Pressure Sensitive Adhesives Market by Chemistry (Acrylic, Rubber, Silicone), Technology (Water-Based, Solvent-Based, Hot-Melt), Application (Tapes, Labels, Graphics), End-Use Industry (Packaging, Automotive), and Region - Global Forecast to 2029

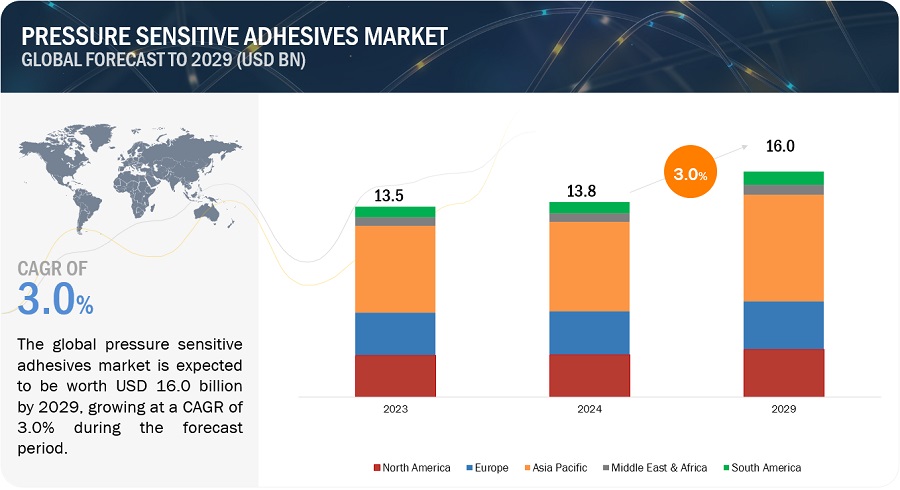

The global pressure sensitive adhesives market size is projected to grow from USD 13.8 billion in 2024 to USD 16.0 billion by 2029, at a CAGR of 3.0%. The various end-use industries for the PSA market include packaging; electrical, electronics, and telecommunication; automotive & transportation; healthcare; building & construction; and other industries (consumer goods, renewable energy, industrial assembly, and paper industry).

PSAs are designed for permanent and removable applications. Permanent applications include safety labels for power equipment, foil tapes for HVAC ductwork, automotive interior trim assembly, and sound or vibration-dampening films. Removable adhesives are designed for temporary applications and are used in surface protection films, masking tapes, bookmark and note papers, price marking labels, promotional graphics materials, and for skin contact [wound care dressings, electrocardiography (ECG) electrodes, athletic tapes, and analgesic and transdermal drug patches, among others].

Attractive Opportunities in the Pressure Sensitive Adhesives Market

To know about the assumptions considered for the study, Request for Free Sample Report

Pressure Sensitive Adhesives Market Dynamics

Driver: Pressure-sensitive adhesives (PSAs) are distinguished by their unique ability to form secure, yet easily peelable bonds with various surfaces. This characteristic allows PSAs to adhere effectively without damaging the substrate or leaving any residue upon removal. As such, they are extensively used globally for manufacturing temporary coatings and labels that require clean removal. According to insights from 3M Corporation, PSAs offer significant advantages in manufacturing due to their ease of use and cost efficiency compared to conventional fastening methods. Their versatility makes them particularly suitable for bonding dissimilar materials under challenging conditions, providing strong adhesion without adding bulk or requiring complex preparation.

The functionality of PSAs stems from their non-linear visco-elastic properties, which are a result of the elastomeric polymers used in their composition. This visco-elastic behavior is engineered through a specific polymer architecture and the strategic inclusion of monomers and tackifying resins. These design choices endow PSAs with their characteristic easy-handling and safe usage profiles, contributing to their growing preference over more traditional bonding agents in various industrial applications. Importantly, PSAs do not need solvents, water, or heat activation, distinguishing them from other adhesive types. The strength of the bond they form is directly influenced by the amount of pressure applied during application, allowing for straightforward and controlled usage across a broad range of applications. This simplicity and effectiveness are what make PSAs a favored choice in both developed and developing markets for a variety of temporary yet reliable bonding solutions.

Restraints: The pricing dynamics and raw material availability are pivotal determinants of product cost structures. These factors hold immense significance in shaping the competitive landscape of the industry. Pressure-sensitive adhesives rely on various raw materials, including rubber, acrylic, silicone, additives, and to name a few. However, most of these raw materials are petroleum-based derivatives, rendering them susceptible to fluctuations in commodity prices.

Historically, oil prices, a linchpin in producing these raw materials, have exhibited remarkable volatility. Factors such as surging global demand, geopolitical unrest in oil-producing regions, and market speculations have contributed to this price turbulence. The implications of such uncertainty and price variations are far-reaching, extending their impact on the growth trajectory of the pressure-sensitive adhesives market.

The adhesives industry, in particular, has faced notable challenges arising from escalating energy costs, which directly translate into higher manufacturing expenses. A compounding issue is the relentless surge in global demand for chemicals, further straining the availability and capacity of essential primary chemicals and resin feedstocks. This supply-demand disbalance, coupled with supply shortages of critical monomers like piperylene and C9 monomers commonly employed in formulating adhesive raw materials, has increased raw material costs.

Opportunity: Bio-based pressure-sensitive adhesives (PSAs) represent an evolving segment within the adhesive industry, offering a more sustainable alternative to traditional petroleum-based products. These innovative adhesives are developed using latex-based formulas that incorporate renewable macromonomers. The University of Minnesota has been at the forefront of this development, creating renewable chains of monomers that can be grafted onto conventional petroleum-based acrylates, such as 2-ethyl hexyl acrylate or n-butyl acrylate. This innovative approach yields a PSA that retains the robust adhesive properties of its petroleum-based counterparts while integrating up to 60% bio-based content.

The significance of these bio-based PSAs lies in their ability to merge traditional acrylate components with sustainable bio-based monomer chains without compromising performance. This compatibility with existing adhesive formulations ensures that bio-based PSAs can be adopted across various applications, from self-adhesive stamps to medical bandages, where the environmental impact of products is increasingly scrutinized. Moreover, the production of bio-based PSAs can be seamlessly integrated into current manufacturing processes through emulsion polymerization, a widely used technology in adhesive manufacturing. This compatibility with established production methods not only facilitates the scaling of bio-based PSA production but also enhances their market viability.

Challenges: In both Europe and North America, the chemical industry is navigating complex regulatory landscapes that influence the production and application of adhesives. Regulatory bodies such as the Control of Substances Hazardous to Health (COSHH) in the UK, the European Union's Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) framework, the Globally Harmonized System (GHS) of classification and labeling, and the Environmental Protection Agency (EPA) in the United States enforce stringent guidelines that focus on reducing the environmental and health impacts of chemical products, including adhesives.

In response to these regulations, and driven by a broader environmental awareness, manufacturers have increasingly transitioned from solvent-based adhesives, which are high in volatile organic compounds (VOCs), to water-based adhesives that emit fewer VOCs. This shift is largely due to the regulatory pressures to mitigate VOC emissions, which are linked to adverse environmental and health effects, including contributions to air pollution and respiratory issues.

The development of water-based adhesives was initially spurred by these regulatory demands; however, it also aligns with growing market demands for safer and more sustainable chemical products. The concerns around substances like formaldehyde, a known VOC with significant health risks, have further accelerated research into and adoption of low-VOC and non-VOC adhesive formulations. This transition is part of a broader trend towards sustainability within the adhesives industry, which is crucial given the pervasive use of these materials in everyday products. Indeed, research highlighted by Eco Building Pulse, a publication of the American Institute of Architects, estimated that a typical home in the European Union could contain up to 185 gallons (approximately 700 liters) of adhesives, either in pure form or incorporated within other products. This statistic underscores the ubiquity of adhesives and the importance of ensuring their safety and environmental compatibility.

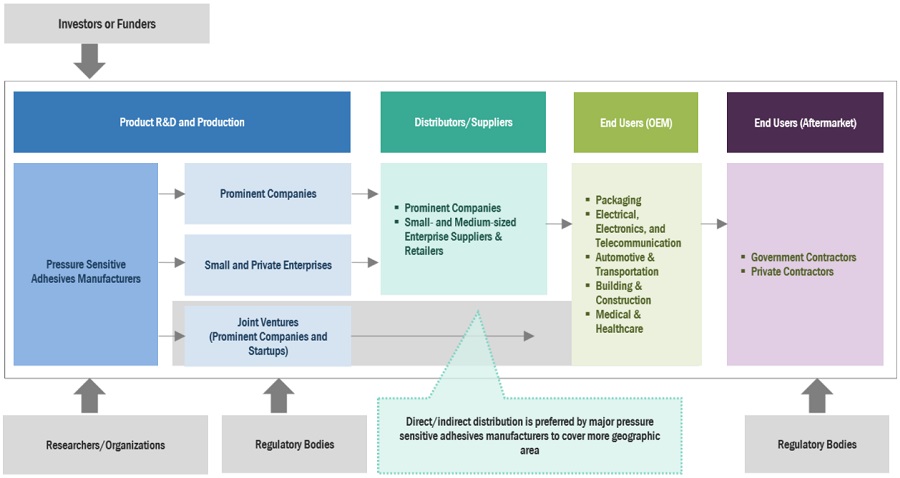

Pressure Sensitive Ahdesives Market Ecosystem

Based on application, the graphics segment is estimated to account for one of the highest CAGR in pressure sensitive adhesives market

Graphics applications of pressure-sensitive adhesives (PSAs) include polyester films, vinyl films, and reflective products used in various scenarios such as securing highway signage, vehicle wraps, container marking, emblems, logos, floors, carpets, mats, safety films, architectural films, and protection films. These PSAs must exhibit strong adhesion, especially for outdoor signage, to withstand environmental conditions. Vehicle wraps benefit from PSA lamination, which protects against abrasion from road grime, rocks, and moisture, while UV protection laminates guard printed graphics against fading and deterioration. Emblems and logos are attached to various materials for decorative purposes, demonstrating the versatility and robustness required of PSAs in graphics applications. This broad range of uses highlights the critical role of PSAs in ensuring durability, visibility, and aesthetic appeal in both indoor and outdoor settings.

Based on end use industry, the automotive & transportation segment is estimated to account for one of the highest market share in the pressure sensitive adhesives market

Digitization, automation, and new business models have revolutionized the transportation industry, significantly impacting the use of pressure-sensitive adhesives (PSAs). PSAs are essential in automotive, railways, marine, defense, military, and aerospace sectors, mainly utilized in tape form due to their excellent resistance to humidity, high temperatures, shear and peel strength properties. In automotive assembly, PSAs bond mirrors, nameplates, headliners, interior trim, carpets, air ducts, and weather stripping, ensuring strong, permanent bonds even under prolonged exposure to harsh conditions. In railways, they are used for windshield and headlight bonding, door systems, thermal and acoustic insulation, cockpit and panel bonding, and floor installation, providing durability and safety. The aerospace industry employs PSAs for bonding subsystem packages, equipment panels of satellites, solar panels, and multi-layer insulation, where their ability to withstand extreme temperatures and environmental conditions is crucial. These applications highlight the versatility and critical role of PSAs in enhancing performance, safety, and efficiency across various transportation modes.

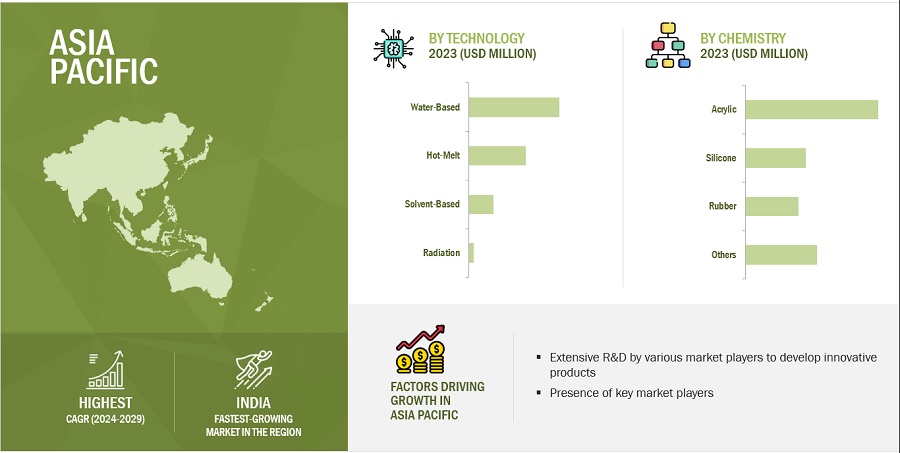

The Asia Pacific market is projected to contribute to the largest shares of the pressure sensitive adhesives market.

The Asia-Pacific region is crucial in driving global demand for pressure-sensitive adhesives (PSAs) due to its diverse and robust industrial landscape, which includes automotive, electronics, packaging, and healthcare sectors. The increasing need for advanced adhesive solutions in these industries positions Asia-Pacific at the forefront of PSA consumption and production. The region's economic resilience and rapid industrialization and urbanization create a sustained demand for sophisticated adhesive technologies. Consequently, businesses and stakeholders must strategically recognize Asia-Pacific's significant influence on the PSA market trajectory, ensuring their operations and innovations align with the region's evolving industrial and technological needs. This strategic alignment will be vital for capturing market opportunities and maintaining competitive advantage in the dynamic PSA market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Henkel AG & Co., KGaA (Germany), Dow (US), Avery Dennison Company (US), H.B. Fuller Company (US), 3M (US), Arkema S.A. (France), Sika AG (Switzerland), Scapa Group PLC (UK), Wacker Chemie AG (Germany), Illinois Tool Works (US) are the key players operating in the global market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2021-2029 |

|

Base year considered |

2023 |

|

Forecast Period |

2024-2029 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

By Chemistry, By Technology, By Application, By End Use Industry, and By Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

Henkel AG & Co., KGaA (Germany), Dow (US), Avery Dennison Company (US), H.B. Fuller Company (US), 3M (US), Arkema S.A. (France), Sika AG (Switzerland), Scapa Group PLC (UK), Wacker Chemie AG (Germany), and Illinois Tool Works (US) |

Based on Chemistry, the pressure sensitive adhesives market has been segmented as follows:

- Acrylic

- Rubber

- Silicone

- Other Chemistry

Based on Technology, the pressure sensitive adhesives market has been segmented as follows:

- Water-Based

- Solvent-Based

- Hot-Melt

- Radiation

Based on Application, the pressure sensitive adhesives market has been segmented as follows:

- Tapes

- Labels

- Graphics

- Other Application

Based on the end use industry, the pressure sensitive adhesives market has been segmented as follows:

- Packaging

- Electrical, Electronics, and Telecommunication

- Automotive & Transportation

- Building & Construction

- Medical & Healthcare

- Other End Use Industry

Based on the region, the pressure sensitive adhesives market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What is the current competitive landscape in the pressure sensitive adhesives market in terms of new applications, production, and sales?

Various major, medium-sized, and small-scale business firms operate in the industry on a global basis. Numerous companies are always inventing and producing new items, as well as moving into developing regions where demand is increasing, resulting in increased sales.

Which countries contribute more to the pressure sensitive adhesives market?

US, Germany, China, India, and Germany are major countries considered in the report.

What is the total CAGR expected to be recorded for the pressure sensitive adhesives market during 2024-2029?

The CAGR is expected to record 3.0% from 2024-2029

Does this report cover the different chemistry of pressure sensitive adhesives market?

Yes, the report covers the different chemistry of pressure sensitive adhesives.

Does this report cover the different end use industry of pressure sensitive adhesives?

Yes, the report covers different end use industry of pressure sensitive adhesives. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

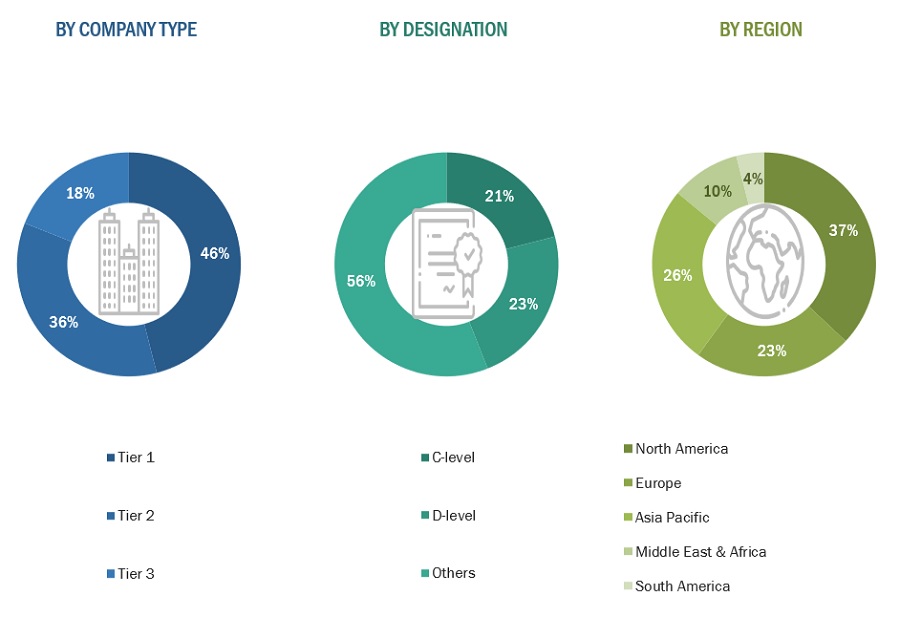

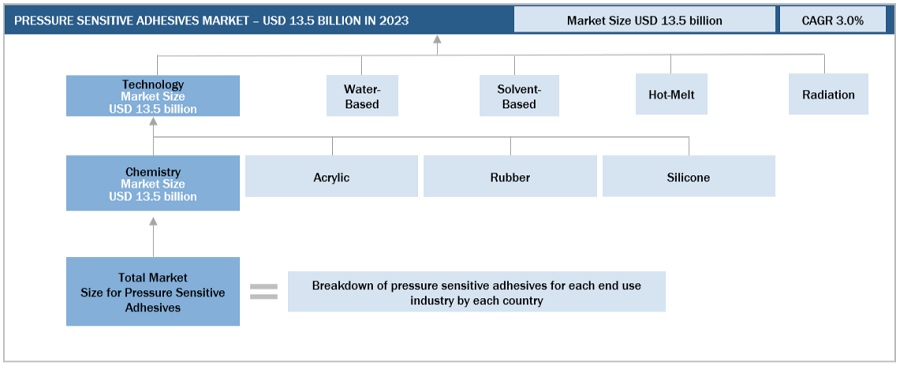

The study involved four major activities in estimating the current size of the pressure sensitive adhesives market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering pressure sensitive adhesives information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the pressure sensitive adhesives market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the pressure sensitive adhesives market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from pressure sensitive adhesives vendors; raw material suppliers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, technology, application, end use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using pressure sensitive adhesives were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of pressure sensitive adhesives and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

3M |

Director |

|

Illinois Tool Works |

Project Manager |

|

H.B. Fuller Company |

Individual Industry Expert |

|

Wacker Chemie AG |

Project Manager |

Market Size Estimation

The research methodology used to estimate the size of the pressure sensitive adhesives market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the end-use industries at a regional level. Such procurements provide information on the demand aspects of pressure sensitive adhesives.

Global Pressure Sensitive Adhesives Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Pressure Sensitive Adhesives Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

According to the Adhesive and Sealant Council, “Pressure Sensitive Adhesives (PSAs) are adhesives with special formulations that form a bond on the application of slight pressure, and which remain tacky at room temperature without solvent or heat. These adhesives offer various properties, such as peel strength, cohesive strength, adhesive strength, shear resistance, and resistance to aging, chemicals, and humidity.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the pressure sensitive adhesives market based on chemistry, technology, application, end use industry, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the pressure sensitive adhesives market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the pressure sensitive adhesives market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the pressure sensitive adhesives Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pressure Sensitive Adhesives Market