Sterilization Equipment Market Size by Product (Instruments, Accessories (Pouches, Lubricants)), Services (Off-site, On-site), Technology (Heat (Steam, Dry), Low- temperature (H2O2, EtO, CH2O), Radiation (E-beam, Gamma, X-Ray)) & Region - Global Forecast to 2029

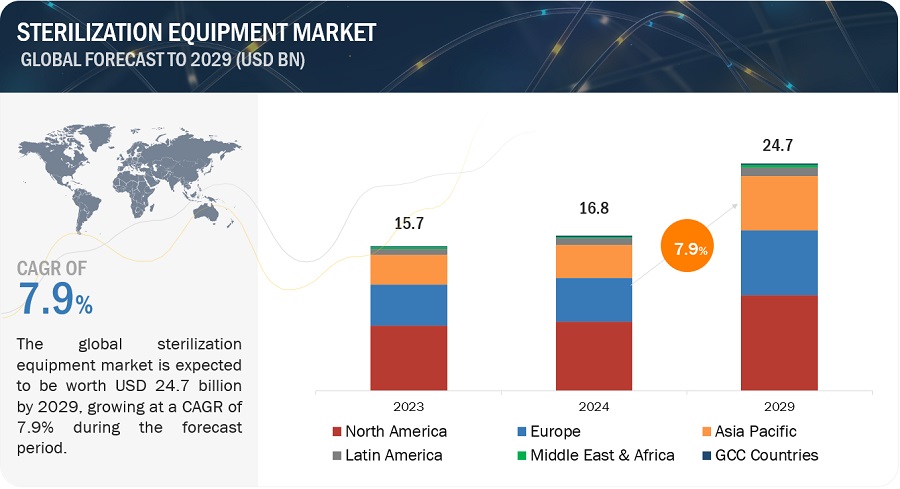

The size of global sterilization equipment market in terms of revenue was estimated to be worth $16.8 billion in 2024 and is poised to reach $24.7 billion by 2029, growing at a CAGR of 7.9% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

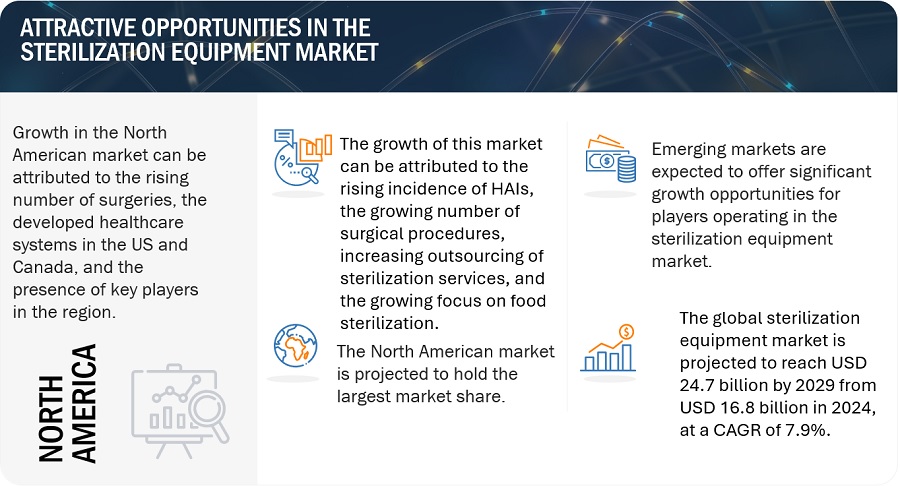

Market growth is driven by increasing incidence of HAIs and other infectious diseases, rise in the volume of surgical procedures performed, increasing focus on food sterilization and disinfection and the increasing outsourcing of sterilization services by pharmaceutical companies and hospitals.

Attractive Opportunities in the Sterilization Equipment Market

To know about the assumptions considered for the study, Request for Free Sample Report

Sterilization Equipment Industry Dynamics

DRIVER: Growing number of surgical procedures is prominently driving the growth of the sterilization equipment market.

There has been a significant rise in the number of surgical procedures performed worldwide. According to the NCBI, 310 million surgeries are carried out annually, with 20 million occurring in Europe and 40–50 million in the United States. This can be attributed to the growing prevalence of obesity and other lifestyle diseases, the rising geriatric population, and the increasing incidence of spinal injuries and sports-related injuries. The growing number of surgical procedures performed has resulted in the increased demand for different surgical equipment and medical devices. This is expected to drive the demand for sterilization products and services due to the proven benefits of sterilization and growing awareness about their effectiveness in healthcare settings.

The rise of surgical procedures is not restricted to any one area of medical practice, but rather includes many specialties, like neurology, orthopedics, and cardiology. With the growth in the number of surgeries, the need for sterilization products and services is also increasing, as improper sterilization of equipment used in surgical procedures or inadequately sterilized hospitals/clinics could lead to growth in HAI and SSI (surgical-site infection) cases. This is expected to play a key role in the greater adoption of sterilization technologies in the coming years.

Opportunity: The increasing number of medical device and pharmaceutical companies in emerging economies is a significant opportunity for the sterilization equipment market.

Emerging economies such as India, China, Brazil, Russia, and countries in Latin America and Southeast Asia are expected to provide significant growth opportunities to players operating in the sterilization equipment market. Over half the world’s population resides in India and China, making these markets home to a large patient population. Public pressure to improve the quality of hospital care, the increased cost of HAIs in healthcare systems, the emergence of multi-drug-resistant microorganisms, and government initiatives play an important role in the growth of the sterilization equipment market in these countries.

For instance, in 2023, the Indian pharmaceutical industry's total annual turnover was USD 49.78 billion, whereas during FY2021–2022, it was USD 41.68 billion. Considering the market potential for several medical devices, there is a greater demand among players for technical expertise, disinfection, and better sterilization standards to ensure the quality of the products being manufactured. This further presents growth opportunities for disinfection and sterilization market players in the APAC region.

Challenge: A significant challenge facing the sterilization equipment market is the sterilization of advanced medical devices.

The materials used to make many advanced medical equipment might not be suitable for all sterilizing techniques. Traditional autoclave sterilization, for instance, may harm instruments that are sensitive to heat. A significant challenge is making sure that sterilizing techniques are compatible with the materials used in high-tech medical equipment. Inadequate sterilization of these devices might expose patients to the risk of acquiring HAIs. An AER that is difficult to use or one that breaks down frequently can significantly increase the risk of improper or ineffective endoscope sterilization and create costly delays. Currently, reprocessing of these instruments after every use is a major challenge faced by healthcare providers in complying with sterilization standards.

Trend: Increasing adoption of sterilization using NO2 is the upcoming trend in the sterilization equipment market.

Nitrogen Dioxide (NO2) gas works rapidly and effectively as a sterilant against many kinds of microbes. Due to its special physical characteristics, NO2 gas can be used to sterilize an enclosed space at room temperature and ambient pressure. Because of its many benefits, including its ultra-low temperature (10°–30°C), reduced pressure needs, lack of cytotoxic residuals, and quick cycle times (2-4 hours, with aeration), nitrogen dioxide sterilization is preferred by users. It has been found that NO2 sterilization is especially useful for sterilizing prefilled syringes, drug-device combo products, and customized implants. This opens up new possibilities for medical device innovation. It is being driven by the need to improve patient safety, reduce production costs, and optimize efficiency, new drugs, technologies, materials, and processes are continually being introduced.

Sterilization Equipment Market Ecosystem

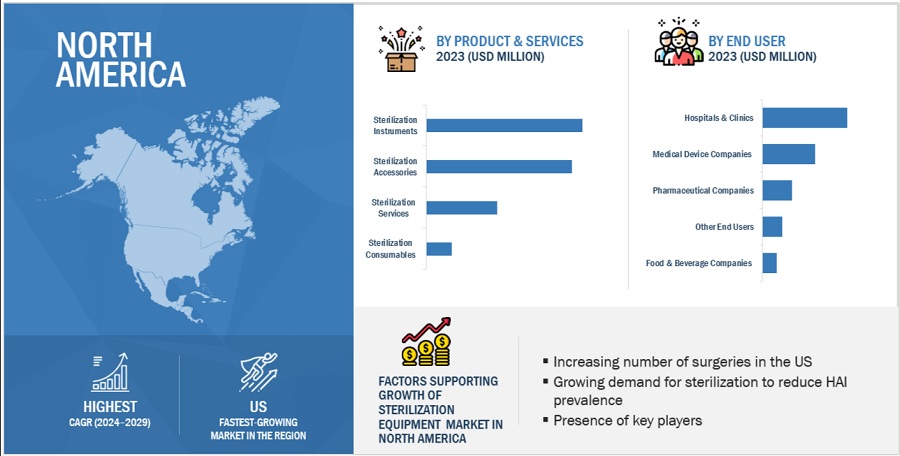

In 2023, sterilization instruments segment accounted for the largest share of the sterilization equipment industry, by product & services

The global sterilization equipment market is segmented into sterilization instruments, sterilization services, sterilization consumables, and sterilization accessories. Growth in sterilization instruments segment is mainly driven by the heightened focus on infection control and prevention, especially within healthcare environments, has led to a surge in demand for sterilization instruments.

In 2023, heat/high-temperature sterilization segment accounted for the largest share in the sterilization equipment industry, by technology

The global sterilization equipment market is segmented into heat/high-temperature sterilization, low-temperature sterilization, ionizing radiation sterilization, and filtration sterilization. Heat/high-temperature sterilization accounted for the largest share of the sterilization equipment market in the year 2023. The widespread adoption of heat/high-temperature sterilization is due to its ability to thoroughly eradicate microbes, its versatility in accommodating diverse materials and equipment, and its simple implementation procedures. These qualities position it as the preferred sterilization technology across numerous industries and applications.

In 2023, hospitals & clinics accounted for the largest share in the sterilization equipment industry, by end user

The sterilization equipment market is segmented into hospitals & clinics, medical device companies, pharmaceutical companies, food & beverage companies, and other end users. Hospitals & clinics accounted for the largest share of the sterilization equipment market in 2023. The large share of this segment can be attributed to rising prevalence of HAIs. Sterilization is the most important defense against HAIs. Government initiatives such as awareness programs and discharge surveys also help spread awareness about HAIs, which is induing the significant growth of sterilization equipment market in this segment.

In 2023, North America accounted for the largest share of the sterilization equipment industry, by region

The global sterilization equipment market is segmented into six major regions namely, North America, Europe, the Asia Pacific, Middle East & Africa, Latin America, and the GCC Countries. North America accounted for the largest share of the sterilization equipment market in 2023. The significant proportion of this regional segment can be attributed to factors such as well-developed healthcare infrastructures and rigorous regulatory policies aimed at ensuring the delivery of safe and high-quality healthcare services.

To know about the assumptions considered for the study, download the pdf brochure

The major players in this market are STERIS (US), Getinge AB (Sweden), Sotera Health (US), Fortive (US), and 3M (US). These players’ market leadership is due to their comprehensive product portfolios and expansive global footprint. These dominant market players have several advantages, including strong research and development budgets, strong marketing and distribution networks, and well-established brand recognition.

Scope of the Sterilization Equipment Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2024 |

$16.8 billion |

|

Projected Revenue Size by 2029 |

$24.7 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 7.9% |

|

Market Driver |

Growing number of surgical procedures is prominently driving the growth of the sterilization equipment market |

|

Market Opportunity |

The increasing number of medical device and pharmaceutical companies in emerging economies is a significant opportunity for the sterilization equipment market |

This research report categorizes the sterilization equipment market to forecast revenue and analyze trends in each of the following submarkets:

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- GCC Countries

By Product & Service

- Sterilization Instruments

- Sterilization Accessories

- Sterilization Consumables

- Sterilization Services

By Technology

- Heat/High-Temperature Sterilization

- Low-temperature Sterilization

- Ionizing Radiation Sterilization

- Filtration Sterilization

By End User

- Hospital & Clinics

- Pharmaceutical Companies

- Medical Device Companies

- Food & Beverage Companies

- Other End Users

Recent Developments of Sterilization Equipment Industry:

- In June 2023, STERIS plc announced that it has successfully acquired the assets from BD (Becton, Dickinson and Company) related to surgical instrumentation, laparoscopic instrumentation, and sterilization containers.

- In December 2023, Getinge unveiled an innovative and modular load handling solution designed for seamless integration with the company's GEV terminal sterilizers.

- In October 2023, the strategic acquisition of Healthmarks by Getinge not only consolidates Getinge's presence in the infection prevention sector within the United States but also enhances its global customer outreach in Europe and Asia.

- In October 2023, ASP has unveiled a substantial enhancement to its Sterilization Monitoring portfolio, introducing innovative Steam Monitoring products.

- In May 2022, Sterigenics S.A.S., a subsidiary of Sotera Health Company, expanded its electron beam (“E-beam”) facility in Columbia City, Indiana.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global sterilization equipment market?

The global sterilization equipment market boasts a total revenue value of $24.7 billion by 2029.

What is the estimated growth rate (CAGR) of the global sterilization equipment market?

The global sterilization equipment market has an estimated compound annual growth rate (CAGR) of 7.9% and a revenue size in the region of $16.8 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

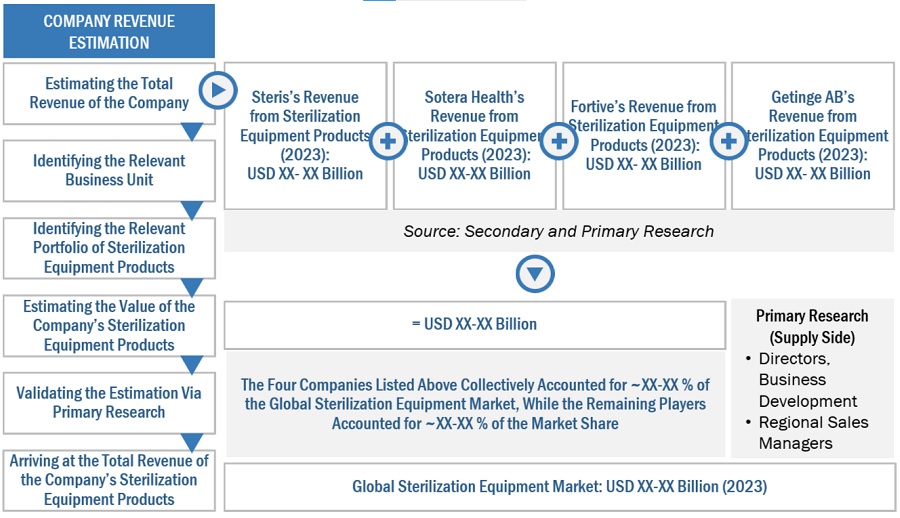

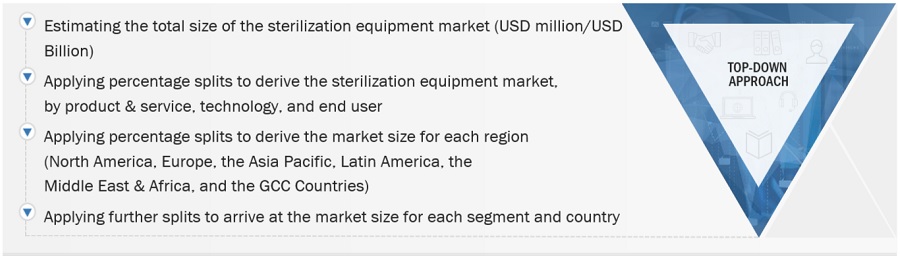

To determine the current size of the sterilization equipment market, this study engaged in four main activities. A comprehensive study was conducted using secondary research methods to gather data about the market, its parent market, and its peer markets. The next stage involved conducting primary research to confirm these conclusions, assumptions, and sizing with industry experts throughout the value chain. A combination of top-down and bottom-up methods was used to assess the overall market size. The market sizes of segments and subsegments were then estimated using data triangulation techniques and market breakdown.

The four steps involved in estimating the market size are

Collecting Secondary Data

Within the secondary data collection process, a range of secondary sources were reviewed so as to identify and gather data for this study, including regulatory bodies, databases (like D&B Hoovers, Bloomberg Business, and Factiva), white papers, certified publications, articles by well-known authors, annual reports, press releases, and investor presentations of companies.

Collecting Primary Data

During the primary research phase, a comprehensive approach was adopted, involving interviews with a diverse array of sources from both the supply and demand sides. These interviews aimed to gather qualitative and quantitative data essential for compiling this report. Primary sources primarily comprised industry experts spanning core and related sectors, as well as favored suppliers, manufacturers, distributors, service providers, technology innovators, and entities associated with all facets of this industry's value chain. In-depth interviews were meticulously conducted with a range of primary respondents, including key industry stakeholders, subject-matter authorities, C-level executives representing pivotal market players, and industry advisors. The objective was to obtain and authenticate critical qualitative and quantitative insights and to evaluate future potentialities comprehensively.

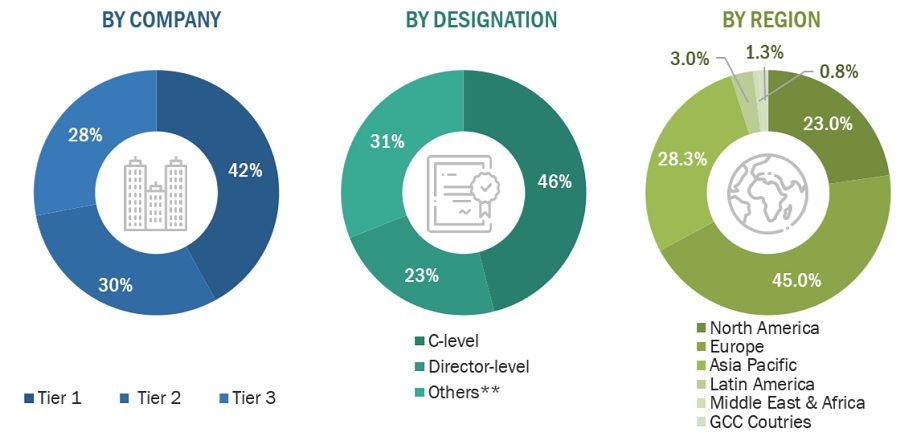

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: Others include sales, marketing, and product managers.

Note 2: Tiers of companies are defined based on their total revenue. As of 2023, Tier 1 = >USD 5 billion, Tier 2 = USD 500 million to USD 5 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Advanced Sterilization Products (ASP) |

Area Business Manager |

|

Getinge AB |

Director of Research and Development |

|

Steris |

Sales Manager |

|

3M |

VP Marketing |

Market Size Estimation

All major product manufacturers offering various sterilization equipment market were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value of in sterilization equipment market was also split into various segments and subsegments at the region and country level based on:

- Product and services mapping of various manufacturers for each type of in sterilization equipment market at the regional and country-level

- Relative adoption pattern of each sterilization equipment market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country level

Global Sterilization Equipment Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Sterilization Equipment Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Sterilization is a process that involves the removal of microorganisms and other pathogens from an object or surface by treating it with chemicals or subjecting it to high heat or radiation. Sterilization is an integral part of infection control procedures. Sterilization equipment are used to sterilize various products and supplies in end-user facilities, whereas consumables & accessories help monitor and simplify the sterilization process.

Key Stakeholders

- Manufacturers of sterilization equipment, consumables, and accessories

- Contract sterilization service providers

- Pharmaceutical & biotechnology companies

- Medical device manufacturers

- Hospitals

- Clinics

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, trends, opportunities, and challenges)

- To define, describe, segment, and forecast the in sterilization equipment market by product & service, by technology, by end user, and by region

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall sterilization equipment market

- To forecast the size of the sterilization equipment market in six main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, Middle East & Africa, and GCC Countries.

- To profile key players in the sterilization equipment market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as product launches and approvals; expansions; and collaborations, of the leading players in the sterilization equipment market

- To benchmark players within the sterilization equipment market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report

Country Information

- Additional country-level analysis of the sterilization equipment market

Company profiles

- Additional 3 company profiles of players operating in the sterilization equipment market.

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the sterilization equipment market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sterilization Equipment Market