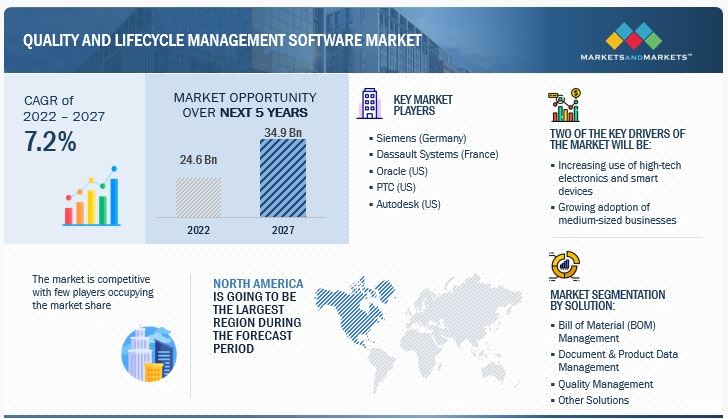

Quality and Lifecycle Management Software Market by Solution (Quality Management and Bill of Material Management), Deployment Mode, Organization Size, Vertical (Automotive & Transport and Industrial Manufacturing) and Region - Global Forecast to 2027

[243 Pages Report] Quality is an important aspect of any product throughout its lifecycle. It is key to the profitability of an organization. Quality and lifecycle management (QLM) solutions include managing the quality of a product and product-related processes. They help reduce the costs incurred to rectify errors. These solutions also cut down the time to market a product. Due to intense competition in the market and the complexities of business processes and manufacturing, managing quality through specialized QLM software is profitable and helps organizations to stay ahead in the market.

The global QLM software market size is expected to grow from USD 24.6 billion in 2022 to USD 34.9 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 7.2%. The growing need for continuous innovation and iteration, reduce production cost, rising demand for smart homes are the major factors fueling the growth of QLM software market. Further, the increasing adoption of QLM software by medium businesses, with limited resources available to optimize their operations, has significantly contributed to the growth in the market in terms of the user base.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Increasing use of high-tech electronics and smart devices

There has been an increasing demand for high-tech electronics and smart devices, leading to a boost in manufacturing these products. This has led to an increased requirement for software for product lifecycle and quality management to increase efficiency and productivity while maintaining the required standards for such devices. QLM software systems are necessary to mitigate risks and deliver high-quality products simultaneously. This reduces the time and cost required for fault detection in the manufacturing process. Quality management in the electronics and appliances industry contributes not only to the delivery of high-quality products, but also to the company's reputation and success. Companies in the electronics and appliances industries face challenges such as increased competition, changing quality requirements, lowering costs and expenditures, and managing suppliers. Qualityze EQMS software is a closed-loop quality system for the Electronics and Appliances Industry. It includes Document Management, Incident Management, Change Management, Nonconformance Management, CAPA Management, Maintenance Management, Calibration Management, Audit Management, Field Safety Action Management, Forms Management, Material Compliance Management, Supplier Quality Management, Training Management, Complaint Management, Inspection Management, EBR Management, and Permit Management, among other features.

Restraint: lack of interoperability and integration of complex systems

Nowadays, the interoperability of information systems throughout the quality lifecycle process is primordial for the successful implementation of QLM software across industries. Moreover, the lack of interoperability between product data management systems, manufacturing process management, and ERP can ensure a continuous and bidirectional information flow from the design to the manufacturing process and the product assembling. The interoperability among different enterprise systems is a necessity that helps enterprises take advantage of new technologies. QLM requires a more strategic and end-to-end approach throughout enterprises. Enterprises must exhibit the same level of proficiency in complex systems integration and software development as they have demonstrated in conventional product designing and manufacturing. They must seek effective ways to manage and integrate QLM software throughout a complex, ever-expanding supply chain in which components are sourced from different locations, arrive with embedded software, and are assembled in various combinations. Hence, for most of the leading manufacturing firms, achieving the level of integration is still an obstacle and hinders the overall development of the quality lifecycle.

Opportunities: Increasing integration of PLM solutions with IoT platforms

With the growing advent of IoT technologies among different verticals, such as manufacturing, energy and utilities, healthcare, and retail and transportation, QLM vendors offer IoT technology product analytics capabilities in their QLM software. These vendors increasingly integrate their QLM software with IoT platforms, enabling enterprises to connect real-time product operational data to QLM platforms. The integration would gain insights into how products perform in the field, thus optimizing their usability, quality, maintenance, and service performance. QLM software integrated with the capability of IoT platforms provides an end-of-end perspective of the quality lifecycle. Many global players have started offering QLM software with integrated AI- and ML-based technologies. For instance, PTC integrated its industry-leading ThingWorx capability into its Creo CAD software and Windchill PLM application suite. This capability has taken an early lead and is gaining significant market traction. Furthermore, Siemens offers PLM software integrated into its MindSphere IoT platform and other application suites to drive the next generation of connectivity and performance improvements.

Challenges: Issues in improving service quality

Nowadays, there is a greater emphasis on service-oriented businesses. Manufacturers who produce quality products must also provide after-sales service to customers who purchase long-lasting products. Similarly, customers expect better and more timely service from service-oriented businesses. Management considers quality service to be an intangible asset. The emerging issue of quality management is to improve service quality.

Based on organization size, large enterprises segment to be the largest contributor to the QLM software market growth during the forecast period

A cloud-based enterprise quality management software that enables businesses to streamline quality processes, work more efficiently, and ensure regulatory compliance. An enterprise QMS requires a well-designed document management system. Users can ensure that documents are effective and efficient by automating the processes of creating, approving, distributing, and archiving. A well-managed enterprise QMS ensures that all employees receive the necessary training and that it is delivered in an effective and efficient manner. Users of QMS software can easily create, assign, and track employee training tasks. Users can create groups that receive the same learning assignments and ensure that people only read documents that are relevant to them. Learning assignments are sent immediately after the user releases or updates the target document, and the user can ensure compliance by tracking the training its employees receive on a continuous basis.

Based on vertical, automotive & transport segment is to be a larger dominator to the QLM software market during the forecast period

The automated transport of materials or commodities within a manufacturing unit is referred to as automated material handling solutions. This defines the manufacturing industry's manufacturing timeline and expenses. Hardware and software can be used to implement automated material handling solutions. Conveyor/sortation systems, mobile robots, automated storage and retrieval systems, and other devices are included in the hardware. Warehouse management systems or warehouse control systems are examples of software solutions that contribute to active inventory management and warehouse maintenance. The implementation of GST compelled businesses to consolidate their warehouses in order to reap tax benefits and improve business efficiency. This encouraged businesses to use mobile automated vehicles (AGVs). AGVs are also used for replenishment and picking in outbound and inbound handling. AGVs, for example, transport inventory components from the source to storage or from long-term storage to forward-picking locations to replenish stocks. Moving inventory from long-term storage to forward picking locations ensures that adequate inventory is available to pickers, improving the efficiency of the order picking process. Increasing automation and digitalization are currently driving the market for automotive electric actuators. The automotive electric actuators market is expanding due to increased demand for fuel efficiency and comfort, particularly in passenger vehicles.

Many high-end models include mini actuators, which are small electric actuators. Mini electric linear actuators are becoming increasingly popular due to their much higher energy conversion rate for various types of linear motion. For example, most automotive headlights remain in a fixed position when mounted on a vehicle with an aligned orientation. High-end manufacturers, on the other hand, offer mini actuators that allow the headlights to move up and down and help focus the light on curving or undulating road surfaces. Mini actuators are preferred over standard actuators because they can be installed in small spaces. Furthermore, luxury manufacturers prefer the conversion of energy into linear motion while providing perfect linear actuation. In addition, sales of SUVs and premium vehicles are increasing in France, fueling growth in other electric actuator segments.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific to grow at the highest CAGR during the forecast period

The market for passenger car active and passive safety systems is expanding, with China and India leading the way. Beginning in 2018, China NCAP will upgrade the five-star requirements to include active safety and collision prevention. This would also help to alter the market dynamics of automotive safety systems in China, where safety would be the most critical issue addressed during the forecast period. As a result, an increased emphasis on automotive safety is expected to significantly boost the market for automotive cameras. China imposed a quota on manufacturers to produce 100% electric or hybrid vehicles that must account for at least 10% of total new sales. Furthermore, major economies such as India, Japan, and South Korea are focusing on imposing stringent restrictions in order to increase EV adoption. As a result, the growing demand for efficient powertrain systems in vehicles, as well as favourable government policies, are expected to open up new opportunities for market participants. For example, India's Automotive Mission Plan FAME-II prioritises government support for the country's expanding automotive and component manufacturing industries. The automotive parts and accessories manufacturing industry has undergone extensive remodelling in recent years, resulting in the emergence of a highly competitive industry.

Furthermore, the country's manufacturers are working to reduce their current GHG emissions levels by optimising their powertrain system design and focusing on lightweight and reduced size powertrain systems with better performance results. As a result, market participants are focusing on providing innovative solutions and expanding their manuf Tesla announced plans to build a second electric vehicle (EV) facility in China in February 2022 to help it meet rising demand both locally and in export markets. Tesla intends to increase capacity in China to at least 1 million vehicles per year in the short term, with a second plant planned near its current production in Shanghai's Lingang free trade zone. Honda's Chinese joint venture with Dongfengan announced in January 2022 that it would build an electric-vehicle manufacturing factory in Wuhan as part of its efforts to increase EV output. The Dongfeng-Honda Automobile facility, with a production capacity of 120,000 units per year, will open in 2024.acturing facilities to consumers in order to capture a growing market share.

Key Players

Aras (US), Arena Solutions (US), Autodesk (US), Dassault Systemes (France), Oracle (US), Parasoft (US), SAP (Germany), SAS Institute (US), ComplianceQuest (US), Siemens (Germany), PTC (US), Atlassian (Australia), HPE (US), IBM Corporation (US), Microsoft (US), Veeva Systems (US), Intellect (US), Kovair Software (US), Micro Focus (UK), Neudesic (US), Rocket Software (US), MasterControl (US), ETQ (US), and Intelex Technologies (Canada) are the key players in the QLM software market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Million/Billion (USD) |

|

Segments covered |

Solution, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa |

|

Companies covered |

Aras (US), Arena Solutions (US), Autodesk (US), Dassault Systemes (France), Oracle (US), Parasoft (US), SAP (Germany), SAS Institute (US), ComplianceQuest (US), Siemens (Germany), PTC (US), Atlassian (Australia), HPE (US), IBM Corporation (US), Microsoft (US), Veeva Systems (US), Intellect (US), Kovair Software (US), Micro Focus (UK), Neudesic (US), Rocket Software (US), MasterControl (US), ETQ (US), and Intelex Technologies (Canada). |

This research report categorizes the QLM software market based on solution, deployment mode, organization size, vertical, and region.

Based on Solution, the QLM software market has been segmented as follows:

- Bill of Material (BOM) Management

- Document and Product Data Management

- Quality Management

- Change Management

- Cost Management

- Governance and Compliance Management

- Lifecycle Analytics Management

-

Other Solutions (Portfolio & Project Management, Process Management, Configuration Management, and New Product Development &

Introduction (NPDI))

Based on deployment mode, the QLM software market has been segmented as follows:

- Cloud

- On-Premises

Based on organization size, the QLM software market has been segmented as follows:

- Small and Medium-sized Enterprises

- Large Enterprises

Based on verticals, the QLM software market has been segmented as follows

- Aerospace & Defense

- Automotive & Transport

- Consumer Goods & Retail

- Healthcare & Lifesciences

- Industrial Manufacturing

- IT & Telecom

- OtherVerticals ((Hospitality, Construction, and Energy & Utilities)

Based on regions, the QLM software market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East and Africa

- KSA (Kingdom of Saudi Arabia)

- United Arab Emirates (UAE)

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In March 2021, Aras has introduced Aras Simulation Management. It is the most scalable, flexible, and open solution for enabling lifecycle simulation. The application provides process and data management capabilities for a wide range of simulation types from a variety of vendors

- In January 2021, Arena Solutions has partnered with Rimsys Inc. Arena and Rimsys' collaboration provides the MedTech industry with a secure cloud-based, product-centric regulatory solution. Rimsys integrates with Arena's QMS and PLM solutions by importing product and documentation data directly into Rimsys for the creation, management, and maintenance of marketing applicationsIn February 2022, IBM completed its acquisition of Neudesic, a cloud services consulting firm based in the US. The acquisition aimed to broaden IBM’s hybrid multi-cloud services offerings as well as to strengthen the company’s AI and hybrid cloud strategy.

- In July 2021, Autodesk launched Digital Twin. Autodesk has announced that Autodesk Tandem, a cloud-based digital twin technology platform, is now commercially available. It enables projects to begin, continue, and end digitally, transforming rich data into business intelligence

Frequently Asked Questions (FAQ):

What is the projected market value of QLM software Market?

The global QLM software market size is expected to grow from USD 24.6 billion in 2022 to USD 34.9 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 7.2%

Which region has the highest market share in the QLM software Market?

Asia Pacific has the highest market share in the QLM software Market.

Which are the major vendors in the QLM software Market?

Aras (US), Arena Solutions (US), Autodesk (US), Dassault Systemes (France), Oracle (US), Parasoft (US), SAP (Germany), SAS Institute (US), Siemens (Germany) are the key vendors in the QLM software market.

What are the some drivers in the QLM software Market?

The growing need for continuous innovation and iteration, reduce production cost, rising demand for smart homes are the major factors fueling the growth of QLM software market.

What are the some challenges in the QLM software Market?

Technological advancements, and improving service quality are the common challenges in the QLM software Market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

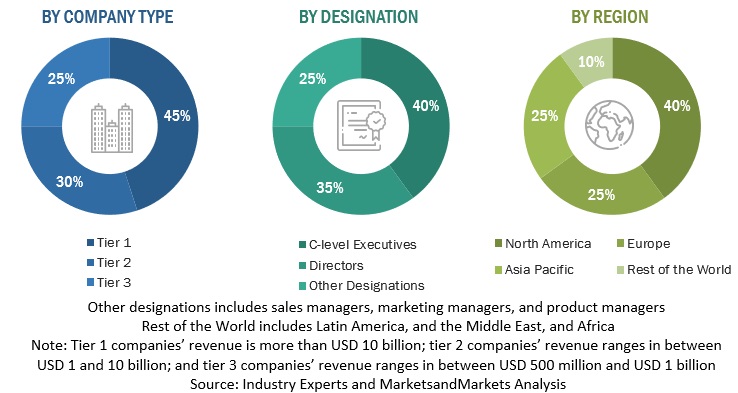

The study involved four major activities in estimating the current market size for QLM software and services. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market size of companies offering quality and lifecycle management software was derived based on the secondary data available through paid and unpaid sources by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was used to obtain the key information related to the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from quality and lifecycle management software vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, components, deployments, and regional trends. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using quality and lifecycle management software, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use, which would affect the overall quality and lifecycle management software market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the quality and lifecycle management software market and various other dependent sub-segments.

The research methodology used to estimate the market size includes the following details:

- The key players in the market have been identified through secondary research, and their revenue contributions in the respective countries have been determined through primary and secondary research.

- This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups have been determined using secondary sources and verified through primary sources.

All possible parameters affecting the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and added with detailed inputs and analysis from MarketsandMarkets.

In the bottom-up approach, the adoption trend of quality and lifecycle management software among different industry verticals in key countries, with respect to regions that contribute to most of the market share, has been identified. For cross-validation, the adoption trend of quality and lifecycle management software, along with different use cases with respect to their business segments, has been identified and extrapolated. Weightage has been given to the use cases identified in different solution areas for calculation. An exhaustive list of all vendors offering solutions and services in the quality and lifecycle management software market has been prepared. The revenue contribution of all vendors in the market has been estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Vendors with quality and lifecycle management software offerings have been considered to evaluate the market size. Each vendor has been evaluated based on its solution and service offerings across verticals. The aggregate of all companies' revenue has been extrapolated to reach the overall market size. Each sub-segment has been studied and analyzed for its market size and regional penetration. Based on these numbers, primary and secondary sources have determined the region split.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Quality and lifecycle management software is used for managing the quality of a product as well as the quality of product-related processes. QLM software is essential to manage the complexity of product development and bring together multi-engineering disciplines effectively and efficiently. The end users deploy this software in their manufacturing processes to improve product quality and share the exact data related to a product throughout cross-functional departments and the extended enterprise.

Key Stakeholders

- Quality and Lifecycle Management Solution Providers

- Consultants/Consultancies/Advisory Firms

- Governments and Standardization Bodies

- Independent Software Vendors

- Information Technology (IT) Infrastructure Providers

- Regional Associations

- Resellers and Distributors

- System Integrators (SIs)

- Third-party Providers

- Value-added Resellers and Distributors

Report Objectives

- To describe and forecast the global quality and lifecycle management (QLM) software market based on solutions, deployment mode, organization size, verticals, and regions

- To forecast the market size of regional segments: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To track and analyze competitive developments, such as new product developments, product enhancements, partnerships, and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Quality and Lifecycle Management Software Market