Urinalysis Market by Product (Dipsticks, Pregnancy & Fertility Kits, Reagents, Disposables, Automated, Semi-automated, POC Analyzers), Application (UTI, Diabetes, Kidney Diseases), End User (Hospitals, Labs, Home Care) & Test Type - Global Forecast to 2027

Updated on : May 02, 2023

The global urinalysis market in terms of revenue was estimated to be worth $3.9 billion in 2022 and is poised to reach $5.7 billion by 2027, growing at a CAGR of 8.1% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Market growth is driven by the increased focus of government on disease screening, high prevalence of life style related diseases like diabetes and kidney disease and increasing initiatives to spread the awareness on diabetes and related diseases.

To know about the assumptions considered for the study, Request for Free Sample Report

Urinalysis Market Dynamics

Driver: Increasing burden of UTIs, diabetes and liver & kidney diseases

There is a widespread application of urinalysis in the diagnosis and management of diseases like kidney and liver diseases. Urinalysis enables clinicians to assess the level of chemical compounds in the urine. These factors will drive the market growth.

Opportunity: Emerging market

the high disease prevalence, large patient population, improving healthcare infrastructure, increasing disposable income, and growing medical tourism in emerging countries play an essential role in upgrading laboratory infrastructure.

Restraint: Availability of refurbished urine analyzers

In developing countries, which are price-sensitive, prefer instruments that are cheap and offer similar functionalities. In the absence of well-grounded regulatory frameworks, there may be an influx of low-quality and refurbished products into the economy. These devilow cost analyzers will hamper the market growth.

Challenge: Changing regulatory landscape for the urinalysis market

Regulatory and legal requirements applied to IVD (including urinalysis) in the US and European countries are becoming more stringent. New applications may be required for software updates or new software installation in an existing device or any other changes made to these devices. Which is a major challenge in the growth of this market.

Consumables segment accounted for the largest share of the urinalysis market, by product

The market is segmented into consumables and instruments. The consumables segment accounted for the largest share of the market, mainly due to the rising investment for development of new diagnostic products, increasing providers awareness about rapid and novel diagnostic technologies and increased need of rapid disease diagnosis.

Pregnancy & fertility tests segment accounted for the largest share of the urinalysis market, by test type

The market is segmented into pregnancy & fertility tests, biochemical tests and sediment urinalysis. The pregnancy & fertility tests segment accounted for the largest share of the market, mainly due to the technological advancements in the diagnostic products.

Disease screening segment accounted for the largest share of the urinalysis market, by application

The market is segmented into disease screening and pregnancy & fertility. The disease screening segment accounted for the largest share of the market, mainly due to the rising geriatric population and age related diseases, emerging economies providing significant growth opportunities and increased adoption of POC diagnosis which largely includes urinalysis for rapid and convenient results.

Diagnostic laboratories segment accounted for the largest share of the urinalysis market, by end user

The market is segmented into diagnostic laboratories, hospitals & clinics, home care settings and research laboratories and institutes based on end user. The diagnostic laboratories segment accounted for the largest share. Factors such as increased age related diseases and increased use of POC analyzers, favorble regulatory guidelines & reimbursement scenarios in the developed countries like North America and Europe .

North America is the largest regional market for urinalysis market

The global market is segmented into five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the global market. The North American market's growth can be attributed to the increase in diseases like diabetes and UTIs, supportive government policies and high investment for the development and approval of diagnostic tests for preventice care.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in urinalysis market are Siemens Healthineers AG (Germany), F. Hoffmann-La Roche Ltd. (Switzerland), Cardinal Health, Inc. (US), Abbott Laboratories (US), Danaher Corporation (US), Sysmex Corporation (Japan), Quidel Corporation (US), Becton, Dickinson and Company (US), Bio-Rad Laboratories, Inc. (US), EKF Diagnostics (UK), Thermo Fisher Scientific Inc. (US), ARKRAY, Inc. (Japan), ACON Laboratories, Inc. (US), 77 Elektronika Kft. (Hungary), URIT Medical Electronic Group Co., Ltd. (China), Dirui Industrial Co., Ltd. (China), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), BIOBASE Group (China), ERBA Mannheim (UK), Alphatech Scientitfic (Peru), Teco Diagnostics (US), Analyticon Technologies AG (Germany), Bioway Biological Technology Co. Ltd. (China), High Technology Inc. (US) and Agappe Diagnostics Ltd. (India)

Urinalysis Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$3.9 billion |

|

Projected Revenue by 2027 |

$5.7 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 8.1% |

|

Market Driver |

Increasing burden of UTIs, diabetes and liver & kidney diseases |

|

Market Opportunity |

Emerging market |

This report categorizes the global urinalysis market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Consumables

- Instruments

By Test Type

- Pregnancy & Fertility Tests

- Biochemical Urinalysis

- Sediment Urinalysis

By Application

- Disease Screening

- Pregnancy and Fertility

By End User

- Diagnostic Laboratories

- Hospitals and Clinics

- Home Care Settings

- Research Laboratories & Institutes

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Rest of the World (RoW)

Recent Developments:

- In September 2022, Sysmex Corporation (Japan) launched the UF-1500 fully automated urine particle analyzer, a Product for the urine sediment testing field.

- In February 2021, Thermo Fisher Scientific, Inc. (US) and Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China) signed an agreement to offer the FDA-cleared and Health Canada–approved BS-480 (400 tests/hour) and BA-800M (800 tests/hour) analyzers to toxicology labs.

- In August 2020, Sysmex America, Inc. (a subsidiary of Sysmex Corporation) and Siemens Healthineers AG (Germany) announced an exclusive agreement.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the urinalysis market?

The urinalysis market boasts a total revenue value of $5.7 billion by 2027.

What is the estimated growth rate (CAGR) of the urinalysis market?

The global market for urinalysis has an estimated compound annual growth rate (CAGR) of 8.1% and a revenue size in the region of $3.9 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

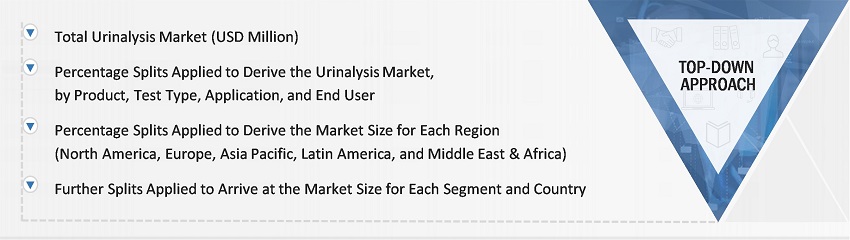

This study involved four major activities in estimating the current size of the urinalysis market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

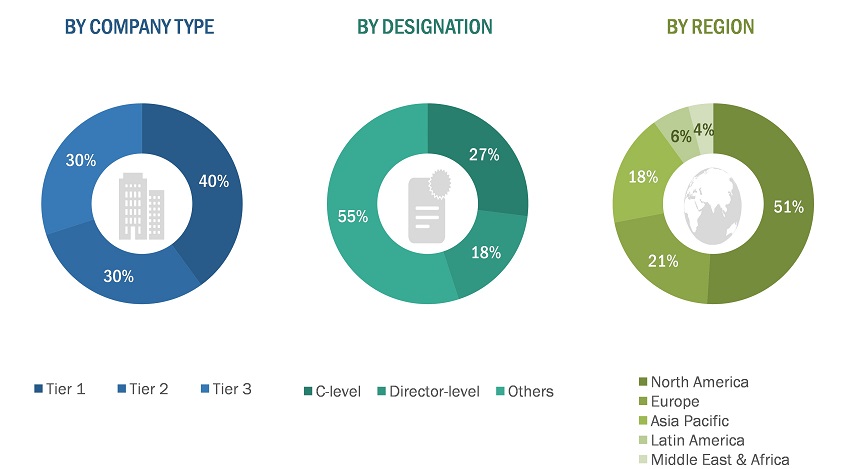

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the urinalysis market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the urinalysis market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the urinalysis market by product, test type, end user and region.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities and challenges).

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa,

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To track and analyze company developments such as product launch, product approval, agreement, partnership in the urinalysis market.

- To benchmark players within the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Urinalysis market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa.

Company profiles

- Product portfolio matrix for leading market players.

Top 10 companies in urine test market

The urine test market includes a range of companies involved in developing, manufacturing, and distributing urine testing products. Here are ten companies that are major players in the urine test market

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Beckman Coulter

- bioMérieux SA

- Thermo Fisher Scientific

- Sysmex Corporation

- BD (Becton, Dickinson and Company)

- Danaher Corporation

- Bio-Rad Laboratories

It's worth noting that this is not an exhaustive list, and there are many other companies involved in the urine test market as well. Additionally, some of these companies may be more focused on other aspects of diagnostic testing beyond urine tests.

Newer urine test applications targeted by Abbott Laboratories in future

Abbott Laboratories has been actively developing and marketing innovative urine testing solutions that can be used for a wide range of applications. Some of the newer applications that Abbott is targeting with its urine testing products include

Chronic kidney disease (CKD): Abbott's iSTAT Alinity platform, which includes the iChem Velocity urine analyzer, is designed to provide rapid and accurate results for a range of urine tests, including those used in the diagnosis and management of CKD.

Pregnancy testing: Abbott's Clearview hCG pregnancy test is a rapid, one-step urine test that detects the presence of human chorionic gonadotropin (hCG), a hormone produced during pregnancy.

Infectious disease testing: Abbott's Alere i platform, which includes the Alere iCup urine drug testing system, can be used to detect the presence of infectious agents such as influenza and respiratory syncytial virus (RSV).

Drug testing: Abbott's Alere iCup urine drug testing system is used to screen for the presence of a range of drugs, including opioids, amphetamines, and benzodiazepines.

Sports medicine: Abbott's iSTAT Alinity platform and other urine testing products can be used to monitor athletes for signs of dehydration, electrolyte imbalances, and other conditions that can impact performance and health.

Overall, Abbott Laboratories is committed to developing and marketing innovative urine testing solutions that can be used for a wide range of applications, from disease diagnosis and management to sports medicine and drug testing. As the healthcare industry continues to evolve, it is likely that Abbott will continue to target new and emerging applications for its urine testing products.

Industries getting impacted in the future by urine test market

The urine test market is expected to impact a wide range of industries in the future, as urine testing is used in many different settings for a variety of applications. Here are a few industries that may be particularly impacted by the urine test market in the future

Healthcare: The healthcare industry is expected to be one of the primary beneficiaries of urine testing, as urine tests are used in the diagnosis and management of a wide range of conditions, from infectious diseases and pregnancy to kidney disease and drug abuse.

Pharmaceuticals: The pharmaceutical industry may also be heavily impacted by urine testing, as the data generated by these tests can be used to develop and test new drugs and therapies. For example, urine tests may be used to monitor the safety and efficacy of new drugs in clinical trials.

Sports: The sports industry is increasingly using urine testing to monitor athletes for signs of dehydration, electrolyte imbalances, and other conditions that can impact performance and health.

Employment: Many employers use urine testing to screen job candidates for drug use and to ensure a safe and drug-free workplace. As the labor market becomes more competitive, employers may increasingly rely on urine testing to make informed hiring decisions.

Forensics: Urine testing is also used in forensics and criminal investigations, as urine can be used to identify drugs, toxins, and other substances in the body.

Overall, the urine test market is expected to impact a wide range of industries in the future, as the technology and applications of urine testing continue to evolve and expand.

Top use cases including existing and futuristic for urine test market

The urine test market has a wide range of use cases, both existing and futuristic. Here are some of the top use cases for urine testing

Disease diagnosis and management: Urine tests are commonly used in the diagnosis and management of a wide range of diseases, including kidney disease, diabetes, liver disease, and urinary tract infections.

Pregnancy testing: Urine tests are often used to detect the presence of human chorionic gonadotropin (hCG), a hormone produced during pregnancy, and to monitor pregnancy-related conditions such as preeclampsia.

Drug testing: Urine tests are used to screen for the presence of a wide range of drugs, including opioids, amphetamines, and benzodiazepines. These tests are commonly used in workplace drug testing programs, as well as in drug rehabilitation programs.

Sports medicine: Urine tests are increasingly used in sports medicine to monitor athletes for signs of dehydration, electrolyte imbalances, and other conditions that can impact performance and health.

Infectious disease testing: Urine tests are used to detect the presence of infectious agents such as influenza and respiratory syncytial virus (RSV).

Cancer screening: Researchers are exploring the potential of urine tests to detect the presence of cancer cells, which could allow for earlier and more accurate cancer diagnosis.

Personalized medicine: Researchers are also exploring the potential of urine tests to provide personalized medical insights based on an individual's unique metabolic profile.

Overall, the urine test market has a wide range of existing and potential use cases, and is expected to continue to grow and evolve as new technologies and applications are developed.

Hypothetic challenges of urine test business in future

While the urine test market has a lot of potential for growth, there are also several hypothetical challenges that could impact the industry in the future. Here are a few examples

Increasing competition: As the urine test market continues to grow, we can expect to see more companies entering the space, which could lead to increased competition and pricing pressure.

Evolving regulations: The urine test market is subject to a range of regulations, both in terms of manufacturing and in terms of how tests are used and interpreted. As regulations evolve, companies may need to adapt their products and processes to remain compliant.

Evolving technology: Advances in technology could change the way urine tests are developed, manufactured, and interpreted. Companies that fail to keep up with these changes may struggle to compete.

Supply chain disruptions: The global COVID-19 pandemic highlighted the fragility of supply chains, and disruptions to the supply of key materials and components could impact the urine test market in the future.

Privacy concerns: As the amount of data generated by urine tests grows, there could be increasing concerns around patient privacy and data security.

It's important to note that these are hypothetical challenges, and the urine test market may not be impacted by all or any of these factors. Additionally, there may be other challenges that emerge in the future that are not currently foreseeable.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Urinalysis Market

Below are the top 3 technological advancements in urinalysis market:

1. Automated Urine Analyzers: Automated urine analyzers are sophisticated machines that can rapidly and accurately analyze a urine sample. This technology allows for automated testing of multiple parameters in a single sample, eliminating the need for manual handling and improving the accuracy of results.

2. High-throughput Urine Testing: High-throughput urine testing technology uses robotic and automated systems to process a large number of urine samples at once, significantly reducing the time and cost of performing urinalysis.

3. Point-of-Care Urine Testing: Point-of-care urine testing technology allows for testing to be done quickly and easily in a clinical setting, without the need for a laboratory. This technology is particularly useful for rapid screening and diagnosis of urinary tract infections.

what is the technological advancement in urinalysis market?