Lithium-Ion Battery Anode Market by Materials (Active Anode Materials and Anode Binders), Battery Product (Cell and Battery Pack), End-Use (Automotive and Non-Automotive), and Region (Asia Pacific, Europe, and North America) - Global Forecast to 2028

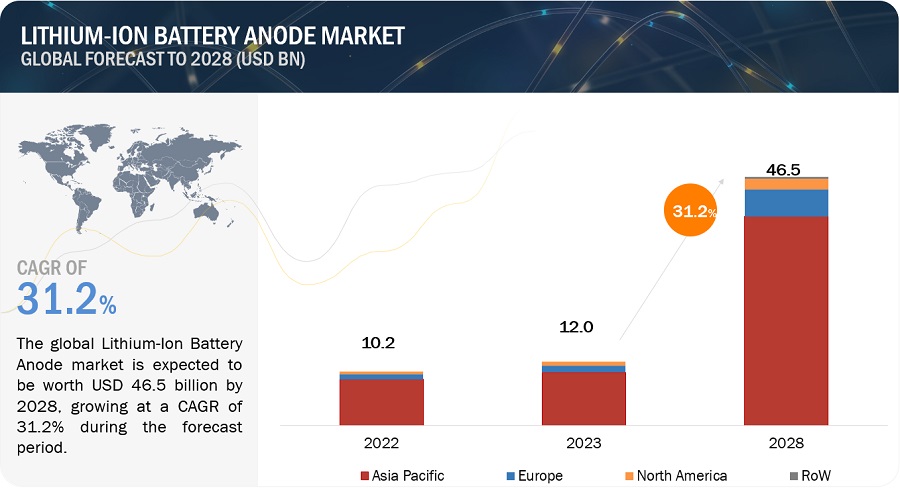

The global Lithium-Ion Battery Anode Market is projected to grow from USD 12.0 billion in 2023 to USD 46.5 billion by 2028, at a CAGR of 31.2% during the forecast period. The growth of the lithium-ion battery anode market is significantly impacted by various factors, including technological advancements, increasing demand for electric vehicles, renewable energy integration, and the development of consumer electronics. This growth is fueled by the rising need for efficient energy storage solutions, environmental concerns driving the shift towards sustainable energy sources, and government initiatives promoting clean energy adoption. As the market expands, key players are innovating to enhance battery performance, reduce costs, and meet the escalating demand for lithium-ion batteries across diverse industries.

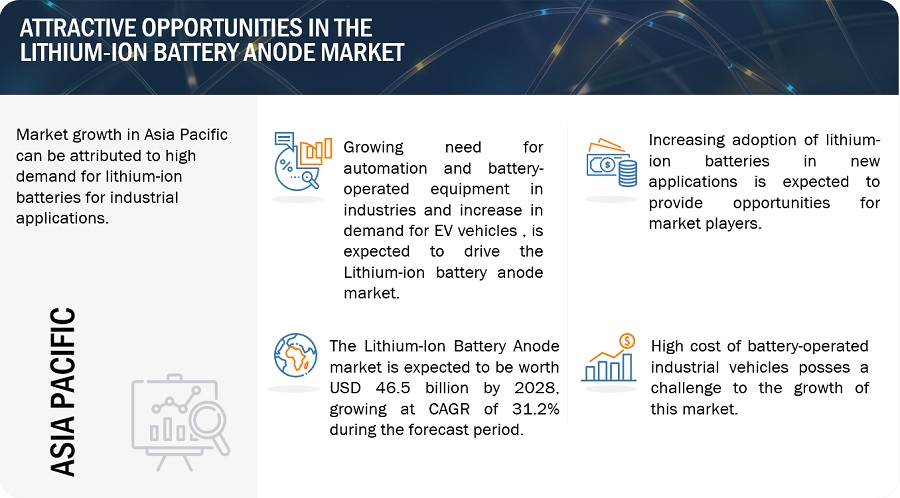

Attractive Opportunities in the Lithium-Ion Battery Anode Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increasing in demand for electric vehicles

The electric vehicle (EV) revolution is acting as a major growth engine for the lithium-ion battery anode market. The widespread adoption of EVs and plug-in hybrids (PHEVs) translates directly to a surge in demand for lithium-ion batteries, a key component of which is the anode. Consumers are increasingly embracing EVs due to their environmental benefits – they reduce pollution and eliminate hazardous oil waste. Furthermore, advancements in battery technology are expanding range and reducing maintenance needs, further accelerating EV adoption. As EVs are widely seen as the future of transportation, this trend is expected to continue, propelling the lithium-ion battery anode market forward.

Restraint: Safety issues related to storage and transportation of batteries

Batteries contain hazardous chemicals, including acids and heavy metals, such as mercury and lead. In July 2007, a lithium-based battery fire resulted in more than 132,000 liters of chemicals being set on fire, causing the closure of two major UK motorways. The increasing number of fire and smoke incidents occurring on airlines due to the malfunctioning of batteries in devices carried by passengers has also raised concerns among aviation and safety experts. There have been instances where the entire aircraft had to be grounded due to a fire in the battery section. All batteries, unless properly labeled, should be treated as holding a charge and stored with care. Some batteries are small enough to be ingested or swallowed and thus should be stored safely out of reach of children. Large lithium-based batteries, such as those used for automotive applications, can also be mistaken for lead-acid batteries if inappropriately labeled by local battery manufacturers. Hence, they must be sorted correctly and separated from spent lead-acid batteries before storage.

Opportunity: Increasing adoption of lithium-ion batteries in new applications

An energy storage device is defined as an apparatus used for storing electric energy. The concept of energy storage technology is quite new but is gaining acceptance. To counteract global warming, energy storage devices are increasingly used in hybrid automobile systems and renewable energy generation. lithium-ion batteries have proven to be suitable for large-capacity energy storage systems. These batteries are designed for superior performance with high power output in various applications. For instance, data centers use UPS, which provides power to a load in emergencies when the main power fails. Larger battery capacity requires more anode materials, therefore, providing better demand opportunities for the lithium-ion battery anode materials.

Challenge: Overheating issues of lithium-ion batteries

Overheating of lithium-ion batteries happens due to several reasons. Lithium is a highly unstable substance. When the separator is placed between the cathode and anode in the battery, it gets disrupted, and a short circuit occurs. The physical damage caused to the separator causes overheating. In the event of a leakage, the liquid reacts with surrounding components, causing overheating. Software issues in devices, where the automated instruction to turn off the charging port are missed while the battery is charging, can also cause overheating. This problem can also cause a battery to overcharge and swell up, posing a major challenge for lithium-ion battery manufacturers and eventually posting a challenge for anode manufacturers to provide advanced anode materials for lithium-ion batteries to eliminate overheating issues.

Rice Husk Ash market: Ecosystem

Prominent companies in this market include well-established, and financially stable manufacturers of lithium-ion battery anode market. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Ningbo Shanshan Co., Ltd. (China), Jiangxi Zhengtuo New Energy Technology (China), Resonac Holdings Corporation (Japan), POSCO FUTURE M (South Korea), Mitsubishi Chemical Group Corporation (Japan), and SGL Carbon (Germany).

Automotive segment is expected to be the largest and fastest-growing segment of the market, by end-use, during the forecast period.

The lithium-ion battery anode market is divided into two primary applications: automotive and non-automotive. The automotive segment is forecast to be the clear leader in terms of growth rate during the forecast period. This surge is primarily driven by the booming electric vehicle (EV) market, particularly in countries like China, Japan, and Germany. Consumers' growing environmental concerns and the desire to move away from fossil fuels are further accelerating the adoption of EVs, which in turn translates to a significant demand for lithium-ion batteries and their crucial component, the anode.

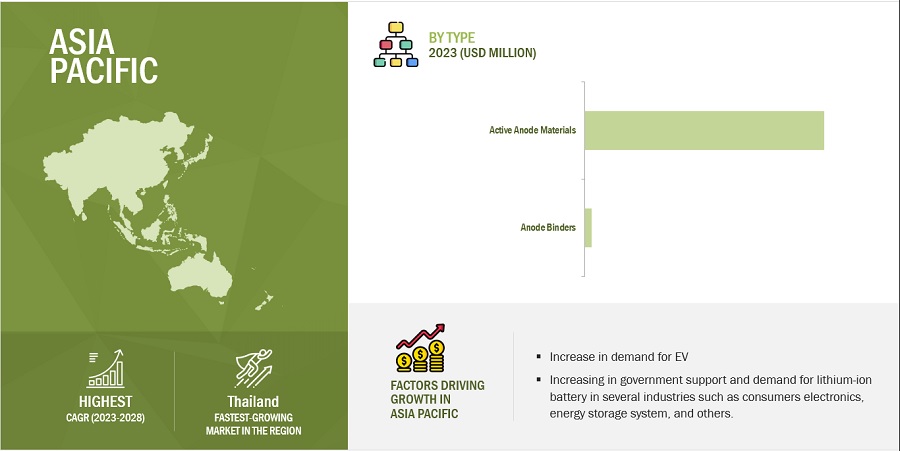

Synthetic graphite active anode material is expected to be the largest growing material during the forecast period.

Within the lithium-ion battery anode market, the active anode material segment can be further divided into four categories: natural graphite, synthetic graphite, silicon, and Lithium-ion compounds & Lithium metal. Synthetic graphite is expected to reign supreme throughout the forecast period. Although it boasts superior purity compared to natural graphite, it has a slightly less crystalline structure. Despite this, its exceptional uniformity and purity make it the preferred choice for specialty applications. An additional advantage of synthetic graphite is its extended lifespan compared to natural graphite, further contributing to the projected growth in demand for this material within the lithium-ion battery anode market.

Asia Pacific is projected to be the highest CAGR market during the forecast period.

The lithium-ion battery anode market is projected for explosive growth, driven by the surging electric vehicle revolution. As consumers and governments embrace clean transportation solutions, demand for EVs and lithium-ion batteries is skyrocketing, particularly in China, Japan, and Germany. This translates to a massive need for battery anodes, with the automotive segment forecast to be the fastest-growing application. Synthetic graphite is expected to dominate the anode material segment due to its superior purity, uniformity, and extended lifespan compared to natural graphite. Finally, the Asia Pacific region is poised to reign supreme in this market, fueled by a combination of high demand for lithium-ion batteries across industries and its position as a hub for innovation in anode materials.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major companies in the Lithium-Ion Battery Anode Market include Ningbo Shanshan Co., Ltd. (China), Jiangxi Zhengtuo New Energy Technology (China), Resonac Holdings Corporation (Japan), POSCO FUTURE M (South Korea), Mitsubishi Chemical Group Corporation (Japan), and SGL Carbon (Germany) and others. A total of 22 major players have been covered. These players have adopted agreements, investments, acquisitions, agreements, and expansions as the major strategies to consolidate their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Billion/Million) and Volume (kilotons) |

|

Segments Covered |

By Material, End-Use, Battery Product, and Region. |

|

Geographies Covered |

Asia Pacific, Europe, and North America |

|

Companies Covered |

The major market players include Ningbo Shanshan Co., Ltd. (China), Jiangxi Zhengtuo New Energy Technology (China), Resonac Holdings Corporation (Japan), POSCO FUTURE M (South Korea), Mitsubishi Chemical Group Corporation (Japan), and SGL Carbon (Germany), and others. |

This research report categorizes the Lithium-Ion Battery Anode Market based on Silica Content, Process, Product, and Region.

Based on Materials, the Lithium-Ion Battery Anode market has been segmented as follows:

-

Active Anode Materials

- Natural Graphite

- Synthetic Graphite

- Silicon

- Li-Compounds & Metal

- Anode Binders

Based on Battery product, the Lithium-Ion Battery Anode market has been segmented as follows:

- Cell

- Battery Pack

Based on End-Use, the Lithium-Ion Battery Anode market has been segmented as follows:

- Automotive

-

Non-Automotive

- Energy Storage

- Aerospace

- Marine

- Others

Based on region, the Lithium-Ion Battery Anode market has been segmented as follows:

- Asia Pacific

- Europe

- North America

Recent Developments

- In January 2024, Ningbo Shanshan Technology Co., Ltd., a leading company in the production of synthetic graphite anode materials for lithium-ion batteries has expanded the establishment of a new production facility 300,000-ton anode integrated project in Yunnan, China.

- In June 2023, Resonac Holdings Corporation acquired 100% shares in AMl Automation. The acquisition is set to significantly benefit Resonade graphite electrodes by expanding its offerings to include total solution services for Electric Arc Furnaces (EAF). By integrating AMI's digital automation and optimization solutions, Resonac aims to meet the growing demand for graphite electrodes, particularly in new EAF projects globally.

- In September 2023, Ningbo Shanshan has a longstanding relationship with LG Energy Solution (LGES), particularly in the field of anode materials and polarizers. Over the past decade, they have collaborated successfully, leading to significant achievements in the development and industrialization of anode materials. Ningbo Shanshan emphasized their commitment to focusing on anode materials and polarizers, aiming to strengthen their bond with LGES to meet localization demands.

Frequently Asked Questions (FAQ):

What is the key driver for the Lithium-Ion Battery Anode market?

Increasing in demand for electric vehicles is a driving force for the Lithium-Ion Battery Anode market

Which region is expected to register the highest CAGR in the Lithium-Ion Battery Anode Market during the forecast period?

The Lithium-Ion Battery Anode in Asia Pacific is accounted for the highest CAGR during the forecast period.

What is the major source of Lithium-Ion Battery Anode?

The primary source for lithium-ion battery anodes is graphite, such as natural and synthetic. Natural graphite, mined from the earth, offers a cost-effective option but has lower purity. Synthetic graphite, produced from petroleum sources, boasts higher purity and consistency, making it ideal for high-performance batteries. Both types play a crucial role in fueling the lithium-ion battery revolution.

Who are the major players of the Lithium-Ion Battery Anode market?

The key players operating in the market include Ningbo Shanshan Co., Ltd. (China), Jiangxi Zhengtuo New Energy Technology (China), Resonac Holdings Corporation (Japan), POSCO FUTURE M (South Korea), Mitsubishi Chemical Group Corporation (Japan), and SGL Carbon (Germany)

What is the total CAGR expected to record for the Lithium-Ion Battery Anode Market during 2023-2028?

The market is expected to record a CAGR of 31.2% from 2023-2028. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

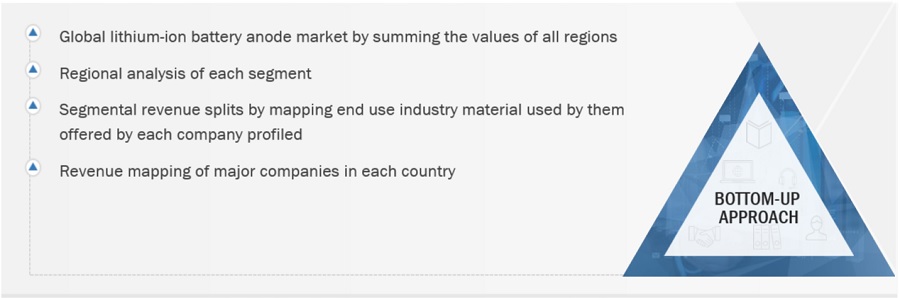

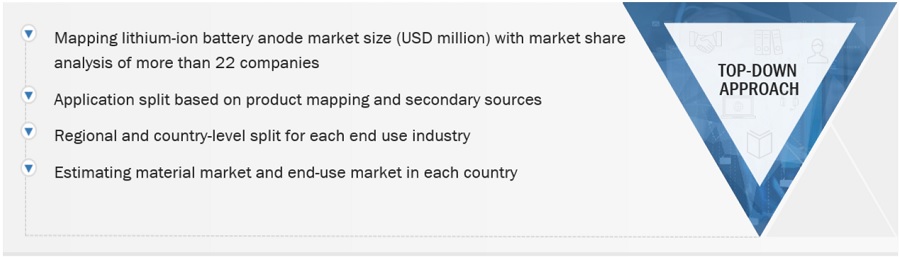

The study involved four major activities in estimating the current size of the lithium-ion battery anode market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the lithium-ion battery anode market value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; lithium-ion battery anode market manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

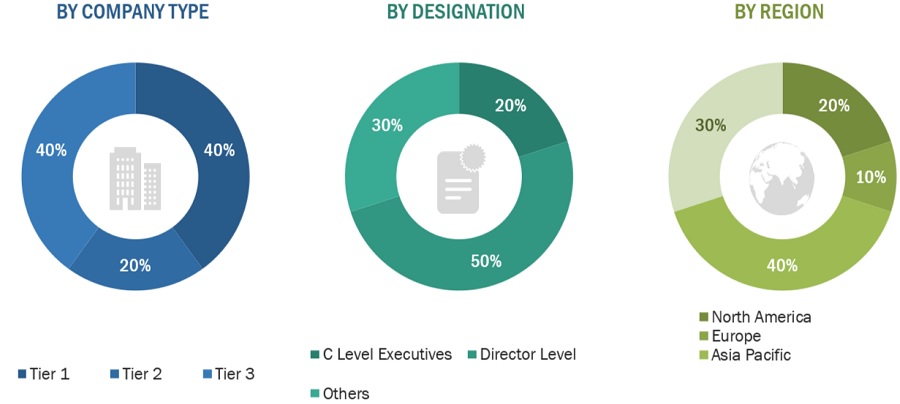

The lithium-ion battery anode market comprises several stakeholders, such as such as raw material suppliers, technology support providers, lithium-ion battery anode market manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the lithium-ion battery anode market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the Lithium-Ion Battery Anode market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the lithium-ion battery anode market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Lithium-Ion Battery Anode market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Lithium-Ion Battery Anode Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

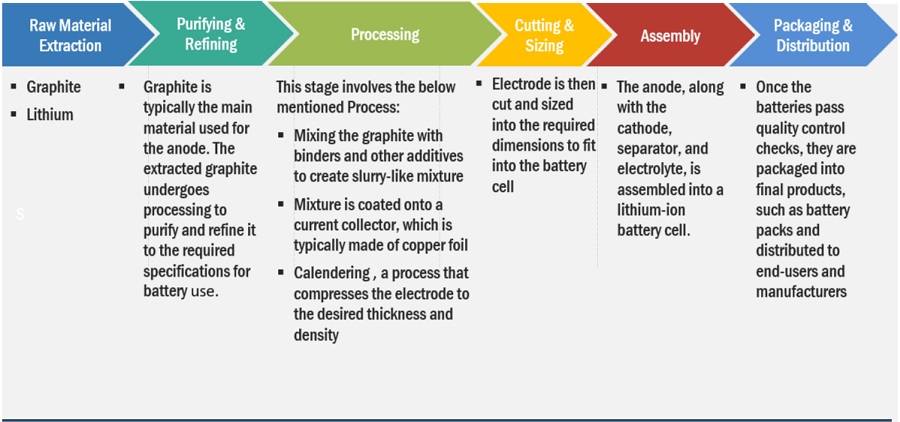

Market Definition

Lithium-ion battery anode is a negative electrode in lithium-ion batteries, paired with a cathode electrode. It acts as a host to reversibly allow lithium-ion intercalation, discharge cycles, and deintercalation during charge. Lithium-ion battery anode is majorly used in lithium-ion batteries. It is a strong reducing agent, highly electropositive, high electrochemical equivalence with high capacity & energy density, strong conducting agent, and has high mechanical stability. Lithium-ion batteries, along with lithium anode as an electrode, are majorly a type of rechargeable battery used for portable electronics with high open-circuit voltage, no memory effect, low self-discharge rate, and a slow loss of charge when not in use. It is used in industries such as automotive, industrial & energy storage, and consumer electronics.

Key Stakeholders

- Raw material manufacturers

- Technology support providers

- Manufacturers of Lithium-Ion Battery Anode market

- Traders, distributors, and suppliers

- Regulatory Bodies and Government Agencies

- Research & Development (R&D) Institutions

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

Report Objectives

- To analyze and forecast the market size of Lithium-Ion Battery Anode market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global Lithium-Ion Battery Anode market on the basis of Battery Product, Materials, End-Use, and Region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on five major regions: Asia Pacific, Europe, and North America along with their respective key countries

- To track and analyze the competitive developments, such as acquisitions, partnerships, collaborations, agreements and expansions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the Lithium-Ion Battery Anode market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lithium-Ion Battery Anode Market