Multi-mode Receiver Market by Platform (Fixed Wing, Rotary Wing), Fit (Line-Fit, Retrofit), Application (Navigation & Positioning, Landing), Sub-System (ILS, MLS, GLS, VOR/DME), and Region - Global Forecast to 2022

The multi-mode receiver market is projected to grow from USD 961.5 Million in 2017 to USD 1,213.1 Million by 2022, at a CAGR of 4.76% from 2017 to 2022. The objective of this study is to analyze, define, describe, and forecast the multi-mode receiver market based on fit, platform, application, sub-system, and region. The report also focuses on the competitive landscape of this market by profiling companies based on their financial position, product portfolio, growth strategies, and analyzing their core competencies and market share to anticipate the degree of competition prevailing in the market. This report also tracks and analyzes competitive developments, such as partnerships, mergers & acquisitions, new product developments, and research & development (R&D) activities in the multi-mode receiver market. The base year considered for this study is 2016 and the forecast period is from 2017 to 2022.

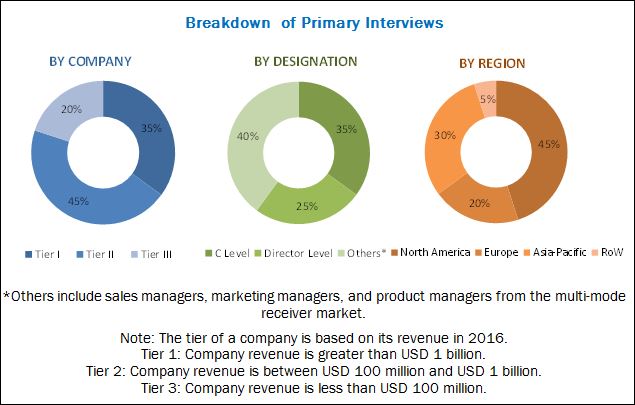

The research methodology used to estimate and forecast the multi-mode receiver market includes the study of data and revenue of key market players through secondary resources, such as annual reports, Yahoo Finance, Federal Aviation Administration (FAA), International Civil Aviation Organization (ICAO), International Air Transport Association (IATA), and Stockholm International Peace Research Institute (SIPRI). The bottom-up procedure was employed to arrive at the overall size of the multi-mode receiver market from the revenue of key market players. After arriving at the overall market size, the multi-mode receiver market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry experts, such as CEOs, VPs, directors, executives, and engineers. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. Breakdown of profiles of primaries is shown in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The multi-mode receiver market has been segmented on the basis of application, fit, platform, sub-system, and region. BAE Systems plc (UK), Honeywell International Inc. (US), Indra Sistemas, SA (Spain), Intelcan Technosystems Inc. (Canada), Leonardo SpA (Italy), Rockwell Collins, Inc. (US), Saab AB (Sweden), Systems Interface Ltd. (UK), Thales Group (France), and VAL Avionics Ltd. (U.S.) are some of the manufacturers in this market. Contracts, new product launches, agreements, and acquisitions are the major strategies adopted by the key players in the multi-mode receiver market.

Target Audience for this Report

- Manufacturers of Multi-Mode Receiver

- Component Manufacturers of Multi-Mode Receiver

- Aircraft Manufacturers

- System Integrators

- Government and Certification Bodies

This study answers several questions for stakeholders, primarily, which market segments to focus on during the next two to five years to prioritize their efforts and investments.

Scope of the Report:

Multi-Mode Receiver Market, By Fit

- Line-fit

- Retrofit

Market, By Platform

- Fixed Wing

- Commercial Aviation

- Narrow Body Aircraft

- Wide Body Aircraft

- Very Large Aircraft

- Regional Transport Aircraft

- General Aviation

- Business Aircraft

- Light Aircraft

- Military Aviation

- Fighter Aircraft

- Transport Aircraft

- Commercial Aviation

- Rotary Wing

- Commercial Helicopters

- Military Helicopters

Market, By Application

- Navigation & Positioning

- Landing

Market, By Sub-System

- ILS Receiver

- MLS Receiver

- GLS Receiver

- VOR / DME Receiver

Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for this report:

- Geographic Analysis

- Further breakdown of the Rest of the World market

- Company Information

- Detailed analysis and profiling of additional market players (up to five)

- Additional Level Segmentation

The multi-mode receiver market is projected to grow from an estimated USD 961.5 Million in 2017 to USD 1,213.1 Million by 2022, at a CAGR of 4.76% from 2017 to 2022. The increasing aircraft deliveries across the globe, as well as the avionics retrofit activities in the general aviation market, are expected to fuel the growth of the multi-mode receiver market.

The multi-mode receiver market has been segmented on the basis of platform, fit, application, sub-system, and region. Based on platform, the multi-mode receiver market has been segmented into fixed wing and rotary wing. The fixed wing segment is projected to lead the market during the forecast period owing to the increasing demand for commercial and military fixed wing aircraft. The commercial fixed wing aircraft market is anticipated to increase due to the growing air passenger traffic.

Based on fit, the multi-mode receiver market has been segmented into line-fit and retrofit. The retrofit market is projected to grow at the highest CAGR during the forecast period. The expected high growth rate can be attributed to aircraft modernization programs that mandate the installation of multi-mode receivers in aircraft.

Based on application, the multi-mode receiver market has been segmented into navigation & positioning and landing. The navigation & positioning segment is expected to grow at a higher CAGR than the landing segment owing to regulations that mandate the use of multi-mode receivers for navigation & positioning application in aircraft.

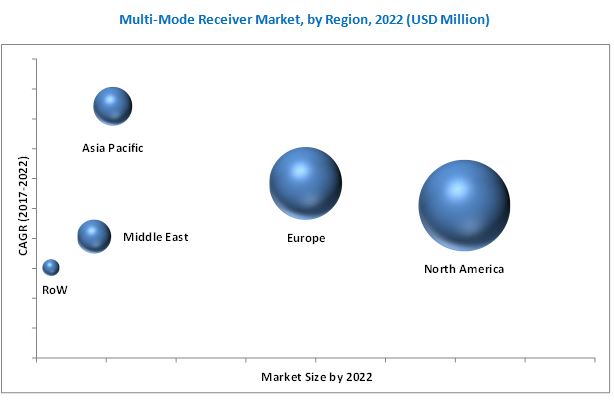

The multi-mode receiver market has been studied for North America, Europe, Asia Pacific, Middle East, and Rest of the World (RoW). The North American region is estimated to be the largest market for multi-mode receivers in 2017. North America is home to major aircraft manufacturers, such as the Boeing Company (US) and Bombardier Inc. (Canada). The multi-mode receiver market in the European and Asia Pacific regions is also expected to witness a high growth due to the rising demand for wide body and large aircraft.

Stringent regulations in aerospace industries can act as a restraint for the multi-mode receiver market. Major companies profiled in the report include Honeywell International Inc. (US), Rockwell Collins, Inc. (US), BAE Systems plc (UK), Leonardo SpA (Italy), and Thales Group (France), among others. New product launch and supply contract were the key strategies adopted by leading players in the multi-mode receiver market from 2012 to 2017. These strategies have enabled companies to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Distribution Channel Participants

1.6 Limitations

1.7 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Multi-Mode Receiver Market

4.2 Market, By Fit

4.3 North America: Market, By Application

4.4 Market, By Fixed Wing

4.5 Market, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market, By Application

5.2.2 Market, By Sub-System

5.2.3 Market, By Platform

5.2.4 Market, By Fit

5.2.5 Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth of the General Aviation Avionics Retrofit Market

5.3.1.2 Demand for Lightweight and Space Saving Aircraft Component

5.3.1.3 Increasing Number of Aircraft Deliveries

5.3.2 Restraint

5.3.2.1 Regulatory Framework

5.3.3 Opportunity

5.3.3.1 Mandate for Integration of Satellite-Based Augmentation System in Aircraft

5.3.4 Challenge

5.3.4.1 Increasing Vulnerability of Avionics to Cyberattacks

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Multi-Mode Receiver Evolution

6.3 Industry Trends

6.3.1 Global Navigation Satellite System (GNSS)

6.3.2 Differential GPS

6.3.3 Integrated Multi-Mode Receiver

6.3.4 Automatic Dependent Surveillance Broadcast (ADS-B)

7 Multi-Mode Receiver Market, By Platform (Page No. - 49)

7.1 Introduction

7.2 Fixed Wing

7.2.1 Commercial Aviation

7.2.1.1 Narrow Body Aircraft

7.2.1.2 Wide Body Aircraft

7.2.1.3 Very Large Aircraft

7.2.1.4 Regional Transport Aircraft

7.2.2 General Aviation

7.2.2.1 Business Aircraft

7.2.2.2 Light Aircraft

7.2.3 Military Aviation

7.2.3.1 Fighter Aircraft

7.2.3.2 Transport Aircraft

7.3 Rotary Wing

7.3.1 Commercial Helicopters

7.3.2 Military Helicopters

8 Market, By Fit (Page No. - 56)

8.1 Introduction

8.2 Line-Fit

8.3 Retrofit

9 Market, By Sub-System (Page No. - 59)

9.1 Introduction

9.2 ILS Receiver

9.3 MLS Receiver

9.4 GLS Receiver

9.5 VHF Omnidirectional Range (VOR) / Distance Measuring Equipment (DME) Receiver

10 Market, By Application (Page No. - 61)

10.1 Introduction

10.2 Navigation & Positioning

10.3 Landing

11 Regional Analysis (Page No. - 65)

11.1 Introduction

11.2 By Region

11.3 North America

11.3.1 By Application

11.3.2 By Platform

11.3.2.1 Fixed Wing Segment, By End Use

11.3.2.2 Rotary Wing Segment, By End Use

11.3.3 By Fit

11.3.4 By Country

11.3.4.1 US

11.3.4.1.1 By Platform

11.3.4.2 Canada

11.3.4.2.1 By Platform

11.4 Europe

11.4.1 By Application

11.4.2 By Platform

11.4.2.1 Fixed Wing Segment, By End Use

11.4.2.2 Rotary Wing Segment, By End Use

11.4.3 By Fit

11.4.4 By Country

11.4.4.1 Russia

11.4.4.1.1 By Platform

11.4.4.2 Germany

11.4.4.2.1 By Platform

11.4.4.3 UK

11.4.4.3.1 By Platform

11.4.4.4 France

11.4.4.4.1 By Platform

11.4.4.5 Italy

11.4.4.5.1 By Platform

11.4.4.6 Spain

11.4.4.6.1 By Platform

11.5 Asia Pacific

11.5.1 By Application

11.5.2 By Platform

11.5.2.1 Fixed Wing Segment, By End Use

11.5.2.2 Rotary Wing Segment, By End Use

11.5.3 By Fit

11.5.4 By Country

11.5.4.1 China

11.5.4.1.1 By Platform

11.5.4.2 Japan

11.5.4.2.1 By Platform

11.5.4.3 India

11.5.4.3.1 By Platform

11.5.4.4 South Korea

11.5.4.4.1 By Platform

11.6 Middle East

11.6.1 By Application

11.6.2 By Platform

11.6.2.1 Fixed Wing Segment, By End Use

11.6.2.2 Rotary Wing Segment, By End Use

11.6.3 By Fit

11.6.4 By Country

11.6.4.1 Israel

11.6.4.1.1 By Platform

11.6.4.2 Saudi Arabia

11.6.4.2.1 By Platform

11.7 Rest of the World (RoW)

11.7.1 By Application

11.7.2 By Platform

11.7.2.1 Fixed Wing Segment, By End Use

11.7.2.2 Rotary Wing Segment, By End Use

11.7.3 By Fit

11.7.4 By Country

11.7.4.1 Brazil

11.7.4.1.1 By Platform

11.7.4.2 South Africa

11.7.4.2.1 By Platform

11.7.4.3 Others

11.7.4.3.1 By Platform

12 Competitive Landscape (Page No. - 93)

12.1 Introduction

12.2 Ranking

12.3 Competitive Leadership Mapping

12.3.1 Visionary Leaders

12.3.2 Innovators

12.3.3 Dynamic Differentiators

12.3.4 Emerging Companies

12.4 Competitive Benchmarking

12.4.1 Strength of Product Portfolio

12.4.2 Business Strategy Excellence

13 Company Profiles (Page No. - 98)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 BAE Systems PLC

13.2 Honeywell International Inc.

13.3 Indra Sistemas, SA

13.4 Intelcan Technosystems Inc.

13.5 Leonardo SPA

13.6 Rockwell Collins, Inc.

13.7 Saab AB

13.8 Systems Interface Ltd.

13.9 Thales Group

13.10 Val Avionics Ltd.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

14 Appendix (Page No. - 121)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (70 Tables)

Table 1 Multi-Mode Receiver Market, By Application

Table 2 Market, By Sub-System

Table 3 Market, By Platform

Table 4 Market, By Fit

Table 5 Aircraft Types By Maximum Takeoff Weight

Table 6 Certifications/Standards Required in Multi-Mode Receiver

Table 7 Cyberattacks in the Aviation Industry

Table 8 Different Operating Modes of Mmr Offered By Top Players

Table 9 Equipment Required in ADS-B in and ADS-B Out

Table 10 Market Size, By Platform, 2015-2022 (USD Million)

Table 11 Fixed Wing: Multi-Mode Receivers Market Size, By End Use, 2015-2022 (USD Million)

Table 12 Commercial Aviation Market Size, By Aircraft Type, 2015-2022 (USD Million)

Table 13 General Aviation Market Size, By Aircraft Type, 2015-2022 (USD Million)

Table 14 Military Market Size, By Aircraft Type, 2015-2022 (USD Million)

Table 15 Rotary Wing: Market Size, By End Use, 2015-2022 (USD Million)

Table 16 Market Size, By Fit, 2015-2022 (USD Million)

Table 17 Line-Fit: Market Size, By Region, 2015-2022 (USD Million)

Table 18 Retrofit: Market Size, By Region, 2015-2022 (USD Million)

Table 19 Market Size, By Application, 2015-2022 (USD Million)

Table 20 Navigation & Positioning: Market Size, By Region, 2015-2022 (USD Million)

Table 21 Landing: Market Size, By Region, 2015-2022 (USD Million)

Table 22 Market Size, By Region, 2015-2022 (USD Million)

Table 23 North America Market Size, By Application, 20152022 (USD Million)

Table 24 North America Market Size, By Platform, 20152022 (USD Million)

Table 25 Fixed Wing: North America Market Size, By End Use, 20152022 (USD Million)

Table 26 Rotary Wing: North America Market Size, By End Use, 20152022 (USD Million)

Table 27 North America Market Size, By Fit, 20152022 (USD Million)

Table 28 North America Market Size, By Country, 2015-2022 (USD Million)

Table 29 US Market Size, By Platform, 20152022 (USD Million)

Table 30 Canada Market Size, By Platform, 20152022 (USD Million)

Table 31 Europe Market Size, By Application, 20152022 (USD Million)

Table 32 Europe Market Size, By Platform, 20152022 (USD Million)

Table 33 Fixed Wing: Europe Market Size, By End Use, 20152022 (USD Million)

Table 34 Rotary Wing: Europe Market Size, By End Use, 20152022 (USD Million)

Table 35 Europe Market Size, By Fit, 20152022 (USD Million)

Table 36 Europe Market Size, By Country, 2015-2022 (USD Million)

Table 37 Russia Market Size, By Platform, 20152022 (USD Million)

Table 38 Germany Market Size, By Platform, 20152022 (USD Million)

Table 39 UK Market Size, By Platform, 20152022 (USD Million)

Table 40 France Market Size, By Platform, 20152022 (USD Million)

Table 41 Italy Market Size, By Platform, 20152022 (USD Million)

Table 42 Spain Market Size, By Platform, 20152022 (USD Million)

Table 43 Asia Pacific Market Size, By Application, 20152022 (USD Million)

Table 44 Asia Pacific Market Size, By Platform, 20152022 (USD Million)

Table 45 Fixed Wing: Asia Pacific Market Size, By End Use, 20152022 (USD Million)

Table 46 Rotary Wing: Asia Pacific Market Size, By End Use, 20152022 (USD Million)

Table 47 Asia Pacific Market Size, By Fit, 20152022 (USD Million)

Table 48 Asia Pacific Market Size, By Country, 2015-2022 (USD Million)

Table 49 China Market Size, By Platform, 20152022 (USD Million)

Table 50 Japan Market Size, By Platform, 20152022 (USD Million)

Table 51 India Market Size, By Platform, 20152022 (USD Million)

Table 52 South Korea Market Size, By Platform, 20152022 (USD Million)

Table 53 Middle East Market Size, By Application, 20152022 (USD Million)

Table 54 Middle East Market Size, By Platform, 20152022 (USD Million)

Table 55 Fixed Wing: Middle East Market Size, By End Use, 20152022 (USD Million)

Table 56 Rotary Wing: Middle East Market Size, By End Use, 20152022 (USD Million)

Table 57 Middle East Market Size, By Fit, 20152022 (USD Million)

Table 58 Middle East Market Size, By Country, 2015-2022 (USD Million)

Table 59 Israel Market Size, By Platform 20152022 (USD Million)

Table 60 Saudi Arabia Market Size, By Platform, 20152022 (USD Million)

Table 61 RoW Market Size, By Application, 20152022 (USD Million)

Table 62 RoW Market Size, By Platform, 20152022 (USD Million)

Table 63 Fixed Wing: RoW Market Size, By End Use, 20152022 (USD Million)

Table 64 Rotary Wing: RoW Market Size, By End Use, 20152022 (USD Million)

Table 65 RoW Market Size, By Fit, 20152022 (USD Million)

Table 66 RoW Market Size, By Country, 2015-2022 (USD Million)

Table 67 Brazil Market Size, By Platform 20152022 (USD Million)

Table 68 South Africa Market Size, By Platform, 20152022 (USD Million)

Table 69 Others Market Size, By Platform, 20152022 (USD Million)

Table 70 Market: Ranking of Key Players

List of Figures (44 Figures)

Figure 1 Multi-Mode Receiver Market: Markets Covered

Figure 2 Years Considered for the Study

Figure 3 Research Process Flow

Figure 4 Multi-Mode Receiver Market: Research Design

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Assumptions of the Research Study

Figure 10 Multi-Mode Receiver Market, By Application, 2017 & 2022 (USD Million)

Figure 11 Fixed Wing Segment Estimated to Lead the Market in 2017

Figure 12 Line-Fit Segment Estimated to Lead the Market in 2017

Figure 13 North America Estimated to Lead the Market in 2017

Figure 14 Increasing Number of Aircraft Deliveries to Drive the Market Growth From 2017 to 2022

Figure 15 Line-Fit Segment Projected to Lead the Market From 2017 to 2022

Figure 16 Navigation & Positioning Segment Estimated to Capture the Major Market Share in North America in 2017

Figure 17 Commercial Aviation Segment of the Fixed Wing Market Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 18 Asia Pacific Multi-Mode Receiver Market Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 19 Multi-Mode Receiver Market, By Application

Figure 20 Market, By Sub-System

Figure 21 Market, By Platform

Figure 22 Market, By Fit

Figure 23 Market, By Region

Figure 24 Market Dynamics

Figure 25 Airbus and Boeing Regional Aircraft Fleet Forecast Comparison By 2035

Figure 26 Multi-Mode Receiver Industry Trends

Figure 27 Companies Offering Integrated Multi-Mode Receiver

Figure 28 Fixed Wing Segment to Dominate the Market During the Forecast Period

Figure 29 Line-Fit Segment to Dominate the Market During the Forecast Period

Figure 30 Navigation & Positioning Application Segment to Dominate the Market During the Forecast Period

Figure 31 Asia Pacific Multi-Mode Receiver Market Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 32 North America Multi-Mode Receiver Market Snapshot

Figure 33 Europe Market Snapshot

Figure 34 Asia Pacific Market Snapshot

Figure 35 Middle East Market Snapshot

Figure 36 Market Ranking Analysis of Key Players

Figure 37 Market Competitive Leadership Mapping, 2017

Figure 38 BAE Systems PLC: Company Snapshot

Figure 39 Honeywell International Inc.: Company Snapshot

Figure 40 Indra Sistemas, SA: Company Snapshot

Figure 41 Leonardo SPA: Company Snapshot

Figure 42 Rockwell Collins, Inc.: Company Snapshot

Figure 43 Saab AB: Company Snapshot

Figure 44 Thales Group: Company Snapshot

Growth opportunities and latent adjacency in Multi-mode Receiver Market