Unmanned Underwater Vehicles Market by Type (Autonomous Underwater Vehicles (AUVs), Remotely Operated Vehicles (ROVs)), Product Type), Propulsion, Application, System, Speed, Shape, Depth and Region - Global Forecast to 2030

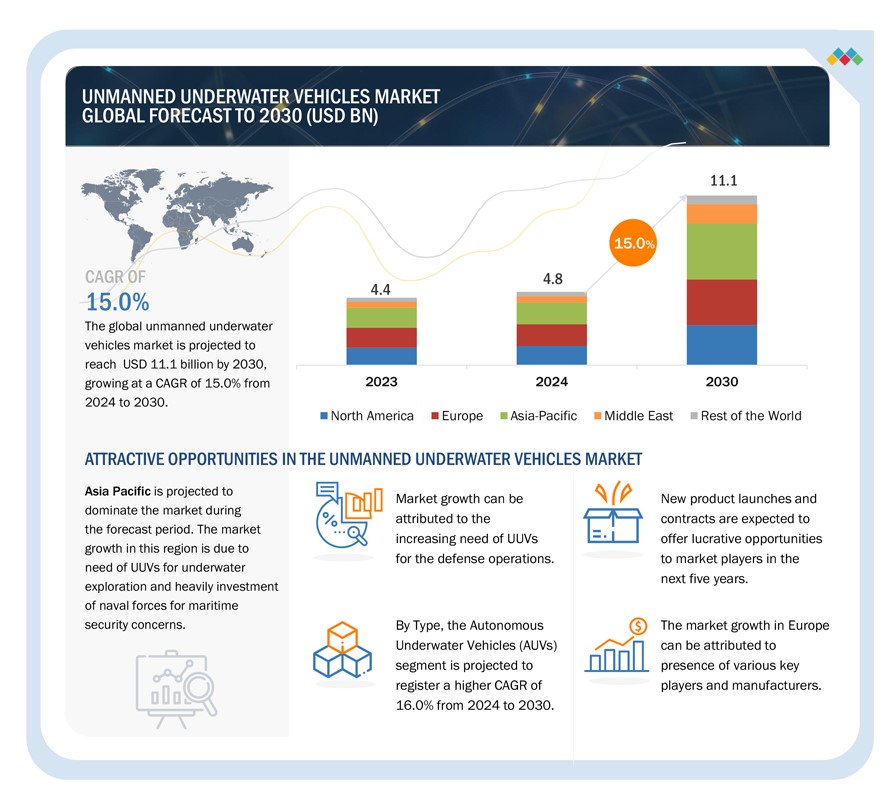

[400 Pages Report] The Unmanned Underwater Vehicles market is projected to grow from USD 4.8 billion in 2024 to USD 11.1 billion by 2030, at a CAGR of 15.0%. The volume of UUVs is projected to grow from 1,275 (In units) in 2024 to 2,911 (In Units) by 2030. There is rise in deployment of UUVs for maritime security, subsea exploration, and environmental monitoring. Government investments in naval defense, marine research for surveillance, reconnaissance, & oceanographic data collection and expanding offshore oil and gas industry which requires advanced inspection and monitoring UUVs are main reasons for the market growth.

Unmanned Underwater Vehicles Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Unmanned Underwater Vehicles Market Dynamics

Driver: Increasing use of UUVs for mine countermeasures and complex underwater research

UUVs are equipped with sensors and payloads and, hence, are useful for ocean research and seabed mapping. They are widely used in mine countermeasures for detection, classification, and neutralization tasks. They can survey large underwater areas, identify mines, and map them for targeted disposal operations, thus reducing risks to human personnel and enhancing mission efficiency. UUVs can also conduct covert operations to deliver specialized payloads like military equipment, sensors, or communication devices in harsh environments. Apart from underwater mapping and mine countermeasures, these UUVs are also used for reconnaissance and surveillance, anti-submarine warfare, and various other operations. They gather various intelligence and provide real-time situational awareness by utilizing imaging technologies, sonar systems, and high-resolution cameras. UUVs contribute to understanding underwater terrain, identifying threats, and improving maritime operations through detailed mapping of the underwater environments.

Restraints: The reliability crisis of UUVs in sensitive missions

UUVs are used in defense, commercial, civil, and research applications. These robots are used to execute critical missions effectively and safely. However, UUVs have been known to break down due to hardware failure, incompetent software, and unpredictable external situations. These malfunctions bring down the reliability of these robots during sensitive missions.

The reliability of UUVs holds major importance in defense applications. Failures in these robots are mainly due to design failures, technology failures, manufacturing failures, environmental failures, and operational failures. Effective preliminary measures and plans are required in case of a failure. Initial arrangements are required to bring the malfunctioning UUVs back to base station. The failure of UUVs in terms of their functionality, restricts their use in various military operations which result in breaching and loss of confidential data, and make them easily accesible for exploitation by enemy forces.

Opportunities: Development and incorporation of advanced technologies in UUVs

UUVs are expected to advance technologically in areas like battery life, self-navigation capabilities, and the ability to manipulate objects. These improvements are expected to enhance their role in commercial operations. Currently, UUVs typically have a battery life of around 24 hours, which decreases further when operating in deep waters due to high power consumption by thrusters. The vehicle's speed is determined by the power available, whereas its operational range is limited by the energy capacity of its batteries. Modern demands for faster, longer-lasting UUVs with enhanced sensors and processing capabilities highlight the need for more efficient energy solutions.

Most of the UUVs cannot recharge their batteries autonomously and must carry multiple batteries for extended missions, requiring human intervention for battery replacement or recharging. Advancements in onboard sensors are improving UUVs' efficiency in carrying and operating electronic equipment for tasks like imaging and monitoring. For instance, companies like WiBotic (US) are developing solutions for underwater wireless power and battery management. These innovations aim to minimize the need for battery swaps during prolonged underwater missions. There is also ongoing research into solar power to recharge UUV batteries, with the current solar propulsion systems requiring large, power-intensive panels. The development of more efficient solar-powered systems remains a priority. The evolution of such technologies is expected to significantly drive the market for UUVs.

Challenges: Slow underwater survey speed

Electromagnetic (EM) waves struggles in underwater environments with a depth of more than 200 meters owing to the conducting nature of seawater. Free-space optical (FSO) communications are also ineffective for UUVs due to their limitation to very short ranges. UUVs rely on slow-moving acoustic waves for conducting deep-sea explorations. The refraction, absorption, and scattering of signals sent by UUVs in the water further impact the propagation. Deep underwater pressures intensifies these effects, slowing down signal speed and creates noise and echoes. This effects generates the requirement of high power for signal transmission and complex signal processing. Thus, high power levels are required for underwater communication for extremely complex signal processing. Environmental disturbances caused by weather changes, waves, wind patterns, and ocean currents also have a significant impact on the underwater communication of UUVs

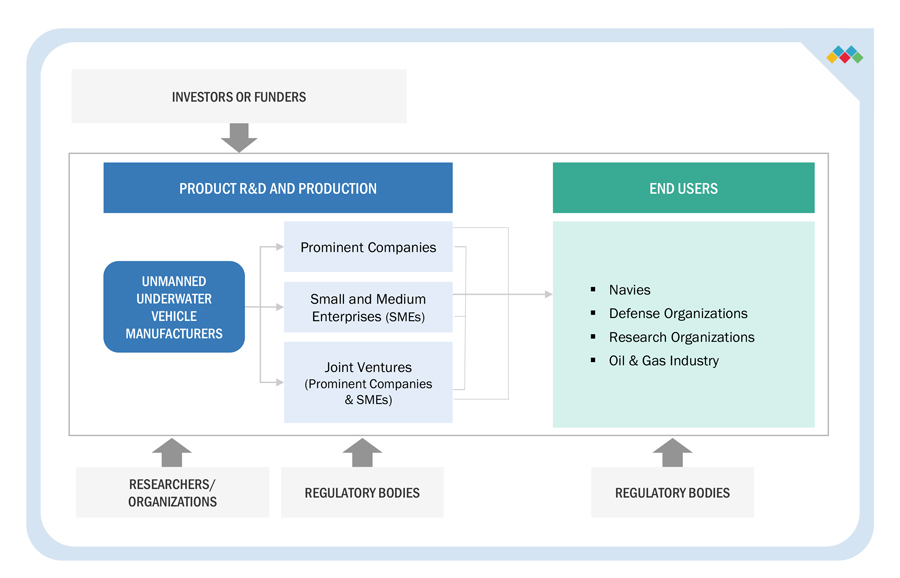

Unmanned Underwater Vehicles Market Ecosystem

Companies that design and manufacture Unmanned Underwater Vehicles solutions, include government firms and industries as key stakeholders in Unmanned Underwater Vehicles Market. Investors, funders, academic researchers, integrators, service providers, and licensing authorities are the major influencers in this market. Prominent companies in this market include Kongsberg (Norway), Saab AB (Sweden), Oceaneering International, Inc. (US), Boeing (US) and Fugro (Netherlands).

Based on the type, the Remotely Operated Vehicles (ROVs) segment is estimated to account for the largest market share during the forecast period.

Based on the type, the ROVs segment is estimated to account for the largest market share during the forecast period. ROVs offer high-resolution cameras, sonar, and other sensors for detailed inspections of underwater structures, and potential threats. The market growth for Remotely Operated Vehicles (ROVs) segment is primarily driven by the rising need of underwater drones for deep-water operations in sectors such as offshore oil and gas, underwater mining, and infrastructure maintenance. Increasing investments in offshore renewable energy projects and the need for various commercial applications fuels the demand for advanced underwater drones.

Based on the AUV- application , the defense segment is anticipated to dominate the market.

Based AUV- application , the defense segment holds the largest market share. The growth of AUVs in the defense segment is primarily driven by advancements in autonomous navigation technologies, enhanced battery life, and increased payload capacities. The increasing geopolitical tensions and the rising need for advanced surveillance, reconnaissance, and anti-submarine warfare capabilities based unmanned submarines are driving the market growth of the segment.

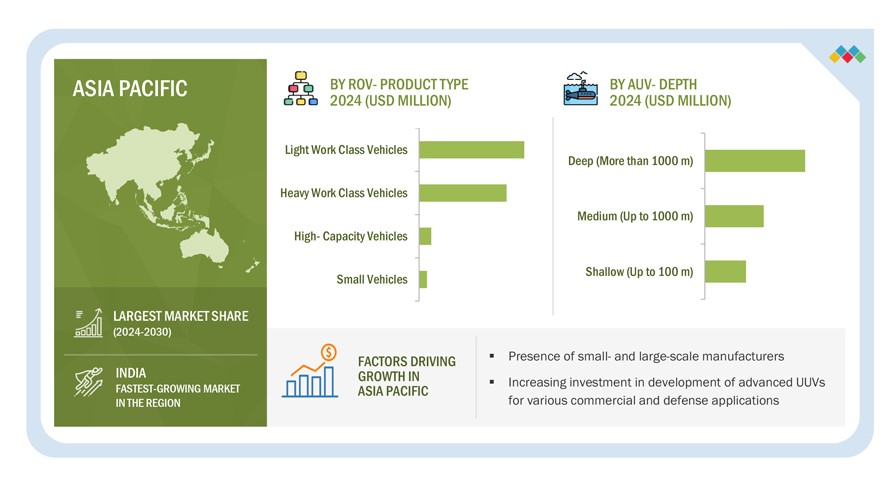

The Asia Pacific market is projected to account largest share for the Unmanned Underwater Vehicles market.

Asia Pacific is projected to account largest share for the Unmanned Underwater Vehicles market during the forecast period. India is projected to show the highest growth rate for the Unmanned Underwater Vehicles market in Asia Pacific. The domination of the Unmanned Underwater Vehicles market in the Asia Pacific can be attributed due to the presence of various manufacturers and increasing investment for development and deployment of various underwater drones.

Unmanned Underwater Vehicles Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Unmanned Underwater Vehicles companies is dominated by a few globally established players such as Kongsberg (Norway), Saab AB (Sweden), Oceaneering International, Inc. (US), Boeing (US) and Fugro (Netherlands) are some of the leading players operating in the Unmanned Underwater Vehicles market; they are the key manufacturers and solution providers that secured Unmanned Underwater Vehicles contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements in defense and commercial industries.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2030 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By type, by system, by application, by propulsion, by speed, by shape, by depth and by region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, and the Rest of the world |

|

Companies covered |

Kongsberg (Norway), Saab AB (Sweden), Oceaneering International, Inc. (US), Boeing (US) and Fugro (Netherlands) are some of the major players in the Unmanned Underwater Vehicles market. |

Unmanned Underwater Vehicles Market Highlights

The study categorizes the Unmanned Underwater Vehicles market based on type, system, application, propulsion, product type, speed, shape, depth and region.

|

Segment |

Subsegment |

|

By Type |

|

|

By ROV-Application |

|

|

By ROV-System |

|

|

By ROV-Product Type |

|

|

By ROV-Propulsion |

|

|

By AUV-Propulsion |

|

|

By AUV-Application |

|

|

By AUV- System |

|

|

By AUV- Shape |

|

|

By AUV- Speed |

|

|

By AUV- Depth |

|

|

By Region |

|

Recent Developments

- In February 2024, Kongsberg :- Kongsberg announced a significant 24-month contract with the Defense Innovation Unit (DIU) to support the US Navy’s efforts in developing a prototype for the Large Displacement Unmanned Underwater Vehicle (LDUUV).

- In September 2022, Northrop Grumman Corporation :- Northrop Grumman Corporation launched a new unmanned underwater vehicle (UUV), Manta Ray. This UUV can conduct long-range missions in ocean environments without the need for on-site human logistics support.

- In March 2021, Mitsubishi Heavy Industries, Ltd.:- Mitsubishi Heavy Industries, Ltd. (MHI) concluded a research and prototype production contract with Japan’s Ministry of Defense for next-generation mine-countermeasure technology.

Frequently Asked Questions(FAQs):

Which are the major companies in the Unmanned Underwater Vehicles market? What are their major strategies to strengthen their market presence?

Some of the key players in the Unmanned Underwater Vehicles market are Kongsberg (Norway), Saab AB (Sweden), Oceaneering International, Inc. (US), Boeing (US) and Fugro (Netherlands), and among others, are the key providers that secured Unmanned Underwater Vehicles contracts in the last few years.

What are the drivers and opportunities for the Unmanned Underwater Vehicles market?

The Increasing use of UUVs for mine countermeasures and complex underwater research, and Rising defense spending in unmanned underwater vehicles worldwide are some of the drivers for the Unmanned Underwater Vehicles market.

Which region is expected to hold the largest share in the next five years?

The market in the Asia Pacific region is projected to account the largest share from 2024 to 2030, showcasing strong demand for Unmanned Underwater Vehicles solutions in the region. The presence of small and large scale manufacturers of UUVs in the region are driving the market growth.

What is the CAGR of the Unmanned Underwater Vehicles Market?

The CAGR of the Unmanned Underwater Vehicles Market is 15.0%.

Which segment shows the highest CAGR of the Unmanned Underwater Vehicles Market?

The Unmanned Systems by AUV- defense to show the highest growth rate during the forecasted year for the Unmanned Underwater Vehicles Market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

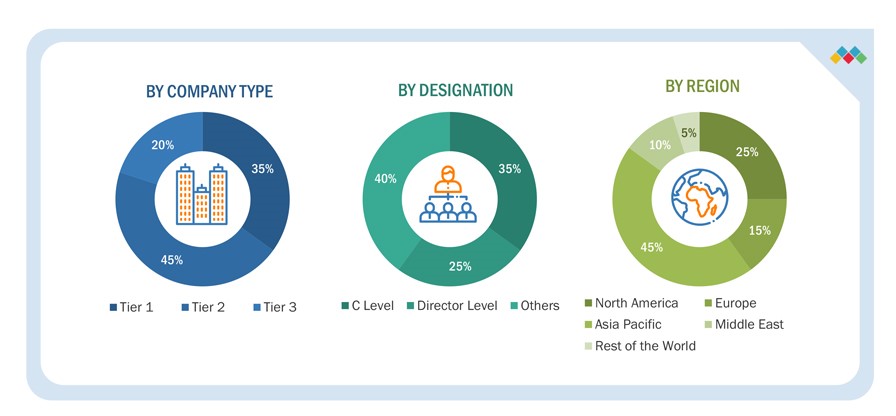

The study involved four major activities in estimating the current size of the Unmanned Underwater Vehicles Market. Exhaustive secondary research was done to collect information on the Unmanned Underwater Vehicles market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Unmanned Underwater Vehicles market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Unmanned Underwater Vehicles market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, which includes Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

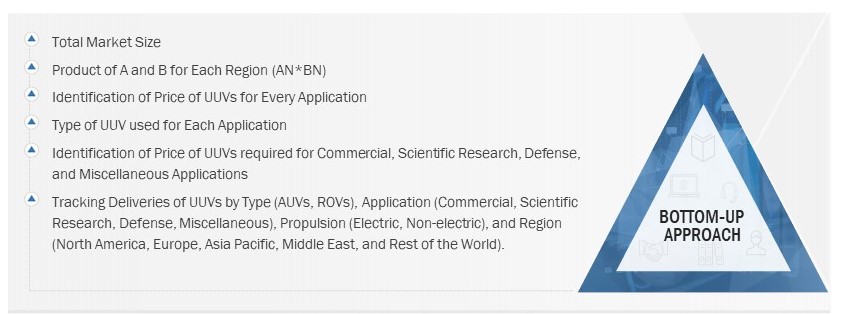

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the unmanned underwater vehicles market. The research methodology used to estimate the size of the market includes the following details.

Key players in the unmanned underwater vehicles market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the unmanned underwater vehicles market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the unmanned underwater vehicles market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Unmanned Underwater Vehicles Market Size: Bottom-up Approach

Unmanned Underwater Vehicles Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Market Definition

Unmanned underwater vehicles (UUVs) are deployed to conduct tasks, such as measuring oceanographic data, capturing bottom images, bathymetric imaging, collecting intelligence, obtaining intelligence, surveillance, and reconnaissance (ISR) data, cable laying, and mine detecting. The size of UUVs varies from small to large depending on various factors, such as their capabilities, dimensions, power, speed, and sensors.

UUVs are broadly classified into remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs). ROVs are tethered underwater vehicles that transmit power, command, and control signals and feed the data into operators' consoles on surface ships. They have limited navigation capacities and are used to carry out ocean exploration activities and ensure port security.

AUVs are torpedo-shaped, untethered underwater vehicles designed to collect oceanographic data for an extended period without remote human supervision. AUVs are operated from submarines and used in anti-submarine warfare to detect manned submarines.

Market Stakeholders

- Unmanned Underwater Vehicle Manufacturers

- Defense Procurement Agencies

- Oil & Gas Suppliers

- Marine Researchers

- Hydrographic Surveyors

- Government Agencies

- Defense Agencies

Report Objectives

- To define, describe, and forecast the unmanned underwater vehicles market size based on Type, ROV-Application, ROV-System, ROV-Product Type, ROV-Propulsion, AUV-Shape, AUV-Depth, AUV-Speed, AUV-Propulsion, AUV-System, AUV-Application, and Region.

- To forecast the size of different segments of the market with respect to five major regions: North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, along with their respective key countries

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the market’s growth

- To identify industry trends and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to their individual growth trends, prospects, and contribution to the overall market

- To profile companies operating in the market based on their product portfolios, market share, and key growth strategies

- To analyze the degree of competition among players in the market by identifying and analyzing their business revenues, products offered, and recent developments and ranking them based on these parameters

- To analyze competitive developments such as deals, new product launches/developments, and partnerships/acquisitions undertaken by key market players

- To strategically profile key players and comprehensively analyze their share and core competencies in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Unmanned Underwater Vehicles Market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Unmanned Underwater Vehicles Market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Unmanned Underwater Vehicles Market

I would like to know the market potential for body/chase materials used in USV and UUV body and would also like to know the relevant reports as per the requirement.