Precision Farming Software Market by Delivery Model (On-premises, Cloud-based), Application (Yield Monitoring, Field Mapping, Variable Rate Application, Weather Tracking & Forecasting), Service, Technology and Region - Global Forecast to 2029

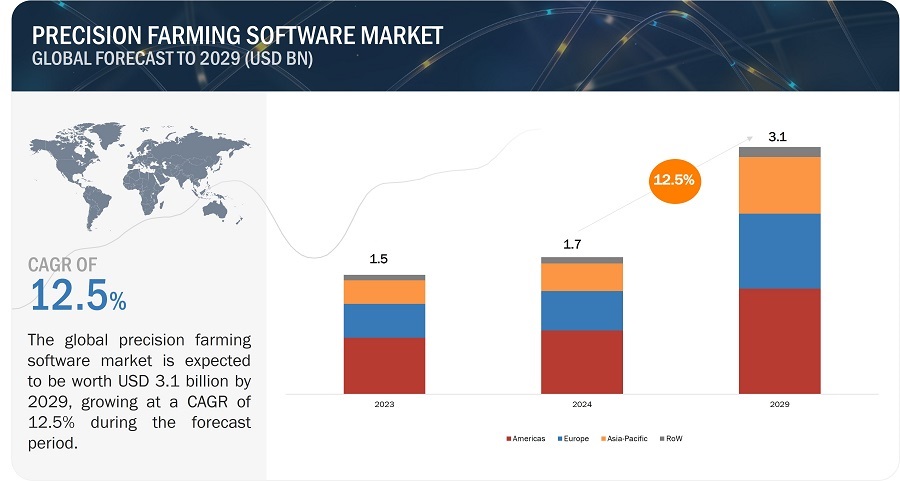

[275 Pages Report] The Precision Farming Software Market is projected to reach from USD 1.7 billion in 2024 to USD 3.1 billion by 2029; it is expected to grow at a CAGR of 12.5% from 2024 to 2029. The widespread adoption of precision farming software can indeed be attributed to a multitude of factors that collectively enhance farm management practices and agricultural sustainability. One of the key factor is the efficiency and productivity afforded by these software solutions, which streamline tasks such as data collection, analysis, and decision-making.

Precision Farming Software Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Precision Farming Software Market Dynamics

Driver: Growing focus on enhancing food security and agricultural productivity

Precision farming software has increasingly emphasized enhancing food security and agricultural productivity. By harnessing technologies like GPS, IoT sensors, drones, and machine learning algorithms, these tools empower farmers to optimize resource usage, such as water, fertilizers, and pesticides, leading to more efficient and sustainable farming methods. These technologies enable farmers to monitor crop health in real time, pinpoint areas for improvement, and make data-informed decisions to maximize yields while minimizing inputs. Moreover, precision farming software offers valuable insights into weather patterns, soil conditions, and crop performance, aiding farmers in risk mitigation and adaptation to environmental changes. Precision farming software significantly contributes to food security by enhancing productivity and reducing waste, which is crucial given the continuous growth of the global population. Additionally, by promoting sustainable farming practices, these technologies play a key role in preserving the environment and ensuring the long-term sustainability of agriculture.

Restraint: Requires specialized expertise to navigate effectively

The complexity and integration challenges in precision farming software arise from the need to effectively manage multiple technologies and data streams. This complexity can be daunting for farmers and agricultural professionals, requiring specialized expertise to navigate effectively. Precision farming involves the use of advanced technologies such as IoT sensors, drones, GPS, and machine learning algorithms to collect and analyze data on soil, plants, and environmental conditions. This data is then used to make informed decisions about crop management, irrigation, and fertilizer use. The integration of these technologies and data streams can be complex, as they must be seamlessly connected and managed to provide actionable insights. This requires a deep understanding of the technologies, data analytics, and agricultural practices.

Opportunity: Initiatives to manage greater amount of data and enhance data analysis

Developing standards and data sharing initiatives is crucial for managing the increasing volume of data and enhancing analysis within precision farming software. Collaboration among industry stakeholders, researchers, and policymakers is important for establishing standardized data formats, protocols, and metadata schemas tailored for agricultural data. This effort guarantees compatibility and interoperability across various software platforms and data sources, facilitating smooth data exchange and integration. Furthermore, the development of data governance frameworks addresses concerns related to privacy, security, and data ownership, ensuring adherence to regulations and ethical principles. Centralized data sharing platforms enable farmers to securely upload, store, and exchange agricultural data with trusted partners, while interoperability solutions facilitate seamless integration and communication among diverse data sources and software applications.

Challenge: Legal, ethical and social barriers related to data ownership, privacy and security

Precision farming generates vast amounts of sensitive data, including crop yields, soil health, and farming practices. Protecting this data from unauthorized access, use, or disclosure is crucial to maintain farmers' privacy and prevent potential misuse by third parties. Implementing robust data privacy measures, such as encryption, access controls, and data anonymization, is essential to safeguard sensitive information. Ethical issues arise concerning the collection, use, and sharing of agricultural data. Farmers may have concerns about how their data is used and whether it benefits them or primarily serves commercial interests. Ethical considerations also include ensuring equitable access to technology and data, avoiding data exploitation, and respecting farmers' autonomy and decision-making rights.

Precision Farming Software Market Ecosystem

The prominent players in the precision farming software market are Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), Raven Industries, Inc. (US), AgEagle Aerial Systems Inc (US). These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks.

On-premises delivery model to account for the largest share of the precision farming software market in 2023

The on-premises delivery model maintains a significant market share in precision farming software due to its ability to provide farmers with a heightened sense of data security and control. By keeping all software and data within their own infrastructure, farmers can ensure compliance with data privacy regulations and maintain full control over their information. This aspect is particularly appealing to farmers who prioritize data security and are cautious about sharing sensitive agricultural data with external parties. Additionally, in remote or rural areas where internet connectivity may be limited or unreliable, on-premises solutions offer uninterrupted access to software and data. This addresses concerns about downtime and ensures that farmers can continue to effectively manage their operations regardless of their location or connectivity challenges. As a result, the on-premises delivery model remains a preferred choice for many farmers seeking to maximize data security and maintain operational reliability in their precision farming practices.

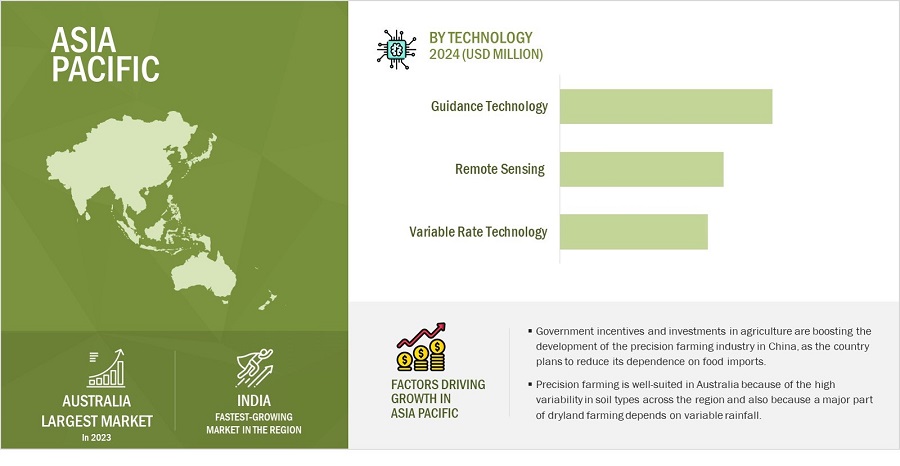

Guidance technology to dominate precision farming software market during the forecast period

The precision and accuracy of guidance technology ensure precise positioning and alignment of agricultural machinery, resulting in improved crop establishment, more effective weed control, and ultimately higher yields. This accuracy enables farmers to achieve uniform planting, targeted application of inputs, and efficient weed management, leading to healthier crops and increased productivity.

Yield monitoring to register the highest share precision farming software market in 2023

Yield monitoring applications dominate the market in precision farming software owing to their diverse advantages and profound influence on farm profitability. These applications serve as invaluable tools, offering insights into crop performance and areas ripe for enhancement. By furnishing farmers with such critical data, they enable informed decision-making regarding input management, crop selection, and harvesting practices, culminating in the maximization of returns on investment. Additionally, by facilitating performance evaluation and providing valuable benchmarks, yield monitoring applications enable farmers to gauge the effectiveness of different strategies and make adjustments accordingly. This adaptability and responsiveness further contribute to their widespread adoption among farmers seeking to optimize their operations and drive long-term success in agriculture.

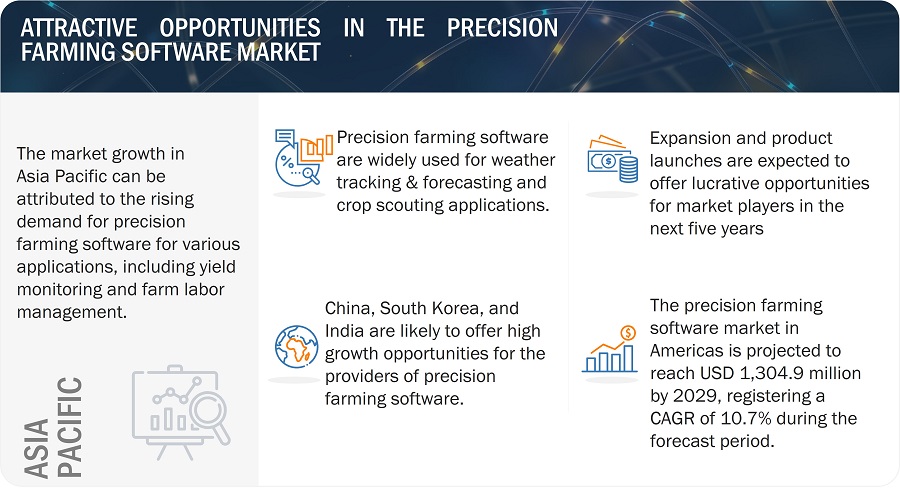

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period.

The Asia Pacific region is witnessing a notable surge in technological adoption across diverse sectors, agriculture being no exception. This surge is largely facilitated by the growing accessibility and affordability of advanced solutions. As a result, farmers are increasingly inclined to embrace precision farming practices and make investments in cutting-edge software to enhance the efficiency and effectiveness of their operations. Moreover, governments throughout the Asia Pacific region are actively advocating for the adoption of precision farming. They do so by implementing supportive policies, offering subsidies, and launching various initiatives aimed at incentivizing farmers to integrate precision farming practices into their operations. These governmental efforts play a crucial role in driving the adoption of precision farming software, encouraging farmers to leverage technology to optimize resource utilization, improve productivity, and foster sustainable agricultural practices.

Precision Farming Software Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the precision farming software companies include Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), Raven Industries, Inc. (US), AgEagle Aerial Systems Inc (US), AgJunction LLC (US), Ag Leader Technology (US), TOPCON CORPORATION (Japan), Climate LLC (US), TeeJet Technologies (US). These companies have used organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships to strengthen their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By Delivery Model, By Service, By Technology, By Application |

|

Geographies Covered |

Americas, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), Raven Industries, Inc. (US), AgEagle Aerial Systems Inc (US), AgJunction LLC (US), Ag Leader Technology (US), TOPCON CORPORATION (Japan), Climate LLC (US), TeeJet Technologies (US), Hexagon AB (Brazil), ABACO S.p.A. (Italy), PrecisionHawk (US), ec2ce (Spain), Descartes Labs, Inc. (US), CropX Inc. (Israel), Farmers Edge Inc. (Canada), Grownetics (US), CropIn Technology Solutions Private Limited (India), Gamaya (Switzerland), FieldBee (Netherlands), AvMap s.r.l (Italy), DICKEY-john (US), TELUS (Canada), and Müller-Elektronik GmbH (Germany) |

Precision Farming Software Market Highlights

This research report categorizes the Precision Farming Software Market based on delivery model, service, technology, application and region.

|

Segment |

Subsegment |

|

By Delivery Model |

|

|

By Technology |

|

|

By Service |

|

|

By Application |

|

|

By Region |

|

Recent Developments

- In January 2023, John Deere released Operations Center PRO, an all-new level of the John Deere Operations Center built specifically for ag service providers requiring specialized fleet and logistics management capabilities beyond what is currently provided with Operations Center.

- In September 2023, Trimble Inc. has disclosed a definitive agreement to establish a joint venture with AGCO, aiming to enhance support for farmers in the mixed fleet precision agriculture market through factory-fitted and aftermarket applications. Together, Trimble and AGCO share the vision of creating a global leader in smart farming and autonomy solutions for mixed fleets.

- In January 2024, AGCO Corporation introduced FarmerCore, a groundbreaking worldwide initiative aimed at revolutionizing the farmer and dealer experience. This unveiling of an innovative end-to-end distribution approach marks a pivotal moment in AGCO's ongoing Farmer-First strategy, reaffirming its dedication to empowering farmers worldwide to achieve greater profitability, productivity, and sustainability.

- In March 2023, CNH Industrial N.V., the parent company of Raven Industries, Inc. revealed its plans for strategic integration. This integration aims to amplify the company's array of automated technologies by incorporating Augmenta's Sense & Act capabilities into various variable-rate crop spraying applications. With this development, Raven Industries, Inc. takes a significant step forward in enhancing its comprehensive suite of automated solutions.

- In January 2024, AgEagle Aerial Systems Inc. recently participated in the UMEX 2024 Unmanned System Exhibition and Conference alongside FEDS Drone-powered Solutions. FEDS is a leading distributor of AgEagle's high-performance unmanned aerial systems. The eBee VISION and eBee TAC units, lightweight fixed-wing drones, can be operated by a single person and deployed in just 3 minutes. The eBee VISION offers HD live video insights in dynamic environments, even in GNSS-denied conditions, ensuring the success of professional intelligence, surveillance, and reconnaissance (ISR) missions.

Frequently Asked Questions (FAQ’s):

What is the current size of the Global Precision Farming Software Market?

The precision farming software market is projected to reach from USD 1.7 billion in 2024 to USD 3.1 billion by 2029; it is expected to grow at a CAGR of 12.5% from 2024 to 2029.

Who are the winners in the Global Precision Farming Software Market?

Companies such as Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), Raven Industries, Inc. (US), AgEagle Aerial Systems Inc (US).

Which region is expected to hold the highest market share?

Asia Pacific is expected to dominate the precision farming software market during the forecast period. Governments across the Asia Pacific region actively promote the adoption of precision farming through supportive policies, subsidies, and initiatives.

What are the major drivers and opportunities related to the precision farming software market?

Rapid adoption of advanced technologies in precision farming software, Growing focus on enhancing food security and agricultural productivity, Initiatives to manage greater amount of data and enhance data analysis are some of the major drivers and opportunities related to the precision farming software market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the precision farming software market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the size of the precision farming software market. Exhaustive secondary research has been conducted to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering precision farming software have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases.

Secondary research has been conducted mainly to obtain critical information about the market’s value chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both demand- and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

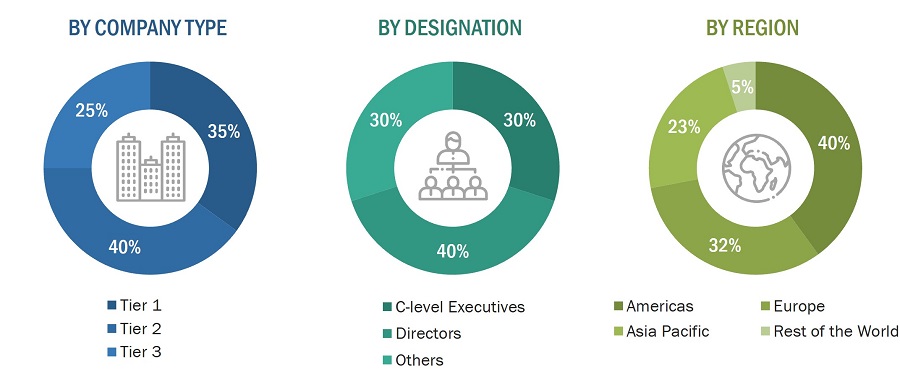

Extensive primary research has been conducted after understanding and analyzing the current scenario of the precision farming software market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand and supply sides across 4 major regions: Americas, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews. questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the precision farming software market.

- Identifying the entities in the precision farming software market influencing the entire market, along with the related players, including different types of precision farming software providers

- Analyzing major precision farming software providers and studying their portfolios, and understanding different types of software

- Analyzing trends pertaining to the use of different types of software for precision farming software applications

- Tracking the ongoing and upcoming developments in the market, such as investments made, R&D activities, government support, software launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the different types of software, functions, applications, and recent trends in the market, thereby analyzing the breakup of the scope of work carried out by major companies

- Arriving at the market estimates by analyzing revenues of the companies generated from precision farming software and then combining the same to get the market estimates

- Dividing the overall market into various other market segments

- Verifying and cross-checking the estimate at every level from the discussion with key opinion leaders, such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

The top-down approach has been used to estimate and validate the total size of the precision farming software market.

- Focusing initially on top-line investments and expenditures being made in the ecosystems of the precision farming software market

- Calculating the market size considering the revenues generated by players through the sale of different types of precision farming software

- Further segmentation based on R&D activities and key developments in key market areas

- Further segmenting the market based on mapping usage of precision farming software for different functions & applications.

- Collecting the information related to the revenues generated by players through different offerings

- Conducting multiple on-field discussions with key opinion leaders across major companies involved in the development of precision farming software

- Estimating the geographic split using secondary sources based on various factors, such as the number of players in a specific country and region, the role of major players in the market for the development of innovative products, adoption, and penetration rates in particular countries for various applications, government support, investments, and other factors.

Data Triangulation

After arriving at the overall size of the precision farming software market through the process explained, the total market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using the top-down and bottom-up approaches.

Market Definition

Precision farming software has revolutionized modern agriculture by leveraging data-driven insights and advanced technologies to optimize farming practices. These software solutions integrate various data sources, including satellite imagery, soil sampling, weather forecasts, and crop sensors, to provide farmers with actionable information for decision-making.

One of the key features of precision farming software is field mapping, which allows farmers to create detailed maps of their fields, including information about soil types, topography, and boundaries. This enables farmers to better understand their land and make informed decisions about crop planning and management.

Key Stakeholders

- Precision farming component providers

- Precision farming integrators and installers

- Precision farming solution providers

- Consulting companies

- Product manufacturers

- Precision farming software providers

- Precision farming-related associations, organizations, forums, and alliances

- Government and corporate bodies

- Research institutes and organizations

- Venture capitalists, private equity firms, and start-ups

- Distributors and traders

- OEMs

- End users

- Research institutes and organizations

- Market research and consulting firms

- Agri-food buyers

- Agriculture technology providers

Report Objectives

- To describe and forecast the precision farming software market in terms of value, based on delivery model, technology, application, and region.

- To forecast the market size, in terms of value, for various segments, with respect to four main regions—Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW).

-

To provide detailed information regarding the major factors influencing the growth of

the precision farming software market (drivers, restraints, opportunities, and challenges). - To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze opportunities for the market stakeholders by identifying high-growth segments of the precision farming software market.

- To benchmark players within the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of market rank and product offering.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2 and provide a detailed competitive landscape for market leaders.

- To track and analyze competitive developments, such as partnerships, collaborations, agreements, and joint ventures; mergers and acquisitions; expansions; and product launches in the precision farming software market.

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Growth opportunities and latent adjacency in Precision Farming Software Market

I am interested/curious about gps driven data capture technologies and handheld devices in north America and Europe e.g. trimble and Topcon and their many competitors worldwide and how smart phones are impacting these traditional suppliers

Increasing need for real time data management and integration of smartphone with agriculture hardware is driving Agtech software market. Have you included Software as a service (SaaS) revenue for this market.

Equipment services in agriculture industry is prevailing from long time. What different services have you included in your study. Do you provide country wise data for services.

I am creating a business plan for our robotics and AI product. Need top-line market size numbers, particularly for crop scouting application.

We are currently selecting equipment and software for a precision agriculture application using IoT platorm. These systems are to be used in vineyards and fruit trees. Do you have vendor analysis report for this platform.

Have you included software vendors revenue in your study. I am looking for software market data for farm management AG Tech

I am looking to estimated market for SaaS services in the Horticultural and forecast period. Thanks.