Smart Lighting Market by Installation Type (New Installations, Retrofit Installations), Offering (Hardware, Software, Services), End-use Application (Indoor, Outdoor), Communication Technology (Wired, Wireless) and Region - Global Forecast to 2029

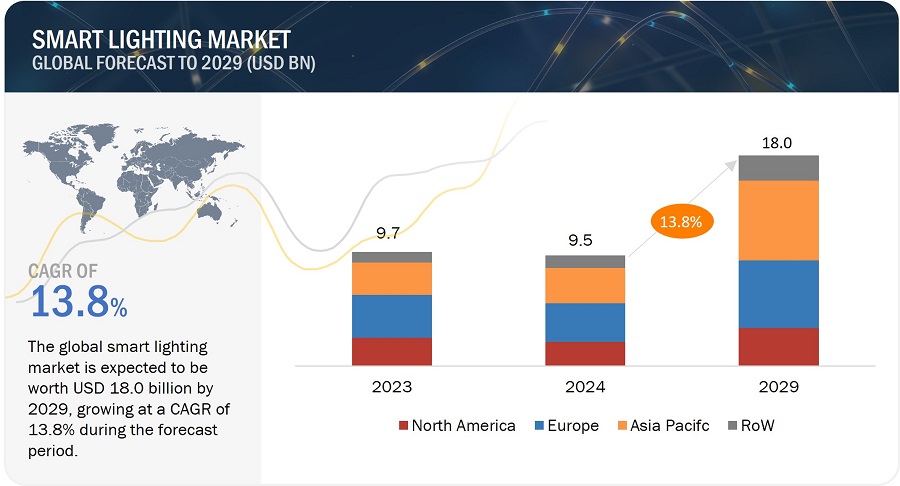

[230 Pages Report] The smart lighting market is expected to reach USD 18.0 billion by 2029 from USD 9.5 billion in 2024, at a CAGR of 13.8% during the 2024-2029 period.

Smart lighting, characterized by its ability to be controlled remotely-often through smartphone applications-offers a plethora of features including timers, schedules, motion detection, voice commands, and color adjustments. Rooted in the concept of self-monitoring, analysis, and reporting technology (SMART), smart lighting systems are engineered to transcend the basic functionality of illumination. They enhance security, safety, convenience, health, wellness, and energy efficiency. Moreover, these systems seamlessly integrate with other smart home devices and can be managed through various wireless transmissions, such as Wi-Fi radios and Bluetooth. The anticipated significant growth of the smart lighting market in the upcoming years is fuelled by the escalating popularity and acceptance of smart home technology.

Smart lighting entails lighting systems controlled by network-driven control systems, ensuring the right amount of light at the right place and time. Its primary aim is to enhance energy efficiency, leading to long-term cost and power savings. Comprising integrated software and hardware, smart lighting systems automatically adjust lighting based on predefined parameters. It includes various hardware devices such as lights, luminaires, and lighting control components, utilizing different communication technologies to facilitate device interaction as per application requirements. Employing both wired and wireless communication technologies, these systems overcome the cost and complexity limitations associated with conventional wired controls. Wireless networking elevates the intelligence of modern lighting control systems, enabling companies to achieve cost savings and operate in an environmentally friendly manner. Smart lighting solutions encompass indoor applications like residential, commercial, and industrial settings, as well as outdoor applications such as highways, roadways, architectural lighting, and public spaces.

Smart Lighting Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Smart Lighting Market Dynamics

Driver: Maximizing efficiency with IoT-integrated smart lighting solutions

Smart lighting leverages IoT-enabled sensors, bulbs, or adapters, empowering users to effortlessly manage their home or office lighting through their smartphone or smart home management platform. These solutions offer versatile control options, allowing users to operate them via external devices like smartphones or smart assistants, set schedules, or activate them based on sound or motion triggers.

According to IBM, the day-to-day operational expenses of a building constitute 70 percent of its total cost throughout its lifespan, encompassing basic utilities such as energy and water. These costs present significant opportunities for optimization through IoT technology.

Smart lighting systems possess the capability to autonomously detect occupancy status within a building, relying on other IoT devices like thermostats or security systems, or adhering to user-defined schedules. By ensuring that lights are not left illuminated unnecessarily, whether at the end of a workday or during periods of absence, smart lighting becomes a valuable asset for energy conservation and operational efficiency.

Moreover, smart lightbulbs predominantly utilize LED technology rather than incandescent bulbs. Switching to LED bulbs can yield substantial savings, with the average household potentially saving around $76 annually by making the transition. However, the appeal of smart lighting solutions lies not only in these savings but also in the added convenience and customization they offer. IoT-enabled smart lighting enables users to:

- Save money by transitioning to energy-efficient LED bulbs.

- Establish schedules to ensure lights are off when not required, or remotely control lighting schedules for security purposes while away from home.

- Adjust the color or dimness of lights in various rooms or individual bulbs, providing personalized lighting experiences tailored to specific preferences and needs.

Restraint: Security risks associated with internet-connected lighting systems

In connected lighting systems, wireless networks serve as the foundation for linking various components within the lighting control infrastructure. Connected lights consist of advanced LED fixtures equipped with integrated sensors and cameras, all interconnected through a wireless network. Data and information are typically stored in the cloud for remote accessibility.

However, the reliance on internet connectivity in connected or smart lighting products introduces security vulnerabilities that can be exploited by hackers. Such breaches could lead to severe consequences, including unauthorized access to control systems for lighting, door locks, and security cameras. The potential for intruders to manipulate smart systems in homes or public venues raises significant security and privacy concerns.

Moreover, in wireless lighting solutions, the reliability of communication diminishes with increasing obstacles and distances between devices, affecting data throughput. To mitigate these challenges, connected luminaires often establish a mesh nodal network, allowing each luminaire to communicate with its nearest counterpart. Despite this approach, the deployment of numerous wireless sensors within a connected lighting system can still result in data loss due to obstacles and interference from unlicensed signals.

Opportunity: Rising demand for PoE-based lighting solution in healthcare and commercial application

Power over Ethernet (PoE) streamlines the provision of power and network connectivity to devices via a single network cable. PoE solutions simplify and reduce the cost of network installation and expansion in buildings where installing new power lines is impractical or costly. These solutions alleviate congestion for organizations, as they eliminate the need for significant budget allocations to enhance operational capabilities.

Commercial buildings, including office spaces, warehouses, and retail establishments, are increasingly embracing PoE-enabled solutions due to their numerous benefits. These include cost savings in installation, reduced overall design and construction expenses, and minimized labor efforts by decreasing the quantity of Ethernet cables required. According to the University of Michigan, the anticipated expansion of commercial building floor space in the US holds substantial promise for PoE lighting vendors, presenting opportunities for manufacturers in the connected lighting sector.

Furthermore, PoE-enabled lighting solutions are gaining traction in various commercial applications, particularly in healthcare environments. In healthcare settings, energy efficiency is crucial for curbing escalating overhead costs, and lighting plays a significant role in enhancing patient experiences. Integration of PoE lighting with IoT technology allows programming environments to adjust lighting intensity, creating a more comfortable and less distracting atmosphere for patients. Hospitals and nursing homes can even automate lighting to respond to patient movements, turning lights on when they leave their bed and off when they return, thereby enhancing convenience and reducing energy waste.

Challenge: Interoperability challenge between multiple network components

The central challenge within the lighting control system sector revolves around the availability of solutions that integrate multiple interoperable technologies within a unified framework. End users grapple with selecting an appropriate lighting control solution from a wide range of options, compounded by the absence of standardized norms, which complicates the integration process. The absence of uniform standards gives rise to compatibility issues among disparate components, impeding seamless interoperability and communication within lighting systems. Traditional lighting control systems typically comprise hardware and software from the same manufacturer, while connected lighting solutions incorporate controls from various manufacturers, exacerbating interoperability challenges. Consequently, there is an urgent need to establish standard protocols to streamline the development of compatible products. Entities such as The Connected Lighting Alliance (TCLA) and the ZigBee Alliance are actively engaged in efforts to standardize protocols within connected lighting technology, with the goal of enabling luminaires to efficiently gather and exchange data for analytical purposes. Among wireless technologies utilized for communication within smart lighting systems, ZigBee, EnOcean, Z-Wave, and Wi-Fi are prominent, with ZigBee being widely preferred by system manufacturers. However, the current landscape is characterized by manufacturers adhering to proprietary protocols and standards to gain competitive advantages, thereby hindering the establishment of common standards and communication protocols, consequently constraining market expansion.

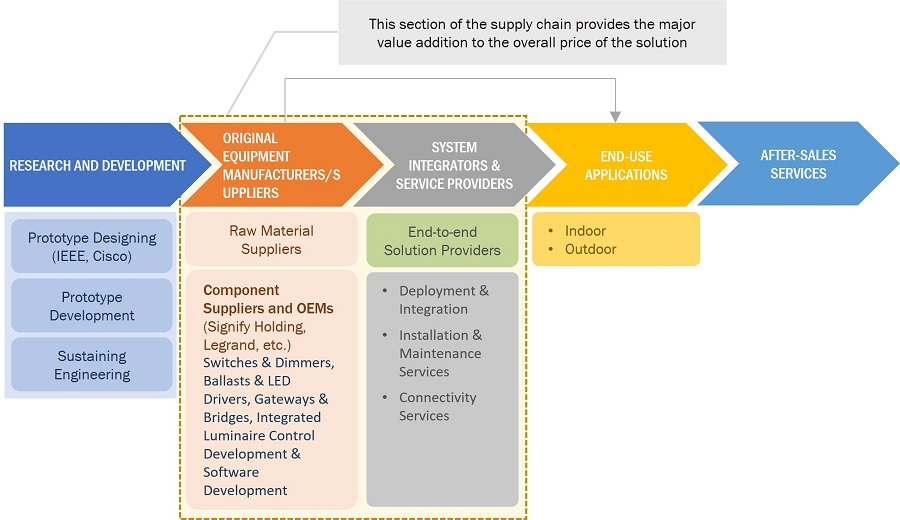

Smart lighting Market Ecosystem

The prominent players in the smart lighting market are Signify Holding (Netherlands), ACUITY BRANDS, INC. (US), Zumtobel Group (Austria), ams-OSRAM AG (Austria), and Panasonic Corporation (Japan).

Retrofit installations are expected to grow at the highest cagr during the forecast period.

Retrofitting involves upgrading old smart lighting systems to enhance lighting performance, adjust light characteristics, decrease heat emissions, and lower energy usage. During retrofitting, portions of existing lighting fixtures and conventional light sources are substituted with LED lamps, along with non-integrated luminaires and controls like LED drivers, dimmers, sensors, switches, and gateways. This process typically doesn't necessitate the installation of new poles or fixtures. Presently, LED retrofitting stands as one of the most prevalent methods for customers to upgrade their lighting systems.

LED retrofitting utilizes existing lighting fixtures by employing straightforward screw-in options or retrofit kits designed to fit into current lighting setups. These retrofits offer simplicity in installation. Plug-and-play LED retrofit options provide the easiest transition to LED technology, allowing users to effortlessly insert plug-in LED modules into their existing fixtures. Nonetheless, retrofit installations can be somewhat more intricate, as they require adjustments to accommodate existing light fixtures for compatibility with the new components.

Outdoor segment is projected to grow at the highest CAGR during the forecast period from 2024-2029.

Smart outdoor lights offer a range of intelligent options for controlling gardens, building exterior lighting, highway & roadways lighting, architectural lighting, and lighting for public places. They can be operated through various means such as motion sensors, wall panels, mobile devices, or voice commands. Users have the flexibility to select from different types of bulbs, light panels, LED strips, and more to achieve the desired illumination for outdoor spaces.

Installation of these lights can be tailored to meet specific requirements. Users can determine the types of lights they prefer and where they want them positioned. Expert installers can then devise a lighting solution that aligns with the user's preferences and complements the style of their garden.

Integrating intelligent lighting technologies ensures real-time dynamic control of outdoor lighting. These systems have the capability to adjust light levels based on factors such as traffic flow, weather conditions, and the presence of pedestrians, thereby enhancing safety and reducing energy consumption.

In November 2023, Signify Holding launched Philips Radii auto-linkable ultra efficient solar lights which are designed to synchronize and illuminate simultaneously upon motion detection. Utilizing ultra efficient technology, these solar lights can illuminate outdoor areas for up to six nights before requiring recharging from sunlight. Available as pedestal and wall lights, they ensure consistent performance even on cloudy days, providing reliable lighting for gardens and other outdoor spaces.

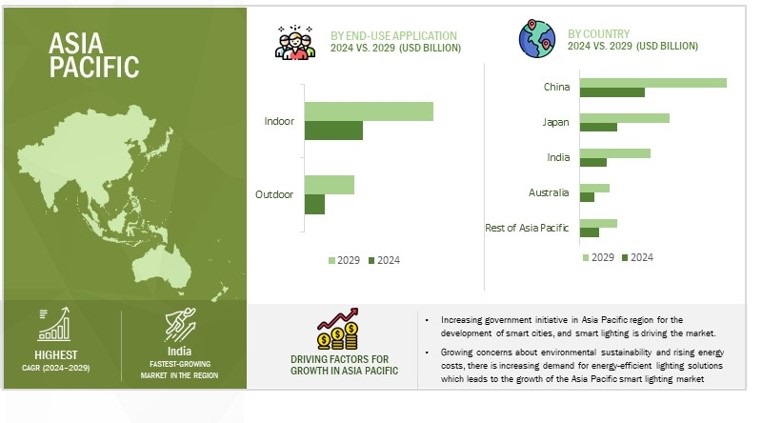

Asia Pacific region is expected to lead the market in 2029 and projected to have the highest CAGR in the forecast period from 2024-2029.

The Asia Pacific region is positioned to lead the charge as the swiftest-growing market for smart lighting systems in the upcoming forecast period. With its vast potential, smart lighting is anticipated to gain widespread adoption among consumers throughout the region, becoming an integral component of modernized households. The burgeoning construction activities across Asia Pacific significantly bolster the market's expansion, presenting numerous opportunities for energy-efficient and cutting-edge lighting systems. China and India are projected to witness the construction of approximately 200 million and 18 million homes, respectively, paving the way for innovative energy-saving lighting solutions and advanced lighting technologies.

Furthermore, the upsurge in smart city and infrastructure projects spearheaded by governments is poised to further fuel the demand for energy-efficient lighting solutions and advanced lighting systems in the years ahead. Government initiatives that offer subsidized LED lights are expected to play a pivotal role in driving the accelerated growth of the smart lighting market in the Asia Pacific region.

Smart Lighting Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the smart lighting companies with a significant global presence includes Signify Holding (Netherlands), Legrand (France), ACUITY BRANDS, INC. (US), ams-OSRAM AG (Austria), Honeywell International Inc. (US), Zumtobel Group (Austria), Wipro Lighting (India), Lutron Electronics Co., Inc (US), IDEAL INDUSTRIES, INC. (US) (Cree Lighting), LEDVANCE GmbH (Germany), Current (US), Savant Systems, Inc (US), Inter IKEA Systems B.V. (Netherlands), Dialight (UK), Schneider Electric (France), ABB (Switzerland), Lightwave (UK), RAB Lighting Inc. (US), Synapse Wireless Inc. (US), Panasonic Corporation (Japan), Leviton Manufacturing Co., Inc. (US), Syska (India), BUILDING ROBOTICS INC. (BRI), A SIEMENS COMPANY (US), Helvar (Finland), LIFX (US), Nanoleaf (Canada), Sengled GmbH (Germany), and TVILIGHT Projects B.V. (Netherlands).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million/Billion), Volume (Million Units) |

|

Segments Covered |

By Installation Type, Offering, End-use Application, Communication Technology and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major players in the smart lighting market are Signify Holding (Netherlands), Legrand (France), ACUITY BRANDS, INC. (US), ams-OSRAM AG (Austria), Honeywell International Inc. (US), Zumtobel Group (Austria), Wipro Lighting (India), Lutron Electronics Co., Inc (US), IDEAL INDUSTRIES, INC. (US) (Cree Lighting), LEDVANCE GmbH (Germany), Current (US), Savant Systems, Inc (US), Inter IKEA Systems B.V. (Netherlands), Dialight (UK), Schneider Electric (France), ABB (Switzerland), Lightwave (UK), RAB Lighting Inc. (US), Synapse Wireless Inc. (US), Panasonic Corporation (Japan), Leviton Manufacturing Co., Inc. (US), Syska (India), BUILDING ROBOTICS INC. (BRI), A SIEMENS COMPANY (US), Helvar (Finland), LIFX (US), Nanoleaf (Canada), Sengled GmbH (Germany), and TVILIGHT Projects B.V. (Netherlands). |

Smart Lighting Market Highlights

The study segments the smart lighting market based on installation type, offering, end-use application, communication technology and region.

|

Segment |

Subsegment |

|

By Installation Type |

|

|

By Offering |

|

|

By End-use Application |

|

|

By Communication Technology |

|

|

By Region |

|

Recent Developments

- In February 2024, Siemens and Enlighted, a prominent property technology company under Siemens, unveiled a strategic alliance with Zumtobel Group, a renowned global provider of lighting solutions. This partnership aims to promote the integration of smart building technologies, particularly intelligent IoT lighting, establishing novel benchmarks for efficiency and sustainability in building operations across the globe.

- In January 2024, at the Consumer Electronics Show in Las Vegas, NV, Legrand, a renowned global specialist and premier single-source provider of electrical wiring solutions, unveiled its newest addition to the radiant collection of smart lighting. This latest offering features new Matter-enabled Wi-Fi smart devices, slated for release in 2024. This advancement represents the next evolution of the Smart Lighting with Wi-Fi line, introducing the Matter standard to light switches, dimmers, and outlets. It underscores Legrand's ongoing dedication to innovation in the realm of smart lighting.

- In January 2024, Lutron Electronics Co., Inc. launched Maestro dual controls with built-in LED+ advanced dimming technology. The Maestro dual control models have been a trusted choice for managing multiple lights or fans from one spot, particularly in areas like kitchens, closets, and bathrooms. A popular option among professional installers and their clients, the latest iterations now integrate Lutron Electronics Co., Inc. LED+ advanced technology, ensuring seamless LED dimming without interference, flicker, or shimmer.

- In November 2023, Signify Holding launched Philips radii auto-linkable ultra efficient solar lights are designed to synchronize and illuminate simultaneously upon motion detection. Utilizing ultra-efficient technology, these solar lights can illuminate outdoor areas for up to six nights before requiring recharging from sunlight. Available as pedestal and wall lights, they ensure consistent performance even on cloudy days, providing reliable lighting for gardens and other outdoor spaces.

- In November 2023, ACUITY BRANDS, INC. launched J6SLC LED Smart Speaker Downlight, featuring RGBW color changing capabilities, offering an ideal connection to smart home lighting solutions. With Bluetooth or Zigbee connectivity, it can be controlled via voice commands or an app. Compatible with Amazon Alexa, Samsung SmartThings, and Google Home platforms, the J6SLC provides versatile customization options for effortless lighting control after installation and pairing.

- In October 2023, IDEAL INDUSTRIES, INC. (Cree Lighting) has unveiled the debut of the brand-new Guideway Series Street Light, showcasing NanoComfort Technology. This innovation aims to revolutionize customer perceptions regarding conventional streetlights, including their performance, features, options, and notably, the level of visual comfort they offer.

- In September 2023, Lutron Electronics Co., Inc. launched Pico line-powered wireless control. It is tailored for commercial projects seeking a battery-free alternative. This new device operates online-voltage power and communicates wirelessly through RF with Vive wireless load-control devices, encompassing dimmers, switches, fixture controllers, and receptacle controllers.

- In June 2023, Signify Holding launched Philips Hue luster E14 bulb which offers a spectrum of warm-to-cool white and vibrant colors. Stay ahead of design trends with the extended range of Philips Hue panels. Tailor lighting experience with the latest features, including the brightness balancer for Entertainment areas and additional time slots for motion sensors, ensuring personalized control over ambiance.

- In June 2023, The strategic partnership between Legrand and Specialty Lighting delivers personalized lighting controls integrated with Specialty Lighting’s premium architectural lighting solutions, encompassing both standard and bespoke downlights, accent lights, linear lights, and picture lighting. This partnership ensures a comprehensive and visually appealing lighting design and user experience for various projects, whether new residential and commercial constructions, remodeling endeavors, or redecorating ventures.

- In April 2023, ACUITY BRANDS, INC. launched SlimBasics JSBT Tapered LED Disk Light Series, designed for cost-effective residential lighting, with smart home compatibility. The new JSBTC model connects via Bluetooth or Zigbee to sync with the mobile device or smart home hub, compatible with Samsung SmartThings, Amazon Alexa, and Google Home platforms. With identical aesthetics to existing models, such as Static and Switchable JSBT, adding the smart JSBTC offers seamless integration and flexibility throughout every room of a home.

- In February 2023, Zumtobel Group, in partnership with Haufe Deckensysteme, implemented a distinctive illuminated ceiling system. It boasts not only aesthetic appeal but also advanced functionality. Within this system, lighting, heating, cooling, and acoustics are seamlessly integrated, offering a cutting-edge, energy-efficient, and adaptable solution. Beyond public areas and offices, Zumtobel Group has outfitted the new high-bay warehouse, laboratory, technology center, and shipping area with contemporary luminaires.

- In January 2023, ACUITY BRANDS, INC. launched DTL DIN networked photocontrol merging a durable 20-year LED photocontrol with the Itron network platform, offering superior performance for smart street lighting systems. It provides unparalleled functionality and adaptive control. With the DIN solution, users gain access to a versatile platform for efficiently managing outdoor infrastructure, including smart lighting, traffic control, smart metering, and other IoT technologies.

- In January 2023, ACUITY BRANDS, INC. announced its subsidiary, Acuity Brands Lighting, Inc. (“Acuity Brands”), entered in an agreement with Biological Innovations and Optimization Systems, LLC (BIOS) through the BIOS ILLUMINATED program. Under this agreement, BIOS will provide ACUITY BRANDS, INC. with human-centric LED lighting components for integration into its architectural lighting fixtures designed for wellness. ACUITY BRANDS, INC. will also gain global rights to use the BIOS trademark for marketing fixtures featuring BIOS SkyBlue technology.

- In September 2022, Signify Holding unveils a range of new app features and products for its WiZ smart lighting system, aimed at enhancing users' daily convenience. Among the new offerings is SpaceSense, a motion detection technology integrated into the lighting system, eliminating the need for separate sensors. The updated WiZ app V2, along with the SpaceSense feature, is set to be available by the end of September 2022.

- In September 2022, Lutron Electronics Co., Inc. launched Diva Smart Dimmer and Claro Smart Switch. The Diva smart dimmer merges the iconic design and user-friendly interface of the DIVA series with the Caséta portfolio, renowned as the most integrated smart lighting control system in the industry

- In September 2022, Signify Holding has launched Philips Hue Lightguide bulbs which combine modern style with smart lighting functionality, featuring a striking design and three unique shapes: large globe, ellipse, and triangular. These bulbs showcase a distinctive inner tube that diffuses light in vibrant colors, enhanced by a reflective, glossy finish for added brilliance. Designed to make a statement, Lightguide bulbs seamlessly complement modern home decor and effortlessly integrate with Philips Hue light scenes.

- In June 2022, Signify Holding has launched Perifo, a new addition to the Philips Hue lineup, consists of individual rails that seamlessly connect to create a fully customizable track. Users have the flexibility to choose the layout and length of the track, as well as which lights to incorporate, granting complete control over home lighting. The track can be easily mounted on walls or ceilings and connected to standard outlets or existing wiring using the provided power supply unit. Once installed, users can enjoy the creative process of clicking their preferred smart lights into the track and arranging them according to their preferences. Perifo allows users to combine color-capable spotlights, pendants, light bars, and light tubes within a single track, enabling them to set the perfect ambiance for any occasion while adding a unique design element to their space.

- In June 2022, Signify Holding has launched Philips Hue Go portable table lamp is designed for both indoor and outdoor use, the portable table lamp boasts a silicone grip for effortless carrying. With up to 48 hours of battery life, the Hue Go lamp can be conveniently recharged using the provided charging base. Its versatile button allows users to effortlessly cycle through preset light scenes, enabling them to create the perfect ambiance for any setting, whether it's reading in bed or enjoying dinner on the patio.

- In January 2022, Signify Holding launched Philips Hue Inara wall light, seamlessly blending the decorative charm of the Filament bulb with outdoor functionality. This vintage-style black lantern incorporates all the smart features of Philips Hue with a traditional touch. With its dimmable warm white light, the Inara creates an elegant and intimate atmosphere on the patio or porch, perfect for welcoming guests and enhancing outdoor socializing.

- In July 2021, Philips Hue and Spotify joined forces to offer an enhanced integration, surpassing the capabilities of other partnerships, and have integrated the experience directly into the Philips Hue app. With Philips Hue + Spotify, the app analyzes the metadata of each Spotify song in real-time, generating a light script that not only syncs with the song's beat but also reflects its mood, genre, tempo, segments, loudness, pitch, and other attributes.

- In July 2021, Signify Holding acquired Telensa Holdings Ltd, a UK-based specialist in wireless monitoring and control systems tailored for smart cities. With this acquisition, Signify Holding incorporates a narrow-band and TALQ-compliant solution into its portfolio of feature-rich, open, and secure systems. This strategic move allows Signify Holding to expand its customer base, offering affordable smart city infrastructure solutions utilizing unlicensed radio space. Telensa will retain its brand name and continue to market its systems independently.

Frequently Asked Questions (FAQs):

What is the current size of the global smart lighting market?

The current size of smart lighting is USD 9.5 billion (2024) and is expected to reach USD 18.0 billion by 2029 with a CAGR of 13.8 % in the forecast period from 2024 to 2029.

Who are the winners in the global smart lighting market?

Companies such as Signify Holding (Netherlands), ACUITY BRANDS, INC. (US), Zumtobel Group (Austria), ams-OSRAM AG (Austria), and Panasonic Corporation (Japan) are the winners in the global smart lighting market.

Which region is expected to hold the highest market share?

Asia Pacific regions are expected to hold the largest market share for the smart lighting market in the forecast period 2024-2029.

What are the major drivers and opportunities related to the smart lighting market?

Smart city initiatives are illuminating opportunities for global development is the major driver of the market and Growing demand of personalized lighting control solution is the major opportunity of the market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, partnership, and collaborations to strengthen their position in the smart lighting market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

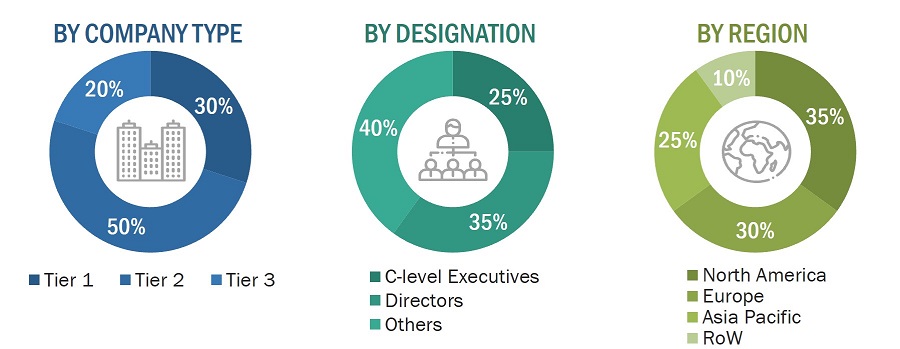

The research report includes four major activities, estimating the size of the smart lighting market. Secondary research has been done to gather important information about the market and peer markets. To validate the findings, assumptions, and sizing with the primary research with industry experts across the supply chain is the next step. Both bottom-up and top-down approaches have been used to estimate the market size. After this, the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments

Secondary Research

During the secondary research phase, a diverse array of secondary sources were consulted to gather pertinent information for this study. These sources included corporate filings such as annual reports, press releases, investor presentations, and financial statements, as well as data from trade, business, and professional associations. Additionally, white papers, location-based marketing journals, accredited publications, articles authored by recognized experts, directories, and databases were utilized.

The primary objective of the secondary research was to obtain crucial insights into the industry's supply chain, market monetary flow, and the comprehensive landscape of key players. It also facilitated the segmentation of the market according to prevailing industry trends, reaching down to granular levels. Moreover, it involved the analysis of geographic markets and significant developments from both market and technology perspectives. The secondary data underwent meticulous collection and analysis to ascertain the overall market size, which was subsequently validated through primary research.

Primary Research

During the primary research phase, a variety of primary sources were utilized to gather qualitative and quantitative insights for this report, encompassing both the supply and demand sides. On the supply side, primary sources included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, subject-matter experts (SMEs), consultants, and other key executives from prominent companies and organizations operating within the Smart lighting market.

Following a rigorous market engineering process, which entailed calculations for market statistics, breakdowns, size estimations, forecasting, and data triangulation, extensive primary research was conducted to collect, verify, and validate critical numerical data. This primary research aimed to identify segmentation types, industry trends, key players, competitive landscapes, and key market dynamics such as drivers, restraints, opportunities, and challenges. Additionally, it sought to understand the key strategies adopted by market players.

Drawing upon insights garnered from secondary research on the Smart lighting market, a thorough primary research effort was undertaken. Multiple primary interviews were conducted with experts from both the demand and supply sides across four key regions: North America, Europe, Asia Pacific, and ROW (Middle East, South America, and Africa). Approximately 25% of the primary interviews were conducted with representatives from the demand side, while 75% were with those from the supply side. Primary data collection was executed through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report employed both top-down and bottom-up methodologies to evaluate and validate the size of the smart lighting market and its related submarkets. Key players in the smart lighting sector were identified through secondary research, while their market share in specific regions was determined through a blend of primary and secondary research. The comprehensive research approach included reviewing annual and financial reports of industry leaders and conducting interviews with key stakeholders, such as CEOs, VPs, directors, and marketing executives, to gather both quantitative and qualitative insights. Percentage shares, divisions, and breakdowns were sourced from secondary references and cross-checked with primary sources. All potential market influencers were examined through primary research and analyzed to compile the final quantitative and qualitative dataset. This data was consolidated and enriched with extensive analysis from MarketsandMarkets. The following figures illustrate the methodology utilized to estimate the overall market size for this study.

Market Size Estimation Methodology-Bottom-up Approach

The overall size of the smart lighting market was determined using a bottom-up approach, which involved calculating the market size based on the revenue generated by key players and their market share. A thorough analysis of key players in the smart lighting market was conducted, and market size estimations were derived by considering the size of their smart lighting offerings.

Market Size Estimation Methodology-Top Down Approach

The top-down methodology utilized the overall market size as the foundation for determining individual market sizes, following the market segmentation with percentage allocations derived from primary and secondary research. To calculate specific market segment sizes, the immediate parent market size was utilized in applying the top-down approach. Additionally, the bottom-up approach was employed to validate segment sizes using data obtained from secondary research sources. Company market share estimates were utilized to confirm revenue distributions previously used in the bottom-up approach. Through a data triangulation process and validation via primary research sources, this study conclusively determined and confirmed both the overall parent market size and the size of each individual market segment.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation was employed to complete the market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Smart lighting, characterized by its ability to be controlled remotely—often through smartphone applications—offers a plethora of features including timers, schedules, motion detection, voice commands, and color adjustments. Rooted in the concept of self-monitoring, analysis, and reporting technology (SMART), smart lighting systems are engineered to transcend the basic functionality of illumination. They enhance security, safety, convenience, health, wellness, and energy efficiency. Moreover, these systems seamlessly integrate with other smart home devices and can be managed through various wireless transmissions, such as Wi-Fi radios and Bluetooth. The anticipated significant growth of the smart lighting market in the upcoming years is fuelled by the escalating popularity and acceptance of smart home technology.

Smart lighting entails lighting systems controlled by network-driven control systems, ensuring the right amount of light at the right place and time. Its primary aim is to enhance energy efficiency, leading to long-term cost and power savings. Comprising integrated software and hardware, smart lighting systems automatically adjust lighting based on predefined parameters. It includes various hardware devices such as lights, luminaires, and lighting control components, utilizing different communication technologies to facilitate device interaction as per application requirements. Employing both wired and wireless communication technologies, these systems overcome the cost and complexity limitations associated with conventional wired controls. Wireless networking elevates the intelligence of modern lighting control systems, enabling companies to achieve cost savings and operate in an environmentally friendly manner. Smart lighting solutions encompass indoor applications like residential, commercial, and industrial settings, as well as outdoor applications such as highways, roadways, architectural lighting, and public spaces.

Key Stakeholders

- Raw material and component suppliers

- Communication network providers

- Smart lighting device manufacturers

- Original equipment manufacturers

- Semiconductor component suppliers

- Analysts and strategic business planners

- Venture capitalists and start-ups

- Research laboratories and intellectual property (IP) companies

- Technology standards organizations, forums, alliances, and associations

- Hardware vendors

- Software integrators

- Smart lighting solutions-related service providers

- End users

- Government bodies such as regulatory authorities and policymakers

The main objectives of this study are as follows:

- To define, estimate, and forecast the smart lighting market's value, the segmentation includes hardware, software, and services offerings, wired and wireless communication technologies, indoor and outdoor applications, and new and retrofit installation types, across different geographical regions.

- To estimate and project market size, in terms of value, are conducted for various segments within four regions: North America, Europe, Asia Pacific, and the Rest of the World (ROW).

- To provide detailed insights regarding driver, restraints, opportunities, and challenges influencing the growth of the market

- To analyze emerging applications and standards in the smart lighting market.

- To examine manufacturers of smart lighting products, their strategies, production plans, and the overall supply chain, including material and component suppliers.

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the market opportunities for stakeholders and a comprehensive competitive landscape analysis is provided.

- To analyze competitive developments, such as partnership, acquisition, agreement, collaboration, and product launches.

- To strategically profile key players a thorough examination of their market share, ranking, and core competencies.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Country-wise Information for Asia Pacific

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Lighting Market

I am very much interested in understanding market revenue and forecast in terms of $ and #units for smart lighting broken down by segments (commercial, industrial, outdoor, residential), and by lighting technology (LED, CFL, HID, etc). Is this information available as a part of this report?

I am developing a wireless smart lighting switch for home usage and want to sell it around the world out of china. I would like to know where in the world could that kind of products be best sold to, the market size right now, and the possible prospect, especially for Europe. Itís not in a hurry, no strict timeline, Itís a new tech of controlling any light anywhere using any device connected to the lighting device wirelessly. Itís not decided for the exact market budget including information taking. Only after the product had been developed successfully.

I'm wireless controller manufacturersand hence, looking specifically into wirelessly connected light bulbs. Do you have any information about this? Also, is the report contain market share analysis of varoius lighting controls manufacturers by region?

I am currently a student at the University of Texas. I am researching the smart lighting industry. My group and I have to do a presentation on the market and how it will be affected with in the near future. I feel this article would be very helpful and would like to read it for some more specific details. I am specifically looking forward the market projections for US by region/states for smart lighitng space. Could you share such infomration? If yes, at what cost?

My company is the distributors of smart lighting product lines. I am researching about smart lighting market. I am specifically looking for market information about Southeast Asia and Africa Markets. Is your study include detailed information for these 2 regions? If it is not readily available how much time will you need for this?

Iím a researcher and analysing smart lightning market in Sweden, Russia and Denmark, compare the demands in them. I am also looking for the market drivers and barrieers within these countries. I feel that your report will be the greatest source of information for me to prepare! Does your report has information about these countries? at what price?