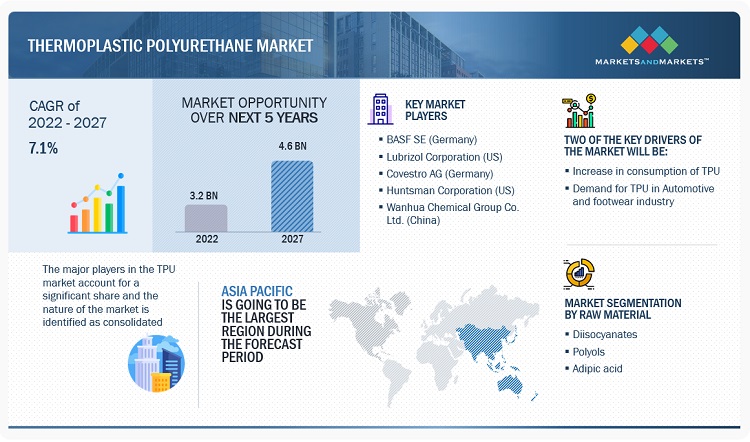

Thermoplastic Polyurethane (TPU) Market Raw Material (Diisocyanates, Polyols, Diols), Type (Polyester, Polyether, Polycaprolactone), End-Use Industry (Footwear, Industrial, Machinery, Automotive, Electronics, Medical), and Region - Global Forecast to 2027

The TPU market is projected to reach USD 4.6 billion by 2027, at a CAGR of 7.1% from USD 3.2 billion in 2022. The market is mainly led by the significant usage of TPU in various end-use industries. The retail sector in emerging countries such as India, Brazil, and China is becoming organized. This is expected to drive demand as TPU possesses properties of both rubber and plastic, such as low-temperature flexibility, biocompatibility, hydrolytic stability, optical clarity, flame retardance, high tensile strength, high elongation, good elasticity, anti-microbial properties, and resistance to oil, grease, solvents, chemicals, and abrasion.

Attractive Opportunities in the TPU Market

To know about the assumptions considered for the study, Request for Free Sample Report

TPU Market Dynamics

Driver: Increasing demand from the footwear industry

TPU has an increasing demand in the footwear industry due to its unique properties and benefits, such as slip and abrasion resistance. Several factors drive the increasing demand for TPU in the footwear industry. TPU is a highly durable material that can withstand wear and tear over extended periods. It has good chemical resistance, abrasion resistance, and flexibility, making it an ideal option for use in various footwear applications, including outsoles, midsoles, and toe caps. As it is lightweight and provides excellent cushioning, which is crucial for sports and athletic footwear, it helps reduce the overall weight of the footwear, enhancing comfort and performance.

Restraint: Higher cost of TPU than conventional material

The manufacturing process of TPU requires significant investments and is more complex than that of conventional materials such as polyethylene, PVC, rubbers, and polyurethane. The manufacturing process functions at high temperatures with a high level of technical expertise required to manufacture TPU. The huge investments and complex manufacturing processes have increased the cost of TPU. The high production cost of TPU has restricted its large-scale use, majorly in high-end applications. For example, compounding grades of polyethylene, polypropylene, acrylonitrile butadiene styrene, and polyurethane are developed to offer properties similar to those of TPU and are also available at lower prices. This provides high competition to TPU in a few end-use industries, such as industrial machinery, building & construction, and electronics. The rising prices of raw materials also affect the price of TPU.

Opportunity: Substitute for PVC in medical applications

The medical industry offers significant opportunities for TPU manufacturers. TPU is used in various medical applications such as catheters, medical devices, orthodontic products, and wound care products. Safety and comfort are the priorities when selecting materials to form medical products, as some of the medical products are inserted into the human body. Therefore, materials consisting of patient-friendly factors such as flexibility and biocompatibility are considered. TPU possesses good chemical and mechanical characteristics and biocompatibility, which are of prime importance in medical applications. TPU has superior properties in terms of resistance to wear, low temperature, oil, chemical, and resilience than PVC. TPU is highly responsive to temperature, as it can be rigid when inserted and flexible once inside the body. These properties have increased the use of TPU in medical applications.

Challenge: Volatility in raw material prices

Volatility in the prices of raw materials has fueled instability in the prices of TPUs. Adipic acid is one of the polyester polyols that is used in the manufacture of TPU. Globally, 15% of the overall adipic acid produced is utilized for TPU, and 85% to produce nylon. The increased demand for nylon, along with the rising standard of living in emerging countries such as China and India, have led to an imbalance in the supply of adipic acid. This imbalance has further increased the prices of TPUs.

TPU Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Diisocyanate was the largest raw material for TPU market in 2021, in terms of value"

Diisocyanate accounted for the largest market share in the global TPU market, in terms of value, in 2021. The segment is also projected to grow at the highest CAGR, in terms of value, during the forecast period, as it is highly reactive with polyols, resulting in polyurethane formation, easily. MDI-based TPU exhibits excellent mechanical properties, such as high tensile strength, abrasion resistance, and elasticity, making it suitable for various applications in industries such as automotive, footwear, and industrial coatings.

"Footwear was the largest end-use industry for TPU market in 2021, in terms of value"

Footwear application accounted for the largest market share in the global TPU market, in terms of value, in 2021. However, automotive segment is projected to grow at highest CAGR, in terms of value, during the forecast period. The significant share of TPU in the footwear segment is due to its excellent properties such as abrasion resistance, durability, and flexibility. TPU is commonly used in shoe soles, heels, and toe caps, providing comfort, shock absorption, and slip resistance. Its versatility, customization options, and cost-effectiveness have also contributed to its popularity in the footwear industry.

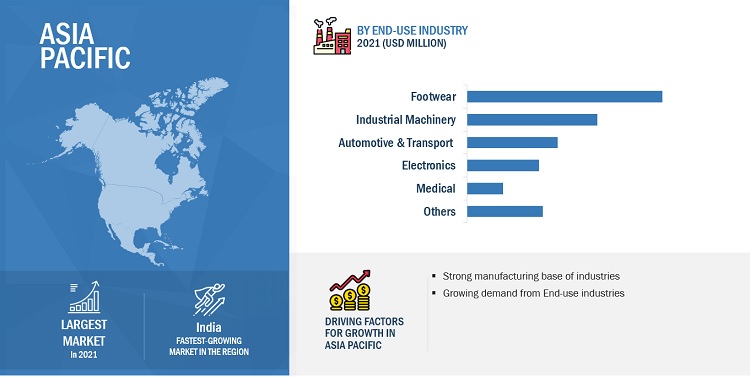

"Asia Pacific was the largest market for TPU in 2021, in terms of value."

Asia Pacific was the largest market for global TPU market, in terms of value, in 2021. China is the largest market in Asia Pacific. It is projected to witness second-highest growth during the forecast period considering of high usage of TPU in the region for automotive and medical application. The major players operating in Asia pacific region includes Wanhua Chemical Group Co. Ltd. (China) and Mitsui Chemicals, Inc. (Japan), among others.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market BASF SE (Germany), The Lubrizol Corporation (US), Covestro AG (Germany), Huntsman Corporation (US), Wanhua Chemical Group Co. Ltd. (China), American Polyfilm, Inc. (US), Epaflex Polyurethanes SpA (Italy), COIM Group (Italy), Mitsui Chemicals, Inc. (Japan), and Avient Corporation (US). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of TPU have opted for new product launches to sustain their market position.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2018-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (KT); Value (USD Million) |

|

Segments |

Type, Technology, Raw Material, End-use Industries, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

BASF SE (Germany), The Lubrizol Corporation (US), Covestro AG (Germany), Huntsman Corporation (US), Wanhua Chemical Group Co. Ltd. (China), American Polyfilm, Inc. (US), Epaflex Polyurethanes SpA (Italy), COIM Group (Italy), Mitsui Chemicals, Inc. (Japan), and Avient Corporation (US) are the key players in the TPU market. |

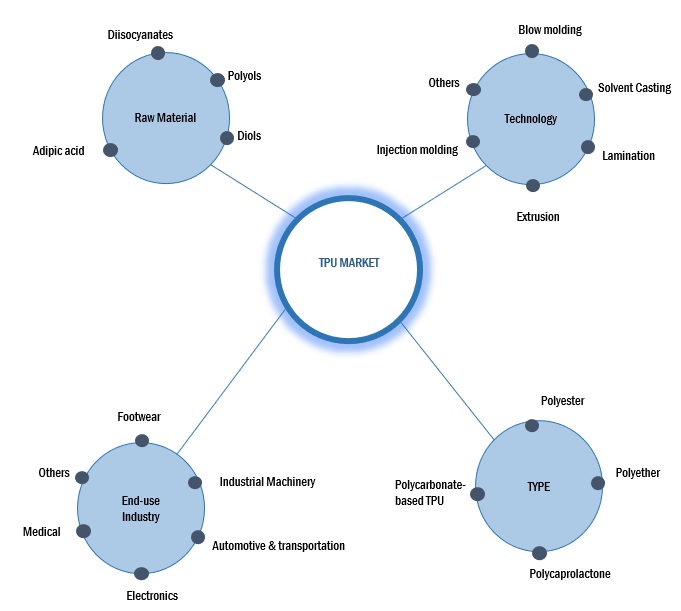

This report categorizes the global TPU market based on technology, type, raw material, end-use industry, and region.

On the basis of technology, the TPU market has been segmented as follows:

- Blow Molding

- Solvent Casting

- Lamination

- Extrusion

- Injection Molding

- Others

On the basis of type, the TPU market has been segmented as follows:

- Polyester

- Polyether

- Polycaprolactone

- Polycarbonate-based TPU

On the basis of raw material, the TPU market has been segmented as follows:

- Diisocyanates

- Polyols

- Diols

- Adipic acid

On the basis of end-use industry, the TPU market has been segmented as follows:

- Footwear

- Industrial Machinery

- Automotive & transportation

- Electronics

- Medical

- Others

On the basis of region, the TPU market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2023, Wanhua Chemical Group Co. Ltd. announced the development of polyether-based medical-grade TPU and radiopaque-grade TPU to provide solutions for medical applications such as extrusion tubes, injection MOLDING accessories, and cast films.

- In December 2022, The Lubrizol Corporation unveiled its new thermoplastic polyurethane (TPU) production line at its Songjiang manufacturing site in Shanghai, China. This action is another milestone of Lubrizol Engineered Polymers' investment in Asia Pacific, expanding the company's TPU production capacity and strengthening regional business support.

- In April 2022, Covestro AG announced the expansion of its production capacities for thermoplastic polyurethane (TPU) Films in the Platilon range, as well as the associated infrastructure and logistics. The competition of the new projects is planned for THE end of 2023.

- In August 2020, BASF SE announced a collaboration with Maincal, the leading company in the manufacture of safety footwear in Argentina. The two companies collaborated for the launch of South America's first safety shoe made with Infinergy.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the TPU market?

The forecast period for the TPU market in this study is 2022-2027. The TPU market is expected to grow at a CAGR of 7.1%, in terms of value, during the forecast period.

Who are the major key players in the TPU market?

BASF SE (Germany), The Lubrizol Corporation (US), Covestro AG (Germany), Huntsman Corporation (US), Wanhua Chemical Group Co. Ltd. (China), American Polyfilm, Inc. (US), Epaflex Polyurethanes SpA (Italy), COIM Group (Italy), Mitsui Chemicals, Inc. (Japan), and Avient Corporation (US) are the leading manufacturers of TPU.

What are the major regulations of the TPU market in various countries?

ECHA-Industrial use of processing aids in processes and products, not becoming part of articles. Industrial use of processing aids in continuous processes or batch processes applying dedicated or multi-purpose equipment, either technically controlled or operated by manual interventions.

What are the drivers and opportunities for the TPU market?

The increased demand from footwear, automotive, and medical industries is driving the market during the forecast period. Substitute for PVC in medical applications acts as an opportunity during the forecast period.

Which are the key technology trends prevailing in the TPU market?

The key technologies prevailing in the TPU market include advancements in polymer synthesis, compounding, and processing techniques such as extrusion, injection molding, and 3D printing. Additionally, there is ongoing research and development in areas such as functional additives and recycling technologies to improve the performance and sustainability of TPUs. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the TPU market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The TPU market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the TPU market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the TPU industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, raw material, type, end-use industries, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of TPU and future outlook of their business which will affect the overall market.

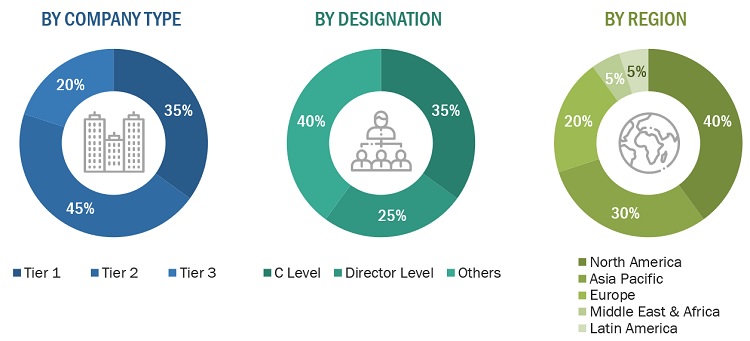

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

BASF |

Individual Industry Expert |

|

Covestro |

Sales Manager |

|

Lubrizol |

Director |

|

Huntsman Corporation |

Marketing Manager |

|

Wanhua |

R&D Manager |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the TPU market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

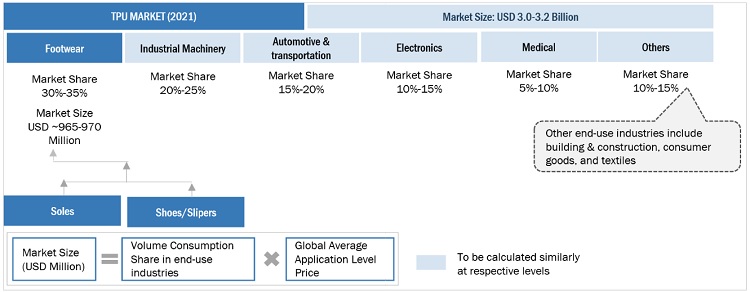

TPU Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

TPU Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Thermoplastic Polyurethane (TPU) is a thermoplastic elastomer that possesses characteristics of both, plastic and rubber; it is soft and processable when heated and hard when cooled. TPU can be reprocessed multiple times without losing its structural integrity due to the linkages between its soft and hard block structures. The soft block contains polyol and a diisocyanate, whereas the hard block is formed of a chain extender and diisocyanate.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the TPU market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on technology, raw material, type, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermoplastic Polyurethane (TPU) Market

Thermoplastic Polyurethane Market by End-Industry (Automotive, Building & Construction, Engineering, Footwear, Hose & Tube, Medical, and Wire & Cable) & Geography - Trends & Forecasts to 2019

Need raw material analysis and market intelligence on Thermoplastic Polyurethane by end-use industries, with data in volume terms in various applications.

Specific information onTPU in US and Canada to understand competition and applications in unconventional energy sector

Executive summary and TOC for the report

Supply demand analysis for all major regions and market estimation for major applications of TPU market

Market data on Global TPU market and breakbown of the data for European Market

Interested in Thermoplastic Polyurethane report

Thermoplastic Polyurethane industry, more specifically, the Expanded Thermoplastic Polyurethane industry.

I want to purchase a corporate user license. What is the procedure?