Micro-Location Technology Market by Application (Asset Management, Proximity Marketing), Technology (BLE, UWB, Wi-Fi, RFID), Offering, Vertical (Retail and Hospitality, Healthcare, Industrial, Transportation, Sports), & Geography - Global Forecast to 2024

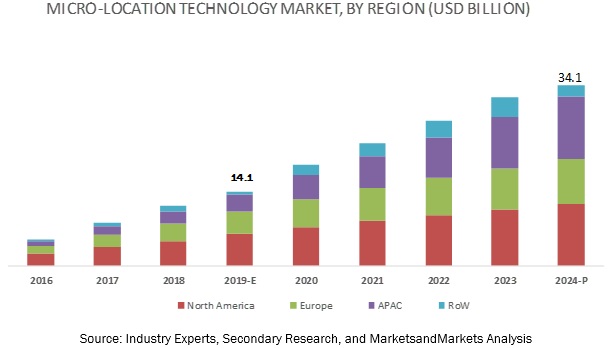

The micro-location technology market is projected to grow from USD 14.1 billion in 2019 to USD 34.1 billion by 2024 at a CAGR of 19.4%.

Factors such as increasing importance of asset management across different industries, rise in the use of location-based mobile advertisement, high return on investment, growing adoption of mobile devices, and inefficiency of GPS in indoor premises are driving the market growth.

Micro-Location Technology Market Segment Overview

“Proximity marketing held larger share of micro-location technology market in 2018”

The micro-location technology market based on application has been segmented into asset management and proximity marketing. The proximity marketing application held a larger share in 2018. Proximity marketing refers to location-based marketing enabled by the micro-location technology.

It delivers personalized information to users based on their location, proximity to other objects, social context, and environmental factors; the technology is adopted for this application in several sectors such as retail and hospitality, sports and entertainment, transportation, and BFSI. Proximity marketing is gaining traction among retailers as it enables them to send special offers to their customers when they come in a certain proximity to their outlet. Proximity marketing is a perfect way to target exact audiences, and it is expected to be widely accepted by the marketers in the coming years.

“Retail and hospitality to dominate micro-location technology market for proximity marketing during forecast period”

The retail and hospitality vertical is expected to dominate the market for the proximity marketing application. This growth is attributed to the emergence of the cloud platform, rapid adoption of smartphones, and increasing need for better customer services and response.

Retailers are able to target customers through various applications installed in the latter’s smartphones. Such applications can be used for purposes such as providing Stock Keeping Unit (SKU) -level information, along with the details on related products, price, location within the retail store; these applications can also facilitate self-checkouts by communicating with the store’s payment systems to facilitate the payment process. The apps also enable mapping of shopping behavior and preferences to drive targeted promotions.

“Services to register highest CAGR in micro-location technology market for asset management during forecast period”

The micro-location technology market for asset management, by offering, has been segmented into hardware, software, and services.

The market for services is expected to grow at the highest CAGR during the forecast period. Organizations or companies using micro-location solutions are expected to spend a significant amount on support and maintenance services on a regular basis; this is likely to contribute to the highest rate of growth of this market during the forecast period.

“APAC to hold largest size of micro-location technology market by 2024”

The micro-location technology market has been segmented into 4 major regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). APAC is expected to dominate the market, in terms of value, by 2024, followed by North America.

APAC is one of the potential markets for the asset management solutions based on micro-location technologies; it is expected to register the highest CAGR in the overall market during the forecast period as the micro-location solution is an ideal method for tracking the assets or people in organizations in real time.

In APAC, the adoption of micro-location solutions for asset management in sectors such as industrial, sports and entertainment, and retail and logistics is expected to increase in the coming years. China is likely to be the major contributor to the deployment of micro-location solutions in APAC during the forecast period.

Key Market Players in Micro-Location Technology Industry

Cisco Systems (US), Aruba Networks (US), Humatics Corporation (US), Estimote (US), Ruckus Networks (US), Zebra Technologies (US), CenTrak (US), Ubisense (UK), Camco Technologies (Belgium), and Siemens (Germany) are key players in the market. Decawave (Ireland), Apple (US), Google (US), Redpine Signals (US), and Visible Assets (US) are key innovators in the market.

Gimbal (Mobile Majority) (US), Bluvision (HID Global Corporation) (US), BlueCats (Australia), Sewio Networks (Czech Republic), and Kontakt.io (US) are the other key players in the market.

Micro-Location Technology Market Report Scope:

|

Report Metric |

Details |

| Market size value in 2019 | USD 14.1 Billion |

| Market size value in 2024 | USD 34.1 Billion |

| Growth Rate | CAGR of 19.4% |

|

Market size available for years |

2016–2024 |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Units |

Value, USD |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Companies covered |

Cisco Systems (US), Aruba Networks (US), Humatics Corporation (US), Estimote (US), Ruckus Networks (US), Zebra Technologies (US), CenTrak (US), Ubisense (UK), Camco Technologies (Belgium), and Siemens (Germany) are key players in the market. Decawave (Ireland), Apple (US), Google (US), Redpine Signals (US), and Visible Assets (US),Gimbal (Mobile Majority) (US), Bluvision (HID Global Corporation) (US), BlueCats (Australia), Sewio Networks (Czech Republic), and Kontakt.io (US) |

Micro-location Technology Market :

In this report, the micro-location technology market has been segmented into the following categories:

Based on application, the micro-location technology market has been segmented as follows:

- Asset management

- By Offering

- Hardware

- Software

- Services

- By Technology

- UWB

- Ultrasound

- IR

- RFID

- Others

- By Vertical

- Industrial

- Healthcare

- Transportation and logistics

- Retail and e-commerce

- Government, defense, and public

- Others

- By Offering

- Proximity Marketing

- By Offering

- Hardware

- Software

- Services

- By Technology

- BLE

- Wi-Fi

- Others

- By Vertical

- Retail and Hospitality

- Sports and Entertainment

- Transportation

- Healthcare

- BFSI

- Others

- By Offering

Based on geography, the micro-location technology market has been segmented as follows:

- APAC

- North America

- Europe

- Rest of The World (RoW)

Recent developments in Micro-Location Technology

- In June 2018, Cisco System acquired “July Systems,” a provider of highly scalable SaaS cloud-based middleware platform for location services provides. July Systems is now an OEM partner of Cisco Systems, and its solution has been branded as Cisco CMX Engage. It is a cloud-based solution available through a subscription an enterprise-grade engagement platform, and it features instant customer activation, data-driven behavioral insights, contextual rules engine, and APIs.

- In June-2017, Aruba Networks modified its portfolio of location-based services by integrating asset-tracking capability with WLAN infrastructure. This allowed it to utilize its tags and software solutions for tracking assets with the use of its Wi-Fi infrastructure.

- In August-2018, Estimote launched “Estimote LTE Beacon” capable of computing precise indoor and outdoor positions, designed primarily to locate assets and vehicles when they move between indoor and outdoor environments.

- In July-2018, Ruckus Networks opened a new development center in Bangalore, India, to focus on the development of emerging technologies in wired, wireless, IoT, and smart cities segment.

- In October-2018, Zebra Technologies expanded its facility in Bentonville, Arkansas. Its services include diagnoses, tests, and repairs for mobiles, computers, and barcode scanners; the facility employs general customer support, operations, quality, and engineering associates.

Key questions addressed by report:

- What are the new emerging applications of micro-location technology in different industries?

- What are the opportunities for the micro-location technology providers?

- Which regions/countries will showcase higher growth in micro-location technology market?

- Which are major current as well as potential competitors in the market, and what are their top priorities, strategies, and developments?

- What would be the contribution of the asset management and proximity management applications in terms of value or percent share to the overall market? What would be their impact on various industries?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities for Micro-Location Technology Market

4.2 Micro-Location Technology Market for Proximity Marketing, By Technology

4.3 Market for Proximity Marketing, By Vertical

4.4 Market for Asset Management, By Vertical

4.5 Market, By Geography

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Inefficiency of GPS in Indoor Premises

5.2.1.2 Growing Adoption of Mobile Devices

5.2.1.3 Necessity to Deliver Unique Customer Experience in Retail and Hospitality

5.2.1.4 High Return on Investment

5.2.1.5 Rise in Use of Location-Based Mobile Advertisement

5.2.1.6 Increasing Importance of Asset Management Across Different Industries

5.2.2 Restraints

5.2.2.1 Concerns Regarding Security and Privacy

5.2.2.2 Growing Trend of E-Commerce in Retail Sector

5.2.3 Opportunities

5.2.3.1 Focus on Industry 4.0, IoT, and Smart Manufacturing

5.2.3.2 Emergence of New Applications, and Untapped Opportunities in APAC and RoW

5.2.3.3 Growing Demand for Location Analytics in Robotics

5.2.4 Challenges

5.2.4.1 Lack of Interoperability

5.2.4.2 High Competition in Market

5.2.4.3 Providing Energy-Efficient and High-Performance Solutions at Low Cost

5.2.4.4 Sophisticated Deployment and Maintenance Requirements

6 Industry Trends (Page No. - 52)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Electronics and Component Providers

6.2.2 Connectivity Technology Developers

6.2.3 Hardware and Software Providers

6.2.4 System Integration and Services

6.3 Key Trends

6.3.1 Smart Cities and Autonomous Vehicles

6.3.2 Use-Cases

7 Micro-Location Technology Market, By Application (Page No. - 56)

7.1 Introduction

7.2 Asset Management

7.2.1 Asset Management Application to Grow at Higher CAGR in Market During Forecast Period

7.3 Proximity Marketing

7.3.1 Proximity Marketing to Capture Major Share in Market During Forecast Period

8 Micro-Location Technology Market for Asset Management (Page No. - 58)

8.1 Introduction

8.2 Market for Asset Management, By Offering

8.2.1 Hardware

8.2.1.1 Tags/Badges

8.2.1.2 Readers/Trackers/Access Points

8.2.1.3 Others

8.2.2 Software

8.2.2.1 UWB to Exhibit Highest Growth in Micro-Location Software Market for Asset Management During Forecast Period

8.2.3 Services

8.2.3.1 Services Segment to Witness Highest CAGR in Market for Asset Management During Forecast Period

8.3 Market for Asset Management, By Technology

8.3.1 Ultra-Wideband (UWB)

8.3.1.1 UWB to Dominate Market for Asset Management During Forecast Period

8.3.2 Ultrasound

8.3.2.1 Hardware to Occupy Major Share of Ultrasound-Based Market During Forecast Period

8.3.3 IR

8.3.3.1 Hardware to Hold Major Size of IR-Based Market for Asset Management By 2024

8.3.4 RFID

8.3.4.1 Services to Exhibit Highest CAGR in RFID-Based Market for Asset Management During Forecast Period

8.3.5 Others

8.3.5.1 Others Include Major Technologies Like Magnetic, Rubee, Zigbee, and BLE

8.4 Market for Asset Management, By Vertical

8.4.1 Industrial

8.4.1.1 North America to Hold Major Share of Market for Industrial Asset Management During Forecast Period

8.4.2 Healthcare

8.4.2.1 APAC to Witness Highest CAGR in Market for Healthcare Asset Management During Forecast Period

8.4.3 Transportation and Logistics

8.4.3.1 UWB to Exhibit Highest Growth in Market for Transportation and Logistics During Forecast Period

8.4.4 Retail and E-Commerce

8.4.4.1 APAC to Exhibit Highest CAGR in Market for Retail and E-Commerce Asset Management During Forecast Period

8.4.5 Government, Defense, and Public

8.4.5.1 North America to Account for Major Share in Market in Government, Defense, and Public Segment During Forecast Period

8.4.6 Others

8.4.6.1 APAC to Grow With Highest CAGR in Other Verticals During Forecast Period

9 Micro-Location Technology Market for Proximity Marketing (Page No. - 90)

9.1 Introduction

9.2 Market for Proximity Marketing, By Offering

9.2.1 Hardware

9.2.1.1 BLE-Based Hardware to Grow at Highest CAGR in Market for Proximity Marketing During Forecast Period

9.2.2 Software

9.2.2.1 BLE-Based Software to Exhibit Highest Growth in Market for Proximity Marketing During Forecast Period

9.2.3 Services

9.2.3.1 Services Segment to Grow at the Highest CAGR in Market for Proximity Marketing During Forecast Period

9.3 Market for Proximity Marketing, By Technology

9.3.1 BLE

9.3.1.1 Software Segment to Boost BLE-Based Market for Proximity Marketing During Forecast Period

9.3.2 Wi-Fi

9.3.2.1 Wi-Fi-Based Services to Grow With Highest CAGR in Market for Proximity Marketing During Forecast Period

9.3.3 Others

9.3.3.1 NFC Expected to Be Major Technology in Other Segment During Forecast Period

9.4 Market for Proximity Marketing, By Vertical

9.4.1 Retail and Hospitality

9.4.1.1 BLE to Dominate Market for Proximity Marketing in Retail and Hospitality Segment During Forecast Period

9.4.2 Sports and Entertainment

9.4.2.1 Major Adoption of BLE-Based Micro-Location Technology Solutions is Expected in Sports and Entertainment Segment for Proximity Marketing During Forecast Period

9.4.3 Transportation

9.4.3.1 APAC to Witness Highest CAGR in Market for Proximity Marketing in Transportation During Forecast Period

9.4.4 Healthcare

9.4.4.1 BLE-Based Micro-Location Technology Solutions for Proximity Marketing to Define Healthcare Segment During Forecast Period

9.4.5 BFSI

9.4.5.1 APAC to Witness Highest CAGR in Market for Proximity Marketing in BFSI Segment During Forecast Period

9.4.6 Others

9.4.6.1 Automotive, Real Estate, and Education Expected to Be Major Verticals in Others Segment During Forecast Period

10 Geographic Analysis (Page No. - 112)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 US to Hold Major Share of Market in North America During the Forecast Period

10.2.2 Canada

10.2.2.1 Canada to Grow With Highest CAGR in Market in North America During Forecast Period

10.2.3 Mexico

10.2.3.1 Development in Industrial Vertical to Create Demand for Micro-Location Solutions in Mexico

10.3 Europe

10.3.1 UK

10.3.1.1 Healthcare and Retail Sectors to Drive Growth of Market in UK

10.3.2 Germany

10.3.2.1 High Demand for Micro-Location Solutions in Automotive and Industrial Verticals to Drive Market in Germany

10.3.3 France

10.3.3.1 Aerospace, Retail, Transportation, and Automotive Sectors to Create Demand for Micro-Location Solutions in France

10.3.4 Rest of Europe

10.3.4.1 Healthcare Sector to Contribute Major Share in Market in Rest of Europe

10.4 APAC

10.4.1 China

10.4.1.1 China to Witness Highest CAGR in Market During Forecast Period

10.4.2 Japan

10.4.2.1 Rapid Penetration of Micro-Location Solutions in Automotive and Healthcare Sector to Be Major Growth Driver in Japan

10.4.3 Australia

10.4.3.1 Australia to Witness Rapid Growth in Market for Healthcare and Mining Industries During Forecast Period

10.4.4 South Korea

10.4.4.1 Industrial Sector to Create Demand for Micro-Location Solutions in South Korea

10.4.5 Rest of APAC

10.4.5.1 Growth of Industrial Manufacturing and Healthcare Sector to Fuel Micro-Location Technology Market in Rest of APAC

10.5 Rest of the World

10.5.1 Middle East

10.5.1.1 Oil & Gas Sectors to Drive the Growth of Market in Middle East

10.5.2 Africa

10.5.2.1 Africa to Witness Demand for Micro-Location Technology Solutions in Mining Industry

10.5.3 South America

10.5.3.1 South America to Witness High Growth in Market on the Back of Retail Sector

11 Competitive Landscape (Page No. - 133)

11.1 Overview

11.2 Ranking Analysis: Micro-Location Technology Market Players

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Companies

11.4 Strength of Product Portfolio

11.5 Business Strategy Excellence

11.6 Competitive Situations and Trends: Micro-Location Technology Market

11.6.1 Product Launches and Developments

11.6.2 Partnerships, Collaborations, Contracts, & JVS

11.6.3 Acquisitions & Expansions

12 Company Profiles (Page No. - 143)

12.1 Introduction

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

12.2 Key Players

12.2.1 Cisco Systems

12.2.2 Aruba Networks (HP Enterprise)

12.2.3 Humatics Corporation

12.2.4 Estimote

12.2.5 Ruckus Networks

12.2.6 Zebra Technologies

12.2.7 Centrak

12.2.8 Ubisense Group

12.2.9 Camco Technologies

12.2.10 Siemens (Agilion)

12.3 Key Innovators

12.3.1 Decawave

12.3.2 Apple

12.3.3 Google

12.3.4 Redpine Signals

12.3.5 Visible Assets

12.4 Other Important Players

12.4.1 Gimbal (Mobile Majority)

12.4.2 Bluvision (Hid Global Corporation)

12.4.3 Bluecats

12.4.4 Sewio Networks

12.4.5 Kontakt.Io, Inc.

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 177)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customization

13.4 Related Reports

13.5 Author Details

List of Tables (64 Tables)

Table 1 Comparison of Micro-Location Tags/Batches Based on Different Technologies

Table 2 Use-Cases of Micro-Location in Different Verticals

Table 3 Micro-Location Technology Market, By Application, 2016—2024 (USD Billion)

Table 4 Market for Asset Management, By Offering, 2016–2024 (USD Million)

Table 5 Micro-Location Hardware Market for Asset Management, By Technology, 2016–2024 (USD Million)

Table 6 Micro-Location Software Market for Asset Management, By Technology, 2016–2024 (USD Million)

Table 7 Micro-Location Services Market for Asset Management, By Technology, 2016–2024 (USD Million)

Table 8 Market for Asset Management, By Technology, 2016–2024 (USD Million)

Table 9 UWB-Based Market for Asset Management, By Offering, 2016–2024 (USD Million)

Table 10 Ultrasound-Based Market for Asset Management, By Offering, 2016–2024 (USD Million)

Table 11 IR-Based Market for Asset Management, By Offering, 2016–2024 (USD Million)

Table 12 RFID-Based Market for Asset Management, By Offering, 2016–2024 (USD Million)

Table 13 Others-Based Market for Asset Management, By Offering, 2016–2024 (USD Million)

Table 14 Market for Asset Management, By Vertical, 2016–2024 (USD Million)

Table 15 Market for Asset Management in Industrial, By Technology, 2016–2024 (USD Million)

Table 16 Market for Asset Management in Industrial, By Region, 2016–2024 (USD Million)

Table 17 Market for Asset Management in Healthcare, By Technology, 2016–2024 (USD Million)

Table 18 Market for Asset Management in Healthcare, By Region, 2016–2024 (USD Million)

Table 19 Market for Asset Management in Transportation and Logistics, By Technology, 2016–2024 (USD Million)

Table 20 Market for Asset Management in Transportation and Logistics, By Region, 2016–2024 (USD Million)

Table 21 Market for Asset Management in Retail and E-Commerce, By Technology, 2016–2024 (USD Million)

Table 22 Market for Asset Management in Retail and E-Commerce, By Region, 2016–2024 (USD Million)

Table 23 Market for Asset Management in Government, Defense, and Public Sector, By Technology, 2016–2024 (USD Million)

Table 24 Market for Asset Management in Government, Defense, and Public Sector, By Region, 2016–2024 (USD Million)

Table 25 Market for Asset Management in Others, By Technology, 2016–2024 (USD Million)

Table 26 Market for Asset Management in Others, By Region, 2016–2024 (USD Million)

Table 27 Market for Proximity Marketing, By Offering, 2016–2024 (USD Million)

Table 28 Micro-Location Hardware Market for Proximity Marketing, By Technology, 2016–2024 (USD Million)

Table 29 Micro-Location Software Market for Proximity Marketing, By Technology, 2016–2024 (USD Million)

Table 30 Micro-Location Services Market for Proximity Marketing, By Technology, 2016–2024 (USD Million)

Table 31 Market for Proximity Marketing, By Technology, 2016–2024 (USD Million)

Table 32 BLE-Based Market for Proximity Marketing, By Offering, 2016–2024 (USD Million)

Table 33 Market for Wi-Fi-Based Proximity Marketing, By Offering, 2016–2024 (USD Million)

Table 34 Other-Based Market for Proximity Marketing, By Offering, 2016–2024 (USD Million)

Table 35 Market for Proximity Marketing, By Vertical, 2016–2024 (USD Million)

Table 36 Market for Proximity Marketing in Retail and Hospitality, By Technology, 2016–2024 (USD Million)

Table 37 Market for Proximity Marketing in Retail and Hospitality, By Region, 2016–2024 (USD Million)

Table 38 Market for Proximity Marketing in Sports and Entertainment, By Technology, 2016–2024 (USD Million)

Table 39 Market for Proximity Marketing in Sports and Entertainment, By Region, 2016–2024 (USD Million)

Table 40 Market for Proximity Marketing in Transportation, By Technology, 2016–2024 (USD Million)

Table 41 Market for Proximity Marketing in Transportation, By Region, 2016–2024 (USD Million)

Table 42 Market for Proximity Marketing in Healthcare, By Technology, 2016–2024 (USD Million)

Table 43 Market for Proximity Marketing in Healthcare, By Region, 2016–2024 (USD Million)

Table 44 Market for Proximity Marketing in BFSI, By Technology, 2016–2024 (USD Million)

Table 45 Market for Proximity Marketing in BFSI, By Region, 2016–2024 (USD Million)

Table 46 Market for Proximity Marketing in Others, By Technology, 2016–2024 (USD Million)

Table 47 Market for Proximity Marketing in Others, By Region, 2016–2024 (USD Million)

Table 48 Market, By Region, 2016–2024 (USD Million)

Table 49 Market in North America, By Application, 2016–2024 (USD Million)

Table 50 Market in North America for Asset Management, By Vertical, 2016–2024 (USD Million)

Table 51 Market in North America for Proximity Marketing, By Vertical, 2016–2024 (USD Million)

Table 52 Market in North America, By Country, 2016–2024 (USD Million)

Table 53 Market in Europe, By Application, 2016–2024 (USD Million)

Table 54 Market in Europe for Asset Management, By Vertical, 2016–2024 (USD Million)

Table 55 Market in Europe for Proximity Marketing, By Vertical, 2016–2024 (USD Million)

Table 56 Market in Europe, By Country, 2016–2024 (USD Million)

Table 57 Market in APAC, By Application, 2016–2024 (USD Million)

Table 58 Market in APAC for Asset Management, By Vertical, 2016–2024 (USD Million)

Table 59 Market in APAC for Proximity Marketing, By Vertical, 2016–2024 (USD Million)

Table 60 Market in APAC, By Country, 2016–2024 (USD Million)

Table 61 Market in RoW, By Application, 2016–2024 (USD Million)

Table 62 Market in RoW for Asset Management, By Vertical, 2016–2024 (USD Million)

Table 63 Market in RoW for Proximity Marketing, By Vertical, 2016–2024 (USD Million)

Table 64 Micro-Location Technology Market in RoW, By Region, 2016–2024 (USD Million)

List of Figures (69 Figures)

Figure 1 Micro-Location Technology Market: Market Segmentation

Figure 2 Market: Process Flow of Market Size Estimation

Figure 3 Market: Research Design

Figure 4 Key Data From Secondary Sources

Figure 5 Bottom-Up Approach to Arrive at Market Size

Figure 6 Top-Down Approach to Arrive at Market Size

Figure 7 Data Triangulation

Figure 8 Assumptions of Research Study

Figure 9 Global Market, 2016–2024 (USD Billion)

Figure 10 UWB to Register Highest CAGR in Market for Asset Management During Forecast Period.

Figure 11 Services to Grow at Highest CAGR During Forecast Period

Figure 12 Retail and Hospitality to Dominate Market for Proximity Marketing, in Terms of Size, During Forecast Period

Figure 13 Healthcare to Hold Largest Size of Micro-Location Technology for Asset Management During Forecast Period

Figure 14 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 15 Market to Witness High Growth During Forecast Period

Figure 16 BLE to Hold Largest Size of Market for Proximity Marketing During Forecast Period

Figure 17 Retail and Hospitality to Be Largest Shareholder in Market for Proximity Marketing During Forecast Period

Figure 18 Industrial Vertical to Register Highest CAGR in Micro-Location Technology for Asset Management During Forecast Period

Figure 19 China to Register Highest CAGR Among Major Countries in Market During Forecast Period

Figure 20 Growing Adoption of Mobile Devices and Inefficiency of GPS in Indoor Premises are Major Drives for Market Growth

Figure 21 Industrial Revolution

Figure 22 Market: Competition Among Large vs Start-Up/Small Players

Figure 23 Focus of Companies in Global Market, By Technology, 2018

Figure 24 Price Comparison of Location Tags, By Technology, 2018

Figure 25 Trade-Off Between Operating Range and Accuracy

Figure 26 Market: Value Chain Analysis

Figure 27 Smart Cities Market, By Type (USD Billion)

Figure 28 Autonomous Vehicles Shipments, By Region (Thousand Units)

Figure 29 Market, By Application

Figure 30 Segmentation of Market for Asset Management

Figure 31 Market for Asset Management, By Offering

Figure 32 Hardware to Hold Largest Size of Market for Asset Management During Forecast Period

Figure 33 UWB to Exhibit Highest Growth in Micro-Location Software Market for Asset Management During Forecast Period

Figure 34 Market for Asset Management, By Technology

Figure 35 UWB to Dominate Market for Asset Management During Forecast Period

Figure 36 Hardware Segment to Hold Largest Size of UWB-Based Market for Asset Management By 2024

Figure 37 Services to Register Highest CAGR in Ultrasound-Based Micro-Location Technology Market for Asset Management During Forecast Period

Figure 38 Hardware to Hold Largest Size of IR-Based Market for Asset Management By 2024

Figure 39 Services to Exhibit Highest CAGR in RFID-Based Market for Asset Management During Forecast Period

Figure 40 Services to Witness Highest CAGR in Others-Based Market for Asset Management During Forecast Period

Figure 41 Market for Asset Management, By Vertical

Figure 42 Industrial to Register Highest CAGR in Market for Asset Management During Forecast Period

Figure 43 RoW to Witness Highest CAGR in Market for Industrial Asset Management During Forecast Period

Figure 44 Market for Healthcare Asset Management in APAC to Grow at Highest CAGR During Forecast Period

Figure 45 APAC to Witness Highest CAGR in Market for Transportation and Logistics Asset Management During Forecast Period

Figure 46 APAC to Exhibit Highest CAGR in Market for Retail and E-Commerce Asset Management During Forecast Period

Figure 47 Market for Government, Defense, and Public Asset Management in APAC to Grow at Highest CAGR During Forecast Period

Figure 48 Segmentation of Market for Proximity Marketing

Figure 49 Market for Proximity Marketing, By Offering

Figure 50 Software to Hold Largest Size of Market for Proximity Marketing During Forecast Period

Figure 51 BLE-Based Hardware to Grow at Highest CAGR in Market for Proximity Marketing During Forecast Period

Figure 52 Market for Proximity Marketing, By Technology

Figure 53 BLE to Exhibit Highest CAGR in Market for Proximity Marketing During Forecast Period

Figure 54 Market for Proximity Marketing, By Vertical

Figure 55 Retail and Hospitality to Be Largest Shareholder in Market for Proximity Marketing During Forecast Period

Figure 56 Market, By Geography

Figure 57 Market in APAC Countries to Grow at High CAGR During Forecast Period

Figure 58 APAC to Dominate Market By 2024

Figure 59 North America: Market Snapshot

Figure 60 Europe: Market Snapshot

Figure 61 APAC: Market Snapshot

Figure 62 Key Developments By Leading Players in Market During 2015–2018

Figure 63 Key Player Ranking, 2018

Figure 64 Micro-Location Technology Market (Global) Competitive Leadership Mapping, 2018

Figure 65 Cisco Systems: Company Snapshot

Figure 66 Hewlett Packard Enterprise (HPE): Company Snapshot

Figure 67 Zebra Technologies: Company Snapshot

Figure 68 Ubisense Group: Company Snapshot

Figure 69 Siemens: Company Snapshot

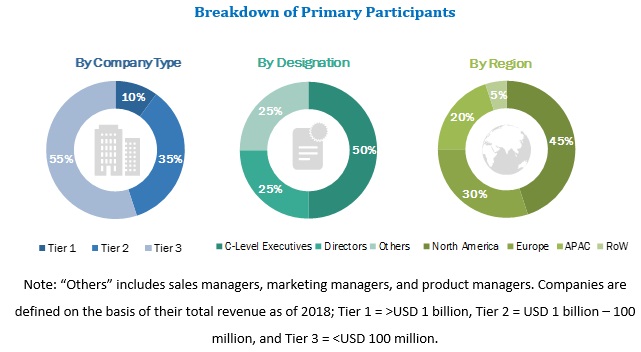

The study involved 4 major activities to estimate the current size of the micro-location technology market. Exhaustive secondary research was accomplished to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter the market sizes based on segments and subsegments have been estimated through market breakdown and data triangulation.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for the study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, articles from recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the industry’s supply chain and value chain, major players, market classification, and segmentation according to the industry trends to the bottommost level, geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated through primary research. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by primary research

Primary Research

In the primary research, various primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include key industry participants, subject matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the micro-location technology ecosystem.

After a complete market engineering (including calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers.

Primary research has also been conducted to identify market segmentation and key players; and analyze the competitive landscape, key factors affecting the market growth (drivers, restraints, opportunities, and challenges), and key player strategies. During market engineering, both top-down and bottom-up approaches have been extensively employed, along with several data triangulation methods, to estimate and forecast the market, including the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed during market engineering to list key information/insights throughout the report.

Primary interviews have been conducted with experts from both the demand and supply sides across 4 regions: North America, Europe, APAC, and RoW. ~15% of the primary interviews have been conducted with demand-side and 85% with supply-side experts. Primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global micro-location technology market as well as other dependent markets. The key players in the market have been identified through secondary research, and their market position in the respective regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of top players and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives for key insights.

All percentage shares have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through the primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. Data has been triangulated by studying various factors and trends from both demand and supply sides.

Study Objectives

- To define, forecast, and analyze the micro-location technology market by application (asset tracking and proximity marketing) and geography

- To define, forecast, and analyze the market for both applications on the basis of offering, application-specific technology, application-specific vertical

- To forecast the market size, in terms of value, for various segments with regard to 4 main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW).

- To describe drivers, restraints, opportunities, and challenges for the market, which are the major factors impacting its dynamics

- To analyze key trends related to components, connectivity technologies, and applications that shape and influence the global micro-location technology market.

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the total market.

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the market.

- To analyze strategic developments such as joint ventures, mergers and acquisitions, expansions, product developments, and research and development (R&D) in the market

- To strategically profile the key players and comprehensively analyze their market position in terms of their market rankings and core competencies, along with analyzing the competitive landscape across the ecosystem

Available Customization

With the given market data, MarketsandMarkets offers customizations according to companies’ specific needs. The following customization options are available for the report.

- Detailed analysis and profiling of additional market players (up to 5)

- Company-product-technology-specifications mapping analysis

- Detailed analysis of major contracts, funding, and other relevant activities in the market.

Growth opportunities and latent adjacency in Micro-Location Technology Market