Surgical Microscopes Market by Application (Neuro and Spine Surgery, Plastic and Reconstructive Surgery, Ear, Nose, and Throat Surgery, Oncology, Urology, Documentations), End User (Hospitals, Outpatient Facility) - Global Forecast to 2021

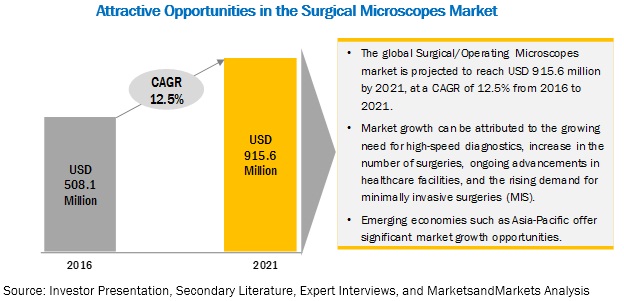

[115 Pages Report] The global surgical microscopes market is projected to reach USD 915.6 million by 2021 from USD 508.1 million in 2016, growing at a CAGR of 12.5% during the forecast period. Growth in this market can mainly be attributed to factors such as the increasing use of fluorescence image-guided surgery (FIGS), increase in the number of surgeries and growing demand for MIS, advancements in healthcare facilities, technological advancements, and customized microscopy solutions. The high growth potential in emerging markets such as China, India, the Middle East, and Brazil and broadened applications of surgical/operating microscopes unfold huge growth opportunities for players in the surgical/operating microscopes market.

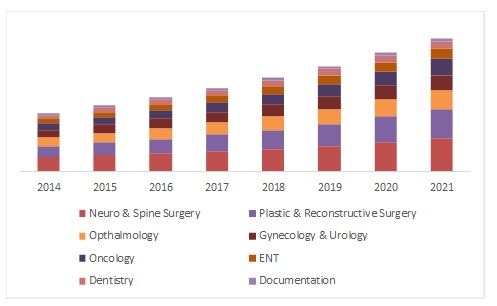

By Application, oncology segment is expected to grow at the fastest rate in the forecast period.

Based on application, the global surgical/operating microscopes market is categorized into dentistry, ENT (ear, nose, and throat) surgery, gynecology and urology, neuro and spine surgery, oncology, ophthalmology, plastic and reconstructive surgery, and documentation. In 2016, the neuro and spine surgery segment is estimated to account for the largest share of the global surgical/operating microscopes market. Oncology forms the fastest-growing segment.

Factors such as increasing R&D activities on tissue clearing and targeted cell labeling for brain functions and growing demand for surgical/operating microscopes for microsurgeries of the brain and spine are the major drivers for the growth of the neuro & spine surgery segment. OPMI Pentero C Neurosurgical/operating microscope from Carl Zeiss, Leica FL800 Neurosurgical Microscope from Leica Microsystems, MultiVision Neurosurgical Microscope from Zeiss, and Leica M720 OH5 Neurosurgical Microscope from Leica Microsystems are some examples of surgical/operating microscopes use in neuro and spine surgeries.

Surgical/Operating Microscopes Market, By Application, 2014 to 2021 (USD Million

By End User, hospitals dominated the market in 2016

Based on end user, the global surgical/operating microscopes market is segmented into hospitals and outpatient facilities. Hospitals dominated this market in 2016. The large share of this segment can be attributed to the growing usage of surgical/operating microscopes in complex neurology, ENT, and dental procedures, and implementation of less-invasive surgical instruments during MIS procedures in hospitals.

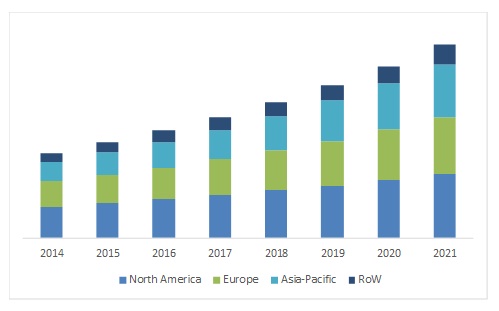

In 2018, North America is expected to account for the largest market share, followed by Europe

In 2018, North America is expected to account for the largest market share, followed by Europe. The major drivers for the growth of the surgical/operating microscopes market are the need for high-speed diagnostics, increase in the number of surgeries, and advancements in healthcare facilities. On the other hand, the high cost of surgical/operating microscopes, implementation of excise tax by the U.S. government, and huge custom duties charged on medical devices in India and Brazil are the major factors hindering the growth of this market.

Surgical/Operating Microscopes Market, By Geography, 2014 to 2021 (USD Million)

Market Dynamics

Driver: Increasing use of fluorescence image-guided surgery (FIGS)

Most of the current intraoperative surgical procedures are based on established white-light reflectance and depend on the surgeon’s ability to differentiate between diseased tissue and adjacent normal tissue. However, it can be extremely challenging even for a well-trained and experienced surgeon to accurately differentiate between diseased tissue and normal tissue. This is especially true while operating on a tumor where the margins are not easily detectable under white-light reflectance. Similarly, in buried tumors, the overlying tissue can prevent detection and removal. Any residual tumor that remains may lead to metastasis, which may significantly affect the surgical outcome and survival rate of the patient.

One of the most promising approaches is the use of fluorescence imaging to guide surgeries at the molecular level, such as molecular navigation. Fluorescence image-guided surgery (FIGS), also referred to as fluorescence-assisted resection and exploration (FLARE), uses fluorescence light that is emitted from a reporter dye molecule that “sticks” to a cancerous mass. This phenomenon serves as an intraoperative visualization tool to aid the surgeon with real-time tumor identification and delineation. In this way, it becomes possible for nearly complete removal of cancerous tissue during the initial surgery. The growing need for surgical tools such as fluorescence modules that can accurately define diseased tissue and its margins will drive the surgical/operating microscopes market.

Restraint: High cost of advanced surgical/operating microscopes

Owing to technological advancements, there has been a paradigm shift in the usage pattern of surgical/operating microscopes. Surgical/operating microscopes used in complex procedures such as neurosurgery and ophthalmic surgery cost between ~USD 40,000 and ~USD 150,000, which is a major factor limiting their adoption. In addition to this, recurrent expenses in the form of maintenance of these microscopes may result in high operational costs. This high cost results in the dependence of users on private funding. Thus, the high cost of advanced surgical/operating microscopes restrains the growth of the surgical/operating microscopes market during the forecast period.

Opportunity: Emerging markets (China, India, Brazil, and The Middle East)

China, India, Brazil, and the Middle East are the emerging markets for surgical/operating microscopes; these markets are currently in the nascent stage. These markets lack proper standards and government regulations and offer a huge potential for providers unable to meet U.S. standards.

China is a high-potential market for surgical/operating microscopes due to the easy availability of a skilled workforce and academic excellence. India, Brazil, and the Middle East are also new revenue pockets for market players. The emerging markets are home to more than 85% of the global population. With the rise in prevalence of lifestyle diseases, there is a large pool of patients in the emerging nations that require medical assistance, including surgeries. Over time, much attention has been given to medical care accessibility in emerging countries. With the increase in the purchasing power of the growing middle-class population in the emerging nations, an increasing number of people are able to afford essential care, including MIS procedures. Hence, the growing middle class in emerging markets will drive the growth of the surgical/operating microscopes market.

Challenge: High degree of technical expertise

Highly skilled personnel are required to handle advanced surgical/operating microscopes, especially in neurosurgery and ophthalmology. Efficiently maneuvering a surgical/operating microscope is a prime requisite while performing a procedure. Maneuvering a surgical/operating microscope is a skill that requires expertise. Lack of this skill could lead to time wastage during the adjustment of the microscope to obtain optimum views of the surgical site. However, microscope maneuvering is often overlooked as a trivial task and there are no quantitative methods to assess microscope maneuvering skill development. Thus, dearth of skilled labor and complexity of the instrumentation may pose as challenges for the growth of this market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2014–2021 |

|

Base year considered |

2015 |

|

Forecast period |

2016–2021 |

|

Forecast units |

Million (USD) |

|

Segments covered |

By Application, End User, By Geography |

|

Geographies covered |

North America (U.S., Canada), Europe (Germany, U.K., ROE), Asia-Pacific (China, India, Rest of Asia-Pacific), Rest of the World (RoW) |

|

Companies covered |

Novartis Ag (Switzerland), Danaher Corporation (U.S.), Topcon Corporation (Japan), Carl Zeiss AG (Germany), Hagg-Streit Surgical GMBH (MÖLLER-WEDEL GMBH) (Germany), Accu-Scope Inc., Alltion (Wuzhou) Co., Ltd., Arri Medical (Arri Group), Karl Kaps GmbH & Co. Kg, Takagi Seiko Co. Ltd. |

Key Market Players

Novartis Ag (Switzerland), Danaher Corporation (U.S.), Topcon Corporation (Japan), Carl Zeiss AG (Germany), Hagg-Streit Surgical GMBH (MÖLLER-WEDEL GMBH) (Germany) Accu-Scope Inc., Alltion (Wuzhou) Co., Ltd., Arri Medical (Arri Group), Karl Kaps GmbH & Co. Kg, Takagi Seiko Co. Ltd.

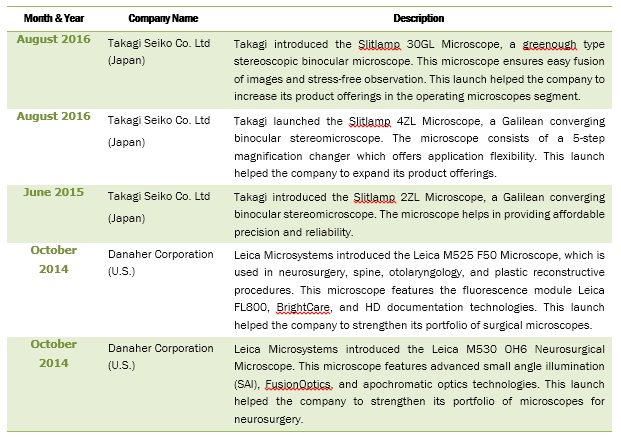

Recent Developments

Product Launches, 2014–2016

Critical questions the report answers:

- Who are the major market players in the surgical microscopes market?

- What are the growth trends and the largest revenue-generating region for surgical microscopes?

- How are surgical microscopes sold to customers?

- What are the major applications of surgical microscopes?

- What are the driving, restraining, opportunistic, and challenging factors for this market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Scope

1.2.1 Markets Covered

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Market Size Estimation

2.2 Market Breakdown and Data Triangulation

2.2.1 Key Data From Secondary Sources

2.2.2 Key Data From Primary Sources

2.2.2.1 Key Industry Insights

2.2.2.2 Assumptions for the Study

2.3 Macroeconomic Factor Analysis

2.3.1 Introduction

2.3.2 Demand-Side Analysis

2.3.2.1 Health Care Expenditure Pattern

2.3.2.2 Increasing Number of New Cancer Cases

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Market to Witness High Growth in the Forecast Period

4.2 Market, By Application

4.3 Market, By End User

4.4 Market, By Region

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Use of Fluorescence Image-Guided Surgery (FIGS)

5.2.1.2 Increase in the Number of Surgeries and Growing Demand for Mis

5.2.1.3 Advancements in Healthcare Facilities

5.2.1.4 Technological Advancements

5.2.1.5 Customized Microscopy Solutions

5.2.2 Restraints

5.2.2.1 High Cost of Advanced Operating Microscopes

5.2.2.2 Implementation of Excise Tax By the U.S. Government

5.2.2.3 Heavy Custom Duties on Medical Devices

5.2.3 Opportunities

5.2.3.1 Emerging Markets (China, India, Brazil, and the Middle East)

5.2.3.2 Broadened Applications of Operating Microscopes

5.2.4 Challenges

5.2.4.1 High Degree of Technical Expertise

6 Surgical Microscopes Market, By Application (Page No. - 37)

6.1 Introduction

6.2 Neuro and Spine Surgery

6.3 Plastic and Reconstructive Surgery

6.4 Ophthalmology

6.5 Gynecology and Urology

6.6 Oncology

6.7 Ear, Nose, and Throat (ENT) Surgery

6.8 Dentistry

6.9 Documentation

7 Surgical Microscopes Market, By End User (Page No. - 53)

7.1 Introduction

7.2 Hospitals

7.3 Outpatient Facilities

8 Surgical Microscopes Market, By Region (Page No. - 59)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.3 Europe

8.3.1 Germany

8.3.2 U.K.

8.3.3 RoE (Rest of Europe)

8.4 Asia-Pacific

8.4.1 China

8.4.2 India

8.4.3 RoAPAC (Rest of APAC)

8.5 Rest of the World (RoW)

9 Competitive Landscape (Page No. - 81)

9.1 Overview

9.2 Battle for Market Share: Product Launch Was the Key Strategy Adopted By Market Players Between 2014 & 2016

9.3 Product Launches

9.4 Agreements and Collaborations

9.5 Other Strategies

10 Company Profiles (Page No. - 85)

(Overview, Products and Services, Financials, Strategy & Development)*

10.1 Introduction

10.2 Novartis AG

10.3 Danaher Corporation

10.4 Topcon Corporation

10.5 Carl Zeiss AG

10.6 Haag-Streit Surgical GmbH (Möller-Wedel GmbH)

10.7 Accu-Scope Inc.

10.8 Alltion (Wuzhou) Co., Ltd.

10.9 Arri Medical (Arri Group)

10.10 Karl Kaps GmbH & Co. Kg

10.11 Takagi Seiko Co. Ltd.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 104)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Other Developments

11.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.5 Introducing RT: Real-Time Market Intelligence

11.6 Available Customizations

11.7 Related Reports

11.8 Author Details

List of Tables (69 Tables)

Table 1 Global Operating Microscopes Market Snapshot (2016 vs 2021)

Table 2 Technological Advancements

Table 3 Operating Microscopes Market Size, By Application, 2014–2021 (USD Million)

Table 4 Operating Microscopes Market Size for Neuro and Spine Surgery, By Region, 2014–2021 (USD Million)

Table 5 North America: Operating Microscopes Market Size for Neuro and Spine Surgery, By Country, 2014–2021 (USD Million)

Table 6 Europe: Operating Microscopes Market Size for Neuro and Spine Surgery, By Country/Region, 2014–2021 (USD Million)

Table 7 Asia-Pacific: Operating Microscopes Market Size for Neuro and Spine Surgery, By Country/Region, 2014–2021 (USD Million)

Table 8 Operating Microscopes Market Size for Plastic and Reconstructive Surgery, By Region, 2014–2021 (USD Million)

Table 9 North America: Operating Microscopes Market Size for Plastic and Reconstructive Surgery, By Country, 2014–2021 (USD Million)

Table 10 Europe: Operating Microscopes Market Size for Plastic and Reconstructive Surgery, By Country/Region, 2014–2021 (USD Million)

Table 11 Asia-Pacific: Operating Microscopes Market Size for Plastic and Reconstructive Surgery, By Country/Region, 2014–2021 (USD Million)

Table 12 Operating Microscopes Market Size for Ophthalmology, By Region, 2014–2021 (USD Million)

Table 13 North America: Operating Microscopes Market Size for Ophthalmology Market Size, By Country, 2014–2021 (USD Million)

Table 14 Asia-Pacific: Operating Microscopes Market Size for Ophthalmology, By Country/Region, 2014–2021 (USD Million)

Table 15 Operating Microscopes Market Size for Gynecology and Urology, By Region, 2014–2021 (USD Million)

Table 16 North America: Operating Microscopes Market Size for Gynecology and Urology, By Country, 2014–2021 (USD Million)

Table 17 Asia-Pacific: Market Size for Gynecology and Urology, By Country/Region, 2014–2021 (USD Million)

Table 18 Surgical Microscopes Market Size for Oncology, By Region, 2014–2021 (USD Million)

Table 19 North America: Market Size for Oncology, By Country, 2014–2021 (USD Million)

Table 20 Asia-Pacific: Market Size for Oncology, By Country/Region, 2014–2021 (USD Million)

Table 21 Market Size for ENT Surgery, By Region, 2014–2021 (USD Million)

Table 22 North America: Market Size for ENT Surgery, By Country, 2014–2021 (USD Million)

Table 23 Asia-Pacific: Market Size for ENT Surgery, By Country/Region, 2014–2021 (USD Million)

Table 24 Surgical Microscopes Market Size for Dentistry, By Region, 2014–2021 (USD Million)

Table 25 North America: Market Size for Dentistry, By Country, 2014–2021 (USD Million)

Table 26 Asia-Pacific: Market Size for Dentistry, By Country/Region, 2014–2021 (USD Million)

Table 27 Market Size for Documentation, By Region, 2014–2021 (USD Million)

Table 28 North America: Market Size for Documentation, By Country, 2014–2021 (USD Million)

Table 29 Asia-Pacific: Surgical Microscopes Market Size for Documentation, By Country/Region, 2014–2021 (USD Million)

Table 30 Market Size, By End User, 2014–2021 (USD Million)

Table 31 Surgical Microscopes Market Size for Hospitals, By Region, 2014–2021 (USD Million)

Table 32 North America: Operating Microscopes Market Size for Hospitals, By Country, 2014–2021 (USD Million)

Table 33 Europe: Operating Microscopes Market Size for Hospitals, By Country/Region, 2014–2021 (USD Million)

Table 34 Asia-Pacific: Operating Microscopes Market Size for Hospitals, By Country/Region, 2014–2021 (USD Million)

Table 35 Operating Microscopes Market Size for Outpatient Facilities, By Region, 2014–2021 (USD Million)

Table 36 North America: Operating Microscopes Market Size for Outpatient Facilities, By Country, 2014–2021 (USDmillion)

Table 37 Europe: Surgical Microscopes Market Size for Outpatient Facilities, By Country/Region, 2014–2021 (USD Million)

Table 38 Asia-Pacific: Surgical Microscopes Market Size for Outpatient Facilities, By Country/Region, 2014–2021 (USD Million)

Table 39 Market Size, By Region, 2014–2021 (USD Million)

Table 40 North America: Surgical Microscopes Market Size, By Country, 2014–2021 (USD Million)

Table 41 North America: Operating Microscopes Market Size, By Application, 2014–2021 (USD Million)

Table 42 North America: Operating Microscopes Market Size, By End User, 2014–2021 (USD Million)

Table 43 U.S.: Operating Microscopes Market Size, By Application, 2014–2021 (USD Million)

Table 44 U.S.: Market Size, By End User, 2014–2021 (USD Million)

Table 45 Canada: Surgical Microscopes Market Size, By Application, 2014–2021 (USD Million)

Table 46 Canada: Market Size, By End User, 2014–2021 (USD Million)

Table 47 Europe: Surgical Microscopes Market Size, By Country/Region, 2014–2021 (USD Million)

Table 48 Europe: Surgical Microscopes Market Size, By Application, 2014–2021 (USD Million)

Table 49 Europe: Market Size, By End User, 2014–2021 (USD Million)

Table 50 Germany: Surgical Microscopes Market Size, By Application, 2014–2021 (USD Million)

Table 51 Germany: Market Size, By End User, 2014–2021 (USD Million)

Table 52 U.K.: Surgical Microscopes Market Size, By Application, 2014–2021 (USD Million)

Table 53 U.K.: Market Size, By End User, 2014–2021 (USD Million)

Table 54 RoE: Surgical Microscopes Market Size, By Application, 2014–2021 (USD Million)

Table 55 RoE: Market Size, By End User, 2014–2021 (USD Million)

Table 56 APAC: Surgical Microscopes Market Size, By Country/Region, 2014–2021 (USD Million)

Table 57 APAC: Surgical Microscopes Market Size, By Application, 2014–2021 (USD Million)

Table 58 APAC: Market Size, By End User, 2014–2021 (USD Million)

Table 59 China: Surgical Microscopes Market Size, By Application, 2014–2021 (USD Million)

Table 60 China: Market Size, By End User, 2014–2021 (USD Million)

Table 61 India: Market Size, By Application, 2014–2021 (USD Million)

Table 62 India: Market Size, By End User, 2014–2021 (USD Million)

Table 63 RoAPAC: Surgical Microscopes Market Size, By Application, 2014–2021 (USD Million)

Table 64 RoAPAC: Market Size, By End User, 2014–2021 (USD Million)

Table 65 RoW: Market Size, By Application, 2014–2021 (USD Million)

Table 66 RoW: Surgical Microscopes Market Size, By End User, 2014–2021 (USD Million)

Table 67 Product Launches, 2014–2016

Table 68 Agreements and Collaborations, 2014–2016

Table 69 Other Strategies, 2014–2016

List of Figures (28 Figures)

Figure 1 Research Design

Figure 2 Surgical Microscopes Market: Top Down Approach

Figure 3 Market: Bottom Up Approach

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Data Triangulation Methodology

Figure 6 Healthcare Expenditure Across Major Countries: 2000 vs 2014

Figure 7 Increasing Number of New Cancer Cases Worldwide (2012 vs 2015 vs 2020)

Figure 8 Market Snapshot (2016 vs 2021)

Figure 9 Global Surgical Microscopes Market, By Application, 2016 vs 2021

Figure 10 Global Operating Microscopes Market, By End User, 2016 vs 2021

Figure 11 Geographical Snapashot of the Operating Microscopes Market

Figure 12 Increase in the Number of Surgeries and Growing Demand for Mis to Drive Market Growth

Figure 13 Neuro and Spine Surgery Application Segment Dominated the Market in 2016

Figure 14 Hospitals Were the Major End Users in 2016

Figure 15 Asia-Pacific to Grow at the Highest Rate During the Forecast Period

Figure 16 Operating Microscopes: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Neuro and Spine Surgery Application Segment to Dominate the Operating Microscopes Market in 2016

Figure 18 Hospitals to Form the Largest End Users of Operating Microscopes in 2016

Figure 19 Operating Microscopes Market: Geographic Snapshot

Figure 20 Asia-Pacific - an Attractive Destination for All Product Categories

Figure 21 North America: Surgical Microscopes Market Snapshot

Figure 22 Asia-Pacific: Market Snapshot

Figure 23 Key Developments Witnessed By Leading Players in the Market, 2014–2016

Figure 24 Geographic Revenue Mix of the Top 4 Market Players

Figure 25 Novartis AG: Company Snapshot (2015)

Figure 26 Danaher Corporation: Company Snapshot (2015)

Figure 27 Topcon Corporation: Company Snapshot (2016)

Figure 28 Carl Zeiss AG: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Surgical Microscopes Market