Wireless Charging Market Size, Share, Statistics and Industry Growth Analysis Report by Implementation (Transmitters, Receivers), Technology (Magnetic Resonance, Inductive, Radio Frequency), Application (Automotive, Consumer Electronics, Healthcare) and Region - Global Growth Driver and Industry Forecast to 2029

Updated on : April 04, 2024

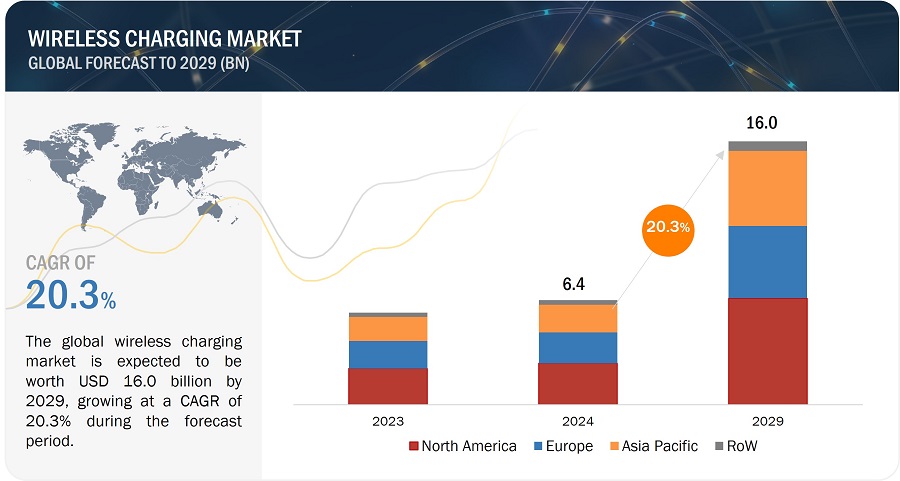

The global wireless charging market size is estimated to be valued at USD 6.4 billion in 2024 and is anticipated to reach USD 16.0 billion by 2029, at a CAGR of 20.3% during the forecast period.

The market growth is ascribed to emerging trends in wireless charging, increased Integration in Electric Vehicles (EVs), integration into Furniture and Infrastructure, Long-range wireless charging, and Bi-directional wireless charging.

Wireless Charging Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Wireless Charging Market Trends

Driver: Increasing trend of of integrating wireless charging capabilities into furniture, infrastructures, smart homes, and IoT devices

The driving force behind the wireless charging market is the increasing trend of integrating wireless charging capabilities into everyday elements such as furniture, infrastructures, smart homes, and IoT devices. This integration involves the inclusion of charging pads or coils directly into furniture pieces like tables and desks, streamlining the charging process for users. Furthermore, wireless charging is being seamlessly embedded into infrastructure, offering convenient charging solutions in public spaces such as coffee shops and airports. In the context of smart homes, the incorporation of wireless charging aligns with the broader movement towards connectivity and automation. Moreover, the surge in demand for Internet of Things (IoT) devices, encompassing various smart gadgets, benefits significantly from the convenience of cable-free charging. This driver underscores the expansive reach of wireless charging, extending beyond individual devices to become an integral part of the environments and infrastructure that shape contemporary living and working spaces.

Restraint: Compatibility issues associated with wireless charging devices

Wireless chargers are characterized by different standards, such as Qi, and PMA (Power Matters Alliance (PMA), and others. While these standards aim to establish a common framework for wireless charging, there are still instances where older devices or those from different manufacturers may not be compatible with certain wireless charging pads or surfaces. Devices without the Qi-compatible wireless charging standard are not compatible with the charging pad. Accessory providers are thus offering external wireless charging solutions for such devices. Different types of wireless chargers, such ase.g., charging pads, charging bowls, and charging boxes, are required for various products, raising the issue of compatibilitycompatibility issues. A user is thus forced to invest in a large number ofmany wireless chargers to suit different products. While some manufacturers offer multi-device wireless chargers, the general issue of compatibility in the case of devices that are not Qi-enabled is expected to restrict the adoption of wireless charging devices, and hence hamper the growth of the wireless charging market.

Opportunity: Development of faster and more efficient wireless charging technology

The opportunity in fast charging technology within the wireless charging market revolves around overcoming a key challenge – the speed of wireless charging compared to traditional wired methods. By reducing charging times significantly, fast charging technology enhances user convenience, making wireless charging more competitive and attractive. The goal is to provide quick and efficient charging experiences, particularly beneficial for users on the go or with time constraints. Advancements in supporting higher power levels, ensuring compatibility across various devices, integrating safety measures, and promoting user education contribute to the successful implementation of fast charging. Continuous research and development are essential for further enhancing the speed and efficiency of wireless charging, fostering broader adoption, and solidifying its position in the market.

Moreover, Inductive charging is widely used for wireless charging of consumer electronic devices and electric vehicles. Magnetic resonance allows power transmission at longer distances between receiver and transmitterbetween receiver and transmitter at longer distances, and increases efficiency. In wireless charging, efficiency depends upon the power accessible to charge the device with the wireless transmitter's transmitter’s power. It is a vital consideration for wireless power, as it determines how hot the battery has got and how much power is wasted. The higher the efficiency, the lesser the cost and size of the charger required for the same delivered power. Wireless chargers offer benefits in terms of security, cost, and efficiency.

Challenge: Limited range of wireless chargers

Limited range in the wireless charging market refers to the constraint where effective power transfer requires close proximity between the charging pad or station and the device being charged. Unlike wired alternatives, which offer more flexibility in positioning, wireless charging systems have a confined range, impacting user convenience and spatial freedom. Accurate alignment between the device and the charging pad is essential for efficient charging, and deviations may disrupt the process. Addressing this constraint involves technological advancements, such as resonant wireless charging and spatial freedom enhancements, aimed at extendingto extend the operational range. Overcoming the limited range challenge is crucial for enhancing the adaptability and widespread acceptance of wireless charging technologiesthe adaptability and widespread acceptance of wireless charging technologies in various applications.

Market Ecosystem

The inductive technology segment accounted for the largest share of the wireless charging market in 2023.

The Inductive technology is widely employed in wireless charging due to its efficiency, convenience, and widespread adoption. Notably used in the Qi wireless charging standard, inductive systems provide a close coupling between transmitter and receiver coils, minimizing energy loss during charging. The technology is recognized for its alignment tolerance, allowing users some flexibility in device placement on charging pads. Inductive charging is considered safe, with communication between the pad and device to ensure proper power delivery and prevent overheating. Its cost-effectiveness, established ecosystem, and adaptability to various devices, including smartphones and wearables, contribute to its popularity. While inductive technology dominates the wireless charging market, other technologies like resonant and radio frequency offer alternative advantages depending on specific application requirements.

The receiver’s segment is to hold the largest market share during the forecast period.

The wireless charging receivers are central to the evolution of cordless power solutions, adhering to standardized specifications for compatibility with various transmitters. The receiver segment is further divided into the aftermarket and integrated subsegments. Enhanced thermal management addresses heat dissipation challenges, ensuring reliability. In a competitive market, innovation drives the development of receivers, emphasizing improved energy harvesting, robust communication protocols, and user-friendly experiences. The increased adoption of smart and portable devices such as smartphone, smartwatch and earbuds is driving the receiver’s sales in market.

Automotive application will grow at the highest CAGR during the forecast period.

The wireless charging market in automotive industry is primarily driven by the adoption of electric vehicles (EVs). Wireless charging technology has become integral in the automotive industry, particularly for electric vehicles (EVs). An electric vehicle that requires charging is parked at a garage or parking space and automatically charged through a charger fixed under the floor beneath it. This technology minimizes dependence on physical cables, offering a cleaner and more convenient charging experience. The removal of physical connectors and cables not only enhances user satisfaction but also contributes to the widespread appeal of wireless charging in the realm of electric vehicles. Government initiatives that promote EV adoption, ongoing advancements in wireless charging technologies, and their integration by automotive Original Equipment Manufacturers (OEMs) collectively contribute to the robust growth of this technology. Fleet electrification trends across both consumer and commercial segments, coupled with the potential role of wireless charging in smart city initiatives and urban planning, underscore the diverse factors propelling the swift expansion of wireless charging within the automotive sector.

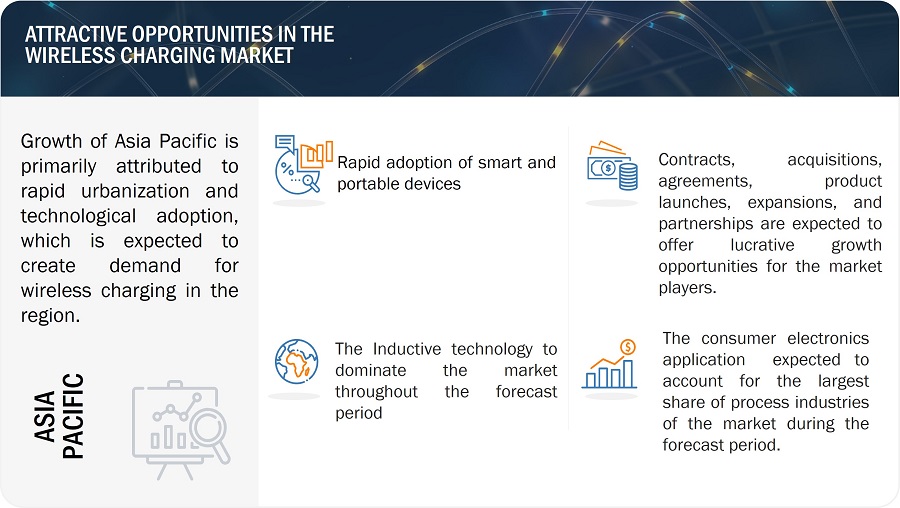

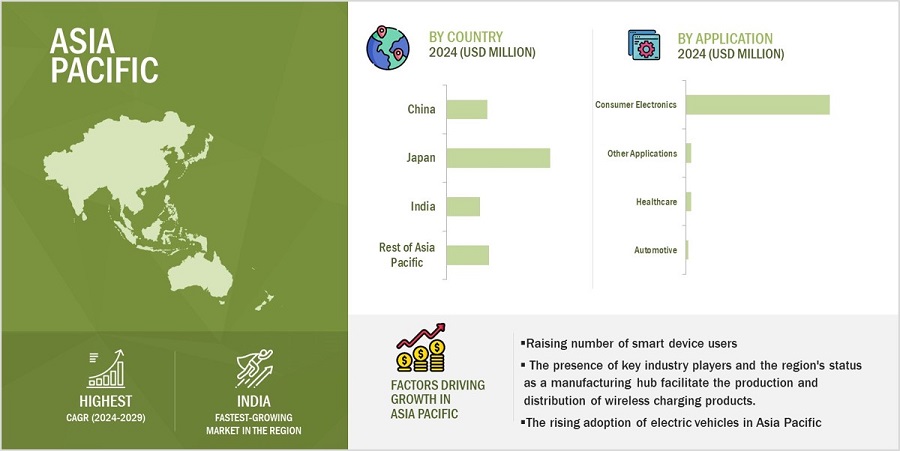

Asia Pacific region to grow at the highest CAGR during the forecast period.

The Asia Pacific region is segmented into China, Japan, India, and the Rest of Asia Pacific, representing the fastest-growing market for wireless charging. Both Japan and India stand out as the world's fastest-growing economies. The widespread proliferation of smartphones in major markets like China, South Korea, and Japan has increased the demand for convenient charging solutions. The region's tech-savvy consumer base readily embraces innovative technologies, contributing to the swift adoption of wireless charging. Additionally, the presence of key industry players and the region's status as a manufacturing hub facilitate the production and distribution of wireless charging products. The rise of electric vehicles in Asia Pacific further propels the need for wireless charging infrastructure, aligning with the broader shift toward sustainable transportation.

Wireless Charging Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major companies in the wireless charging companies are Energizer (US), SAMSUNG (South Korea), Plugless Power Inc. (US), Ossia Inc. (US), and Qualcomm Technologies, Inc. (US), Leggett & Platt, Incorporated (US), Infineon Technologies AG (Germany), Renesas Electronics Corporation (Japan), Texas Instruments Incorporated (US), WiTricity Corporation (US) and others. These companies have used both organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships to strengthen their position in the wireless charging market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years Considered |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD million/billion) |

|

Segments Covered |

Implementation, Technology, Application, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Energizer (US), SAMSUNG (South Korea), Plugless Power Inc. (US), Ossia Inc. (US), and Qualcomm Technologies, Inc. (US), A total of 25 players are covered. |

Wireless Charging Market Highlights

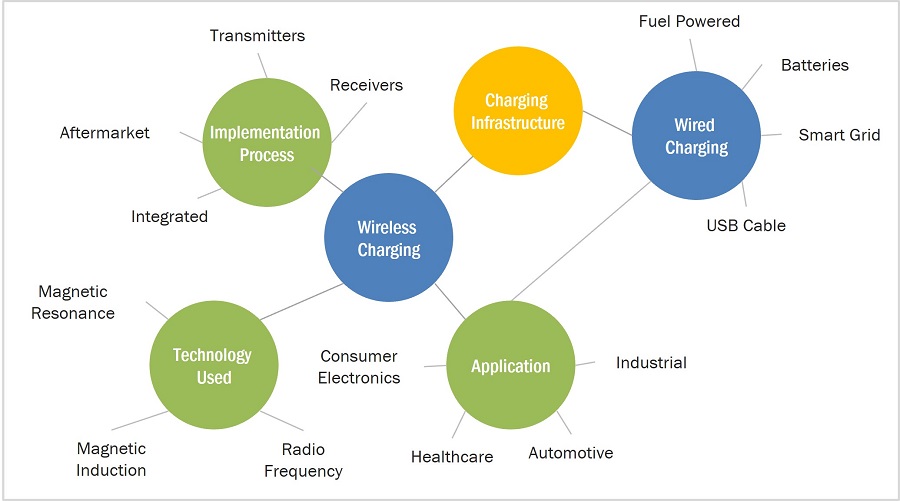

In this report, the overall wireless charging market has been segmented based on Implementation, Technology, Application and Region.

|

Segment |

Subsegment |

|

By Implementation |

|

|

By Technology |

|

|

By Discrete Industry |

|

|

By Region |

|

Recent Developments

- In July 2023, WiTricity Corporation announced the FastTrack Integration Program for vehicle manufacturers. This streamlined program enables automotive OEMs to begin evaluation as well as testing of electric vehicles with wireless charging in just 90 days. The wireless charging will be fully enabled and operational on the automaker’s EV platform using the company’s Halo receiver & Halo 11kW charger.

- In June 2023, Ossia Inc. announced a partnership with Nichicon Corporation. Nichicon will promote Ossia’s Cota Real Wireless Powe by utilizing the Cota Technology in association with Nichicon’s SLB Batteries. This partnership will produce a Nichicon branded battery in proximity to a Cota Power Transmitter, which will always receive power. With the Cota Technology, the SLB battery can be charged continuously, offering more convenience and efficiency when powering and charging devices.

- In February 2023, SAMSUNG launched SmartThings Hub, the modified version of SAMSUNG’s existing wireless charger. SmartThings hub and wireless charger in one Cheapest Matter controller and Thread border router, can tie with smart home automations to Galaxy phone charging.

Frequently Asked Questions(FAQs):

What will be the global wireless charging market size in 2024?

The wireless charging market is expected to be valued at USD 6.4 billion in 2024.

Who are the global wireless charging market winners?

Companies such as Energizer, SAMSUNG, Plugless Power Inc., Ossia Inc., and Qualcomm Technologies, Inc., WiTricity Corporation fall under the winners’ category.

Which region is expected to hold the highest global wireless charging market share?

North America will dominate the global wireless charging market in 2024.

What are the major drivers of the wireless charging market?

Rising adoption of smart and portable devices, increasing demand for wireless charging in electric vehicles, rising requirement for multi-device charging stations, increasing trend of integrating charging capabilities into furniture, infrastructures, smart homes, and IoT devices.

What are the major strategies adopted by wireless charging companies?

The companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

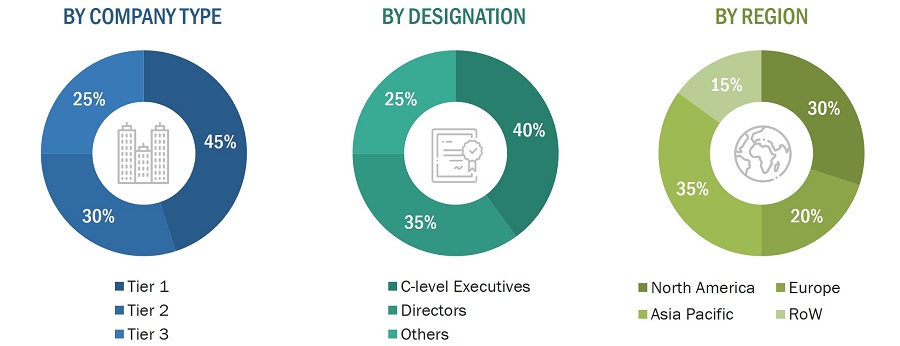

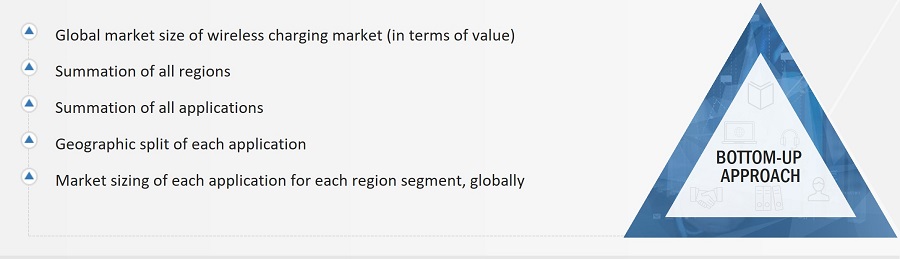

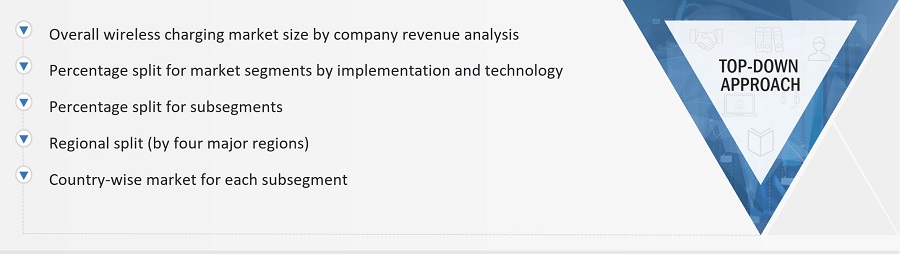

The study involves four major activities that estimate the size of the wireless charging market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the wireless charging market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research. The relevant data is collected from various secondary sources, it is analyzed to extract insights and information relevant to the market research objectives. This analysis has involved summarizing the data, identifying trends, and drawing conclusions based on the available information.

Primary Research

In the primary research process, numerous sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from wireless charging providers, (such as Energizer, SAMSUNG, Plugless Power Inc., Ossia Inc., and Qualcomm Technologies, Inc.) research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the wireless charging market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

Wireless charging, or cordless charging, is a method of charging electronic devices without a physical connection. Wireless charging of electronic devices covers a variety of technologies and transmission ranges used in consumer electronics, healthcare, automotive, industrial, and other applications.

Players in the wireless charging market offer different types of technology, such as magnetic resonance, inductive, and RF technology. A wireless charging device comprises a transmitter and receiver. The transmitter acts as a standalone charger, whereas the receiver is an integrated chipset in electronic devices such as smartphones, smart watches, electric vehicles, and others.

Stakeholders

- Raw material and manufacturing equipment suppliers

- Electronic design automation (EDA) and design tool vendors

- Component manufacturers

- Original equipment manufacturers (OEMs)

- Integrated device manufacturers (IDMs)

- Original design manufacturers (ODMs)

- Wireless technology service, and solution providers

- Suppliers and distributors

- System integrators

- Government and other regulatory bodies

- Technology investors

- Research institutes and organizations

- Market research and consulting firms

The main objectives of this study are as follows:

- To describe and forecast the overall wireless charging market based on Implementation, technology, application, in terms of value

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective countries, in terms of value

- To analyze competitive developments such as product launches and developments, acquisitions, collaborations, agreements, and partnerships in the wireless charging market

- To provide an analysis of the recession impact on the growth of the market and its segments

- To define and describe the overall wireless charging market on the basis of implementation, technology, application, and geography

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2

- To forecast the overall wireless charging market till 2029

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall wireless charging market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the wireless charging market

- To analyze the opportunities in the wireless charging market and provide details of the competitive landscape for market leaders

- To strategically profile the key players in the wireless charging market and comprehensively analyze their market presence and core competencies2

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, and new product launches, along with research and development (R&D) in the wireless charging market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wireless Charging Market

Part of a marketing project, where we are pitching a new wireless charging device and we want to have data to build our proposal

Part of a marketing project, where we are pitching a new wireless charging device and we want to have data to build our proposal

Hello, I work on the wireless charging technology and I would to know the repartition market of each techno BR Jeremy

Working on a project on wireless EV charging network and its present status

We are in the consumer electronics industry, we would like to know the market share for the phone wireless chargers and would like to know the market share for the kitchen applicants. Thank you so much.

:: We are working on a research project on electric engines for agricultural machinery. So the charging of batteries far from farms or roads or in-field is of interest for our research aims.

I am implementing wireless charging in a wearable device application, and I seek to understand what the leading technologies are currently in the market. I would like to also understand what technology is expected to longer prevail in the wireless charging game. This will help me make a decision on what direction I will go with my project.