Small Satellite Market by Mass (Small Satellite, CubeSat), Application, Subsystems (Satellite Bus, Payload, Solar Panel, Satellite Antenna), Frequency, End-use (Commercial, Government & Defence, Dual-use), Orbit and Region - Global Forecast to 2028

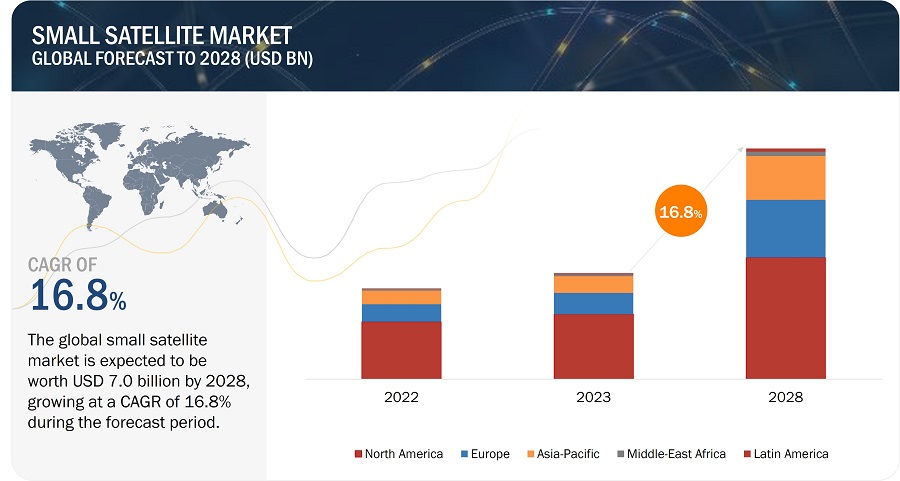

The Small Satellite Market size is expected to reach USD 7.0 Billion by 2028 from USD 3.2 Billion in 2023 growing at a CAGR of 16.8%. during the forecast period.The cost of launching small satellites into orbit has decreased significantly over the years, this is due to the advancement in launch vehicle technology and the emergence of dedicated small satellite launch providers.

Technological advancements in small satellite industry have made it easier and more cost-effective to design, build, and operate small satellites. For example, improvements in miniaturization have made it possible to pack more functionality into smaller and lighter satellites. Additionally, there is a growing demand for earth observation data and imagery for applications such as weather forecasting, crop monitoring, and environmental monitoring. Small satellites are well-suited for these types of missions, as they can provide frequent and detailed imagery at a relatively low cost. Small satellites are also used for communications services, such as providing internet connectivity to remote areas of the world. With the increasing demand for high-speed internet and the proliferation of connected devices, the demand for satellite-based communication services is likely to continue to grow. Small satellites are also being increasingly used for defense and military applications, such as intelligence gathering, surveillance, and reconnaissance. The compact size and maneuverability of small satellites make them an attractive option for these types of missions.

Small Satellite Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Small Satellite Market Dynamics

Driver: Growing demand for LEO-based small satellites

There is a growing demand for low-cost small satellites with increased capacity for enterprise data (retail, banking), the energy sector (oil, gas, mining), and governments in industrialized countries. The demand for low-cost broadband is also rising among individual consumers in less developed countries and rural areas, which may not have access to the internet. These market expectations are driving investments in small sat-based LEO constellations. There is a high demand for low-cost, high-speed broadband in industrialized countries. If all planned GEO HTS satellites and LEO constellations succeed, the supply could be much higher than the expected demand, which would drive the price per megabit down.

Satellite constellations by SpaceX (US), Orbcomm (US), SES SA (Luxembourg), and Planet Labs (US) are present in orbit. OneWeb (UK), Boeing (US), TeleSat (Canada), and Amazon (US) are developing their constellation of small satellites. Although there is high demand for low-cost, high-speed broadband in industrialized countries, if all planned GEO HTS satellites and LEO constellations succeed, the supply could be much higher than expected. This would drive the price per megabit down to 3 terabits of bandwidth by 2025 for broadband access from GEO, MEO, and LEO satellites. The proposed LEO constellations collectively could deliver these broadband access services almost ten times as much.

Driver: Rising need for Earth Observation imagenry and analytics

Earth observation services primarily cover the monitoring of agricultural fields, detection of climatic changes, disaster mitigation, meteorology, and several other resources. The requirement for high-resolution earth imaging has increased across verticals, as images can be used to manage land, water, and forest resources precisely. The US government is the largest buyer of satellite imagery today. Thus, most smallsat companies from the US and other countries consider the US a primary executor of this technology.

According to the Science and Technology Policy Institute, the smallsat imagery market is expected to rise at a compound annual growth rate of 49%, which could take the market to USD 8.8 billion by 2030 if growth remains that high.

Restraints: Absence of unified regulations and government policies across nations

Government policies at the nation-state and international levels directly or indirectly influence the evolution of the small satellite ecosystem and industry. Currently, there is no comprehensive global or domestic on-orbit regulation regime. There are regulations related to the launch and re-entry of satellites in the spectrum and remote sensing in the US. For instance, there are no regulations related to on-orbit activities, such as rendezvous and proximity operations, space-based Space Situational Awareness (SSA), or RF mapping. A consensus has not been reached internationally, with more than 75 countries engaged in small satellite activities. A few indicators depict that there will be a comprehensive global regime beyond the high-level dictates in the Outer Space Treaty.

National acceptance and commitment determine the liability of satellites. Hence, small satellite manufacturers are hindered due to supervision and authorization for registration and licensing. They are usually regulated slowly for countries with experience in the space field. The national governments either lack knowledge or adopt a time-consuming process when they monitor all space activities that implicate their country on the international level. It is also important to record all objects sent to space and ensure that each space-related project has peaceful purposes. Although operators have expressed interest in developing regulations that would provide certainty to investors, there are concerns about burdensome regulations that could drive companies to move from country to country. Developing policies and regulations for the quickly evolving commercial space industry will be a challenge for the next 10 years as the timeline in which operators and policymakers function does not necessarily align. The main goals of these policies had been formulated on the principles of promoting international cooperation between the operators and users of different sizes of satellites. These policies aim to better the proposed future human space flight, prevent damages caused by man-made debris, and improve the lives of humans by continuing space exploration in a mutually peaceful environment. The policy outcome is to protect all the users of space and the prosperity of human society.

Restraints: Lack of dedicated small satellite launch vehicles

Current options for smallsat launches are limited to rideshares either as secondary payloads on rockets launching large satellites or carrying cargo to the International Space Station. The piggyback launch has the advantage of low price, but it implies a defined orbit and eventually delays the prime spacecraft launch. These options impose restrictions in terms of integration & launch schedules, orbit destinations, and loss of flexibility with respect to subsystems in the small satellite.

Spaceflight Industries (US), ECM Space (Germany), TriSept (US), Tyvak (US), and Innovative Solutions in Space (Netherlands) have developed technology to safely include large numbers of smallsats as secondary payloads on large launchers to ease the launch process. Existing large launcher organizations such as ISRO (India), ULA (US), Glavkosmos (Russia), Arianespace (Europe), and MH (Japan) are announcing plans to increase the number of launches in the coming years. Blue Origin, SpaceX, and ULA are developing large new launchers, which are expected to arrive online in the next 2–5 years for smallsat rideshares.

There is a deficiency of dedicated small satellite launch vehicles for only small payloads that would provide reliable, fast, and dedicated access to a variety of orbits and planes. The typical specific launch cost of these vehicles is often greater than their medium and intermediate lift counterparts, and the payload may not utilize the full capability of the vehicle. The payload operator may, therefore, not justify the use of the launch vehicle economically. Competitive prices, similar complexity as huge LVs, profit reduction for LV manufacturers, and export issues are the restraints for the growth of the small satellite market.

Opportunities: Development of satellite network to provide internet access in areas without broadband connectivity

LEO satellite systems like Starlink, TeleSat, OneWeb, etc., are already placed in orbit. Thus, customers can check satellite services worldwide, even where the terrestrial internet is inaccessible. Companies are making efforts to capitalize on the opportunity to provide internet to those parts of the world with little infrastructure and connectivity. Although the global telecommunications industry has built a robust internet network comprising fiber optic cables, radio, and microwave towers for terrestrial communications, along with undersea cables, huge global populations still remain unconnected.

Currently, over 40% of the global population does have access to the internet. The construction of cable infrastructure for every home in the world would cost billions of dollars. The US telecom estimates that laying a fiber optic cable costs approximately USD 27,000 per mile. Satellite internet connectivity is less expensive than laying millions of miles of fiber optic cables. It is ideally suited for delivering internet access to rural and remote areas. This is a great opportunity for the market as the internet allows people to live in the countryside and enjoy the benefits of fast internet, including remote working, schooling, and staying connected to friends, entertainment, and news.

Opportunities: Increased government investemnets in space agencies

The US government invests in every part of the smallsat ecosystem and is likely to continue investing upstream and downstream. Governments worldwide have increased their investments in smallsats.

For many countries, government investments, generally in R&D and start-ups, are seen as a way to address societal challenges, facilitate independence from imports, and eventually become a global solutions provider in space. The governments also recognize that they do not have a well-developed venture sector like the US. Thus, the governments provide venture capital (VC) funds.

In 2020, Japan started cabinet-level Impulsing Paradigm Change through the Disruptive Technologies Program (IMPACT) and the Innovation Network Corporation of Japan (INCJ). They both have the potential to advance space start-ups.

ESA announced a nearly USD 33 million investment in advancing Hall Effect thruster (HET) propulsion technology and other business incubators. The government of China has dedicated USD 339 billion to start-ups in the nation (not all of which would focus on space), which is a sign that governments compensate for the lack of private funding. Also, the Industrial Technologies office of the Canadian government plans to provide Canada-based UrtheCast USD 13 million to support the ongoing development of its X- and L-band synthetic aperture radar (SAR) constellation on a smallsat platform. Thus, increased government investments will offer growth opportunities for the small satellite market.

Challenges: Telemetry, tracking, and command issues

The size limitations of small satellites need integrated electronic equipment based on digital logic. Moreover, the LEO requires telecommunication modules with high throughput to transmit a large amount of data to Earth in a short time. There is a need for new technology regarding the Telemetry, Tracking, and Command (TT&C) module to meet such requirements. Several spacecraft terminal designs that could be used to support TT&C exist. A significant driver to develop the more advanced recent designs is the prospect of LEO communication systems, such as Teledesic/Celestri, which include laser communications crosslinks as part of the baseline design. Since this represents a large potential market with a need for hundreds to thousands of terminals in a complete constellation, much effort has been made to develop designs that will result in low-cost terminals. This creates an opportunity for low-cost, high-data-rate systems to be applied to small satellite TT&C for a cost on par with current spacecraft transponders. Distributed systems using formation-flying satellites might use a synergy of payloads onboard different satellites instead of a multiplying effect of constellations to enhance coverage.

Challenges: Complex propulsion systems

The small size and relatively low cost of small satellites have made them a popular choice for commercial launches in recent years, but the process of propelling such satellites into space comes with many problems. Several methods of pragmatic spacecraft propulsion have been developed, each with its drawbacks and advantages. Most satellites have simple, reliable chemical thrusters (often monopropellant rockets) or resist jet rockets for orbital station-keeping, and some use momentum wheels for attitude control.

These systems are complex and require minimal volume to the surface area to dissipate heat. They may be used on larger small satellites, while other micro/nanosats have to use electric propulsion, compressed gas, vaporizable liquids such as butane or carbon dioxide, or other innovative propulsion systems that are simple, cheap, and scalable. There is a need for new micro-propulsion systems with low mass fraction, high specific impulse, and high Delta-V for smallsat deployment and control. This control is needed because of the increasing number of small satellites in any specific orbit and the growing use of software-defined payloads. The lack of micro-propulsion is a roadblock that is one of the top priority challenges. Several micro-propulsion technologies, miniaturization of existing systems, and innovative concepts have been proposed. However, very few were beyond Technical Readiness Level 3.

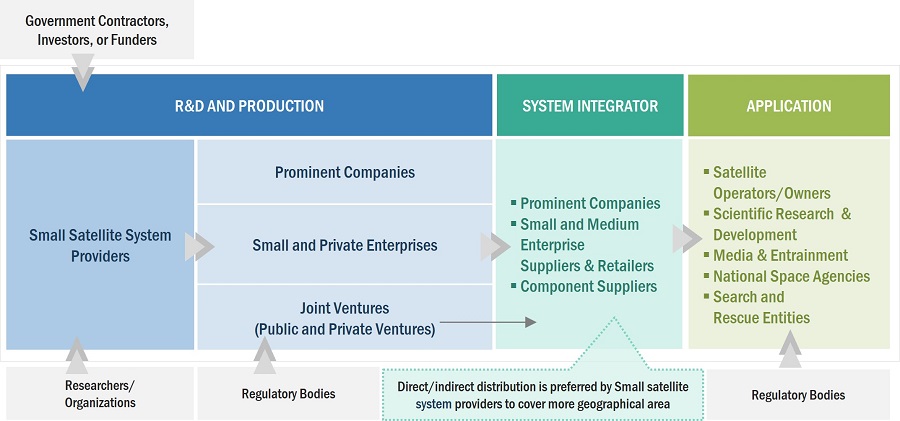

Small Satellite Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of small satellite systems and platforms. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Sierra Nevada Corporation (US), L3Harris Technologies (US), Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), and Airbus Defence and Space (Netherlands).

Based on Application, earth observation segment is estimated to account for the largest market share of the small satellite market

Based on application, the earth observation segment is estimated to account for the largest market share. The growing utilization earth observation satellites in a variety of industry sectors, as well as the integration of digital data analysis and geospatial data fusion, have all contributed to the market value growth.

Based on Application, commuincation segment is projected to register the highest CAGR of the small satellite market during the forecast period

Based on application, the communication segment is projected to registar the highest growth rate during the forecast period. A rise in R&D activities for communication-related missions is expected to offer enhanced quality communication systems with the help of highly sophisticated miniaturized onboard nano, micro, and mini subsystems, coupled with advanced mission-compatible ground-station technology.

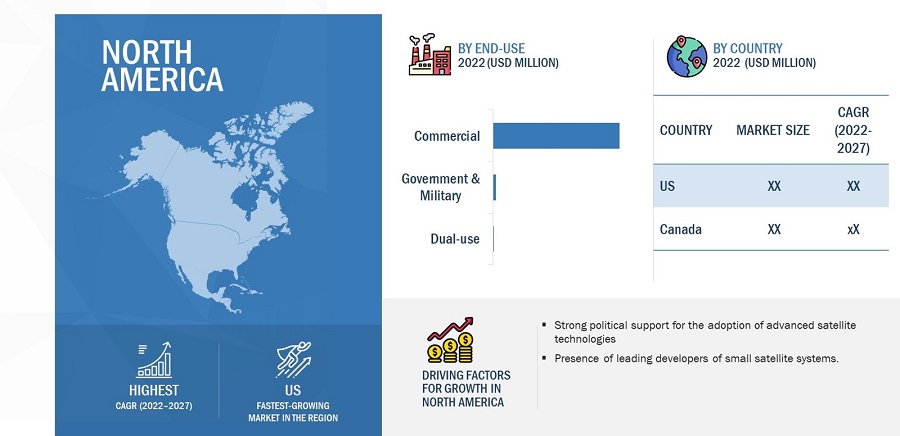

Based on end-use, the commercial segment are anticipated to dominate the market

Based on end-use, the commercial segmented holds the largest market share. Due to the expanding number of internet services and mobile users in 2022, the commercial category will hold the largest market share. The growing usage of small satellites for enemy surveillance is propelling the market forward. Commercial applications for small satellites include navigation, telecommunication, weather forecasting, and others.

The military segment will expand dramatically as satellites are increasingly used in surveillance operations. The government segment will expand significantly as government space organizations get more involved in small satellite development initiatives.

Based on end-use, the commercial segment is also anticipated to hold the highest growth rate

Based on end-use, The commercial sector in the small satellite market is being driven by a surge in demand for cost-efficient solutions in Earth observation, communication, and data services. Smaller satellites present advantages in terms of lower launch expenses and quicker deployment, which are appealing to businesses aiming to leverage space-based opportunities while managing financial risks..

CubeSat Segment of the small satellite market by mass is projected to witness the highest CAGR during the forecast period.

Based on mass, the market is segmented into small satellite and CubeSat. The CubeSat market is witness to show the highest growth rate during the forecast year , but small satellite segments holds the major market share in 2023. The adoption of CubeSat for the research purpose by the educational institutes to promote the adoption of CubeSat. Additionally, the, CubeSats are also used to test new technology. This has included putting new propulsion systems, communication systems, and navigation technologies.

Small Satellite Segment of the small satellite market by mass is anticipated to hold the highest market share during the forecast period.

Based on mass, the market is segmented into small satellite and CubeSat. Reduced launch costs, faster deployment, and enhanced data accessibility appeal to businesses, fostering innovation in Earth observation, telecommunications, and scientific research is enhancing the small satellite business. The growing application of small satellites due to their ability to provide enhanced space imagery and better communication is one of the key factors driving the small satellite segment.

Satellite bus segment of the small satellite market by subsystem is projected to witness the highest market share of the small satellite market.

The satellite bus segment is to hold the highest market share. The demand is influenced by the adoption of small satellites for government and commercial applications. the satellite bus segment in the small satellite market plays a crucial role in enabling the development and operation of small satellites, by providing a standardized, cost-effective platform that can be easily customized for a range of applications. The market for satellite buses is anticipated to continue expanding and innovating as long as there is a demand for small satellite missions.

The laser/optical band segment of the small satellite market by frequency is projected to dominate the market.

The market based on the frequency is segment into Ku-band, Ka-band, X-band, C-band, L-band, S-band, HF/VHF/UHF-band, laser/optical band and Q/V-band. The laser/optical band holds the highest CAGR during the forecast period. The Ku band is to holds the highest market share. The technological advantage of Ku-band such as high speed data transfer, enhanced connectivity and short-range and high-resolution imaging capability to propel the market.

The LEO segment of the small satellite market by orbit is projected to dominate the market.

The Low Earth Orbiting (LEO) Segment holds the major market share of the small satellite market by orbit segment. The market is influenced by the growing demand for launching CubeSats and small satellites that help achieve attitude and orbit control and orbital transfers. The growth of the space sector has led to the greater use of advanced payload components.

The GEO segment of the small satellite market by orbit is anticipated to hold the highest CAGR

The Geostationary Earth Orbit (GEO) Segment holds the highest growth rate of the small satellite market by orbit segment. The GEO (Geostationary Earth Orbit) segment in the small satellite market is thriving due to rising demand for persistent connectivity and high-resolution Earth observation and communication services. GEO satellites offer stable, fixed-point coverage, making them essential for real-time data access, attracting commercial and government clients. This sustained demand presents profitable business opportunities for satellite manufacturers and service providers.

The North American market is projected to contribute the largest share for the small satellite market.

North America is expected to lead the small satellite market in 2023. The US is the largest market for small satellite market in North America. The growth of the small satellite market in North America can be attributed to the increased demand for small satellite deployments, along with advancements in digital satellites carried out by NASA, the US Department of Defense, and private players, such as SpaceX (US), Sierra Nevada Corporation (US), and Lucix Corporation (US). The successful launch of flexible satellites in space has led to increased space expeditions.

The European market is projected to hold the highest growth rate for the small satellite market.

Europe is expected to hold the highest growth rate the small satellite market during the forecast period. Technological innovations in the small satellite ecosystem and the increased deployment of these satellites are expected to fuel the growth of the market in Europe. The number of space exploration projects in the region is expected to increase over the next five years and is anticipated to trigger the demand for small satellites during the forecast period. The ability of small satellites to provide enhanced geospatial imagery has further boosted their demand in the region, as companies expect geospatial data to provide crucial information for supply chain management and business development.

Small Satellite Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Small Satellite Companies - Key Market Players

The Small Satellite Companies are dominated by globally established players such as Sierra Nevada Corporation (US), L3Harris Technologies (US), Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), and Airbus Defence and Space (Germany) are some of the leading players operating in the small satellite market, are the key manufacturers that secured small satellite contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements of commercial, government and military & space users across the world.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Estimated Market Size |

USD 3.2 Billion |

|

Projected Market Size |

USD 7.0 Billion |

|

CAGR |

16.8% |

|

Market size available for years |

2019–2022 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Mass, By Application, By Subsystem, By End-use, By Frequency, By Orbit |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Companies covered |

Sierra Nevada Corporation (US), L3Harris Technologies (US), Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), and Airbus Defence and Space (Germany) and among others. |

Small Satellite Market Highlights

The study categorizes the small satellite market based on Application, Sub-system, End-use, Mass, Frequency, Orbit and Region.

|

Segment |

Subsegment |

|

By Application |

|

|

By Subsystem |

|

|

By End-use |

|

|

By Mass |

|

|

By Frequency |

|

|

By Orbit |

|

|

By Region |

|

Recent Developments

- In January 2022, SpaceX:- Starlink, the satellite internet division of SpaceX, applied for a commercial license in India to provide broadband and other services.

- In November 2021, SpaceX:- Starlink introduced a new rectangular dish capable of receiving the company’s internet signal orbiting overhead.

- In June 2021, Raytheon Intelligence & Space (RI&S) signed a contract to offer logistics and repair services for all US Marine Corps (USMC) ground equipment.

- In March 2021, Raytheon Technologies signed a contract worth USD 178 Million to support the US Air Force intel-sharing system transition, the service’s primary intelligence-sharing system.

- In February 2021, The French defense procurement agency (DGA) awarded Thales and Airbus a contract for the new joint tactical signals intelligence (SIGINT) system to upgrade the French forces' critical signal monitoring, direction finding, and spectrum analysis capabilities.

Frequently Asked Questions (FAQ):

Which are the major companies in the small satellite market? What are their major strategies to strengthen their market presence?

Some of the key players in the small satellite market are Sierra Nevada Corporation (US), L3Harris Technologies (US), Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), and Airbus Defence and Space (Netherlands) among others, are the key manufacturers that secured small satellite system contracts in the last few years.

What are the drivers and opportunities for the small satellite market?

The market for small satellite equipment has grown substantially across the globe, and especially in Asia Pacific. Small satellites, are revolutionizing the space industry by allowing for more cost-effective and efficient access to space. Satellite-based services and applications such as Earth observation, remote sensing, communication, and navigation are in high demand. The small Satellites can deliver this services at the affordable price to the end-users. The Small satellites allow universities and research institutions to conduct experiments and research in space that were previously only available to larger organizations. As a result, the number of educational and research-focused small satellite missions has increased.

Which region is expected to grow at the highest rate in the next five years?

The market in Europe region is projected to grow at the highest CAGR of from 2023 to 2028, showcasing strong demand from small satellite in the region. The Several European countries and organizations are also actively investing in small satellite. For example, through its ARTES program, which provides funding and technical support for research and development projects, the European Space Agency (ESA) has actively promoted and supported the development of small satellites. Several European firms, including Airbus, Thales Alenia Space, and OHB, have also developed and launched small satellites for a variety of applications.

Which type of small satellite is expected to significantly lead in the coming years?

Minisatellites segment of the small satellite market is projected to witness the highest CAGR due to increasing use for the communication and earth observation application in the commercial market. Another factor is their low-cost manufacturing and adaptability. Minisatellites are expected to be utilized in the future as technology advances and the need for space-based services and applications develops. The growing demand for high-speed internet connectivity in remote and underserved areas is one of the major factors driving the adoption of minisatellites.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

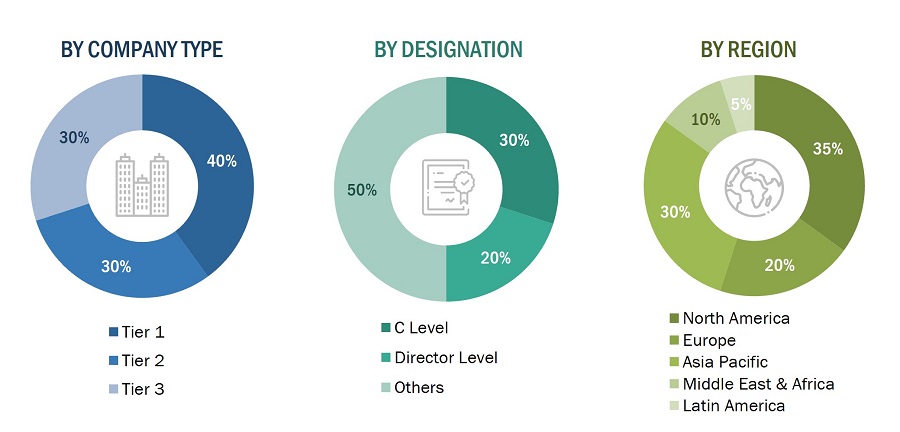

The study involved four major activities in estimating the current size of the small satellite market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The ranking analysis of companies in the small satellite market was carried out using secondary data from paid and unpaid sources, as well as by analyzing the product portfolios and service offerings of key companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study included the European Space Agency (ESA), the National Aeronautics and Space Administration (NASA), the United Nations Conference on Trade and Development (UNCTAD), the Satellite Industry Association (SIA), corporate filings such as annual reports, investor presentations, and financial statements of trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the small satellite market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from small satellite vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using small satellite were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of small satellite and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

Small Satellite Manufacturers |

Others |

|

Surrey Satellite Technology Ltd. |

Head of International Business |

|

Manatsu Space |

Co-Founder |

|

YSPM, LLC |

CEO & Principal Consultant |

|

Sapienza Universita di Roma |

Research Scholar |

|

Space Generation Advisory Council |

PR & Communication Coordinator |

|

Australian Youth CubeSat Initiative |

Project Advisor |

Market Size Estimation

The research methodology used to estimate the size of the small satellite market includes the following details.

- The top-down and bottom-up approaches were used to estimate and validate the size of the small satellite market. The research methodology used to estimate the market size includes the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

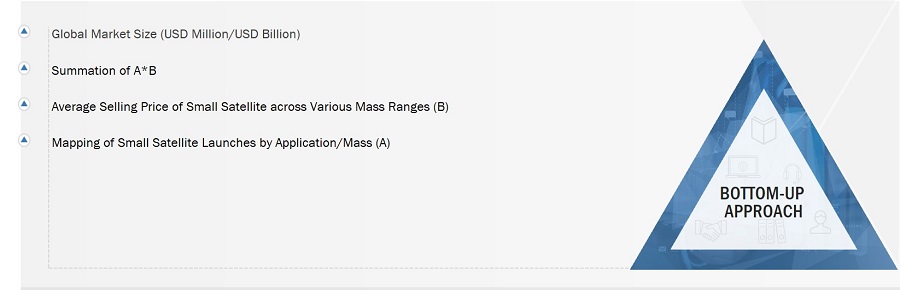

Global small satellite market size: Bottom-Up Approach

The small satellite market, by application and mass, was used as a primary segment for estimating and projecting the global market size from 2023 to 2028.

The market size was calculated by adding the mass subsegments mentioned below, and the different methodologies adopted for each to arrive at the market numbers are delineated below:

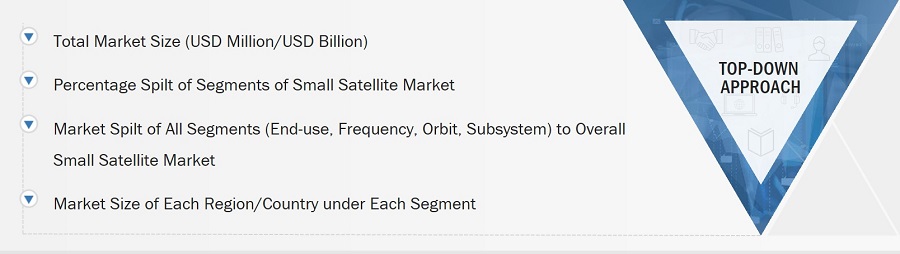

Global small satellite market Size: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research. The size of the immediate parent market was used to implement the top-down approach and calculate specific market segments. The bottom-up approach was also implemented to validate the revenues obtained for various market segments.

- Companies manufacturing small satellites and their subsystems are included in the report.

- The total revenue of these companies was identified through their annual reports and other authentic sources. In cases where annual reports were unavailable, the company revenue was estimated based on the number of employees, sources such as Factiva, ZoomInfo, press releases, and any publicly available data.

- Company revenue was calculated based on their operating segments.

- All publicly available company contracts related to small satellites were mapped and summed up.

Based on these parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), the share of small satellites in each segment was estimated

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the small satellite market based on application, frequency, mass, subsystem , end-use orbit and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the small satellite market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies.

Market Definition

Small satellites are miniaturized, low-cost satellites designed for commercial, communication, and space research purposes. According to the National Aeronautics and Space Administration (NASA), small satellites are classified according to their mass in kilograms (kg). The launch mass of a small satellite can be considered below 500 kg.

These satellites are used for Earth observation & remote sensing, communication, mapping & navigation, surveillance & security, meteorology, scientific research & exploration, space observation, and various other applications by the defense, civil, commercial, and government verticals.

Market Stakeholders

- Satellite Component Manufacturers

- Satellite Manufacturers

- Satellite Integrators

- Launch Service Providers

- Government and Civil Organizations Related to the Market

- Small Satellite Companies

- Payload Suppliers

- Scientific Institutions

- Meteorological Organizations

- Component Suppliers

- Technologists

- R&D Staff

Available Customizations

MarketsAndMarkets offers the following customizations for this market report:

- Additional country-level analysis of the small satellite market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the small satellite market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Small Satellite Market

Hi Team, kindly provide market intelligence on commercial space transportation. Thanks

Hi Team, Kindly provide intelligence on space platforms and products such as Göktürk-1, earth observation satellite, Göktürk-2 (launched 2012), earth observation satellite, Göktürk-3 satellite, Türksat 6A, communications satellite. Thanks, Turkish aerospace.

Looking into the current small satellite quantitative trend over the past few years (mainly micro/mini satellite size) and any future predictions.

VACCO builds small propulsion systems for several prime contractors. We are evaluating investing in additional B&L and M&E to support this product line and would like to understand how large is the market place, key suppliers, and timeline with the technology. [email protected]

Looking to estimate the potential market for much lower-cost liquid propellant rocket engine; scalable across a wide range of thrusts for boost, sustain, orbital, and planetary ascent applications.