Plant Growth Regulators Market by Type (Auxins, Cytokinins, Gibberellins, and Ethylene), Function (Plant Growth Promoters, And Plant Growth Inhibitors), Crop Type (Cereals, Oilseeds Fruits, Turfs), Formulation and Region - Global Forecast to 2029

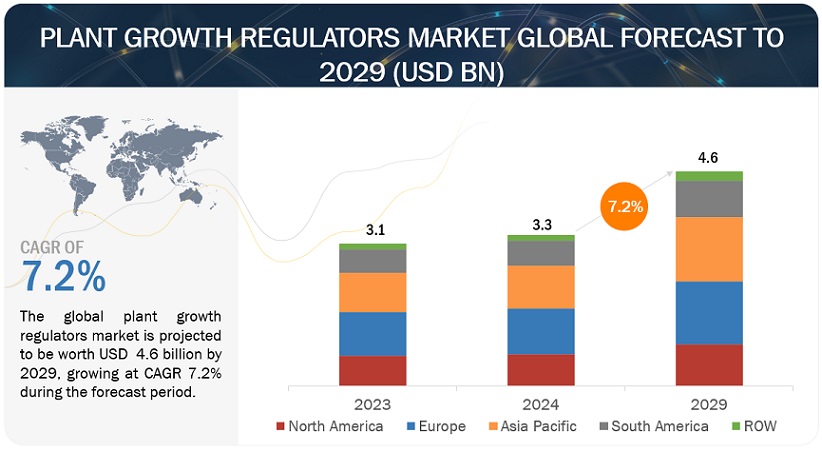

[280 Pages Report] According to MarketsandMarkets, the plant growth regulators market is projected to reach USD 4.6 billion by 2029 from USD 3.3 billion by 2024, at a CAGR of 7.2% during the forecast period in terms of value. Demand for high-value crops is increasing, leading to higher consumption of natural plant growth regulators in agriculture. There is a growing need for sustainable agricultural practices and a rise in organic farming, contributing to market expansion. Changing dietary preferences and the emphasis on sustainable agriculture further propel market growth. Overall, these trends highlight the growing significance and adoption of plant growth regulators in modern agriculture, fostering market expansion.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver : Rise in resistance development in certain pest and insect species to drive market.

The surge in resistance development among certain pest and insect species is poised to propel market growth. Currently, an excessive reliance on pesticides fosters the emergence of pesticide resistance in insects, weeds, and diseases. Repetitive application of the same pesticides by farmers eliminates susceptible populations initially. However, with yearly widespread application, resistant individuals proliferate rapidly, leading to overall resistance within the population. Weeds acquiring resistance to multiple herbicides evolve into superweeds, posing significant challenges to farmers. Herbicide resistance is becoming increasingly prevalent, with some regions facing numerous herbicide-resistant weed species, exacerbating weed control difficulties. In the United States alone, scientists have identified 25 weed species resistant to herbicides. Notably, a recent report highlighted that resistant black grass in the UK diminishes cereal crop yields by up to 800,000 tons annually, translating to a substantial financial loss of USD 449.2 million per year for farmers.

Restraint : Long approval period for new products

The extensive approval process for plant growth regulators is primarily due to the need for multi-location field trials and consideration of residual effects, particularly for synthetic variants. The stringent regulatory procedures often result in a prolonged timeline, exceeding ten years and requiring investments upwards of USD 100 million to bring a new crop protection product to market. Patent protection and exclusivity play vital roles in recouping research and development costs, motivating companies to continue investing in industry growth. However, the escalating costs associated with product development and the extended regulatory period contribute to higher retail prices, consequently diminishing net profit margins for growers. These reduced margins impede the expansion of plant growth regulators within the global agrochemicals market.

Moreover, even generic products face a registration period of up to five years. Manufacturers encounter substantial hurdles in navigating the complex and costly approval process, involving both state and federal regulators. Many jurisdictions lack a clear regulatory framework for these products, and regulatory bodies often struggle with insufficient resources and infrastructure, leading to delays in product registration. Additionally, unclear rules pose interpretation challenges, fostering confusion and exacerbating complexities for crop protection chemical companies. These obstacles hinder companies' ability to introduce new products to market and dampen investments in research and development efforts.

Opportunity : Increased production and yield of crops

The expansion of crop production relies heavily on resource availability and climatic conditions. Limited arable land and resources like labor, inputs, and irrigation, compounded by unpredictable weather patterns, directly impact global production goals. According to the Organisation for Economic Cooperation and Development (OECD), there's a projected limited increase in the area for coarse grains by 2023, but significant growth is anticipated in crop yields, especially for wheat, oilseeds, and sugarcane. Plant growth regulators offer benefits by enhancing crop health, unlike traditional fertilizers that may disrupt soil balance and cause toxicity.

An uptick in oilseed crop and sugarcane production is expected due to rising demands in food, feed, and fuel industries. The OECD-FAO Agricultural Outlook 2020-2029 forecasts a growth in global soybean oilseed production from 367 metric tons in 2021 to an estimated 406 metric tons in 2029. This expansion is fueled by increased demand for protein meals, notably in China, potentially improving farmers' economic conditions with appropriate government support.

Challenge: Lack of awareness among growers regarding benefits of plant growth regulators

Plant growth regulators (PGRs) are pivotal in shaping plant growth, affecting cell, tissue, and organ development. Their judicious use can significantly enhance crop yield. However, a notable proportion of farmers remain uninformed about the various types of PGRs and their correct application methods, as well as the cost-saving advantages they offer.

This lack of awareness poses a substantial challenge to the market, as PGRs are underutilized due to limited knowledge among growers. Education and marketing efforts are imperative to rectify this situation. Many farmers are unaware of the environmental benefits of PGRs and may hesitate to adopt them. Organic farming demands specialized knowledge, but knowledge exchange among farmers in developing regions is lacking. Biologically synthesized PGRs hold promise for sustainable crop production, aiding growers in meeting the escalating demand for organic produce. Manufacturer-led educational campaigns, coupled with targeted distribution, can play a pivotal role in disseminating awareness among farmers.

Plant Growth Regulators Market Ecosystem

Key players within this market consist of reputable and financially robust plant growth regulators manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, cutting-edge technologies, and robust global sales and marketing networks. Prominent companies in this market are BASF SE (Germany), Corteva Agriscience (US), Syngenta Group (Switzerland), FMC Corporation (US), Nufarm (Australia), Bayer AG (Germany), Tata Chemicals Ltd. (India), UPL (India), Sumitomo Chemical Co., Ltd. (Japan), Nippon Soda Co., Ltd. (Japan), Sipcam Oxon Spa (Italy), De Sangosse (France), DHANUKA AGRITECH LTD (India), Sichuan Guoguang Agrochemical Co., Ltd. (China), and Zagro (Singapore).

In by type segment cytokinins segment holds the largest market share in the plant growth regulators market.

Cytokinins dominate the plant growth regulators market due to their vital role in promoting cell division, shoot growth, and overall plant development. These hormones stimulate cell enlargement and differentiation, leading to enhanced crop yield and quality. Cytokinins are widely utilized in various agricultural applications, including fruit and vegetable production, to improve plant vigor, increase flower and fruit set, and delay senescence. Their effectiveness in enhancing plant growth and yield has propelled their demand among growers globally, contributing to cytokinins holding the largest market share in the plant growth regulators segment. Additionally, advancements in biotechnology and research have led to the development of novel cytokinin formulations, further driving their adoption and market dominance.

In by function segment, plant growth inhibitors segment is expected to grow at highest CAGR during the forecast period.

Increased awareness among farmers and growers regarding the advantages of plant growth inhibitors in regulating plant growth and development is notable. Compounds like abscisic acid induce dormancy and abscission, aiding in managing excessive growth and bolstering stress tolerance in plants. The rise in abiotic stressors like drought, salinity, and extreme temperatures has spurred the adoption of plant growth inhibitors to counter their detrimental impact on crop yield. Additionally, advancements in research and development have led to the creation of more efficient and cost-effective plant growth inhibitors, stimulating their market expansion. In summary, these factors collectively drive the rapid growth of the plant growth inhibitors segment within the plant growth regulators market.

The solutions segment is expected to grow at the highest CAGR during the forecast period.

The expansion of the solutions segment in the plant growth regulators market can be attributed to multiple factors. Firstly, solutions offer ease of application and rapid absorption by plants, ensuring optimal utilization of growth regulators. Secondly, they allow for precise dosing, enabling growers to tailor concentrations to specific crops and growth stages, thereby enhancing effectiveness. Additionally, advancements in formulation technologies have led to the creation of innovative solutions with enhanced stability and bioavailability, further boosting demand. Furthermore, the solutions segment is increasingly adopted in various agricultural practices, such as greenhouse and hydroponic cultivation, where precise nutrient delivery is essential for maximizing crop yield and quality. Collectively, these factors drive the robust growth projection for the solutions segment in the plant growth regulators market during the forecast period.

The Asia Pacific region is expected to grow at the highest CAGR in the plant growth regulators market during the forecast period.

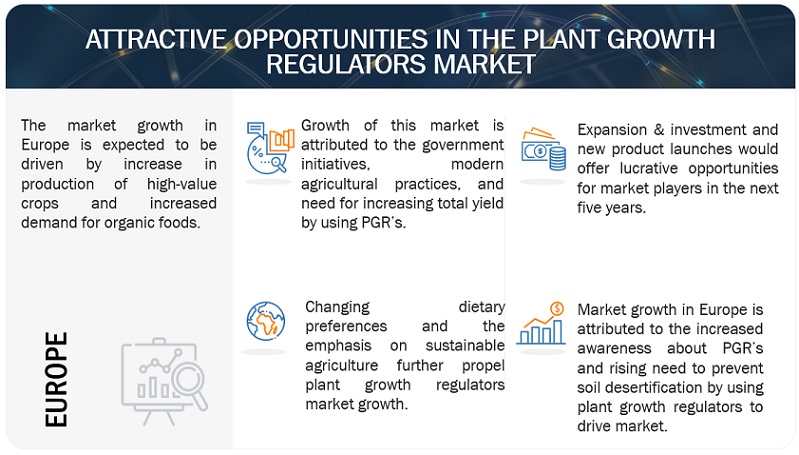

The plant growth regulators market is experiencing growth in the Asia-Pacific region due to several key factors. Firstly, the region has a significant agricultural industry, with a large portion of the global agricultural output originating from countries in Asia-Pacific. As these countries strive to enhance agricultural productivity to meet the increasing food demand driven by population growth and changing dietary preferences, there is a growing need for effective solutions like plant growth regulators. Additionally, the Asia-Pacific region is witnessing rapid technological advancements and increasing adoption of modern agricultural practices, which include the use of plant growth regulators to optimize crop yields and improve quality. Furthermore, favorable government initiatives, investments in agriculture, and supportive policies are further propelling the growth of the plant growth regulators market in the Asia-Pacific region. Overall, the convergence of these factors is driving the expansion of the plant growth regulators market in the Asia-Pacific region.

Key Market Players

The key players in the market include BASF SE (Germany), Corteva Agriscience (US), Syngenta Group (Switzerland), FMC Corporation (US), Nufarm (Australia), Bayer AG (Germany), Tata Chemicals Ltd. (India), UPL (India), Sumitomo Chemical Co., Ltd. (Japan), Nippon Soda Co., Ltd. (Japan), Sipcam Oxon Spa (Italy), De Sangosse (France), DHANUKA AGRITECH LTD (India), Sichuan Guoguang Agrochemical Co., Ltd. (China), and Zagro (Singapore). These market participants are emphasizing the expansion of their footprint via agreements and partnerships. They maintain a robust presence in North America, Asia Pacific, South America, RoW, and Europe, and they are supported by manufacturing facilities and well-established distribution networks spanning these regions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2024–2029 |

|

Base year considered |

2023 |

|

Forecast period considered |

2024–2029 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Crop Type, Function, Formulation, Type, and Region |

|

Regions covered |

North America, Europe, South America, Asia Pacific, and RoW |

|

Companies studied |

|

This research report categorizes the plant growth regulators market based on crop type, function, formulation, type, and region.

Target Audience

- Plant growth regulators traders, retailers, and distributors.

- Plant growth regulators manufacturers & suppliers.

- Related government authorities, commercial research & development (R&D) institutions.

- Regulatory bodies, including government agencies and NGOs.

- Commercial research & development (R&D) institutions and financial institutions.

- Government and research organizations.

- Venture capitalists and investors.

- Technology providers to Plant growth regulators and Plant growth regulators companies.

- Associations and industry bodies.

Plant Growth Regulators Market:

By Function

- Plant Growth Inhibitors

- Plant Growth Promoters

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Turf & Ornamentals

By Formulation

- Water-dispersible & Water-Soluble Granules

- Wettable Powder

- Solutions

By Type

- Cytokinins

- Auxins

- Gibberellins

- Ethylene

- Other Types

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In March 2023, Corteva Agriscience solidified its status as a frontrunner in the swiftly growing Biologicals sector by finalizing the acquisitions of Symborg, a specialist in microbiological technologies headquartered in Murcia, Spain, and Stoller, a prominent independent Biologicals firm based in Houston, Texas, U.S. These acquisitions bolster Corteva's presence in the market and enable it to enhance its portfolio with plant growth regulators, positioning the company to capture a significant market share.

- In December 2022, Corteva Agriscience announced a collaboration with NEVONEX, powered by Bosch, to explore the precision application of crop protection products using on-farm data, advanced analytics, and spray equipment. By merging data-driven crop protection applications with conventional machine spray technology, the collaboration aimed to add value for farmers, thereby helping the company retain clients.

- In January 2020, BASF SE launched Attraxor, a new plant growth regulator using the powerful active ingredient, prohexadione; this could reduce the longitudinal shoot growth of grass, lessening the need for mowing frequently. It would be used to manage amenity turf and grassland, including sod farms, sports turf, golf courses, airfields, and road and railway embankments. This expanded its amenity market portfolio and helped the company increase its market share in the amenity market.

Frequently Asked Questions (FAQ):

Which are the major companies in the plant growth regulators market? What are their major strategies to strengthen their market presence?

The key players in the market include BASF SE (Germany), Corteva Agriscience (US), Syngenta Group (Switzerland), FMC Corporation (US), Nufarm (Australia), Bayer AG (Germany), Tata Chemicals Ltd. (India), UPL (India), Sumitomo Chemical Co., Ltd. (Japan), Nippon Soda Co., Ltd. (Japan), Sipcam Oxon Spa (Italy), De Sangosse (France), DHANUKA AGRITECH LTD (India), Sichuan Guoguang Agrochemical Co., Ltd. (China), and Zagro (Singapore). These players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities and strong distribution networks across these regions.

What are the drivers and opportunities for the plant growth regulators market?

The plant growth regulators market thrives on various catalysts, ushering in ample prospects for expansion and innovation. With the global population on the rise, the imperative for increased food production escalates, thereby driving the demand for plant growth regulators to augment crop yield and quality. Concurrently, shifting climatic dynamics and the imperative for sustainable agricultural practices propel the adoption of growth regulators to counteract the detrimental impacts of environmental stressors on crops.

Moreover, strides in biotechnology and nanotechnology have birthed novel plant growth regulators boasting heightened efficacy and precision, thereby paving fresh pathways for market proliferation. The ascendancy of precision agriculture, buoyed by the convergence of IoT and data analytics, offers avenues for the optimized deployment of growth regulators, maximizing their utility while mitigating ecological footprints. Furthermore, the burgeoning consciousness regarding food safety and quality among consumers spurs the need for plant growth regulators that conform to stringent regulatory benchmarks, thereby fostering the creation of eco-friendly and compliant products by manufacturers. Simultaneously, the emergence of bio-based and organic plant growth regulators resonates with the escalating consumer inclination towards sustainable and naturally derived agricultural inputs, further propelling market expansion.

Which region is expected to hold the highest market share?

Europe is expected to hold the highest market share in the plant growth regulators market. Europe's dominance in the plant growth regulators market stems from its robust agricultural sector, advanced technologies, and stringent regulatory standards ensuring sustainable agrochemical use. The continent's diverse climate fuels demand for tailored regulators, while its focus on eco-friendly practices boosts bio-based products. With leading research institutions and collaborative industry efforts, Europe continues to innovate, backed by supportive government initiatives, solidifying its leadership in this market.

What are the key technology trends prevailing in the plant growth regulators market?

Advancements in biotechnology have led to the development of biological plant growth regulators derived from natural sources such as microbes and plants. These bio-based regulators offer eco-friendly alternatives to synthetic chemicals, catering to the growing demand for sustainable agriculture. Integration of nanotechnology in plant growth regulators enables precise delivery of active ingredients at the cellular level, enhancing efficacy while minimizing environmental impact. Nanoparticle-based formulations improve bioavailability and uptake by plants, optimizing resource utilization. Gene editing techniques like CRISPR enable precise modification of plant genes associated with growth and development. This technology offers the potential to develop crop varieties with enhanced responsiveness to growth regulators, leading to improved yield and stress tolerance.

What total CAGR is expected to be recorded for the plant growth regulators market from 2024 to 2029?

The CAGR is expected to be 7.2% from 2024-2029. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

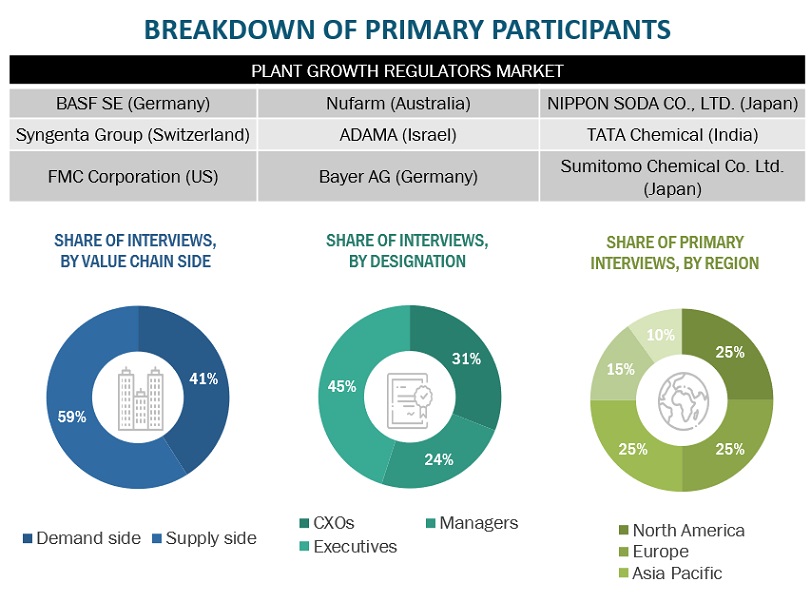

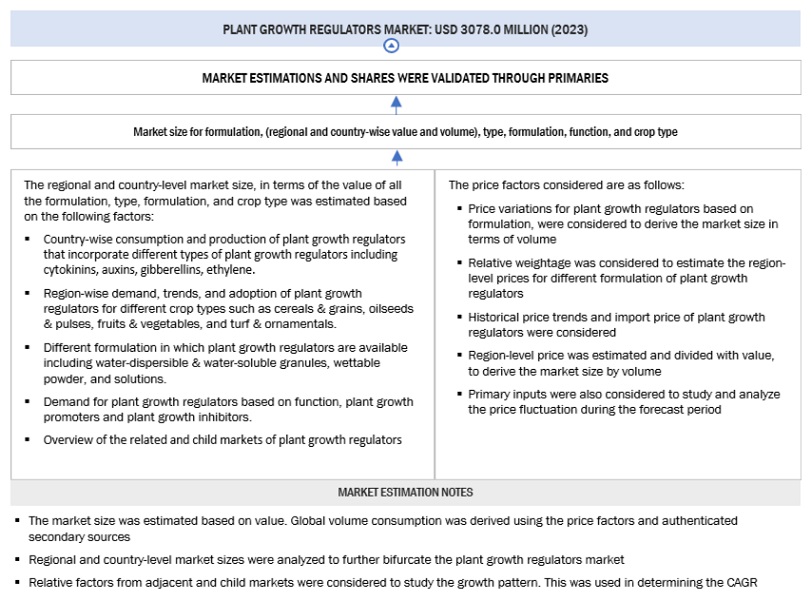

The study involved four major activities in estimating the current size of the plant growth regulators market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the plant growth regulators market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the plant growth regulators market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the plant growth regulators market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to crop type, type, formulation, function, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Plant Growth Regulators Market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research.

- Primary and secondary research determined the industry’s value chain and market size.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The following figure provides an illustrative representation of the complete market size estimation process implemented in this research study for an overall estimation of the plant growth regulators market in a consolidated format.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for the purpose of this study.

Global Plant Growth Regulators Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Plant Growth Regulators Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall plant growth regulators market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to the Ministry of Agriculture, Food and Rural Affairs, Ontario:

Plant Growth Regulators are chemicals used to modify plant growth, such as increasing branching, suppressing shoot growth, increasing return bloom, removing excess fruit, or altering fruit maturity. Numerous factors affect plant growth regulator performance, including how well the plant absorbs the chemical, tree vigor and age, dose, timing, cultivar, and weather conditions before, during, and after application. Plant growth regulators can be grouped into six classes: compounds related to auxins, gibberellins, gibberellin biosynthesis inhibitors, cytokinins, abscisic acid, and compounds affecting the ethylene status.

Key Stakeholders

- Supply-Side: Plant Growth Regulators Producers, Suppliers, Distributors, Importers, and Exporters

- Demand Side: Large-Scale Crop Farmers, Large-Scale Orchids, and Researchers

- Agricultural Co-operative Societies

- Government, Research Organizations, and Institutions

- Technology Providers to Plant Growth Regulator Manufacturing Companies.

- Regulatory Bodies

- World Health Organization (WHO)

- European Crop Protection Agency (ECPA)

- Pesticides Manufacturers and Formulators Association (PMFAI)

- China Crop Protection Industry Association (CCPIA)

- Food and Agriculture Organization (FAO)

- US Department of Agriculture (USDA)

- Institute of Food and Agricultural Sciences (IFAS)

- US Environmental Protection Agency (US EPA)

- Organization for Economic Co-operation and Development (OECD)

- Federal Office Of Consumer Protection and Food Safety

- European Food Safety Authority

- Ministry of Agriculture & Farmers Welfare

- Department Of Agriculture, Cooperation & Farmers Welfare

- Directorate Of Plant Protection, Quarantine & Storage

- Commercial Research & Development (R&D) Institutions and Financial Institutions

Report Objectives

Market Intelligence

- To determine and project the size of the plant growth regulators market with respect to the function, type, formulation, crop type, and region, over five years, ranging from 2024 to 2029.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

-

To analyze the demand-side factors based on the following:

- Impact of macro-and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

Competitive Intelligence

- Identifying and profiling the key players in the plant growth regulators market

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies players across the country adopt.

- Providing insights on key product innovations and investments in the plant growth regulators market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe into Spain, the Czech Republic, the Netherlands, Belgium, Hungary, Romania, Ireland, and other EU & non-EU countries.

- Further breakdown of the Rest of Asia Pacific into South Korea, Thailand, Kazakhstan, Vietnam, Indonesia, and Myanmar.

- Further breakdown of the Rest of South America into Chile, Colombia, Peru, Uruguay, and other South American countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Plant Growth Regulators Market

We need information on unique PGR product not being used in India and manufactured internationally. Is this information covered in the report?