Retail Analytics Market by Offering (Software, Services), Business Function (Sales and Marketing, Finance and Accounting), Application (Order Fulfillment and Returns Management, Merchandize Planning), End User and Region - Global Forecast to 2029

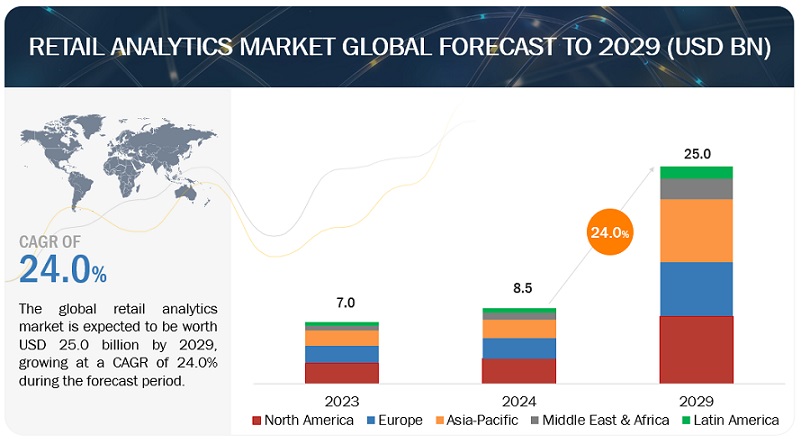

[317 Pages Report] The global Retail Analytics Market size is projected to grow from USD 8.5 billion in 2024 to USD 25.0 billion by 2029, at a compound annual growth rate (CAGR) of 24.0% during the forecast period. Due to various business drivers, the retail analytics market is expected to grow significantly during the forecast period. The market is experiencing significant growth due to the proliferation of data generated through diverse channels. Exponential growth of e-commerce platforms, and increasing adoption of omnichannel retail strategies are also responsible for driving the market’s growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Exponential growth of e-commerce platforms

The exponential growth of e-commerce platforms has profoundly impacted the retail analytics market, presenting a wealth of opportunities for retailers to leverage data-driven insights for strategic decision-making and operational optimization. With the increasing prevalence of online shopping, fueled by factors such as convenience, broader product selection, and competitive pricing, e-commerce platforms have become a dominant force in the retail landscape. This surge in online transactions generates vast amounts of data, ranging from customer demographics and browsing behavior to purchase history and feedback, providing retailers with rich sources of information to analyze. Retail analytics solutions play a pivotal role in helping retailers extract actionable insights from this data, enabling them to understand consumer preferences, identify trends, forecast demand, optimize pricing and promotions, personalize marketing campaigns, and enhance the overall customer experience. As e-commerce continues to expand globally, driven by technological advancements, changing consumer behaviors, and market dynamics, the demand for sophisticated retail analytics tools and services is expected to skyrocket, creating lucrative opportunities for vendors in the retail analytics market to innovate and cater to the evolving needs of retailers in the digital age.

Restraints: Rising integration challenges with legacy systems due to diverse data sources

One of the foremost restraints encountered is the rising integration complexity stemming from the coexistence of diverse data sources and the prevalence of legacy systems within retail infrastructures. As retailers strive to harness the power of data analytics to gain insights into consumer behavior, market trends, and operational efficiencies, they often grapple with the integration of disparate data streams originating from various sources such as point-of-sale (POS) systems, e-commerce platforms, customer relationship management (CRM) tools, and social media channels. These data sources may employ distinct formats, structures, and protocols, posing significant hurdles to seamless integration with existing legacy systems. The integration challenge exacerbates further due to the presence of legacy systems within many retail organizations. These legacy systems, characterized by their long-standing usage and historical significance, often lack the flexibility and compatibility required to efficiently incorporate and process data from modern sources. Attempts to integrate diverse data streams with legacy systems frequently encounter compatibility issues, data inconsistency, and processing bottlenecks, impeding the real-time analysis and utilization of critical insights. Consequently, retail enterprises face mounting pressure to modernize their data infrastructure and streamline integration processes to extract maximum value from their data assets.

Addressing the integration challenges posed by diverse data sources and legacy systems necessitates a multifaceted approach involving technological innovation, strategic planning, and organizational restructuring. Retailers increasingly seek solutions that offer seamless integration capabilities, scalability, and adaptability to accommodate evolving data landscapes. Leveraging advanced analytics platforms equipped with robust integration frameworks, retailers can consolidate data from disparate sources, standardize formats, and facilitate interoperability with legacy systems.

Opportunity: Integration of AI and ML with retail analytics will create new opportunities for innovation

AI and ML technologies offer retailers the ability to analyze vast amounts of data with unprecedented accuracy and efficiency, enabling them to gain deeper insights into consumer behavior, preferences, and trends. By leveraging AI and ML algorithms, retailers can extract valuable insights from diverse data sources such as transaction records, customer demographics, social media interactions, and even sensor data from physical stores. One of the key advantages of integrating AI and ML with retail analytics is the ability to personalize the shopping experience for individual consumers. These technologies enable retailers to create highly targeted marketing campaigns, tailored product recommendations, and personalized promotions based on each customer's unique preferences and purchasing history. By delivering personalized experiences, retailers can enhance customer satisfaction, loyalty, and ultimately drive sales and revenue growth. Additionally, AI-powered analytics can help retailers optimize pricing strategies, inventory management, and supply chain operations to maximize efficiency and profitability.

Furthermore, the integration of AI and ML with retail analytics opens up new avenues for innovation in areas such as predictive analytics, demand forecasting, and trend analysis. Retailers can use advanced predictive models to anticipate future consumer trends, identify emerging market opportunities, and optimize product assortments accordingly.

Challenge: Complexity of assortment in the retail analytics

Assortment complexity refers to the vast array of products offered by retailers, each with varying attributes such as size, color, style, and price point. Retailers must carefully curate their product assortments to meet the diverse needs and preferences of their target customers while balancing factors like shelf space, inventory costs, and seasonal demand fluctuations. Managing this complexity effectively requires sophisticated analytics solutions capable of analyzing large volumes of data to identify trends, patterns, and insights that can inform assortment decisions. The complexity of assortment management is further compounded by the dynamic nature of consumer preferences and market trends. Consumer tastes and preferences can change rapidly in response to factors such as changing demographics, cultural shifts, and emerging fashion trends. Retailers must continuously monitor market trends, gather customer feedback, and adapt their assortments accordingly to remain competitive. However, keeping pace with these changes and effectively predicting future trends requires advanced analytics capabilities that can process real-time data and generate actionable insights in a timely manner. Moreover, the proliferation of sales channels and the rise of omnichannel retailing add another layer of complexity to assortment management. With consumers increasingly shopping across multiple channels, including online, mobile, and brick-and-mortar stores, retailers must ensure consistency and coherence across all channels while optimizing assortments to meet the unique characteristics and preferences of each channel's customer base. This requires retailers to integrate data from disparate sources, such as point-of-sale systems, e-commerce platforms, and customer loyalty programs, to gain a holistic view of consumer behavior and preferences across channels and make informed assortment decisions that drive sales and customer satisfaction.

Retail Analytics market ecosystem

By professional services, the Support & Maintenance segment registered the highest CAGR during the forecast period.

As retailers increasingly rely on data-driven insights to enhance operations and customer experiences, support services become indispensable for addressing technical issues, troubleshooting, and providing timely assistance to users. Maintenance services encompass regular updates, patches, and performance optimizations to uphold system integrity and functionality. These services are crucial for minimizing downtime, maximizing system efficiency, and safeguarding against potential disruptions that could impact business operations. Moreover, support and maintenance providers often offer training and knowledge transfer sessions to empower retail teams in harnessing the full potential of analytical tools and technologies.

By application, Price Recommendation & Optimization segment to register the highest CAGR during the forecast period.

The demand for price recommendation and optimization applications is at an all-time high. These sophisticated tools leverage advanced analytics and machine learning algorithms to analyze vast amounts of data, including historical sales data, competitor pricing, market trends, and customer behavior. By doing so, they empower retailers to make data-driven pricing decisions that maximize profitability while remaining competitive in the market. These applications offer real-time insights and recommendations, enabling retailers to adjust prices dynamically based on factors such as demand fluctuations, inventory levels, and promotional effectiveness.

By end user by product type, Industry segment register the highest CAGR during the forecast period.

In the ever-evolving landscape of retail analytics, industrial product types play a pivotal role in shaping market dynamics. These products, ranging from machinery and equipment to raw materials and components, form the backbone of various industries. Retail analytics solutions tailored for industrial product types provide invaluable insights into inventory management, pricing strategies, and market trends. By harnessing data analytics technologies, businesses can identify patterns, forecast demand, and make informed decisions to stay competitive in a rapidly changing market.

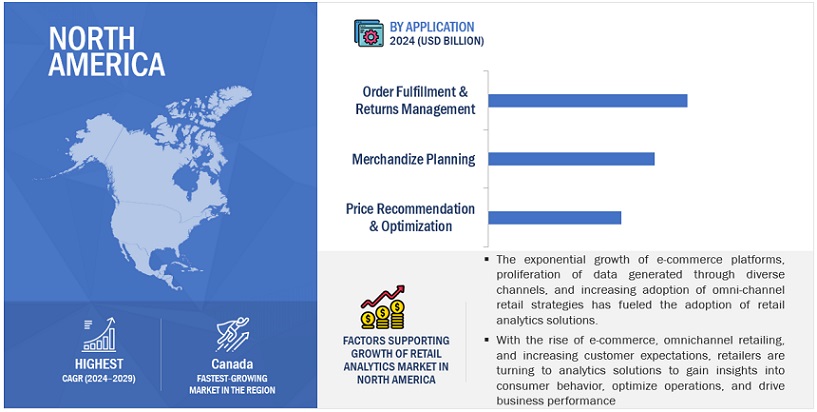

By region, North America to witness the largest market size during the forecast period.

With the rise of e-commerce, omnichannel retailing, and increasing customer expectations, retailers are turning to analytics solutions to gain insights into consumer behavior, optimize operations, and drive business performance. From large retailers to small businesses, there's a growing recognition of the importance of data-driven decision-making in staying competitive in today's market. Key trends in the North American retail analytics market include the adoption of advanced technologies like artificial intelligence and machine learning to enhance predictive analytics capabilities, the integration of data from multiple sources for a holistic view of the customer journey, and the emphasis on real-time analytics for timely insights and actions.

Key Market Players

The retail analytics solution and service providers have implemented various types of organic and inorganic growth strategies, such as product upgrades, new product launches, partnerships, and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the retail analytics market include Microsoft (US), IBM (US), SAP (Germany), Oracle (US), Salesforce (US), MicroStrategy (US), SAS Institute (US), AWS (US), Qlik (US), Teradata (US), WNS (India), HCL (India), Lightspeed Commerce (Canada), RetailNext (US), Manthan Systems (India), Fit Analytics (Germany), Trax (Singapore), ThoughtSpot (US), RELEX Solutions (Finland), Tredence (US), Creatio (US), Solvoyo (US), datapine (Germany), Sisense (US), EDITED (UK), Retail Zipline (US), ThinkINside (Italy), Dor Technologies (US), Triple Whale (Israel), Flame Analytics (Spain), Alloy.ai Technologies (US), Conjura (UK), Kyvos Insights (US), Pygmalion (Slovakia), and SymphonyAI (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

USD (Billion) |

|

Segments Covered |

Offering, Business Function, Application, End User, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), IBM (US), SAP (Germany), Oracle (US), Salesforce (US), MicroStrategy (US), SAS Institute (US), AWS (US), Qlik (US), Teradata (US), WNS (India), HCL (India), Lightspeed Commerce (Canada), RetailNext (US), Manthan Systems (India), Fit Analytics (Germany), Trax (Singapore), ThoughtSpot (US), RELEX Solutions (Finland), Tredence (US), Creatio (US), Solvoyo (US), datapine (Germany), Sisense (US), EDITED (UK), Retail Zipline (US), ThinkINside (Italy), Dor Technologies (US), Triple Whale (Israel), Flame Analytics (Spain), Alloy.ai Technologies (US), Conjura (UK), Kyvos Insights (US), Pygmalios (Slovakia), and SymphonyAI (US) |

This research report categorizes the retail analytics market based on offering, business function, application, end user, and region.

By Offering:

-

Software by Analytics Type

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

-

Software by Deployment Mode

- Cloud

- On-premise

-

Services

- Consulting & Advisory

- Integration & Deployment

- Support & Maintenance

- Training & Education

By Business Function:

- Sales & Marketing

- Operations & Supply Chain

- Finance & Accounting

- HR

By Application:

-

Order Fulfillment & Returns Management

- Order Processing & Packaging

- Shipping & Transportation

- Returns Processing

- Payment Processing

-

Customer Relationship Management

- Customer Segmentation

- Revenue Optimization

- Customer Retention

- Predictive Modeling

-

Price Recommendation & Optimization

- Prsonalised Pricing

- Real-Time Price Adjustment

- Price Optimization Strategy

-

Merchandise Planning

- Demand Sensing & Forecasting

- Trend Analysis

- Assortment Planning

-

Supply Chain Management

- Contract Management

- Vendor Management

- Work Order Management

- Invoice Management

-

Fraud Detection & Prevention

- Point-Of-Sale (Pos) Verification

- Product Counterfeit Management

- Root Cause Analysis

- Risk Assessment & Complaince Management

- Other Applications (Store Performance Monitoring Management And Brand Management)

By End User:

-

End User by Product Type

- Industry

- Consumer

-

End User by Channel

- Online

- Offline

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia and New Zealand (ANZ)

- South Korea

- ASEAN Countries

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Turkey

- Egypt

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In February 2024, IBM announced the availability of the popular open-source Mixtral-8x7B large language model (LLM), developed by Mistral AI, on its Watsonx AI and data platform, as it continues to expand capabilities to help clients innovate with IBM's own foundation models and those from a range of open-source providers.

- In January 2024, IBM announced its collaboration with SAP to develop solutions to help clients in the consumer-packaged goods and retail industries enhance their supply chain, finance operations, sales and services using generative AI.

- In January 2024, Salesforce announced the availability of Einstein 1 Studio, a set of low-code tools that enables Salesforce admins and developers to customize Einstein Copilot and seamlessly embed AI across any app for every customer and employee experience.

- In November 2023, MicroStrategy announced the availability of MicroStrategy ONE in the AWS Marketplace. By bringing together MicroStrategy's powerful generative artificial intelligence (AI) capabilities for business intelligence (BI) and the scalability and reliability of Amazon Web Services (AWS), customers can now access a ready solution for deploying trusted AI at scale for analytics.

- In September 2023, Oracle showcased new AI-powered capabilities within Oracle Analytics Cloud. Leveraging the Oracle Cloud Infrastructure (OCI) Generative AI service, the new capabilities assist analytics self-service users to conduct sophisticated analysis and make better business decisions without having to wait for data scientists or IT teams more quickly and efficiently.

Frequently Asked Questions (FAQ):

What is Retail Analytics?

Retail analytics involves monitoring various business data such as inventory, customer actions, and sales figures to make smarter decisions. It helps understand and improve different aspects of retail operations such as supply chain, customer behavior, sales patterns, and overall performance.

What is the total CAGR expected to be recorded for the Retail Analytics market during the forecast period?

The market is expected to record a CAGR of 24.0% during the forecast period.

Which are the key drivers supporting the growth of the Retail Analytics market?

Some factors driving the growth of the retail analytics market are exponential growth of e-commerce platforms, proliferation of data generated through diverse channels, and increasing adoption of omnichannel retail strategies.

Which are the key applications prevailing in the Retail Analytics market?

The key applications gaining a foothold in the retail analytics market are Order Fulfillment & Returns Management, Customer Relationship Management, Price Recommendation & Optimization, Merchandise Planning, Supply Chain Management, Fraud Detection & Prevention, and other applications (Store Performance Monitoring Management And Brand Management)

Who are the key vendors in the Retail Analytics market?

Some major players in the retail analytics market include Microsoft (US), IBM (US), SAP (Germany), Oracle (US), Salesforce (US), MicroStrategy (US), SAS Institute (US), AWS (US), Qlik (US), Teradata (US), WNS (India), HCL (India), Lightspeed Commerce (Canada), RetailNext (US), Manthan Systems (India), Fit Analytics (Germany), Trax (Singapore), ThoughtSpot (US), RELEX Solutions (Finland), Tredence (US), Creatio (US), Solvoyo (US), datapine (Germany), Sisense (US), EDITED (UK), Retail Zipline (US), ThinkINside (Italy), Dor Technologies (US), Triple Whale (Israel), Flame Analytics (Spain), Alloy.ai Technologies (US), Conjura (UK), Kyvos Insights (US), Pygmalios (Slovakia), and SymphonyAI (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

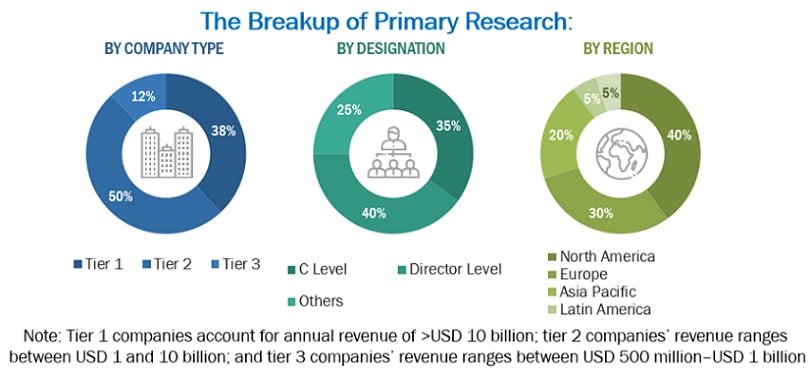

The retail analytics market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred retail analytics providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, retail analytics spending of various countries were extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on software, services, market classification, and segmentation according to offerings of major players, industry trends related to software, services, deployment modes, business function, application, end user, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and retail analytics expertise; related key executives from retail analytics solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from software and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using retail analytics solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of retail analytics software and services, which would impact the overall retail analytics market.

To know about the assumptions considered for the study, download the pdf brochure

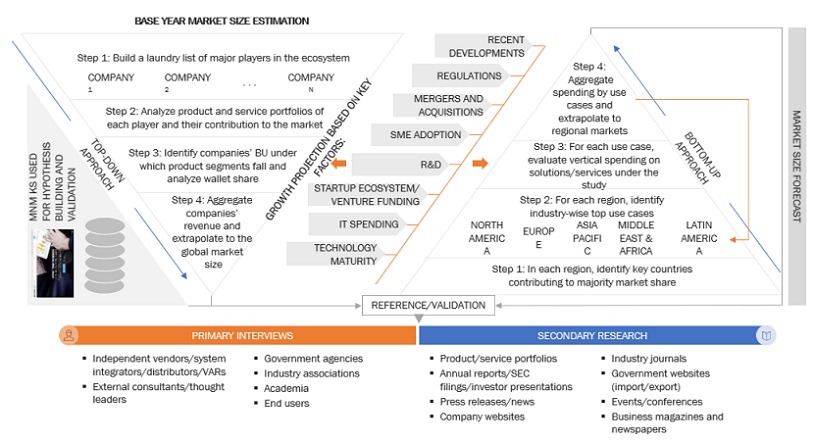

Market Size Estimation

In the bottom-up approach, the adoption rate of retail analytics solutions and services among different end users in key countries concerning their regions contributing the most to the market share was identified. For cross-validation, the adoption of retail analytics solutions and services among industries and different use cases concerning their regions was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the retail analytics market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major retail analytics providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall retail analytics market size and segments’ size were determined and confirmed using the study.

Global Retail Analytics Market Size: Bottom-Up and Top-Down Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the retail analytics market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major retail analytics providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall retail analytics market size and segments’ size were determined and confirmed using the study.

Market Definition

Retail analytics involves using software to collect and analyze data from physical, online, and catalog outlets to provide retailers with insights into customer behavior and shopping trends. It can also be used to inform and improve decisions about pricing, inventory, marketing, merchandising, and store operations by applying predictive algorithms against data from both internal sources (such as customer purchase histories) and external repositories (such as weather forecasts).

STAKEHOLDERS

- Application design and software developers

- Retail analytics vendors

- Business analysts

- Cloud service providers

- Consulting service providers

- Data scientists

- Distributors and Value-added Resellers (VARs)

- Government agencies

- Independent Software Vendors (ISV)

- Market research and consulting firms

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Technology providers

- Value-added resellers (VARs)

Report Objectives

- To define, describe, and predict the retail analytics market by offering (software and services), business function, application, end user, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the retail analytics market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the retail analytics market

- To analyze the impact of recession across all the regions across the retail analytics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American retail analytics market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle Eastern & African market

- Further breakup of the Latin America retail analytics market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Retail Analytics Market

Looking for product revenue / market size of the warehouse management, allocation & replenishment, store operations, space & category management, demand management, and transportation & logistics management.

Analysis in the market share of the biggest companies in predictive analytics in retail especially in Germany.

Gather insights into retail Merchandising Analysis, Customer Analysis, Performance Analysis, inventory analysis and losses by Specialized brand stores and Muti brand stores in India.

Understand the market dynamics of the Retail market.

"Gather insights into world retail technology,world eletronic security specifically for the Brazil region."

Specifically interested for in-store analytics.

Detailed understanding of the market of loyalty cards and retail analytics, regarding consumable residential products.

Detailed understanding of the market of loyalty cards and retail analytics, regarding consumable residential products.

Indepth understanding of the retail analytics market and the competitive analysis of the market.

Understand the High level breakdown of market size and growth (quantitive data or graphs) per Business function and Region.

Looking to learn more about the competitive landscape for retail tracking services and retail analytics