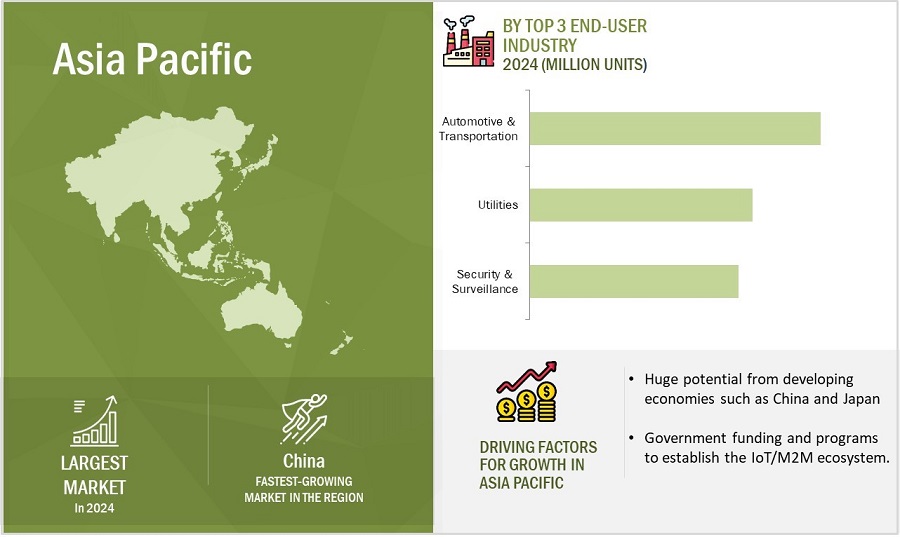

The machine-to-machine (M2M) connections market is expected to have a high market share in China from the Asia Pacific region during the forecast period.

The Asia Pacific region continues to be a significant market for machine-to-machine (M2M) connections. The adoption of machine-to-machine (M2M) connection products and solutions has been more rapid in Asia Pacific than in other regions. A major industrial center, the Asia Pacific area is also a developing and significant market for a number of other industries. Some of the major factors supporting the growth of the M2M connections market in the Asia Pacific are the expanding Internet's penetration into both commercial and residential areas, as well as the region's large consumer base, rising disposable income, and developing IT infrastructure. It is anticipated that the Internet of Things is currently in its boom phase in terms of commercialization and convergence across all industries, particularly in Asia Pacific's growing economies. Large-scale investments and commercial expansion prospects are increasingly being drawn to the region from around the world. Because of the region's high levels of electronic device manufacture and consumption, Asia Pacific is predicted to experience significant growth. The adoption of new technologies and improvements in businesses across many industries is changing dynamically.

China was at the forefront of the M2M connections market in Asia Pacific in 2023 and is likely to continue its dominance during the forecast period, in terms of market size. The country’s aggressively developing economy contributes to the growth of the M2M connections market. Growing demand from the automotive & transportation sector will be one of the key drivers for the growth of the market in China. Moreover, increasing product development by various companies is also driving the market growth. In 2019, Sunsea AIoT partnered with China Telecom to install over 500,000 NB-IoT sensors for monitors, five hydrant water pressure sensors, and gas and smoke detectors.

Machine-to-machine (M2M) Connections Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the machine-to-machine (M2M) connections companies include AT&T Intellectual Property (US), Cisco Systems, Inc. (US), Huawei Technologies (China), NXP Semiconductors N.V. (Netherlands), Texas Instruments Incorporated (US), Intel (US), China Mobile International Limited (China), Thales (France), Vodafone Group Plc (UK), Murata Manufacturing Co., Ltd. (Japan), and U-Blox Holding AG (Switzerland), and among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Estimated Value |

USD 2.9 billion units |

|

Expected Value |

USD 5.3 billion units |

|

Growth Rate |

CAGR of 12.7% |

|

Market Size Available for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Units |

Value (USD Million/USD Billion), Volume (Million Units) |

|

Segments Covered |

Technology, End-user Industry, and Region |

|

Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

AT&T Intellectual Property (US), Cisco Systems, Inc. (US), Huawei Technologies (China), NXP Semiconductors N.V. (Netherlands), Texas Instruments Incorporated (US), Intel Corporation (US), China Mobile International Limited (China), Thales (France), Vodafone Group Plc (UK), Murata Manufacturing Co., Ltd. (Japan), U-Blox Holding AG (Switzerland), and among others. |

Machine-to-machine (M2M) Connections Market Highlights

This report categorizes the machine-to-machine (M2M) connections market based on technology, end-user industry, and region.

|

Segment |

Subsegment |

|

By Technology |

|

|

By End-User Industry |

|

|

By Region |

|

Recent Developments

- In January 2024, Intel Corporation (US) set up an independent company offering enterprises a full-stack, vertically-optimized and secure generative artificial intelligence (genAI) software platform. With help from investment firm DigitalBridge, Intel has formed Articul8 to deliver AI capabilities that keep user data, training and inference within the enterprise security perimeter. The platform also provides the choice of cloud, on-premises or hybrid deployment.

- In August 2023, Huawei and Ericsson signed a long-term cross-licensing agreement that includes patents relating to a broad range of technology areas, including those covering 3G, 4G, and 5G cellular networks.

- In April 2023, Texas Instruments Incorporated introduced a new SimpleLink family of Wi-Fi 6 companion integrated circuits (ICs) to help designers implement highly reliable, secure and efficient Wi-Fi connections at an affordable price for applications that operate in high-density or high-temperature environments up to 105ºC.

Frequently Asked Questions(FAQs):

Which are the major companies in the machine-to-machine (M2M) connections market? What are their primary strategies to strengthen their market presence?

AT&T Intellectual Property (US), Cisco Systems, Inc. (US), Huawei Technologies (China), China Mobile International Limited (China), and Vodafone Group Plc (UK) are among the leading players in the market. These companies have adopted organic and inorganic growth strategies such as product launches, partnerships and acquisitions, to gain a competitive advantage in the market.

Which is the potential market for the end-user industry?

Automotive & Transportation and healthcare are end-user industries with high growth opportunities owing to advancements in technology.

What are the opportunities for new market entrants?

Factors such as the emergence of M2M devices in telemedicine and growing trend of cloud platforms and big data analytics are creating opportunities for the players in the market.

Which product type is expected to drive market growth in the next six years?

Wireless machine-to-machine (M2M) connections are expected to remain the major technology driving machine-to-machine (M2M) connections demand.

What are the major strategies adopted by machine-to-machine (M2M) connections companies?

The machine-to-machine (M2M) connections companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the machine-to-machine (M2M) connections market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

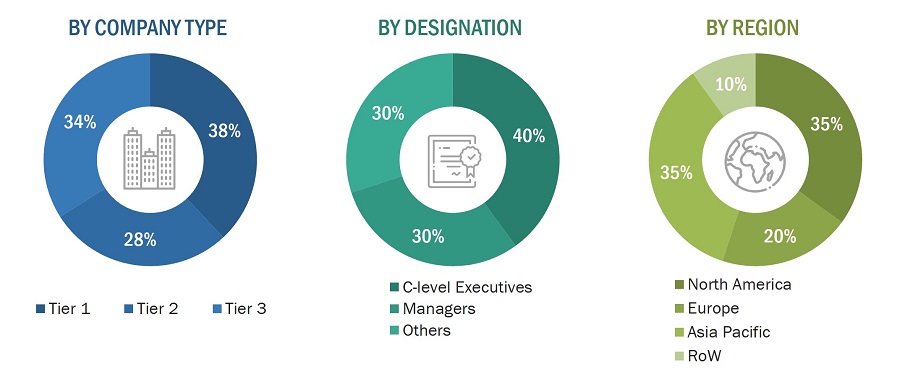

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the machine-to-machine (M2M) connections market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the machine-to-machine (M2M) connections market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the machine-to-machine (M2M) connections market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers; machine-to-machine (M2M) connections products-related journals; certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the machine-to-machine (M2M) connections market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the machine-to-machine (M2M) connections market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Machine-to-machine (M2M) connections market: Bottom-up Approach

Machine-to-machine (M2M) connections market: Top-down Approach

Data Triangulation

After arriving at the overall size of the machine-to-machine (M2M) connections market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Market Definition

The definition of Machine-to-Machine (M2M) connections for this report is as follows: “the ability of assets, devices, and machines to remotely operate, perform actions, and exchange information by communicating with each other, through wired or wireless mediums, and without human assistance.” M2M can also be defined as “Technologies that allow two or more machines of the same type other than smartphones, tablets, and wearables to communicate with each other through wired or wireless connectivity.”

Machine-to-machine (M2M) refers to all forms of technologies that enable communication between two or more machines of the same type (other than smartphones, tablets, and wearables) through wired or wireless connections. The growing connectivity among edge devices such as smart appliances, medical devices, and white goods has transformed the way in which technology affects humans in almost every sphere of activity. Since the advent of network automation and cellular communication, M2M has been used in telemetry, automation, and supervisory control and data acquisition (SCADA).

Key Stakeholders

- Raw material and manufacturing equipment suppliers

- Semiconductor wafer vendors

- Telecom operators

- Application providers

- Foundry players

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODM) and OEM technology solution providers

- Distributors and retailers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

Report Objectives

- To define, describe, and forecast the M2M connections market based on technology, end-user industry, and region.

-

To forecast the sizes of various segments with respect to four major regions—

North America, Europe, Asia Pacific, and Rest of the World (RoW) - To provide a detailed analysis of the M2M connections supply chain.

- To analyze the impact of the recession on M2M connections market

- To strategically analyze the micromarkets1 with respect to individual growth trends and prospects and their contributions to the total market

- To analyze competitive developments such as expansions, agreements, partnerships, acquisitions, product developments, and research and development (R&D) in the M2M connections market

- To analyze the opportunities for market players and provide details of the competitive landscape of the market.

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios.

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape of the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product analysis

- Detailed analysis and profiling of additional market players

The following customization options are available for the report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Growth opportunities and latent adjacency in Machine-to-machine (M2M) Connections Market