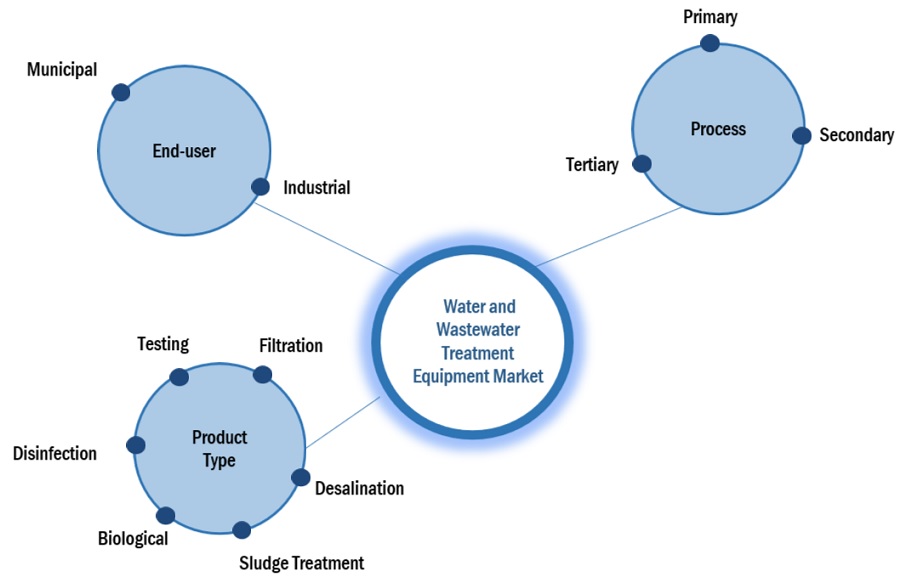

Water and Wastewater Treatment Equipment Market by Product Type (Filtration, Disinfection, Desalination, Sludge Treatment, Biological), Process (Primary, Secondary And Tertiary), End-User (Municipal, Industrial), And Region -Global Forecast to 2029

Updated on : April 15, 2024

Water and Wastewater Treatment Equipment Market

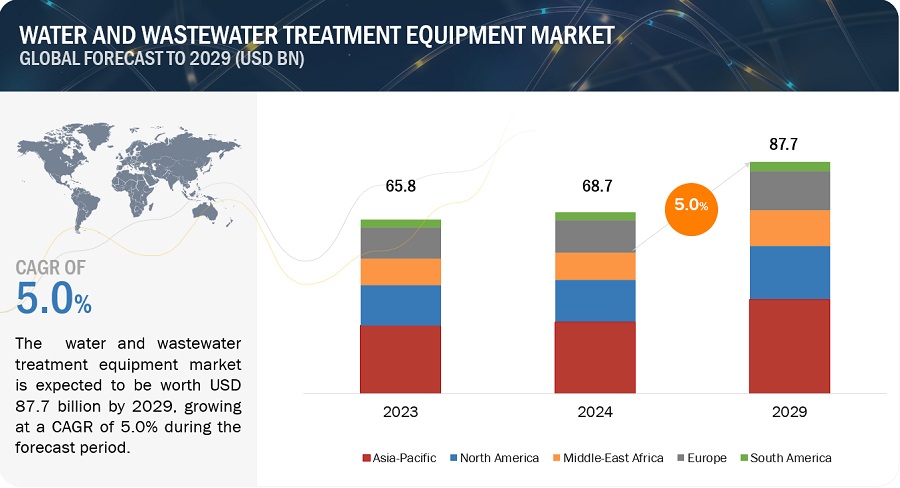

The global water and wastewater treatment equipment market was valued at USD 68.7 billion in 2024 and is projected to reach USD 87.7 billion by 2029, growing at 5.0% cagr from 2024 to 2029. The market growth is driven by increasing water scarcity concerns which in turn drives the adoption of sustainable water management practices. The increase in industrial water consumption and discharge and growing global population along with rising industrialization and urbanization.

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Water and Wastewater Treatment Equipment Market

Market Dynamics

Driver: Lack of freshwater and water scarcity concerns driving the adoption of sustainable water management practices

The lack of freshwater and escalating water scarcity concerns are significant drivers propelling the adoption of sustainable water management practices, consequently impacting the water and wastewater treatment equipment market. As freshwater sources dwindle due to factors such as climate change, population growth, and industrialization, the need for effective water conservation and management becomes paramount. This imperative drives governments, industries, and communities to prioritize sustainable water practices, including efficient water treatment and recycling. In response to water scarcity challenges, there's a heightened focus on optimizing water use and reducing wastage across sectors. This shift towards sustainable water management practices directly translates into increased demand for advanced water and wastewater treatment equipment. These systems play a crucial role in recycling and reusing wastewater, thereby conserving precious freshwater resources and mitigating the impact of water scarcity. Furthermore, regulatory pressures and environmental mandates aimed at safeguarding water resources further drive the adoption of sustainable water management practices and necessitate investments in modern water treatment technologies. Governments and regulatory bodies worldwide are implementing stringent standards for water quality and discharge, compelling industries and municipalities to upgrade their water treatment infrastructure. Overall, the convergence of water scarcity concerns, regulatory requirements, and the growing emphasis on sustainability creates a strong driver for the water and wastewater treatment equipment market, fostering innovation and growth in the industry.

Restraint: Stringent regulation in wastewater industry

Stringent regulation in the wastewater industry poses a significant restraint for the market due to several key reasons. Firstly, these regulations often require industries and municipalities to adhere to strict standards and discharge limits for wastewater effluent. Compliance with such regulations necessitates the implementation of advanced and costly water treatment technologies and equipment, which can significantly increase operational expenses for businesses and utilities. This financial burden can be particularly challenging for smaller companies or regions with limited financial resources, potentially hindering their ability to invest in modern wastewater treatment solutions. Secondly, the complexity and evolving nature of regulatory frameworks can create uncertainty and compliance challenges for stakeholders in the wastewater industry. Constant updates, changes in regulations, and varying requirements across different jurisdictions can lead to confusion and increased administrative burdens. This can result in delays in implementation, regulatory non-compliance issues, and additional costs associated with legal and regulatory compliance efforts. Moreover, stringent regulations may also act as a deterrent for innovation and market entry, as companies may hesitate to invest in research and development of new technologies or enter new markets due to the perceived risks and uncertainties associated with regulatory compliance. Overall, while regulatory standards are crucial for protecting the environment and public health, excessive stringency or complexity in wastewater industry regulations can impede market growth, increase operational costs, and create challenges for stakeholders in the water and wastewater treatment equipment market.

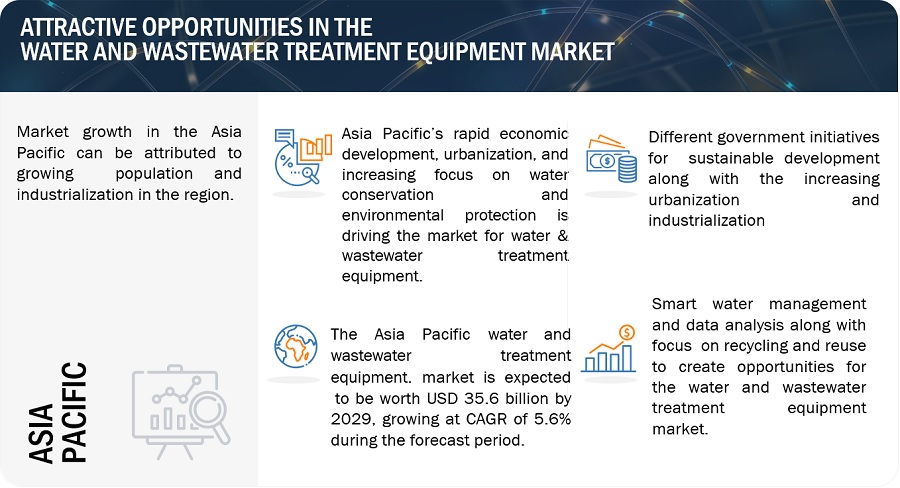

Opportunity: Smart water management and data analysis & Focus on Reuse and Recycling

Smart water management and data analysis represent a significant opportunity for the water and wastewater treatment equipment market due to several compelling factors. Firstly, the integration of smart technologies such as Internet of Things (IoT) sensors, automation systems, and data analytics software into water treatment processes enables real-time monitoring and optimization of water usage, treatment efficiency, and equipment performance. This data-driven approach allows for proactive maintenance, predictive analytics, and improved decision-making, leading to enhanced operational efficiency and cost savings for industries and utilities. Secondly, smart water management solutions facilitate the detection of leaks, anomalies, and inefficiencies in water distribution and treatment systems, enabling timely interventions and resource conservation. By leveraging advanced data analytics and machine learning algorithms, stakeholders can identify patterns, trends, and opportunities for optimization, leading to more sustainable water management practices. Furthermore, the growing emphasis on digitalization, sustainability, and water resource management initiatives by governments, industries, and environmental organizations worldwide creates a favorable environment for the adoption of smart water solutions. This trend is driving investments in smart water infrastructure and technologies, presenting lucrative opportunities for suppliers of water and wastewater treatment equipment to innovate and deliver advanced, data-driven solutions to meet evolving market demands.

The increasing focus on reuse and recycling of water presents a significant opportunity for the water and wastewater treatment equipment market. As water scarcity concerns intensify globally, there's a growing recognition of the importance of conserving and maximizing the use of existing water resources. Reuse and recycling initiatives aim to treat wastewater to a quality level suitable for various non-potable applications, such as irrigation, industrial processes, and even indirect potable water reuse with advanced treatment. This trend opens up new avenues for the water and wastewater treatment equipment market, as it requires innovative and advanced technologies to effectively treat wastewater to meet the stringent quality standards for reuse.

Challenges: High installation, equipment & operational costs

High installation, equipment, and operational costs pose significant challenges for the water and wastewater treatment equipment market across various sectors and regions. Firstly, the initial investment required for installing advanced water treatment equipment can be substantial, especially for large-scale projects such as municipal wastewater treatment plants or industrial facilities. These high upfront costs can deter potential buyers, particularly smaller municipalities, companies, or regions with limited budgets, from investing in modern water treatment technologies. Secondly, the cost of purchasing and maintaining specialized water treatment equipment, such as membrane filtration systems, UV disinfection units, and advanced chemical dosing systems, can be considerable. This can strain the financial resources of businesses and utilities, especially when considering ongoing maintenance, replacement of consumables, and upgrades to meet evolving regulatory standards. Furthermore, the operational costs associated with running water treatment facilities, including energy consumption, chemical usage, labor costs, and waste disposal, can be substantial over the long term. High operational expenses can erode profit margins and competitiveness, particularly in industries with tight cost constraints or volatile market conditions. Moreover, the complexity of financing and funding water treatment projects, coupled with regulatory uncertainties and changing market dynamics, adds to the challenge of managing costs effectively. Companies and municipalities often face challenges in balancing the need for advanced water treatment solutions with the financial feasibility and return on investment considerations. Addressing these challenges requires a comprehensive approach that considers cost-effective technologies, innovative financing models, regulatory support, and operational optimization strategies. Collaboration between stakeholders, technological advancements, and strategic planning are essential to overcome the barriers posed by high installation, equipment, and operational costs in the water and wastewater treatment equipment market.

Market Ecosystem

A market ecosystem for water & wastewater treatment equipment refers to the interconnected network of various entities, factors, and dynamics that collectively influence the production, distribution, and consumption of water & wastewater treatment equipment in the market. This ecosystem involves a range of participants, both internal and external, and includes various components that interact with each other to shape the overall functioning of the market. The key players in the market are Veolia (France), Xylem (US), Ecolab (US), DuPont (US), Pentair (UK), 3M (US), Aquatech International (US), Thermax Limited (India), Culligan Water (US), Calgon Carbon Corporation (US) etc.

Water & wastewater treatment equipment market: ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Tertiary is the largest sub-segment amongst the process segment in the water & wastewater treatment equipment market in 2024, in terms of value."

The prominence of the tertiary process segment in the water and wastewater treatment equipment market stems from its crucial role in meeting stringent water quality standards. This segment employs advanced treatment methods such as filtration, disinfection, and nutrient removal, essential for effectively eliminating remaining contaminants and pathogens from treated water before its release or reuse. The global escalation of concerns regarding water scarcity and pollution has led to an increased emphasis on recycling wastewater, thereby driving the demand for sophisticated tertiary treatment equipment. Furthermore, technological advancements, notably in membrane filtration and UV disinfection, have significantly improved treatment efficiency and broadened the applicability of tertiary treatment solutions across various industries. These advancements have not only enhanced the effectiveness of treatment processes but also expanded the range of applications for tertiary treatment equipment. Moreover, the rising awareness of the environmental impact of untreated wastewater has spurred the widespread adoption of robust tertiary treatment equipment. Stakeholders across industries and municipalities are increasingly prioritizing the implementation of effective tertiary treatment solutions to mitigate environmental risks and ensure sustainable water management practices.

“Filtration accounted for the largest by product type share of the water & wastewater treatment equipment market in 2024” in terms of value.

The filtration segment's leading position in the water and wastewater treatment equipment market is attributable to several pivotal factors. Firstly, filtration plays a fundamental and irreplaceable role in water treatment processes, irrespective of the water source or type undergoing treatment. By efficiently removing suspended solids, contaminants, and impurities, filtration enhances water quality, making it suitable for various applications such as drinking water supply, industrial operations, and agricultural use. Secondly, escalating concerns about water pollution and the global imperative for clean water drive a significant demand surge for reliable and effective filtration solutions. This demand spike is particularly pronounced in rapidly developing regions grappling with prevalent water quality challenges. Moreover, ongoing advancements in filtration technologies, including innovations like membrane filtration and ultrafiltration, have markedly improved the efficacy and versatility of filtration systems, thereby further propelling market growth. Additionally, stringent regulatory frameworks and environmental directives mandating the deployment of efficient filtration systems in wastewater treatment plants and industrial settings significantly contribute to the filtration segment's dominance. These regulations ensure compliance with water quality standards and environmental protection measures, underscoring the critical role of filtration in safeguarding public health and environmental sustainability. In essence, the filtration segment's formidable stature and continual growth trajectory within the water and wastewater treatment equipment market are rooted in its indispensable function, continuous technological advancements, mounting concerns regarding water quality, and regulatory imperatives driving adoption and innovation in filtration technologies.

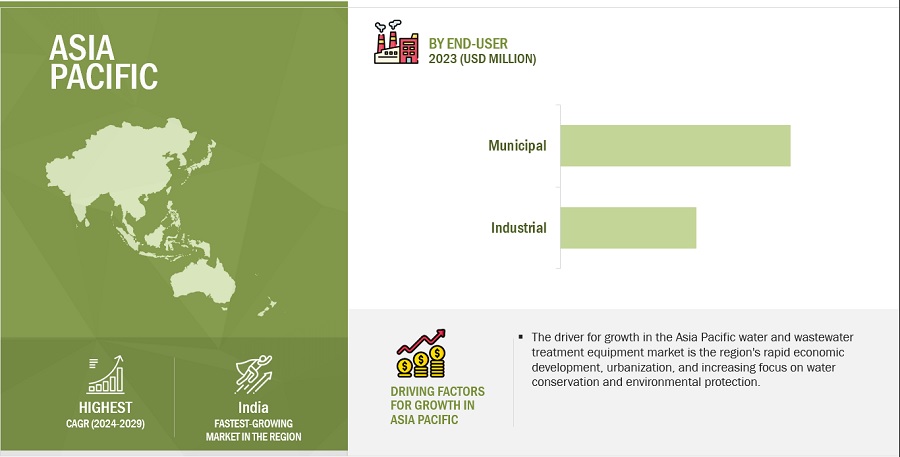

“Municipal accounted for the largest end-user for the water & wastewater treatment equipment market, in terms of value in 2024”

The municipal segment's dominance in the water and wastewater treatment equipment market is rooted in several key factors. Firstly, municipalities play a critical role in delivering safe drinking water to their communities and managing wastewater from various sources like households, businesses, and public facilities. This essential responsibility creates a consistent and substantial demand for water and wastewater treatment solutions and equipment. Secondly, rapid urbanization and population growth in urban areas intensify the pressure on municipal water infrastructure. The increasing population density and urban expansion necessitate continuous upgrades and expansions of treatment facilities and processes to meet the rising demand for water services effectively. Additionally, stringent regulatory frameworks and guidelines mandate municipalities to adhere to water quality standards and environmental protection measures. Compliance with these regulations compels municipalities to invest in advanced treatment technologies and equipment to ensure public health safety and environmental sustainability. Furthermore, government initiatives and funding programs, especially in developing regions, incentivize investments in municipal water and wastewater treatment projects. These initiatives aim to enhance water infrastructure and address water quality challenges, driving market growth in the municipal segment. Moreover, growing community awareness about clean water importance and sustainable water management practices motivates municipalities to adopt innovative and efficient treatment solutions. Public support for environmentally friendly initiatives further strengthens the position of the municipal segment in the global water and wastewater treatment equipment market. Collectively, these factors underscore the significant role of municipalities and their continued dominance in driving market demand and technological advancements in the water and wastewater treatment sector.

"Asia pacific is the largest market for water & wastewater treatment equipment Market in 2024, in terms of value."

Asia Pacific stands out as the largest region segment in the water and wastewater treatment equipment market due to several key factors that drive its prominence and growth in the industry. Firstly, the region's rapid economic development, industrialization, and urbanization have significantly increased the demand for water and wastewater treatment solutions. As countries in Asia Pacific experience robust economic growth and urban expansion, there is a corresponding surge in water consumption across various sectors, including manufacturing, energy production, agriculture, and municipal services. This heightened water demand necessitates advanced treatment technologies and equipment to address water quality challenges and ensure sustainable water management practices. Secondly, Asia Pacific faces significant water scarcity and pollution issues, particularly in densely populated urban areas and industrial zones. The region's growing population, coupled with industrial activities and agricultural practices, contributes to water pollution and depletes freshwater sources. As a result, there is a pressing need for effective water treatment solutions to mitigate pollution, conserve water resources, and meet regulatory standards for water quality. Furthermore, government initiatives, regulatory measures, and investments in water infrastructure play a crucial role in driving the water and wastewater treatment equipment market in Asia Pacific. Many countries in the region have implemented stringent environmental regulations and standards to protect water bodies, promote water conservation, and ensure safe drinking water supply. These regulations mandate industries and municipalities to invest in advanced treatment technologies and equipment, creating a conducive environment for market growth. Moreover, Asia Pacific's increasing focus on sustainability, resilience, and innovation in water management further accelerates market expansion. The adoption of smart water technologies, data analytics, and digitalization initiatives enhances operational efficiency, reduces water wastage, and optimizes resource utilization in water treatment processes. Additionally, the region's diverse geography, ranging from highly industrialized areas to rural communities, presents varied market opportunities for water and wastewater treatment equipment suppliers. The demand for portable and decentralized treatment solutions in remote locations complements the market for larger centralized treatment systems in urban centers.

To know about the assumptions considered for the study, download the pdf brochure

Water and Wastewater Treatment Equipment Market Players

The key players in this market are Veolia (France), Xylem (US), Ecolab (US), DuPont (US), Pentair (UK), 3M (US), Aquatech International (US), Thermax Limited (India), Culligan Water (US), Calgon Carbon Corporation (US) etc. Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of water & wastewater treatment equipment have opted for new product launches to sustain their market position.

Water and Wastewater Treatment Equipment Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2020-2029 |

|

Base Year |

2023 |

|

Forecast period |

2024–2029 |

|

Units considered |

Value (USD Billion/Million), Volume (Thousand Units) |

|

Segments |

Product type, Process, End-user and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Veolia (France), Xylem (US), Ecolab (US), DuPont (US), Pentair (UK), 3M (US), Aquatech International (US), Thermax Limited (India), Culligan Water (US), Calgon Carbon Corporation (US) |

Segmentation

This report categorizes the global Water and wastewater treatment equipment market based on product type, process, end-user and region.

On the basis of product type, the market has been segmented as follows:

- Filtration

- Disinfection

- Desalination

- Sludge Treatment

- Biological

- Testing

On the basis of process, the market has been segmented as follows:

- Primary

- Secondary

- Tertiary

On the basis of end-user, the market has been segmented as follows:

- Municipal

- Industrial

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In November 2023, France's pioneering unit for utilizing treated wastewater to generate drinking water was inaugurated by Veolia (France) and Vendée Eau on November 16, 2023, as part of the Jourdain program. This innovative approach is set to contribute an extra 1.5 million cubic meters of drinking water during the heightened water scarcity periods from May to October in the Vendée region.

- In July 2023, DuPont (US) has unveiled the official commercial release of the DuPont™ FilmTec™ LiNE-XD nanofiltration membrane elements designed specifically for lithium brine purification.

- In May 2023, Xylem Inc. (US) has successfully finalized its acquisition of Evoqua Water Technologies Corp., a prominent provider of mission-critical water treatment solutions and services. This all-stock transaction, valued at around $7.5 billion, marks a significant strategic move for Xylem in expanding its capabilities in the water treatment sector.

- In April 2022, Pentair (US) has introduced the Pentair Rocean Reservoir, an avant-garde and eco-friendly water filtration system designed to offer consumers cleaner tap water effortlessly. Featuring InstaClean Technology and certified to eliminate or reduce 76 contaminants, the Pentair Rocean is positioned as an environmentally conscious substitute for bottled water, accompanied by a sleek and clean countertop appearance.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the water and wastewater treatment equipment market?

This study's forecast period for the water & wastewater treatment equipment market is 2024-2029. The market is expected to grow at a CAGR of 5.0% in terms of value, during the forecast period.

Who are the major key players in the water and wastewater treatment equipment market?

Veolia (France), Xylem (US), Ecolab (US), DuPont (US), Pentair (UK), 3M (US), Aquatech International (US), Thermax Limited (India), Culligan Water (US), Calgon Carbon Corporation (US) etc. are the leading manufacturers and service provider of water & wastewater treatment equipment market.

What are the emerging trends in the Water and wastewater treatment equipment market?

The water and wastewater treatment equipment market is witnessing several emerging trends that are shaping the industry's future. These trends include the adoption of advanced technologies such as membrane filtration, UV disinfection, and IoT sensors, which enhance treatment efficiency and performance. There's also a growing emphasis on water reuse and recycling solutions to address water scarcity and sustainability challenges, alongside the integration of smart water management systems with data analytics for real-time monitoring and optimization. Energy efficiency has become a key focus, driving the demand for green technologies and energy-efficient equipment to reduce operational costs and environmental impact. Additionally, the market is seeing a rise in decentralized and modular treatment systems, offering flexibility, scalability, and resilience in water management strategies. These trends collectively reflect the industry's evolution towards more innovative, efficient, and sustainable water treatment solutions.

What are the drivers and opportunities for the water and wastewater treatment equipment market?

The market growth is driven by lack of freshwater and water scarcity concerns driving the adoption of sustainable water management practices, increase in industrial consumption & discharge, growing global population coupled with risein urbanization & industrialization. The opportunities are smart water management and data analysis, focus on reuse and recycling along with growing demand for energy efficient advanced water treatment technologies.

What are the restraining factors in the water and wastewater treatment equipment market?

Stringent regulations in wastewater industry is the major restraint for this market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the Water and wastewater treatment equipment market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The water and wastewater treatment equipment market comprises several stakeholders in the value chain, which include raw material suppliers, research and development, manufacturers, distribution and logistics, and end users. Various primary sources from the supply and demand sides of the water and wastewater treatment equipment market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the water & wastewater treatment equipment industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to procees, product type, end-user and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, fabricators, and their current usage of water & wastewater treatment equipment and the outlook of their business, which will affect the overall market.

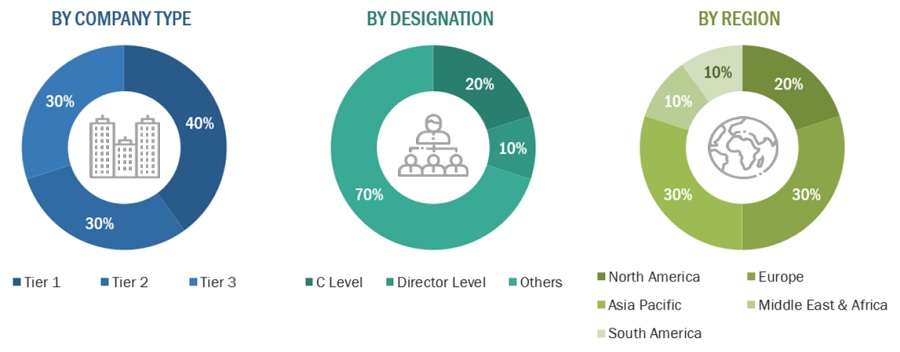

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Top Bottom

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Water And Wastewater Treatment Equipment Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Water and wastewater treatment is essential to maintain quality standards of water for drinking, daily public use, industrial usage & disposal, and pharmaceutical usage. Water treatment equipment are used to alter the physical, chemical, or bacteriological quality of water. Water treatment equipment refers to systems and devices used to purify water, making it suitable for drinking, household use, or industrial applications. These systems typically involve filtration, disinfection, and other methods to remove impurities like sediments, harmful microorganisms, and chemicals.

Wastewater treatment equipment, on the other hand, deals with treating used water from homes, industries, and other sources. This equipment aims to remove contaminants and pollutants before releasing the treated water back into the environment or for reuse in specific applications. Wastewater treatment processes often involve multiple stages like physical separation, biological treatment, and disinfection among others. The report covers commercially used water & wastewater treatment equipment and process equipment used in primary, secondary and tertiary water & wastewater treatment applications.

Key Stakeholders

- Water and wastewater treatment equipment manufacturers

- Raw material suppliers

- End-use industries of different segments of water and wastewater treatment equipment

- Water and wastewater treatment equipment traders, distributors, and suppliers

- Research organizations

- Industry associations

- Governments and research organizations

- Regulatory bodies

- Environment support agencies

Report Objectives

- To define, describe, and forecast the size of the water and wastewater treatment equipment market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on product type, process, end-user and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Water and Wastewater Treatment Equipment Market

General information on Water Desalination, wastewater treatment, thermal steam power generation, reverse osmosis , oil treatment plant

General information required on water and wastewater treatment power generation and oil treatment plants

Looking for sample of water testing equipment market

General information required on water and wastewater treatment in bioenergy

Water treatment market and major players and porter five forces analysis

Market information on global Water treatment market

Waste water treatment process information

Specific information of water and wastewater equipment/systems market in US

custom study for water and wastewater equipment/systems in US

Information on water purification machines in MEA region

Looking for disinfection technologies nvolving UV, Ozone; Filtration Systems : Granular, Adsorption, Membrane process involved in Desalination RO, MF, UF

Interested in 3D printing (metal) market

Information on supply and demand analysis for water treatment market in New Zealand

Market size inforamtion on Water & Waste Water Treatment Market, focus on Global, Middle East and Saudi Arabia

water purification market information

Water treatment systems makret with key application in to residential, commercial, and industrial area

Interested in water tretment equipments for their plant (Water & Wastewater Treatment Equipment Market)

Report title not mentioned

Need information on disinfection efficiency improvement in the potable water treatment to develop new designs of water treatment tanks.

Water & Wastewater Treatment Equipment Market

Looking for global and US market information on Wastewater treatment Chemicals

General information on MBR systems for sewage and wastewater

Wastewater Treatment Services Market in US

Interested in Industrial Water Treatment report

Global Water Pump market

General information on Wasterwater Septage and Sewage Management

POE and POE market split by Commercial and residential application

we have a new technology fir for desalination and also providing electric energy from low temperature heat.