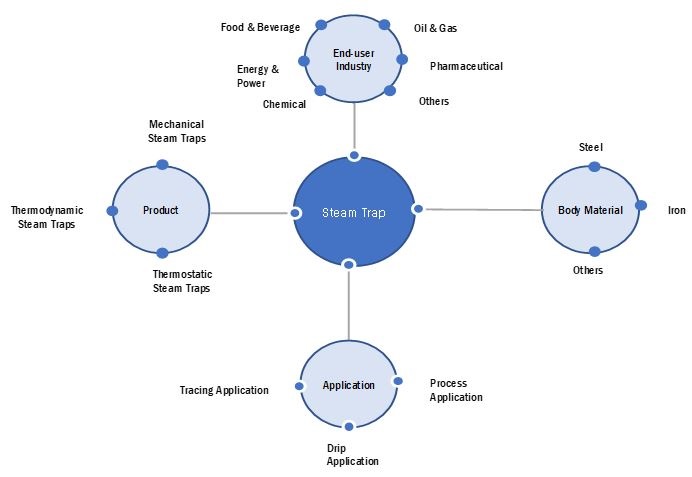

Steam Trap Market by Mechanical (Ball Float, Inverted Bucket), Thermodynamic, Thermostatic (Balanced Pressure, Bimetallic), Application (Drip, Process, Tracing), Body Material (Steel, Iron), End-User Industry and Region - Global Forecast to 2028

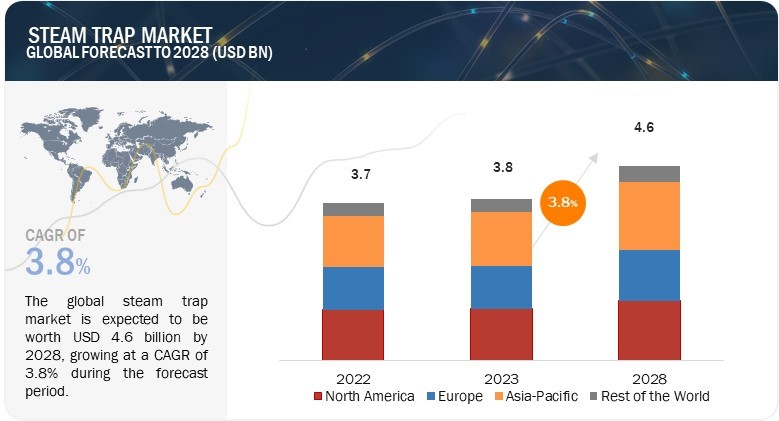

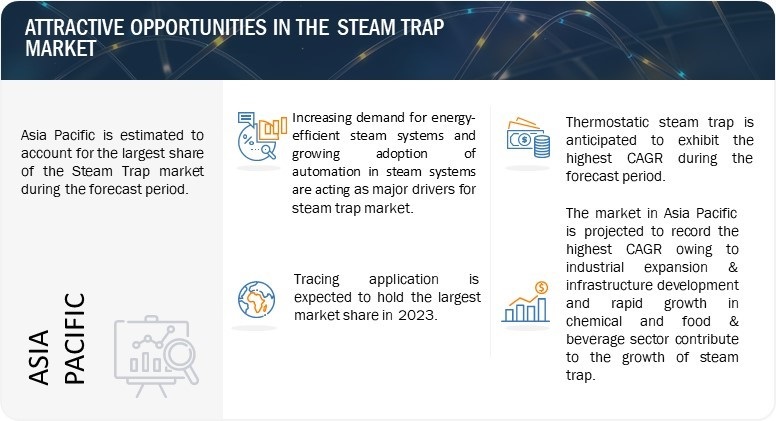

[183 Pages Report] The global steam trap market size is projected to grow from USD 3.8 billion in 2023 to USD 4.6 billion by 2028, at a CAGR of 3.8% during the forecast period. The market growth is driven by factors including the increasing demand for energy-efficient steam systems and rapid economic growth in emerging economies provinding opportunities for steam trap market. However, lack of awareness and benefits of steam trap systems are challenging the market growth.

Steam Trap Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Steam Trap Market Dynamics

Driver: Increasing demand for energy-efficient steam systems

The demand for energy-efficient steam systems is rising as businesses actively seek ways to lower their energy costs. Steam traps play a vital role in achieving this objective by preventing the wasteful loss of live steam and minimizing the potential risk of water hammer. Live steam, a valuable resource generated by boilers for powering equipment and heating processes, holds significant importance for businesses, prompting them to ensure optimal utilization. In this regard, steam traps prove indispensable as they automatically discharge condensate and non-condensable gases from steam systems, effectively preventing the loss of live steam. This automated process improves steam system efficiency, thereby reducing energy consumption. Furthermore, steam traps go beyond their role in conserving live steam; they play a crucial part in ensuring the safety of steam systems. Swift and automatic discharge of condensate and non-condensable gases by steam traps effectively averts pressure build-up within the system, thereby mitigating the potential risk of explosions.

Restraint: High investments are required to implement steam trap systems

Investing in steam traps can be a substantial expense for businesses, primarily due to the high initial cost associated with their purchase and installation. The price of steam traps can vary significantly depending on various factors, such as the type of steam trap chosen, its size, and the materials used in its construction. One significant factor is the complexity of the steam trap design. More advanced and intricate steam trap models typically command higher prices due to the added engineering and precision required to deliver superior performance and efficiency. These sophisticated designs ensure optimal functionality, making them attractive for businesses seeking top-tier steam system management. Similarly, another contributing factor to the cost of steam traps is the choice of materials used in their construction. Steam traps made from premium materials like stainless steel generally come at a higher price than those crafted from more cost-effective materials like cast iron. The selection of materials directly impacts the trap’s durability and performance under varying conditions, making high-quality materials a desirable investment for businesses focused on long-term reliability and reduced maintenance costs.

Opportunity: Rapid economic growth in emerging economies

The rapid economic growth in emerging economies presents significant opportunities for the steam trap market. As these economies continue to expand and industrialize, there is a rising demand for energy, especially in manufacturing, power generation, and petrochemicals. Steam is a fundamental energy source used in various industrial processes, making steam traps essential for optimizing energy efficiency. As per the International Energy Agency (IEA), emerging markets and developing economies are expected to become the primary energy consumers of the future. The combined energy consumption of Brazil, China, India, Indonesia, Mexico, and South Africa already accounts for one-third of global energy usage, and this figure is projected to increase to 40% under current policy directions. In addition 2021, robust economic growth in countries such as India, Indonesia, and Saudi Arabia contributed to heightened energy consumption.

Challenge: Lack of awareness and benefits of steam trap systems

The lack of awareness is a significant challenge faced by the steam trap market, primarily because many businesses are unaware of the benefits of steam traps. They may need to grasp the proper selection and installation process fully. This can result in businesses making incorrect purchasing decisions, acquiring unsuitable steam traps, or improperly installing them. In addition, steam traps are less widely recognized than other energy-saving technologies, such as insulation or variable speed drives. This lack of visibility contributes to a limited understanding of steam traps’ advantages and potential impact on energy efficiency. Furthermore, the unawareness of steam trap systems leads to a lack of knowledge regarding maintenance and proper operation. Steam traps require periodic inspection, maintenance, and troubleshooting to ensure they function optimally. However, unaware of these requirements, businesses may neglect proper upkeep, leading to inefficient or malfunctioning steam traps. Ineffective steam traps can inadvertently release live steam, leading to higher energy costs and contributing to greenhouse gas emissions, exacerbating environmental challenges.

Steam Trap Market Ecosystem

This section describes the Steam Trap ecosystem, the deployment of steam trap solutions in different end-user industries, and the impact of associated technologies on the market.

Mechanical steam trap Segment to hold the largest share of the steam trap market during 2023–2028

The mechanical steam trap segment is expected to account for the largest size of the steam trap market during the forecast period. Mechanical steam traps are a type of steam trap that operates based on mechanical principles rather than relying on external energy sources or complex control systems. They are known for their reliability, simplicity, and robustness, contributing to their popularity in various industrial applications. Furthermore, these steam traps are generally easier to install than more complex traps that may require additional infrastructure or control systems. This ease of installation can make them a preferred choice for retrofitting or upgrading existing systems.

Steel body material to dominate the steam trap market during the forecast period.

The steel body material segment is expected to account for the largest size of the steam trap market during the forecast period. Steel is rugged and robust, making it an excellent fit for steam traps that handle high temperatures and pressures without breaking. It’s also good at resisting rust and other types of damage, which helps the steam traps last a long time and need less fixing. Maintaining high levels of hygiene is paramount in industries like food & beverage and pharmaceutical. Steel’s non-porous surface is easy to clean and sterilize, ensuring compliance with stringent regulatory standards and safeguarding product purity. This is especially important in steam trap applications where cleanliness is essential to prevent contamination.

Oil & Gas end-user industry to dominate the market during the forecast period

The oil & gas end-user industry is expected to account for the largest share of the steam trap market during the forecast period. In the oil & gas industry, steam is utilized for various critical applications, including heating, distillation, separation, and power generation. Effective management of steam systems is paramount to ensure operational efficiency, cost-effectiveness, and safety within these industrial operations. Steam traps play a pivotal role in these contexts by efficiently removing condensate and preventing steam loss, which can significantly impact energy consumption and overall productivity. Moreover, the oil and gas industry operates under stringent regulatory frameworks and safety standards. The seamless functioning of steam systems is essential to comply with environmental regulations and safety protocols. In this context, steam traps ensure the proper functioning of steam distribution, minimizing the potential for leaks and energy waste that could lead to environmental hazards or operational disruptions.

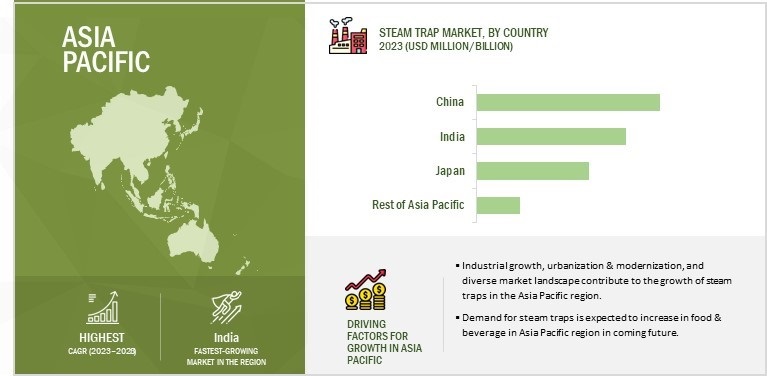

The steam trap market in the Asia Pacific is expected to maintain the highest share during 2023–2028

Asia Pacific is expected to hold the largest share of the Steam trap market throughout the forecast period. The region is home to diverse industries, including manufacturing, petrochemicals, power generation, and more, all of which rely heavily on steam-based processes for their operations. As economies in this region continue to grow, the demand for efficient and sustainable steam systems becomes increasingly pronounced, creating a substantial market for steam traps. Furthermore, the Asia-Pacific region is experiencing significant urbanization and industrialization, leading to increased infrastructure development and expansion. As new industrial facilities are established, and existing ones undergo modernization, the demand for advanced steam trap technologies to enhance energy efficiency, reduce operational costs, and meet stringent environmental regulations is rising.

Steam Trap Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The steam trap companies have implemented various types of organic and inorganic growth strategies, such as product launches, product developments, partnerships, and collaborations, to strengthen their offerings in the market. The major players are Spirax-Sarco Engineering plc (UK), Emerson Electric Co. (US), Schlumberger Limited (US), Thermax Limited (India), Velan Inc. (Canada), Watts Water Technologies, Inc. (US), Armstrong International Inc. (US), TLV CO., LTD. (Japan), Forbes Marshall (India), and Xylem Inc. (US). The study includes an in-depth competitive analysis of these key players in the steam trap market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Product, Application, Body Material, End-User Industry, and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

Key players in the steam trap market are Spirax-Sarco Engineering plc (UK), Emerson Electric Co. (US), Schlumberger Limited (US), Thermax Limited (India), Velan Inc. (Canada), Watts Water Technologies, Inc. (US), Armstrong International Inc. (US), TLV CO., LTD. (Japan), Forbes Marshall (India), and Xylem Inc. (US) are some of the key players in steam trap market.—a total of 25 companies. |

Steam Trap Market Highlights

This report categorizes the steam trap market based on product, application, body material, end-user industry, and region.

|

Segment |

Subsegment |

|

By Product: |

|

|

By Application: |

|

|

By Body Material: |

|

|

By End-User Industry: |

|

|

By Region: |

|

Recent Developments

- In September 2022, TLV CO., LTD., a specialist in steam technology, introduced the FJ32 series of free-float steam traps. These steam traps are designed for various process applications, including jacketed pans, heat exchangers, and vulcanizers. These steam traps incorporate the QuickTrap connection, a universal feature that enables convenient, secure, and efficient removal, repair, and reuse.

- In January 2022, Spirax-Sarco Engineering plc acquired Cotopaxi Limited (UK), a digital energy optimization specialist, for USD 18 million. This move strengthens Spirax-Sarco’s Steam Specialties business, focusing on efficient steam solutions. Cotopaxi’s digital expertise will enhance steam system efficiency and waste reduction, benefiting from Steam Specialties’ global sales reach in 67 countries.

- In September 2019, Emerson Electric Co. acquired the Spence and Nicholson product lines from Circor International, Inc. (US), an industrial valve manufacturing company. This acquisition strengthens Emerson’s steam system solutions for process industries and commercial buildings. The Spence and Nicholson lines are established industry-leading products that include steam regulators, control valves, safety relief valves, temperature regulators, steam traps, and other steam accessories and solutions.

- In December 2018, Spirax Sarco Engineering plc unveiled the FT23 series of float and thermostatic steam traps. This comprehensive lineup features the FTC23 model, which boasts a robust carbon steel body and a stainless steel cover. Additionally, the FTS23 variant presents a stainless steel body adorned with a stainless steel cover.

Critical Questions:

What is a Steam Trap?

A steam trap is a mechanical device designed to automatically remove condensate (liquid formed when steam changes back to its liquid state) and non-condensable gases, such as air, from steam systems, ensuring efficient and controlled release while retaining the steam.

What is the current size of the global steam trap market?

The global steam trap market is estimated to be around USD 3.8 billion in 2023 and is projected to reach USD 4.6 billion by 2028 at a CAGR of 3.8%.

Who are the top players in the steam trap market?

The major vendors operating in the steam trap market include Spirax-Sarco Engineering plc (UK), Emerson Electric Co. (US), Schlumberger Limited (US), Thermax Limited (India), Velan Inc. (Canada), Watts Water Technologies, Inc. (US), Armstrong International Inc., and others.

Which major countries are considered in the Asia Pacific region?

The report includes an analysis of China, Japan, India, and Rest of the Asia Pacific countries.

Which are the major industries in which steam traps are used?

Significant industries for steam traps are Oil & Gas, Chemical, Food & Beverage, Energy & Power, Pharmaceutical, and Others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involves four significant activities for estimating the size of the steam trap market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the steam trap market. After that, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data has been collected and analyzed to determine the overall market size estimations, further validated by primary research.

Primary Research

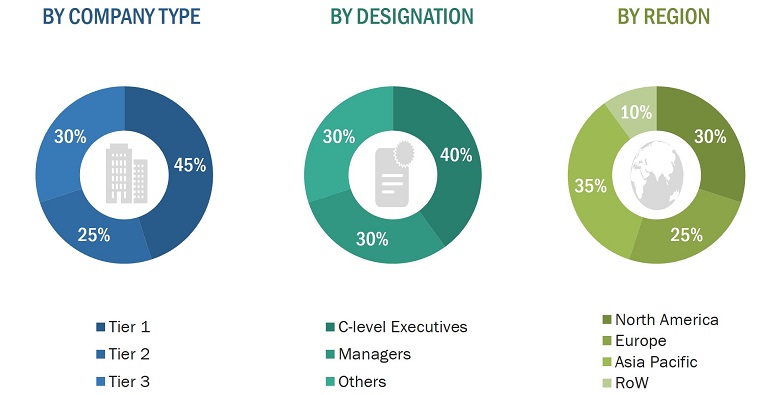

In the primary research process, several sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. Several primary interviews have been conducted with market experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and the Rest of the World. This primary data has been collected through questionnaires, emails, and telephonic interviews. Approximately 60% of the preliminary interviews have been conducted with the demand side and 40% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Additionally, questionnaires and emails were used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the steam trap market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

A steam trap is an automatic device designed to eliminate condensate and non-condensable gases from a steam system while ensuring that live steam is not released. Functioning as an automatic valve, it opens to permit condensate discharge and closes to safeguard against live steam leakage. The presence of steam traps is crucial for the efficient functioning of steam systems. They play a vital role in preventing the accumulation of condensate, which could otherwise lead to energy wastage and equipment deterioration. Additionally, steam traps aid in removing non-condensable gases, preventing any hindrance to the steam flow and preserving the system’s overall efficiency. Different types of steam traps are available, each with its own mechanism and operation principles. Some common types include mechanical steam traps, thermostatic steam traps, and thermodynamic traps. Each type is suitable for specific applications and operating conditions, and selecting the appropriate steam trap is essential to ensure optimal performance and energy efficiency in steam systems.

Key Stakeholders

- Government bodies and policymakers

- Industry organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Analysts and strategic business planners

- End users of steam trap across various industries such as the oil & gas, chemical, food & beverage, pharmaceutical, energy & power, and others (metals & mining), pulp & paper, and water & wastewater treatment.

Study Objectives:

- To define, describe, and forecast the steam trap market by product, application, body material, end-user industry, and geography

- To provide the market statistics, along with a detailed classification of the market size in terms of value

- To provide critical trends related to the steam trap market that shape and influence business growth

- To forecast the market size for various segments—in terms of value, concerning four main regions (along with their respective countries), namely North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To strategically profile the key players in the market and analyze their market position in terms of ranking and core competencies1, along with detailing the competitive landscape for market leaders

- To provide detailed information regarding major factors influencing the growth of the steam trap market (drivers, restraints, opportunities, and industry-specific challenges)

- To provide an overall view of the global market through illustrative segmentation, analysis, and forecast of the significant regional segments

- To analyze strategic developments—such as joint ventures, mergers and acquisitions, new product launches and developments, and research and development—in the steam trap market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of 25 market players

Growth opportunities and latent adjacency in Steam Trap Market