VCSEL Market by Type (Single-mode and Multimode), Material (GaAs, InP, GaN), Wavelength, Application (Sensing, Data Communication, Industrial Heating & Printing, Emerging), Data Rate, Industry and Region - Global Forecast to 2028

Updated on : April 24, 2023

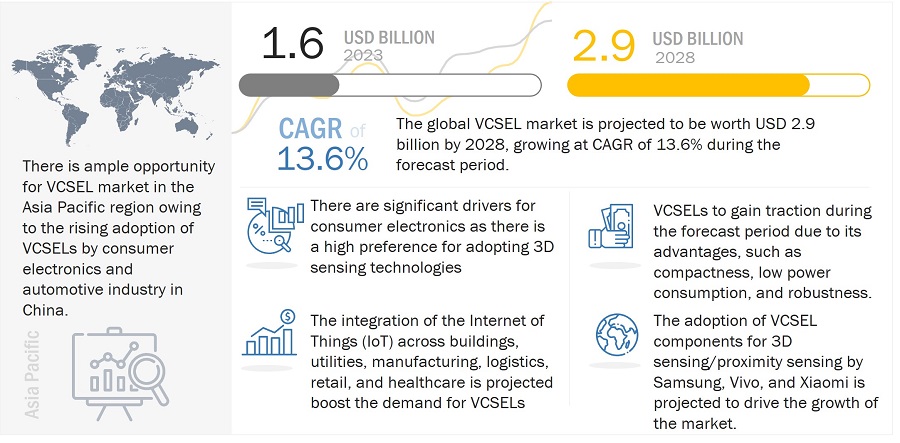

[226 Pages Report] The VCSEL market is estimated to grow from USD 1.6 billion in 2023 to USD 2.9 billion by 2028; it is projected to grow at a CAGR of 13.6% from 2023 to 2028.

The major drivers for this market include increase in applications of VCSELs in data communication and the growing adoption of 3D sensing applications in smartphones. The high adoption of VCSELs by wafer manufacturers, integrators, and testing and inspection companies, use of VCSELs in LiDAR systems of autonomous vehicles, and technological advancements, and increasing interest of OEMs to adopt VCSELs in consumer devices are the key factors that are likely to create growth opportunities for the market players during the forecast period.

VCSEL Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Recession Impact on Vcsel Market

The recession's impact on the VCSEL market has been analyzed in this study. The short-term outlook for semiconductor revenues has worsened in the third quarter of 2023. A rapid deterioration in the global economy and weakening consumer demand will negatively impact the global semiconductor market in 2023. Weakness in consumer-driven markets like telecommunication, networking is driven largely by the decline in disposable income, caused by rising inflation and interest rates. This will negatively impact the production and sales of smartphones, PCs, and other consumer electronics products. If regional or global economic conditions deteriorate, companies’ results of operations, financial position, and cash flows could be materially adversely affected.

VCSEL Market Dynamics

DRIVERS: Growing adoption of 3D sensing applications in smartphones

VCSELs play an important role in 3D sensing applications in smartphones. 3D camera sensing using a flood illuminator, dot projector, and proximity sensor are all based on VCSEL laser components. Cameras that scan and render objects in 3D have now become a standard feature in high-end smartphones. The cameras, when paired with proper software, enable the user to sense light levels, movements, and textures more precisely than previously possible. VCSELs offer several advantages, such as relatively low cost, optical efficiency, low power consumption, wavelength stability, and high modulating rates.

RESTRAINT: Limited data transmission range

The data rates attained are considerably high for optical communication using VCSELs, with the latest devices transmitting at more than 50Gbps. Multimode fiber (MMF) is designed to operate at wavelengths of 850 and 1,300nm, where 850nm is the most common wavelength for VCSELs. However, signal attenuation is high in MMF, and the range of VCSELs is limited to a maximum of ~300 m. Hence, transmitting data using VCSELs over a certain distance can be a challenge due to the weakening of the signal. Attenuation is higher for data communication over longer distances, which results in signal losses, thereby affecting performance. As a result, the VCSELs are not suitable for long-range optical communication.

OPPORTUNITIES: Growing IoT market and data processing across commercial and government sectors

The integration of the Internet of Things (IoT) across buildings, utilities, manufacturing, logistics, retail, and healthcare is also projected to drive the demand for VCSELs. Apart from commercial businesses, governments are also keen to implement this technology across the transportation and defense sector. The implementation of IoT in smart cities is likely to generate a large amount of raw data as a result of a large number of connected devices. Companies such as Facebook (US), Microsoft (US), Google (US), and Apple (US) are building a large number of data processing centers across the globe that are projected to leverage VCSELs. Apart from IoT, the growth in cloud computing and 5G communications is also projected to drive the market for VCSELs in the data processing.

CHALLENGES: Recession impact on smartphone market

Smartphone are among the significant adopters of VCSEL technology, which have witnessed market disruptions and substantial changes in buying patterns. The expected recession would slow down the growth of high-end devices. Reduced demand for smartphones could set back the development of high-end smartphones that incorporate VCSEL technology. The global semiconductor shortage is also expected to discourage large-scale adoption of VCSELs in more affordable smartphones. This shortage is more prevalent in the semiconductor industry as semiconductor foundries reassigned production for smartphones, laptops, and gaming devices to cater to the surge in demand for such devices during the recession.

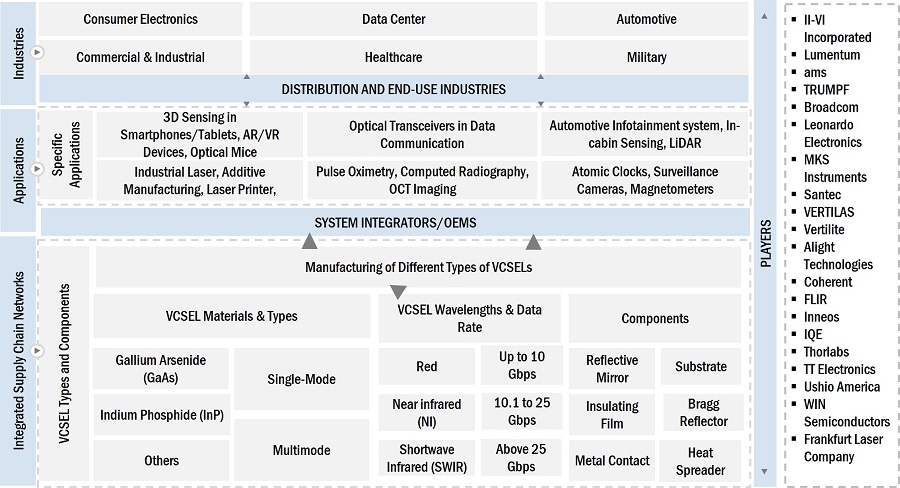

VCSEL Market Ecosystem

SWIR expected to grow at the second fastest VCSEL market during forecasted period

VCSELs in the SWIR band have a wavelength between 1,400nm and 3,000nm. The majority of VCSELs in the SWIR band are made of InP material. In recent times, numerous studies have been conducted to ascertain the use of gallium antimonide (GaSb) for VCSELs used in the SWIR band. These VCSELs are used in gas sensing applications, optical communications, medical, imaging & security applications, and long-range LiDAR. At present, however, VCSELs based on SWIR are limited in their applications. Vertilas (Germany) is one of the few players offering VCSELs in the SWIR band segment

VCSELs based on other materials, such as GaAsP, InAlGaAs, GaInPAs, and GaInP to hold the second largest share in VCSEL market in 2023

The market penetration of 850 nm VCSELs based on GaAs has prompted researchers to explore other materials for the development of VCSELs with wavelengths in the range of 1,300–1,500nm, and also in the orange and red spectrum. Frankfurt Laser Company (Germany) is one of the major providers of GaAsP-based VCSELs. However, these materials have niche industrial applications and are mostly used for research and testing purposes.

Industrial heating and laser printing is expected to be the second largest segment of the VCSEL market during the forecasted period

VCSELs are used in various industrial applications, and industrial heating & processes is one of them. Industrial heating applications include general thermal processing plastics welding/forming, composite manufacturing, drying/curing of coatings, printed electronics, photovoltaics selective metal treatment, and preheating for additive manufacturing in 3D printing. TRUMPF is one of the important players in the industrial VCSEL market. The growth potential is likely to depend on how well the industrial sector responds to these high-power VCSEL arrays, as industrial heating applications are still in the innovation phase for VCSELs, as well as its market is currently emerging.

Commercial and industrial is expected to be the second largest industry of the VCSEL market during the forecasted period.

Developments and modifications in the VCSEL architecture have not only enhanced the efficiency of VCSELs for data centers but also increased the integration of VCSELs in an extensive range of emerging and innovative commercial & industrial applications. VCSELs are used in various industries for applications, such as infrared illumination, sensing, laser printing, and industrial heating. Innovations pertaining to VCSELs would benefit industries that involve different thermal processes. These thermal processes include melting, curing, annealing, and drying all kinds of materials. Infrared illuminators are also used in commercial & industrial applications, such as surveillance, imaging, and object detection.

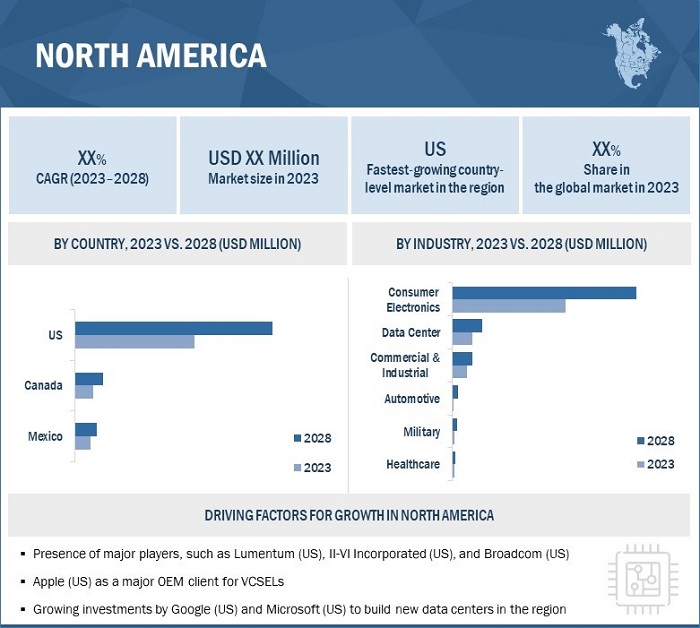

North America is expected to hold the second largest share in VCSEL market during forecasted period

The growth of the VCSEL industry in North America is due to the growing number of technological innovations in field of laser technology for various application areas such as medical, telecommunication, military, and automotive. The increase in R&D activities, particularly in the military and defense industries, has propelled the demand for VCSEL in the region. As of 2021, the annual military expenditure in the US was about 3.6% of the global GDP of the country. This will create lucrative growth opportunities for VCSEL in military applications. Apart from this, increasing application of VCSEL in the healthcare sector is one of the major market drivers.

VCSEL Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The VCSEL companies such as Lumentum Holding Inc. (US), AMS-Osram AG (Austria), Coherent Corporation (US), TRUMPF (Germany), Broadcom (US), Leonardo Electronics (US), MKS Instruments (US), Santec (Japan), VERTILAS (Germany), Vertilite (China), Alight Technologies (Denmark), Inneos (US), IQE (UK), Thorlabs (UK), TT Electronics (UK), Ushio America (US), WIN Semiconductors (Taiwan), and Frankfurt Laser Company (Germany).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size availability for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Thousand/Million/Billion) and Volume (Million Units) |

|

Segments covered |

By Type, Material, Wavelength, Application, Data Rate, and Industry |

|

Geographies covered |

Asia Pacific, Europe, North America, and Rest of the World |

|

Companies covered |

The major market player includes Lumentum (US), Coherent Corporation (US), ams-OSRAM (Austria), TRUMPF (Germany), Broadcom (US), Leonardo Electronics (US), MKS Instruments (US), Santec (Japan), VERTILAS (Germany), Vertilite (China), Alight Technologies (Denmark), Inneos (US), IQE (UK), Thorlabs (UK), TT Electronics (UK), Ushio America (US), WIN Semiconductors (Taiwan), and Frankfurt Laser Company (Germany) among others |

VCSEL Market Highlights

The study categorizes the VCSEL market based on type, material, wavelength, application, data rate, industry, and region at the global level.

|

Segment |

Subsegment |

|

By Type |

|

|

By Material |

|

|

By Wavelength |

|

|

By Data Rate |

|

|

By Application |

|

|

By Industry |

|

|

By Region |

|

Recent Developments

- May 2022, ams OSRAM launched a high-performance infrared laser flood illuminator for the latest automotive indirect Time-of-Flight (iToF) demonstrator from Melexis company which is a global supplier of microelectronic semiconductor solutions.

- April 2022, Lumentum launched M Series multi-junction VCSEL arrays for next-generation automotive, industrial LiDAR, and 3D sensing applications. The M51-100 905 nm 70 W multi-junction VCSEL array is a compact, highly reliable, power-dense solution optimized for next-generation LiDAR systems.

- December 2022, Coherent Corp. partnered with two Korean institutions, the Electronics and Telecommunications Research Institute (ETRI) and the Korea Advanced Institute of Science & Technology (KAIST), to foster collaboration on advanced electronic and photonic devices. It will also strengthen the company’s position in the Korean market.

- July 2022, II-VI Incorporated acquired Coherent, Inc. to become a global leader in materials, networking, and lasers. Post the acquisition, the combined business will be more distributed across the value chain, from materials to components, subsystems, systems, and service.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the VCSEL market during forecasted?

The global VCSEL market is forecasted to reach USD ~2.9 billion in 2028, growing at a CAGR of 13.6% from 2023–2028. This growth attributed by the surging demand of 3D sensing technology for smartphone and other consumer electronics application.

What are some of the technology trends of VCSEL market?

The recent trends of the VCSEL market include 3D sensing and LiDAR in automotive application.

What are the different doping materials covered in VCSEL market?

The doping materials covered in VCSEL market include gallium arsenide (GaAs), gallium nitride (InGaN), and others.

Which region will lead the VCSEL market in the future?

Asia Pacific is expected to lead the VCSEL market during the forecast period. The region has emerged as a global focal point for large investments and business expansion opportunities. The region represents the fastest-growing market worldwide for VCSELs, as it has leading manufacturers and end users of consumer devices.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

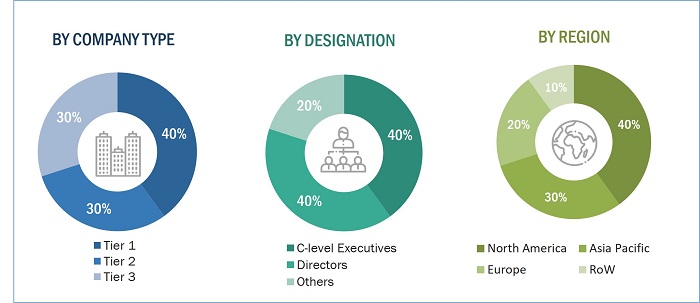

The study involved four major activities in estimating the current size of the VCSEL market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information-secondary and primary-have been used to identify and collect information for an extensive technical and commercial study of the VCSEL market.

Secondary Research

Secondary sources referred for this study include company websites, magazines, industry news, associations (Indian Laser Association, International Laser Class Association, Victorian Laser Association, and International Laser Display Association among others), and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, trade, and databases. The secondary data has been collected and analyzed to arrive at the overall VCSEL market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the present scenario of the VCSEL market through secondary research. Several primary interviews have been conducted with market experts from both the demand (adopters of VCSEL used for various VCSEL technology type and its applications) and supply (VCSEL manufacturers, integrators, and distributors) sides across 4 key regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% and 75% of the primary interviews have been conducted with parties from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the VCSEL market and other dependent submarkets. The key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of the top market players and extensive interviews with industry experts, such as CEOs, vice presidents, directors, and marketing executives, for both qualitative and quantitative key insights related to the VCSEL market. While estimating and calculating the market sizing of the VCSEL market, recession impact has been considered. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

- For the calculation of sizes of segments of the VCSEL market, the market size obtained by implementing the bottom-up approach has been used in the top-down approach. This has been later confirmed with primary respondents across different geographies.

- The bottom-up approach has also been implemented for the data extracted from secondary research to validate the size of various market segments.

- The market share of each company has been estimated to verify revenue shares used in the bottom-up approach earlier.

- The sizes of the overall parent and peer markets (Laser Technology market and Edge Emitting Diodes market) and each individual market have been determined and confirmed in this study with the help of a data triangulation procedure and validation of data through primary interviews.

Global VCSEL Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the VCSEL market, in terms of value and volume, based on type, material, wavelength, application, data rate, and industry.

- To describe and forecast the market size of the VCSEL market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the supply chain of the VCSEL ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the VCSEL market

- To benchmark players within the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape of the market

- To analyze competitive developments, such as acquisitions, product launches and developments, expansions, partnerships, and acquisitions, in the VCSEL market

Available Customizations

MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in VCSEL Market

Hi, I am interested in purchasing this report. But I would need to understand your methodology first. Does your market size refer to VCSEL chip or VCSEL module? Did you add up revenue from suppliers or use the volume x price methodology?

I've been a VCSEL pioneer and developer for over 30 years. I give presentations on VCSEL history and markets. Most people still don't know what a VCSEL is. Market reports including volumes and sales by application, with past and projected growth aid greatly in increasing public awareness. So would like to get a report brochure and few insights about applications so that I can integrate this information in my presentations. Also, I will cite MarketsandMarkets wherever I include the information sourced from your research.

Currently, I am doing research about the VCSEL market and relevant companies in this industry. As the reports from your company are highly recommended, I searched through your website and have found your report to be most relevant. Can you share the report brochure and few more data pointers about the VCSEL market. Does the report include few use cases of VCSEL? If yes, can I have a look at those too?

Does the report break the CMP equipment data into various applications such as integrated circuits, MEMs & NEMs, and compound semiconductors? If not, are there any provisions for customization?

I am interested in - VCSEL Market in general - TAM, business evolution, on going market consolidation, foundry model, technology roadmap

I am active in academic research on optoelectronic devices. I am interested in knowing the trend and challenges of current technologies, in order to give the best orientation to my research.