Sepsis Diagnostics Market Size By Technology (Microbiology, PCR, Immunoassay, microfluidics, Biomarker), Product (Media, Reagent, Instrument), Method (Automated), Test (Lab, POC), Pathogen (Bacterial, Fungal), End User & Region - Global Forecast to 2029

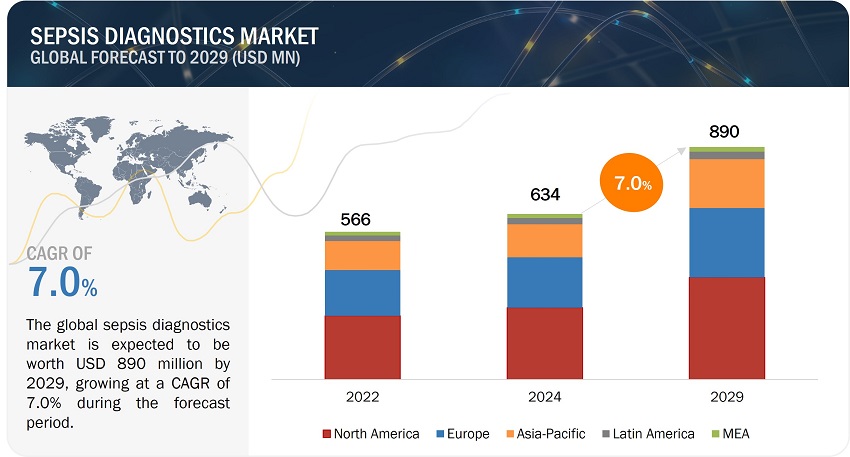

The size of global sepsis diagnostics market in terms of revenue was estimated to be worth $634 million in 2024 and is poised to reach $890 million by 2029, growing at a CAGR of 7.0% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

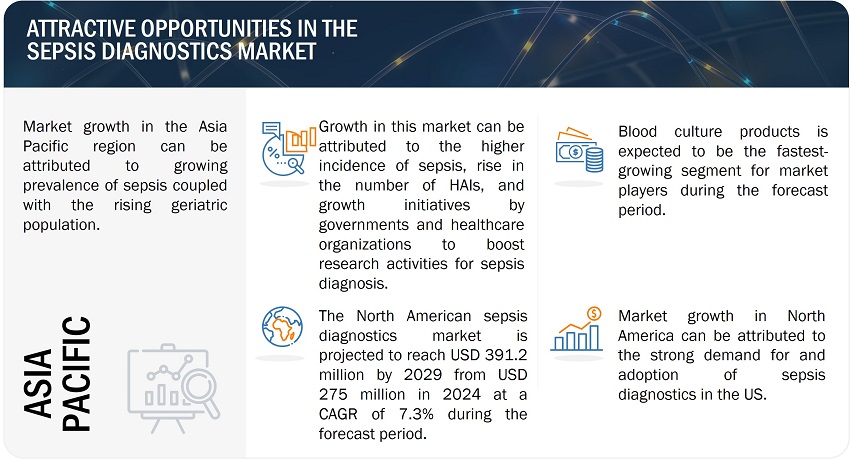

During the forecast years, the growth of the market is attributed to the growing burden of infectious diseases, growing government initiatives for creating sepsis awareness, the increasing public-private funding for sepsis diagnostic research activities, and the rising number of sepsis incidences.

Global Sepsis Diagnostics Industry Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Sepsis Diagnostics Market Dynamics

Driver: Increasing hospital-acquired infection incidences

The main driving force for the growth of the sepsis diagnostics market is the rising incidence of Hospital-acquired infections (HAIs). Hospital-acquired infections (healthcare-associated infections) are nosocomially acquired infections that are not present or incubating at the time of admission to a hospital. Globally there is a rapid increase in HAIs, due to which in the coming years the demand for sepsis diagnostic products is also expected to rise. In the US, sepsis is the third most common cause of death in U.S. hospitals affecting 1.7 million people nationwide each year (Source: Centers for Disease Control and Prevention (CDC)).

Restraint: High costs of automated diagnostic devices

The material used in the development of diagnostic devices significantly contribute to the cost of the automated diagnostic devices. For instance, the price of the molecular diagnostic tests is USD 300–3,000 (and above), thus diagnostic devices are too expensive (with advanced materials) to be used on a regular basis (mainly in the developing markets). The price is very high compared to the cost of blood culture tests, priced as low as ~USD 28–35. Further, though in developed countries sepsis diagnosis is relatively common, automated diagnostic devices are still unaffordable in countries with a per capita government healthcare expenditure below USD 50. Government hospitals (especially in emerging nations) and academic research laboratories due to limited budgets, cannot afford such systems.

Opportunity: Rapid diagnostic/POC techniques development for early sepsis diagnosis

The product offering are being expanded by many sepsis diagnostic manufacturers in point of care (POC) technology for rapidly detecting the sepsis, reducing the overall turnaround time of diagnosis. Within three hours in septic shock, the risk of mortality increases by 35% with every one hour delay in antibiotic administration. Thus, increasing the need for the rapid diagnosis of sepsis to reduce the delay of antibiotic therapy among patients with sepsis. Becton Dickinson and Company (US) manufacture blood culturing instruments like BACTEC FX, BACTEC Plus and BacT/Alert which are automated microbial detection systems offering a rapid diagnosis of sepsis in the minimum turnaround time.

Challenge: Dearth of skilled healthcare professionals

The shortage of skilled professionals is a major concern worldwide. Sepsis is a life-threatening condition that needs to be diagnosed and treated at the earliest with the help of skilled healthcare professionals. The lack of trained paramedics affects each phase of patient care— screening patients for the presence of sepsis and sepsis awareness. Only 50% of patients with severe sepsis transported by the EMS system have a paramedic.

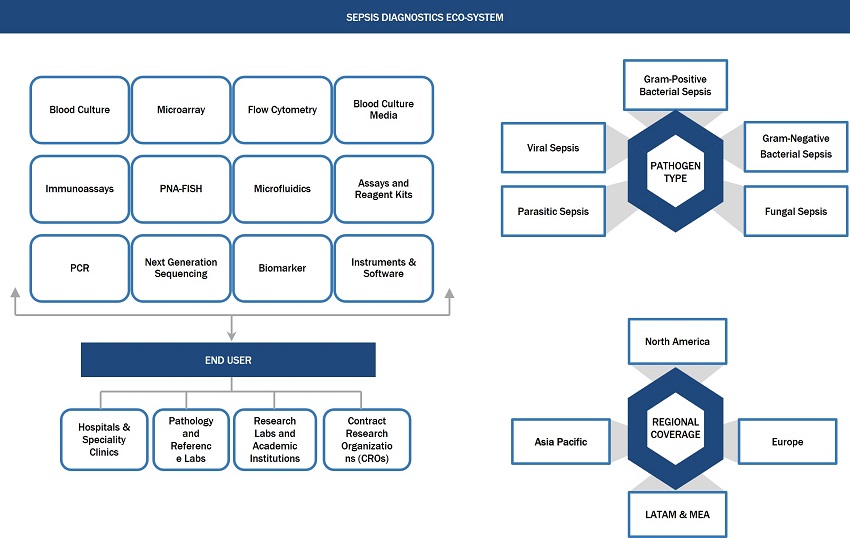

Sepsis Diagnostics Market Ecosystem

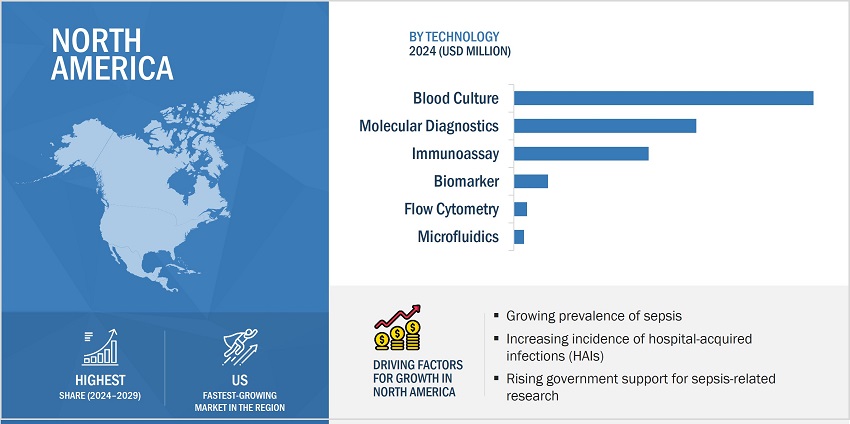

By technology, the blood culture segment accounted for the largest share of sepsis diagnostics industry during the forecast period.

Based on the technology, the sepsis diagnostics is segmented into blood culture, immunoassays, molecular diagnostics, flow cytometry, microfluidics, and biomarkers. Molecular diagnostics is further sub-segmented into PCR, microarray, peptide nucleic acid fluorescent in situ hybridization and DNA sequencing. The blood culture segment accounts for the largest share of the sepsis diagnostics market. The extensive use of blood culture methods for the diagnosis of sepsis and the low cost of microbiology techniques contribute to the large share.

By product, the blood culture media segment of sepsis diagnostics industry is expected to grow at the highest rate during the forecast period.

Based on the product, the sepsis diagnostics is segmented into blood culture media, assays & reagent kits, instruments, and software. In 2024, the blood culture media segment is expected accounted for the largest share of market during the forecast period. The increase in the availability of blood culture media and growing utilization of blood culture media by hospitals & pathology laboratories for the diagnosis of sepsis has led to the growth of the segment.

By pathogen type, the bacterial sepsis segment of sepsis diagnostics industry is expected to witness significant growth during the forecast period.

Based on the pathogen type, the sepsis diagnostics is segmented into bacterial sepsis, fungal sepsis, and other pathogen. The other pathogen segment of the sepsis diagnostics market includes viral sepsis and parasitic sepsis. The bacterial sepsis segment is expected to witness significant growth during the forecast period. the rising prevalence of HAIs and the increasing number of surgical procedures have led to the significant growth and dominance of the segment in the industry in the upcoming years.

North America is expected to be the largest market of sepsis diagnostics industry during the forecast period.

The sepsis diagnostics market has been segmented into five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America, comprising the US and Canada, held the largest share of the global market in 2023. This region is witnessing growth due to rising number of surgical procedures, the presence of a highly developed healthcare system, technological advancements, increasing incidence of health-associated infections (HAIs) and high adoption of innovative sepsis diagnostic technologies among medical professionals.

On the other hand, the Asia Pacific market is estimated to register the highest growth rate during the forecast period. North America accounted for a share of 43.4% of the market, followed by Europe with a share of 30.7%.

To know about the assumptions considered for the study, download the pdf brochure

As of 2023, prominent players in the Sepsis diagnostics market are bioMérieux (France), Becton, Dickinson and Company (US), Danaher Corporation (US), T2 Biosystems (US), QuidelOrtho Corporation (US), F. Hoffmann-La Roche AG (Switzerland), Thermo Fisher Scientific (US), Bruker Corporation (US), Abbott Laboratories (US), Immunexpress (Australia), Axis-Shield Diagnostics (UK), among others.

Scope of the Sepsis Diagnostics Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2024 |

$634 million |

|

Projected Revenue Size by 2029 |

$890 million |

|

Industry Growth Rate |

Poised to grow at a CAGR of 7.0% |

|

Market Driver |

Increasing hospital-acquired infection incidences |

|

Market Opportunity |

Rapid diagnostic/POC techniques development for early sepsis diagnosis |

This study categorizes the global sepsis diagnostics market to forecast revenue and analyze trends in each of the following submarkets:

By Technology

- Blood Culture

- Immunoassays

-

Molecular Diagnostics

- PCR

- Peptide Nucleic Acid-Fluorescent In Situ Hybridization

- Microarrays

- DNA sequencing

- Syndromic Panel-Based Testing

- Flow Cytometry

- Microfluidics

- Biomarkers

By Product

- Blood Culture Media

- Assays & Reagents

- Instruments

- Software

By Method

- Automated Diagnostics

- Conventional Diagnostics

By Pathogen Type

-

Bacterial Sepsis

- Gram-Negative Bacterial Sepsis

- Gram-Positive Bacterial Sepsis

- Fungal Sepsis

- Other Pathogen

By Test Type

- Laboratory Tests

- Point-of-Care Tests

By End User

- Hospitals and specialty clinics

- Pathology & Reference Laboratories

- Research Laboratories, Academic Institutes & CROs

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Spain

- Italy

- RoE

-

Asia Pacific

- China

- Japan

- Australia

- South Korea

- India

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

-

Middle East & Africa

- GCC Countries

- Rest of the Middle East & Africa

Recent Developments of the Sepsis Diagnostics Industry

- In April 2023, BioMérieux launched BIOFIRE FIREWORKS, an integrated software solution for BIOFIRE Systems optimizing laboratory services and supporting data-driven decisions.

- In May 2023, Sysmex Corporation launched clinical flow cytometry system Flow Cytometer XF-1600, Sample Preparation System PS-10, antibody reagents, and other related products in Japan.

- In June 2023, T2 Biosystems collaborated with Vanderbilt University Medical Center to implement and evaluate the T2Bacteria Panel for clinical use.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global sepsis diagnostics market?

The global sepsis diagnostics market boasts a total revenue value of $890 million by 2029.

What is the estimated growth rate (CAGR) of the global sepsis diagnostics market?

The global sepsis diagnostics market has an estimated compound annual growth rate (CAGR) of 7.0% and a revenue size in the region of $634 million in 2024.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the sepsis diagnostics market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the sepsis diagnostics market. The primary sources from the demand side include OEMs, private and contract testing organizations and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

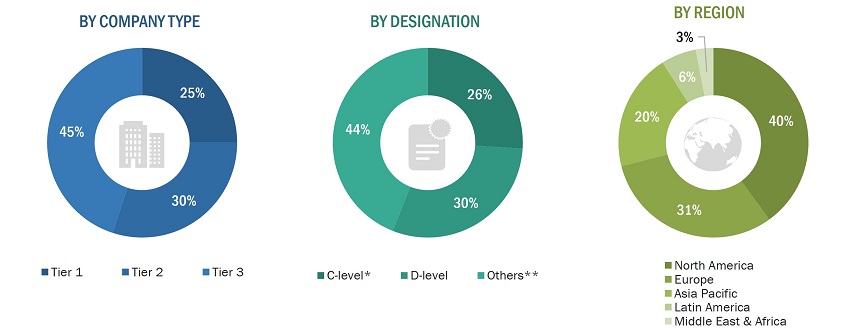

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation Methodology

In this report, the global sepsis diagnostics market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the sepsis diagnostics products business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

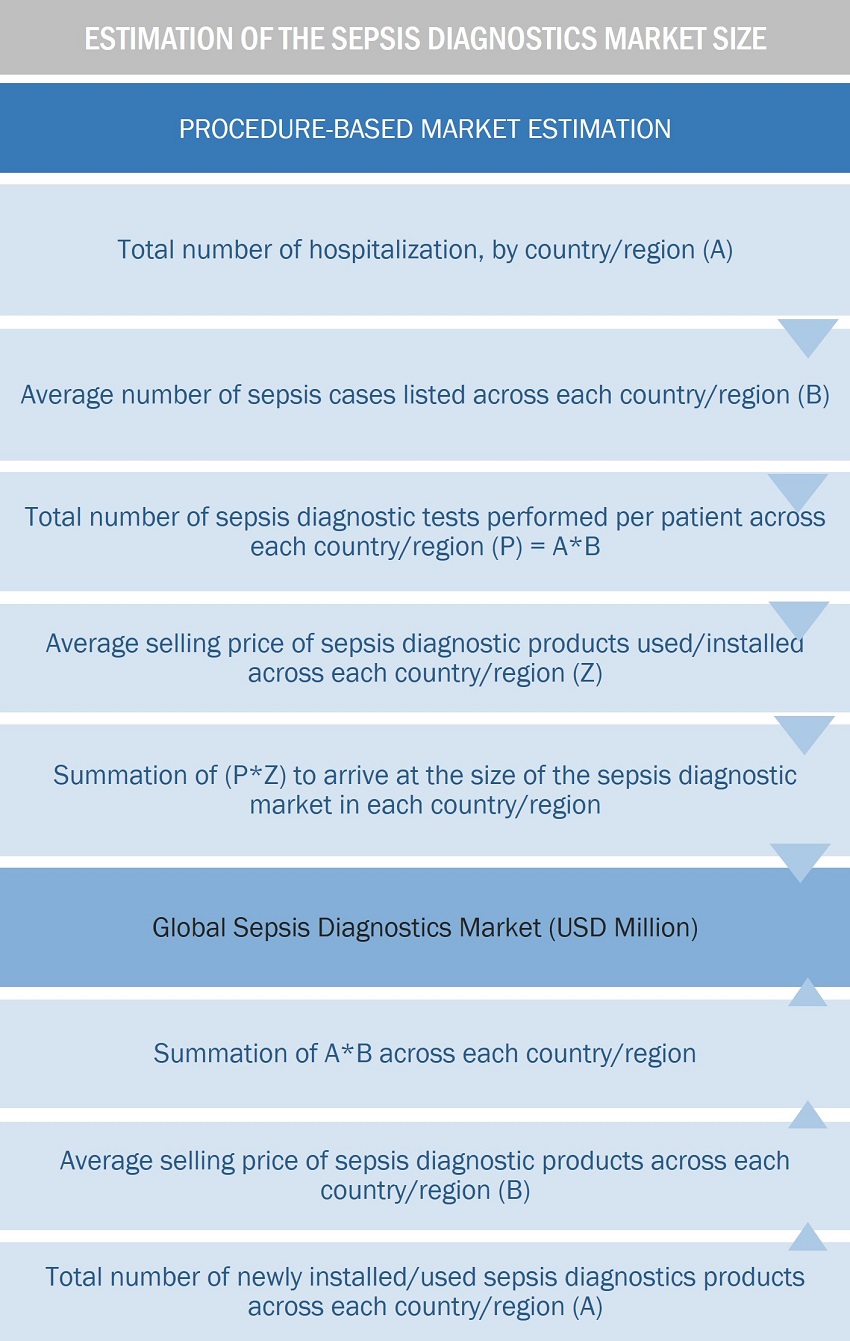

Approach 1: Procedure-based estimation approach

To calculate the global market value, installation/volume consumption of sepsis diagnostic products were calculated. This process involved the following steps:

- Finding the total number of hospitalization at the regional and/or country-level

- The average number of sepsis cases at the regional and/or country level

- The average number of sepsis diagnostics tests performed per patient at the regional and/or country-level

- The average selling price of each product type for a given year was triangulated to arrive at the market value data at the regional and/or country-level

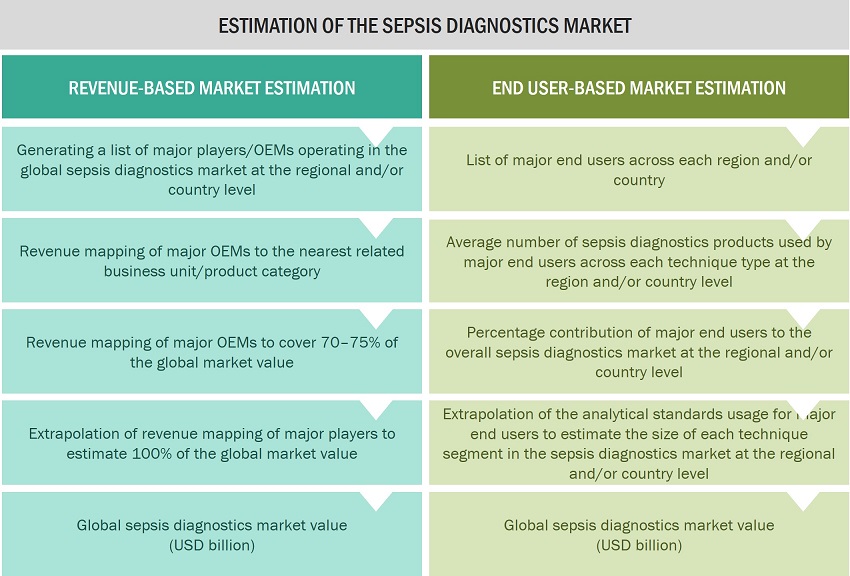

Approach 2: End user-based market estimation

During preliminary secondary research, the total sales revenue of sepsis diagnostics was estimated and validated at the regional and country level, triangulated, and validated to estimate the global market value. This process involved the following steps:

- Generating a list of major customer facilities across each region and country

- Identifying the average number of sepsis diagnostics product supplies used by major customer facilities across each product type at the regional/country level, annually

- Identifying the percentage contribution of major customer facilities to the overall sepsis diagnostics expenditure and usage at the regional/country level, annually

- Extrapolating the annual usage patterns for various products across major customer facilities to estimate the size of each product segment at the regional/country level, annually

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global sepsis diagnostics market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the sepsis diagnostics market was validated using both top-down and bottom-up approaches.

Market Definition

Sepsis is a life-threatening condition caused by pathogen infection. It develops when chemicals released into the bloodstream to fight the infection trigger inflammatory responses throughout the body. This is a three-stage syndrome—from sepsis to severe sepsis and septic shock. Septic shock is the last stage that results in extremely low blood pressure and a lack of response to normal fluid replacement. Inflammation leads to multi-organ failure; progress to septic shock could lead to death.

Key Market Stakeholders

- Sepsis diagnostics reagents, instruments, blood culture media manufacturers

- Research & academic laboratories

- Healthcare service providers (including hospitals, reference labs, diagnostic centers, and specialty clinics)

- Market research and consulting firms

- Medical device suppliers, distributors, channel partners, and third-party suppliers

- Business research and consulting service providers

- Venture capitalists and other government funding organizations

Objectives of the Study

- To define, describe, and forecast the sepsis diagnostics market on the basis of on technology, product, method, pathogen type, test type, end user and region.

- To provide detailed information regarding the major factors influencing the growth potential of the global sepsis diagnostics market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global sepsis diagnostics market.

- To analyze key growth opportunities in the global sepsis diagnostics market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East and Africa (GCC Countries and Rest of MEA).

- To profile the key players in the global sepsis diagnostics market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the global sepsis diagnostics market, such as agreements, expansions, and & acquisitions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global sepsis diagnostics market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top fifteen companies

Company Information

- Detailed analysis and profiling of additional market players (up to 15)

Geographic Analysis

- Further breakdown of the Rest of Europe's sepsis diagnostics market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of Asia Pacific sepsis diagnostics market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of the Latin America sepsis diagnostics market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sepsis Diagnostics Market

Have you not heard of T2 Biosystems rapid diagnostics direct from blood? Much faster than blood cultures, which is vital considering how quickly sepsis kills. FDA and CMS labeled it "breakthrough technology" and CMS subsidizes the test at 65, $97.

What are the after-effects of the COVID19 on the Global Sepsis Diagnostics Industry?

What are the upcoming trends in the Global Sepsis Diagnostics Industry?