Nuclear Medicine Equipment Market by Product (SPECT (Hybrid SPECT, Standalone SPECT), hybrid PET, & Planar Scintigraphy), Application (Cardiology, Oncology & Neurology) & by End user (Hospitals, Imaging Centers) - Global Forecasts to 2020

Nuclear medicine equipment makes use of radioactive substances (also called as nuclear medicine or radiopharmaceuticals) that are inserted into the body orally or intravenously. These systems capture the radiations emitted by radiopharmaceuticals to create images of the structures and activities inside the human body. These images enable physicians to look inside a human body to help determine the cause of an illness or injury and provide an accurate diagnosis. The nuclear medicine equipment market is expected to grow at a single-digit CAGR in the next five years. This market is poised to reach USD 2.13 Billion by 2020 from USD 1.78 Billion in 2015, at a CAGR of 3.6% during the forecast period.

The nuclear medicine equipment market is segmented on the basis of product, application, and end user. The market by product is segmented into hybrid PET, SPECT, and planar scintigraphy systems. The SPECT product segment is further divided into hybrid SPECT and standalone SPECT. On the basis of application, the market is segmented into oncology, cardiology, neurology and other applications which includes orthopedics, urology, thyroid related disorders, and gastroenterology. Based on the end users the market is divided into hospitals, imaging centers, academic and research institutes and others which include pharma/biotech companies and CROs. Rising prevalence/incidence of cancer, cardiac disorders, and neurological disorders; growing awareness about the importance of early diagnosis of diseases; launch of advanced nuclear medicine equipment in the market; and rising adoption of nuclear medicine equipment by end users are major factors driving this market. However, high cost of nuclear medicine equipment and shorter half-life of radiopharmaceuticals are expected to restrain the growth of the market. In addition, growing adoption of refurbished diagnostic imaging systems and hospital budget cuts acts as a challenge for the market. On the other hand, strong product pipeline coupled with expansion & penetration opportunities in emerging economies are expected to be lucrative opportunities for the market.

Philips Healthcare (Netherlands), GE Healthcare (U.K.), Siemens Healthcare (Germany), Digirad Corporation (U.S.), Mediso Medical Imaging Systems, Ltd. (Hungary), Toshiba Medical Systems Corporation (Japan), DDD-Diagnostics A/S (Denmark), Neusoft Medical Systems Co. Ltd. (China), and SurgicEye GmbH (Germany), CMR Naviscan Corporation (U.S.).

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

:

This research report categorizes the nuclear medicine equipment market into the following segments:

Market, by Product

- SPECT

- Hybrid SPECT

- Standalone SPECT

- Hybrid PET

- Planar Scintigraphy

Market, by Application

- Oncology

- Cardiology

- Neurology

- Others (Orthopedics, Urology, Thyroid Related Disorders, and Gastroenterology)

Market, by End User

- Hospitals

- Imaging Centers

- Academic & Research Institutes

- Others (Pharma/Biotech companies, and CROs)

Market, by Region

- North America

- U.S.

- Canada

- Europe

- EU5

- Rest of Europe (RoE)

- Asia-Pacific

- Japan

- China

- India

- Rest of Asia-Pacific (RoAPAC)

- Rest of the World (RoW)

Nuclear Medicine Equipment Ecosystem Comprises of:

- Raw Material Suppliers of nuclear medicine equipment

- Vendors/Suppliers/Distributors of nuclear medicine equipment

- End-users: Hospitals, imaging centers, academic & research institutes, among others.

- Other Stakeholders: government organizations, consulting firms, venture capitalists, among others

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Portfolio Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company (top 3 companies)

Company Information

- Detailed analysis and profiling of additional market players (up to 3)

Nuclear medicine equipment make use of radioactive substances (also called as nuclear medicine or radiopharmaceuticals) that are inserted into the body orally or intravenously. These systems capture the radiations emitted by radiopharmaceuticals to create images of the structures and activities inside the human body. These images enable physicians to look inside a human body to help determine the cause of an illness or injury and provide an accurate diagnosis.

The global nuclear medicine equipment market is segmented on the basis of product, application, end user and geography. The global medicine equipment market is valued at an estimated USD 1.7 billion in 2015. The major factors driving the growth of this market are:

- Introduction of new and advanced products: Companies in the market are increasingly focusing on developing technologically advanced imaging equipment. New product launches with advanced technologies or advanced features mainly deal with the development of more economical and easy-to-use nuclear medicine equipment that provide improved patient safety.

- Advancements in radiotracers: Players operating in the market are increasingly focusing on the development of novel radiopharmaceuticals. The launch of novel radiopharmaceuticals that have the potential of providing better quality results will in turn drive the demand for nuclear imaging procedures for the diagnosis of various diseases.

- Rising prevalence/incidence of cancer, cardiac disorders, and neurological disorders: With the growing prevalence of cancer, cardiac disorders, and neurological disorders, the demand for various diagnostic procedures, including nuclear imaging procedures, is expected to increase across the globe.

The high cost of nuclear medicine equipment is a major factor restraining the growth of this market. This is because small hospitals and imaging centers have restricted budgets owing to which the adoption of nuclear medicine equipment is low among these end users. Moreover, the shorter half-life of radiopharmaceuticals is another factor restraining the growth of the global market.

Based on product, the nuclear medicine equipment market is categorized into SPECT, hybrid PET, and planar scintigraphy. The SPECT segment is further categorized into hybrid SPECT and standalone SPECT. In 2015, the SPECT products segment is estimated to account for the largest share of market. However, the hybrid PET segment is expected to grow at the fastest rate during the forecast period.

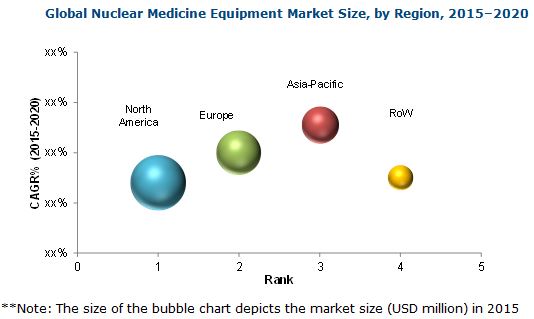

The nuclear medicine equipment market is expected to reach USD 2.13 Billion in 2020, growing at a CAGR of 3.6%. The market is dominated by North America, followed by Europe, Asia-Pacific, and the Rest of the World (RoW). Asia-Pacific is expected to grow at the fastest rate during the forecast period.

*Source: Organisation for Economic Co-operation and Development (OECD) Publications, American College of Radiology (ACR), European Association of Nuclear Medicine (EANM), National Institutes of Health (NIH), World Nuclear Association (WNA), Society of Nuclear Medicine and Molecular Imaging (SNMMI), Australian Nuclear Science and Technology Organisation (ANSTO), Canadian Nuclear Association (CNA), Nuclear Medicine Associations, Centers for Disease Control and Prevention (CDC), Expert Interviews, and MarketsandMarkets Analysis

Some of the major players in the global nuclear medicine equipment market include Philips Healthcare (Netherlands), GE Healthcare (U.K.), Siemens Healthcare (Germany), Digirad Corporation (U.S.), Mediso Medical Imaging Systems, Ltd. (Hungary), Toshiba Medical Systems Corporation (Japan), DDD-Diagnostics A/S (Denmark), Neusoft Medical Systems Co. Ltd. (China), SurgicEye GmbH (Germany), and CMR Naviscan Corporation (U.S.) among others.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Methodology Steps

2.2 Secondary and Primary Research Methodology

2.2.1 Secondary Research

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Research

2.2.2.1 Key Industry Insights

2.2.2.2 Key Data From Primary Sources

2.2.2.3 Key Insights From Primary Sources

2.3 Market Size Estimation Methodology

2.4 Market Data Validation and Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 29)

3.1 Current Scenario

3.2 Future Outlook

3.3 Conclusion

4 Premium Insights (Page No. - 33)

4.1 Global Nuclear Medicine Equipment Market

4.2 Nuclear Medicine Equipment Market, By Application and End User

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Introduction of New and Advanced Products

5.3.1.2 Investments Through Public-Private Partnerships to Modernize Diagnostic Imaging Centers

5.3.1.3 Advances in Radiotracers

5.3.1.4 Increasing Incidence and Prevalence of Cancer and Cardiac Ailments

5.3.1.5 Growing Geriatric Population

5.3.1.6 Increasing Investments, Funds, and Grants By Government Bodies Worldwide

5.3.2 Restraints

5.3.2.1 High Cost of Nuclear Medicine Equipment

5.3.2.2 Shorter Half-Life of Radiopharmaceuticals

5.3.3 Challenges

5.3.3.1 Increasing Adoption of Refurbished Diagnostic Imaging Systems

5.3.3.2 Hospital Budget Cuts

5.3.4 Opportunities

5.3.4.1 Strong Product Pipeline

5.3.4.2 High Demand in Emerging Markets

6 Nuclear Medicine Equipment Market, By Product (Page No. - 47)

6.1 Introduction

6.2 Single Photon-Emission Computed Tomography (SPECT)

6.2.1 Standalone SPECT Systems

6.2.2 Hybrid SPECT Systems

6.3 Hybrid Pet

6.4 Planar Scintigraphy

7 Nuclear Medicine Equipment Market, By Application (Page No. - 56)

7.1 Introduction

7.2 Cardiology

7.3 Oncology

7.4 Neurology

7.5 Other Applications

8 Nuclear Medicine Equipment Market, By End User (Page No. - 64)

8.1 Introduction

8.2 Hospitals

8.3 Imaging Centers

8.4 Academic and Research Centers

8.5 Other End Users

9 Nuclear Medicine Equipment Market, By Region (Page No. - 70)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.1.1 Increased Adoption of Nuclear Medicine Equipment

9.2.1.2 Increase in the Aging Population and Rising Prevalence of Chronic Diseases

9.2.1.3 Declining Reimbursements for Radiology

9.2.1.4 Unfavorable Healthcare Reforms

9.2.2 Canada

9.2.2.1 High Incidence Rate Chronic Diseases

9.3 Europe

9.3.1 EU5

9.3.1.1 Increasing Number of Pet-Ct Procedures in the U.K.

9.3.1.2 Increasing Adoption of Nuclear Medicine Equipment

9.3.1.3 Increasing Incidence and Prevalence of Cancer

9.3.1.4 Increasing Investment By Stakeholders

9.3.1.5 Sluggish Growth in Healthcare Expenditure

9.3.2 RoE

9.3.2.1 Government and Public-Private Investments

9.3.2.2 Increased Focus of Market Players

9.3.2.3 Rapid Rise in the Geriatric Population

9.4 Asia-Pacific (APAC)

9.4.1 Japan

9.4.1.1 Aging Population and High Healthcare Expenditure in Japan

9.4.2 China

9.4.2.1 Developing Healthcare Infrastructure

9.4.2.2 Rise in Population, Prevalence of Diseases

9.4.2.3 Irregularities in the Tendering Process

9.4.3 India

9.4.3.1 High Incidence and Prevalence of Chronic Diseases

9.4.3.2 Increasing Installations of Nuclear Medicine Equipment

9.4.3.3 Increasing Focus of Global Market Players

9.4.3.4 Improving Healthcare Insurance Coverage

9.4.3.5 Increasing Use of Refurbished Medical Devices A Major Challenge for Market Players

9.4.4 Rest of Asia-Pacific (RoAPAC)

9.4.4.1 Increasing Incidence of Chronic Disease, Growing Geriatric Population

9.4.4.2 Favorable Regulatory Changes in New Zealand and Australia

9.4.4.3 Increasing Public-Private Investments

9.5 Rest of the World

9.5.1 Latin America

9.5.1.1 Favorable Reimbursement Scenario in Brazil

9.5.1.2 Consolidation of Healthcare Service Providers in Brazil

9.5.1.3 Growing Healthcare Infrastructure in Latin America

9.5.2 The Middle East

9.5.3 Africa

10 Competitive Landscape (Page No. - 117)

10.1 Overview

10.2 Market Share Analysis

10.3 Competitive Situation and Trends

10.3.1 New Product Launches

10.3.2 Expansions

10.3.3 Acquisitions

10.3.4 Other Strategies

11 Company Profiles (Page No. - 128)

(Overview, Financials, Products & Services, Strategy, & Developments)*

11.1 Introduction

11.2 Philips Healthcare

11.3 Siemens AG (Siemens Healthcare)

11.4 GE Healthcare

11.5 Digirad Corporation

11.6 Mediso Medical Imaging Systems Ltd.

11.7 Surgiceye GmbH

11.8 Toshiba Medical Systems Corporation

11.9 Ddd-Diagnostic A/S

11.10 Neusoft Medical Systems Co., Ltd.

11.11 CMR Naviscan Corporation

*Details on Financials, Product & Services, Strategy, & Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 150)

12.1 Discussion Guide

12.2 Company Developments (20122015)

12.2.1 Philips Healthcare

12.2.2 Siemens Healthcare

12.2.3 GE Healthcare

12.2.4 Digirad Corporation

12.2.5 Toshiba Medical Systems Corporation

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (83 TAbles)

Table 1 Introduction of Advanced Products is Driving the Growth of the Nuclear Medicine Equipment Market

Table 2 High Cost of Nuclear Medicine Equipment Restraining Market Growth

Table 3 Growing Adoption of Refurbished Systems is A Major Challenge for the Nuclear Medicine Equipment Market

Table 4 Emerging Markets Present An Array of Opportunities for Growth of the Nuclear Medicine Equipment Market

Table 5 Nuclear Medicine Equipment Market Size, By Product, 20132020 (USD Million)

Table 6 Nuclear Medicine Equipment Market Size, By Product, 20132020 (Units)

Table 7 Market Size for SPECT, By Region, 20132020 (USD Million)

Table 8 Market Size for SPECT, By Type, 20132020 (USD Million)

Table 9 Nuclear Medicine Equipment Market Size for SPECT, By Type, 20132020 (Units)

Table 10 Nuclear Medicine Equipment Market Size for Standalone SPECT, By Region, 20132020 (USD Million)

Table 11 Market Size for Hybrid SPECT, By Region, 20132020 (USD Million)

Table 12 Market Size for Hybrid Pet, By Region, 20132020 (USD Million)

Table 13 Nuclear Medicine Equipment Market Size for Planar Scintigraphy, By Region, 20132020 (USD Million)

Table 14 Nuclear Medicine Equipment Market Size, By Application, 20132020 (USD Million)

Table 15 Hybrid Pet Imaging Systems/Equipment Market Size, By Application, 20132020 (USD Million)

Table 16 SPECT Imaging Systems/Equipment Market Size, By Application, 20132020 (USD Million)

Table 17 Planar Scintigraphy Systems/Equipment Market Size, By Application, 20132020 (USD Million)

Table 18 Nuclear Medicine Equipment Market Size for Cardiology, By Region, 2013-2020 (USD Million)

Table 19 Nuclear Medicine Equipment Market Size for Oncology, By Region, 2013-2020 (USD Million)

Table 20 Market Size for Neurology, By Region, 2013-2020 (USD Million)

Table 21 Market Size for Other Applications, By Region, 2013-2020 (USD Million)

Table 22 Nuclear Medicine Equipment Market Size, By End User, 20132020 (USD Million)

Table 23 Market Size for Hospitals, By Region, 2013-2020 (USD Million)

Table 24 Market Size for Imaging Centers, By Region, 2013-2020 (USD Million)

Table 25 Nuclear Medicine Equipment Market Size for Academic & Research Centers, By Region, 2013-2020 (USD Million)

Table 26 Nuclear Medicine Equipment Market Size for Other End Users, By Region, 2013-2020 (USD Million)

Table 27 Nuclear Medicine Equipment Market Size, By Region, 20132020 (USD Million)

Table 28 North America: Nuclear Medicine Equipment Market Size, By Country, 20132020 ($Million)

Table 29 North America: Market Size, By Product, 20132020 (USD Million)

Table 30 North America: Market Size for SPECT, By Type, 20132020 (USD Million)

Table 31 North America: Market Size, By Application, 20132020 (USD Million)

Table 32 North America: Market Size, By End User, 20132020 (USD Million)

Table 33 U.S.: Nuclear Medicine Equipment Market Size, By Product, 20132020 (USD Million)

Table 34 U.S.: Market Size for SPECT, By Type, 20132020 (USD Million)

Table 35 U.S.: Market Size, By Application, 20132020 (USD Million)

Table 36 U.S.: Market Size, By End User, 20132020 (USD Million)

Table 37 Canada: Nuclear Medicine Equipment Market Size, By Product, 20132020 (USD Million)

Table 38 Canada: Market Size for SPECT, By Type, 20132020 (USD Million)

Table 39 Canada: Market Size, By Application, 20132020 (USD Million)

Table 40 Canada: Market Size, By End User, 20132020 (USD Million)

Table 41 Europe: Nuclear Medicine Equipment Market Size, By Region, 20132020 ($Million)

Table 42 Europe: Market Size, By Product, 20132020 (USD Million)

Table 43 Europe: Market Size for SPECT, By Type, 20132020 (USD Million)

Table 44 Europe: Market Size, By Application, 20132020 (USD Million)

Table 45 Europe: Market Size, By End User, 20132020 (USD Million)

Table 46 EU5: Nuclear Medicine Equipment Market Size, By Product, 20132020 (USD Million)

Table 47 EU5: Market Size for SPECT, By Type, 20132020 (USD Million)

Table 48 EU5: Market Size, By Application, 20132020 (USD Million)

Table 49 EU5: Market Size, By End User, 20132020 (USD Million)

Table 50 RoE: Market Size, By Product, 20132020 (USD Million)

Table 51 RoE: Market Size for SPECT, By Type, 20132020 (USD Million)

Table 52 RoE: Market Size, By Application, 20132020 (USD Million)

Table 53 RoE: Market Size, By End User, 20132020 (USD Million)

Table 54 Asia-Pacific: Nuclear Medicine Equipment Market Size, By Country, 20132020 ($Million)

Table 55 APAC: Market Size, By Product, 20132020 (USD Million)

Table 56 APAC: Market Size for SPECT, By Type, 20132020 (USD Million)

Table 57 APAC: Market Size, By Application, 20132020 (USD Million)

Table 58 APAC: Market Size, By End User, 20132020 (USD Million)

Table 59 Japan: Nuclear Medicine Equipment Market Size, By Product, 20132020 (USD Million)

Table 60 Japan: Market Size for SPECT, By Type, 20132020 (USD Million)

Table 61 Japan: Market Size, By Application, 20132020 (USD Million)

Table 62 Japan: Market Size, By End User, 20132020 (USD Million)

Table 63 China: Nuclear Medicine Equipment Market Size, By Product, 20132020 (USD Million)

Table 64 China: Market Size for SPECT, By Type, 20132020 (USD Million)

Table 65 China: Market Size, By Application, 20132020 (USD Million)

Table 66 China: Market Size, By End User, 20132020 (USD Million)

Table 67 India: Nuclear Medicine Equipment Market Size, By Product, 20132020 (USD Million)

Table 68 India: Market Size for SPECT, By Type, 20132020 (USD Million)

Table 69 India: Market Size, By Application, 20132020 (USD Million)

Table 70 India: Market Size, By End User, 20132020 (USD Million)

Table 71 RoAPAC: Nuclear Medicine Equipment Market Size, By Product, 20132020 (USD Million)

Table 72 RoAPAC: Market Size for SPECT, By Type, 20132020 (USD Million)

Table 73 RoAPAC: Market Size, By Application, 20132020 (USD Million)

Table 74 RoAPAC: Market Size, By End User, 20132020 (USD Million)

Table 75 RoW: Nuclear Medicine Equipment Market Size, By Product, 20132020 (USD Million)

Table 76 RoW: Market Size for SPECT, By Type, 20132020 (USD Million)

Table 77 RoW: Market Size, By Application, 20132020 (USD Million)

Table 78 RoW: Market Size, By End User, 20132020 (USD Million)

Table 79 Agreements, Joint Ventures, Partnerships, Collaborations, and Alliances, 20122015

Table 80 New Product Launches, 20122015

Table 81 Expansions, 20122014

Table 82 Acquisitions, 20122015

Table 83 Other Strategies, 20122015

List of Figures (42 Figureas)

Figure 1 Research Methodology Steps

Figure 2 Sampling Frame: Primary Research

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Research Design

Figure 7 Data Triangulation Methodology

Figure 8 North America is Expected to Dominate the Overall Nuclear Medicine Equipment Market in 2015

Figure 9 Hybrid Pet Segment to Witness Highest Growth in the Nuclear Medicine Equipment Market Between 2015 & 2020

Figure 10 Asia-Pacific is Expected to Be the Fastest-Growing Regional Segment During the Forecast Period

Figure 11 Market Overview

Figure 12 Cardiology Segment to Dominate the Market in 2015

Figure 13 Asia-Pacific Poised to Witness Highest Growth Rate During the Forecast Period

Figure 14 Market Segmentation

Figure 15 Market Drivers, Restraints, Opportunities, and Challenges

Figure 16 SPECT Segment Will Continue to Dominate the Nuclear Medicine Equipment Market

Figure 17 Cardiology Segment is Expected to Dominate the Nuclear Medicine Equipment Market in 2015

Figure 18 Hospitals Segment Projected to Account for More Than 1/3rd of the Total Nuclear Medicine Equipment Market

Figure 19 Share of Geriatric Population in the Total Population, 2010 vs 2030

Figure 20 Number of New Cancer Cases, By Country, 2012 vs 2020

Figure 21 Increasing Prevalence of Cancer is Driving the Market Growth in North America

Figure 22 North American Market Snapshot

Figure 23 Europe: Number of Cancer Cases Reported, By Country

Figure 24 European Market Snapshot

Figure 25 Number of New Cancer Cases, By Type

Figure 26 Asia-Pacific Market Snapshot: China, the Fastest-Growing Country in the Market

Figure 27 RoW Market Snapshot

Figure 28 New Product Launches Was the Key Growth Strategy Adopted By Market Players Between 2012 & 2015

Figure 29 Market Share, By Key Player, 2014

Figure 30 New Product Launches Was the Key Strategy

Figure 31 Key Players Focusing on Agreements, Collaborations, Joint Ventures, Alliances, and Partnerships, 20122015

Figure 32 Key Players Focusing on New Product Launches, 20122015

Figure 33 Key Players Focusing on Expansions, 20122015

Figure 34 Key Players Focusing on Acquisitions, 20122015

Figure 35 Key Players Focusing on Other Strategies, 20122015

Figure 36 Geographic Revenue Mix of the Top 3 Market Players

Figure 37 Philips Healthcare : Company Snapshot

Figure 38 Siemens AG: Company Snapshot

Figure 39 GE Healthcare: Company Snapshot

Figure 40 Digirad Corporation

Figure 41 Toshiba Medical Systems Corporation: Company Snapshot

Figure 42 Neusoft Medical Systems Co., Ltd.: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nuclear Medicine Equipment Market