Well Intervention Market by Service (Logging and Bottomhole Survey, Tubing/Packer Failure and Repair, Stimulation), Intervention (Light, Medium, Heavy), Application (Onshore, Offshore) Well (Horizontal, Vertical) Region - Global Forecast to 2026

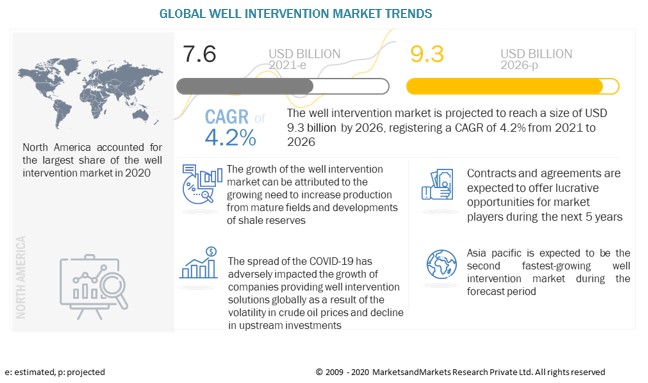

The global well intervention market in terms of revenue was estimated to worth $7.6 billion in 2021 and is poised to reach $9.3 billion by 2026, growing at a CAGR of 4.2 % from 2021 to 2026. Increasing efforts by upstream companies to enhance the production from the mature fields is driving the market. Development of shale reservoirs is also expected to drive the growth of the well intervention market as more intervention processes optimize oil production.

To know about the assumptions considered for the study, Request for Free Sample Report

Well Intervention Market Dynamics

Driver: Development of Shale Reservoirs

Shale reservoir is one of the fastest-growing energy resources for oil and gas production. Shale reservoirs are highly impermeable in nature. The oil or gas in these reservoirs is trapped within tiny pore spaces or adsorbed onto clay mineral particles that make up the shale, which makes it difficult to extract the crude oil and gas. Although drilling can help extract a large amount of oil and natural gas from the reservoir rock, a large portion remains trapped within the reservoirs. Thus, requiring more intervention processes to optimize oil production in shale reservoirs. The horizontal drilling technique, in combination with well stimulation tools and technologies, enables the extraction of shale oil and gas. The shale reservoirs are prone to water shut off and require proper zonal isolation and cementing processes, which drive the demand for well intervention services. Most of the production from shale reserves has increased since 2005 and is a result of horizontal drilling and hydraulic fracturing techniques, notably in shale, sandstone, carbonate, and other tight geologic formations.

Shale developments in other countries such as China, Mexico, Libya, Russia, and Argentina are also likely to boost well drilling and production activities, which is expected to drive the growth of the well intervention markets in North America, Latin America, and Asia Pacific.

Restraints: Decling demand for oil in Europe

The declining consumption of oil in Europe is affecting the rate of drilling activities in the region. According to the International Energy Agency Oil Demand Report for 2021, the oil demand witnessed a shocking decline in Europe and dropped by 1.9 million barrels per day in 2019. The declining oil consumption is expected to continue due to the European Union’s transition in its energy consumption from conventional fossil energy to renewable energy. In addition, industries and governments are focusing on actions associated with the climate-driven energy transition resulting in a shift from a high dependence on fossil-based fuels to alternative low carbon renewable energy sources, such as wind, solar, hydro, and geothermal energy.

According to the BP Statistical Review 2020, Europe generated 9.8% of its overall energy through renewables in 2019. The European Union leads in the climate change initiatives in the world with a net-zero emission policy, which comprises a 55.0% greenhouse gas (GHG) reduction target for 2030.

Europe’s transition toward renewable energy has impacted the global demand for oil & gas, which consequently is expected to hamper the potential growth of the well intervention market. This transition to cleaner energies is affecting the growth of oil production, resulting in a decline in well exploration, drilling, and intervention activities.

Opportunities: Growing demand for offshore and subsea well intervention

The exploration and production division witnessed an increase in demand for offshore and subsea exploration, as the upstream operators try to meet the growing demand for oil & gas. As onshore wells are aging, companies have opted to explore unconventional offshore resources. Additionally, as many existing offshore wells are becoming mature, the requirement for more intervention services to enhance the production of oil & natural gas is increasing. High investments are made to explore and drill new wells in the offshore areas.

Subsea well interventions pose many challenges and require advance planning. There is a massive gap in offshore well counts compared to the onshore wells. The total offshore rig count was 165 as compared to the total onshore rig count of 1,189 as of April 2021. Investments involved in offshore well interventions are higher than that of the latter. As technological developments have made offshore production economical, they have led to the expansion of the oilfield services in offshore regions. The increase in oil recovery rate of offshore wells and the deployment of technologies, such as light well intervention, riserless intervention, and remotely operated intervention, help provide cost-effective surveillance and well intervention solutions for mature and new fields in shallow water, deepwater, and ultra-deepwater applications. This is expected to provide the potential for the well intervention market to expand and create opportunities for the new entrants in the offshore markets.

Challenges: Implementation of artificial lift technologies in horizontal wells

Mature wells require an artificial lift to improve the production of liquid hydrocarbons and/or dewater the gas wells. Horizontal drilling is crucial to access hydrocarbons that are locked away in unconventional reservoirs. Horizontal wells are characterized by steep decline curves, turbulent fluid production, and irregular wellbore geometries. These complexities, especially in unconventional formations, pose a formidable challenge for conventional artificial lift technologies and related intervention services. Artificial lift technologies play an important role in unconventional wells as they require some form of artificial lift earlier in their life cycle to maximize recovery from the production zone. It can be particularly challenging to implement artificial lift technologies in deep wells with long horizontal sections in shale reserves.

The selection of one type of artificial lift for horizontal wells is complicated due to various factors such as wellbore casing size, severity of the curvature of the well, and production flow rate. The upstream operators experience challenges in selecting suitable artificial lift systems capable of handling the wide fluctuations in the production volumes in horizontal well conditions. The operators install different artificial lift types across the lifecycle of the well, although the replacement of each system might prove to be costly. Several methods of artificial lift have been deployed in these wells, ranging from rod pumps to electric submersible pumps and gas lifts. Depending on the application of the well, some artificial lifts have proven to be more successful than others.

Mature wells have low reservoir pressure and a low inflow rate of liquids. Therefore, artificial methods can be used to recover oil and other liquids from these wells, but plungers and other types of artificial lifts may no longer be viable, and new methods are needed to lift relatively small volumes of liquid from deep wells.

By service, the sand controls services segment is expected grow at the fasted rate during the forecast period.

The sand control services segment, by service, is estimated to grow at the fastest rate during the forecast period. The sand control intervention services are carried out in regions with high sand infiltration when the formation is loosely packed, and the chances of sand intrusion in the well from the producing zone are higher, creating problems related to production. The demand for sand control services witnesses high growth owing to unconventional and subsea oil & gas field developments.

By application, the onshore segment is expected to dominate the well intervention market during the forecast period.

Onshore wells are extensively drilled globally, with more oil and gas production potential from regions such as the Middle East, North America, Africa, and Asia Pacific. The demand for well intervention services and solutions in the onshore application segment is increasing as the cost incurred in onshore oilfield activities is less compared to the offshore application segment. In addition, most of the onshore fields in the Middle East and North America are in their declining phase, where well intervention services are implemented to restore or enhance the production from reservoirs. Furthermore, the discoveries in shale reserves are driving the growth of the onshore well intervention market, as well intervention operations are fundamentally required in all wells for their completion and production phases.

By well type, the horizontal wells segment is expected to grow at the fasted rate during the forecast period.

A horizontal well is a type of multi-directional drilling technique that generally drills with an inclination of greater than 80° to enhance reservoir performance. Some of the major advantages of a horizontal well are increased production rate because of the greater wellbore length; reduce pressure drop around the wellbore; reduced remedial work required in the future; and lower fluid velocities around the wellbore. According to a survey by service providers, horizontal wells require 2–3 times more intervention operations compared to vertical wells as horizontal wells face more challenges while production, for instance, the water shutoffs and the wax formations are higher in horizontal wells.

By intervention type, the medium intervention segment is expected to grow at the fasted rate during the forecast period.

Medium well intervention is carried out by using coiled tubing and snubbing units, i.e., hydraulic workover rigs. The snubbing units are used to perform well intervention services at dead or live oil & gas wells at unconventional oilfields. These units are generally preferred at wells that show a higher tendency of kicks. The services categorized under the medium well intervention segment include stimulation services, tubing/packer failure & repair, fishing, paraffin/asphaltene/hydrates removal, and remedial cementing. The offshore medium well intervention services take about 4–15 days for vessel deployment. The medium well intervention segment is expected grow at the fastest rate due to the surge in developments of unconventional oilfields.

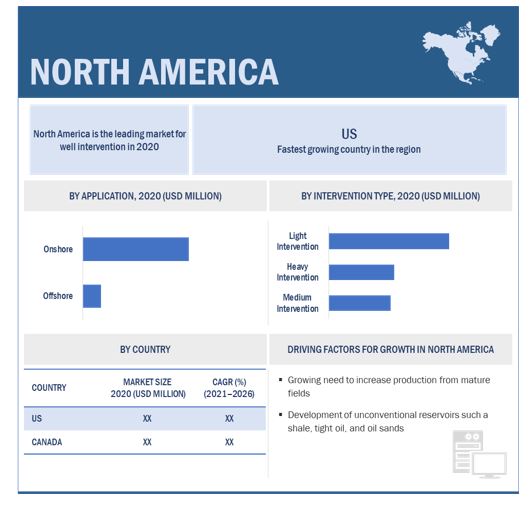

North America is expected to be the largest and the fasted region during the forecast period.

According to the BP Statistical report, the US was the largest producer of oil in the world, accounting for 17.9% of the total production in 2019, and also the largest consumer of crude oil and related products for owing up to 20.3% of the global oil consumption. In 2019, the US was the third-largest oil exporter, after Russia and Saudi Arabia, exporting about 8 million barrels per day.

The country is focused on expanding its oil production. The combination of hydraulic fracturing and horizontal drilling led to the “Shale Revolution,” which enabled the US to significantly increase its production of oil and natural gas from unconventional reserves such tight oil formations and shale formations. Furthermore, artificial lifts are used to enhance production from mature fields. Furthermore, most of the fields in the Permian Basin, Texas, and offshore fields in the Gulf of Mexico have matured, thus new discoveries in the region are increasing the demand for well intervention services in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the global well intervention market are Halliburton (US), Schlumberger (US), Baker Hughes (US), Weatherford International (US), NexTier Oilfield Solutions(US), NOV (US), Archer (Norway), Altus Intervention (Norway), and Expro Group (UK).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size value in 2021: |

USD 7.6 Billion |

|

Projected to reach: |

USD 9.3 Billion |

|

CAGR in % |

4.2% |

|

Base year considered |

2020 |

|

Segments covered |

Service type, Intervention Type, Well Type, and Application |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East, Africa, and South & Central America |

|

Companies covered |

Halliburton (US), Schlumberger (US), Baker Hughes (US), Weatherford International (US), NexTier Oilfield Solutions(US), Archer (Norway), Expro Group (UK), Trican Well Service (Canada), Pioneer Energy Services(US), Basic Energy Services (US), Nine Energy Services(US), Key Energy Services(US), Oceaneering International (US), Welltec (Denmark), and Altus Intervention (Norway) and others. |

This research report categorizes the well intervention market based on service, intervention type, well type, application, and region

Based on Service:

- Logging and Bottomhole Survey

- Tubing/Packer Failure and Repair

- Stimulation

- Remedial Cementing

- Zonal Isolation

- Sand Control

- Artificial Lift

- Re-perforation

- Fishing

- Others

Based on Intervention Type:

- Light Intervention

- Medium Intervention

- Heavy Intervention

Based on Well Type:

- Horizontal Well

- Vertical Well

Based on Application:

- Onshore

-

Offshore

- Shallow Water

- Deepwater

- Ultra-deepwater

Based on the region:

- North America

- Asia Pacific

- South & Central America

- Europe

- Middle East

- Africa

Recent Developments

- In April 2021, Halliburton has launched StrataXaminer, a wireline logging service that provides images of the reservoir structure to identify bedding, fracture patterns, fault zones, and potential flow barriers.

- In March 2021, Schlumberger and Microsoft have entered into a partnership to provide open, enterprise-scale data management to the energy industry. The companies launched an Artificial Intelligence (AI) enhanced cloud-native solution for the Open Subsurface Data Universe (OSDU) platform optimized for Microsoft Azure as part of the partnership.

- In March 2021, Baker Hughes’ Subsea Drilling Systems business and MHWirth, a wholly owned subsidiary of Akastor created a joint venture company. The company would deliver offshore drilling equipment and service offering that will provide customers with a broad portfolio of products and services across the globe.

- In October 2020, Weatherford International launched ForeSite sense, a reservoir monitoring solution that provides real-time critical downhole data such as pressure, temperature, and flow measurements. ForeSite sense serves applications across mature wells, shale wells, and deepwater wells.

- In July 2020, Halliburton and TechnipFMC launched Odassea, a distributed acoustic sensing solution for subsea wells. The technology enables operators to execute live seismic imaging and reservoir diagnostics to improve the quality of reservoir data.

Frequently Asked Questions (FAQ):

What is the current size of the well intervention market?

The current market size of global well intervention market is USD 7.1 billion in 2020.

What is the total CAGR expected to be recorded for the well intervention market during 2021-2026?

The global well intervention market is expected to record a CAGR of 4.2% from 2021–2026.

What are the major drivers for well intervention market?

Growing need for maximizing production potential of mature oil & gas fields and developments of shale reservoirs are some of the major drivers driving the market of well intervention.

Which is the fastest-growing region during the forecasted period in well intervention market?

North America is the fastest-growing region during the forecasted period owing to rise in shale gas & tight oil production, favorable regulations related to the licensing of exploration & production activities, and an increase in well count.

Which is the fastest-growing segment, by service during the forecasted period in well intervention market?

The sand control services segment, by service is the fastest-growing segment during the forecasted period due to increasing exploration and production of subsea reserves.

Which are the significant players operating in the well intervention market?

The major players in the global well intervention market are Halliburton (US), Schlumberger (US), Baker Hughes (US), Weatherford International (US), NexTier Oilfield Solutions(US), NOV (US), Archer (Norway), Altus Intervention (Norway), and Expro Group (UK). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 WELL INTERVENTION MARKET, BY SERVICE: INCLUSIONS VS. EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET: SEGMENTATION

1.4.2 GEOGRAPHIC SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 WELL INTERVENTION MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 SCOPE

2.3.1 IMPACT OF COVID-19 ON OIL & GAS ACTIVITIES

2.4 WELL INTERVENTION MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.3 KEY INFLUENCING FACTORS/DRIVERS

2.4.3.1 Well Count

TABLE 1 DEMAND FOR WELL INTERVENTION SERVICES: NEW WELLS VS.OLD WELLS

2.4.3.2 Rig Count

FIGURE 5 CRUDE OIL PRICE VS. RIG COUNT

2.4.3.3 Production

FIGURE 6 OPERATIONAL WELL COUNT VS. CRUDE OIL PRODUCTION

2.4.3.4 Crude oil prices

FIGURE 7 CRUDE OIL PRICE TREND

2.4.4 DEMAND SIDE METRICS

FIGURE 8 MAIN METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR WELL INTERVENTION

2.4.4.1 Demand side calculations

2.4.4.2 Assumptions for demand side analysis

TABLE 2 COST & FREQUENCY OF WELL GOING FOR WELL INTERVENTION

2.4.5 SUPPLY SIDE ANALYSIS

FIGURE 9 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF WELL INTERVENTION

FIGURE 10 MARKET: SUPPLY SIDE ANALYSIS

2.4.5.1 Supply side calculations

2.4.5.2 Assumptions for supply side

2.4.6 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 55)

TABLE 3 WELL INTERVENTION MARKET SNAPSHOT

FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2020

FIGURE 12 LOGGING AND BOTTOMHOLE SEGMENT, BY SERVICE, TO LEAD MARKET FROM 2021 TO 2026

FIGURE 13 LIGHT INTERVENTION SEGMENT, BY INTERVENTION TYPE, TO HOLD LARGEST SHARE OF MARKET FROM 2021 TO 2026

FIGURE 14 HORIZONTAL WELL SEGMENT TO HOLD LARGER SHARE OF MARKET, BY WELL TYPE, FROM 2021 TO 2026

FIGURE 15 OFFSHORE SEGMENT TO REGISTER HIGHER CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 ATTRACTIVE OPPORTUNITIES IN WELL INTERVENTION MARKET

FIGURE 16 GROWING NEED TO ENHANCE PRODUCTION FROM MATURE OIL AND GAS FIELDS TO DRIVE GROWTH OF MARKET FROM 2021 TO 2026

4.2 MARKET, BY SERVICE

FIGURE 17 LOGGING AND BOTTOMHOLE SURVEY SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2026

4.3 MARKET, BY INTERVENTION TYPE

FIGURE 18 LIGHT INTERVENTION SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2026

4.4 MARKET, BY WELL TYPE

FIGURE 19 HORIZONTAL WELL SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET IN 2026

4.5 MARKET, BY APPLICATION

FIGURE 20 ONSHORE SEGMENT TO HOLD LARGER SHARE OF MARKET IN 2026

4.6 MARKET IN NORTH AMERICA, BY INTERVENTION AND COUNTRY

FIGURE 21 ONSHORE SEGMENT AND US HELD LARGEST SHARES OF NORTH AMERICAN MARKET IN 2020

FIGURE 20 ONSHORE SEGMENT TO HOLD LARGER SHARE OF MARKET IN 2026

FIGURE 22 MARKET IN NORTH AMERICA TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 23 COVID-19 GLOBAL PROPAGATION

FIGURE 24 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 25 RECOVERY ROAD FOR 2020 AND 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 26 REVISED GDP FOR SELECTED G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 27 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Growing need for maximizing production potential of mature oil & gas fields

FIGURE 28 PEAK LOSS OF OIL FROM MATURE CONVENTIONAL OILFIELDS (2010–2017)

5.5.1.2 Developments of shale reservoirs

TABLE 4 TOP COUNTRIES WITH SIGNIFICANT TECHNICALLY RECOVERABLE OIL AND GAS RESOURCES IN 2019

5.5.1.3 Increasing demand for oil and gas in Asia Pacific

FIGURE 29 GLOBAL OIL DEMAND FROM 2016 TO 2019

5.5.2 RESTRAINTS

5.5.2.1 Strict government regulations pertaining to exploration and production activities

5.5.2.2 Declining demand for oil in Europe

FIGURE 30 OIL CONSUMPTION TREND IN EUROPE (2016–2026)

5.5.2.3 Volatility in oil prices and decline in upstream capital investments

FIGURE 31 GLOBAL OIL & GAS UPSTREAM CAPITAL SPENDING (2010–2020)

5.5.3 OPPORTUNITIES

5.5.3.1 Increasing oil and gas discoveries

5.5.3.2 Digitalization and automation of well intervention solutions

5.5.3.3 Growing demand for offshore and subsea well intervention

5.5.4 CHALLENGES

5.5.4.1 Complex well intervention operations in harsh high-pressure and high temperature (HPHT) environmental conditions

5.5.4.2 Implementation of artificial lift technologies in horizontal wells

5.5.4.3 Supply chain disruption and demand shock attributed to COVID-19

5.6 TRENDS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR WELL INTERVENTION SERVICE PROVIDERS

FIGURE 32 REVENUE SHIFT FOR WELL INTERVENTION

5.7 MARKET MAP

FIGURE 33 MARKET MAP FOR WELL INTERVENTION

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 34 WELL INTERVENTION SUPPLY CHAIN ANALYSIS

5.8.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.8.2 WELL INTERVENTION EQUIPMENT MANUFACTURERS

5.8.3 WELL INTERVENTION SERVICE PROVIDERS

5.8.4 OILFIELD OPERATORS/END USERS

5.9 TECHNOLOGY ANALYSIS

5.9.1 WELL INTERVENTION BASED ON DIFFERENT TECHNOLOGIES

5.10 WELL INTERVENTION: CODES AND REGULATIONS

TABLE 5 WELL INTERVENTION: CODES AND REGULATIONS

5.11 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 6 WELL INTERVENTION: INNOVATIONS AND PATENT REGISTRATIONS, NOVEMBER 2016–MARCH 2021

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 35 PORTER’S FIVE FORCES ANALYSIS FOR MARKET

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.13 CASE STUDY ANALYSIS

TABLE 8 MARKET: CASE STUDY ANALYSIS

6 WELL INTERVENTION MARKET, BY SERVICE (Page No. - 91)

6.1 INTRODUCTION

FIGURE 36 MARKET SHARE, BY SERVICE, 2020 (%)

TABLE 9 MARKET, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 10 MARKET, BY SERVICE, 2020–2026 (USD MILLION)

6.2 LOGGING AND BOTTOMHOLE SURVEY

6.2.1 NORTH AMERICA TO BE LARGEST LOGGING AND BOTTOMHOLE SURVEY MARKET

TABLE 11 MARKET FOR LOGGING AND BOTTOMHOLE SURVEY, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 MARKET FOR LOGGING AND BOTTOMHOLE SURVEY, BY REGION, 2020–2026 (USD MILLION)

6.3 TUBING/PACKER FAILURE AND REPAIR

6.3.1 EUROPE TO BE SECOND-LARGEST TUBING/PACKER FAILURE AND REPAIR SERVICE MARKET

TABLE 13 MARKET FOR TUBING/PACKER FAILURE AND REPAIR, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 MARKET FOR TUBING/PACKER FAILURE AND REPAIR, BY REGION, 2020–2026 (USD MILLION)

6.4 STIMULATION

6.4.1 GROWING DEMAND FOR HYDRAULIC FRACTURING IN NORTH AMERICA TO OFFER LUCRATIVE OPPORTUNITIES TO STIMULATION SERVICE PROVIDERS

TABLE 15 MARKET FOR STIMULATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 MARKET FOR STIMULATION, BY REGION, 2020–2026 (USD MILLION)

6.5 REMEDIAL CEMENTING

6.5.1 COMPLEXITIES IN CARRYING OUT EXPLORATION AND PRODUCTION ACTIVITIES IN UNCONVENTIONAL RESERVES TO DRIVE GROWTH OF REMEDIAL CEMENTING SEGMENT

TABLE 17 MARKET FOR REMEDIAL CEMENTING, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 MARKET FOR REMEDIAL CEMENTING, BY REGION, 2020–2026 (USD MILLION)

6.6 ZONAL ISOLATION

6.6.1 INCREASE IN OIL AND GAS PRODUCTION FROM MATURE AND HORIZONTAL WELLS TO DRIVE GROWTH OF ZONAL ISOLATION MARKET

TABLE 19 MARKET FOR ZONAL ISOLATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 MARKET FOR ZONAL ISOLATION, BY REGION, 2020–2026 (USD MILLION)

6.7 SAND CONTROL

6.7.1 REDEVELOPMENT OF AGING RESERVOIRS TO PROVIDE LUCRATIVE OPPORTUNITIES FOR PLAYERS IN SAND CONTROL MARKET

TABLE 21 MARKET FOR SAND CONTROL, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 MARKET FOR SAND CONTROL, BY REGION, 2020–2026 (USD MILLION)

6.8 ARTIFICIAL LIFT

6.8.1 NORTH AMERICA TO BE FASTEST-GROWING ARTIFICIAL LIFT MARKET

TABLE 23 MARKET FOR ARTIFICIAL LIFT, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 MARKET FOR ARTIFICIAL LIFT, BY REGION, 2020–2026 (USD MILLION)

6.9 FISHING

6.9.1 ASIA PACIFIC HELD THIRD-LARGEST SHARE OF FISHING SEGMENT

TABLE 25 MARKET FOR FISHING, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 MARKET FOR FISHING, BY REGION, 2020–2026 (USD MILLION)

6.10 RE-PERFORATION

6.10.1 GROWING PRODUCTION FROM MATURE WELLS TO SUPPORT GROWTH OF RE-PERFORATION SEGMENT

TABLE 27 MARKET FOR RE-PERFORATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 MARKET FOR RE-PERFORATION, BY REGION, 2020–2026 (USD MILLION)

6.11 OTHERS

TABLE 29 MARKET FOR OTHERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 MARKET FOR OTHERS, BY REGION, 2020–2026 (USD MILLION)

7 WELL INTERVENTION MARKET, BY INTERVENTION TYPE (Page No. - 107)

7.1 INTRODUCTION

FIGURE 37 MARKET SHARE, BY INTERVENTION TYPE, 2020 (%)

TABLE 31 MARKET, BY INTERVENTION TYPE, 2016–2019 (USD MILLION)

TABLE 32 MARKET, BY INTERVENTION TYPE, 2020–2026 (USD MILLION)

7.2 LIGHT INTERVENTION

7.2.1 INCREASING DEMAND FOR RISERLESS LIGHT WELL INTERVENTION VESSELS TO BOOST GROWTH OF LIGHT INTERVENTION SEGMENT

TABLE 33 LIGHT MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 LIGHT MARKET, BY REGION, 2020–2026 (USD MILLION)

7.3 MEDIUM INTERVENTION

7.3.1 INCREASING DEVELOPMENTS OF UNCONVENTIONAL RESERVES WITH SUPPORT OF SNUBBING UNITS TO BOOST MARKET GROWTH

TABLE 35 MEDIUM MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 MEDIUM MARKET, BY REGION, 2020–2026 (USD MILLION)

7.4 HEAVY INTERVENTION

7.4.1 DEVELOPMENTS IN MATURE FIELDS TO SUPPORT ADOPTION OF HEAVY INTERVENTION SERVICES

TABLE 37 HEAVY MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 HEAVY MARKET, BY REGION, 2020–2026 (USD MILLION)

8 MARKET, BY WELL TYPE (Page No. - 112)

8.1 INTRODUCTION

FIGURE 38 MARKET SHARE, BY WELL TYPE, 2020 (%)

TABLE 39 MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 40 MARKET, BY WELL TYPE, 2020–2026 (USD MILLION)

8.2 HORIZONTAL WELL

8.2.1 SHALE DEVELOPMENTS TO BOOST GROWTH OF HORIZONTAL WELL SEGMENT

TABLE 41 MARKET FOR HORIZONTAL WELLS, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 MARKET FOR HORIZONTAL WELLS, BY REGION, 2020–2026 (USD MILLION)

8.3 VERTICAL WELL

8.3.1 ASIA PACIFIC TO DOMINATE MARKET FOR VERTICAL WELLS OWING TO INCREASING COUNT OF MATURE CONVENTIONAL FIELDS

TABLE 43 MARKET FOR VERTICAL WELLS, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 MARKET FOR VERTICAL WELLS, BY REGION, 2020–2026 (USD MILLION)

9 MARKET, BY APPLICATION (Page No. - 117)

9.1 INTRODUCTION

FIGURE 39 MARKET SHARE, BY APPLICATION, 2020 (%)

TABLE 45 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 46 MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.2 ONSHORE

9.2.1 INCREASING NUMBER OF ONSHORE OIL & GAS AND MATURE FIELDS TO DRIVE GROWTH OF MARKET

TABLE 47 MARKET FOR ONSHORE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 48 MARKET FOR ONSHORE APPLICATION, BY REGION, 2020–2026 (USD MILLION)

9.3 OFFSHORE

9.3.1 INCREASING DEEP AND ULTRA-DEEPWATER DRILLING AND PRODUCTION ACTIVITIES AND NUMBER OF MATURING SUBSEA WELLS TO DRIVE MARKET GROWTH

TABLE 49 MARKET FOR OFFSHORE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 50 MARKET FOR OFFSHORE APPLICATION, BY REGION, 2020–2026 (USD MILLION)

9.3.2 SHALLOW WATER

9.3.2.1 Maturing shallow oilfields in Middle East and Europe to fuel growth of market

9.3.3 DEEPWATER

9.3.4 ULTRA-DEEPWATER

9.3.4.1 Critical environmental conditions in ultra-deepwater locations to drive growth of market

TABLE 51 MARKET FOR OFFSHORE APPLICATION, BY DEPTH, 2016–2019 (USD MILLION)

TABLE 52 MARKET FOR OFFSHORE APPLICATION, BY DEPTH, 2020–2026 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 124)

10.1 INTRODUCTION

FIGURE 40 MARKET IN NORTH AMERICA TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

FIGURE 41 MARKET SHARE, BY REGION, 2020 (%)

TABLE 53 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 54 MARKET, BY REGION, 2020–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 42 REGIONAL SNAPSHOT: NORTH AMERICA LED MARKET IN 2020

TABLE 55 NORTH AMERICA MARKET, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 56 NORTH AMERICA MARKET, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 57 NORTH AMERICA MARKET, BY INTERVENTION TYPE, 2016–2019 (USD MILLION)

TABLE 58 NORTH AMERICA MARKET, BY INTERVENTION TYPE, 2020–2026 (USD MILLION)

TABLE 59 NORTH AMERICA MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 60 NORTH AMERICA MARKET, BY WELL TYPE, 2020–2026 (USD MILLION)

TABLE 61 NORTH AMERICA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 62 NORTH AMERICA MARKET, BY APPLICATION,2020–2026 (USD MILLION)

TABLE 63 NORTH AMERICA MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 64 NORTH AMERICA MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Increasing production from mature shale and tight oil reserves in the US to drive growth of market

TABLE 65 US MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 66 US MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Potential drilling of oil sands and increase in onshore oil production to boost demand for well intervention services

TABLE 67 CANADA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 68 CANADA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.3 EUROPE

FIGURE 43 REGIONAL SNAPSHOT: EUROPE MARKET, 2020

TABLE 69 EUROPE MARKET, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 70 EUROPE MARKET, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 71 EUROPE MARKET, BY INTERVENTION TYPE, 2016–2019 (USD MILLION)

TABLE 72 EUROPE MARKET, BY INTERVENTION TYPE, 2020–2026 (USD MILLION)

TABLE 73 EUROPE MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 74 EUROPE MARKET, BY WELL TYPE, 2020–2026 (USD MILLION)

TABLE 75 EUROPE MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 76 EUROPE MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 77 EUROPE MARKET, BY COUNTRY,2016–2019 (USD MILLION)

TABLE 78 EUROPE MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.1 RUSSIA

10.3.1.1 Increasing exploration and production activities in Russia’s Far East region to drive growth of market

TABLE 79 RUSSIA MARKET, BY APPLICATION,2016–2019 (USD MILLION)

TABLE 80 RUSSIA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.3.2 NORWAY

10.3.2.1 Rapidly depleting mature oil & gas fields and increase in exploration activities in Norwegian Continental Shelf (NCS) to offer lucrative opportunities for market

TABLE 81 NORWAY MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 82 NORWAY MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.3.3 UK

10.3.3.1 Maximizing production potential in brownfields to fuel growth of market in UK during forecast period

TABLE 83 UK MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 84 UK MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.3.4 DENMARK

10.3.4.1 Redevelopment of mature offshore fields to support growth of market

TABLE 85 DENMARK MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 86 DENMARK MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.3.5 REST OF EUROPE

TABLE 87 REST OF EUROPE MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 88 REST OF EUROPE MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.4 ASIA PACIFIC

TABLE 89 ASIA PACIFIC MARKET, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 90 ASIA PACIFIC MARKET, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 91 ASIA PACIFIC MARKET, BY INTERVENTION TYPE,2016–2019 (USD MILLION)

TABLE 92 ASIA PACIFIC MARKET, BY INTERVENTION TYPE, 2020–2026 (USD MILLION)

TABLE 93 ASIA PACIFIC MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 94 ASIA PACIFIC MARKET, BY WELL TYPE, 2020–2026 (USD MILLION)

TABLE 95 ASIA PACIFIC MARKET, BY APPLICATION,2016–2019 (USD MILLION)

TABLE 96 ASIA PACIFIC MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 97 ASIA PACIFIC MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 98 ASIA PACIFIC MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Increasing exploration and production from unconventional resources to fuel growth of Chinese market

TABLE 99 CHINA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 100 CHINA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.4.2 INDIA

10.4.2.1 Redevelopment of legacy oilfields and government initiatives to improve exploration activities to drive growth of Indian market during forecast period

TABLE 101 INDIA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 102 INDIA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.4.3 AUSTRALIA

10.4.3.1 Development of unconventional shale resources and focus on redeveloping mature fields to create growth opportunities for market

TABLE 103 AUSTRALIA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 104 AUSTRALIA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.4.4 INDONESIA

10.4.4.1 Steep decline in production from mature fields to fuel demand for well intervention

TABLE 105 INDONESIA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 106 INDONESIA MARKET, BY APPLICATION,2020–2026 (USD MILLION)

10.4.5 MALAYSIA

10.4.5.1 Increasing capital expenditures in exploration and drilling activities to boost growth of Malaysian market

TABLE 107 MALAYSIA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 108 MALAYSIA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 109 REST OF ASIA PACIFIC MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 110 REST OF ASIA PACIFIC MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.5 SOUTH & CENTRAL AMERICA

TABLE 111 SOUTH & CENTRAL AMERICA MARKET, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 112 SOUTH & CENTRAL AMERICA MARKET, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 113 SOUTH & CENTRAL AMERICA MARKET,BY INTERVENTION TYPE, 2016–2019 (USD MILLION)

TABLE 114 SOUTH & CENTRAL AMERICA MARKET, BY INTERVENTION TYPE, 2020–2026 (USD MILLION)

TABLE 115 SOUTH & CENTRAL AMERICA MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 116 SOUTH & CENTRAL AMERICA MARKET, BY WELL TYPE, 2020–2026 (USD MILLION)

TABLE 117 SOUTH & CENTRAL AMERICA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 118 SOUTH & CENTRAL AMERICA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 119 SOUTH & CENTRAL AMERICA MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 120 SOUTH & CENTRAL AMERICA MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

10.5.1 MEXICO

10.5.1.1 Increasing investments in maximizing production from aging fields and shale developments to boost market growth

TABLE 121 MEXICO MARKET, BY APPLICATION,2016–2019 (USD MILLION)

TABLE 122 MEXICO MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.5.2 BRAZIL

10.5.2.1 Increasing offshore exploration and production activities to boost market growth

TABLE 123 BRAZIL MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 124 BRAZIL MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.5.3 VENEZUELA

10.5.3.1 Government initiates to revitalize oil production activities to fuel growth of Venezuelan market

TABLE 125 VENEZUELA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 126 VENEZUELA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.5.4 ARGENTINA

10.5.4.1 Shale developments to create potential demand for well intervention services in Argentina

TABLE 127 ARGENTINA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 128 ARGENTINA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.5.5 REST OF SOUTH & CENTRAL AMERICA

TABLE 129 REST OF SOUTH & CENTRAL AMERICA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 130 REST OF SOUTH & CENTRAL AMERICA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.6 MIDDLE EAST

TABLE 131 MIDDLE EAST MARKET, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 132 MIDDLE EAST MARKET, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 133 MIDDLE EAST MARKET, BY INTERVENTION TYPE, 2016–2019 (USD MILLION)

TABLE 134 MIDDLE EAST MARKET, BY INTERVENTION TYPE,2020–2026 (USD MILLION)

TABLE 135 MIDDLE EAST MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 136 MIDDLE EAST MARKET, BY WELL TYPE, 2020–2026 (USD MILLION)

TABLE 137 MIDDLE EAST MARKET, BY APPLICATION,2016–2019 (USD MILLION)

TABLE 138 MIDDLE EAST MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 139 MIDDLE EAST MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 140 MIDDLE EAST MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

10.6.1 SAUDI ARABIA

10.6.1.1 Enhanced crude production from onshore fields and surge in offshore exploration to drive growth of market

TABLE 141 SAUDI ARABIA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 142 SAUDI ARABIA MARKET, BY APPLICATION,2020–2026 (USD MILLION)

10.6.2 UAE

10.6.2.1 Fast depleting oil production from oilfields to boost demand for well intervention services

TABLE 143 UAE MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 144 UAE MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.6.3 IRAQ

10.6.3.1 Increasing onshore well drilling activities in Iraq to create growth opportunities for market

TABLE 145 IRAQ MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 146 IRAQ MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.6.4 IRAN

10.6.4.1 Onshore segment to drive growth of Iranian market

TABLE 147 IRAN MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 148 IRAN MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.6.5 QATAR

10.6.5.1 Large untapped oil and gas reserves to offer lucrative opportunities for well drilling activities and boost growth of Qatar market

TABLE 149 QATAR MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 150 QATAR MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.6.6 KUWAIT

10.6.6.1 Upcoming investments in oilfields are likely to boost growth of market in Kuwait

TABLE 151 KUWAIT MARKET, BY APPLICATION,2016–2019 (USD MILLION)

TABLE 152 KUWAIT MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.6.7 REST OF THE MIDDLE EAST

TABLE 153 REST OF THE MIDDLE EAST MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 154 REST OF THE MIDDLE EAST MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.7 AFRICA

TABLE 155 AFRICA MARKET, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 156 AFRICA MARKET, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 157 AFRICA MARKET, BY INTERVENTION TYPE, 2016–2019 (USD MILLION)

TABLE 158 AFRICA MARKET, BY INTERVENTION TYPE, 2020–2026 (USD MILLION)

TABLE 159 AFRICA MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 160 AFRICA MARKET, BY WELL TYPE, 2020–2026 (USD MILLION)

TABLE 161 AFRICA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 162 AFRICA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 163 AFRICA MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 164 AFRICA MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

10.7.1 NIGERIA

10.7.1.1 Rise in exploration activities and developments in mature oil & gas fields to boost market growth

TABLE 165 NIGERIA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 166 NIGERIA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.7.2 ALGERIA

10.7.2.1 Initiatives to increase exploration activities to support growth of market during forecast period

TABLE 167 ALGERIA MARKET, BY APPLICATION2016–2019 (USD MILLION)

TABLE 168 ALGERIA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.7.3 ANGOLA

10.7.3.1 Deepwater and ultra-deepwater developments to create growth opportunities for market in Angola

TABLE 169 ANGOLA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 170 ANGOLA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

10.7.4 REST OF AFRICA

TABLE 171 REST OF AFRICA MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 172 REST OF AFRICA MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 188)

11.1 KEY PLAYERS STRATEGIES

TABLE 173 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, JANUARY 2016–MAY 2021

11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 174 MARKET: DEGREE OF COMPETITION

FIGURE 44 MARKET SHARE ANALYSIS, 2020

11.3 MARKET EVALUATION FRAMEWORK

TABLE 175 MARKET EVALUATION FRAMEWORK

11.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 45 TOP FIVE PLAYERS IN MARKET FROM 2016 TO 2020

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 PERVASIVE

11.5.3 EMERGING LEADER

11.5.4 PARTICIPANT

FIGURE 46 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2020

TABLE 176 SERVICE FOOTPRINT OF COMPANIES

TABLE 177 APPLICATION FOOTPRINT OF COMPANIES

TABLE 178 REGIONAL FOOTPRINT OF COMPANIES

TABLE 179 OVERALL FOOTPRINT OF COMPANIES

11.6 COMPETITIVE SCENARIO

TABLE 180 MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2016–APRIL 2021

TABLE 181 MARKET: DEALS, FEBRUARY 2016–APRIL 2021

TABLE 182 MARKET: OTHERS, JANUARY 2016–FEBRUARY 2020

12 COMPANY PROFILES (Page No. - 207)

(Business and financial Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 HALLIBURTON

TABLE 183 HALLIBURTON: BUSINESS OVERVIEW

FIGURE 47 HALLIBURTON: COMPANY SNAPSHOT

TABLE 184 HALLIBURTON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 185 HALLIBURTON: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 186 HALLIBURTON: DEALS

TABLE 187 HALLIBURTON: OTHERS

12.1.2 SCHLUMBERGER

TABLE 188 SCHLUMBERGER: BUSINESS OVERVIEW

FIGURE 48 SCHLUMBERGER: COMPANY SNAPSHOT

TABLE 189 SCHLUMBERGER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 190 SCHLUMBERGER: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 191 SCHLUMBERGER: DEALS

TABLE 192 SCHLUMBERGER: OTHERS

12.1.3 BAKER HUGHES

TABLE 193 BAKER HUGHES: BUSINESS OVERVIEW

FIGURE 49 BAKER HUGHES: COMPANY SNAPSHOT

TABLE 194 BAKER HUGHES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 195 BAKER HUGHES: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 196 BAKER HUGHES: DEALS

TABLE 197 BAKER HUGHES: OTHERS

12.1.4 WEATHERFORD INTERNATIONAL

TABLE 198 WEATHERFORD INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 50 WEATHERFORD INTERNATIONAL: COMPANY SNAPSHOT

TABLE 199 WEATHERFORD INTERNATIONAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 200 WEATHERFORD INTERNATIONAL: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 201 WEATHERFORD INTERNATIONAL: DEALS

TABLE 202 WEATHERFORD INTERNATIONAL: OTHERS

12.1.5 NEXTIER OILFIELD SOLUTIONS

TABLE 203 NEXTIER OILFIELD SOLUTIONS: BUSINESS OVERVIEW

FIGURE 51 NEXTIER OILFIELD SOLUTIONS: COMPANY SNAPSHOT

TABLE 204 NEXTIER OILFIELD SOLUTIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 205 NEXTIER OILFIELD SOLUTIONS: DEALS

12.1.6 ARCHER

TABLE 206 ARCHER: BUSINESS OVERVIEW

FIGURE 52 ARCHER: COMPANY SNAPSHOT

TABLE 207 ARCHER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 208 ARCHER: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 209 ARCHER: DEALS

12.1.7 EXPRO GROUP

TABLE 210 EXPRO GROUP: BUSINESS OVERVIEW

FIGURE 53 EXPRO GROUP: COMPANY SNAPSHOT

TABLE 211 EXPRO GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 212 EXPRO GROUP: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 213 EXPRO GROUP: DEALS

12.1.8 TRICAN WELL SERVICE

TABLE 214 TRICAN WELL SERVICE: BUSINESS OVERVIEW

FIGURE 54 TRICAN WELL SERVICE: COMPANY SNAPSHOT

TABLE 215 TRICAN WELL SERVICE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 216 TRICAN WELL SERVICE: DEALS

12.1.9 PIONEER ENERGY SERVICES

TABLE 217 PIONEER ENERGY SERVICES: BUSINESS OVERVIEW

FIGURE 55 PIONEER ENERGY SERVICES: COMPANY SNAPSHOT

TABLE 218 PIONEER ENERGY SERVICES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.10 BASIC ENERGY SERVICES

TABLE 219 BASIC ENERGY SERVICES: BUSINESS OVERVIEW

FIGURE 56 BASIC ENERGY SERVICES: COMPANY SNAPSHOT

TABLE 220 BASIC ENERGY SERVICES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 221 BASIC ENERGY SERVICES: DEALS

12.1.11 NINE ENERGY SERVICES

TABLE 222 NINE ENERGY SERVICES: BUSINESS OVERVIEW

FIGURE 57 NINE ENERGY SERVICES: COMPANY SNAPSHOT

TABLE 223 NINE ENERGY SERVICES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 224 NINE ENERGY SERVICES: DEALS

TABLE 225 NINE ENERGY SERVICES: OTHERS

12.1.12 KEY ENERGY SERVICES

TABLE 226 KEY ENERGY SERVICES: BUSINESS OVERVIEW

FIGURE 58 KEY ENERGY SERVICES: COMPANY SNAPSHOT

TABLE 227 KEY ENERGY SERVICES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.13 OCEANEERING INTERNATIONAL

TABLE 228 OCEANEERING INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 59 OCEANEERING INTERNATIONAL: COMPANY SNAPSHOT

TABLE 229 OCEANEERING INTERNATIONAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 230 OCEANEERING INTERNATIONAL: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 231 OCEANEERING INTERNATIONAL: DEALS

12.1.14 ALTUS INTERVENTION

TABLE 232 ALTUS INTERVENTION: BUSINESS OVERVIEW

TABLE 233 ALTUS INTERVENTION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 234 ALTUS INTERVENTION: DEALS

12.1.15 WELLTEC

TABLE 235 WELLTEC: BUSINESS OVERVIEW

TABLE 236 WELLTEC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 237 WELLTEC: DEALS

TABLE 238 WELLTEC: OTHERS

12.1.16 AJ LUCAS GROUP

TABLE 239 AJ LUCAS GROUP: BUSINESS OVERVIEW

FIGURE 60 AJ LUCAS GROUP: COMPANY SNAPSHOT

TABLE 240 AJ LUCAS GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 241 AJ LUCAS GROUP: DEALS

12.2 OTHER PLAYERS

12.2.1 NATIONAL OILWELL VARCO (NOV)

12.2.2 OILSERV

12.2.3 AKOFS OFFSHORE

12.2.4 ALMANSOORI SPECIALIZED ENGINEERING

12.2.5 HUNTING

*Details on Business and financial Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 305)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the well intervention market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

The research study on the well intervention market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, the World Bank, and BP Statistical Review of World Energy, to identify and collect information useful for this technical, market-oriented, and commercial study. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

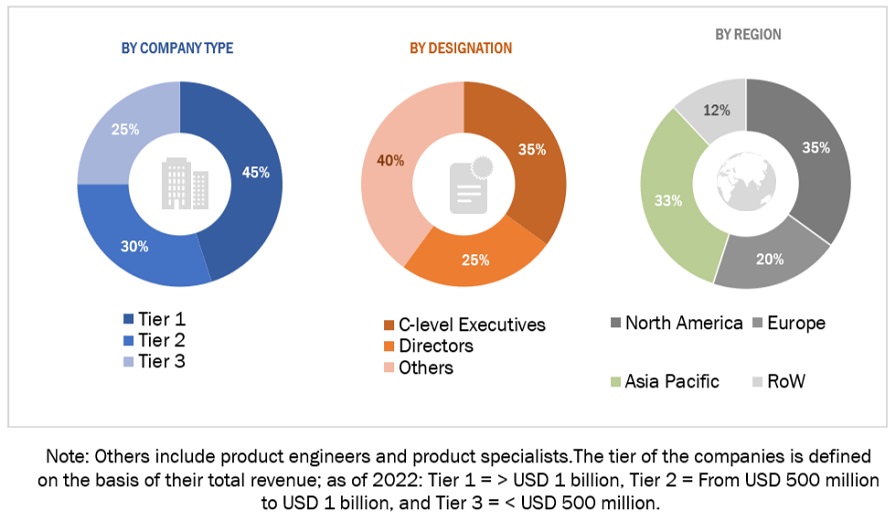

The well intervention market comprises several stakeholders, such as end-product manufacturers and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as drilling service providers, upstream operators, and others. The supply-side is characterized by intervention service providers, tool providers, integrators, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global well intervention market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Well Intervention Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the well intervention market based on service, application, intervention type, and well type

- To forecast the market size in six key regions, namely, North America, South & Central America, Europe, Asia Pacific, the Middle East, and Africa, along with their key countries

- To provide detailed information about the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze the market opportunities for stakeholders and provide a detailed competitive landscape for the market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments in the well intervention market, including contracts, agreements, expansions, product launches and developments, mergers, and acquisitions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Well Intervention Market

Interested in the major factors influencing the growth and policies applied by the companies of the global well intervention market for the period of 2022-2030.