Disaster Recovery as a Service (DRaaS) Market by Service Type (Backup & Restore, Real-Time Replication, Data Protection), Deployment Mode (Public Cloud, Private Cloud), Organization Size, Vertical and Region - Global Forecast to 2028

Disaster Recovery as a Service (DRaaS) Market Growth & Trends

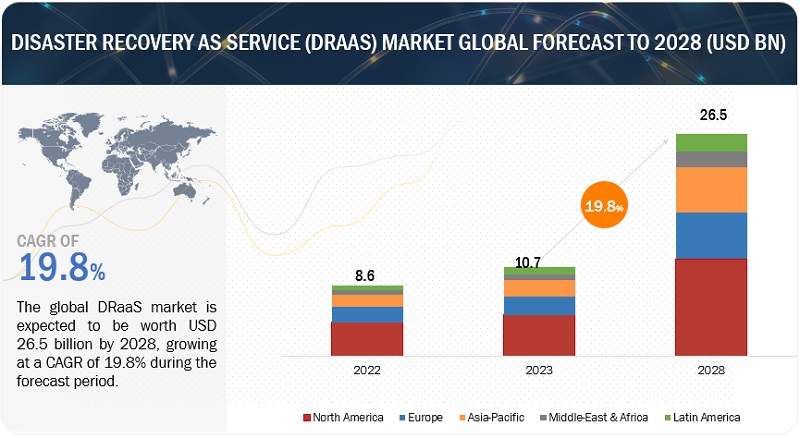

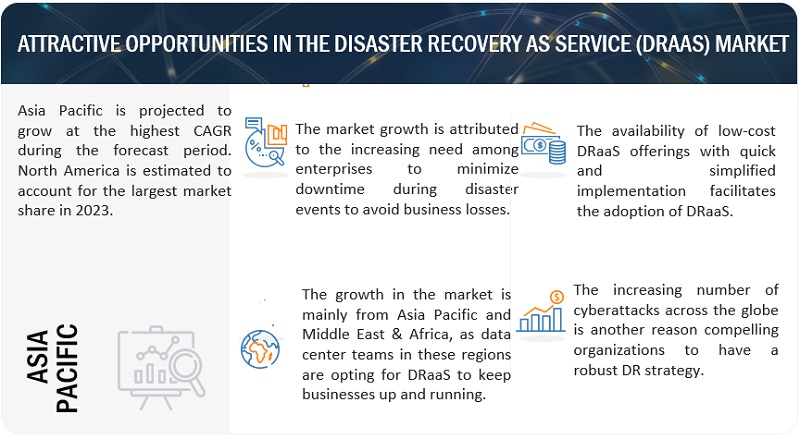

The Disaster recovery as a service Market size is expected to grow from $10.7 billion in 2023 to $26.5 billion by 2028 at a compound annual growth rate (CAGR) of 19.8% during the forecast period. DRaaS plays a pivotal role during heavy disasters by providing organizations with a lifeline to ensure business continuity and data resilience in the face of adversity. When disasters strike, such as natural catastrophes like hurricanes and earthquakes, or artificial crises such as cyberattacks, DRaaS serves as a reliable and essential tool. DRaaS allows organizations to replicate their critical data and IT infrastructure offsite, typically in secure data centers or the cloud. This redundancy ensures that even if the primary infrastructure is severely affected or compromised, the data remains intact and accessible. When a heavy disaster occurs, organizations can swiftly activate their DRaaS solutions to continue operations from the replicated environment. This minimizes downtime and prevents catastrophic data loss, enabling businesses to maintain essential functions and services.

Furthermore, DRaaS provides geographic diversity, which is crucial during heavy disasters. Data centers used for DRaaS are often located in different regions or even countries, reducing the risk of a single catastrophe impacting both the primary and backup infrastructure simultaneously. This geographic dispersal enhances data resilience and ensures that organizations can recover their operations despite widespread disasters.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

DRaaS Market Dynamics

Driver: Increased need for data security and scalability

The DRaaS market has increased due to increased demand for improved data security and seamless scalability. DRaaS provides a comprehensive solution to protect critical data and applications from unexpected disruptions, guaranteeing business continuity and reducing downtime. Data breaches, cyberattacks, and natural disasters have highlighted the importance of robust data security measures. As businesses increasingly rely on digital platforms, the risks associated with data loss and operational interruptions have intensified. DRaaS proactively tackles these challenges by replicating data and applications to offsite or cloud-based environments. This ensures that data can be recovered quickly in the event of a disruption, minimizing the impact on operations and maintaining customer trust. Scalability is another key factor driving the growth of the DRaaS market. Traditional disaster recovery solutions often require significant upfront investments in hardware and infrastructure, which could be inflexible when adapting to changing business needs. DRaaS, on the other hand, allows organizations to scale their recovery resources on demand, adjusting to changes in data volume and application requirements. This flexibility enables businesses to manage their IT resources efficiently, optimizing costs while ensuring optimal performance.

Restraint: Reluctance of enterprises in adopting cloud-based DRaaS over traditional methods

The growth of the DRaaS market faces a significant hurdle as enterprises hesitate to transition from traditional disaster recovery methods to cloud-based alternatives. Their reluctance is mainly attributed to concerns related to data security, control, and unfamiliarity with the cloud environment. Many businesses have long relied on conventional disaster recovery setups, which involve on-premises infrastructure and data centers, providing a sense of control over data and operations. This makes some enterprises hesitant to entrust their critical data and applications to external cloud providers. They believe that on-premises solutions offer more tangible control over data security and accessibility, which deters the full adoption of cloud-based DRaaS.

The primary concern is data security, which remains paramount for enterprises, especially those dealing with sensitive information. They worry about the potential vulnerabilities of storing their data in the cloud. The fear of data breaches or unauthorized access is a significant deterrent to embracing cloud-based solutions despite the advancements in cloud security technologies and protocols. Furthermore, the shift to cloud-based DRaaS may require a significant adjustment in operational procedures and IT skill sets. Enterprises accustomed to managing their infrastructure might find it challenging to navigate the complexities of cloud platforms. The unfamiliarity with cloud technologies, coupled with the perceived difficulties in migration and integration, can hinder the willingness to adopt DRaaS. Enterprises have been reluctant to shift from traditional disaster recovery methods, which has resulted in resistance to the DRaaS market. This resistance includes concerns over data security, control, and operational adjustments. However, as cloud technology evolves and gains trust, businesses may gradually adopt cloud-based DRaaS solutions. These solutions can improve efficiency, scalability, and resilience against disruptions.

Opportunity: SMEs represent a significant opportunity within the DRaaS market

Small and medium-sized enterprises (SMEs) increasingly recognize the value of outsourced disaster recovery solutions. DRaaS provides access to enterprise-level disaster recovery capabilities without the upfront investments in building and managing their infrastructure. This is particularly well-suited for SMEs due to its scalability, affordability, and ease of implementation.

SMEs often lack the financial and technical resources to establish and maintain elaborate in-house disaster recovery systems. DRaaS offers a compelling proposition for these businesses, providing cost-effective yet reliable solutions that safeguard critical data and applications in the face of unexpected disruptions. Cloud-based DRaaS is especially favorable for SMEs as it allows businesses to scale resources based on their evolving needs, optimize costs, and maintain efficient recovery processes.

Cloud providers continuously enhance their security measures, addressing compliance requirements across industries and assuaging concerns about data protection. This is essential for SMEs that rely on remote access to applications or have distributed teams. Adopting remote work arrangements and the globalization of markets further emphasize the importance of accessible and flexible disaster recovery solutions. SMEs can leverage DRaaS to ensure uninterrupted operations, regardless of location.

Challenge: Vendor lock-in

One of the major challenges in the DRaaS market is vendor lock-in. This term is when a business becomes overly dependent on a particular DRaaS provider's technology and services. This can make switching to another provider or revert to previous solutions hard. Several factors contribute to this challenge, including complex configurations that are designed to work with a specific provider’s infrastructure and services. Such intricacies can hinder interoperability between providers, making data and application migration cumbersome. Additionally, DRaaS providers use different data formats, storage mechanisms, and proprietary technologies, making transferring data from one provider's environment to another problematic and disruptive. Cost also plays a role in vendor lock-in, as transitioning from one DRaaS provider to another may involve unexpected expenses, such as data transfer and setup fees, which can discourage businesses from switching.

Migrating to a different cloud service provider can be a time-consuming and complex process, resulting in downtime that can negatively impact business operations and continuity. This problem is especially critical when businesses need to maintain uninterrupted services. To overcome the challenge of vendor lock-in, companies should prioritize data portability and interoperability. This can be achieved by choosing DRaaS providers that follow industry standards and open architectures, making it easier to transition if necessary. In addition, implementing a multi-cloud or hybrid approach can help mitigate vendor lock-in by distributing data and applications across several providers or combining cloud and on-premises resources. This approach enhances flexibility and reduces the dependence on a single vendor's ecosystem.

DRaaS Market Ecosystem

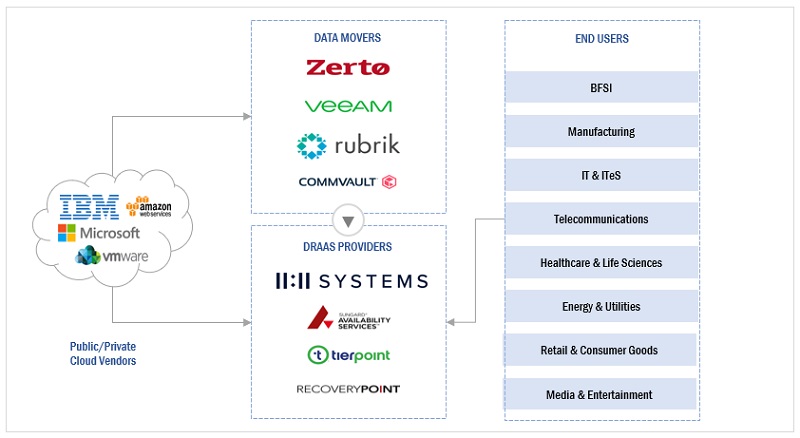

The DRaaS ecosystem comprises various entities that work together to cater to the disaster recovery needs of enterprises of different sizes. These entities include data movers, cloud service providers (CSPs), and end-users comprising SMEs and large enterprises. DRaaS vendors offer system integration to provide DR services to end-users through various deployment modes. Cloud providers use cutting-edge cloud-based technologies to develop high-end cloud services tailored to their customers' IT requirements. These services include real-time replication, backup, data security, and professional services. DRaaS vendors, such as 11:11 Systems, TierPoint, and Recovery Point Systems, provide cloud-based DRaaS services.

On the other hand, data movers provide backup and replication of data to on-premises or cloud targets. DRaaS providers adopt partnerships, collaborations, and agreements as their primary strategies for large-scale DR strategy implementation. The following figure shows the ecosystem of the DRaaS market:

Based on vertical, BFSI vertical is expected to hold the largest market share during the forecast period.

Based on the vertical, the DRaaS market is segmented into BFSI, Telecommunications, IT & ITeS, Government & Public Sector, Retail & Consumer Goods, Manufacturing, Energy & Utilities, Media & Entertainment, Healthcare & Life Sciences, and Other Verticals. Among the verticals, the BFSI segment is expected to hold the largest market share during the forecast period. DRaaS is a crucial component of the BFSI sector, where continuous operations, data security, and regulatory compliance are essential. In this dynamic and highly regulated industry, DRaaS provides a strategic solution for ensuring business continuity, safeguarding critical data, and adhering to strict compliance requirements. Even minor disruptions can have far-reaching consequences in the BFSI sector. DRaaS enables these institutions to recover quickly from disruptions such as cyberattacks, hardware failures, natural disasters, and human errors. Which reduces downtime, minimizes financial losses, and maintains customer trust.

Data security is most important in the BFSI sector due to the sensitive and confidential nature of financial transactions and personal information. DRaaS guarantees that data is encrypted, replicated, and stored securely in offsite or cloud-based environments. This prevents data breaches and adheres to regulatory requirements, such as the GDPR and industry-specific mandates. Compliance with regulatory standards is a crucial consideration in the BFSI vertical. DRaaS solutions address these needs by providing auditable disaster recovery processes, data retention policies, and data recovery testing. This helps BFSI organizations comply with the regulations and demonstrate their commitment to safeguarding customer information.

The BFSI sector benefits significantly from the scalability of DRaaS. Institutions can adjust their resources based on transaction volumes, ensuring optimal performance during peak times while efficiently managing costs during lulls. DRaaS in the BFSI vertical generally assures swift recovery, data protection, regulatory compliance, and operational continuity. As digital transformation continues to reshape the industry, the role of DRaaS in safeguarding sensitive information, maintaining customer trust, and upholding regulatory mandates becomes increasingly indispensable.

The SME segment holds the highest CAGR during the forecast period based on organization size.

The DRaaS market is segmented into large enterprises and SMEs based on the organization size. As per the organization size, the SME segment is expected to hold the highest CAGR during the forecast period. The SME segment plays a vital role in driving innovation within the DRaaS market. These businesses require tailored solutions that match their unique requirements, which leads DRaaS providers to create simplified interfaces, flexible pricing models, and user-friendly setups. It expands the options available to SMEs and influences the overall direction of DRaaS development.

In conclusion, the SME segment has a transformative impact on the DRaaS market. Its increasing adoption of these solutions contributes to market expansion, innovation, and accessibility. DRaaS solutions play a crucial role in enhancing business resilience across industries by providing SMEs a pathway to bolster their disaster recovery capabilities, fostering a dynamic and adaptable digital ecosystem.

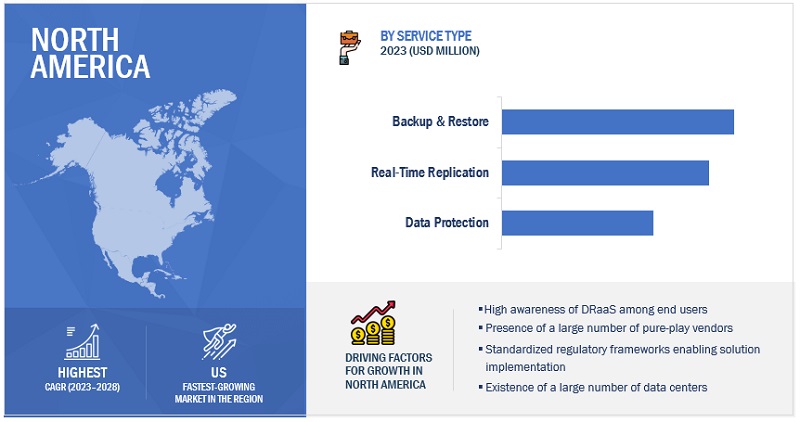

The US market is projected to contribute the largest share of the DRaaS market in North America.

North America is expected to lead the DRaaS market in 2023. The US is estimated to account for the largest market share in North America in 2023 in the DRaaS market, and the trend is expected to continue until 2028. In the US, DRaaS plays a crucial role in protecting businesses from various threats. With the increasing dependence on digital technology, concerns about cybersecurity, and the constant risk of natural disasters, DRaaS has become essential for business continuity. The US has stringent data protection regulations that include HIPAA and GDPR for international data transfers. DRaaS ensures data availability and recovery, thus aiding compliance. Hurricanes, wildfires, and other disasters pose a constant threat to businesses. DRaaS enables IT systems to recover quickly, thereby minimizing disruption. Numerous American companies opt for managed DRaaS solutions, outsourcing disaster recovery management to experts. In summary, DRaaS in the US ensures business resilience, data protection, and regulatory compliance, making it a fundamental component of disaster preparedness and continuity planning for American businesses.

Key Market Players

The DRaaS market is dominated by a few globally established players such as AWS (US), Microsoft (US), IBM (US), VMware (US), 11:11 Systems (US), Recovery Point Systems (US) InterVision Systems (US), TierPoint (US), Infrascale (US), and Zerto (US) among others, are the key vendors that secured DRaaS contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the DRaaS market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Service Type, Deployment Mode, Organization Size, Vertica, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies Covered |

Some of the significant DRaaS market vendors are AWS (US), Microsoft (US), IBM (US), VMware (US), 11:11 Systems (US), Recovery Point Systems (US), InterVision Systems (US), TierPoint (US), Infrascale (US), and Zerto (US). |

This research report categorizes the DRaaS market based on service types, verticals, organization sizes, deployment modes, and regions.

Based on the Service Type:

- Real-time Replication

- Backup & Restore

- Data Protection

- Professional Services

Based on the Organization Size:

- Large Enterprises

- SMEs

Based on the Deployment Mode:

- Public Cloud

- Private Cloud

Based on the Vertical:

- BFSI

- Telecommunication

- IT & ITeS

- Government & Public Sector

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Healthcare & Life Sciences

- Other Verticals

Based on the Region:

-

North America

- United States

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In August 2023, Microsoft updated and improved the Azure Site Recovery service to help users stay up-to-date; it provides users with information about the latest releases, new features, and new content.

- In July 2023, VMware improved its products' security features to help prevent and mitigate ransomware attacks. This includes enhanced access controls, encryption, network segmentation, and integration with third-party security tools. Moreover, VMware offers backup and recovery solutions that enable users to create regular snapshots and backups of their virtual machines. These snapshots can be used to restore systems to a previous state in case of a ransomware attack. Organizations can recover data without paying ransom to attackers by having reliable backup processes.

- In March 2023, 11:11 Systems, a managed infrastructure solutions provider, announced the general availability of 11:11 Managed Backup for Cohesity, a fully managed service for on-premises data protection. By combining Cohesity’s solution deployed on-site with 11:11’s onboarding, configuration, and ongoing management, customers get comprehensive protection from a secure, scalable backup offering in a single, seamless solution. In a ransomware attack, customers can quickly recover at scale.

Frequently Asked Questions (FAQ):

What is Disaster Recovery as a Service (DRaaS)?

According to HPE, DRaaS providers replicate a subscriber’s physical disaster recovery sites to the cloud to rapidly restore data servers and applications when needed. Restorations can be initiated from anywhere using most types of computers, allowing an organization to recover its data directly to a disaster recovery site in a different location if its data center is unavailable. The cloud instantly mirrors any data changes that occur at the primary site, updating automatically, and can restore environments to a point seconds before an outage occurs in a matter of minutes.

According to Nutanix, disaster recovery means protecting business applications and data from IT downtime, which can occur for various reasons (e.g., natural disasters, human error, cyber-attack). When a data center, or even a portion of it, fails to serve its clients, companies are subject to lost revenue, damaged reputation, and jeopardized industry-specific credentials.

Which country is an early adopter of Disaster Recovery as a Service (DRaaS)?

The US is an early adopter of Disaster Recovery as a Service (DRaaS).

Who are vital clients adopting Disaster Recovery as a Service (DRaaS)?

Key clients adopting the DRaaS market include: -

- Government Agencies

- Resellers and Distributors

- Research Organizations

- Corporates

- Administrators

Which key vendors are exploring Disaster Recovery as a Service (DRaaS)?

Some of the significant DRaaS vendors are AWS (US), Microsoft (US), IBM (US), VMware (US), 11:11 Systems (US), Recovery Point Systems (US), InterVision Systems (US), TierPoint (US), Infrascale (US), and Zerto (US).

What is the total CAGR expected to be recorded for the DRaaS market during 2023-2028?

The market is expected to record a CAGR of 19.8% from 2023-2028

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

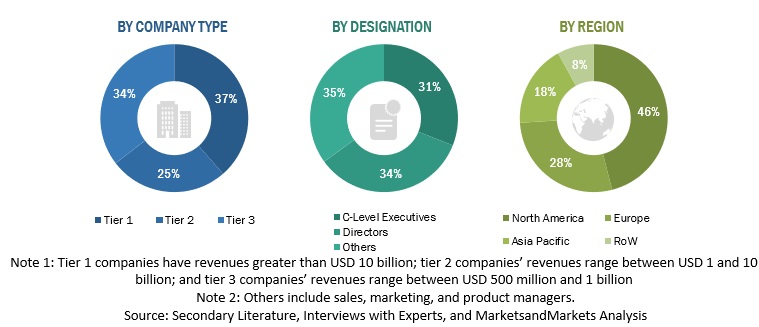

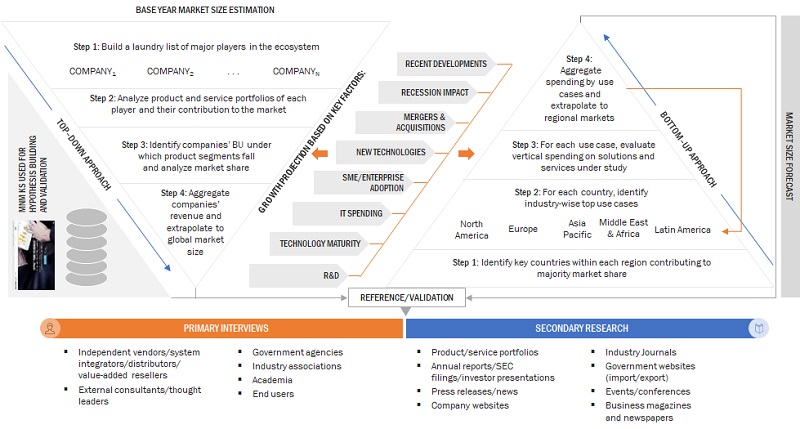

This research study involved extensive secondary sources, directories, and paid databases to identify and collect information useful for this technical, market-oriented, and commercial study of the DRaaS market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market prospects. The following figure highlights the market research methodology in developing this report on the DRaaS market.

Secondary Research

The market size of companies offering DRaaS was based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, articles from recognized authors, government websites, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; and related key executives from DRaaS vendors, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology, service type, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using DRaaS, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of solutions, which would affect the overall DRaaS market.

The Breakup of Primary Profiles:

To know about the assumptions considered for the study, download the pdf brochure

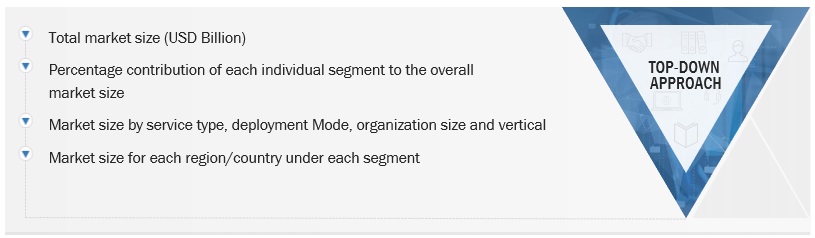

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the DRaaS market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

Top Down and Bottom Up Approach of the DRaaS market.

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down and bottom-up approaches were used to estimate and validate the size of the DRaaS market and various other dependent subsegments. The research methodology used to estimate the market size included the following:

Key players in the market were identified through secondary research, and their revenue contributions in respective countries were determined through primary and secondary research.

This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Top Down Approach of DRaaS market.

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying various factors and trends from government agencies’ demand and supply sides.

Market Definition

DRaaS refers to a cloud model that enables replicating enterprise data and applications on a third-party virtual or cloud environment to ensure business continuity during artificial or natural disasters. It is mainly facilitated by System Integrators (SIs) and Managed Service Providers (MSPs). DRaaS is based on three crucial aspects: disaster planning/management, business continuity, and backup.

Key Stakeholders

- Cloud service providers (CSPs)

- Colocation providers

- Technology service providers

- Data center managed service providers

- Government organizations

- Networking companies

- Consultants/consultancies/advisory firms

- Support and maintenance service providers

- Telecom service providers

- Information Technology (IT) infrastructure providers

- System Integrators (SIs)

- Regional associations

- Independent software vendors

- Value-added resellers and distributors

Report Objectives

- To describe and forecast the global Disaster Recovery as a Service (DRaaS) market based on service types, deployment modes, organization size, verticals, and regions

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents & innovations, and pricing data related to the DRaaS market

- To analyze the impact of recession impact on service types, deployment modes, organization size, verticals, and regions across the globe

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the DRaaS market

Company Information

- Detailed analysis and profiling of five additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Disaster Recovery as a Service (DRaaS) Market

Analyse the Mergers and acquisitions opportunities for the Apple Seagate EVault Downtime Ecosystem and their Strategy Technology partners and suppliers value chain.

Understand the market dynamics impacting the Tier-1, Tier-2, Tier-3 companies in this market

Need insights on cloud disaster recovery and business continuity as a service for SMBs in APAC

Detailed understanding of the role of ISPs in DRaaS and redundancy of the internet connections and potential growth opportunities

Interested in country-level analysis and forecast for Central and Eastern Europe - Slovak Republic, Czech Republic, Poland, Hungaria, Ukraina and baltic countries: Croatia, Romania,Bulgaria, Monte Negro, Serbia

Interested in customer reasoning that leads to purchasing DRaaS offerings

Understand the DRaaS market dynamics

Understanding the Data backup and recovery for the New Zealand market by various segments including market size and industry verticals.

Need in-depth information on the market segmentation at country-level