Population Health Management Market by Component (Software, Services), Mode of Delivery (On-premise, Cloud-based), End User (Healthcare Providers (Hospitals, ACOs), Healthcare Payers, Employer Groups, Government Bodies) & Region - Global Forecast to 2027

The global population health management market in terms of revenue was estimated to be worth $27.8 billion in 2022 and is poised to reach $53.3 billion by 2027, growing at a CAGR of 13.9% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The current edition of the report consists of an updated market overview for each country in the geographic analysis chapter. Country-wise market size and market share have also been provided. The factors driving market growth include the need to maintain regulatory compliance, the rising need to curtail healthcare costs, and the growing demand for patient-centric healthcare. However, the dearth of skilled IT professionals and security concerns are challenging the growth of this market to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Population Health Management Market Dynamics

Driver: rising geriatric population and subsequent growth in the burden of chronic diseases

The rising geriatric population and subsequent growth in disease burden are expected to impact the healthcare systems in various countries significantly. The impact of the increasing geriatric population is even more pronounced given the growing pressure on government budgets, the decline in the number of health personnel in various regions, and the higher incidence of chronic diseases. Some of the important statistics in this regard have been mentioned below:

- The number of people aged 65 or older is projected to grow from an estimated 524 million in 2010 to nearly 1.5 billion by 2050, with most of the increase occurring in developing countries (source: WHO).

- In the US, the number of people aged over 65 is expected to double between 2005 and 2030 (source: National Institute on Aging, Maryland, US).

- According to the National Council on Aging, approximately 92% of older adults have at least one chronic disease, and 77% have at least two. Four chronic diseases—heart disease, cancer, stroke, and diabetes—cause almost two-thirds of all deaths each year in the US.

With a colossal pool of geriatric individuals requiring health and long-term care services, the healthcare cost per person is expected to increase in many countries. Moreover, with the growing expectations of citizens regarding healthcare services and social care, the burden on healthcare systems across the globe is increasing. In this regard, many strategies are being pursued by stakeholders to control costs while maintaining the quality of care. Population health management is one such approach that could enhance care quality while simultaneously reducing costs. Solutions such as EHR and population health management solutions are being employed to reduce the burden on the overworked healthcare delivery systems in most countries. As a result of these market conditions, the adoption of population health management solutions is increasing globally.

Opportunity: increasing focus on value-based medicine

Value-based medicine is redefining healthcare by capturing results-oriented data and making it usable. Business intelligence (BI) helps healthcare organisations determine what data they actually need and further helps them analyze, evaluate, and utilise this data to understand the overall costs versus benefits and gain a competitive advantage. It also enables transparency in all processes to examine every purchase from the standpoint of value, utility, and outcomes.

Moreover, governments, health insurance companies, and healthcare providers seek new opportunities to reduce costs as the current healthcare model is unsustainable across the globe. Besides, the growing volume and availability of healthcare data and the rising need to deliver quality care to patients will increasingly require healthcare organisations to rely on these new methodologies. This will serve as a strategic competency to differentiate themselves from their competitors and take advantage of the growth opportunities. The rapid transition from fee-for-service (FFS) payments to value-based reimbursement models and the key role of analytics in new pay-for-performance models like accountable care organisations (ACOs) will provide an impetus to the growth of the population health management industry.

Restraint: Data Breach Concerns

In healthcare, approximately one-third of data breaches result in medical identity theft, mainly due to a lack of internal control over patient information, a lack of top management support, outdated policies and procedures or non-adherence to existing ones, and inadequate personnel training, all of which contribute to the rise in data breaches and medical identity theft cases in the industry. This makes patient confidentiality a major challenge in the healthcare industry.

A major concern with cloud-based population health management solutions is that data hosted by vendors is not as secure as its on-premise counterparts. Patient information is highly sensitive, and a high degree of privacy needs to be maintained to ensure access only to authorised users. Moreover, the digitization of medical and patient information has created greater data risks and liabilities and increased the chance of data breaches. In the US, the HIPAA Journal recorded 616 healthcare data breaches in its 2020 breach list, an increase of 66% over the total number of breaches tracked in 2018. According to a publication from the HIPAA Journal, HIPAA-covered companies and business associates paid around USD 13.6 million for HIPAA violations in 2020 and around USD 15.3 million in 2019. Thus, creating a secure communication platform is a major challenge faced by IT vendors catering to the healthcare industry. Thus, concerns over the security and privacy of sensitive patient information are limiting the adoption of cloud-based population health management solutions.

Challenge: Interoperability issues

The lack of interoperability is a major challenge for effective population health management. A critical factor in population health management is engaging patients with meaningful information about their health, including providing them with a summary of the care received, along with information on labs, medications, and images. Such information is particularly important when patients want to engage in shared decision-making with their physicians (regarding a care plan or course of treatment). However, the inability of patients to access their health records affects population health management outcomes.

The lack of interoperability across healthcare settings is also a barrier to advancing population health management. Confronted with poor interoperability, hospitals typically build or licence interfaces to import and export data from both internal and external sources, such as the hospital's EHR, laboratories, admit/discharge/transfer processes, medical devices, as well as outside laboratories. Thus, a single hospital may employ a few dozen interfaces, while a large health system with many sites may have to employ hundreds or even thousands of interfaces. For care coordination models, far more complicated interfaces will be necessary to accommodate data exchange. These interfaces prove to be expensive and difficult to maintain and require highly skilled technicians for their efficient operation. The health information exchanges employed by hospitals as a solution to interoperability barriers also pose several challenges, including capital-intensive operations as well as technical difficulties in their management.

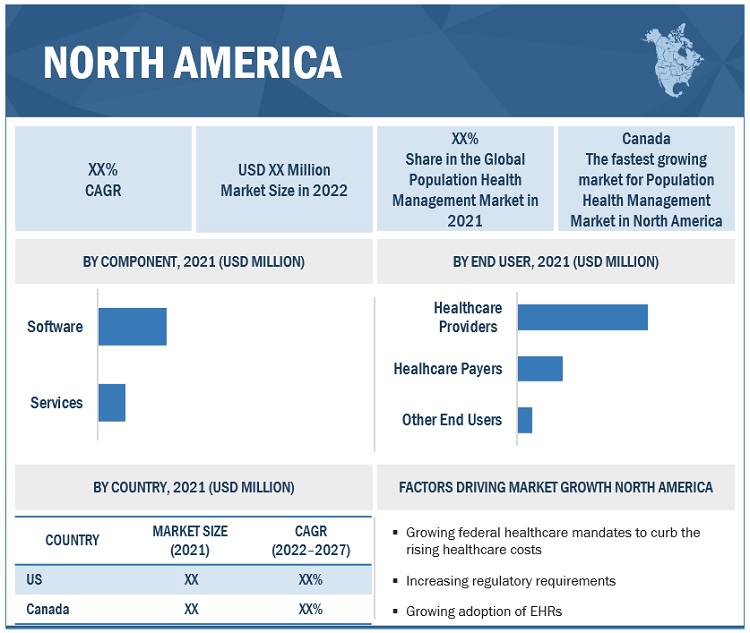

Software to register the highest growth in the product and service segment of the population health management industry.

On the basis of product and service, the software segment of population health management market will register the highest growth. The high growth of this segment can be attributed to its ability to reduce readmissions, enhance patient engagement, and provide flexibility in customizations.

Healthcare providers account for the largest end user segment in the population health management industry.

Based on end users, the healthcare providers segment accounted for the largest share in population health management market during the forecast period. The large share of this segment can be attributed to the growing patient pool, the increasing load on hospitals to integrate and manage patient data, as well as the growing need to improve the affordability and accessibility of healthcare services, which are propelling the growth of the PHM solutions market for healthcare providers.

North America accounted for the largest share of the population health management industry during the forecast period.

North America holds the largest share of population health management market. Growth in the North American market can be attributed to factors such as stringent regulations, increasing government support for improving healthcare infrastructure, and the presence of leading market players in the region.

To know about the assumptions considered for the study, download the pdf brochure

The population health management market is dominated by a few globally established players, such as Cerner Corporation (US), Epic Systems Corporation (US), Koninklijke Philips (Netherlands), i2i Population Health (US), Health Catalyst (US), Optum (US), Enli Health Intelligence (US), eClinicalWorks (US), Allscripts Healthcare Solutions (US), IBM Corporation (US), HealthEC LLC (US), Medecision (US), Arcadia (US), athenahealth (US), Cotiviti (US), NextGen Healthcare, Inc. (US), Conifer Health Solutions (US), SPH Analytics (US), Lightbeam Health Solutions (US), Innovaccer (US), Lumeris (US), Zeomega (US), HGS Healthcare, LLC (US), Persivia (US) and Color Health, Inc.(US).

Scope of the Population Health Management Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$27.8 billion |

|

Projected Revenue by 2027 |

$53.3 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 13.9% |

|

Market Driver |

rising geriatric population and subsequent growth in the burden of chronic diseases |

|

Market Opportunity |

increasing focus on value-based medicine |

The study categorizes the global population health management market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Introduction

- Software

- Services

By Mode of Delivery

- Introduction

- On-premise

- Cloud-based

By End User

- Introduction

- Healthcare Providers

- Healthcare Payers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

- Latin America

- Middle East & Africa

Recent Developments of Population Health Management Industry

- Cerner Corporation and Change Healthcare announced a strategic partnership in January 2021 to combine Cerner’s population health management (PHM) capabilities with Change Healthcare’s claims and analytics offerings.

- Humana acquired the population health technology company, Genoa Healthcare, in March 2021.

- In April 2021, Optum and the Advisory Board Company announced a merger that will combine Optum’s population health management capabilities with the Advisory Board Company’s technology and analytics.

- In May 2021, CVS Health announced the acquisition of Aetna, which includes a population health management component.

- In June 2021, UnitedHealth Group announced the acquisition of Change Healthcare, which includes a population health management component.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global population health management market?

The global population health management market boasts a total revenue value of $53.3 billion by 2027.

What is the estimated growth rate (CAGR) of the global population health management market?

The global population health management market has an estimated compound annual growth rate (CAGR) of 13.9% and a revenue size in the region of $27.8 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 POPULATION HEALTH MANAGEMENT INDUSTRY DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 POPULATION HEALTH MANAGEMENT MARKET

FIGURE 2 REGIONAL SEGMENTS COVERED

1.2.3 YEARS CONSIDERED

1.3 CURRENCY CONSIDERED

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.4 STAKEHOLDERS

1.5 LIMITATIONS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Insights from primary experts

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH 1: BOTTOM-UP APPROACH (DEMAND SIDE ANALYSIS)

FIGURE 7 BOTTOM-UP APPROACH (DEMAND SIDE ANALYSIS)

FIGURE 8 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

2.2.2 APPROACH 2: TOP-DOWN APPROACH (SUPPLY SIDE ANALYSIS)

FIGURE 9 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: GLOBAL MARKET

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 11 POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

FIGURE 12 GLOBAL MARKET, BY MODE OF DELIVERY, 2022 VS. 2027 (USD MILLION)

FIGURE 13 GLOBAL MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 14 GLOBAL POPULATION HEALTH MANAGEMENT INDUSTRY: GEOGRAPHICAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 POPULATION HEALTH MANAGEMENT INDUSTRY OVERVIEW

FIGURE 15 NEED TO CURTAIL ESCALATING HEALTHCARE COSTS TO DRIVE MARKET

4.2 ASIA PACIFIC: MARKET, BY END USER AND COUNTRY (2021)

FIGURE 16 JAPAN DOMINATED ASIA PACIFIC MARKET IN 2021

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 17 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

4.4 REGIONAL MIX: GLOBAL MARKET (2022−2027)

FIGURE 18 NORTH AMERICA TO DOMINATE GLOBAL MARKET DURING FORECAST PERIOD

4.5 GLOBAL MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 19 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 POPULATION HEALTH MANAGEMENT INDUSTRY DYNAMICS

TABLE 3 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IMPACT ANALYSIS

FIGURE 20 GLOBAL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Government mandates and support for healthcare IT solutions

5.2.1.2 Need to curtail escalating healthcare costs

FIGURE 21 US HEALTHCARE SPENDING, 2012–2020 (USD BILLION)

5.2.1.3 Rising geriatric population and subsequent growth in chronic disease burden

5.2.2 RESTRAINTS

5.2.2.1 High investments in infrastructure to set up robust PHM program

5.2.2.2 Rising data breach concerns

5.2.3 OPPORTUNITIES

5.2.3.1 Growing importance of emerging markets in healthcare sector

5.2.3.2 Rising focus on personalized medicine

5.2.3.3 Increasing focus on value-based medicine

5.2.4 CHALLENGES

5.2.4.1 Lack of data management capabilities and skilled analysts

5.2.4.2 Interoperability issues

6 INDUSTRY INSIGHTS (Page No. - 57)

6.1 POPULATION HEALTH MANAGEMENT INDUSTRY TRENDS

6.1.1 NEED FOR INTEROPERABILITY AND INTEGRATION TO DRIVE INNOVATION

6.1.2 SHIFT OF RISK BURDEN FROM PAYERS TO PROVIDERS

6.1.3 GROWING DEMAND FOR PATIENT-CENTRIC HEALTHCARE

FIGURE 22 VALUE-BASED CARE WORKFLOW

6.1.4 CLOUD-BASED IT SOLUTIONS

6.1.5 CONSOLIDATION OF HEALTHCARE PROVIDERS

6.2 ECOSYSTEM ANALYSIS

FIGURE 23 GLOBAL MARKET: ECOSYSTEM ANALYSIS

6.3 EVOLUTION OF ACOS: A PROMISING PAYMENT REFORM

6.3.1 INTRODUCTION

FIGURE 24 ACOS: REIMBURSEMENT MODEL

6.3.2 US: EVOLUTION OF ACOS

FIGURE 25 EVOLUTION OF ACO MODELS

6.3.3 ROLE OF INFORMATION TECHNOLOGY IN ACCOUNTABLE CARE

FIGURE 26 ACCOUNTABLE CARE SOLUTIONS AND THEIR USE

6.4 HCIT EXPENDITURE ANALYSIS

6.4.1 NORTH AMERICA

TABLE 4 NORTH AMERICA: HEALTHCARE EXPENDITURE, BY COUNTRY

6.4.2 EUROPE

6.4.3 ASIA PACIFIC

TABLE 5 JAPAN: HEALTHCARE IT INITIATIVES AND FUNDING

TABLE 6 CHINA: HEALTHCARE IT INITIATIVES AND FUNDING

6.5 REGULATORY ANALYSIS

6.5.1 NORTH AMERICA

6.5.2 EUROPE

6.5.3 ASIA PACIFIC

6.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 DEGREE OF COMPETITION TO BE HIGH IN GLOBAL MARKET

TABLE 7 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

6.7 PATENT ANALYSIS

FIGURE 28 TOP PATENT OWNERS AND APPLICANTS FOR POPULATION HEALTH MANAGEMENT SOLUTIONS (JANUARY 2011–SEPTEMBER 2022)

FIGURE 29 PATENT ANALYSIS: GLOBAL MARKET (JANUARY 2017–SEPTEMBER 2022)

6.8 ADJACENT MARKET ANALYSIS

FIGURE 30 PATIENT REGISTRY SOFTWARE MARKET: MARKET OVERVIEW

FIGURE 31 AMBULATORY EHR MARKET: MARKET OVERVIEW

6.9 CASE STUDY

6.10 KEY STAKEHOLDERS AND BUYING CRITERIA

6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR DEPLOYMENT MODES (%)

6.10.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR DEPLOYMENT MODES

TABLE 9 KEY BUYING CRITERIA FOR DEPLOYMENT MODES

6.11 KEY CONFERENCES AND EVENTS (2022-2023)

6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 34 REVENUE SHIFT IN GLOBAL MARKET

6.13 PRICING ANALYSIS

6.13.1 INITIAL FEES

TABLE 10 PRE-ELEMENT FEE FOR PHM SOLUTIONS

6.13.2 ANNUAL MAINTENANCE FEES

TABLE 11 ANNUAL MAINTENANCE FEE FOR PHM SOLUTIONS

6.14 TECHNOLOGY ANALYSIS

6.14.1 INTEGRATION OF AI AND ML

6.14.2 DATA ANALYTICS

7 POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT (Page No. - 80)

7.1 INTRODUCTION

TABLE 12 GLOBAL POPULATION HEALTH MANAGEMENT INDUSTRY, BY COMPONENT, 2020–2027 (USD MILLION)

7.2 SOFTWARE

7.2.1 SOFTWARE TO DOMINATE COMPONENT SEGMENT

TABLE 13 POPULATION HEALTH MANAGEMENT SOFTWARE OFFERED BY KEY PLAYERS

TABLE 14 POPULATION HEALTH MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 SERVICES

7.3.1 INDISPENSABLE AND RECURRING NATURE OF SERVICES TO PROPEL MARKET

TABLE 15 POPULATION HEALTH MANAGEMENT SERVICES OFFERED BY KEY PLAYERS

TABLE 16 POPULATION HEALTH MANAGEMENT SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 POPULATION HEALTH MANAGEMENT MARKET, BY MODE OF DELIVERY (Page No. - 88)

8.1 INTRODUCTION

TABLE 17 GLOBAL POPULATION HEALTH MANAGEMENT INDUSTRY, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

8.2 ON-PREMISE MODE OF DELIVERY

8.2.1 TRADITIONAL ON-PREMISE DEPLOYMENT TO ALLOW TIME TO TEST SOFTWARE UPGRADES BEFORE IMPLEMENTATION

TABLE 18 ON-PREMISE MODE OF DELIVERY: PROS AND CONS

TABLE 19 GLOBAL MARKET FOR ON-PREMISE SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 CLOUD-BASED MODE OF DELIVERY

8.3.1 CLOUD-BASED DELIVERY TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 20 CLOUD-BASED MODE OF DELIVERY: PROS AND CONS

TABLE 21 GLOBAL MARKET FOR CLOUD-BASED SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9 POPULATION HEALTH MANAGEMENT MARKET, BY END USER (Page No. - 93)

9.1 INTRODUCTION

TABLE 22 GLOBAL POPULATION HEALTH MANAGEMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.2 HEALTHCARE PROVIDERS

9.2.1 NEED TO IMPROVE PROFITABILITY OF HEALTHCARE OPERATIONS TO BOOST MARKET

TABLE 23 GLOBAL MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 HEALTHCARE PAYERS

9.3.1 INCREASED FOCUS ON OUTCOME-BASED PAYMENT MODELS TO STIMULATE DEMAND FOR PHM SOLUTIONS

TABLE 24 GLOBAL MARKET FOR HEALTHCARE PAYERS, BY COUNTRY, 2020–2027 (USD MILLION)

9.4 OTHER END USERS

TABLE 25 GLOBAL MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

10 POPULATION HEALTH MANAGEMENT MARKET, BY REGION (Page No. - 99)

10.1 INTRODUCTION

TABLE 26 GLOBAL MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: POPULATION HEALTH MANAGEMENT MARKET SNAPSHOT

TABLE 27 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 US to dominate North American market during forecast period

TABLE 31 US: MACROECONOMIC INDICATORS

TABLE 32 US: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 33 US: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 34 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Deployment of digital health initiatives to boost market

TABLE 35 CANADA: MACROECONOMIC INDICATORS

TABLE 36 CANADA: POPULATION HEALTH MANAGEMENT INDUSTRY, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 37 CANADA: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 38 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 EUROPE

TABLE 39 EUROPE: E-HEALTH PRIORITIES FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2019

TABLE 40 EUROPE: POPULATION HEALTH MANAGEMENT INDUSTRY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 41 EUROPE: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 42 EUROPE: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 43 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany to dominate European population health management industry

TABLE 44 GERMANY: MACROECONOMIC INDICATORS

TABLE 45 GERMANY: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 46 GERMANY: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 47 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Increasing public-private initiatives to support adoption of PHM solutions

TABLE 48 UK: MACROECONOMIC INDICATORS

TABLE 49 UK: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 50 UK: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 51 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Increasing patient volume for chronic and age-related conditions to fuel market

TABLE 52 FRANCE: MACROECONOMIC INDICATORS

TABLE 53 FRANCE: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 54 FRANCE: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 55 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Government initiatives to support market

TABLE 56 ITALY: MACROECONOMIC INDICATORS

TABLE 57 ITALY: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 58 ITALY: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 59 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Demand for e-prescriptions and better patient record management to drive adoption of PHM solutions

TABLE 60 SPAIN: MACROECONOMIC INDICATORS

TABLE 61 SPAIN: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 62 SPAIN: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 63 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 64 REST OF EUROPE: POPULATION HEALTH MANAGEMENT INDUSTRY, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 65 REST OF EUROPE: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 66 REST OF EUROPE: POPULATION HEALTH MANAGEMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 67 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Japan accounted for largest share of Asia Pacific market in 2021

TABLE 71 JAPAN: MACROECONOMIC INDICATORS

TABLE 72 JAPAN: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 73 JAPAN: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 74 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Strong government support to propel market

TABLE 75 CHINA: MACROECONOMIC INDICATORS

TABLE 76 CHINA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 77 CHINA: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 78 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Growing volume of patient data generated within healthcare systems to drive market

TABLE 79 INDIA: MACROECONOMIC INDICATORS

TABLE 80 INDIA: POPULATION HEALTH MANAGEMENT MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 81 INDIA: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 82 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 83 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 84 REST OF ASIA PACIFIC: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 85 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 BRAZIL, ARGENTINA, AND MEXICO TO EMERGE AS POTENTIAL HEALTHCARE MARKETS

TABLE 86 LATIN AMERICA: POPULATION HEALTH MANAGEMENT INDUSTRY, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 87 LATIN AMERICA: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 88 LATIN AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 INCREASING INVESTMENTS IN MODERNIZING HEALTHCARE TO PROPEL MARKET

TABLE 89 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 90 MIDDLE EAST & AFRICA: MARKET, BY MODE OF DELIVERY, 2020–2027 (USD MILLION)

TABLE 91 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 138)

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 37 KEY DEVELOPMENTS OF MAJOR PLAYERS BETWEEN JANUARY 2019 AND AUGUST 2022

11.3 POPULATION HEALTH MANAGEMENT MARKET: R&D EXPENDITURE

FIGURE 38 R&D EXPENDITURE OF KEY PLAYERS (2020 VS. 2021)

11.4 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS (2021)

11.5 GEOGRAPHIC REVENUE ASSESSMENT OF KEY PLAYERS

FIGURE 40 GLOBAL MARKET: GEOGRAPHIC REVENUE MIX

11.6 COMPANY EVALUATION QUADRANT

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 41 COMPETITIVE LEADERSHIP MAPPING, 2020

11.7 COMPETITIVE LEADERSHIP MAPPING – START-UPS/SMES

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 42 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES

11.8 KEY PLAYERS ANALYSIS

TABLE 92 GLOBAL MARKET ANALYSIS, BY VENDOR TYPE

11.9 COMPETITIVE SITUATIONS AND TRENDS

11.9.1 PRODUCT LAUNCHES

11.9.2 DEALS

11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 151)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 CERNER CORPORATION

TABLE 93 CERNER CORPORATION: COMPANY OVERVIEW

FIGURE 43 CERNER CORPORATION: COMPANY SNAPSHOT (2021)

12.1.2 ALLSCRIPTS HEALTHCARE SOLUTIONS

TABLE 94 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY OVERVIEW

FIGURE 44 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY SNAPSHOT (2021)

12.1.3 IBM CORPORATION

TABLE 95 IBM CORPORATION: COMPANY OVERVIEW

FIGURE 45 IBM CORPORATION: COMPANY SNAPSHOT (2021)

12.1.4 EPIC SYSTEMS CORPORATION

TABLE 96 EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

12.1.5 KONINKLIJKE PHILIPS

TABLE 97 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

FIGURE 46 PHILLIPS HEALTHCARE: COMPANY SNAPSHOT (2021)

12.1.6 I2I POPULATION HEALTH

TABLE 98 I2I POPULATION HEALTH: COMPANY OVERVIEW

12.1.7 HEALTH CATALYST

TABLE 99 HEALTH CATALYST: COMPANY OVERVIEW

FIGURE 47 HEALTH CATALYST: COMPANY SNAPSHOT (2021)

12.1.8 OPTUM INC. (A SUBSIDIARY OF UNITEDHEALTH GROUP)

TABLE 100 OPTUM, INC: COMPANY OVERVIEW

FIGURE 48 OPTUM: COMPANY SNAPSHOT (2021)

12.1.9 ENLI HEALTH INTELLIGENCE (A CEDAR GROUP TECHNOLOGIES)

TABLE 101 ENLI HEALTH INTELLIGENCE: COMPANY OVERVIEW

12.1.10 ECLINICALWORKS

TABLE 102 ECLINICALWORKS: COMPANY OVERVIEW

12.1.11 HEALTHEC, LLC

TABLE 103 HEALTHEC LLC: COMPANY OVERVIEW

12.1.12 MEDECISION

TABLE 104 MEDECISION: COMPANY OVERVIEW

12.1.13 ARCADIA

TABLE 105 ARCADIA: COMPANY OVERVIEW

12.1.14 ATHENAHEALTH

TABLE 106 ATHENAHEALTH, INC: COMPANY OVERVIEW

12.1.15 COTIVITI (VERSCEND TECHNOLOGIES)

TABLE 107 COTIVITI: COMPANY OVERVIEW

12.1.16 NEXTGEN HEALTHCARE, INC.

TABLE 108 NEXTGEN HEALTHCARE, INC.: COMPANY OVERVIEW

FIGURE 49 NEXTGEN HEALTHCARE: COMPANY SNAPSHOT (2021)

12.2 OTHER PLAYERS

12.2.1 CONIFER HEALTH SOLUTIONS

12.2.2 SPH ANALYTICS

12.2.3 LIGHTBEAM HEALTH SOLUTIONS

12.2.4 INNOVACCER

12.2.5 LUMERIS

12.2.6 ZEOMEGA

12.2.7 HGS HEALTHCARE, LLC

12.2.8 PERSIVIA

12.2.9 COLOR HEALTH, INC.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 199)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This research study involved the extensive use of both primary and secondary sources. Various factors affecting the industry were studied to identify segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, and key player strategies.

Secondary Research

This research study involved secondary sources; directories; databases such as Bloomberg Business and Factiva; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the population health management market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

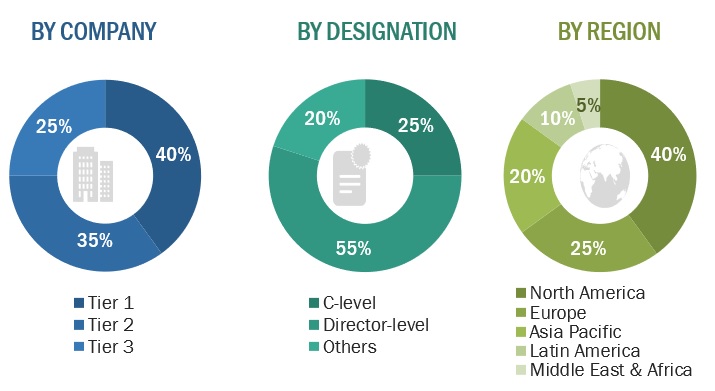

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, marketing managers, regional/area sales managers, product managers, distributors, business development managers, technology & innovation directors of population health management software solutions providers, KOLs, and suppliers & distributors. Primary sources from the demand side include industry experts such as directors of hospitals, ambulatory surgical centers, healthcare payers, and healthcare providers.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 =

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the population health management market was arrived at after data triangulation from five different approaches, as mentioned below. After each approach, the weighted average of approaches was taken based on the level of assumptions used.

Data Triangulation

The individual share of each segment was arrived at by assigning weightages based on their utilization rate. The regional splits of the market and its subsegments are based on the adoption or utilization rates of the given solutions in the respective regions or countries. For countries with the limited availability of reliable and recent data, the analogy/benchmarking-based market estimation and forecast technique was used.

Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Objectives of the Study

- To define, describe, and forecast the size of the population health management market on the basis of component, mode of delivery, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To strategically analyze the market structure and profile the key players in the global market and comprehensively analyze their core competencies2

- To track and analyze company developments such as agreements, collaborations, partnerships, acquisitions, expansions, and solution launches & enhancements in the population health management market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific market into Australia, South Korea, New Zealand, Hong Kong, Singapore, and other countries

- Further breakdown of the Rest of Europe market into Russia, Switzerland, the Netherlands, Nordic countries, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Population Health Management Market

Some of the disruptions in population health management market 2030 includes:

What are the disruptions happening in population health management market in 2030?

Population health management market in 2030 will grow at a considerable CAGR.

Some of the possible predictions of population health management market in 2030 are:what are the predictions of population health management market 2030 ?