Technical Textile Market by Material (Natural Fiber, Synthetic Polymer, Metal, Mineral, Regenerated Fiber), by Process (Woven, Knitted, Non-woven), by Application (Mobiltech, Indutech, Protech, Buildtech, Packtech), and Region - Global Forecast to 2025

Technical Textile Market

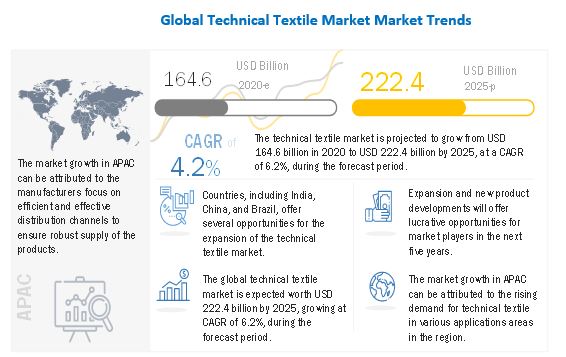

The global technical textile market was valued at USD 164.6 billion in 2020 and is projected to reach USD 222.4 billion by 2025, growing at a cagr 6.2% from 2020 to 2025. Technical textiles are products which have higher performance qualities as compared to traditional textiles. The types of materials used for manufacturing comprise synthetic fibers and natural. The synthetic fibers that are used for these applications are manufactured by the combination of some special chemical processes on various natural fibers to impart the new properties. These fibers have greater qualities, such as higher strength, than manmade fibers; hence, they are widely used not only for apparel use, but also in other different applications such as medical, automotive, and others.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global technical textile market

The outbreak of COVID-19 has affected the demand as well as the manufacturing in supply regions. The COVID-19 crisis has affected the chemical industry supply chain to a major extent; thus, having a major impact on raw material procurement.The above factors have impacted the growth of the technical textile market. However, this pandemic resulted in a sudden increase in demand for medical apparels such as gown, mask, and others, which positively affected the demand for technical textiles.

Thus, the technical textile market is expected to witness significant growth during to the COVID-19. The technical textile manufacturers around the globe are expanding their production capacity and investing in machinery to manufacture healthcare essentials) in response to the COVID-19 pandemic. The increase in the number of cases worldwide and the growing need for healthcare workers are expected to boost the demand for disposable hospital supplies and nonwoven materials during the forecast period

- On May 2020, Berry Global has announced an expansion of its Meltex melt-blown capacity, with the addition of an asset to support the growing demand for face masks during COVID-19. The new line will focus on the manufacturing of nonwoven protection materials and filter materials for premium FFP2 (N95) and FFP3 (N99) grade filter media.

- On April 2020, Ahlstrom-Munksjo has increased its nonwoven production across its entire protective materials portfolio, in response to COVID-19. The company has expanded its product offering of protective materials for all three face mask categories- civil masks, surgical masks, and respiratory masks.

Technical Textile Market Dynamics

Driver: Increasing adaptability and awareness of the products

Growing awareness about the superior functionality and application of technical textiles is encouraging the higher consumption of technical textiles and related products. The increasing adaptability of unconventional value in textiles has influenced traditional manufacturing to escalate the pace of innovation, and upgrade the traditional fibers by contributing to technical textile development. The change is attributed to accelerated demand for product which offers flexibility, durability and offers superior functionalities such as personal safety, high strength, and light weight.

Restraint: High cost of finished products affect s the pricing structure of the intermediate industry

The complex procedure of technical textiles manufacturing is a restraint to the market participants as it requires advanced infrastructure which is cost sensitive. Along with this, high cost of raw material procurement inevitably raises the total cost of finished product to an extent where the manufacturers are left with limited opportunities for profit margin. On the other hand, the high price of technical textiles products affects the pricing structure of the intermediate industries which makes the final product available to the customer.

Opportunity: Proliferation of new technologies

With the technological enhancement, the textile industry has witnessed high growth in most of its product segments, especially for technical textiles. New technologies are expected to bring down the production cost, thus making manufacturing of technical textile commercially feasible. The improved technologies in spinning, weaving & knitting segment, such as melt spinning, thermo-forming, and three dimensional weaving & knitting wet spinning, have made it possible to produce technical textiles fibers with functional properties required for technical textiles. The production of high performance fibers is largely grounded in technologically advanced countries such as the US, Japan, Canada, and some European countries and is progressing in developing countries such as India, China, and Korea.

Challenge: Varying environmental mandates across regions

Environmental mandates regarding the chemical use in industry differ across various countries; this makes it difficult for manufacturers to adjust the usage of textile manufacturing materials according to the region specific regulations. Environmental mandates are rampant on the final consumer, government, and intermediate industry as well. Consumers are showing more interest towards biodegradable and eco-friendly materials; the intermediate industry tries to ensure that the product does not increase the cost of the final product to an extent that they lose out on market share. Governments in Europe, North America, and Asia have developed regulations strictly pertaining to the chemical industry with regards to their recycling rates, container deposits, and wastes.

Synthetic polymer is widely preferred material for technical textile production

Based on material, the synthetic polymer segment is estimated to account for the largest share in 2019, owing to factors such as low cost and high quality.Whereas, based on application, the mobiltech segment of the technical textile market accounts for the karger share. This demand can be attributed to the increasing use of technical textiles in various areas of automobile sector such as seat belts, seating upholstery, tire cords & linear, and others.

Significant increase in the hygiene products during COVID-19 pandemic

By application, the hygiene segment is projected to be the largest segment in the technical textile market. Nonwovens process are used as an alternative to traditional textiles in hygiene products due to their excellent absorption properties, softness, smoothness, strength, comfort & fit, stretchability, and cost-effectiveness. Owing to the spread of the COVID-19 pandemic, the demand for technical textile for hygiene applications is also accelerating, bringing more opportunities for the manufacturers operating in the nonwoven hygiene products.

APAC region to lead the global technical textile market by 2025

The APAC region accounted for the largest market share in 2019. Factors such as improving global economy, expanding working population, rising domestic demand for hygiene products are expected to boost the market for technical textile. The market for technical textile in APAC is growing in the automobile, agriculture, geotextiles, industrial/military, medical/healthcare, and construction industries due to the unique functional properties offered by technical textile, such as hygiene and safety, cost-effectiveness, durability, strength, lightweight, versatility, user-friendliness, environmental-friendliness, and logistical convenience.

Technical Textile Market Players

The technical textile market is dominated by a few globally established players, such as Asahi Kasei (Japan), Kimberly Clarke (US), Berry Global Group (US), DuPont (US), Mitsui Chemicals (Japan), and Freudenberg & Co. (Germany). Other players include Low & Bonar (UK), Huntsman (US), Toyobo Co. (Japan), Milliken & Company (US), SRF Limited (India), Koninklijke Ten Cate (Netherlands), and International Textile Group (US), among many others.

Technical Textile Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Thousand Tons) |

|

Segments covered |

Material, Technology, Application and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

Asahi Kasei (Japan), Kimberly Clarke (US), Berry Global Group (US), DuPont (US), Mitsui Chemicals (Japan), and Freudenberg & Co. (Germany). Other players include Low & Bonar (UK), Huntsman (US), Toyobo Co. (Japan), Milliken & Company (US), SRF Limited (India), Koninklijke Ten Cate (Netherlands), and International Textile Group (US) |

This research report categorizes the technical textile market based on material, technology, application and region.

On the basis of material

-

Natuiral Fiber

- Cotton

- Wool

- Others

-

Synthetic Polymer

- Polyethersulfone (PES)

- Polyamide (PA)

- Polyacrylonitrile (PAN)

- Polypropylene (PP)

- Polyester

- Others

-

Mineral

- Asbestos

- Glass

- Ceramic fiber

- Metal

- Regenerated Fiber

- Rayon

- Acetate

- Others

On the basis of technology

- Woven

- Knitted

- Non-Woven

- others

On the basis of application

- Mobiltech

- Sportech

- Buildtech

- Hometech

- Clothtech

- Meditech

- Agrotech

- Protech

- Packtech

- Oekotech

- Geotech

On the basis of

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In September 2017, Asahi Kasei Fibers & Textiles expanded its capacity to produce Lamous, a high-quality microfiber suede. It is used in a wide variety of applications such as furniture upholstery, automotive interiors, IT accessories, apparel, and industrial materials.

- In May 2017, Kimberly-Clark introduced two new products under Kleenex brand for modern day life. Kleenex Ultra Soft Go-Anywhere tissue and Kleenex Multicare tissue are larger and stronger tissue under the facial tissue category.

- In June 2017, Freudenberg & Co. Kg launched Evolon® New Generation which is made up of microfilaments that improves the product’s resistance to mechanical stress, abrasion and repeated washing. This has helped the company to improve its product offerings in the textile industry.

Frequently Asked Questions (FAQ):

What is the current size of global technical textile market?

The global technical textile market size is projected to grow from USD 179.2 billion in 2020 to USD 220.4 billion by 2025, at a CAGR of 4.2% from 2020 to 2025.

How is the technical textile market aligned?

The technical textile market is highly fragmented, and has a large number of global, regional and domestic players who have a very strong presence in the market. These players have strong and well-established procurement and distribution networks, which help in cost-efficient production.

Who are the key players in the global technical textile market?

The key players operating in the technical textile market are DuPont (US), Kimberly Clark (US), Asahi Kasei (Japan), Berry Global Group (US), Mitsui Chemicals (Japan), and others.

What are the latest ongoing trends in the technical textile market?

The players operating in the technical textile market aim to offer a low-cost, sustainable, and environmentally friendly, nonwoven based-products, owing to a shift in trend (use of lightweight, recycled materials, and nanotechnology for the nonwoven) among the end-users who are engaged in the production of healthcare, hygiene, construction, automotive, geotextiles, and packaging product. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 TECHNICAL TEXTILE MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

FIGURE 2 REGIONS COVERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 3 TECHNICAL TEXTILE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: TECHNICAL TEXTILE MARKET

FIGURE 5 TECHNICAL TEXTILE MARKET, BY REGION

FIGURE 6 TECHNICAL TEXTILE MARKET, BY APPLICATION

FIGURE 7 MARKET SIZE ESTIMATION: BY MATERIAL AND PROCESS

2.2.1 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

FIGURE 10 TECHNICAL TEXTILE MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 11 NATURAL FIBER TO BE THE FASTEST-GROWING MATERIAL IN THE TECHNICAL TEXTILE MARKET

FIGURE 12 NONWOVEN PROCESS TO GROW AT THE HIGHEST CAGR IN THE TECHNICAL TEXTILE MARKET

FIGURE 13 MOBILTECH TO BE THE LARGEST APPLICATION IN THE TECHNICAL TEXTILE MARKET

FIGURE 14 APAC LED THE TECHNICAL TEXTILE MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 EMERGING ECONOMIES TO WITNESS RELATIVELY HIGHER DEMAND FOR TECHNICAL TEXTILE

FIGURE 15 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN THE TECHNICAL TEXTILE MARKET

4.2 APAC: TECHNICAL TEXTILE MARKET, BY APPLICATION AND COUNTRY

FIGURE 16 CHINA WAS THE LARGEST MARKET IN APAC IN 2019

4.3 TECHNICAL TEXTILE MARKET, BY MATERIAL

FIGURE 17 SYNTHETIC POLYMER TO LEAD THE MARKET DURING THE FORECAST PERIOD

4.4 TECHNICAL TEXTILE MARKET, BY PROCESS

FIGURE 18 NONWOVEN PROCESS TO GROW AT THE HIGHEST RATE IN THE MARKET

4.5 TECHNICAL TEXTILE MARKET, BY APPLICATION

FIGURE 19 MOBILTECH TO BE LARGEST APPLICATION IN THE MARKET

4.6 TECHNICAL TEXTILE MARKET, BY COUNTRY

FIGURE 20 TECHNICAL TEXTILE MARKET IN INDIA TO GROW AT THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES, IN THE TECHNICAL TEXTILE MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing adaptability and awareness of products

5.2.1.2 Increase in demand for technical textiles in the healthcare industry

5.2.1.3 Demand for lightweight and fuel-efficient transportation vehicles

5.2.1.4 Growing awareness regarding environmentally-friendly fabrics and regulatory framework promoting the use of technical textiles

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of new technologies

5.2.3.2 Growing demand from emerging industrial markets

5.2.3.3 Increase in the significance of geotextiles

5.2.4 CHALLENGES

5.2.4.1 Cost-to-benefit ratio a concern for small manufacturers

5.2.4.2 Varying environmental mandates across regions

5.2.4.3 Availability issues regarding raw materials for technical textiles

6 YC-YCC DRIVERS (Page No. - 57)

FIGURE 22 YC-YCC DRIVERS

7 INDUSTRY TRENDS (Page No. - 58)

7.1 INTRODUCTION

7.2 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING THE RAW MATERIAL SUPPLIERS’ PHASE

7.2.1 PROMINENT COMPANIES

7.2.2 SMALL & MEDIUM ENTERPRISES

7.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 TECHNICAL TEXTILE MARKET: PORTER’S FIVE FORCES ANALYSIS

7.3.1 THREAT OF NEW ENTRANTS

7.3.2 THREAT OF SUBSTITUTES

7.3.3 BARGAINING POWER OF SUPPLIERS

7.3.4 BARGAINING POWER OF BUYERS

7.3.5 INTENSITY OF COMPETITIVE RIVALRY

8 IMPACT OF COVID-19 ON TECHNICAL TEXTILE MARKET (Page No. - 63)

TABLE 1 UPDATE ON OPERATIONS BY MANUFACTURERS IN RESPONSE TO COVID-19

9 PATENT ANALYSIS (Page No. - 67)

9.1 INTRODUCTION

9.2 METHODOLOGY

9.2.1 DOCUMENT TYPE

FIGURE 25 PUBLICATION TRENDS - LAST 5 YEARS

9.2.2 INSIGHT

9.3 JURISDICTION ANALYSIS

9.4 TOP APPLICANTS

TABLE 2 LIST OF PATENTS BY SANKO TEKSTIL ISLETMELERI SAN VE TIC A.S

TABLE 3 LIST OF PATENTS BY ARKEMA FRANCE

TABLE 4 LIST OF PATENTS BY BRRR! INC

TABLE 5 LIST OF PATENTS BY JANSSEN PHARMACEUTICA NV

TABLE 6 LIST OF PATENTS BY RHODIA OPERATIONS

TABLE 7 LIST OF PATENTS BY HENKEL AG & CO KGAA

TABLE 8 LIST OF PATENTS BY VUTS A. S.

10 TECHNICAL TEXTILE MARKET, BY MATERIAL (Page No. - 72)

10.1 INTRODUCTION

FIGURE 26 SYNTHETIC POLYMER MATERIAL SEGMENT TO DOMINATE THE TECHNICAL TEXTILE MARKET

TABLE 9 TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 10 TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

10.2 NATURAL FIBER

10.2.1 COTTON

10.2.2 WOOL

10.2.3 OTHERS

10.3 SYNTHETIC POLYMER

10.3.1 POLYETHERSULFONE (PES)

10.3.2 POLYAMIDE (PA)

10.3.3 POLYACRYLONITRILE (PAN)

10.3.4 POLYPROPYLENE (PP)

10.3.5 POLYESTER

10.3.6 OTHERS

10.4 MINERAL

10.4.1 ASBESTOS

10.4.2 GLASS

10.4.3 CERAMIC FIBER

10.5 METAL

10.6 REGENERATED FIBER

10.6.1 RAYON

10.6.2 ACETATE

10.7 OTHERS

11 TECHNICAL TEXTILE MARKET, BY PROCESS (Page No. - 78)

11.1 INTRODUCTION

FIGURE 27 WOVEN SEGMENT ACCOUNTED FOR THE LARGEST SHARE IN 2019

TABLE 11 TECHNICAL TEXTILE MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 12 TECHNICAL TEXTILE MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

11.2 WOVEN

11.3 KNITTED

11.4 NONWOVEN

11.5 OTHERS

12 TECHNICAL TEXTILE MARKET, BY APPLICATION (Page No. - 82)

12.1 INTRODUCTION

FIGURE 28 MOBILTECH APPLICATION TO DOMINATE THE TECHNICAL TEXTILE MARKET

TABLE 13 TECHNICAL TEXTILE MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 14 TECHNICAL TEXTILE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

12.2 MOBILTECH

12.3 INDUTECH

12.4 SPORTECH

12.5 BUILDTECH

12.6 HOMETECH

12.7 CLOTHTECH

12.8 MEDITECH

12.9 AGROTECH

12.10 PROTECH

12.11 PACKTECH

12.12 OEKOTECH

12.13 GEOTECH

13 TECHNICAL TEXTILE MARKET, BY REGION (Page No. - 89)

13.1 INTRODUCTION

TABLE 15 TECHNICAL TEXTILE MARKET SIZE, BY REGION, 2018–2025 (USD BILLION)

TABLE 16 MARKET SIZE, BY REGION, 2018–2025 (MILLION TON)

13.2 NORTH AMERICA

TABLE 17 NORTH AMERICA: TECHNICAL TEXTILE MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 18 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION TON)

TABLE 19 NORTH AMERICA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 20 NORTH AMERICA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 21 NORTH AMERICA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 22 NORTH AMERICA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 23 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 24 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.2.1 US

13.2.1.1 US to lead the market in North America from 2020 to 2025

TABLE 25 US: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 26 US: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 27 US: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 28 US: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 29 US: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 30 US: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.2.2 CANADA

13.2.2.1 The technical textile manufacturers in Canada focus on producing specialized products

TABLE 31 CANADA: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 32 CANADA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 33 CANADA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 34 CANADA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 35 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 36 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.2.3 MEXICO

13.2.3.1 Availability of natural resources has created opportunities in the country

TABLE 37 MEXICO: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 38 MEXICO: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 39 MEXICO: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 40 MEXICO: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 41 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 42 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.3 EUROPE

TABLE 43 EUROPE: TECHNICAL TEXTILE MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 44 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION TON)

TABLE 45 EUROPE: MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 46 EUROPE: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 47 EUROPE: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 48 EUROPE: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 49 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 50 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.3.1 GERMANY

13.3.1.1 Germany to lead the technical textile market in Europe

TABLE 51 GERMANY: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 52 GERMANY: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 53 GERMANY: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 54 GERMANY: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 55 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 56 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.3.2 FRANCE

13.3.2.1 Growing automobile sector to boost the market in the country

TABLE 57 FRANCE: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 58 FRANCE: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 59 FRANCE: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 60 FRANCE: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 61 FRANCE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 62 FRANCE: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.3.3 UK

13.3.3.1 The automotive and construction industries account for a major demand in the country

TABLE 63 UK: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 64 UK: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 65 UK: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 66 UK: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 67 UK: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 68 UK: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.3.4 RUSSIA

13.3.4.1 Increase in construction activities to drive the consumption of technical textile

TABLE 69 RUSSIA: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 70 RUSSIA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 71 RUSSIA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 72 RUSSIA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 73 RUSSIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 74 RUSSIA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.3.5 ITALY

13.3.5.1 Significant increase in healthcare expenditure drives the demand in the technical textile market

TABLE 75 ITALY: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 76 ITALY: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 77 ITALY: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 78 ITALY: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 79 ITALY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 80 ITALY: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.3.6 SPAIN

13.3.6.1 Rise in the use of feminine hygiene products to boost the demand for nonwoven process

TABLE 81 SPAIN: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 82 SPAIN: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 83 SPAIN: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 84 SPAIN: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 85 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 86 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.3.7 REST OF EUROPE

TABLE 87 REST OF EUROPE: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 88 REST OF EUROPE: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 89 REST OF EUROPE: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 90 REST OF EUROPE: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 91 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 92 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.4 APAC

FIGURE 29 APAC: TECHNICAL TEXTILE MARKET SNAPSHOT

TABLE 93 APAC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 94 APAC: MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION TON)

TABLE 95 APAC: MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 96 APAC: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 97 APAC: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 98 APAC: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 99 APAC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 100 APAC: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.4.1 CHINA

13.4.1.1 China to dominate the technical textile market in the region

TABLE 101 CHINA: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 102 CHINA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 103 CHINA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 104 CHINA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 105 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 106 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.4.2 INDIA

13.4.2.1 India to be the fastest-growing country globally for technical textile market

TABLE 107 INDIA: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 108 INDIA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 109 INDIA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 110 INDIA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 111 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 112 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.4.3 JAPAN

13.4.3.1 Increased demand for technical textiles from various end-use industries

TABLE 113 JAPAN: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 114 JAPAN: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 115 JAPAN: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 116 JAPAN: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 117 JAPAN: MARKET SIZE, BY APPLICATION 2018–2025 (USD BILLION)

TABLE 118 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.4.4 AUSTRALIA

13.4.4.1 Strong international and commercial export of technical textile to drive the market

TABLE 119 AUSTRALIA: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 120 AUSTRALIA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 121 AUSTRALIA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 122 AUSTRALIA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 123 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 124 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.4.5 INDONESIA

13.4.5.1 Demand for personal care and hygiene products to boost the technical textile market

TABLE 125 INDONESIA: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 126 INDONESIA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 127 INDONESIA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 128 INDONESIA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 129 INDONESIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 130 INDONESIA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.4.6 REST OF APAC

TABLE 131 REST OF APAC: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 132 REST OF APAC: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 133 REST OF APAC: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 134 REST OF APAC: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 135 REST OF APAC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 136 REST OF APAC: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.5 MIDDLE EAST & AFRICA

TABLE 137 MIDDLE EAST & AFRICA: TECHNICAL TEXTILE MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 138 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION TON)

TABLE 139 MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 140 MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 141 MIDDLE EAST & AFRICA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 142 MIDDLE EAST & AFRICA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 143 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 144 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.5.1 TURKEY

13.5.1.1 Turkey to be the leading technical textile market in Middle East & Africa

TABLE 145 TURKEY: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 146 TURKEY: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 147 TURKEY: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 148 TURKEY: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 149 TURKEY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 150 TURKEY: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.5.2 UAE

13.5.2.1 The country to be the second-highest growing market for technical textile in the region

TABLE 151 UAE: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 152 UAE: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 153 UAE: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 154 UAE: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 155 UAE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 156 UAE: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.5.3 SOUTH AFRICA

13.5.3.1 Increase in the number of healthcare units to boost the use of technical textiles

TABLE 157 SOUTH AFRICA: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 158 SOUTH AFRICA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 159 SOUTH AFRICA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 160 SOUTH AFRICA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 161 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 162 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.5.4 SAUDI ARABIA

13.5.4.1 Increasing GDP and key end users are expected to increase the demand for technical textiles

TABLE 163 SAUDI ARABIA: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 164 SAUDI ARABIA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 165 SAUDI ARABIA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 166 SAUDI ARABIA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 167 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 168 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.5.5 REST OF THE MIDDLE EAST & AFRICA

TABLE 169 REST OF THE MIDDLE EAST & AFRICA: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 170 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 171 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 172 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 173 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 174 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.6 SOUTH AMERICA

TABLE 175 SOUTH AMERICA: TECHNICAL TEXTILE MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 176 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION TON)

TABLE 177 SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 178 SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 179 SOUTH AMERICA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 180 SOUTH AMERICA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 181 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 182 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.6.1 BRAZIL

13.6.1.1 Brazil to dominate technical textile market in South America

TABLE 183 BRAZIL: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 184 BRAZIL: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 185 BRAZIL: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 186 BRAZIL: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 187 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 188 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.6.2 ARGENTINA

13.6.2.1 A shift of the global textile industry to more high-end and high-quality products

TABLE 189 ARGENTINA: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 190 ARGENTINA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 191 ARGENTINA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 192 ARGENTINA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 193 ARGENTINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 194 ARGENTINA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

13.6.3 REST OF SOUTH AMERICA

TABLE 195 REST OF SOUTH AMERICA: TECHNICAL TEXTILE MARKET SIZE, BY MATERIAL, 2018–2025 (USD BILLION)

TABLE 196 REST OF SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION TON)

TABLE 197 REST OF SOUTH AMERICA: MARKET SIZE, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 198 REST OF SOUTH AMERICA: MARKET SIZE, BY PROCESS, 2018–2025 (MILLION TON)

TABLE 199 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 200 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION TON)

14 COMPETITIVE LANDSCAPE (Page No. - 176)

14.1 OVERVIEW

FIGURE 30 COMPANIES ADOPTED ACQUISITION AS THE KEY GROWTH STRATEGY BETWEEN 2012 AND 2020

14.2 MARKET RANKING

FIGURE 31 MARKET RANKING OF KEY PLAYERS, 2019

14.3 SHARE OF KEY PLAYERS IN THE TECHNICAL TEXTILE MARKET

FIGURE 32 DUPONT LED THE TECHNICAL TEXTILE MARKET IN 2019

14.4 COMPETITIVE LEADERSHIP MAPPING

14.4.1 STAR

14.4.2 EMERGING LEADERS

14.4.3 PERVASIVE

14.4.4 EMERGING COMPANIES

FIGURE 33 TECHNICAL TEXTILE MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

14.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN TECHNICAL TEXTILE MARKET

14.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN TECHNICAL TEXTILE MARKET

15 COMPANY PROFILES (Page No. - 183)

(Business Overview, Financial Assessment, Operational Assessment, Products Offered, Recent Developments, COVID-19-Related Developments/Strategies, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat from Competition, and Right to Win)*

15.1 DUPONT

FIGURE 36 DUPONT: COMPANY SNAPSHOT

FIGURE 37 DUPONT: SWOT ANALYSIS

15.2 ASAHI KASEI

FIGURE 38 ASAHI KASEI: COMPANY SNAPSHOT

FIGURE 39 ASAHI KASEI: SWOT ANALYSIS

15.3 KIMBERLEY-CLARK CORPORATION

FIGURE 40 KIMBERLEY-CLARK CORPORATION: COMPANY SNAPSHOT

FIGURE 41 KIMBERLEY-CLARK CORPORATION: SWOT ANALYSIS

15.4 BERRY GLOBAL GROUP

FIGURE 42 BERRY GLOBAL GROUP: COMPANY SNAPSHOT

FIGURE 43 BERRY GLOBAL INC.: SWOT ANALYSIS

15.5 FREUDENBERG

FIGURE 44 FREUDENBERG: COMPANY SNAPSHOT

FIGURE 45 FREUDENBERG: SWOT ANALYSIS

15.6 AHLSTROM-MUNKSJO

FIGURE 46 AHLSTROM-MUNKSJO: COMPANY SNAPSHOT

FIGURE 47 AHLSTROM-MUNKSJO: SWOT ANALYSIS

15.7 MITSUI CHEMICALS

FIGURE 48 MITSUI CHEMICALS: COMPANY SNAPSHOT

FIGURE 49 MITSUI CHEMICALS: SWOT ANALYSIS

15.8 HUNTSMAN

FIGURE 50 HUNTSMAN: COMPANY SNAPSHOT

15.9 TORAY INDUSTRIES INC.

FIGURE 51 TORAY INDUSTRIES INC.: COMPANY SNAPSHOT

15.10 LOW & BONAR

FIGURE 52 LOW & BONAR: COMPANY SNAPSHOT

15.11 TOYOBO CO., LTD.

FIGURE 53 TOYOBO CO., LTD.: COMPANY SNAPSHOT

15.12 KONINKLIJKE TEN CATE BV

FIGURE 54 KONINKLIJKE TEN CATE BV: COMPANY SNAPSHOT

15.13 SRF LIMITED

FIGURE 55 SRF LIMITED: COMPANY SNAPSHOT

15.14 MILLIKEN CHEMICAL

15.15 INTERNATIONAL TEXTILE GROUP

15.16 ADDITIONAL COMPANIES

15.16.1 BAYTEKS TEKSTIL SAN. VE TIC. A.

15.16.2 DUVELTEX

15.16.3 HUESKER GROUP

15.16.4 BALTEX FABRICS

15.16.5 BRUCK TEXTILES

*Details on Business Overview, Financial Assessment, Operational Assessment, Products Offered, Recent Developments, COVID-19-Related Developments/Strategies, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat from Competition, and Right to Win might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 241)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

Technical Fabrics Market Overview

The Technical Fabrics Market involves the production and supply of fabrics that are engineered for specific technical applications. These fabrics are designed to offer superior performance characteristics such as strength, durability, flame resistance, water resistance, and UV resistance. They are used in various industries, including automotive, aerospace, construction, healthcare, and sports and outdoor activities.

The Technical Fabrics Market and the Technical Textile Market are closely connected. Technical fabrics are a type of technical textile, which refers to any textile material designed for functional purposes rather than fashion. Technical fabrics are a subset of technical textiles that are specifically designed to provide high-performance properties.

The growth of the Technical Fabrics Market is expected to have a positive impact on the Technical Textile Market. The increasing demand for technical fabrics is expected to drive the demand for technical textiles, as technical fabrics are a subset of technical textiles. Additionally, the development of innovative technical fabrics is expected to create new opportunities for the Technical Textile Market.

Futuristic Growth Use-Cases of Technical Fabrics Market

The Technical Fabrics Market is expected to witness significant growth in the future due to the increasing demand for high-performance fabrics in various industries. Some of the futuristic growth use-cases of the market include the rising demand for smart fabrics with embedded sensors and electronics, the increasing use of technical fabrics in 3D printing, and the growing demand for sustainable and eco-friendly technical fabrics.

Top Players in Technical Fabrics Market

The top players in the Technical Fabrics Market include DuPont, 3M, Toray Industries Inc., Teijin Limited, and Owens Corning, among others. These companies are investing in research and development activities to develop new technical fabrics with advanced properties and to improve the efficiency of their production processes.

Other Industries Impacted by Technical Fabrics Market

The Technical Fabrics Market is expected to impact several other industries in the future, including the automotive, aerospace, construction, healthcare, and sports and outdoor activities industries. Technical fabrics are widely used in these industries for applications such as airbags, seat belts, protective clothing, medical textiles, and outdoor gear. The increasing demand for technical fabrics is expected to create new opportunities for these industries and to drive innovation in their respective fields.

Speak to our Analyst today to know more about Technical Fabrics Market!

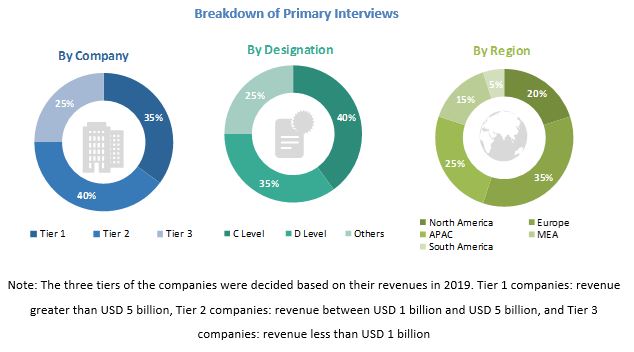

The study involved four major activities for estimating the current global size of the technical textile market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of technical textile through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the technical textile market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the technical textile market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the technical textile market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the technical textile industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the technical textile market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the technical textile market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the technical textile market in terms of value and volume based on material, technology, application, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product developments, expansions & investments, mergers & acquisitions, and joint ventures & agreements in the technical textile market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the technical textile report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the technical textile market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Technical Textile Market