Machine Vision Market by Component (Hardware (Camera, Frame Grabber, Optics, Processor) and Software (Deep Learning and Application Specific)), Product (PC Systems and Smart Camera Systems), Application, Vertical, and Geography - Global Forecast to 2022

The overall machine vision market is expected to grow from USD 8.12 Billion in 2015 to USD 14.43 Billion by 2022, at a CAGR of 8.15% between 2016 and 2022. This report provides the market size and future growth potential of the machine vision market across different segments such as component, product, application, vertical, and geography. The study identifies and analyses the market dynamics such as drivers, restraints, opportunities, and industry-specific challenges for the market. It also profiles the key players operating in the studied market. Increasing need for quality inspection and automation is expected to propel the growth of the machine vision market. The base year considered for the study is 2015, and the market size forecast is provided for the period between 2016 and 2022.

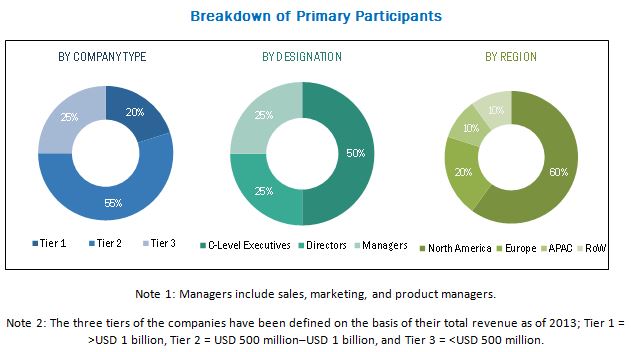

The research methodology used to estimate and forecast the machine vision market begins with capturing data on key vendor revenues through secondary research. Some of the secondary sources include associations such as European Machine Vision Association, Japan Industrial Imaging Association, and Automated Imaging Association. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the size of the overall studied market from the revenue of the key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments that have been verified through primary research by conducting extensive interviews with key experts such as CEOs, VPs, and directors. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of primary respondents is depicted in the below figure.

To know about the assumptions considered for the study, download the pdf brochure

The machine vision ecosystem includes research and development (R&D), followed by manufacturers and system integrators such as Cognex Corporation (U.S.), Basler AG (Germany), Omron Corporation (Japan), National Instruments Corporation (U.S.), Keyence Corporation (Japan), Sony Corporation (Japan), Teledyne Technologies, Inc. (U.S.), Texas Instruments, Inc. (U.S.), Allied Vision Technologies GmbH (Germany), Intel Corporation (U.S.), Baumer Optronic GmbH (Germany), and JAI A/S (Denmark). These companies further sell these systems to end users and cater to their unique business requirements.

Key Target Audience

- Semiconductor product designers and fabricators

- Application providers

- Professional service/solution providers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

The machine vision market has been covered in detail in this report. To provide a holistic picture, the current market demand and forecasts have also been included in the report. The machine vision market has been segmented as follows:

By Component:

- Hardware

- Camera

- Sensor Type (CMOS and CCD)

- Interface Standards (Camera Link, GigE Vision, USB 3.0, CoaXPress, and Others)

- Frame Rate (Area Scan and Line Scan)

- Format (25125 fps, >125 fps, <25 fps)

- Processor (FPGA, DSP, Microcontroller, and Microprocessor)

- Optics

- Frame Grabber

- LED Lighting

- Others

- Camera

- Software

- Deep Learning

- Application Specific

By Product:

- PC-Based Machine Vision System

- Smart Camera-Based Machine Vision System

By Application:

- Quality Control and Inspection

- Positioning and Guidance

- Measurement

- Identification

- Recognition

By Vertical:

- Industrial

- Automotive

- Consumer Electronics

- Electronics & Semiconductor

- Printing

- Metals

- Wood & Paper

- Food & Packaging

- Rubber & Plastics

- Pharmaceutical

- Glass

- Machinery

- Solar Panel Manufacturing

- Nonindustrial

- Healthcare & Medical Imaging

- Postal & Logistics

- Intelligent Transportation System (ITS)

- Security & Surveillance

- Agriculture

- Consumer Electronics

- Autonomous Cars

By Geography:

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

- Product Matrix which gives a detailed comparison of product portfolio of each company

- Company information: Detailed analysis and profiling of additional market players (up to five)

According to MarketsandMarkets forecast, the overall machine vision market was valued at USD 8.12 Billion in 2015 and is expected to reach USD 14.43 Billion by 2022, growing at a CAGR of 8.15% between 2016 and 2022. The growth of this market is driven by the increasing need for quality inspection and automation across industry verticals, surge in demand for vision-guided robotic systems in automotive, pharmaceutical, food and packaging, and industrial sectors, and growing demand for application-specific machine vision systems.

This report covers the machine vision market based on component, product, application, vertical, and geography. The hardware component held the largest size of the studied market in 2015. Rapid changes in terms of manufacturing technology, innovation, and technical advancements in automotive and pharmaceutical industries are expected to drive the machine vision market. Under the hardware component, the camera segment held the largest size of the machine vision market and the market for the same is expected to grow at the highest rate during the forecast period. In future, the camera segment is likely to undergo more advancement with the introduction of 3D machine vision concept and is expected to bring new growth avenues for the studied market.

With regard to the application segment, the market for the identification application is expected to grow at the highest rate during the forecast period. Machine vision systems are widely used for identifying the labels, barcodes, and texts to help in the entire automatic operation of packaging. It is mostly used in healthcare and consumer packaged goods sectors to resist the counterfeit products. This system makes the process fast and eliminates duplicate packets. It is also used for security purpose such as camera surveillance, traffic monitoring, number plate recognition, lane identification, and other intelligent transportation system.

In terms of the product segment, PC-based systems held the largest market size during the forecast period. The rise in wages of labor in China and developing countries, growing number of regulatory mandates in manufacturing industries, and growing demand for application-specific machine vision systems are creating a huge demand for machine vision systems across the world.

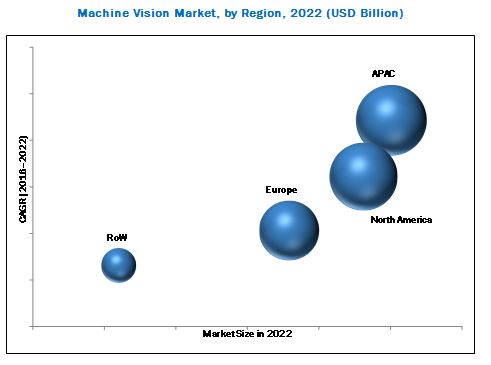

APAC held the largest share of the machine vision market in 2015. APAC is expected to provide ample of opportunities for machine vision systems since it is considered as the manufacturing hub of the world. China has been a potential market for all the emerging technologies including machine vision. Its massive manufacturing industries have contributed to the growth and prosperity of the country. Increasing manufacturing facilities and growing industrial base of China are the factors driving the machine vision market in APAC. Owing to the recent developments and increased expenditure on vision-related R&D activities, APAC is expected to be the fastest-growing market.

The major challenges for the companies in the market are complexity in integrating machine vision systems and lack of user awareness about rapidly changing machine vision technology. The major vendors in the machine vision market include Cognex Corporation (U.S.), Basler AG (Germany), Omron Corporation (Japan), National Instruments Corporation (U.S.), Keyence Corporation (Japan), Sony Corporation (Japan), Teledyne Technologies, Inc. (U.S.), Texas Instruments, Inc. (U.S.), Allied Vision Technologies GmbH (Germany), Intel Corporation (U.S.), Baumer Optronic GmbH (Germany), and JAI A/S (Denmark). These players adopted various strategies such as new product developments, mergers, partnerships, collaborations, and expansions to cater to the customer demands.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary and Primary Research

2.1.1.1 Key Industry Insights

2.1.2 Secondary Data

2.1.2.1 Major Secondary Sources

2.1.2.2 Key Data From Secondary Sources

2.1.3 Primary Data

2.1.3.1 Primary Interviews With Experts

2.1.3.2 Breakdown of Primaries

2.1.3.3 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 37)

4.1 Machine Vision Market, 20202025 (USD Billion)

4.2 Machine Vision Market, By Product

4.3 Machine Vision Market, By Application

4.4 Machine Vision Market in APAC, By End-User Industry & Country, 2019

4.5 Machine Vision Market, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Need for Quality Inspection and Automation

5.2.1.2 Growing Demand for Vision-Guided Robotics Systems

5.2.1.3 Increasing Adoption of 3D Machine Vision Systems

5.2.1.4 Rising Need for Asics

5.2.1.5 Growing Need for Inspection in Food and Packaging Industries

5.2.2 Restraints

5.2.2.1 Varying End-User Requirements

5.2.2.2 Lack of Flexible Machine Vision Solutions

5.2.2.3 Lack of Skilled Professionals in Manufacturing Factories

5.2.3 Opportunities

5.2.3.1 Increasing Manufacturing of Hybrid and Electric Cars

5.2.3.2 Government Initiatives to Support Industrial Automation

5.2.3.3 Increasing Demand for Artificial Intelligence (AI) in Machine Vision

5.2.3.4 Government Initiatives to Boost AI-Related Technologies

5.2.3.5 Growing Adoption of Industry 4.0

5.2.3.6 Need for Miniaturization of Cameras and Processors

5.2.3.7 Increasing Wages Leading to Opportunities in Vision-Guided Industrial Robots and Other Automation Technologies in China

5.2.4 Challenges

5.2.4.1 Complexity in Integrating Machine Vision Systems

5.2.4.2 Lack of User Awareness About Rapidly Changing Machine Vision Technology

6 Machine Vision Market, By Deployment (Page No. - 54)

6.1 Introduction

6.2 General Machine Vision System

6.2.1 Machine Vision System Automatically Takes Pictures to Inspect Materials as They Come Down the Assembly Line

6.3 Robotic Cell

6.3.1 Robotic Cell is Growing at A Higher Rate Due to the Advent of Low-Cost Smart Cameras and Pattern-Matching Software

7 Machine Vision Market, By Component (Page No. - 61)

7.1 Introduction

7.2 Hardware

7.2.1 Cameras

7.2.1.1 Interface Standard

7.2.1.2 USB 2.0

7.2.1.3 USB 3.0

7.2.1.4 Camera Link

7.2.1.5 Camera Link HS

7.2.1.6 Gige

7.2.1.7 10 Gige & 25 Gige Bandwidth Over the Gige Vision Standard

7.2.1.8 Others (Coaxpress, EMVA-1288, Genicam)

7.2.1.9 Imaging Spectrum

7.2.1.10 Visible Light

7.2.1.11 Visible + IR/IR

7.2.1.12 By Frame Rates

7.2.1.12.1 <25 FPS

7.2.1.12.2 25125 FPS

7.2.1.12.3 More Than 125 FPS

7.2.1.13 By Formats

7.2.1.13.1 Line Scan

7.2.1.13.2 Area Scan

7.2.1.14 By Sensors

7.2.1.14.1 CMOS

7.2.1.15 CCD

7.2.2 Frame Grabbers

7.2.2.1 Frame Grabber is A Part of the Computer Vision System Wherein Video Frames are Captured in A Digital Form

7.2.3 Optics

7.2.3.1 The Camera Lens Captures Images on A Photographic Film Or Other Media That are Capable of Storing an Image Chemically Or Electronically

7.2.4 LED Lighting

7.2.4.1 LED Lighting Conditions Determine the Quality of Images Captured By A Camera, the Images Can Be Enhanced in Such A Way That Some Features Can Get Negated, While Others Get Enriched

7.2.5 Processors

7.2.5.1 FPGA

7.2.5.1.1 An FPGA Consists of an Array of Programmable Logic Blocks, Which Can Be Configured to Design Desired Logic

7.2.5.2 DSP

7.2.5.2.1 DSPS have A Specially Designed Architecture, Which Helps in Fetching Multiple Data and Instructions at the Same Time

7.2.5.3 Microcontroller and Microprocessor

7.2.5.3.1 Microcontrollers and Microprocessors are Specifically Designed for Real-Time Applications

7.2.5.4 VPU

7.2.5.4.1 VPU is A Type of AI Accelerator to Fulfill the Growing Need for Faster Processing Along With Compact Sizing for Data Generation in Vision-Related Applications

7.3 Software

7.3.1 Traditional Software

7.3.1.1 Traditional Software Provides A Framework to Develop and Deploy Machine Vision Applications

7.3.2 Deep Learning Software

7.3.2.1 Deep Learning Frameworks Offer Great Flexibility to Program Developers Owing to Their Ability to Design and Train Customized Deep Neural Networks

8 Machine Vision Market, By Product (Page No. - 75)

8.1 Introduction

8.2 PC-Based Machine Vision System

8.2.1 PC-Based Machine Vision Systems have the Ability to Compensate for Unexpected Variations in Certain Tasks

8.3 Smart Camera-Based Machine Vision System

8.3.1 Smart Camera-Based Vision Systems Consist of an Embedded Controller With an Integrated Vision Software That is Directly Connected to One Or More Cameras, Which May Differ in Image Resolution, Size, and Imaging Rates

9 Industrial Machine Vision Market, By Application (Page No. - 91)

9.1 Introduction

9.2 Quality Assurance & Inspection

9.2.1 Manufacturers Use Machine Vision Systems for Visual Inspections That Require High Speed, High Magnification, Round-The-Clock Operation, and Repeatability of Measurements

9.3 Positioning & Guidance

9.3.1 Positioning Tools, Co-Ordinate Locators, Or Pattern Identifiers Recognize and Determine the Exact Position and Orientation of Parts and Objects

9.4 Measurement

9.4.1 Machine Vision Measurement Tools Combined With the Right Optics and Stable Lighting Provide Precision Repeatability to Ensure Manufacturing Accuracy

9.5 Identification

9.5.1 in Identification, Vision Systems are Used to Read Various Codes and Alphanumeric Characters, Such as Text and Numbers

9.6 Predictive Maintenance

9.6.1 Predictive Maintenance Can Be Very Useful When There is Machine Downtime.

10 Machine Vision Market, By End-User Industry (Page No. - 97)

10.1 Introduction

10.2 Automotive

10.2.1 Machine Vision Systems Offer High Accuracy in Critical Activities Such as Bin Picking and Positioning of Parts for Assembly

10.3 Electronics and Semiconductor

10.3.1 The Main Objectives of Deploying Machine Vision Systems are to Improve Product Quality and Increase Production Volume in A Short Period of Time.

10.4 Consumer Electronics

10.4.1 2D and 3D Machine Vision Systems are Emerging as Powerful Technologies for Electronics Assembly Applications

10.5 Glass

10.5.1 Modern Machine Vision Technology Improves Operational Efficiency, Traces Defects, Reduces Wastage, and Provides Detailed Statistical Information

10.6 Metals

10.6.1 The Machine Vision System Enhances Product Quality By 3D Inspection and Can Be Easily Incorporated Into Existing Manufacturing Systems to Enhance the Quality of the Overall Production Process

10.7 Wood and Paper

10.7.1 Machine Vision Systems Can Work Efficiently in Different Environmental Conditions, Such as Wood Dust, Heat, Smoke, Water, and Chemicals

10.8 Pharmaceutical

10.8.1 Machine Vision Systems are Used in Detecting Defects to Ensure Product Quality

10.9 Food and Packaging

10.9.1 Food

10.9.1.1 The Machine Vision Systems are Pre-Trained With the Required Algorithms, Which Help Them Understand Characteristics Such as Size, Stage of Growth, and Variety

10.9.2 Packaging

10.9.2.1 Machine Vision Helps in the Inspection of Packaging Processes and Reduction of Errors By Carrying Out Multiple Inspections at A Single Time

10.10 Rubber and Plastics

10.10.1 The Machine Vision Systems are Designed to Examine and Evaluate Parts and Determine If the Parts are Good, Bad, Or Undefined

10.11 Printing

10.11.1 Machine Vision Systems Used in Digital Printing Applications Check for Readable Texts and the Correct Number of Collated Pages Based on Individual Recipients as Well as to Ensure That the Right Pages are Used in the Right Envelopes

10.12 Machinery

10.12.1 Machine Vision Systems Help in Completing Processes Much Faster and Also Help in Detecting Defects and Validating Quality

10.13 Solar Panel Manufacturing

10.13.1 Industrial Machine Vision-Based Inspection is an Important Tool for Inspecting the Quality of Solar Panels

10.14 Textile

10.14.1 Machine Vision Systems Help Manufacturers Produce High-Quality Textiles While Minimizing the Costs and Maximizing the Profits

11 Geographic Analysis (Page No. - 116)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 The US Offers an Ideal Environment for Innovation, Which has Facilitated Massive Advancements in Machine Vision Technologies and Standards

11.2.2 Canada

11.2.2.1 Canada is One of the Leading Contributors to the Development of Machine Vision Technologies

11.2.3 Mexico

11.2.3.1 Mexico is Evolving as A Major Industrial Hub in North America

11.3 Europe

11.3.1 Germany

11.3.1.1 Increasing Demand for Robots in the Automotive and Electronics Industries is Driving the Growth of the Market for Camera-Based Machine Vision Systems in Germany

11.3.2 UK

11.3.2.1 Manufacturers Based in the UK are Progressively Considering Machine Vision Systems to Improve Their Product Quality and Minimize Waste

11.3.3 France

11.3.3.1 France Focuses Heavily on Its Aerospace & Defense Industry

11.3.4 Italy

11.3.4.1 The Market for Electric Vehicles in Italy is Emerging

11.3.5 Spain

11.3.5.1 The Growth of the Market in Spain is Driven By Industries Such as Consumer Electronics and Pharmaceuticals

11.3.6 Rest of Europe (RoE)

11.3.6.1 The Use of Camera-Based Machine Vision Systems is Expected to Increase in Europe as They are Widely Used in Oil Refineries for Quality Inspection as Well as Other Environmental Issues

11.4 Asia Pacific (APAC)

11.4.1 China

11.4.1.1 China is Known to have A Robust Export Industry, Which Manufactures Products for the Global Market, Including the Developed Countries in North America and Europe

11.4.2 Japan

11.4.2.1 Manufacturers in Japan have Been Early Adopters of Machine Vision Systems as They Consider This Technology to Be A Quality-Enhancing Element in Their Manufacturing Processes

11.4.3 South Korea

11.4.3.1 South Korea is Among the Leading Manufacturers of Robots in the World

11.4.4 India

11.4.4.1 The Manufacturing Sector in India is Expected to Grow Further in the Near Future, Which Will Require Automated Quality Check Mechanisms

11.4.5 Rest of APAC

11.4.5.1 The Use of Machine Vision Systems is Growing Owing to the Continuously Increasing Number of Applications in Various Industries

11.5 Rest of the World (RoW)

11.5.1 South America

11.5.1.1 South America has Significant Potential to Use Machine Vision Systems

11.5.2 Middle East

11.5.2.1 The Increase in Manufacturing Activities in Israel, the Middle East, and North Africa is A Key Growth Driver for This Market

11.5.3 Africa

11.5.3.1 Increasing Production in Food & Beverage, Automotive and Pharmaceutical Industries is Key Driver of Growth of Machine Vision Market

12 Competitive Landscape (Page No. - 134)

12.1 Overview

12.2 Market Rank Analysis

12.3 Competitive Situations and Trends

12.3.1 Product Launches

12.3.2 Others

12.4 Competitive Leadership Mapping

12.4.1 Visionary Leaders

12.4.2 Dynamic Differentiators

12.4.3 Innovators

12.4.4 Emerging Companies

12.5 Strength of Product Portfolio

12.6 Business Strategy Excellence (For All 25 Players)

13 Company Profile (Page No. - 143)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

13.1 Key Players

13.1.1 Cognex Corporation

13.1.2 Basler AG

13.1.3 Omron Corporation

13.1.4 Keyence Corporation

13.1.5 National Instruments

13.1.6 Sony Corporation

13.1.7 Teledyne Technologies

13.1.8 Texas Instruments

13.1.9 Intel Corporation

13.1.10 ISRA Vision AG

13.1.11 Sick AG

13.1.12 FLIR Systems

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

13.2 Right-To-Win

13.3 Startup Ecosystem

13.3.1 Ametek Inc.

13.3.2 Qualitas Technologies

13.3.3 Baumer Optronic

13.3.4 Algolux

13.3.5 Tordivel As

13.3.6 Inuitive

13.3.7 Mvtec Software GmbH

13.3.8 Jai A/S

13.3.9 Industrial Vision Systems LTD.

13.3.10 Allied Vision Technologies GmbH

14 Appendix (Page No. - 186)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Available Customizations

14.4 Related Report

14.5 Author Details

List of Tables (103 Tables)

Table 1 Machine Vision Market, By Deployment, 20172025 (USD Million)

Table 2 Machine Vision Market for Automotive Industry, By Deployment, 20172025 (USD Million)

Table 3 Machine Vision Market for Consumer Electronics Industry, By Deployment, 20172025 (USD Million)

Table 4 Machine Vision Market for Electronics and Semiconductor Industry, By Deployment, 20172025 (USD Million)

Table 5 Machine Vision Market for Printing Industry, By Deployment, 20172025 (USD Million)

Table 6 Machine Vision Market for Metals Industry, By Deployment, 20172025 (USD Million)

Table 7 Machine Vision Market for Wood and Paper Industry, By Deployment, 20172025 (USD Million)

Table 8 Machine Vision Market Food and Packaging Industry, By Deployment, 20172025 (USD Million)

Table 9 Machine Vision Market for Rubber & Plastics Industry, By Deployment, 20172025 (USD Million)

Table 10 Machine Vision Market for Pharmaceutical Industry, By Deployment, 20172025 (USD Million)

Table 11 Machine Vision Market for Glass Industry, By Deployment, 20172025 (USD Million)

Table 12 Machine Vision Market for Machinery Industry, By Deployment, 20172025 (USD Million)

Table 13 Machine Vision Market for Solar Panel Manufacturing Industry, By Deployment, 20172025 (USD Million)

Table 14 Machine Vision Market for Textile Industry, By Deployment, 20172025 (USD Million)

Table 15 Machine Vision Market, By Component, 20172025 (USD Million)

Table 16 Machine Vision Market, By Hardware, 20172025 (USD Million)

Table 17 Machine Vision Hardware Market for Cameras in Terms of Value and Volume, 20172025

Table 18 Machine Vision Hardware Market for Cameras, By Product, 20172025 (USD Million)

Table 19 Machine Vision Hardware Market for Cameras, By Interface Standard, 20172025 (USD Million)

Table 20 Machine Vision Hardware Market for Cameras, By Imaging Spectrum, 20172025 (USD Million)

Table 21 Machine Vision Hardware Market for Cameras, By Frame Rates, 20172025 (USD Million)

Table 22 Machine Vision Hardware Market for Cameras, By Formats, 20172025 (USD Million)

Table 23 Machine Vision Hardware Market for Cameras, By Sensors, 20172025 (USD Million)

Table 24 Machine Vision Hardware Market, By Processors, 20172025 (USD Million)

Table 25 Machine Vision Market, By Software, 20172025 (USD Million)

Table 26 Machine Vision Market, By Product, 20172025 (USD Million)

Table 27 PC-Based Machine Vision System Market, By Region, 20172025 (USD Million)

Table 28 PC-Based Machine Vision System Market, By Application, 20172025 (USD Million)

Table 29 PC-Based Machine Vision System Market, By End-User Industry, 20172025 (USD Million)

Table 30 PC-Based Machine Vision System Market for Automotive Industry, By Region, 20172025 (USD Million)

Table 31 PC-Based Machine Vision System Market for Consumer Electronics Industry, By Region, 20172025 (USD Million)

Table 32 PC-Based Machine Vision System Market for Electronics and Semiconductor Industry, By Region, 20172025 (USD Million)

Table 33 PC-Based Machine Vision System Market for Printing Industry, By Region, 20172025 (USD Million)

Table 34 PC-Based Machine Vision System Market for Metals Industry, By Region, 20172025 (USD Million)

Table 35 PC-Based Machine Vision System Market for Wood and Paper Industry, By Region, 20172025 (USD Million)

Table 36 PC-Based Machine Vision System Market for Food and Packaging Industry, By Region, 20172025 (USD Million)

Table 37 PC-Based Machine Vision System Market for Rubber and Plastics Industry, By Region, 20172025 (USD Million)

Table 38 PC-Based Machine Vision System Market for Pharmaceuticals Industry, By Region, 20172025 (USD Million)

Table 39 PC-Based Machine Vision System Market for Glass Industry, By Region, 20172025 (USD Million)

Table 40 PC-Based Machine Vision System Market for Machinery Industry, By Region, 20172025 (USD Million)

Table 41 PC-Based Machine Vision System Market for Solar Panel Manufacturing Industry, By Region, 20172025 (USD Million)

Table 42 PC-Based Machine Vision System Market for Textile Industry, By Region, 20172025 (USD Million)

Table 43 Smart Camera-Based Machine Vision System Market, By Region, 20172025 (USD Million)

Table 44 Smart Camera-Based Machine Vision System Market, By Application, 20172025 (USD Million)

Table 45 Smart Camera-Based Machine Vision System Market, By End-User Industry, 20172025 (USD Million)

Table 46 Smart Camera-Based Machine Vision System Market for Automotive Industry, By Region, 20172025 (USD Million)

Table 47 Smart Camera-Based Machine Vision System Market for Consumer Electronics Industry, By Region, 20172025 (USD Million)

Table 48 Smart Camera-Based Machine Vision System Market for Electronics and Semiconductor Industry, By Region, 20172025 (USD Million)

Table 49 Smart Camera-Based Machine Vision System Market for Printing Industry, By Region, 20172025 (USD Million)

Table 50 Smart Camera-Based Machine Vision System Market for Metals Industry, By Region, 20172025 (USD Million)

Table 51 Smart Camera-Based Machine Vision System Market for Wood and Paper Industry, By Region, 20172025 (USD Million)

Table 52 Smart Camera-Based Machine Vision System Market for Food and Packaging Industry, By Region, 20172025 (USD Million)

Table 53 Camera-Based Machine Vision System Market for Rubber and Plastics Industry, By Region, 20172025 (USD Million)

Table 54 Smart Camera-Based Machine Vision System Market for Pharmaceuticals Industry, By Region, 20172025 (USD Million)

Table 55 Smart Camera-Based Machine Vision System Market for Glass Industry, By Region, 20172025 (USD Million)

Table 56 Smart Camera-Based Machine Vision System Market for Machinery Industry, By Region, 20172025 (USD Million)

Table 57 Smart Camera-Based Machine Vision System Market for Solar Panel Manufacturing Industry, By Region, 20172025 (USD Million)

Table 58 Smart Camera-Based Machine Vision System Market for Textile Industry, By Region, 20172025 (USD Million)

Table 59 Machine Vision Market, By Application, 20172025 (USD Million)

Table 60 Machine Vision Market for Quality Assurance and Inspection Application, By Product, 20172025 (USD Million)

Table 61 Machine Vision Market for Positioning and Guidance Application, By Product, 20172025 (USD Million)

Table 62 Machine Vision Market for Measurement Application, By Product, 20172025 (USD Million)

Table 63 Machine Vision Market for Identification Application, By Product, 20172025 (USD Million)

Table 64 Machine Vision Market for Predictive Maintenance Application, By Product, 20172025 (USD Million)

Table 65 Machine Vision Market, By End-User Industry, 20172025 (USD Million)

Table 66 Machine Vision Market for Automotive Industry, By Region, 20172025 (USD Million)

Table 67 Machine Vision Market for Automotive Industry, By Product, 20172025 (USD Million)

Table 68 Machine Vision Market for Electronics and Semiconductor Industry, By Region, 20172025 (USD Million)

Table 69 Machine Vision Market for Electronics and Semiconductor Industry, By Product, 20172025 (USD Million)

Table 70 Machine Vision Market for Consumer Electronics Industry, By Region, 20172025 (USD Million)

Table 71 Machine Vision Market for Consumer Electronics Industry, By Product, 20172025 (USD Million)

Table 72 Machine Vision Market for Glass Industry, By Region, 20172025 (USD Million)

Table 73 Machine Vision Market for Glass Industry, By Product, 20172025 (USD Million)

Table 74 Machine Vision Market for Metals Industry, By Region, 20172025 (USD Million)

Table 75 Machine Vision Market for Metals Industry, By Product, 20172025 (USD Million)

Table 76 Machine Vision Market for Wood and Paper Industry, By Region, 20172025 (USD Million)

Table 77 Machine Vision Market for Wood and Paper Industry, By Product, 20172025 (USD Million)

Table 78 Machine Vision Market for Pharmaceutical Industry, By Region, 20172025 (USD Million)

Table 79 Machine Vision Market for Pharmaceutical Industry, By Product, 20172025 (USD Million)

Table 80 Machine Vision Market for Food and Packaging Industry, By Region, 20172025 (USD Million)

Table 81 Machine Vision Market for Food and Packaging Industry, By Product, 20172025 (USD Million)

Table 82 Machine Vision Market for Rubber and Plastics Industry, By Region, 20172025 (USD Million)

Table 83 Machine Vision Market for Rubber and Plastics Industry, By Product, 20172025 (USD Million)

Table 84 Machine Vision Market for Printing Industry, By Region, 20172025 (USD Million)

Table 85 Machine Vision Market for Printing Industry, By Product, 20172025 (USD Million)

Table 86 Machine Vision Market for Machinery Industry, By Region, 20172025 (USD Million)

Table 87 Machine Vision Market for Machinery Industry, By Product, 20172025 (USD Million)

Table 88 Machine Vision Market for Solar Panel Manufacturing Industry, By Region, 20172025 (USD Million)

Table 89 Machine Vision Market for Solar Panel Manufacturing Industry, By Product, 20172025 (USD Million)

Table 90 Machine Vision Market for Textile Industry, By Region, 20172025 (USD Million)

Table 91 Machine Vision Market for Textile Industry, By Product, 20172025 (USD Million)

Table 92 Machine Vision Market, By Region, 20172025 (USD Million)

Table 93 Machine Vision Market in North America, By Country, 20172025 (USD Million)

Table 94 Machine Vision Market in North America, By End-User Industry, 20172025 (USD Million)

Table 95 Machine Vision Market in Europe, By Country, 20172025 (USD Million)

Table 96 Machine Vision Market in Europe, By End-User Industry, 20172025 (USD Million)

Table 97 Machine Vision Market in APAC, By Country, 20172025 (USD Million)

Table 98 Machine Vision Market in APAC, By End-User Industry, 20172025 (USD Million)

Table 99 Machine Vision Market in RoW, By Region, 20172025 (USD Million)

Table 100 Machine Vision Market in RoW, By End-User Industry, 20152024 (USD Million)

Table 101 Product Launches (2019)

Table 102 Mergers & Acquisitions (2017- 2018)

Table 103 Agreements (2018)

List of Figures (52 Figures)

Figure 1 Market Segmentation

Figure 2 Machine Vision Market: Research Design

Figure 3 Market Size Estimation Methodology: Revenue of Market Players

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions for Research Study

Figure 8 Cameras Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 9 Quality Assurance & Inspection Application Expected to Hold the Largest Market Share Between 2020 and 2025

Figure 10 Food & Packaging End-User Industry Segment Expected to Register the Highest Growth During the Forecast Period

Figure 11 APAC Accounted for the Largest Share of the Machine Vision Market in 2019

Figure 12 Increasing Demand From Food & Packaging Industry Driving the Machine Vision Market Growth

Figure 13 Smart Camera-Based Machine Vision Systems to Grow at Higher CAGR Than PC-Based During the Forecast Period

Figure 14 Market for Predictive Maintenance is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 15 China Accounted for the Largest Share of the APAC Machine Vision Market in 2019

Figure 16 APAC Held the Largest Share of the Machine Vision Market in 2019

Figure 17 Increasing Manufacturing of Hybrid and Electric Cars to Drive the Growth of the Machine Vision Market

Figure 18 Machine Vision Market: Drivers and Their Impact

Figure 19 Growth of Industrial Robotics, in Terms of Shipment, Between 2012 and 2018

Figure 20 Machine Vision Market Restraints and Their Impact

Figure 21 Underqualified Workers in Various Countries, in 2019

Figure 22 Machine Vision Market Opportunities and Their Impact

Figure 23 Increasing Demand for Hybrid and Electric Vehicles Between 2020 and 2040

Figure 24 Average Yearly Wages in the Manufacturing Sector in China

Figure 25 Machine Vision Market Challenges and Their Impact

Figure 26 General Machine Vision System to Hold the Major Market Share During the Forecast Period

Figure 27 Machine Vision Market for Software Component Expected to Grow at A Higher Rate During the Forecast Period

Figure 28 Smart Camera-Based Machine Vision System to Grow at A Higher Rate Between 2020 and 2025

Figure 29 Smart Camera-Based Machine Vision System Market in APAC to Register the Highest CAGR During the Forecast Period

Figure 30 Predictive Maintenance Expected to Register Highest Growth Rate Between 2020 and 2025

Figure 31 Automotive End-User Industry Estimated to Hold the Largest Size of the Machine Vision Market in 2020

Figure 32 Glass Production in Europe

Figure 33 Geographic Snapshot of the Machine Vision Market (20202025)

Figure 34 North America: Machine Vision Market Snapshot

Figure 35 Europe: Machine Vision Market Snapshot

Figure 36 APAC: Machine Vision Market Snapshot

Figure 37 RoW: Machine Vision Market Snapshot

Figure 38 Organic and Inorganic Strategies Adopted By Companies Operating in Machine Vision Market

Figure 39 Major Machine Vision Providers

Figure 40 Machine Vision Market (Global) Competitive Leadership Mapping, 2019

Figure 41 Cognex Corporation: Company Snapshot

Figure 42 Basler AG: Company Snapshot

Figure 43 Omron Corporation: Company Snapshot

Figure 44 Keyence: Company Snapshot

Figure 45 National Instruments: Company Snapshot

Figure 46 Sony Corporation: Company Snapshot

Figure 47 Teledyne Technologies: Company Snapshot

Figure 48 Texas Instruments: Company Snapshot

Figure 49 Intel Corporation: Company Snapshot

Figure 50 ISRA Vision AG: Company Snapshot

Figure 51 Sick AG: Company Snapshot

Figure 52 FLIR Systems: Company Snapshot

Growth opportunities and latent adjacency in Machine Vision Market