Welding Equipment, Accessories & Consumables Market by Equipment, Accessory, Consumable (Electrodes & Filler Materials, Fluxes & Wires Gases), Technology (Arc Welding, Oxy-Fuel Welding ), End-Use Industry, and Region - Global Forecast to 2026

Updated on : April 11, 2024

Welding Equipment, Accessories and Consumables Market

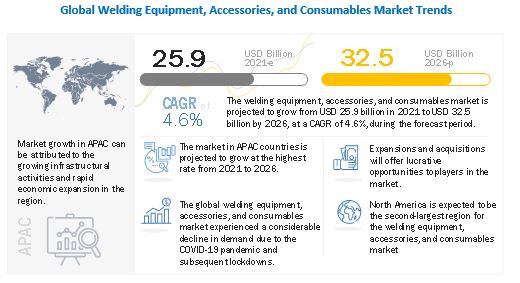

The global welding equipment, accessories, and consumables market was valued at USD 25.9 billion in 2021 and is projected to reach USD 32.5 billion by 2026, growing at 4.6% cagr from 2021 to 2026. Innovations and technological advancements in the automotive industry to cater to the growing demand from customers is expected to create higher demand for welding products which is likely to drive the global welding equipment, accessories, and consumables market during the forecast period. APAC is the fastest-growing market for welding equipment, accessories, and consumables due to growing population, favorable investment policies, growing economies, and government initiatives directed at promoting electronics and automobile industries in the region

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 impact on global welding equipment, accessories, and consumables market

The welding equipment, accessories, and consumables industry was majorly impacted by COVID-19. In the initial stages of the pandemic, factories in several countries were forced to shut down as the governments implemented strict lockdowns to stop the spread of the virus. After the lockdown was lifted and restrictions were eased, welding equipment, accessories, and consumables manufacturers were allowed to resume factory operations but at a limited capacity and under several rules and regulations.

The welding equipment, accessories, and consumables industry was majorly impacted by COVID-19. In the initial stages of the pandemic, factories in several countries were forced to shut down as governments implemented strict lockdowns to stop the spread of the virus. After the lockdown was lifted and restrictions were eased, welding material manufacturers were allowed to resume factory operations but at a limited capacity and under several rules and regulations.

The demand for welding equipment, accessories, and consumables also reduced as a majority of the demand is linked to the end-use industries, which are also facing difficulties operating during the pandemic. Many construction projects and activities, including government infrastructure projects, which were initially running, came to a complete halt due to the imposition of lockdowns. The construction industry, like many others, is labor-intensive. Mass unemployment in the construction industry led to widespread panic, leading laborers to return to their homelands. Even after the easing of restrictions in several countries, construction companies are working with reduced finances, labor, and working hours, which are further going to delay project deliveries. The impact of the slowdown of the construction industry was felt by the welding equipment, accessories, and consumables industry as well. Apart from the shutdown of production facilities, the cancellation of several projects in the commercial and industrial construction sectors reduced the demand for welding equipment, accessories, and consumables in 2020. The adverse effect of COVID-19 on the automotive industry also had a negative impact on the welding equipment, accessories, and consumables market. Major impacts on the industry were due to a disruption in Chinese parts exports, the closure of assembly plants in the US, and large-scale manufacturing interruptions across Europe. This placed intense pressure on an industry already coping with a downshift in global demand.

Welding Equipment, Accessories, and Consumables Market Dynamics

Driver: Increasing demand from end-use industries

The welding equipment, accessories, and consumables market majorly depends on the transportation, building & construction, and heavy industries. Welding is widely used in the transportation industry to manufacture various vehicle body parts. According to OICA (Organisation Internationale des Constructeurs d'Automobiles), the global production of passenger cars amounted to 67.14 million. Even though the production of vehicles saw a decline of approximately 5% in 2019 from 2018, there is still significant scope for welding materials in this end-use industry. Innovations and technological advancements in the automotive industry to cater to the growing demand from customers is expected to create higher demand for welding products which is likely to drive the global welding equipment, accessories, and consumables market during the forecast period.

Welding products also find application in the building & construction industry, which is growing at a steady rate, especially in the emerging economies of India, China, and Brazil where new infrastructural development projects are likely to drive the welding equipment, accessories, and consumables market.

The growing demand for welded steel in the construction of residential and commercial buildings is also expected to drive the market over the forecast period. According to the Global Construction Perspectives and Oxford Economics, global construction output is expected to grow by 85% and reach USD 15.5 trillion by 2030 with three countries – India, China, and the US leading the way and accounting for over 50% of all global growth. This growth in the construction output will also positively impact the market for welding equipment, accessories, and consumables

Restraint: High running and maintenance costs

The welding equipment, accessories, and consumables market is expanding at a significant pace; however, high energy consumption, sensitivity to environmental conditions, improper selection, poor maintenance, high cost, and difficulty in fabrication are some of the major problems faced by some equipment.

Energy consumption of welding equipment, accessories, and consumables plays a significant role as it contributes to the operating cost of any company. As per a study conducted by Lincoln Electric Company in 2018, welding annually consumed at least USD 15 million worth of electricity in the US and about USD 99 million worldwide, which is significantly high.

Problems related to accuracy, drift, and sensitivity in welding equipment can only be resolved with proper and timely maintenance. These also equipment need to be calibrated on a regular basis for them to function efficiently. In the absence of maintenance or in case of improper maintenance, impurities could choke the equipment, resulting in incorrect measurements equipment malfunctioning.

The cost of welding equipment, accessories, and consumables is also high due to the complex nature of the manufacturing process. Some welding techniques such as laser and plasma welding are expensive for commercial and residential customers. Sensitivity, selectivity, stability, cost, and portability are the key aspects considered by customers while purchasing these equipment. For instance, welding machines based on laser and plasma technology are more expensive as compared to arc welding machines but are far better in terms of accuracy and reliability. Such high-end technologies are selected for high-end applications in the medical, electronics, and aerospace industries. These high costs pose a restraint for the market.

Opportunity: New and advanced applications

Techniques such as laser welding and ultrasonic welding are witnessing increased adoption, which, in turn, is propelling the welding market. These welding techniques are highly efficient and offer several advantages that make them suitable for numerous applications, which makes them increasingly popular in end-use industries where precision and accuracy of the joints are of high importance such as electric appliances, robotic appliances, and moving automotive parts.

The demand for welding products will be further propelled as it is the only joining technique that can be used in space and underwater. Welding plays an important role in the repair and maintenance of ships, pipelines, and offshore oil platforms. Underwater welding is also emerging as a favorable technique in marine applications.

Recently, the demand to reduce the weight of car to reduce the environmental load substance and enhance workability for international competitiveness is on the rise. Under such circumstances, steel materials are required to have super high tensile strength and be able to deal with complex structures of parts with high performance. Welding joints provide fatigue and corrosion resistance, and strength in these applications, boosting the equipment, accessories, and consumables market.

In the field of thick plates and steel pipes, the trend of mega-structural construction and high efficiency transportation leads to the demand for thick and high tensile strength steel products. To fully utilize such advanced steel products, innovation in welding technologies is necessary, which boosts market growth.

Challenges: Shortage of skilled labor and high labor cost

The welding industry is highly dependent on labor. According to industry experts, there is a shortage of skilled welders across the world, and it is only getting worse as each year passes. This, coupled with the high labor cost in North America and Europe, is expected to act as a challenge for the growth of the welding equipment, accessories, and consumables market.

A number of infra-project contractors use welding and cutting operators from China, India, Russia, and Eastern European countries, as they face a shortage of skilled welding manpower. All projects in infrastructure, roads, railways, bridges, power, and shipping are highly reliant on the right metal joining technology, which can only be successfully executed by trained and certified manpower. The Indian Institute of Welding (IIW) in 2019, estimated a shortage in supply of 1.2 million welding professionals including welders, cutters, fitters, equipment operators, and also engineers and inspectors. This may balloon to 1.35 million in the next three years. Hence, the IIW has petitioned the Union Ministry for Skill Development and Entrepreneurship about the shortfall of skilled welders due to the growing industry and a retiring workforce.

The Electrodes & Filler Metal Equipment segment is projected to lead the global welding equipment, accessories, and consumables market through 2026

Welding electrodes are used to weld two metals. In arc welding, a current is passed using electrodes to join two metal pieces together. Depending on the process that is adopted, the electrode is either consumable or non-consumable. Electrodes required for gas metal arc welding or shielded metal arc welding are consumable, whereas those for welding metals with gas tungsten arc welding are non-consumable Stick welding is generally used for metals such as mild steel, cast iron, and stainless steel. Stick welding is a manual arc process that needs consumable electrodes coated with flux to place the weld. Electrodes & Filler Metal Equipment widely used to create stronger joints with relative ease.

The Gas filters segment is projected to grow at the highest CAGR during the forecast period.

The Gas filters, by accessory, is projected to grow at the highest CAGR during the forecast period. Gas filters are used to filter out dust and debris from the gas and allow the filtered gas to flow through the equipment. This property of gas filters prevents damage to solenoids and guns used for welding metals in welding equipment. The demand for Gas filters is expected to increase, due to the demand from end-use industries

The Asia Pacific is projected to hold the largest share in the welding equipment, accessories, and consumables market during the forecast period

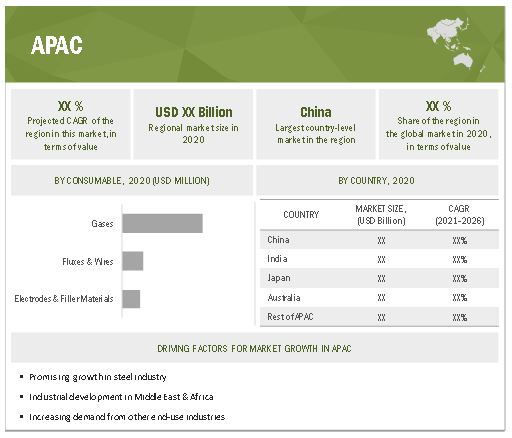

APAC is the largest producer and consumer of welding equipment, accessories, and consumables across the globe, with almost all major manufacturers and end-use companies present in the region. It has witnessed tremendous growth in the last few years, driven by its growing population, favorable investment policies, growing economies, and government initiatives directed at promoting electronics and automobile industries in the region.

Key Market Players

Key players operating in the welding equipment, accessories, and consumables market are Lincoln Electric Holdings, Inc (US), Colfax Corporation (US), Illinois Tool Works Inc. (US), Kobe Steel Ltd (Japan), and Air Liquide S.A( France). These players have adopted various growth strategies to expand their global presence and increase their market share.

Welding Equipment, Accessories and Consumables Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 25.9 billion |

|

Revenue Forecast in 2026 |

USD 32.5 billion |

|

CAGR |

4.6% |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Equipment, Accessory, Consumables, Technology And End-Use Industry, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa (MEA), and South America. |

|

Companies covered |

Lincoln Electric Holdings, Inc (US), Colfax Corporation (US), Illinois Tool Works Inc. (US), Kobe Steel Ltd (Japan), and Air Liquide S.A( France). Total 20 market players are covered in the report. |

This research report categorizes the welding equipment, accessories, and consumables market based on equipment, accessory, consumables, technology, end-use industry and region.

Based on Equipment:

- Electrodes & Filler Metal Equipment

- Oxy-fuel Gas Equipment

- Other Equipment

Based on the Accessory

- Protective Gear

- Gas Manifolds

- Flow Controllers

- Gas Panels

- Gas Flow Meters

- Gas Regulators

- Gas Cabinets

- Gas Filters

- Check Valves

Based on the Consumable

- Electrodes & Filler Materials

- Gases

- Fluxes & Wires

Based on the Technology

- Arc Welding

- Oxy-fuel Welding

- Others

Based on the End-Use Industry

- General Fabrication

- Power Generation

- Automotive

- Construction & Infrastructure

- Heavy Fabrication

- Shipbuilding

- Maintenance & Repair

- Offshore

- Pipe Mill

- Pipeline

Based on the Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa (MEA)

- South America

Recent Developments

- In February 2021, Lincoln Electric introduced the latest addition to its Vantage line of diesel engine driven welder/generators with the new Vantage 441X. This generator has features to help maintain jobsite welding at peak performance.

- In December 2020, In collaboration with The Harris Products Group — a Lincoln Electric company and the leader in cutting — Lincoln Electric introduced a VRTEX OxyFuel Cutting feature that combines welding and cutting by enabling users to practice torch cutting safely and virtually.

- In November 2020, ESAB. and leading robot and robot system company, YASKAWA, announced a global cooperation agreement to jointly develop and market a line of pre-engineered robotic welding systems called XCellerator. The XCellerator systems will be engineered and built by Yaskawa and marketed by ESAB through its global sales channels.

- In November 2019, ESAB Welding & Cutting Products launched its Pipeweld series of filler metals with formulations specifically tailored for welding X52 to X100 grade pipe. They include cellulosic electrodes, low-hydrogen vertical up and vertical down electrodes, solid wires, gas-shielded flux cored wires, and submerged arc welding fluxes.

Frequently Asked Questions (FAQ):

What is the current size of global welding equipment, accessories, and consumables market?

The welding equipment, accessories, and consumables market is projected to grow from USD 25.9 billion in 2021 to USD 32.5 billion by 2026, at a CAGR of 4.63% during the forecast period.

How is the welding equipment, accessories, and consumables market aligned?

The welding equipment, accessories, and consumables market is relatively consolidated and has several global and regional players who have a very strong presence in the market. These players have strong and well-established procurement and distribution networks, which help in cost-efficient production.

Who are the key players in the global welding equipment, accessories, and consumables market?

The welding equipment, accessories, and consumables market is dominated by a few globally established players, such as Lincoln Electric Holdings, Inc (US), Colfax Corporation (US), Illinois Tool Works Inc. (US), Kobe Steel Ltd (Japan), and Air Liquide S.A( France).

What are the factors driving the welding equipment, accessories, and consumables market?

Increasing demand from end-use industries

Increasing demand for clean energy .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.3.1 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET – FORECAST TO 2026

1.4 SCOPE OF THE STUDY

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 APAC TO WITNESS HIGHER GROWTH RATE DUE TO HIGH GROWING DEMAND FOR SEVERAL END-USE INDUSTRIES

4.2 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET: BY REGION AND EQUIPMENT

4.3 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET: BY REGION AND CONSUMABLE

4.4 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET: BY REGION AND GAS TYPE

4.5 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Promising growth in steel industry

5.2.1.2 Industrial development in Middle East & Africa

5.2.1.3 Increasing demand from other end-use industries

5.2.2 RESTRAINTS

5.2.2.1 High running and maintenance costs

5.2.2.2 Environmental impact of welding

5.2.3 OPPORTUNITIES

5.2.3.1 Absence of stringent standards in developing countries

5.2.3.2 New and advanced applications

5.2.3.3 Development of wind energy infrastructure

5.2.4 CHALLENGES

5.2.4.1 Shortage of skilled labor and high labor cost

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN

5.4.1 END-USE INDUSTRIES

5.4.2 PROMINENT COMPANIES

5.4.3 SMALL & MEDIUM ENTERPRISES

5.5 YC & YCC SHIFT

5.5.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR WELDING EQUIPMENT, ACCESSORY, AND CONSUMABLE MANUFACTURERS

5.6 REGULATORY LANDSCAPE

5.7 TECHNOLOGY ANALYSIS

5.7.1 UNMANNED ROBOT WELDING SYSTEM

5.7.2 FIELD GIRTH WELDING OF GAS PIPELINES

5.7.3 RAIL WELDING TECHNOLOGIES

5.7.4 ADVANCED MATERIALS

5.7.5 MICRO WELDING

5.8 CASE STUDY ANALYSIS

5.8.1 MULTI-PROCESS ROBOTIC WELDING OF LARGE CONSTRUCTION EQUIPMENT

5.9 MARKET MAP

5.10 TRADE ANALYSIS

5.11 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET: PATENT ANALYSIS

6 COVID-19 IMPACT ON WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET (Page No. - 74)

6.1.1 COVID-19 IMPACT ON WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES END-USE INDUSTRIES

7 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET, BY EQUIPMENT (Page No. - 76)

7.1 INTRODUCTION

7.2 ELECTRODE & FILLER METAL EQUIPMENT

7.2.1 WIDELY USED TO CREATE STRONGER JOINTS WITH RELATIVE EASE

7.3 OXY-FUEL GAS EQUIPMENT

7.3.1 LOW EQUIPMENT COST LEADS TO HIGH VOLUMES

7.4 OTHER EQUIPMENT

8 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET, BY ACCESSORY (Page No. - 82)

8.1 INTRODUCTION

8.2 GAS REGULATORS

8.3 GAS FLOW METERS

8.4 GAS FILTERS

8.5 CHECK VALVES

8.6 GAS MANIFOLDS

8.7 FLOW CONTROLLERS

8.8 GAS PANELS

8.9 GAS CABINETS

8.10 PROTECTIVE GEAR

9 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET, BY CONSUMABLE (Page No. - 87)

9.1 INTRODUCTION

9.2 ELECTRODES & FILLER MATERIALS

9.2.1 ECONOMICAL AND CAN BE USED ON A WIDE RANGE OF METALS

9.3 FLUXES & WIRES

9.3.1 FLUXES SHIELD WELD AND PREVENT OXIDATION

9.4 GASES

9.4.1 USED TO PROTECT MOLTEN METAL FROM CONTAMINATION AND OXIDATION

9.4.1.1 Shielding gases

9.4.1.2 Oxy-fuel gases

10 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET, BY TECHNOLOGY (Page No. - 94)

10.1 INTRODUCTION

10.2 ARC WELDING

10.2.1 MOST PREFERRED TECHNOLOGY FOR WELDING

10.3 OXY-FUEL WELDING

10.3.1 CAN BE USED TO WELD WITHOUT THE USE OF ELECTRICITY

10.4 OTHERS

11 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET, BY END-USE INDUSTRY (Page No. - 99)

11.1 INTRODUCTION

11.2 GENERAL FABRICATION

11.3 AUTOMOTIVE

11.4 HEAVY FABRICATION

11.5 SHIPBUILDING

11.6 CONSTRUCTION & INFRASTRUCTURE

11.7 MAINTENANCE & REPAIR

11.8 PIPE MILL

11.9 OFFSHORE

11.10 PIPELINE

11.11 POWER GENERATION

12 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET, BY REGION (Page No. - 104)

12.1 INTRODUCTION

12.2 APAC

12.2.1 CHINA

12.2.1.1 Increasing urbanization drives demand welding equipment, accessories, and consumables in China

12.2.2 JAPAN

12.2.2.1 Increasing production of hybrid and electric vehicles drives market in Japan

12.2.3 INDIA

12.2.3.1 India witnesses high demand from automobile and construction sectors

12.2.4 AUSTRALIA

12.2.4.1 Market in Australia driven by metal fabrication, shipping, and construction industries

12.2.5 REST OF APAC

12.3 EUROPE

12.3.1 GERMANY

12.3.1.1 Market in Germany growing due to demand from automotive sector

12.3.2 UK

12.3.2.1 Construction sector to offer lucrative opportunities for market in UK

12.3.3 FRANCE

12.3.3.1 Increasing investment in infrastructure boosts market in France

12.3.4 ITALY

12.3.4.1 Increasing demand for welding consumables from automakers in Italy

12.3.5 REST OF EUROPE

12.4 NORTH AMERICA

12.4.1 US

12.4.1.1 US to lead market in North America by 2026

12.4.2 CANADA

12.4.2.1 Vast automobile industry in Canada drives market growth

12.4.3 MEXICO

12.4.3.1 Increasing investment in infrastructure boosts market in Mexico

12.5 MIDDLE EAST & AFRICA

12.5.1 SAUDI ARABIA

12.5.1.1 Market growth in Saudi Arabia supported by government investment in public infrastructure projects

12.5.2 SOUTH AFRICA

12.5.2.1 Growing automotive trade to boost market in South Africa

12.5.3 REST OF MIDDLE EAST & AFRICA

12.6 SOUTH AMERICA

12.6.1 BRAZIL

12.6.1.1 Increasing demand for automobiles from commercial as well as passenger vehicles sectors fuels market in Brazil

12.6.2 ARGENTINA

12.6.2.1 Growing construction industry drives market in Argentina

12.6.3 REST OF SOUTH AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 208)

13.1 KEY PLAYER STRATEGIES

13.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2020

13.3 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

13.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

13.5 MARKET EVALUATION FRAMEWORK

13.6 COMPANY EVALUATION QUADRANT

13.6.1 STAR

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE

13.7 SME MATRIX, 2019

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 DYNAMIC COMPANIES

13.8 COMPETITIVE SCENARIO

13.8.1 NEW PRODUCT LAUNCHES

13.8.2 DEALS

14 COMPANY PROFILES (Page No. - 223)

14.1 KEY PLAYERS

14.1.1 THE LINCOLN ELECTRIC COMPANY

14.1.1.1 Business overview

14.1.1.2 Products/solutions/services offered

14.1.1.3 Recent developments

14.1.1.4 MnM view

14.1.1.4.1 Key strengths/right to win

14.1.1.4.2 Strategic choices made

14.1.1.4.3 Weakness and competitive threats

14.1.2 COLFAX CORPORATION

14.1.2.1 Business overview

14.1.2.2 Products/solutions/services offered

14.1.2.3 Recent developments

14.1.2.4 MnM view

14.1.2.4.1 Key strengths/right to win

14.1.2.4.2 Strategic choices made

14.1.2.4.3 Weakness and competitive threats

14.1.3 ILLINOIS TOOL WORKS INC

14.1.3.1 Business overview

14.1.3.2 Products/solutions/services offered

14.1.3.3 MnM view

14.1.3.3.1 Key strengths/right to win

14.1.3.3.2 Strategic choices made

14.1.3.3.3 Weakness and competitive threats

14.1.4 KOBE STEEL LTD

14.1.4.1 Business overview

14.1.4.2 Products/solutions/services offered

14.1.4.3 Recent developments

14.1.4.4 MnM view

14.1.4.4.1 Key strengths/right to win

14.1.4.4.2 Strategic choices made

14.1.4.4.3 Weakness and competitive threats

14.1.5 AIR LIQUIDE S.A.

14.1.5.1 Business overview

14.1.5.2 Products/solutions/services offered

14.1.5.3 Recent developments

14.1.5.4 MnM view

14.1.5.4.1 Key strengths/right to win

14.1.5.4.2 Strategic choices made

14.1.5.4.3 Weakness and competitive threats

14.1.6 LINDE PLC

14.1.6.1 Business overview

14.1.6.2 Products/solutions/services offered

14.1.7 TIANJIN GOLDEN BRIDGE WELDING MATERIALS INTERNATIONAL TRADING CO, LTD

14.1.7.1 Business overview

14.1.7.2 Products/solutions/services offered

14.1.8 PANASONIC CORPORATION

14.1.8.1 Business overview

14.1.8.2 Products/solutions/services offered

14.1.8.3 Recent developments

14.1.9 MESSER GROUP GMBH

14.1.9.1 Business overview

14.1.9.2 Products/solutions/services offered

14.1.10 VOESTALPINE BÖHLER WELDING GMBH

14.1.10.1 Business overview

14.1.10.2 Products/solutions/services offered

14.1.10.3 Recent developments

14.2 OTHER PLAYERS

14.2.1 DAIHEN CORPORATION

14.2.2 HYUNDAI WELDING CO. LTD.

14.2.3 AIR PRODUCTS AND CHEMICALS, INC

14.2.4 ATLANTIC CHINA WELDING CONSUMABLES, INC

14.2.5 FRONIUS INTERNATIONAL GMBH

14.2.6 KEMMPI OY

14.2.7 OBARA GROUP INC

14.2.8 AMADA WELD TECH

14.2.9 SWAGELOK COMPANY

14.2.10 CARL CLOOS SCHWEISSTECHNIK GMBH

15 APPENDIX (Page No. - 258)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONSMARKETSANDMARKETS OFFERS CUSTOMIZATIONS ACCORDING TO CLIENT-SPECIFIC NEEDS ALONG WITH THE MARKET DATA. THE FOLLOWING CUSTOMIZATION OPTIONS ARE AVAILABLE FOR THE REPORT:

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

LIST OF TABLES (303 Tables)

TABLE 1 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT

TABLE 2 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 3 WELDING EQUIPMENT IMPORT DATA 2019 (USD THOUSAND)

TABLE 4 WELDING EQUIPMENT EXPORT DATA 2019 (USD THOUSAND)

TABLE 5 LIST OF PATENTS BY DAIHEN CORPORATION

TABLE 6 LIST OF PATENTS BY KOBE STEEL LTD.

TABLE 7 LIST OF PATENTS BY LINCOLN GLOBAL INC

TABLE 8 LIST OF PATENTS BY ILLINOIS TOOL WORKS

TABLE 9 LIST OF PATENTS BY JFE STEEL

TABLE 10 LIST OF PATENTS BY PANASONIC IP MAN CO LTD

TABLE 11 TOP 20 PATENT OWNERS (US) IN LAST 10 Y EARS

TABLE 12 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 13 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 14 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 15 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 16 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 17 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILO TONS)

TABLE 18 WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 19 WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILO TONS)

TABLE 20 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 21 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 22 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY REGION, 2019–2026 (USD BILLION)

TABLE 23 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 24 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 25 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 26 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 27 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 28 WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 29 WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 30 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 31 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 32 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 33 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 34 APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 35 APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 36 APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 37 APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 38 APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026

TABLE 39 APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 40 APAC: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 2019–2026 (KILOTONS)

TABLE 41 APAC: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 2019–2026 (USD BILLION)

TABLE 42 APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 43 APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 44 APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 45 APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 46 CHINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 47 CHINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 48 CHINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 49 CHINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 50 CHINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 51 CHINA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 52 CHINA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 53 CHINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 54 CHINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 55 CHINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 56 JAPAN: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 57 JAPAN: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 58 JAPAN: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 59 JAPAN: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 60 JAPAN: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 61 JAPAN: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 62 JAPAN: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 63 JAPAN: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 64 JAPAN: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 65 JAPAN: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 66 INDIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 67 INDIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 68 INDIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 69 INDIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 70 INDIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 71 INDIA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 72 INDIA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 73 INDIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 74 INDIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 75 INDIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 76 AUSTRALIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 77 AUSTRALIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 78 AUSTRALIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 79 AUSTRALIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 80 AUSTRALIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 81 AUSTRALIA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 82 AUSTRALIA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 83 AUSTRALIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 84 AUSTRALIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 85 AUSTRALIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 86 REST OF APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 87 REST OF APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 88 REST OF APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 89 REST OF APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 90 REST OF APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 91 REST OF APAC: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 92 REST OF APAC: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 93 REST OF APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 94 REST OF APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 95 REST OF APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 96 EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 97 EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 98 EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 99 EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 100 EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 101 EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 102 EUROPE: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 103 EUROPE: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 2019–2026 (USD BILLION)

TABLE 104 EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 105 EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 106 EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 107 EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 108 GERMANY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 109 GERMANY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 110 GERMANY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 111 GERMANY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 112 GERMANY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 113 GERMANY: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 114 GERMANY: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 115 GERMANY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 116 GERMANY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 117 GERMANY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 118 UK: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 119 UK: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 120 UK: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 121 UK: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 122 UK: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 123 UK: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 124 UK: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 125 UK: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 126 UK: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 127 UK: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 128 FRANCE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 129 FRANCE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 130 FRANCE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 131 FRANCE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 132 FRANCE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 133 FRANCE: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 134 FRANCE: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 135 FRANCE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 136 FRANCE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 137 FRANCE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 138 ITALY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 139 ITALY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 140 ITALY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 141 ITALY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 142 ITALY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 143 ITALY: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 144 ITALY: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 145 ITALY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 146 ITALY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 147 ITALY: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 148 REST OF EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 149 REST OF EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 150 REST OF EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 151 REST OF EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 152 REST OF EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 153 REST OF EUROPE: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 154 REST OF EUROPE: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 155 REST OF EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 156 REST OF EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 157 REST OF EUROPE: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 158 NORTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 159 NORTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 160 NORTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 161 NORTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 162 NORTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 163 NORTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 164 NORTH AMERICA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 165 NORTH AMERICA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 166 NORTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 167 NORTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 168 NORTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 169 NORTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 170 US: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 171 US: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 172 US: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 173 US: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 174 US: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 175 US: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 176 US: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 177 US: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 178 US: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 179 US: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 180 CANADA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD MILLION)

TABLE 181 CANADA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 182 CANADA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 183 CANADA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 184 CANADA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 185 CANADA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 186 CANADA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 187 CANADA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 188 CANADA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 189 CANADA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 190 MEXICO: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD MILLION)

TABLE 191 MEXICO: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 192 MEXICO: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 193 MEXICO: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 194 MEXICO: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 195 MEXICO: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 196 MEXICO: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 197 MEXICO: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 198 MEXICO: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 199 MEXICO: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 200 MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 201 MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 202 MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 203 MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 204 MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 205 MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 206 MIDDLE EAST & AFRICA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 207 MIDDLE EAST & AFRICA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 208 MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 209 MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 210 MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 211 MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 212 SAUDI ARABIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 213 SAUDI ARABIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 214 SAUDI ARABIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 215 SAUDI ARABIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 216 SAUDI ARABIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 217 SAUDI ARABIA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 218 SAUDI ARABIA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 219 SAUDI ARABIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 220 SAUDI ARABIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 221 SAUDI ARABIA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 222 SOUTH AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 223 SOUTH AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 224 SOUTH AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 225 SOUTH AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 226 SOUTH AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 227 SOUTH AFRICA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 228 SOUTH AFRICA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 229 SOUTH AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 230 SOUTH AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 231 SOUTH AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 232 REST OF MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 233 REST OF MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 234 REST OF MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 235 REST OF MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 236 REST OF MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 237 REST OF MIDDLE EAST & AFRICA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 238 REST OF MIDDLE EAST & AFRICA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 239 REST OF MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 240 REST OF MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 241 REST OF MIDDLE EAST & AFRICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 242 SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 243 SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 244 SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 245 SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 246 SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 247 SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 248 SOUTH AMERICA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 249 SOUTH AMERICA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 250 SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 251 SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 252 SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 253 SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 254 BRAZIL: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 255 BRAZIL: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 256 BRAZIL: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 257 BRAZIL: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 258 BRAZIL: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 259 BRAZIL: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 260 BRAZIL: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 261 BRAZIL: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 262 BRAZIL: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 263 BRAZIL: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 264 ARGENTINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 265 ARGENTINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 266 ARGENTINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 267 ARGENTINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 268 ARGENTINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 269 ARGENTINA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 270 ARGENTINA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 271 ARGENTINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 272 ARGENTINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 273 ARGENTINA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 274 REST OF SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, 2019–2026 (USD BILLION)

TABLE 275 REST OF SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (THOUSAND UNITS)

TABLE 276 REST OF SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY EQUIPMENT, 2019–2026 (USD BILLION)

TABLE 277 REST OF SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (KILOTONS)

TABLE 278 REST OF SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY CONSUMABLE, 2019–2026 (USD BILLION)

TABLE 279 REST OF SOUTH AMERICA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (KILOTONS)

TABLE 280 REST OF SOUTH AMERICA: WELDING CONSUMABLES MARKET SIZE, BY GAS TYPE, 2019–2026 (USD BILLION)

TABLE 281 REST OF SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (MILLION UNITS)

TABLE 282 REST OF SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY ACCESSORY, 2019–2026 (USD BILLION)

TABLE 283 REST OF SOUTH AMERICA: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 284 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, 2018–2021

TABLE 285 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET: DEGREE OF COMPETITION

TABLE 286 MARKET EVALUATION FRAMEWORK

TABLE 287 COMPANY PRODUCT FOOTPRINT

TABLE 288 COMPANY END-USE INDUSTRY FOOTPRINT

TABLE 289 COMPANY REGION FOOTPRINT

TABLE 290 COMPANY PRODUCT FOOTPRINT

TABLE 291 COMPANY REGION FOOTPRINT

TABLE 292 PRODUCT LAUNCHES, JULY 2020–FEBRUARY 2021

TABLE 293 DEALS, MAY 2018–JANUARY 2021

TABLE 294 THE LINCOLN ELECTRIC COMPANY: BUSINESS OVERVIEW

TABLE 295 COLFAX CORPORATION: BUSINESS OVERVIEW

TABLE 296 ILLINOIS TOOL WORKS INC: BUSINESS OVERVIEW

TABLE 297 KOBE STEEL, LTD: BUSINESS OVERVIEW

TABLE 298 AIR LIQUIDE S.A.: BUSINESS OVERVIEW

TABLE 299 LINDE PLC.: BUSINESS OVERVIEW

TABLE 300 TIANJIN GOLDEN BRIDGE WELDING MATERIALS INTERNATIONAL TRADING CO., LTD.: BUSINESS OVERVIEW

TABLE 301 PANASONIC CORPORATION.: BUSINESS OVERVIEW

TABLE 302 MESSER GROUP GMBH: BUSINESS OVERVIEW

TABLE 303 VOESTALPINE BÖHLER WELDING GMBH.: BUSINESS OVERVIEW

LIST OF FIGURES (50 Figures)

FIGURE 1 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SEGMENTATION

FIGURE 2 BOTTOM-UP APPROACH

FIGURE 3 TOP-DOWN APPROACH

FIGURE 4 SUPPLY-SIDE APPROACH

FIGURE 5 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET: DATA TRIANGULATION

FIGURE 6 KEY MARKET INSIGHTS

FIGURE 7 STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 8 WELDING ELECTRODE & FILLER METAL EQUIPMENT TO ACCOUNT FOR LARGEST MARKET SIZE

FIGURE 9 ELECTRODES & FILLER MATERIALS LEADS CONSUMABLES SEGMENT

FIGURE 10 PROTECTIVE GEAR TO DOMINATE AMONG WELDING ACCESSORIES

FIGURE 11 ARC WELDING SEGMENT TO LEAD IN TERMS OF TECHNOLOGY

FIGURE 12 GENERAL FABRICATION COMMANDS LEADING END-USE INDUSTRY POSITION

FIGURE 13 APAC TO GROW AT HIGHEST RATE IN WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET

FIGURE 14 GROWING INFRASTRUCTURE AND RAPID ECONOMIC EXPANSION DRIVE WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET

FIGURE 15 APAC AND ELECTRODES & FILLER METAL EQUIPMENT LED RESPECTIVE SEGMENTS IN 2020

FIGURE 16 APAC AND GASES DOMINATED RESPECTIVE SEGMENTS IN 2020

FIGURE 17 APAC AND SHIELDING GASES COMMANDED LARGEST SHARE IN 2020

FIGURE 18 MARKET IN INDIA PROJECTED TO HAVE HIGHEST CAGR FROM 2021 TO 2026

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET

FIGURE 20 WORLD CRUDE STEEL PRODUCTION 2010-2019

FIGURE 21 GLOBAL CUMULATIVE CAPACITY OF WIND POWER

FIGURE 22 GLOBAL CUMULATIVE CAPACITY PROJECTION OF WIND POWER 2020-2024

FIGURE 23 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 24 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET: VALUE CHAIN

FIGURE 25 REVENUE SHIFT FOR WELDING EQUIPMENT, ACCESSORY, AND CONSUMABLE MANUFACTURERS

FIGURE 26 MARKET MAP FOR WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET

FIGURE 27 PATENTS FOR WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET

FIGURE 28 PUBLICATION TRENDS FOR WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET

FIGURE 29 JURISDICTION ANALYSIS FOR WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET

FIGURE 30 TOP APPLICANT ANALYSIS FOR WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET

FIGURE 31 ELECTRODES & FILLER METAL TO LEAD MARKET THROUGHOUT FORECAST PERIOD

FIGURE 32 PROTECTIVE GEAR SEGMENT TO LEAD MARKET THROUGHOUT FORECAST PERIOD

FIGURE 33 ELECTRODES & FILLER MATERIALS TO COMMAND LARGEST MARKET SHARE THROUGH FORECAST PERIOD

FIGURE 34 ARC WELDING TECHNOLOGY TO COMMAND LARGEST MARKET SHARE IN FORECAST PERIOD

FIGURE 35 GENERAL FABRICATION TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 36 REGIONAL SNAPSHOT: INDIA TO BE THE FASTEST-GROWING COUNTRY-LEVEL MARKET FROM 2021 TO 2026

FIGURE 37 APAC: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET SNAPSHOT

FIGURE 38 REVENUE & RANKING ANALYSIS OF TOP 5 PLAYERS IN WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET, 2020

FIGURE 39 SHARE OF KEY PLAYERS IN WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET, 2019

FIGURE 40 TOP 5 PLAYERS DOMINATED MARKET IN LAST 5 YEARS

FIGURE 41 COMPETITIVE LEADERSHIP MAPPING: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET, 2020

FIGURE 42 SME MATRIX: WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET, 2020

FIGURE 43 THE LINCOLN ELECTRIC COMPANY: COMPANY SNAPSHOT

FIGURE 44 COLFAX CORPORATION: COMPANY SNAPSHOT

FIGURE 45 ILLINOIS TOOL WORKS INC: COMPANY SNAPSHOT

FIGURE 46 KOBE STEEL, LTD: COMPANY SNAPSHOT

FIGURE 47 AIR LIQUIDE S.A.: COMPANY SNAPSHOT

FIGURE 48 LINDE PLC.: COMPANY SNAPSHOT

FIGURE 49 PANASONIC CORPORATION.: COMPANY SNAPSHOT

FIGURE 50 MESSER GROUP GMBH: COMPANY SNAPSHOT

The study involved four major activities for estimating the current global size of the welding equipment, accessories, and consumables market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of welding equipment, accessories, and consumables through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the welding equipment, accessories, and consumables market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the welding equipment, accessories, and consumables market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

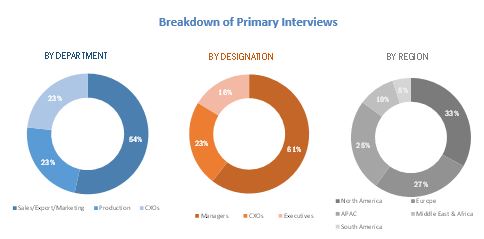

Various primary sources from both the supply and demand sides of the welding equipment, accessories, and consumables market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in welding equipment, accessories, and consumables industry. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the welding equipment, accessories, and consumables market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the welding equipment, accessories, and consumables market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Research Objectives

- To define, describe, and forecast the welding equipment, accessories, and consumables market in terms of value

- To elaborate drivers, restraints, opportunities, and challenges in the market

- To analyze and forecast the market size on the basis of equipment, accessory, consumables, technology and end-use industry.

- To forecast the market size, along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), MEA, and South America along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their core competencies2

- To analyze competitive developments in the market, such as agreements, joint venture & contracts.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the welding equipment, accessories, and consumables report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the welding equipment, accessories, and consumables market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Welding Equipment, Accessories & Consumables Market