Polytetrafluoroethylene (PTFE) Market by Form, Application (Sheets, Coatings, Pipes, Films), End-use Industry (Chemical & Industrial Processing, Automotive & Aerospace, Electrical & Electronics, Construction), and Region - Global Forecast to 2028

Updated on : March 19, 2024

Polytetrafluoroethylene (PTFE) Market

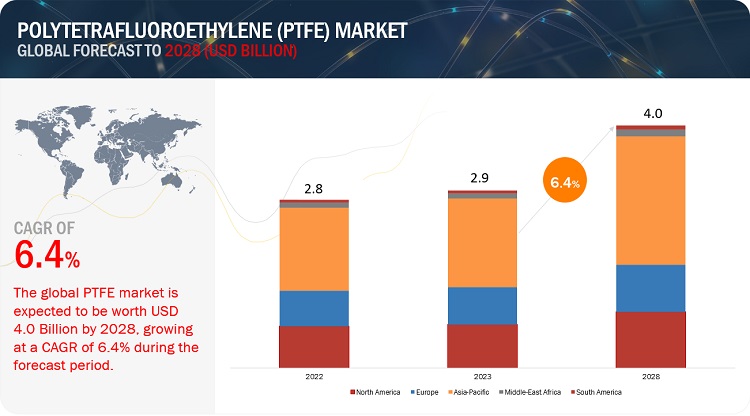

The global polytetrafluoroethylene (PTFE) market size was valued at USD 2.9 billion in 2023 and is projected to reach USD 4.0 billion by 2028, growing at 6.4% cagr from 2023 to 2028. PTFE is a versatile material with many unique properties, and it is widely used in various industries due to its exceptional chemical resistance, temperature tolerance, and low friction properties. The market is growing, and the trend is expected to continue in the long term due to high demand from electrical & electronics, automotive & aerospace, chemicals & industrial, and consumer goods industries.

Attractive Opportunities in the PTFE Market

To know about the assumptions considered for the study, Request for Free Sample Report

PTFE Market Dynamics

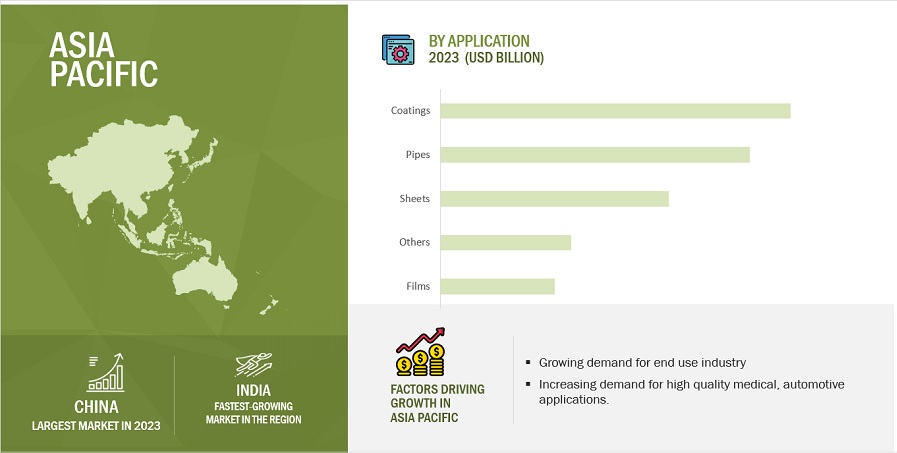

Driver: Demand from emerging countries in Asia Pacific

Asia Pacific is the most promising chemical market, which is expected to be the same soon. The large, developing middle-class population of Asia Pacific and rapid industrialization & growth in the manufacturing sector drive the demand for PTFE in various industries, such as automotive, consumer goods, chemical, and electrical & electronics. The region is also home to several emerging economies with rapidly growing manufacturing sectors, which further drives the demand for PTFE products. China is the largest producer and consumer of PTFE in the region. The growing demand for PTFE in China is mainly driven by the expanding manufacturing sector, which has increased the demand for PTFE-based products in various industries. The Chemours Company, Daikin Industries Ltd., and 3M Company are the leading companies operating in Asia Pacific. In July 2021, Daikin Industries, Ltd. announced the completion of the Kashima Integrated Production Center (IPC) at the Kashima Plant. This center has been producing fluorochemicals since June 2021. The increasing R&D capabilities to improve the performance and properties of PTFE-based products are expected to drive the growth of the market further.

Restraint: New perfluorooctanoic acid regulations

PFOA (perfluorooctanoic acid) is a synthetic compound that has been used in the manufacture of PTFE (Polytetrafluoroethylene), which is the primary component of Teflon. PFOA is a material of high concern worldwide because it is a persistent organic pollutant based on its ubiquitous, persistent, bio-accumulative, and reprotoxic nature. Exposure to PFOA has been linked to health problems, including cancer, reproductive and developmental issues, and immune system damage. Because of its classification as a persistent organic pollutant and potential health risks associated with PFOA, regulatory agencies around the world have taken steps to restrict its use and exposure. Many countries and the entire European Union have created new legislations to limit PFOA exposure to people. EU legislation requires that no producer can have a process or put into market any product that has more than 25 parts per billion (ppb) PFOA. In the US, the Environmental Protection Agency (EPA) established a voluntary PFOA Stewardship Program, in which eight major companies agreed to reduce their emissions.

Opportunity: Strong government focus on green hydrogen and hydrogen fuel cells

Governments worldwide are providing support for the development and use of hydrogen fuel cells as part of their efforts to reduce carbon emissions and combat climate change. Governments are providing funding for the R&D of hydrogen fuel cell technologies and offering incentives to encourage the adoption of hydrogen fuel cells, such as tax credits, rebates, and subsidies. The Japanese government has established the Green Innovation Fund, which provides funding for the development and commercialization of innovative technologies, including hydrogen fuel cells. The fund provides financial support for R&D, demonstration projects, and commercialization efforts. The US Department of Energy’s Hydrogen and Fuel Cell Technologies Office provides funding for the R&D of hydrogen fuel cell technologies, as well as for demonstration projects and infrastructure development.

PTFE is a key material used in the production of components and parts for hydrogen fuel cells. It has a unique set of properties that make it ideal for use in fuel cell applications. It is highly resistant to corrosion and can withstand exposure to harsh chemicals, making it a reliable material for use in the fuel cell’s acidic environment. PTFE is also an excellent insulator, which is important for preventing electrical short circuits within the fuel cell.

Challenge: Non-biodegradbility of PTFE

PTFE is a non-biodegradable material. It can’t be broken down by natural biological processes. PTFE possesses a highly stable molecule structure, which makes it resistant to degradation by microorganisms or enzymes in the environment. As a result, PTFE can persist in the environment for a long time, potentially causing environmental problems. If PTFE waste is not properly disposed of, it can accumulate in landfills, water bodies, or other ecosystems, posing a risk to wildlife and humans.

PTFE Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Fine powder was the largest form for PTFE market in 2022, in terms of value."

PTFE fine powders are converted into various shapes, tapes, and insulation wires through the paste extrusion process, which further increases the density of the material. Compared to other forms of PTFE, fine powder has superior stress-crack resistance, higher thermal stability, lower permeability, and higher clarity. Also, this resin is widely used in high-performance materials, low-density tapes, and comfortable sealing materials.

"Chemical & industrial processing was the largest end-use industry for PTFE market in 2022, in terms of value."

PTFE is widely used in the chemical & industrial processing industry owing to its excellent resistance to chemicals. It does not react with process streams, thereby preventing contamination of products and maintaining the purity of processing streams. PTFE requires low maintenance, is economical, durable, and a viable alternative to metal alloys. It prevents contamination in chemical processes and enhances the performance of the product in various industries, such as polymers, specialty chemicals, and other chemical products. In addition, PTFE reduces the need for frequent replacements and ultimately reduces waste.

In the chemical processing sector, sustainability is becoming more important, and PTFE is a material that can contribute to this trend.

"Asia Pacific was the largest market for PTFE in 2022, in terms of value."

Asia Pacific was the largest market for global PTFE market, in terms of value, in 2022. China is the largest market in Asia Pacific. It is projected to witness the second-highest growth during the forecast period considering of high usage of PTFE in the region for chemical & industrial processing application. The major players operating in Asia pacific region includes Daikin Industries, Ltd. (Japan) and Dongyue Group Limited. (China), among others.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market The Chemours Company (US), Daikin Industries, Ltd. (Japan), 3M (US), The AGC Group (Japan), Solvay (Belgium), HaloPolymer, OJSC (Moscow), Dongyue Group Limited (China), Gujarat Fluorochemicals Limited (India), Jiangsu Meilan Chemical Co. Ltd. (China), and Shanghai Huayi 3F New Materials Co. Ltd. (China). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of PTFE have opted for new product launches to sustain their market position.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (KT); Value (USD Million) |

|

Segments |

Form, Application, End-use Industries, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

The Chemours Company (US), Daikin Industries, Ltd. (Japan), 3M (US), The AGC Group (Japan), Solvay (Belgium), HaloPolymer, OJSC (Moscow), Dongyue Group Limited (China), Gujarat Fluorochemicals Limited (India), Jiangsu Meilan Chemical Co. Ltd. (China), and Shanghai Huayi 3F New Materials Co. Ltd. (China) are the key players in the PTFE market. |

This report categorizes the global PTFE market based on form, application, end-use industry, and region.

Based on form, the PTFE market has been segmented as follows:

- Granular/Molded Powder

- Fine Powder

- Dispersion

- Micronized Powder

Based on application, the PTFE market has been segmented as follows:

- Sheets

- Coatings

- Pipes

- Films

- Other Applications

Based on end-use industry, the PTFE market has been segmented as follows:

- Chemical & Industrial Processing

- Electronics & Electrical

- Automotive & Aerospace

- Consumer Goods

- Building & Construction

- Other End-use Industries

Based on region, the PTFE market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2023, Solvay shifted its headquarters from Neder-over-Heembeek to a new facility in Brussels, specifically designed and equipped to host the group’s research, innovation, and administration activities.

- In November 2022, Gujarat Fluorochemicals Limited (GFL) announced a successful development in the use of non-fluorinated polymerization aid (NFPA) technology to manufacture PTFE fine powder and PFA. With this development, the company will be able to manufacture its entire fluoropolymer portfolio without the use of fluorinated polymerization aids.

- In February 2022, Gujarat Fluorochemicals Limited (GFL) announced an investment into the expansion of PTFE & PVDF capacities in its integrated manufacturing facility at Dahej in India. This new plan will further support the growing demand for these fluoropolymers across regions and major industries globally.

- In July 2021, Daikin Industries, Ltd. announced the completion of the Kashima Integrated Production Center (IPC) at the Kashima Plant. This center has been producing fluorochemicals since June 2021. The center will integrate the people, organization, and information related to operational control, equipment management, and production management at the Kashima plant.

- In May 2019, Dongyue Group announced its strategic plan to expand its capacities of PTFE concentrated emulsion and dispersion resin. This project aims to build a device for the production of 10,000t/a PTFE dispersion resin, a device for the production of 10,000t/a PTFE concentrated emulsion, two sets of devices for the production of 12,000t/a PTFE as well as two sets of devices for the production of 30,000t/a chlorodifuoromethane along with commonly shared auxiliary facilities and reserve facilities.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the PTFE market?

The forecast period for the PTFE market in this study is 2023-2028. The PTFE market is expected to grow at a CAGR of 6.4%, in terms of value, during the forecast period.

Who are the major key players in the PTFE market?

The Chemours Company (US), Daikin Industries, Ltd. (Japan), 3M (US), The AGC Group (Japan), Solvay (Belgium), HaloPolymer, OJSC (Moscow), Dongyue Group Limited (China), Gujarat Fluorochemicals Limited (India), Jiangsu Meilan Chemical Co. Ltd. (China), and Shanghai Huayi 3F New Materials Co. Ltd. (China)are the leading manufacturers of PTFE.

What are the major regulations of the PTFE market in various countries?

The various countries passed a law in which public water systems in the state are now required to test for PFAS and report the results to the state.

What are the drivers and opportunities for the PTFE market?

The increased demand from end-use industries is driving the market during the forecast period. High penetration in medical applications acts as an opportunity during the forecast period.

Which are the key technology trends prevailing in the PTFE market?

The key technologies prevailing in the PTFE market include emulsion polymerization, plasma treatment, and 3D treatment. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the PTFE market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

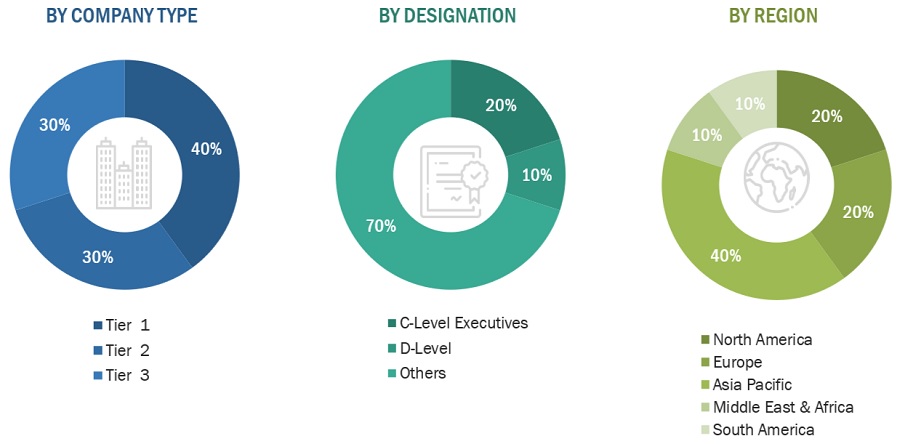

The PTFE market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the PTFE market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the PTFE industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, raw material, application type, end-use industries, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of PTFE and outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

The Chemours Company |

Individual Industry Expert |

|

Daikin Industries, Ltd. |

Sales Manager |

|

3M |

Director |

|

Solvay |

Marketing Manager |

|

Dongyue Group Limited |

R&D Manager |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the PTFE market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

PTFE Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

PTFE Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Polytetrafluoroethylene (PTFE) is a type of synthetic fluoropolymer. It is a solid high-molecular weight compound, which is available in different forms: granular, fine powder, dispersion, and micronized. It is used in a variety of applications due to its unique properties, such as high resistance to heat, chemicals, and water, low friction coefficient, and non-stick properties. PTFE resin is used to make products, such as gaskets, coatings, tubes, hoses, membranes, sheets, and fabrics. The PTFE market is driven by various end-use industries such as chemical & industrial processing, automotive & aerospace, electronics & electrical, consumer goods, and building & construction.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the PTFE market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on form, application, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on PTFE market

- Countermeasures pertaining to PTFE regulations.

- Alternative materials in PTFE market

By Form Analysis

- Market size for PTFE dispersion in terms of value and volume

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polytetrafluoroethylene (PTFE) Market

Report title not mentioned

PTFE Market report

Interested in Chemical tubes market from the aspect of market size, industry profile, end-use industry, etc.

PTFE market

General information on overall PTFE consumption and specific focus on PTFE tubes

General information on overall PTFE consumption and specific focus on automotive industry