Surface Inspection Market Size, Share, Statistics and Industry Growth Analysis by Component (Cameras, Frame Grabbers, Processors, Software), Surface Type (2D, 3D), System (Computer-based, Camera-based), Deployment Type (Traditional Systems, Robotic Cells), Vertical - Global Forecast to 2028

Updated on : April 01 , 2024

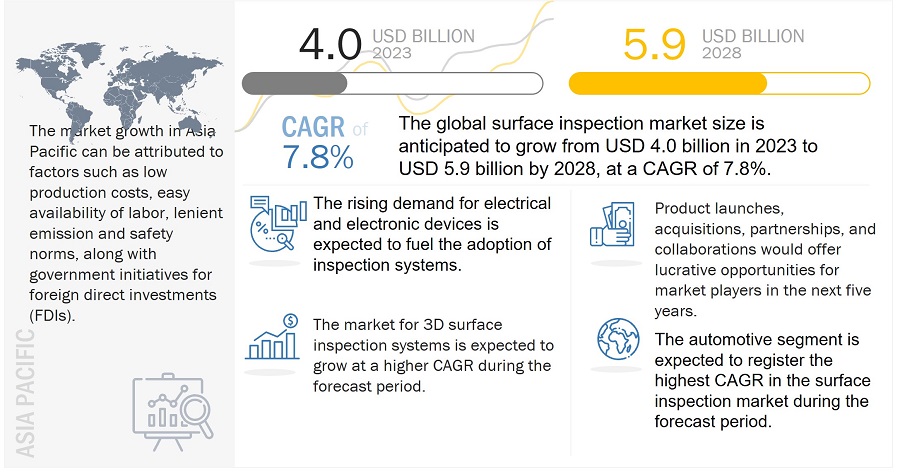

The global surface inspection market size is anticipated to grow from USD 4.0 billion in 2023 to USD 5.9 billion by 2028, recording a CAGR of 7.8%. The rising demand for high-quality and innovative inspection systems across industries and the rising labor costs are the notable factors empowering the growth of the surface inspection market.

Surface Inspection Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

The surface inspection market share will show significant growth due to its various applications in several industries, such as semiconductor, automotive, electrical & electronics, food & packaging, and pharmaceutical. Various key players in the market adopt different strategies such as acquisitions, product launches, collaborations, and partnerships to grow in the surface inspection industry.

Market Dynamics

Driver: Integration of smart cameras, advanced software, and powerful image processors into surface inspection systems

Features of components such as cameras, optics, image sensors, processors, illumination equipment, and software determine the performance of a surface inspection system. The capabilities of smart cameras have been expanded due to advancements in embedded processors, allowing them to execute inspection activities autonomously. In April 2020, Cognex (US) introduced In-Sight D900, the world's first industrial smart camera powered by deep learning. Optical character recognition (OCR), assembly verification, and defect detection are a few complicated in-line inspection applications for which these self-contained systems are designed. Smart cameras have image sensors ranging from VGA to 2 megapixels (MP). These cameras are suitable for inspecting large automotive parts and identifying smaller defects in images. Various companies are manufacturing smart cameras with up to 36MP resolution image sensors. For example, FH-S and FZ-S camera series by OMRON (Japan) offer an image resolution of 21 MP with 2 to 8 camera ports.

Restraint: Lack of technical know-how regarding integration of surface inspection systems with robots and 3D models

Surface inspection systems necessitate a technically skilled workforce capable of deciphering machine signals and integrating collaborative robots with surface inspection systems. More advanced surface vision systems that can be integrated with robots and perform 3D inspection are introduced in technologically advancing markets. Customers’ needs in this market are constantly changing, necessitating the training of workers to operate the new systems. Economic growth is heavily reliant on labor productivity. The current challenge is to promote lifelong learning, particularly among the elderly but economically active. For example, China and Japan will witness a rapid population aging in the coming decades, necessitating the maintenance and upgrading of a growing pool of mature and older workers and making further progress in formal education. In several regions, the growing number of young people entering the labor force will continue to strain education, training capacity, and job creation rates. International migrant workers will continue to grow, posing new challenges regarding equitable access to training and how to fill skill gaps in some countries.

Opportunity: Surging adoption of collaborative robots (cobots) owing to their progressive features

Existing surface inspection systems are integrated with robots to improve process speed, lower costs, and reduce human errors. These systems are also known as VGR systems and are used in the automotive, electronics, and food processing industries. As the demand for robots grows, the demand for surface inspection systems also increases. Collaborative robots are becoming more popular because they allow humans and robots to work effectively together in open or uncaged environments. They are widely adopted not only in small and medium-sized businesses but also in large-scale, traditional industries such as automotive. The demand for collaborative vision systems is increasing due to the fast-changing nature of industries. This scenario is observed in the consumer goods industry, specifically packaging, where the shape, size, surface, or weight of the packaging is constantly changing. The collaborative robot market share is expected to grow at a CAGR of 41.5% between 2022 and 2028, with a presence across industries such as automotive and electrical & electronics, pharmaceutical, and food & beverage. Collaborative robots are outfitted with vision systems that allow them to inspect various shapes and sizes. Robotic arms provide the leverage to rotate and move at specific angles. Moreover, integrated robotic solutions enable to retrieve the benefits of robotic vision quickly and easily, without the need for programming knowledge.

Challenge: Intricacies in product designing and manufacturing

Surface inspection systems are used in the automotive, food, web inspection, nonwovens, metal, paper, semiconductor, and electrical & electronics industries. Each industry has its quirks, and technological advancements add daily complexity to the manufacturing process. Surface inspection systems face the challenge of meeting the diverse and ever-changing needs of various industries. Surface inspection systems in the metal industry should be capable of inspecting cut, shaped, rolled, or coated metal surfaces. Surface defects in various steel products have been reported to be extremely common.

Within surface type, 2D surface inspection systems held larger share of surface inspection market during 2022

The growth of the 2D segment is attributed to the first entry advantage, low cost, easy maintenance, and easy-to-program software. Despite the numerous benefits of 3D machine vision technology for quality inspection applications, many organizations continue to rely solely on 2D machine vision for quality control processes. While useful in a limited number of scenarios, 2D vision is limited in its ability to achieve 100% quality control, which is considered a major concern, especially in the semiconductor and the electrical & electronics industries, where 100% quality control is a major preference. 2D sensors measure an object's contrast (edge data), which means that 2D detects features based on lighting and color/greyscale variation. This is especially difficult when inspecting low-contrast objects with key features that are the same color as the background.

Semiconductor industry is expected to account for a significant market share in 2023.

Surface inspection systems are popular in the semiconductor industry, where exponential miniaturization is touching the nanometer range, and PCBs have a dense population of components. Furthermore, wafer inspection adds to the huge potential for the surface inspection market size in semiconductor and electrical & electronics verticals.

Surface Inspection Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Robotic cell-based surface inspection systems are expected to grow at highest CAGR from 2023 to 2028”

Due to various advantages such as higher flexibility, accuracy, ability to handle various product variants and reach difficult areas, and ease of handling several inspection points, the market for the robotic cells segment is expected to grow at a higher CAGR during the forecast period. Further, the demand for the collaborative robot (cobots)-based inspection cell systems is expected to grow due to the ability of cobots to work safely alongside humans and better return on investment (RoI) than traditional industrial robots.

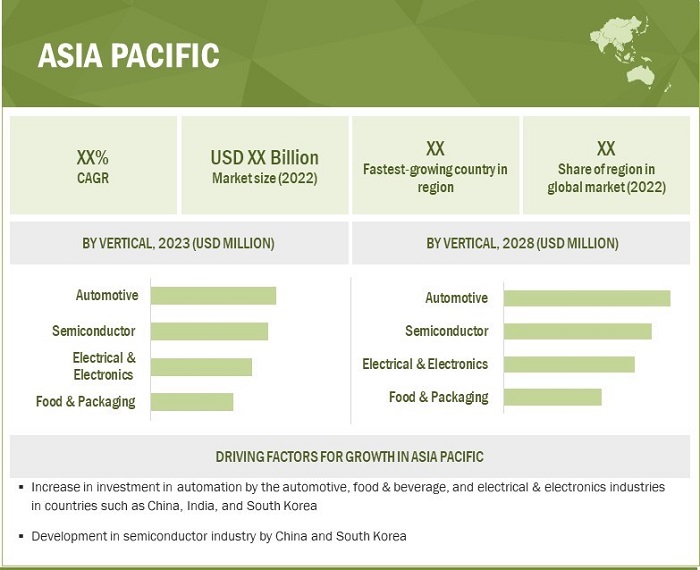

The surface inspection market in Asia Pacific to grow at highest CAGR during forecast period

The surface inspection market share in Asia Pacific has witnessed higher growth in the past 10 years than the maturing markets in Europe and the Americas due to low production costs, easy availability of economical labor, lenient emission and safety norms, and government initiatives for foreign direct investments (FDIs). OEMs and suppliers of surface inspection systems have set up production and sales facilities in this region to cater to local and other markets. The aging population in China and Japan has resulted in rising labor costs, leading to the growing adoption of automation. The growing population is also attracting companies to invest in Asia Pacific. Major companies have a base in Asia Pacific, including KEYENCE (Japan), OMRON (Japan), Panasonic (Japan), Sony (Japan), Sipotek (China), ADLINK (Taiwan), Alpha Techsys (India), SensoVision Systems (India), Kevision Systems (India), and MORITEX (Japan).

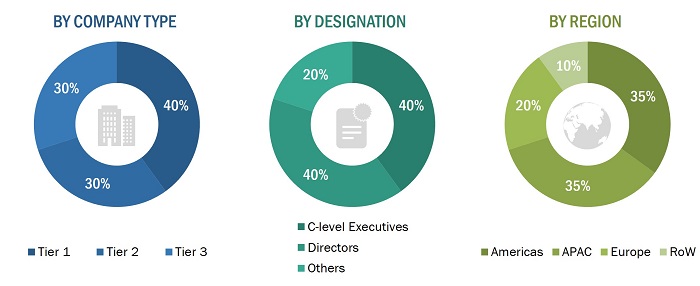

- By Company Type – Tier 1 – 40%, Tier 2 – 30%, and Tier 3 – 30%

- By Designation – C-level Executives – 40%, Directors – 40%, and Others – 20%

- By Region – North America - 35%, Europe – 20%, Asia Pacific – 35%, and RoW – 10

Top Surface Inspection Companies - Key Market Players:

The surface inspection companies players have implemented various organic and inorganic growth strategies, such as product launches, collaborations, partnerships, and acquisitions, to strengthen their offerings in the market. The major players in the market are ISRA VISION (Germany), Cognex (US), OMRON (Japan), Teledyne Technologies (US), and Keyence (Japan).

The study includes an in-depth competitive analysis of these key players in the surface inspection market with their company profiles, recent developments, and key market strategies.

Surface Inspection Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 4.0 billion in 2023 |

| Projected Market Size | USD 5.9 billion by 2028 |

| Growth Rate | CAGR of 7.8% |

|

Years Considered |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

|

|

Regions Covered |

|

|

Companies Covered |

|

Surface Inspection Market Highlights

This report has segmented the overall surface inspection market based on component, surface type, system, deployment type, vertical, and region.

|

Aspect |

Details |

|

By Component |

|

|

By Surface Type |

|

|

By System |

|

|

By Deployment Type |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments in surface inspection Industry :

- In October 2022, Vitronic (Germany) expanded its facilities in Louisville, Kentucky (US). The expansion is a part of the company’s growth strategy in the North American market, which includes additional capacity for regional engineering and customer collaboration centers dedicated to innovation.

- In September 2022, Datalogic (Italy) collaborated with Prophesee SA (France) to offer the most advanced neuromorphic vision system. The collaboration will commercialize the readiness of the Datalogic Metavision platform and its ability to meet a growing range of vision challenges.

- In August 2022, IMS Messsysteme (Germany) developed a unique camera cluster system that guarantees the highest accuracy for flatness measurement, even on high-gloss materials. High-performance cameras are used to detect and record the topography of the individual measuring material.

Frequently Asked Questions (FAQ):

What will be the surface inspection market size in 2023?

The surface inspection market is expected to be valued at USD 4.0 billion in 2023.

What CAGR will be recorded for the surface inspection market from 2023 to 2028?

The global surface inspection market is expected to record a CAGR of 7.8% from 2023–2028.

Who are the top players in the surface inspection market?

The major vendors operating in the surface inspection market include ISRA VISION (Germany), Cognex (US), OMRON (Japan), Teledyne Technologies (US), and Keyence (Japan).

Which major countries are considered in the Americas region?

The report includes an analysis of the US, Canada, Mexico, Brazil, and Rest of the Americas.

Which systems have been considered under the surface inspection market?

Computer-based and camera-based systems are considered in the market study.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involves four major activities for estimating the size of the surface inspection market. Exhaustive secondary research has been conducted to collect information related to the market. The next step is to validate these findings and assumptions related to the market size with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the surface inspection market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the surface inspection market through secondary research. Several primary interviews have been conducted with experts from the demand and supply sides across four major regions—Americas, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the surface inspection market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments. The data has then been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the surface inspection market, in terms of value, based on surface type, system, deployment type, component, and vertical

- To describe and forecast the surface inspection market, in terms of value with regard to four main regions: the Americas, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To provide a detailed overview of the supply chain pertaining to the surface inspection ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the surface inspection market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments in the surface inspection market, such as acquisitions, product launches and developments, and research and developments

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

Company Information:

- Detailed analysis and profiling of additional five market players

Outlook and Growth of Surface Inspection and Frame grabbers Market

Frame grabbers are devices that capture individual frames of digital video signals and convert them into digital images that can be processed by a computer. They are often used in conjunction with imaging sensors, such as cameras or sensors used for surface inspection, to capture high-quality images at high speeds.

In the context of surface inspection, frame grabbers are used to capture and process images of the surface being inspected, allowing defects and anomalies to be identified and analyzed. The high-speed processing capabilities of frame grabbers make them particularly useful in applications where real-time detection and analysis is necessary.

Surface inspection is a process that involves using various types of sensors and imaging technologies to detect and inspect the surface of an object for defects or anomalies. This process is commonly used in manufacturing and quality control applications, where it is necessary to ensure that products meet certain standards and specifications.

Niche Threats for the Frame grabbers Market:

The frame grabbers market may face several niche threats, including:

Advancements in camera technology: As camera technology continues to advance, manufacturers may opt for cameras with built-in image processing capabilities, reducing the need for separate frame grabbers.

Emergence of alternative technologies: Alternative technologies, such as field-programmable gate arrays (FPGAs) and system-on-chip (SoC) solutions, may offer similar functionality to frame grabbers and could potentially replace them in certain applications.

Economic downturns: The frame grabbers market is highly dependent on the manufacturing sector, which can be adversely affected by economic downturns. During periods of economic instability, manufacturers may reduce their investments in technology and equipment.

Increasing adoption of wireless systems: As wireless technology becomes more prevalent, there may be a shift towards wireless image transfer systems, reducing the need for physical connections and potentially impacting the demand for frame grabbers.

Intellectual property issues: There may be intellectual property issues surrounding the development and manufacture of frame grabbers, such as patent disputes, which could potentially impact the market.

Market Scope of Frame Grabbers Market

The frame grabbers market is expected to grow significantly in the coming years, driven by the increasing demand for high-quality image capture and processing in various industries. Frame grabbers are widely used in applications such as industrial automation, medical imaging, surveillance, and scientific research.

The growing adoption of machine vision systems in manufacturing and quality control is also driving the demand for frame grabbers. These systems use cameras and imaging sensors to detect defects and anomalies in products, and frame grabbers play a critical role in capturing and processing the images for analysis.

Furthermore, the increasing use of digital imaging in medical applications, such as X-ray and ultrasound imaging, is also fueling the demand for frame grabbers. These devices help to capture and process high-quality images for diagnosis and treatment planning.

Geographically, the Asia-Pacific region is expected to experience the highest growth rate in the frame grabbers market, driven by the increasing adoption of automation and digital imaging technologies in industries such as automotive, electronics, and healthcare. North America and Europe are also significant markets for frame grabbers, with strong demand from industries such as aerospace, defense, and scientific research.

How is Frame Grabbers going to impact the surface inspection market?

Frame grabbers are already having a significant impact on the surface inspection market and are expected to continue to play a critical role in this field. The use of frame grabbers enables high-quality images of the surface being inspected to be captured and processed quickly and accurately, which is essential in ensuring that defects and anomalies are identified and corrected in real-time.

One of the key benefits of frame grabbers is their ability to process large amounts of data at high speeds, which is essential in surface inspection applications. With advances in imaging and automation technologies, the amount of data generated during surface inspection is increasing rapidly, making it more important than ever to have fast and efficient processing capabilities. Frame grabbers provide the speed and efficiency necessary to handle this growing amount of data and enable real-time analysis of the surface being inspected.

Another advantage of frame grabbers is their flexibility and compatibility with a wide range of imaging sensors and cameras. This allows for the integration of the latest imaging technologies into surface inspection systems, enabling high-quality images to be captured with greater precision and accuracy.

Overall, the use of frame grabbers in surface inspection is expected to continue to grow, driven by the increasing demand for high-quality standards and greater efficiency in manufacturing processes. The impact of frame grabbers in this field is already significant, and as new imaging and automation technologies continue to emerge, the adoption of frame grabbers is likely to increase even further. By enabling real-time detection and analysis of surface defects and anomalies, frame grabbers are playing a critical role in improving product quality and customer satisfaction in various industries.

What will be future use cases of Frame Grabbers along with commentary of adaption, market potential, risk

The future use cases of frame grabbers are likely to be diverse and varied, with increasing demand in various industries for high-quality image capture and processing. Some potential use cases of frame grabbers are:

Autonomous vehicles: Frame grabbers can be used to capture and process high-quality images in autonomous vehicles, enabling real-time analysis of the environment for safe and efficient navigation.

Virtual and augmented reality: Frame grabbers can be used to capture high-quality images for use in virtual and augmented reality applications, providing a more immersive and realistic experience.

3D printing: Frame grabbers can be used to capture and process high-quality images for 3D printing, enabling accurate and precise printing of complex objects.

Agriculture: Frame grabbers can be used in agriculture to capture and process images of crops, enabling real-time analysis of plant health and growth.

The adaptation of frame grabbers in these and other industries is likely to be driven by the increasing demand for high-quality image capture and processing. With the continuous advancements in imaging and automation technologies, the market potential for frame grabbers is significant, and the adoption of these devices is likely to continue to grow.

However, there are also potential risks associated with the future use cases of frame grabbers. These include the emergence of alternative technologies, such as FPGAs and SoC solutions, that could potentially replace frame grabbers in certain applications. Additionally, economic downturns could impact the demand for frame grabbers, and intellectual property issues, such as patent disputes, could potentially impact the frame grabbers market.

Key challenges for growing frame grabbers market in the future:

While the market potential for frame grabbers is significant, there are several key challenges that may impact the growth of this market in the future. Some of the key challenges are:

Competition from alternative technologies: As technology continues to evolve, there is always the possibility that alternative imaging and automation technologies could emerge that could potentially replace frame grabbers in certain applications. For example, FPGAs and SoC solutions are becoming increasingly popular, and these alternatives could potentially challenge the dominance of frame grabbers in certain markets.

Cost: The cost of frame grabbers can be relatively high, which may make it difficult for smaller businesses and organizations to adopt these devices. This could potentially limit the growth of the frame grabbers market in certain sectors.

Complexity: Frame grabbers can be relatively complex devices that require specialized knowledge and expertise to operate and integrate into existing systems. This could potentially limit the adoption of frame grabbers in certain industries, where the necessary expertise may not be readily available.

Intellectual property issues: There is always the potential for patent disputes and other intellectual property issues to arise, which could impact the growth of the frame grabbers market. This could potentially lead to legal battles and increased costs for manufacturers and customers.

Top Companies in frame grabbers market:

The frame grabbers market is dominated by several top companies that are driving innovation and growth in the field. Teledyne DALSA, National Instruments, Matrox Imaging, Baumer, and ADLINK Technology are among the key players in the market, offering a wide range of frame grabbers for various applications. These companies are known for their high-performance and reliable products, which are used in industries ranging from industrial automation and machine vision to scientific research and medical imaging. Despite the competitive market, these companies and others are continuing to innovate, driving improvements in speed, accuracy, and efficiency for imaging and automation applications.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Surface Inspection Market