Neurovascular Devices Market by Disease Pathology (Cerebral Ameurysm (Embolic coils), Ischemic Stroke (Clot retrievers, Aspiration, Microcatheters), AVM (Liquid Embolic Agents), End User (Hospitals), & Region - Global Forecast to 2028

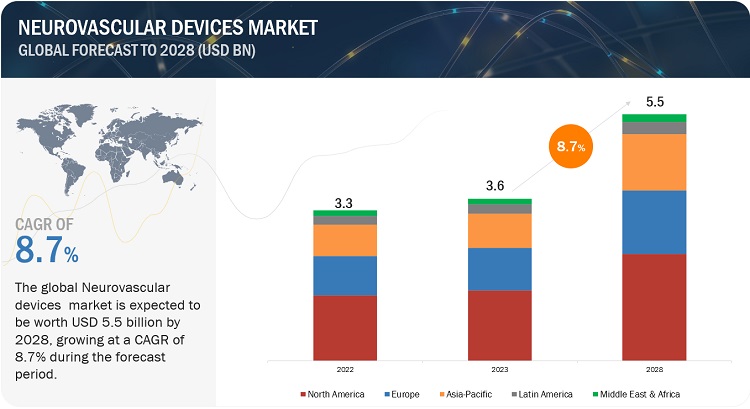

The global neurovascular devices market in terms of revenue was estimated to be worth $3.6 billion in 2023 and is poised to reach $5.5 billion by 2028, growing at a CAGR of 8.7% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth in this market is attributed to the increase in the prevalence of various neurovascular diseases, rising adoption of minimally invasive surgical procedures, expansion of healthcare infrastructure in emerging countries, and strategic collaborations & partnerships among manufacturers and research institutes to boost the new developments in interventional neurology. However, high cost of neurovascular interventional procedures & related devices to pose a barrier towards the adoption of neurovascular treatment, especially in developing countries with poor reimbursement policies.

Attractive Opportunities in the Neurovascular Devices Market

To know about the assumptions considered for the study, Request for Free Sample Report

Neurovascular Devices Market Dynamics

DRIVER: Growing prevalence of neurovascular diseases

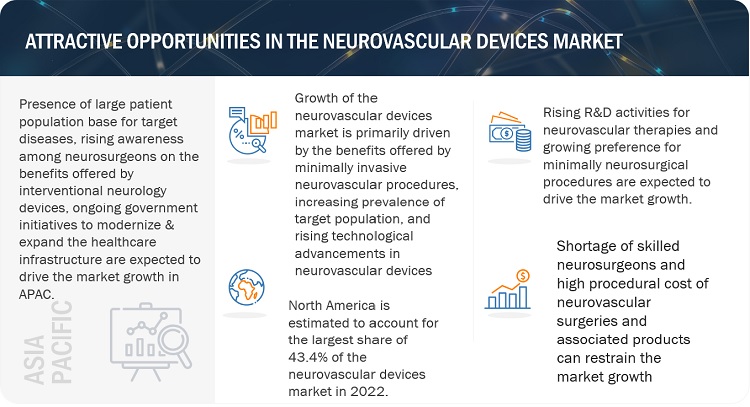

With proven clinical efficacy, interventional therapeutic procedures are being adopted for better diagnosis, monitoring, and therapy for neurological conditions. The significant adoption of neurovascular devices can be mainly attributed to the large and rapidly growing patient population base for target diseases across the key markets. According to the World Stroke Organization (WSO) in 2022, around 7.6 million new ischemic stroke cases were registered worldwide. Globally, a larger proportion of the population is at risk of developing neurovascular diseases as a result of the growing prevalence of obesity, high blood pressure, smoking, and surge in geriatric patient population. According to CDC, the risk of developing stroke is doubling every 10 years after the age 55. All these factors are anticipated to boost the demand for neurovascular interventional devices in the coming years.

RESTRAINT: High procedural cost of neurovascular surgeries and associated products

The high cost of neurovascular surgical procedures and devices is a major factor restraining the global market, especially in developing countries with poor reimbursement policies. Additionally, maintenance costs and other associated indirect expenses increase the total cost of ownership of these devices, thereby limiting their adoption. Owing to high costs and a poor reimbursement scenario, a very limited pool of patients in developing countries can afford neurological treatment. As a result, healthcare facilities are reluctant to invest in new or technologically advanced systems, thus limiting the market.

OPPORTUNITY: Rising number of research activities for neurovascular therapies

Neurovascular devices are witnessing a growing demand among the major stakeholders globally, due to increasing clinical research activities in the field of neurovascular therapies, which offer credible clinical data related to their safety & efficacy profiles. Moreover, the growing emphasis by patients on effective, accurate and early diagnoses of target diseases is driving the number of industry-academia collaborations, investments in clinical studies aimed at the development and commercialization of innovative and therapeutically diverse neurovascular products. In 2021, EIT Health-supported start-up, Oxford Endovascular (UK), raised USD 10 million to boost the research & development of novel neurovascular devices for the treatment of ischemic stroke.

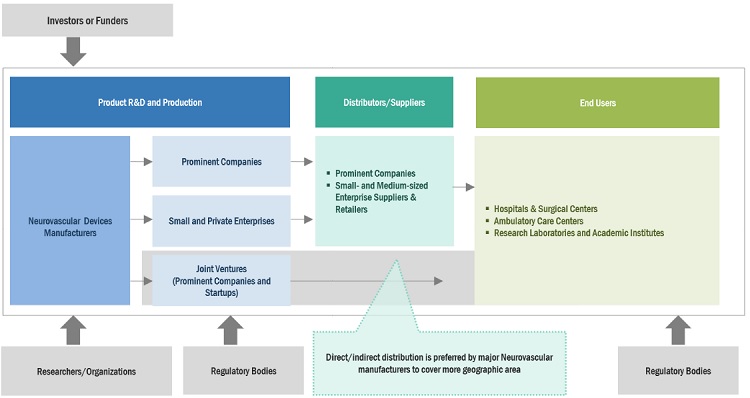

Neurovascular Devices Market Ecosystem

Prominent companies in this neurovascular devices industry include well-established, financially stable manufacturers of neurovascular devices systems, reagent, gel documentation systems and software. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Stryker (US), Johnson & Johnson (US), Medtronic plc (US), Terumo Corporation (Japan), and Penumbra, Inc. (US).

In 2022, Ischemic stroke segment of neurovascular devices industry, to observe highest growth rate during the forecast period, by disease pathology

Based on disease pathology, the neurovascular devices market is segmented into cerebral aneurysm, ischemic strokes, carotid artery stenosis, arteriovenous malformations & fistulas, and other disease pathologies. The ischemic stroke segment is anticipated to grow at the highest CAGR during the forecast period. This can be attributed to the growing prevalence of ischemic stroke globally, increasing number of ischemic stroke patients undergoing mechanical thrombectomy procedures; and the rising focus of manufacturers on boosting R&D to launch technologically advanced neurovascular interventional devices such as clot retrieval devices and aspiration catheters for the treatment of Ischemic stroke

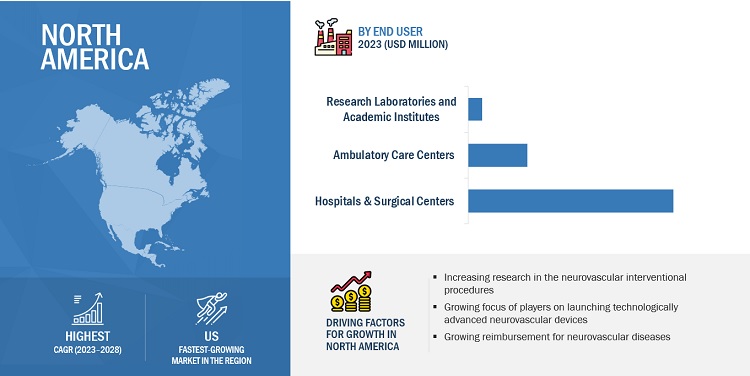

In 2022, hospitals & surgical centers segment to dominate the neurovascular devices industry, by end user

Based on end user, the neurovascular devices market is segmented into hospitals & surgical centers, ambulatory care centers, and research laboratories and academic institutes. The hospital & surgical centers captured the largest share of market during the forecast period. This can be attributed to the rising hospitalized patient volume with neurovascular disease in hospitals, expansion of hospital infrastructure in developing countries, and growing availability of cutting-edge technologies in hospitals to boost neurovascular treatment.

In 2022, North America to dominate in neurovascular devices industry

The global neurovascular devices market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. North America is expected to dominate during the forecast period, due to the significant rise in the burden of neurovascular diseases, continued expansion of ambulatory care facilities, increasing volume of minimally invasive procedures and growing reimbursement for various neurovascular conditions.

To know about the assumptions considered for the study, download the pdf brochure

The neurovascular devices market is dominated by players such Stryker (US), Johnson & Johnson (US), Medtronic plc (US), Terumo Corporation (Japan), and Penumbra, Inc. (US).

Scope of the Neurovascular Devices Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$3.6 billion |

|

Projected Revenue by 2028 |

$5.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 8.7% |

|

Market Driver |

Growing prevalence of neurovascular diseases |

|

Market Opportunity |

Rising number of research activities for neurovascular therapies |

This research report categorizes the neurovascular devices market to forecast revenue and analyze trends in each of the following submarkets:

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

By Disease Pathology

-

Cerebral Aneurysm

- Embolic coils

- Flow Diversion Devices

- Microcatheters

- Intracranial Stent

- Guidewires

-

Ischemic Stroke

- Clot Retrievers Devices

- Suction and Aspiration Devices

- Vascular Snares

- Microcatheter

- Microguidewires

- Balloon Guide Catheters

-

Carotid Artery Stenosis

- Carotid Artery Stents

- Embolic Protection Devices

- Balloon Catheters

-

Arteriovenous Malformation & Fistulas

- Liquid Embolic Agents

- Microcatheters

- Occlusion Balloon Catheters

- Other Disease Pathologies

By End User

- Hospitals & Surgical Centers

- Ambulatory Care Centers

- Research Laboratories And Academic Institutes

Recent Developments of Neurovascular Devices Industry

- In December 2022, Stryker (US) established a new research & development facility at International Park, Gurgaon, India, intending to accelerate innovations in neurovascular devices for stroke treatment

- In February 2022, Johnson & Johnson (US) launched the EMBOGUARD, a balloon guide catheter for treating acute ischemic stroke.

- In January 2021, Penumbra, Inc.(US) and Genesis Medtech (Australia) collaborated to expand Penumbra’s market capabilities in China by commercializing and producing novel neurovascular products in China.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global neurovascular devices market?

The global neurovascular devices market boasts a total revenue value of $5.5 billion by 2028.

What is the estimated growth rate (CAGR) of the global neurovascular devices market?

The global neurovascular devices market has an estimated compound annual growth rate (CAGR) of 8.7% and a revenue size in the region of $3.6 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The objective of the study is analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track companies developments such as acquisitions, product launches, expansions, collaborations, agreements and partnerships of the leading players, the competitive landscape of the neurovascular devices market to analyzes market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were use to estimate the market size. To estimate the market size of segments and subsegments the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as World Health Organization (WHO), World Bank, Organisation for Economic Co-operation and Development (OECD), American Stroke Association (ASA), American Neurological Association (ANS), Society of Therapeutic Neuro Interventions (STNI), Centers for Disease Control and Prevention (CDC), US Food and Drug Association (FDA) National Institutes of Health (NIH), annual reports, investor presentations, and SEC filings of companies). Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the market. A database of the key industry leaders was also prepared using secondary research.

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (hospitals and surgical centers, ambulatory centers, and research institutes)) and supply-side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Approximately 40% of the primary interviews were conducted with stakeholders from the demand side while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

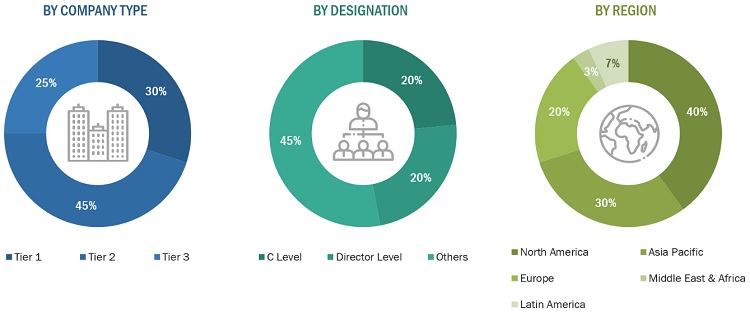

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Stryker |

General Manager |

|

Medtronic |

Senior Product Manager |

|

Johnson & Johnson |

Regional Manager |

|

Penumbra, Inc |

General Manager of Sales |

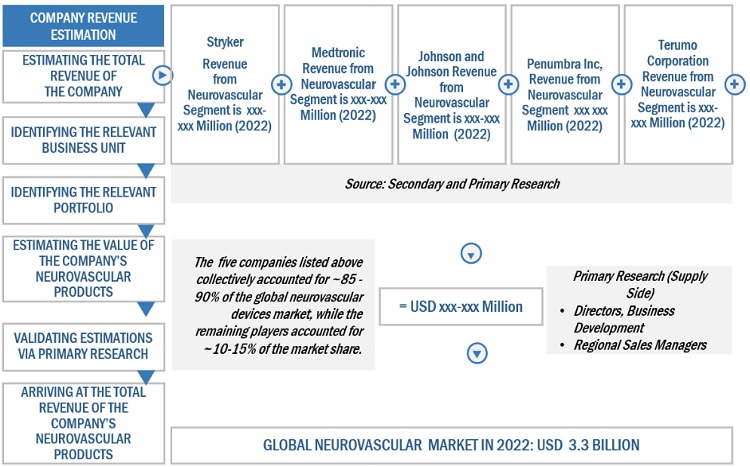

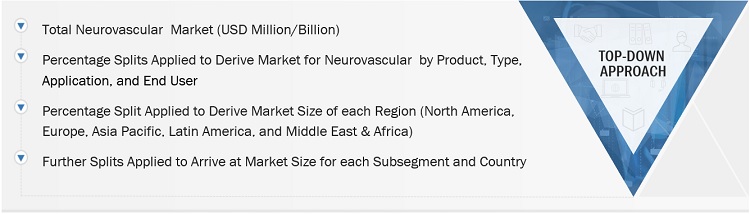

Market Size Estimation

All major product manufacturers offering various neurovascular devices were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value neurovascular devices market was also split into various segments and subsegments at the region and country level based on:

- Product mapping of various manufacturers for each type of market at the regional and country-level

- Relative adoption pattern of each market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Global Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Neurovascular devices industry.

Market Definition

Neurovascular devices are used for the minimally invasive treatment of neurological disorders and neurovascular diseases that affect the central nervous system (including brain and spinal cord). These diseases include aneurysms, arteriovenous malformations, intracranial stenosis, atherosclerosis, and Moyamoya disease. Interventional neurology includes angiography, endovascular, and catheter-based techniques, among others.

Key Stakeholders

- Original Equipment Manufacturers (OEMs)

- Product Sales And Distribution Companies

- Healthcare Service Providers (Hospitals And Surgical Centers)

- Non-Government Organizations

- Government Regulatory Authorities

- Ambulatory Care Centers

- Contract Manufacturers And Third-Party Suppliers

- Research Laboratories And Academic Institutes

- Clinical Research Organizations (CROs)

- Government And Non-Governmental Regulatory Authorities

- Market Research And Consulting Firms

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To define, describe, segment, and forecast the neurovascular devices market by disease pathology, end user, and region

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions; product launches; expansions; collaborations, agreements, & partnerships; and R&D activities of the leading players in the market

- To benchmark players within the market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Neurovascular devices market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Neurovascular devices Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Neurovascular Devices Market

need data on advancements in the Neurovascular Devices market. outlook, size, share everything.

Detailed US geo information of Neurovascular Devices Market with a vision to 2022 - 2026

In what way COVID19 is Impacting the global growth of the Neurovascular Devices Market?