Nutraceutical Ingredients Market by Type (Probiotics, Proteins, Amino Acids, Phytochemicals & Plant Extracts, Fibers & Specialty Carbohydrates), Application (Food, Beverages, Animal Nutrition, Dietary Supplements), Form & Region - Global Forecast to 2027

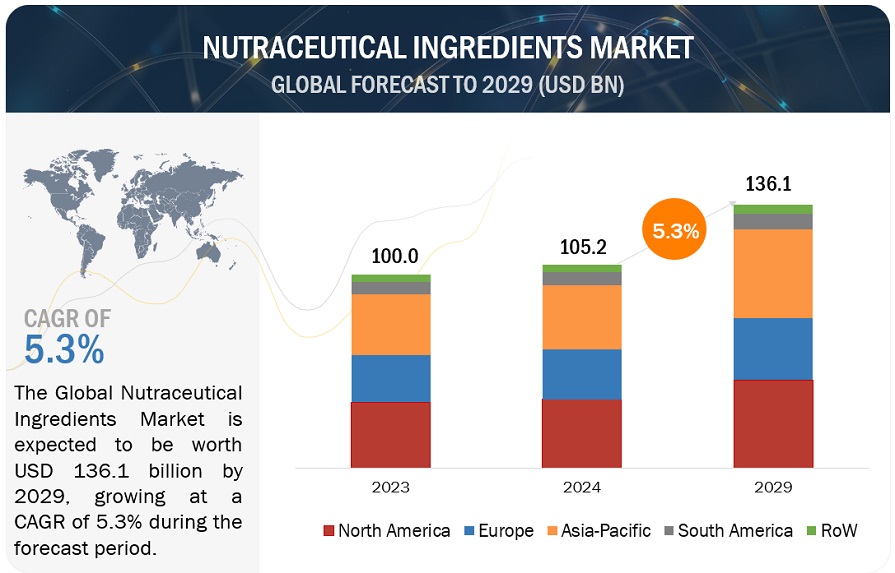

The global nutraceutical ingredients market is estimated to reach $261.7 billion by 2027, growing at a 7.2% compound annual growth rate (CAGR). The global market size was valued $185.2 billion in 2022.

This impressive trend underscores the growing awareness among consumers of the profound connection between diet and wellbeing. As consumers increasingly prioritize health and wellness, demand for functional foods and dietary supplements is expected to drive this growth, creating opportunities for both established players and new entrants to the market. Nutraceutical businesses can use AI to select ingredients quickly by comparing millions of data points from nutritional studies. The nutraceutical industry is an innovative, dynamic sector that gives new chances to combine scientific advancement with rising consumer interest in foods that promote good health. In order to lower the expensive treatment, nutraceutical products are gaining popularity as nutraceuticals are more of preventive method than cure. Consumer demand is a major driver of the nutraceutical industry's explosive expansion. In order to prevent diseases like diabetes, high blood pressure, and obesity, consumers are striving to lead healthy lifestyles and eat optimally. Since, healthcare is luxurious for most of the population, they are opting for alternative cure or taking preventive methods to avoid health problems.

Nutraceutical ingredients are natural compounds that offer health benefits beyond basic nutrition. They can be found in food, supplements, and functional foods. Examples of nutraceutical ingredients include omega-3 fatty acids, probiotics, prebiotics, polyphenols, curcumin, coenzyme Q10, and vitamin D. These ingredients are increasingly popular as people look for natural alternatives to pharmaceuticals and strive to maintain optimal health through nutrition. However, it's important to be cautious because not all nutraceuticals are thoroughly studied or regulated, and some may have unintended side effects or interact with medications. It's always wise to consult a healthcare professional before taking any new supplement or making significant dietary changes.

To know about the assumptions considered for the study, Request for Free Sample Report

Nutraceutical Ingredients Market Dynamics

Driver: Growth in the demand for fortified food owing to the increasing health consciousness amongst consumers

In recent years, most countries have recognized lifestyle-related diseases to be a major problem. This has resulted in an increasing consumer consciousness toward healthy food products, in turn, fueling the Market for nutritive products. The rising aging population, increased life expectancy rates, and increasing instances of chronic diseases have further been driving changes in eating patterns. Fortified food products have been one of the fastest-growing health and wellness food & beverage categories worldwide, followed by naturally healthy and organic food products.

"Food fortification" refers to the process of enhancing the nutritional content of food and beverage products by adding nutrients such as proteins, minerals, and vitamins. Important organizations like the World Health Organization and the United Nations’ Food and Agricultural Organization see food fortification as a crucial tool in the fight against worldwide malnutrition. Overall, the Market for food fortification is booming as a result of strong backing from organizations. Many underdeveloped and emerging countries are going one step further and mandating food fortification. This has led to a surge in the growth of the fortified-foods Market in various regions.

According to the World Food Programme, 2019 nearly 690 million people experienced hunger in 2019, an increase of 10 million from 2018 and about 60 million over the past five years. Numerous governmental and non-governmental organizations must collaborate with food producers to prepare food in such a way that micronutrient shortages are finally addressed in order to trigger a global movement to combat hidden hunger. For a very low cost, micronutrients can be added to common foods like rice, oil, wheat, or maize flour as well as condiments like salt. Therefore, food fortification is a low-cost innovation with long-term advantages for human capital and economic benefits. Food fortification is one of the most economical and reliable investment opportunities as part of broader national efforts to prevent chronic undernutrition.

According to CSIRO (Commonwealth Scientific and Industrial Research Organisation) Government agency, Australia, Demand for fortified and functional foods is expected to reach $9.7 billion by 2030 at around 3% per annum growth. With the continued rise of the world's population and shifts in consumer preferences, the market demand for fortified and functional foods is anticipated to remain strong. The sector is characterized by a varied product mix, which ranges from meals for elderly digestive and cardiovascular health to foods for infant and child growth. By 2030, the domestic Market for fortified and functional products is expected to reach $5.5 billion, while the opportunity for exports is expected to reach $4.2 billion. Consumer tastes will be influenced by lifestyle trends.

According to the article, The Top 10 Functional Food Trends, 2020 published by Institute of Food Technologists, In February 2020, sale of fortified/functional foods were over $267 billion and those of naturally healthy foods were $259 billion globally; in the United States, sales were $63 billion and $42 billion, respectively. In terms of food and nutrition, Asia Pacific continues to dominate global health and wellness growth. The Market having the greatest potential for growth for fortified foods is China, which is followed by Indonesia, Japan, Hong Kong, India, Vietnam, Saudi Arabia, Mexico, Malaysia, and Brazil. According to the U.S census, 2020, With 109 million Americans aged 50 or older and 48 million aged 65 and older, lifestyle issues and aging-related illnesses will increasingly drive functional food sales

According to the International Food Information Council (IFIC) Foundation survey, "Consumer Perspectives on Vitamins, Minerals, and Food and Beverage Fortification," 2020, 72% of Americans said they consider specific vitamins at least sometimes (22% consider them always) when deciding what to eat or drink every day, and 65% consider specific minerals at least sometimes (17% consider them always) when making those choices.

An increase in consumer health consciousness is the main factor driving the fortified food growth. People all around the world are changing their lives since doing so tends to be beneficial in the long run by strengthening their immune systems and reducing their susceptibility to disease. The support of government organizations has also encouraged market growth. For instance, the Food and Agricultural Organization (FAO) and the World Health Organization (WHO) have recognized food fortification as one of the crucial strategies for eradicating widespread malnutrition, particularly in developing nations.

Conversely, as a result of changing lifestyles, consumers no longer have the time or desire to prepare home-cooked meals. As a result, they are more likely to choose convenience foods, which are typically highly processed and, and upon manufacturing, result in reduced levels of essential nutrients than other types of food. Consequently, there has been a shift in focus toward the general well-being of customers, with proper weight management, enhancement of digestive health, boosting of energy, and endurance being of the utmost significance to consumers. Today's consumers are more likely to favour nutrient-dense, fortified foods, food supplements, and wellness-related products. The demand for nutritive convenience foods and fortified food products with specialised capabilities to meet their demands and help them in various health aspects has increased as a result of consumers' increased understanding of nutrition. As a result, market players are looking to diversify their businesses by producing new varieties of enriched and fortified food products, which further propels the market's growth. Consumers' growing needs for wellness products is expected to fuel the growth of this Market.

Restraint: Higher costs of fortified products dissuading large-scale usage and adoption

The price of a product might vary dramatically based on the ingredients' origin (synthetic or natural) and seasonality. Synthetic ingredients have lower production costs and eliminate the need to manage natural sources from which the functional principles are to be extracted. Synthetic raw materials, on the other hand, cannot match the quality of natural raw materials. The bioavailability or seasonality of the raw materials in the product is another factor that can influence the final cost of your project. Furthermore, most natural ingredients are not available all year, or their prices may increase during certain months; these problems affect the cost of manufacturing a supplement.

Some ingredients are sensitive to air, light, and temperature variations, necessitating highly product-specific packaging and formats. Such formats that differ from standard packing are usually more costly. Using patented ingredients rather than standard ones can result in a higher manufacturing cost. These products guarantee that the compounds or strains produced are more effective than standard ingredients. FloraGlo (lutein) and BC30 (probiotic strain), for example, are more expensive than standard ingredients

Food fortification will increase prices of food items by increasing cost of manufacturing. Premixes and capital costs are two significant costs related to food fortification. The mixture of micronutrients known as premix is used to fortify any food. Earlier one is related to the variable costs, it is hence accounted in price determination, while later one is linked with the fixed costs, and it is therefore not accounted in the price of fortified food items. Let's use wheat flour as an example. Utilizing a feeder, which adds premix to flour at predetermined rates during the flour production process, is the most popular method of fortifying wheat flour. Additionally, millers need to set up a lab for quality and standard control. In addition to these fixed expenses, millers have to regularly purchase premix to be mixed with wheat flour. Purchasing premix will increase the overall variable cost for commercial millers who have already invested in a feeder and a laboratory, and they will pass this added financial burden on to consumers by raising the prices of the fortified products to cover their total average expenditures.

According to a study by the industry chamber FICCI, the country's $1.0 billion nutraceutical market is suffering from high product pricing. The study noted that although one kg of salt costs Rs 11, the cost of the low sodium variant was 73% higher. In a similar manner, one kg of flour costs Rs 18, but the nutrient-fortified mix costs 139% more. Similar to this, a chilled beverage costs Rs 20, but an energy drink costs Rs 70, which is 350% higher. According to The Pharma Innovation Journal 2019, high cost of commercially available fortified foods, vegetables, animal proteins, the lack of readily available affordable nutritious foods, and the late introduction of supplementary foods, are mostly responsible for the observed malnourishment among children in Asia.

Nutraceutical ingredients such as probiotics, prebiotics, vitamins, omega-3 fatty acids, and minerals are used to improve the nutritional benefit of food & feed products. Numerous food formulations such as protein bars, protein drinks, soups, sauces, toppings, and dietary supplements, among various other fortified food products, use nutraceutical ingredients to attain a preferred viscosity, or mouthfeel while assuring health benefits. For animal nutrition products, both prebiotics and probiotics are used to enhance the host’s defense and help reduce mortality caused by gut pathogens. Furthermore, fatty acids such as omega 3 & 6 that are also essential to the body’s immunity are used in end products such as bakery, confectionery, and R.T.E. snacks, which, in turn, contribute to a markup price increase in these products. Therefore, the premium pricing of fortified products highly hinders market growth for nutraceutical ingredients during the forecast period.

Growth Opportunities: Product-based and technological innovations in the nutraceutical ingredients market

During the pandemic, there was an increase in demand for food products that contained health-improving additives or nutraceuticals, which has led the nutraceutical industry to use artificial intelligence to introduce personalized diets for each person's nutritional needs, supplementation, and dosage computation. According to a global industry survey conducted by Nutrify Today, the leading i2c (ideas to commercialization) platform for nutraceuticals, technological advancements in the sector will allow for a more personalized approach to nutrition over the next three years, with accurate sensors made possible through partnerships with experts in the MedTech (New York’s trade association for the bio/med industry) sector. According to Association of Herbal and Nutraceuticals Manufacturers of India (AHNMI), Artificial intelligence (AI) will play a crucial part in the evolution of the nutraceutical business, which is expected to see a double-digit growth to reach USD 25 billion in the next ten years.

To support the nutrition drive of Mission Poshan 2.0 (Mission Poshan 2.0 got announced during the Budget 2021) the Nutraceutical industry provides a distinctive amalgamation of traditional science and modern technologies. By combining the traditional medicine heritage, resources, and tech capabilities, numerous economic opportunities with tremendous growth potential are open for exploration. At the national level, regulators are more concerned about nutrition. Nutraceutical products can naturally assist the drive as dietary supplements, functional foods, and drinks are designed to fill the nutritional gap between what is consumed through food and what is required for overall health. A collective effort can augment the upswing for the nutraceutical industry that is anticipated to grow by double digits.

The future of Nutraceuticals is multi-disciplinary science convergence. With the technological advancement, nutraceutical industries have leveraged a good deal of investment. The following is a list of some important technological advancements:

Artificial Intelligence

Nutraceutical businesses can use AI to select ingredients quickly by comparing millions of data points from nutritional studies. On the basis of the dietary and health information provided by the customer, it can also assist in recommending the most personalized nutrient formulations. Businesses can estimate demand for nutritious products as well as supply chain elements with the help of AI.

Robotic Process Automation (RPA)

RPA can be successfully implemented to boost productivity, lower costs, improve performance, and accelerate product marketing. RPA can produce insights on business practices, consumer behavior, and market trends, giving businesses the opportunity to carry out crucial tasks more effectively.

Edge computing and Internet of Things

Every touch point of the production line now has sensors built in to record a huge volume of data due to the Internet of Things' (IoT) proliferation across the manufacturing spectrum. Thanks to edge computing, everything from smartwatches to heart rate monitors sits at the network's edge and offers real-time data.

Gene Editing

With a vast global population affected by chronic diseases and disorders, gene editing techniques are being employed to develop medicines for disease treatment.

Microfluidics

Microfluidic technology is an emerging method for precise control of the delivery of nutraceuticals

3-D printing trends

3-D printing techniques in the nutraceutical industry have given rise to newer business ventures who utilize the technology to improve nutraceutical drug delivery. It enables the use of customizable ingredients to make products with food ingredients that are specifically customized for the consumer. A nutritional requirement associated with a restricted diet, can be met through the personalization of 3D food printing, perhaps avoiding complications and hospitalization. Diabetics frequently ingest sugar substitutes like maltitol and xylitol. As a result, a complex blend of these artificial sweeteners and functional polysaccharides was used to create a chocolate-based 3D-printed food product. The most recent technology also plays a special role in the delivery of personalized nutritional supplements. These personalized supplements claim to release vital nutrients on schedule to meet individual needs and daily routine.

Challenge: Consumer skepticism associated with nutraceutical products

Over the past two decades, natural-source products such as nutraceuticals and dietary supplements with claimed health advantages have become more widely available. These products have been difficult to define. Nutraceuticals, as opposed to dietary supplements, are dietary supplements that provide health advantages beyond their basic nutritional value by enhancing diets and/or helping in the prevention and/or treatment of diseases and disorders. However, due to efficacy and safety issues, these products are typically met with skepticism. This is partly because the nutraceuticals industry is well known for lacking regulation and monitoring. Customers and the industry trade community have expressed worry over instances of fake or counterfeit products that are unregistered and unapproved.

Although the demand for nutraceutical products, such as nutritional supplements, has increased recently, the majority of the population is skeptical about using them, especially dietary supplements. Additionally, lack of knowledge about nutraceuticals and growing consumer awareness about them among rural and semi-urban consumers hinder important players from making investments. This group makes up a sizable portion of consumers of non-nutraceutical supplements in both emerging and developed countries. Additionally, consumers view nutraceuticals as medicines and are hesitant to include them in their regular diets. Due to these factors, several supplement manufacturers are concentrating on creating new formulations, such as gummies, soft chews, and others, to alleviate consumers' fears about using tablets and capsules as nutraceuticals.

Another hindering factor for nutraceutical products market growth is their formulation or synthetic sourcing. The majority of consumers do not favour products that have been genetically modified to produce advantageous product characteristics. In 2018, the Trust Transparency Center released the results of a survey, which revealed that most Americans prefer natural dietary supplements over synthetic ones. According to the survey, 83 % of respondents who used supplements or had an opinion said synthetic supplements should always be labelled. 51 % of female respondents said supplements should always be labeled as synthetic. Only 8.15 % of respondents stated they would buy supplements with a synthetic label, and of that group, 4.32 % wanted the product to be labelled as synthetic. These factors further limit the ground for nutraceutical ingredient manufacturers, who often opt for cheaper synthetic substitutes of naturally sourced ingredients. These factors act as major deterrents to market growth for various nutraceutical ingredient manufacturers.

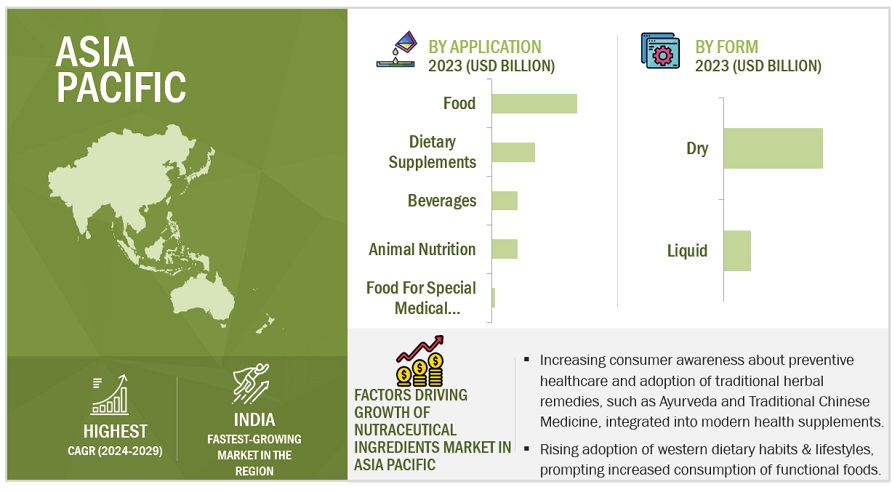

The dry ingredient, by form is projected to attain the fastest market growth in the nutraceutical ingredients market.

Dry nutraceutical ingredients are preferred by manufacturers due to their greater stability, ease of handling & storage, and convenience of usage in a wide range of products. The storage handling being a concern among the manufacturers, is one of the major factors driving the demand for dry ingredients. As liquid ingredients are more unstable compounds to dry ingredient.

The food segment is estimated to account for the largest share in the nutraceutical ingredients market, in terms of value.

Past decade, consumption of junk foods found to be increased drastically, Because of their palatability, mouth feel and texture. Considering this, food producers started innovating products which can be healthy alternative. As consumers are becoming health conscious and aware, the preference for balanced diets and healthy food has remained high. This has widened the applications for functional foods and created profitable growth opportunities for manufacturers in the nutraceutical ingredients market.

The probiotics segment dominated the nutraceutical ingredients market in terms of value.

Probiotics are frequently consumed in the hopes of balancing their intestinal flora, also known as the gut microbiome. However, probiotics have additional benefits such as improving the health of the gut microbiome, restoring microbiome balance after illness or treatment, and supporting the immune system. Probiotics are popular among people due to their numerous benefits.

APAC is projected to account for the highest CAGR in the nutraceutical ingredients market during the forecast period.

Nutraceutical ingredients is projected to increase at a rapid rate in the APAC region due to a surge in demand and the presence of a large consumer base for food, beverages, dietary supplements, personal care products, and feed. This large consumer base being the reason for the highest market growth, as population in these regions increases.

To know about the assumptions considered for the study, download the pdf brochure

Key Companies

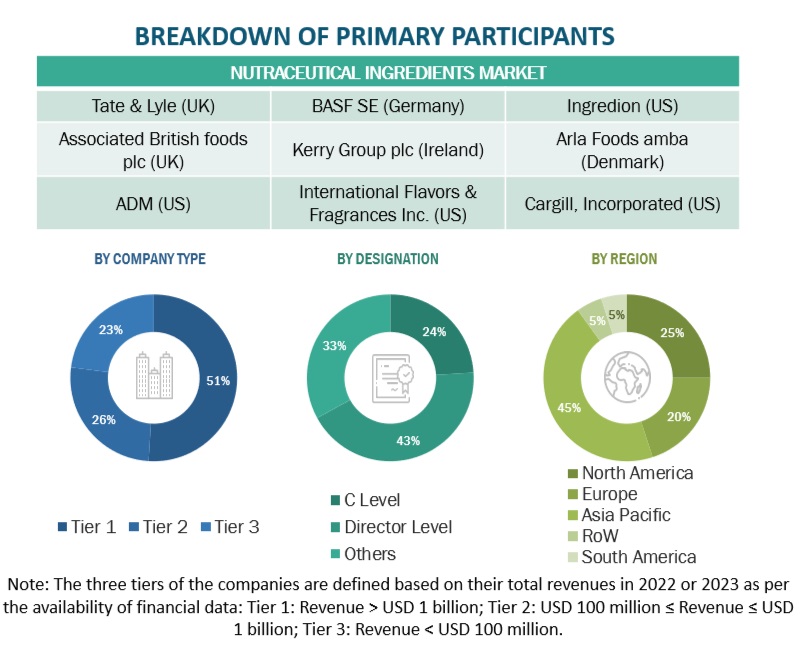

The key players in this Market include Associated British Foods Plc (UK), Arla Foods Ingredients Group P/S (Denmark), DSM (Netherland), Ingredion (US), Tate & Lyle (UK), Ajinomoto Co., Inc. (Japan), CHR Hansen Holdings A/S. (Denmark), Kyowa Hakko Bio Co., Ltd. (Japan), Glanbia Plc (Ireland), Fonterra Co. Operative Group Limited (New Zealand), Cargill Incorporated (US), ADM (US), International Flavors & Fragrances, Inc. (US), BASF SE (Germany) and Kerry Groups (Ireland). Strategic partnerships were the dominant strategy adopted by the key players, followed by expansions and new product launches. These strategies have helped them to increase their presence in different regions and industrial segments. These players in this Market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market valuation in 2022 |

USD 185.2 billion |

|

Revenue forecast in 2027 |

USD 261.7 billion |

|

Progress rate |

CAGR of 7.2% by 2027 |

|

Historical data |

2020-2027 |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage |

Company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Region, Type, Application |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Prominent firms featured |

Associated British Foods Plc (UK), Arla Foods Ingredients Group P/S (Denmark), DSM (Netherland), Ingredion (US), Tate & Lyle (UK), Ajinomoto Co., Inc. (Japan), CHR Hansen Holdings A/S. (Denmark), Kyowa Hakko Bio Co., Ltd. (Japan), Glanbia Plc (Ireland), Fonterra Co. Operative Group Limited (New Zealand), Cargill Incorporated (US), ADM (US), International Flavors & Fragrances, Inc. (US), BASF SE (Germany) and Kerry Groups (Ireland). |

|

Major driving factors |

|

This research report categorizes the nutraceutical ingredients market based on By Ingredient Type, By Application, Form and Region.

|

Aspect |

Details |

|

By Ingredient Type |

|

|

By Form |

|

|

By Application |

|

|

By Region |

|

Recent Developments

- In June 2022, DSM announced to acquire Prodap, an animal nutrition, service, and technology company. This acquisition will complement DSM’s deep animal nutrition knowledge and services. Especially, for the company’s existing animal management system Verax and intelligent sustainability services Sustell. The acquisition also expands company’s market entry in Brazil.

- In November 2020, Ingredion signed an agreement to acquire the remaining portion of ownership in Verdient Foods Inc. that the Company did not already own. This acquisition enables Ingredion to accelerate net sales growth, further expand manufacturing capability and co-create customers to serve the increasing consumer demand for plant-based protein.

- In May 2022, Tate & Lyle announced its completion of acquisition of Nutriati, an ingredient technology company producing chickpea protein and flour. Whit whom they previously had a distribution agreement in 2021 for supply of chickpea protein and flour. This transaction also includes certain assets, intellectual property asset and certain liabilities of Nutriati. This acquisition builds up the company’s ingredient portfolio.

Frequently Asked Questions (FAQ):

How big is the nutraceutical ingredients market?

With a 7.2% compound annual growth rate (CAGR), the nutraceutical ingredients market is projected to reach $261.7 billion by 2027. The market size was estimated to be $185.2 billion globally in 2022.

Which players are involved in the manufacturing of the nutraceutical ingredients market?

The key players in this market include Associated British Foods Plc (UK), Arla Foods Ingredients Group P/S (Denmark), DSM (Netherland), Ingredion (US), Tate & Lyle (UK), Ajinomoto Co., Inc. (Japan), CHR Hansen Holdings A/S. (Denmark), Kyowa Hakko Bio Co., Ltd. (Japan), Glanbia Plc (Ireland), Fonterra Co. Operative Group Limited (New Zealand), Cargill Incorporated (US), ADM (US), International Flavors & Fragrances, Inc. (US), BASF SE (Germany) and Kerry Groups (Ireland). Strategic partnerships were the dominant strategy adopted by the key players, followed by expansions and new product launches. These strategies have helped them to increase their presence in different regions and industrial segments. These players in this Market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for nutraceutical ingredients market?

On request, We will provide details on market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of the nutraceutical ingredients market?

The nutraceutical ingredients market holds significant promise for future growth, buoyed by a convergence of factors driving demand for health-centric products. With a global shift towards prioritizing health and wellness, consumers are increasingly seeking functional foods and beverages fortified with nutraceutical ingredients known for their health benefits. This trend is further fueled by an aging population focused on preventive healthcare and a desire to maintain vitality. Lifestyle changes, including hectic schedules and poor dietary habits, are prompting individuals to turn to nutraceuticals as a convenient means of supporting their well-being amidst modern challenges. Continuous innovation in ingredient sourcing, formulation, and delivery systems is expanding the market's offerings, catering to diverse health needs and preferences.

What are the key development strategies undertaken by companies in the nutraceutical ingredients market?

Strategies such as new product launches, investments into expansion and development, research initiatives are the key strategies being used by large players in order to achieve differential positioning in the global Market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 NUTRACEUTICAL INGREDIENTS MARKET SNAPSHOT

1.3.2 GEOGRAPHIC SEGMENTATION

FIGURE 2 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION

1.4 INCLUSIONS & EXCLUSIONS

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2013–2018

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 3 NUTRACEUTICAL INGREDIENTS: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.3 SUPPLY-SIDE

FIGURE 7 DATA TRIANGULATION: SUPPLY-SIDE

2.2.4 DEMAND-SIDE

FIGURE 8 DATA TRIANGULATION: DEMAND-SIDE

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 55)

TABLE 2 NUTRACEUTICAL INGREDIENTS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 10 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022 VS. 2027 (USD BILLION)

FIGURE 11 NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2022 VS. 2027 (USD BILLION)

FIGURE 12 NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2022 VS. 2027 (USD BILLION)

FIGURE 13 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 ATTRACTIVE OPPORTUNITIES IN NUTRACEUTICAL INGREDIENTS MARKET

FIGURE 14 INCREASED CONSUMPTION OF FORTIFIED FOODS DUE TO GROWING HEALTH CONSCIOUSNESS AMONG CONSUMERS

4.2 ASIA PACIFIC: NUTRACEUTICAL INGREDIENTS MARKET, BY KEY TYPE AND COUNTRY

FIGURE 15 INDIA AND PROBIOTICS ACCOUNTED FOR LARGEST SHARES, BY COUNTRY AND TYPE, RESPECTIVELY

4.3 NUTRACEUTICAL INGREDIENTS MARKET: REGIONAL SUBMARKETS

FIGURE 16 JAPAN TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE AND REGION

FIGURE 17 ASIA PACIFIC TO DOMINATE NUTRACEUTICAL INGREDIENTS MARKET ACROSS ALL TYPES

4.5 NUTRACEUTICAL INGREDIENTS MARKET, BY FORM

FIGURE 18 DRY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.6 NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION

FIGURE 19 DIETARY SUPPLEMENTS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 GLOBAL POPULATION WITNESSING HIGH PREVALENCE OF OBESITY

5.2.2 KEY FACTS

5.2.2.1 Aging population becoming more aware of benefits of nutraceuticals

FIGURE 20 US POPULATION AGED 65 AND OLDER, 2000–2060 (MILLION)

FIGURE 21 AGING POPULATION IN JAPAN, 2014–2018

5.3 MARKET DYNAMICS

FIGURE 22 NUTRACEUTICAL INGREDIENTS: MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Growing demand for fortified food due to increased health consciousness among consumers

FIGURE 23 CONSUMERS' PERCEPTION REGARDING WHAT TO CONSUME OR AVOID

5.3.1.2 Increase in incidences of chronic diseases

FIGURE 24 PERCENTAGE OF US POPULATION WITH MULTIPLE CHRONIC ILLNESSES, 2017

FIGURE 25 CHRONIC DISEASES MOST PREVALENT WORLDWIDE AMONGST ALL AGES, 2019

FIGURE 26 NUMBER OF AMERICANS WITH CHRONIC CONDITIONS

5.3.1.3 Mandates on food fortification by government organizations

TABLE 3 PREVALENCE OF THREE MAJOR MICRONUTRIENT DEFICIENCIES, BY REGION

TABLE 4 WIDELY USED FORTIFIED FOODS

FIGURE 27 NUMBER OF COUNTRIES WITH MANDATORY OR VOLUNTARY FOOD FORTIFICATION, 2021

5.3.2 RESTRAINTS

5.3.2.1 Higher costs of fortified products dissuade large-scale usage and adoption

5.3.3 OPPORTUNITIES

5.3.3.1 Innovations in nutraceutical ingredients industry

5.3.3.2 Consumer awareness of micronutrient deficiencies

TABLE 5 FOODS TO BOOST IMMUNE SYSTEM

TABLE 6 MICRONUTRIENTS DEFICIENCY CONDITIONS AND THEIR WORLDWIDE PREVALENCE

5.3.4 CHALLENGES

5.3.4.1 Consumer skepticism associated with nutraceutical products

6 INDUSTRY TRENDS (Page No. - 80)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN: NUTRACEUTICAL INGREDIENTS MARKET

6.2.1 SOURCING OF RAW MATERIALS

6.2.2 MANUFACTURING

6.2.3 DISTRIBUTION, MARKETING, AND SALES

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 29 REVENUE SHIFT FOR NUTRACEUTICAL INGREDIENTS MARKET

6.4 TECHNOLOGY ANALYSIS

6.4.1 FOOD MICROENCAPSULATION

6.4.1.1 Encapsulation of omega-3 to mask the odor

6.4.2 INNOVATIVE AND DISRUPTIVE TECH

6.4.2.1 Robotics leading to innovations in market

6.4.2.2 3D printing to uplift dietary supplements market

6.4.2.3 Hologram Sciences—platform for personalized nutrition and advice

6.5 PRICING ANALYSIS

FIGURE 30 PRICING ANALYSIS, 2017–2022 (USD/KG)

6.6 PATENT ANALYSIS

FIGURE 31 PATENTS GRANTED FOR NUTRACEUTICAL INGREDIENTS MARKET, 2011–2021

FIGURE 32 REGIONAL ANALYSIS OF PATENTS GRANTED FOR NUTRACEUTICAL INGREDIENTS MARKET, 2011–2021

TABLE 7 KEY PATENTS PERTAINING NUTRACEUTICAL INGREDIENTS MARKET, 2021

6.7 MARKET MAP

6.7.1 UPSTREAM

6.7.1.1 Ingredient Manufacturers

6.7.1.2 Technology Providers

6.7.1.3 Start-ups/Emerging Companies

6.7.2 DOWNSTREAM

6.7.2.1 Regulatory Bodies

6.7.2.2 End Users

FIGURE 33 NUTRACEUTICALS INGREDIENTS MARKET MAP

TABLE 8 NUTRACEUTICAL INGREDIENTS MARKET: ECOSYSTEM

6.8 TRADE SCENARIO

FIGURE 34 VITAMINS: IMPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 9 IMPORT DATA OF VITAMINS FOR KEY COUNTRIES, 2021 (VALUE)

FIGURE 35 VITAMINS: EXPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 10 EXPORT DATA ON VITAMINS FOR KEY COUNTRIES, 2021 (VALUE)

FIGURE 36 AMINO ACIDS: IMPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 11 IMPORT DATA ON AMINO ACIDS FOR KEY COUNTRIES, 2021 (VALUE)

FIGURE 37 AMINO ACIDS: EXPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 12 EXPORT DATA ON AMINO ACIDS FOR KEY COUNTRIES, 2021 (VALUE)

6.9 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 13 NUTRACEUTICAL INGREDIENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

6.10 TARIFF AND REGULATORY LANDSCAPE

6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.10.2 REGULATORY FRAMEWORK

6.10.2.1 Organizations/Regulations governing nutraceutical ingredients market

TABLE 19 DEFINITIONS & REGULATIONS FOR NUTRACEUTICAL INGREDIENTS WORLDWIDE

6.10.2.2 North America

6.10.2.2.1 Canada

6.10.2.2.2 US

6.10.2.2.3 Mexico

6.10.2.3 European Union (EU)

6.10.2.4 Asia Pacific

6.10.2.4.1 Japan

6.10.2.4.2 China

6.10.2.4.3 India

6.10.2.4.4 Australia & New Zealand

6.10.2.5 Rest of the World (RoW)

6.10.2.5.1 Israel

6.10.2.5.2 Brazil

6.10.2.6 Probiotics

6.10.2.6.1 Introduction

6.10.2.6.2 National/International bodies for safety standards and regulations

TABLE 20 DEFINITIONS & REGULATIONS FOR NUTRACEUTICALS WORLDWIDE

6.10.2.6.3 Codex Alimentarius Commission (CAC)

6.10.2.6.4 North America: Regulatory environment analysis

6.10.2.6.5 Europe: Regulatory environment analysis

6.10.2.6.6 Asia Pacific: Regulatory environment analysis

6.10.2.6.7 South America: Regulatory environment analysis

6.10.2.7 Prebiotics

6.10.2.7.1 Introduction

6.10.2.7.2 Asia Pacific

TABLE 21 SCHEDULE – XI OF FOOD SAFETY AND STANDARDS REGULATIONS FOR LIST OF APPROVED PREBIOTIC INGREDIENTS, 2015

6.10.2.7.3 North America

TABLE 22 LIST OF ACCEPTED DIETARY FIBERS BY CANADIAN REGULATORY AUTHORITIES & THEIR SOURCES

6.10.2.7.4 European Union

6.11 PORTER'S FIVE FORCES ANALYSIS

TABLE 23 NUTRACEUTICAL INGREDIENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

6.11.1 DEGREE OF COMPETITION

6.11.2 BARGAINING POWER OF SUPPLIERS

6.11.3 BARGAINING POWER OF BUYERS

6.11.4 THREAT OF SUBSTITUTES

6.11.5 THREAT OF NEW ENTRANTS

6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TYPES

TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TYPES (%)

6.12.2 BUYING CRITERIA

TABLE 25 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

FIGURE 39 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

6.13 CASE STUDY ANALYSIS

6.13.1 FRUNUTTA STARTED OFFERING EASY-TO-USE AND EFFICIENT-TO-TAKE VITAMIN AND MINERAL PILLS THAT DISSOLVE INSTANTLY

6.13.2 MINDRIGHT’S BARS HELP COMBAT MENTAL HEALTH ISSUES

7 NUTRACEUTICAL INGREDIENTS MARKET, BY HEALTH BENEFITS (Page No. - 119)

7.1 INTRODUCTION

7.2 COGNITIVE HEALTH

7.3 GUT HEALTH

7.4 HEART HEALTH

7.5 BONE HEALTH

TABLE 26 BONE-BUILDING NUTRIENTS & THEIR THERAPEUTIC RANGE

7.6 IMMUNITY

7.7 NUTRITION

7.8 WEIGHT MANAGEMENT

7.9 OTHERS

8 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE (Page No. - 124)

8.1 INTRODUCTION

FIGURE 40 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022 VS. 2027 (BY VALUE)

TABLE 27 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 28 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 29 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (KT)

TABLE 30 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (KT)

8.2 PROBIOTIC

8.2.1 HIGH DEMAND FOR SCIENTIFICALLY PROVEN HEALTH FOODS AND DIETARY SUPPLEMENTS

TABLE 31 PROBIOTICS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 32 PROBIOTICS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 PROBIOTICS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (KT)

TABLE 34 PROBIOTICS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (KT)

8.3 PROTEINS & AMINO ACIDS

8.3.1 IMPORTANT INGREDIENTS IN FOOD AND FEED INDUSTRIES

TABLE 35 PROTEINS & AMINO ACIDS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 36 PROTEINS & AMINO ACIDS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 PROTEINS & AMINO ACIDS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (KT)

TABLE 38 PROTEINS & AMINO ACIDS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (KT)

8.4 PHYTOCHEMICALS & PLANT EXTRACTS

8.4.1 GROWING DEMAND FOR ORGANIC FOOD PRODUCTS AND INGREDIENTS

TABLE 39 SPECIFIC PHYTOCHEMICALS AND THEIR POTENTIAL BENEFITS

TABLE 40 PHYTOCHEMICALS & PLANT EXTRACTS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 PHYTOCHEMICALS & PLANT EXTRACTS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 PHYTOCHEMICALS & PLANT EXTRACTS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (KT)

TABLE 43 PHYTOCHEMICALS & PLANT EXTRACTS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (KT)

8.5 FIBERS & SPECIALTY CARBOHYDRATES

8.5.1 ADDED TO FUNCTIONAL FOOD & BEVERAGES MORE FREQUENTLY

TABLE 44 FIBERS & SPECIALTY CARBOHYDRATES: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 FIBERS & SPECIALTY CARBOHYDRATES: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 46 FIBERS & SPECIALTY CARBOHYDRATES: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (KT)

TABLE 47 FIBERS & SPECIALTY CARBOHYDRATES: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (KT)

8.6 OMEGA-3 FATTY ACIDS

8.6.1 INCREASED USE OF OMEGA-3 TO ENHANCE HEART AND BRAIN HEALTH

TABLE 48 OMEGA-3 FATTY ACIDS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 49 OMEGA-3 FATTY ACIDS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 OMEGA-3 FATTY ACIDS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (KT)

TABLE 51 OMEGA-3 FATTY ACIDS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (KT)

8.7 VITAMINS

8.7.1 AWARENESS, WIDE ACCEPTANCE, AND EASY AVAILABILITY DRIVE DEMAND

TABLE 52 VITAMINS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 53 VITAMINS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 VITAMINS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (KT)

TABLE 55 VITAMINS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (KT)

8.8 PREBIOTICS

8.8.1 USED AS TEXTURE ENHANCEMENT AND SWEETENING AGENTS

TABLE 56 PREBIOTICS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 57 PREBIOTICS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 58 PREBIOTICS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (KT)

TABLE 59 PREBIOTICS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (KT)

8.9 CAROTENOIDS

8.9.1 GROWING FOOD ADDITIVES AND PERSONAL CARE INDUSTRIES TO PROPEL DEMAND

TABLE 60 SOURCES OF CAROTENOIDS IN FRUIT AND VEGETABLES AND THEIR MEDICINAL PROPERTIES

TABLE 61 CAROTENOIDS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 62 CAROTENOIDS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 63 CAROTENOIDS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (KT)

TABLE 64 CAROTENOIDS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (KT)

8.10 MINERALS

8.10.1 SEVERAL HEALTH ADVANTAGES ASSOCIATED WITH MINERALS

TABLE 65 MACROMINERALS & THEIR FUNCTIONS

TABLE 66 MICROMINERALS & THEIR FUNCTIONS

TABLE 67 MINERALS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 68 MINERALS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 69 MINERALS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (KT)

TABLE 70 MINERALS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (KT)

8.11 OTHER TYPES

TABLE 71 OTHER TYPES: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 72 OTHER TYPES: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 73 OTHER TYPES: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (KT)

TABLE 74 OTHER TYPES: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (KT)

9 NUTRACEUTICAL INGREDIENTS MARKET, BY FORM (Page No. - 155)

9.1 INTRODUCTION

FIGURE 41 NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2022 VS. 2027 (BY VALUE)

TABLE 75 NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2017–2021 (USD MILLION)

TABLE 76 NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2022–2027 (USD MILLION)

9.2 DRY

9.2.1 BETTER STABILITY AND EASE OF HANDLING

TABLE 77 DRY: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 78 DRY: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 LIQUID

9.3.1 LIMITED APPLICATIONS COMPARED TO DRY FORM

TABLE 79 LIQUID: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 80 LIQUID: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

10 NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION (Page No. - 160)

10.1 INTRODUCTION

FIGURE 42 NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2022 VS. 2027 (VALUE)

TABLE 81 NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 82 NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 FOOD

TABLE 83 FOOD: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 84 FOOD: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.1 SNACKS

10.2.1.1 Inclination toward protein-rich foods

10.2.2 CONFECTIONERY

10.2.2.1 Nutraceutical ingredients enhance texture, stability, and flavor

10.2.3 BAKERY

10.2.3.1 Adding omega-3 fatty acids lowers baking defects

10.2.4 DAIRY

10.2.4.1 Rising consumer awareness of health advantages of dairy products

10.2.5 MEAT & MEAT PRODUCTS

10.2.5.1 Major source of protein

10.2.6 BABY FOOD

10.2.6.1 High standards of living and preference for convenience foods

TABLE 85 RECOMMENDED DIETARY REFERENCE INTAKES (DRIS) FOR MACRONUTRIENTS

TABLE 86 RECOMMENDED DIETARY REFERENCE INTAKES (DRIS) FOR MICRONUTRIENTS

10.2.7 OTHERS

FIGURE 43 GLOBALLY RISING IMPORTS AND EXPORTS OF CEREALS AND CEREAL PRODUCTS, 2016–2020

TABLE 87 FOOD: NUTRACEUTICAL INGREDIENTS MARKET, BY SUB-APPLICATION, 2017–2021 (USD MILLION)

TABLE 88 FOOD: NUTRACEUTICAL INGREDIENTS MARKET, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

10.3 BEVERAGES

TABLE 89 BEVERAGES: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 90 BEVERAGES: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3.1 ENERGY DRINKS

10.3.1.1 Offer specific medical and health benefits

10.3.2 JUICES

10.3.2.1 Functional benefits and growing health concerns

10.3.3 HEALTH DRINKS

10.3.3.1 Improves quality by reducing health risks

TABLE 91 NUTRACEUTICAL INGREDIENTS MARKET FOR BEVERAGES, BY SUB-APPLICATION, 2017–2021 (USD MILLION)

TABLE 92 NUTRACEUTICAL INGREDIENTS MARKET FOR BEVERAGES, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

10.4 PERSONAL CARE

10.4.1 PREFERENCE FOR ORGANIC PERSONAL CARE PRODUCTS.

TABLE 93 PERSONAL CARE: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 94 PERSONAL CARE: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 ANIMAL NUTRITION

10.5.1 RISING ANIMAL HEALTH AND NUTRITION MARKET

TABLE 95 ANIMAL NUTRITION: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 96 ANIMAL NUTRITION: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 DIETARY SUPPLEMENTS

10.6.1 OFFER SEVERAL HEALTH BENEFITS

TABLE 97 DIETARY SUPPLEMENTS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 98 DIETARY SUPPLEMENTS: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

11 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION (Page No. - 178)

11.1 INTRODUCTION

TABLE 99 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 100 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 44 REGIONAL SNAPSHOT: US ACQUIRED LARGEST SHARE IN NUTRACEUTICAL INGREDIENTS MARKET, 2021

11.2 NORTH AMERICA

TABLE 101 NORTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 102 NORTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 103 NORTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 104 NORTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 105 NORTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 106 NORTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 107 NORTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2017–2021 (USD MILLION)

TABLE 108 NORTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Improved quality of livestock-based products amid increased consumer demand

TABLE 109 US: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 110 US: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Increased government support for R&D

FIGURE 45 CANADA: OVERWEIGHT OR OBESE, BY AGE GROUP AND SEX, 2018

TABLE 111 CANADA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 112 CANADA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Growing health and wellness trends

FIGURE 46 MEXICO: PER CAPITA EXPENDITURE ON FOOD, 2010–2018

TABLE 113 MEXICO: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 114 MEXICO: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3 EUROPE

TABLE 115 EUROPE: NUTRACEUTICAL INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 116 EUROPE: NUTRACEUTICAL INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 117 EUROPE: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 118 EUROPE: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 120 EUROPE: NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 121 EUROPE: NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2017–2021 (USD MILLION)

TABLE 122 EUROPE: NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Multiple applications of nutraceuticals in food & beverages and personal care products.

TABLE 123 GERMANY: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 124 GERMANY: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 Increased health awareness and strategic government initiatives

TABLE 125 FRANCE: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 126 FRANCE: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.3 UK

11.3.3.1 High demand for nutraceutical ingredients from food & beverage industry

TABLE 127 UK: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 128 UK: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Increased consumption of food supplements

TABLE 129 ITALY: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 130 ITALY: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Preference for functional food and beverages

TABLE 131 SPAIN: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 132 SPAIN: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.6 RUSSIA

11.3.6.1 Complicated and expensive registration process

TABLE 133 RUSSIA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 134 RUSSIA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 135 REST OF EUROPE: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 136 REST OF EUROPE: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 47 ASIA PACIFIC: NUTRACEUTICAL INGREDIENTS MARKET, 2021

TABLE 137 ASIA PACIFIC: NUTRACEUTICAL INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 138 ASIA PACIFIC: NUTRACEUTICAL INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 140 ASIA PACIFIC: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 141 ASIA PACIFIC: NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 142 ASIA PACIFIC: NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2017–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Changing lifestyles of consumers

TABLE 145 CHINA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 146 CHINA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Preference for fortified foods over conventional ones

TABLE 147 JAPAN: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 148 JAPAN: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 High consumer demand due to rising hospitalization costs

TABLE 149 INDIA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 150 INDIA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.4 AUSTRALIA & NEW ZEALAND

11.4.4.1 Preference for low-calorie foods to prevent chronic conditions

TABLE 151 AUSTRALIA & NEW ZEALAND: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 152 AUSTRALIA & NEW ZEALAND: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

TABLE 153 REST OF ASIA PACIFIC: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 154 REST OF ASIA PACIFIC: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 155 SOUTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 156 SOUTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 157 SOUTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 158 SOUTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 159 SOUTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 160 SOUTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 161 SOUTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2017–2021 (USD MILLION)

TABLE 162 SOUTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2022–2027 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Rising health consciousness and rapid urbanization

TABLE 163 BRAZIL: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 164 BRAZIL: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Affinity toward healthy foods and functional beverages

FIGURE 48 PREVALENCE OF UNDERNOURISHMENT IN ARGENTINA, 2012–2019

TABLE 165 ARGENTINA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 166 ARGENTINA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

TABLE 167 REST OF SOUTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 168 REST OF SOUTH AMERICA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.6 REST OF THE WORLD (ROW)

TABLE 169 REST OF THE WORLD: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 170 REST OF THE WORLD: NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 171 REST OF THE WORLD: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 172 REST OF THE WORLD: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 173 REST OF THE WORLD: NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 174 REST OF THE WORLD: NUTRACEUTICAL INGREDIENTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 175 REST OF THE WORLD: NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2017–2021 (USD MILLION)

TABLE 176 REST OF THE WORLD: NUTRACEUTICAL INGREDIENTS MARKET, BY FORM, 2022–2027 (USD MILLION)

11.6.1 MIDDLE EAST

11.6.1.1 Increased demand for healthy foods amid rising health concerns

TABLE 177 MIDDLE EAST: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 178 MIDDLE EAST: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.6.2 AFRICA

11.6.2.1 Government initiatives for fortification of food with essential vitamins and minerals

TABLE 179 AFRICA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 180 AFRICA: NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 237)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2021

TABLE 181 NUTRACEUTICAL INGREDIENTS MARKET: DEGREE OF COMPETITION (COMPETITIVE)

12.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 49 SEGMENTAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2017–2021 (USD MILLION)

12.4 STRATEGIES ADOPTED BY KEY PLAYERS

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 50 NUTRACEUTICAL INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

12.5.5 PRODUCT FOOTPRINT

TABLE 182 COMPANY FOOTPRINT, BY TYPE

TABLE 183 COMPANY FOOTPRINT, BY APPLICATION

TABLE 184 COMPANY FOOTPRINT, BY REGION

TABLE 185 OVERALL COMPANY FOOTPRINT

12.6 NUTRACEUTICAL INGREDIENTS MARKET: EVALUATION QUADRANT FOR START-UPS/SMES, 2021

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 51 NUTRACEUTICAL INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UPS/SME)

12.6.5 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

TABLE 186 NUTRACEUTICAL INGREDIENTS MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 187 NUTRACEUTICAL INGREDIENTS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

12.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

12.7.1 PRODUCT LAUNCHES

TABLE 188 NUTRACEUTICAL INGREDIENTS: PRODUCT LAUNCHES, 2018–2022

12.7.2 DEALS

TABLE 189 NUTRACEUTICAL INGREDIENTS: DEALS, 2018–2022

12.7.3 OTHERS

TABLE 190 NUTRACEUTICAL INGREDIENTS: OTHERS, 2019-2022

13 COMPANY PROFILES (Page No. - 274)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 ASSOCIATED BRITISH FOODS PLC

TABLE 191 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

FIGURE 52 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

TABLE 192 ASSOCIATED BRITISH FOODS PLC: PRODUCTS OFFERED

13.2.2 ARLA FOODS AMBA

TABLE 193 ARLA FOODS AMBA: BUSINESS OVERVIEW

FIGURE 53 ARLA FOODS AMBA: COMPANY SNAPSHOT

TABLE 194 ARLA FOODS AMBA: PRODUCTS OFFERED

13.2.3 DSM

TABLE 195 DSM: BUSINESS OVERVIEW

FIGURE 54 DSM: COMPANY SNAPSHOT

TABLE 196 DSM: PRODUCTS OFFERED

TABLE 197 DSM: DEALS

13.2.4 INGREDION

TABLE 198 INGREDION: BUSINESS OVERVIEW

FIGURE 55 INGREDION: COMPANY SNAPSHOT

TABLE 199 INGREDION: PRODUCTS OFFERED

TABLE 200 INGREDION: PRODUCT LAUNCHES

TABLE 201 INGREDION: DEALS

TABLE 202 INGREDION: OTHERS

13.2.5 TATE & LYLE

TABLE 203 TATE & LYLE: BUSINESS OVERVIEW

FIGURE 56 TATE & LYLE: COMPANY SNAPSHOT

TABLE 204 TATE & LYLE: PRODUCTS OFFERED

TABLE 205 TATE & LYLE: PRODUCT LAUNCHES

TABLE 206 TATE & LYLE: DEALS

TABLE 207 TATE & LYLE: OTHERS

13.2.6 AJINOMOTO CO., INC.

TABLE 208 AJINOMOTO CO., INC.: BUSINESS OVERVIEW

FIGURE 57 AJINOMOTO CO., INC.: COMPANY SNAPSHOT

TABLE 209 AJINOMOTO CO., INC.: PRODUCTS OFFERED

TABLE 210 AJINOMOTO CO., INC.: DEALS

TABLE 211 AJINOMOTO CO., INC.: OTHERS

13.2.7 CHR HANSEN HOLDING A/S.

TABLE 212 CHR HANSEN HOLDING A/S. BUSINESS OVERVIEW

FIGURE 58 CHR HANSEN HOLDING A/S. COMPANY SNAPSHOT

TABLE 213 CHR HANSEN HOLDING A/S. PRODUCTS OFFERED

TABLE 214 CHR HANSEN HOLDING A/S. PRODUCT LAUNCHES

TABLE 215 CHR HANSEN HOLDING A/S. DEALS

TABLE 216 CHR HANSEN HOLDING A/S: OTHERS

13.2.8 KYOWA HAKKO BIO CO., LTD.

TABLE 217 KYOWA HAKKO BIO CO., LTD.: BUSINESS OVERVIEW

FIGURE 59 KYOWA HAKKO BIO CO., LTD.: COMPANY SNAPSHOT

TABLE 218 KYOWA HAKKO BIO CO., LTD.: PRODUCTS OFFERED

13.2.9 GLANBIA PLC

TABLE 219 GLANBIA PLC: BUSINESS OVERVIEW

FIGURE 60 GLANBIA PLC: COMPANY SNAPSHOT

TABLE 220 GLANBIA PLC: PRODUCTS OFFERED

TABLE 221 GLANBIA PLC: PRODUCT LAUNCHES

TABLE 222 GLANBIA PLC: DEALS

TABLE 223 GLANBIA PLC: OTHERS

13.2.10 FONTERRA CO-OPERATIVE GROUP LIMITED

TABLE 224 FONTERRA CO.-OPERATIVE GROUP LIMITED: BUSINESS OVERVIEW

FIGURE 61 FONTERRA CO.-OPERATIVE GROUP LIMITED: COMPANY SNAPSHOT

TABLE 225 FONTERRA CO. OPERATIVE GROUP LIMITED: PRODUCTS OFFERED

TABLE 226 FONTERRA CO.-OPERATIVE GROUP LIMITED: DEALS

13.2.11 CARGILL INCORPORATED

TABLE 227 CARGILL INCORPORATED: BUSINESS OVERVIEW

FIGURE 62 CARGILL INCORPORATED: COMPANY SNAPSHOT

TABLE 228 CARGILL INCORPORATED: PRODUCTS OFFERED

TABLE 229 CARGILL INCORPORATED: PRODUCT LAUNCHES

TABLE 230 CARGILL INCORPORATED: DEALS

TABLE 231 CARGILL INCORPORATED: OTHERS

13.2.12 ADM

TABLE 232 ADM: BUSINESS OVERVIEW

FIGURE 63 ADM: COMPANY SNAPSHOT

TABLE 233 ADM: PRODUCTS OFFERED

TABLE 234 ADM: PRODUCT LAUNCHES

TABLE 235 ADM: DEALS

TABLE 236 ADM: OTHERS

13.2.13 INTERNATIONAL FLAVORS & FRAGRANCES INC.

TABLE 237 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

FIGURE 64 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

TABLE 238 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS OFFERED

TABLE 239 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCT LAUNCHES

TABLE 240 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

TABLE 241 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHERS

13.2.14 BASF SE

TABLE 242 BASF SE: BUSINESS OVERVIEW

FIGURE 65 BASF SE: COMPANY SNAPSHOT

TABLE 243 BASF SE: PRODUCTS OFFERED

TABLE 244 BASF SE: OTHERS

13.2.15 KERRY GROUP PLC

TABLE 245 KERRY GROUP PLC: BUSINESS OVERVIEW

FIGURE 66 KERRY GROUP PLC: COMPANY SNAPSHOT

TABLE 246 KERRY GROUP PLC: PRODUCTS OFFERED

TABLE 247 KERRY GROUP PLC: PRODUCT LAUNCHES

TABLE 248 KERRY GROUP PLC: DEALS

TABLE 249 KERRY GROUP PLC: OTHERS

13.3 OTHER PLAYERS

13.3.1 BALCHEM INC.

13.3.2 SYDLER INDIA PVT. LTD.

13.3.3 PROBI

13.3.4 DIVI’S LABORATORIES LIMITED

13.3.5 MARTIN BAUER

13.3.6 BENEO GMBH

13.3.7 NEXIRA

13.3.8 ROQUETTE FRÈRES

13.3.9 CONAGEN, INC.

13.3.10 NUTRACEUTICALS GROUPS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 348)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 FUNCTIONAL FOOD INGREDIENTS MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE

14.3.3.1 Introduction

TABLE 250 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 251 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

14.3.4 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION

14.3.4.1 Introduction

TABLE 252 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 253 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2021–2026 (USD MILLION)

14.4 NUTRACEUTICAL EXCIPIENTS MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

14.4.3 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT

14.4.3.1 Introduction

TABLE 254 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2018–2025 (USD MILLION)

TABLE 255 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2018–2025 (KT)

14.4.4 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION

14.4.4.1 Introduction

TABLE 256 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 257 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018–2025 (KT)

15 APPENDIX (Page No. - 356)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

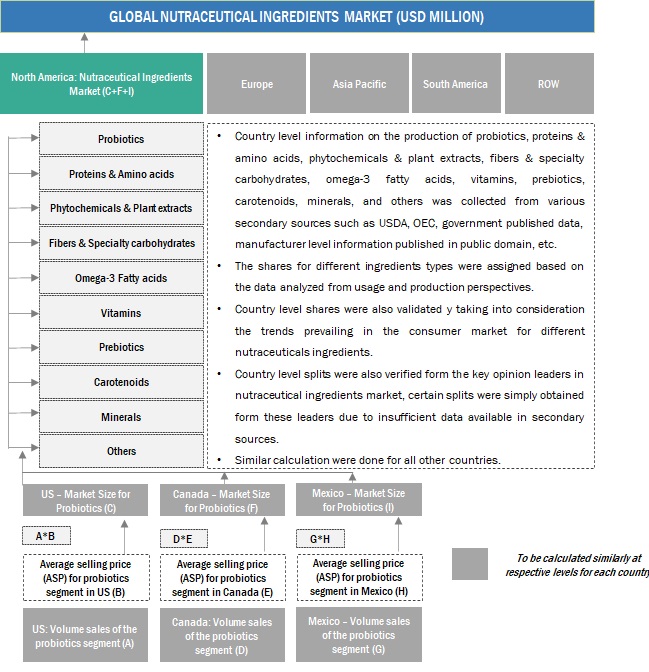

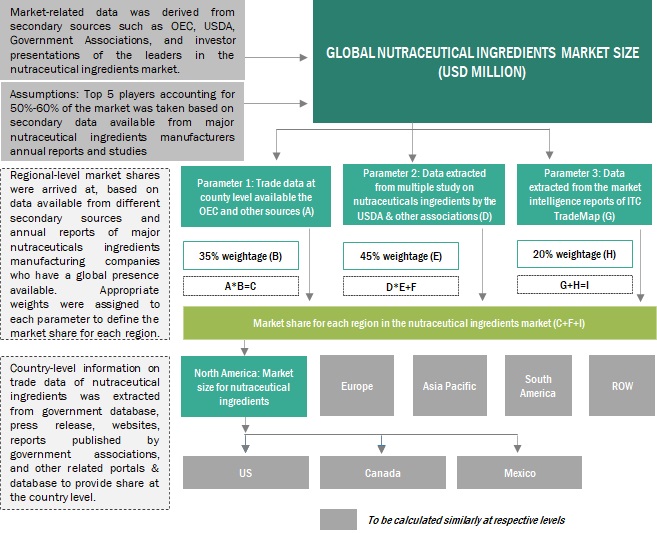

The study involved four major steps in estimating the size of the nutraceutical ingredients market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Nutraceutical Ingredients Market Secondary Research

In the secondary research process, various sources such as Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), Animal Feed Manufacturers Association (AFMA), Food and Drug Administration (FDA), Food Standards Australia New Zealand (FSANZ), Dietary Supplement Health and Education Act (DSHEA), and Organisation for Economic Co-operation and Development (OECD) were referred to, so as to identify and collect information for this study. The secondary sources also include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Nutraceutical Ingredients Market Primary Research

The market comprises several stakeholders in the supply chain, which include suppliers, manufacturers, and end-product manufacturers. Various primary sources from both the supply and demand sides of both markets were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs of the functional food, beverages, animal nutrition, personal care, and dietary supplement industries. The primary sources from the supply side include research institutions involved in R&D, key opinion leaders, and nutraceutical ingredient manufacturing companies.

To know about the assumptions considered for the study, download the pdf brochure

Nutraceutical Ingredients Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of nutraceutical ingredients market. These approaches have also been used extensively to determine the size of the various sub-segments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and market have been identified through extensive secondary research.

- The industry’s value chain and market size in terms of value have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the nutraceutical ingredients market were considered while estimating the market size.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for the purpose of this study.

Bottom-Up

- With the bottom-up approach, type of nutraceutical ingredient, health benefit, application and region were added up to arrive at the global and regional market size and CAGR.

- The bottom-up procedure has been employed to arrive at the overall size of the nutraceutical ingredients market from the revenues of key players (companies) and their product share in the market.

- The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and data validation through primaries, the exact values of the overall parent and each market have been determined and confirmed in this study. The data triangulation procedure implemented for this study is explained in the next section.

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down

The top-down approach, the overall market size was used to estimate the size of individual markets (type, form, application, and region) through percentage splits from secondary and primary research. To calculate each specific market segment, the most appropriate and immediate parent market size was used to implement the top-down approach. The data obtained was further validated by conducting primary interviews with industry experts, key suppliers, and manufacturers of nutraceutical ingredients in the market.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation & market breakdown procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market size has been validated using both the top-down and bottom-up approaches.

Nutraceutical Ingredients Market Report Objectives

Market Intelligence

- Determining and projecting the size of the nutraceutical ingredients market with respect type, form, application, and region, over a five-year period, ranging from 2022 to 2027

-

Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors on the basis of the following:

- Impact of macro- and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key market players in the nutraceutical ingredients market

- Determining the market share of key players operating in the nutraceutical ingredients market

-

Providing a comparative analysis of the market leaders on the basis of the following:

- Service offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Providing insights on the trade scenario

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Application Analysis

- Further breakdown of the application by country nutraceutical ingredients market.

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific nutraceutical ingredients market

- Further breakdown of the Rest of Europe nutraceutical ingredients market

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nutraceutical Ingredients Market