3D Printing Market by Offering (Printer, Material, Software, Services), Technology (Fused Deposition Modelling, Stereolithography), Process (Powder Bed Fusion, Material Extrusion, Binder Jetting), Application, Vertical & Region - Global Forecast to 2029

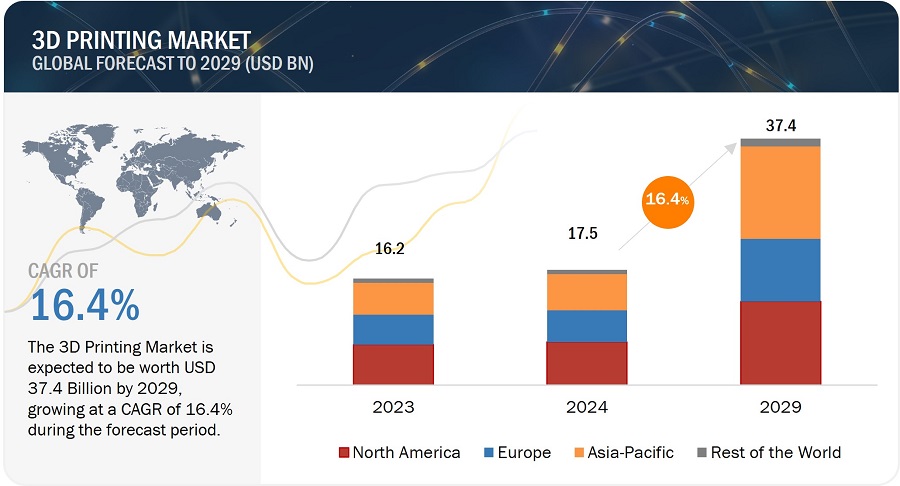

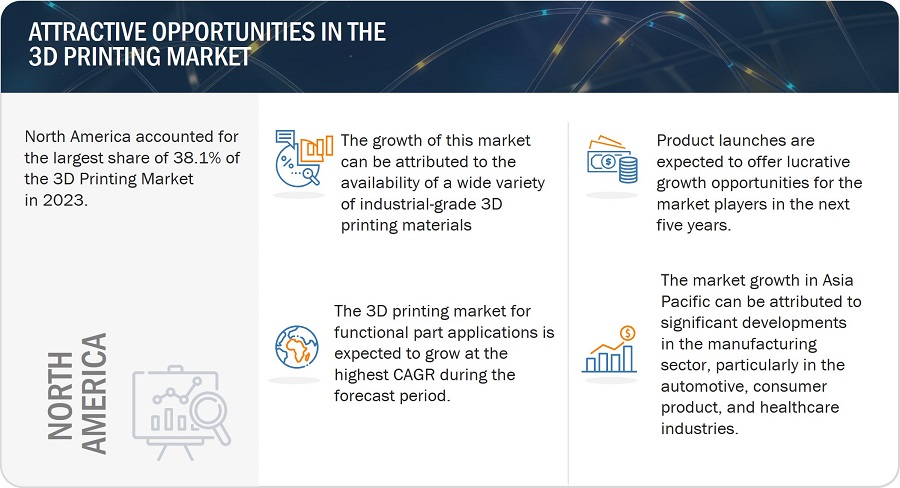

[300 Pages Report] The 3D Printing market was valued at USD 17.5 billion in 2024 and is estimated to reach USD 37.4 billion by 2029, registering a CAGR of 16.4% during the forecast period. The growth of the 3D Printing market is driven by ease in the development of customized products, reduction in manufacturing cost and process downtime, global government investment in 3D printing projects, availability of a wide variety of industrial-grade 3D printing materials, and complex part manufacturing in the aerospace & defense sector.

3D Printing Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Drivers: Ease in the development of customized products.

3D printing enables the manufacturing of personalized products according to individual needs and requirements. Companies provide customized services, such as essential design development by designers, followed by customers' being able to co-design the product. Ongoing technological advancements in the existing 3D printing technologies, reducing costs of printers, and availability of a range of materials enable the easy manufacturing of custom-made products. AM makes print-on-demand possible for part replacement, complex structural designs, specialty products, and low-volume production of customized functional parts. In producing low-demand items, 3D printing reduces overhead costs, such as inventory costs and costs associated with stock wastage. In the current market for consumer goods, where customers’ choice is limited to model, color, and size, 3D printing allows customers to opt for more complex designs. 3D printing minimizes the time spent on programming and developing the design, accelerating the shipment of final 3D printed parts to its intended end users. 3D printing is still widely used for prototyping as it reduces scrap and reworks; however, the trend is shifting toward manufacturing functional parts and tooling equipment. 3D printing also allows manufacturers to make crucial trial and error processes possible for physical products, owing to developing complex designs without needing any particular expertise.

Restraint: Lack of standardized testing methods to verify mechanical properties of 3D printing materials and high cost of raw materials.

The lack of standardized testing methods to verify the mechanical properties of 3D printing materials presents a substantial challenge for the 3D printing market. This issue becomes particularly critical in aerospace, automotive, and healthcare industries, where printed parts' reliability and performance are paramount. Without standardized testing protocols, there can be inconsistencies in part quality, leading to uncertainties about structural integrity and increasing the risk of failures. This uncertainty can hinder the full-scale adoption of 3D printing in industries that require stringent quality control measures. Moreover, the high cost of raw materials used in 3D printing, including metal powders, high-performance polymers, and composite filaments, contributes significantly to production expenses. This cost factor limits the scalability of 3D printing, especially for large-scale manufacturing applications. Addressing these challenges through the development of robust testing standards and advancements in material affordability is crucial for overcoming these restraining factors and unlocking the full potential of the 3D printing market across various industries.

Opportunity: Increasing demand for medical products and supplies in post-pandemic scenario

The post-pandemic landscape has witnessed a substantial surge in the demand for medical products and supplies, creating fertile ground for opportunities within the 3D printing market. This heightened demand stems from various factors, such as the need for agile response capabilities in healthcare, the imperative for localized manufacturing to address supply chain vulnerabilities, and the increasing preference for personalized medical solutions. For instance, in October 2023, CurifyLabs (Finland), CurifyLabs launched the world's first GMP (good manufacturing practice)-produced Pharma Inks for 3D printable medicines, addressing the growing demand for personalized medicine in healthcare. The Pharma Kit, comprising automated 3D printing technology and printable pharmaceutical inks, enabled the efficient production of customized drugs, leading to better patient care and improved medication outcomes. 3D printing technology is a critical solution in this framework due to its inherent flexibility and adaptability. It enables the rapid and customized production of various medical devices, equipment, and supplies.

Challenge: Ensuring consistent quality of final 3D product with repeatable and stable production processes

Ensuring consistent quality of the final 3D product with repeatable and stable production processes presents a multifaceted challenge for the growth of the 3D printing market. This challenge encompasses various aspects, such as the inherent variability of 3D printing materials, necessitating meticulous control over properties like viscosity, shrinkage, and thermal behavior to achieve uniform quality across diverse print runs. Moreover, optimizing print parameters like layer height, print speed, and temperature settings for different materials and designs requires extensive testing and expertise to ensure consistent results. Machine calibration also plays a critical role, as precise calibration is necessary to maintain performance and accuracy, with factors like wear, environmental conditions, and software updates influencing calibration stability.

3D Printing Ecosystem

The market for printer segment to hold largest market share during the forecast period.

The 3D printing market is divided into desktop and industrial printers, serving various applications across personal, professional, and production sectors. These printers offer a continuous printing capability that minimizes material costs and reduces wastage, making them environmentally sustainable options for manufacturing. Companies like BigRep and WASP have developed industrial-grade printers capable of printing objects on a massive scale, which are ideal for creating large prototypes, sculptures, architectural models, and building components. Simultaneously, the market has seen the emergence of affordable desktop 3D printers, democratizing access to this technology for hobbyists, small businesses, educational institutions, and individuals. These compact devices have sparked creativity and innovation, empowering users to materialize their ideas and explore new product development, research, and education possibilities. The versatility of 3D printers extends beyond traditional manufacturing, finding applications in healthcare, aerospace, automotive, and consumer products industries, among others. This ongoing evolution and accessibility of 3D printing technology continue to drive innovation, efficiency, and cost-effectiveness, revolutionizing modern manufacturing and design processes across various sectors.

Fused Deposition Modelling (FDM) segment to hold largest market share in the technology segment in the 3D Printing market during the forecast period.

Fused Deposition Modeling (FDM) is the most prevalent technology in the 3D printing market, known for its versatility and cost-effectiveness. It utilizes a range of thermoplastic materials including polylactic acid (PLA), acrylonitrile butadiene styrene (ABS), polyethylene terephthalate glycol (PETG), polycarbonate (PC), and polyetherimide (PEI) to produce prototypes and functional parts swiftly and at a low cost. FDM's short lead times, sometimes as fast as next-day delivery, are facilitated by the high availability and accessibility of the technology. This rapid turnaround time is advantageous for industries requiring quick iterations and prototypes. Additionally, FDM offers a broad selection of thermoplastic materials suitable for both prototyping and non-commercial functional applications, capable of producing high-precision plastic components with intricate geometries and fine details. These factors contribute to FDM's dominance in the market, enabling industries to accelerate product development cycles and create high-quality components for diverse applications.

Powder Bed Fusion segment to hold the largest market share in the process segment in the 3D Printing market during the forecast period.

Powder Bed Fusion (PBF) has become a cornerstone technology within the Additive Manufacturing (AM) market, offering diverse applications across industries. The adoption of PBF encompasses various technologies such as Direct Metal Laser Sintering (DMLS), Selective Heat Sintering (SHS), Electron Beam Melting (EBM), Selective Laser Sintering (SLS), and Selective Laser Melting (SLM) each tailored for specific material requirements and part complexities. Metal PBF processes like DMLS and EBM are witnessing substantial growth, driven by demand for high-performance metal parts in the aerospace, automotive, and medical sectors. DMLS stands out for its cost-effectiveness and material versatility, while EBM is favored for superior mechanical properties and compatibility with reactive materials like titanium. SLM offers an alternative for high-strength metal components. Polymer PBF, including SLS and SHS, remains significant due to affordability, making it suitable for prototyping, low-volume production, and parts with good dimensional accuracy.

Prototyping segment to hold the largest market share in the application segment in the 3D Printing market during the forecast period.

Adopting 3D printing for prototype development substantially reduces material waste and operational costs, offering a more sustainable and cost-effective approach compared to traditional manufacturing methods. 3D printing achieves this through its additive approach, building models layer-by-layer and using only the necessary material, thus minimizing scrap and optimizing material usage within designs, especially for complex geometries. This approach reduces material waste and lowers material consumption costs, particularly for expensive materials like metals and high-performance plastics. Additionally, 3D printing streamlines the prototyping process, potentially reducing labor costs, minimizing inventory needs, and enabling faster design cycles with fewer revisions. While there may be considerations such as material costs and post-processing needs, the overall impact of 3D printing on reducing waste and operational costs makes it a highly attractive option for prototype development.

Industrial segment in vertical to hold the highest market share of the 3D Printing market during the forecast period

Large-scale 3D printing, also known as additive manufacturing, is reshaping manufacturing by offering numerous advantages over traditional techniques like machining and milling. This technology provides unparalleled design freedom, allowing for intricate designs with internal channels and complex geometries, resulting in lighter, stronger, and more efficient components. It minimizes waste by building objects layer-by-layer, making it a sustainable manufacturing method. Large-scale 3D printing also enables faster prototyping and production, facilitating rapid design iterations and customization ideal for low-volume, high-value components or bespoke tools. In aerospace, it revolutionizes lightweight aircraft production, improving fuel efficiency and performance.

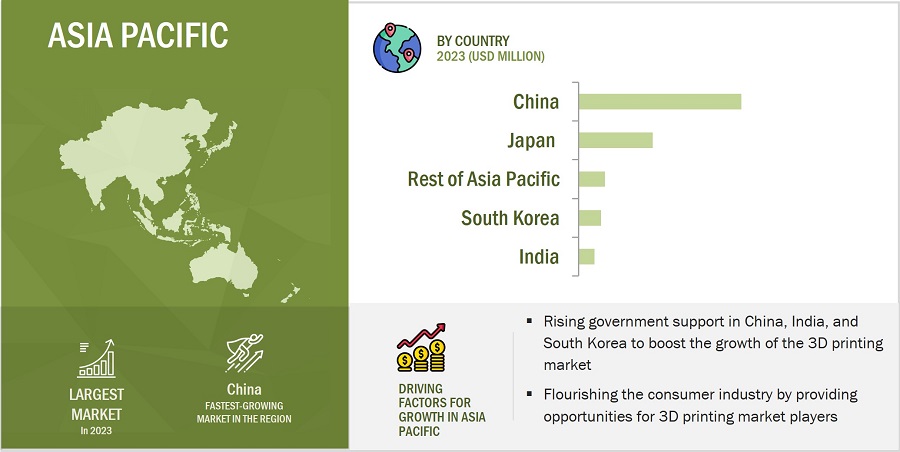

The 3D Printing market in the Asia Pacific is estimated to grow at a higher CAGR during the forecast period.

The Asia-Pacific region is poised to experience rapid growth in the 3D printing market, driven by government initiatives promoting advanced manufacturing technologies and a growing demand for personalized products. This surge in adoption can be attributed to significant developments in the manufacturing sector, particularly in the automotive and healthcare industries. With a strong presence in consumer electronics and ongoing urbanization, the region sees a rising need for additive manufacturing solutions. Small and medium-sized enterprises benefit from 3D printing's ability to efficiently produce customized products in small batches, a key advantage in sectors like automotive, aerospace, and healthcare. Asian-Pacific governments recognize this potential and offer support through funding and infrastructure development, fostering a favorable environment for 3D printing companies. As technology advances and competition increases, the cost of 3D printing continues to decrease, further boosting market growth. The region's proactive policies and investments in research and development attract renowned companies to establish their operations, particularly in countries like China, South Korea, and Japan, highlighting the immense potential of the Asia-Pacific 3D printing market in the foreseeable future.

3D Printing Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the 3D Printing companies include Stratasys (US), 3D Systems, Inc. (US), HP Development Company, L.P. (US), EOS GmbH (Germany), General Electric (US), Materialise NV (Belgium), Desktop Metal, Inc. (US), voxeljet AG (Germany), SLM Solutions (Germany), Renishaw plc. (UK). Apart from this, Protolabs (US), Optomec, Inc. (Mexico), Prodways Group (France), Ultimaker (Netherlands), Tiertime (China), XYZprinting (Taiwan), Höganäs AB (Sweden), UnionTech (China), Nexa3D (US), Trumpf (Germany), Formlabs (US), Markforged (US), Carbon (US), Nano Dimension (Israel), Rapid Shape GmbH (Germany) are among a few emerging companies in the 3D Printing market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020—2029 |

|

Base year |

2023 |

|

Forecast period |

2024—2029 |

|

Segments covered |

Offering, Application, Process, Technology, Vertical and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major players include Stratasys (US), 3D Systems, Inc. (US), HP Development Company, L.P. (US), EOS GmbH (Germany), General Electric (US), Materialise NV (Belgium), Desktop Metal, Inc. (US), voxeljet AG (Germany), SLM Solutions (Germany), Renishaw plc. (UK). and Others- total 25 players have been covered. |

3D Printing Market Highlights

This research report categorizes the 3D Printing market offering, technology, process, application, vertical and Region.

|

Segment |

Subsegment |

|

By Offering: |

|

|

By Technology: |

|

|

By Process: |

|

|

By Application: |

|

|

By Vertical: |

|

|

By Region: |

|

Recent Developments

- In November 2023, Stratasys introduced the F3300 Fused Deposition Modeling (FDM) 3D printer at the Formnext conference, promising enhanced manufacturing capabilities with improved accuracy, uptime, and doubled output. With faster print speeds, higher part quality, and cost savings, it targeted demanding industries like aerospace and automotive. The F3300 aimed to streamline production and overcome supply chain challenges.

- In November 2023, Gilmour Space Technologies, an Australian launch services company, partnered with EOS for additive manufacturing solutions, transitioning from R&D to manufacturing for Australia's first sovereign orbital launch. Supported by the Australian Government's Modern Manufacturing Strategy, the partnership aimed to enhance in-house manufacturing capabilities, leveraging metal additive manufacturing for rapid innovation and space launch vehicle development.

Key Questions Addressed in the Report:

What is the total CAGR expected to be recorded for the 3D Printing market during 2024-2029?

The global 3D Printing market is expected to record a CAGR of 16.4% from 2024-2029.

Which regions are expected to pose significant demand for the 3D Printing market from 2024-2029?

North America & Asia Pacific are expected to pose significant demand from 2024 to 2029. Major economies such as US, Canada, China, Japan, and India are expected to have a high potential for the future growth of the market.

What are the major market opportunities for the 3D Printing market?

Growing demand for medical products and supplies in post- pandemic scenario; Advancements in printing technologies and materials and development of knowledge and skills progression framework; Emerging applications of 3D printing technology in automotive, printed electronics, jewelry, and education fields; Advancements in materials of 3D Printing are the significant market opportunities in the 3D Printing market during the forecast period.

Which are the significant players operating in the 3D Printing market?

Key players operating in the 3D Printing market are Stratasys (US), 3D Systems, Inc. (US), HP Development Company, L.P. (US), EOS GmbH (Germany), General Electric (US), Materialise NV (Belgium), Desktop Metal, Inc. (US), voxeljet AG (Germany), SLM Solutions (Germany), Renishaw plc. (UK).

What are the major industries of the 3D Printing market?

Automotive, Aerospace & Defense, Healthcare, Architecture & Construction, Consumer Products, Education, Industrial, Energy, Printed Electronics, Jewelry, Food & Culinary, and Other Verticals are the major applications of 3D Printing market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

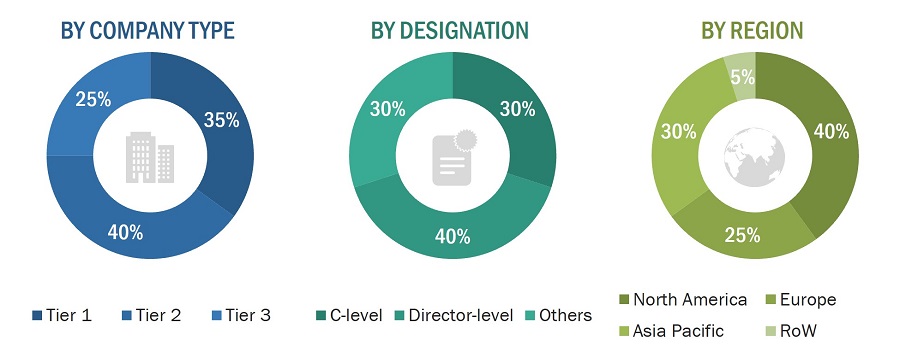

Two basic sources of information-secondary and primary-have been used to identify and collect information for an extensive technical and commercial study of the 3D printing market. Secondary sources include company websites, magazines, industry news, associations, and databases (OneSource, Factiva, and Bloomberg). Primary sources mainly comprise several experts from core and related industries, along with preferred suppliers, manufacturers, distributors, technology developers, alliances, standards, and certification organizations related to various segments of this industry’s value chain. They have been interviewed to understand, obtain, and verify critical information and assess future market trends and prospects. The key players in the 3D printing market have been identified through secondary research, and their market ranking has been determined through primary and secondary research. This research includes the study of annual reports of market players to identify top players and interviews with key opinion leaders such as CEOs, directors, and marketing personnel.

Secondary Research

In the secondary research, various sources were referred to identify and collect information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers, 3D Printing products-related journals, and certified publications; articles by recognized authors; directories; and databases. Secondary research was conducted to obtain key information regarding the industry supply chain, market value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the 3D printing market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across four major regions—North America, Europe, APAC, and RoW. Approximately 30% of the primary interviews were conducted with the demand side and 70% with the supply side. This primary data has been collected mainly through telephonic interviews, consisting of 80% of the primary interviews; questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, we have implemented top-down and bottom-up approaches to estimate and validate the size of the 3D printing market and various other dependent submarkets. The key players in the 3D printing market have been identified through secondary research, and their market share in the respective regions has been determined through primary and secondary research.

This entire research methodology includes the study of annual and financial reports of top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The recession impact has been analyzed while calculating the market estimations of the 3D printing market. The figures below show the overall market size estimation process employed for this study.

In this approach, important manufacturers for 3D Printing Market such Stratasys (US), 3D Systems, Inc. (US), HP Development Company, L.P. (US), EOS GmbH (Germany), General Electric (US) were identified. After confirming these companies through primary interviews with industry experts, their total revenue was estimated by referring to annual reports, SEC filings, and paid databases. Revenues of these companies pertaining to the business units (BUs) that offer printers, materials, software, and services for 3D printing market were identified through similar sources. Collective revenues of key companies that offer printers, materials, software, and services for 3D printing products were estimated for the market. Industry experts have reconfirmed these revenues through primary interviews.

3D Printing Market: Bottom-Up Approach

The bottom-up approach has been employed to arrive at the overall size of the 3D Printing market from the revenues of key players and their share in the market.

3D Printing Market: Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research. The most appropriate parent market size has been considered to calculate specific market segments to implement the top-down approach. Data from interviews have been consolidated, checked for consistency and accuracy, and inserted into the data model to arrive at the market numbers following the top-down approach. Market sizes in different geographies have been identified and analyzed through secondary research.

Data Triangulation

After arriving at the overall size of the dark fiber market from the estimation process explained above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed (wherever applicable) to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The size of the 3D printing market was validated using both top-down and bottom-up approaches.

Market Definition

Three-dimensional (3D) printing involves the development of real 3D object with digital model by constructing thin layers of materials (which can be solid, liquid and powder forms), generally layer-upon-layer in horizontal cross-section, distinct to subtractive manufacturing methods. It is also known as additive manufacturing (AM) or freeform fabrication. 3D printing has its applications in tooling, prototyping, and functional part manufacturing. The functional parts manufactured with 3D printing are used in wide range of industries namely automotive, healthcare, aerospace, jewelry, consumer goods, art and architecture, and education.

Key Stakeholders

- 3D printing products and solutions providers

- 3D printing-related service providers

- 3D printing materials and accessories providers

- 3D printing consulting companies

- 3D printing assembly companies

- 3D printing software providers

- 3D printing-related associations, organizations, forums, and alliances

- Government and corporate offices

- Venture capitalists, private equity firms, and start-up companies

- Distributors and traders

- End users willing to know more about 3D printing technologies and the latest technological developments in the 3D printing market

Report Objectives

- To define, describe, and forecast the global 3D printing market, in terms of value, based on offering, process, technology, application, vertical, and geography

- To forecast the market size, in terms of value, for various segments, with respect to four main regions—North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the 3D printing market (drivers, restraints, opportunities, and industry-specific challenges)

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, ASP analysis, Porter’s Five Forces analysis, and regulations pertaining to the market.

- To offer a comprehensive overview of the value chain of 3D Printing market ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for the market stakeholders by identifying high-growth segments of the 3D printing market

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2 and provide a detailed competitive landscape for market leaders

- To analyze competitive developments such as partnerships, collaborations, agreements, and joint ventures; mergers and acquisitions; expansions; and product launches and developments in the 3D printing market

- To evaluate the impact of the recession on the 3D Printing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 3D Printing Market

SWOT analysis Porter's 5 Forces Barriers to Entry. I am a student and cannot afford to buy the full report on 3d printing, your help is appreciated!

Interested in finding out about Food and Biomedical printing market. Please send me a cost for the report.

Wish to have a better understanding of the markets and trends for 3D Printing and how they will influence the local Mexican market, needs of plastic materials according to the main markets and growth.

I am interested in knowing the below information- Market sizes, segmentation, and estimated growth. Variety of Healthcare and Building/Industrial product and service categories.

To understand the trajectory of consumer adoption of 3d printing services. Opportunities in consumer side vs B2B segment.

We want to emerge in 3D prototyping industry and want to know the market size and opportunity.

I am looking for an up to date global market reports on 3D printing and conventional injection molding. Can you provide a free sample for reference?

We are planning to set up an R&D ALM technology platform in Vernon France. I need some market figures to substantiate our claim that Additive manufacturing is a disruptive technology that will affect all manufacturing.

We are looking for the 3D printing healthcare market in particular. I want to ask how much the healthcare chapter would cost and whether it would be possible to buy it separate from the rest of the report. We are looking for the market size of the 3D printing healthcare market (some numbers, growth rates etc.). If you could contact me tomorrow right away that would be more than awesome.

I am a communication and marketing intern at IMCD. I would like to request a pdf brochure of 3D printing as part of my assignment.

I am writing a report as part of my part time degree at university, as part of the business side of the degree. I have to write a report on a business. I have chosen a 3D printing business and require information regarding the growth of the market and sustainability etc.

I am very interested in how you have developed its 3D printing report - about 5 years ago I didn't have such a good experience with one of your reports.

I'm interested on this chapters: 5.4.2 Market Restraints 5.4.2.1 Issues Related to Material Availability, Cost, Quality, Development & Validation, Standardization, and Characterization 5.4.2.1.1 Material Availability & Cost 5.4.2.1.2 Material Development & Validation 5.4.2.1.3 Material Standardization & Characterization 5.4.2.1.4 Material Quality 5.4.2.2 Lack of Standardized Equipment and Process Control

I am currently studying my MBA. I am writing a thesis on the 3d printing industry. Due to my budget constraints, is there any possibility of getting the market info on the filaments section as well as market data on the paints that could be applied to 3D printed objects ( DIY 3d printed object paints)? Any information would be really helpful.

We are a team that research about Holographic 3D printing. We need some help about product development, potential customer segment, SLA 3D printing limitations, Resin or photo polymer. Please provide a pdf brochure of the report.

There is the need for researching market of 3D-Printing of our time for developing new technologies which improves product of 3D-printers. Can I get a pdf brochure of 3D printing report?

I would be particularly interested in the information related to the applications of 3D printing in the healthcare setting

I am interested in the following - 1. Applications of 3D printing, especially in medicine. 2. Expected social changes induced by 3D printing.

I am interested in what the report has to say about the market for 3D printers that print metal for a project I am working on.

I am doing some research into the competitive landscape of 3D printing and would be grateful if you can clarify whether your report has some of the data I am looking for . Primarily, I am looking for: - Total 3D Printing market segmented by technology (revenue and units) - Each technology segmented by company (e.g. how what % of the total FDM market revenue was Strategy) - Total 3D Printing market segmented by company (revenue and units) - Competitive offering analysis by company? I know your table of contents mentions some of the above, but if you can confirm which of the above you have that would be great.

Trying to learn about both technologies and market size related Metal Additive Manufacturing industry. Any more information will be helpful.

Trying to learn about both technologies and market size related Metal Additive Manufacturing industry. Any more information will be helpful.

I am writing content for 3D Printed Talent's new website and would like to gain valuable statistics on the AM industry, in particular the employment aspects. From reading the abstract there is a lot here that is relevant to my needs.

Can I get more information about the emerging technologies and trends in the 3D printing market?

I am interested in the following chapters of the 3d printing report: SLS and EBM (metal additive manufacturing) in medical sector, mainly orthopedic applications, USA, rest of America, EU, Asia-Pacific, ROW.

I'm interested in the size of EBM market as for this technology vacuum is needed. It would be very helpful if you could send me a sample of this report.

I am studying the 3D Printing market and would like to know the market size for the US. Also, is there a secondary market for used equipment?

I am currently working on a project to define the overall strategy for HP MJP in the US. I would like access to this information on 3d printing to get a overall view and do a benchmark analysis about the opportunities we might have in the US.

Do you provide the 3D printing report only for specific chapters? I am interested in the Application and Geography chapter of the report.

I'm doing a broad research on the 3D printing market and therefore I'm interested in your 230 pages document about it.

I am doing a market research and benchmark analysis in order to define the 3D printing strategy for HP in Latam. Can you share a PDF copy of this report?

I am looking for the following information: Market Size and Number of Machines (Projection) for 3D Printing concepts that use Energy Curing (UV). Preferably specific to Polymer-Type concepts

I'm interested in theses chapters: 4. 3D Printing Market Overview 7. 3D Printing Market By Application 9. Competitive Landscape

I am looking to have analysis of the market in Middle-East 1. Advanced manufacturing (with a specific focus on 3D printing) 2. Applied mechanics 3. Automotive: Smart Materials, Adaptive Structures and Intelligent Systems 4. Bioengineering: Nano engineering for Medicine and Biology 5. Design engineering 6. Energy: Renewable, Solar, Sustainability, Transition 7. Gas Turbines 8. Hydraulic fracturing 9. Mechatronics

Material Characterization and Component qualification. Interested in seeing samples of chapter 3, and sections 5.3, 7.4, 7.5, and 8.3 of 3D printing market report

Thank you for sending a free sample of the most economical 3D printers market in The UK and GCC countries

I am interested in knowing the areas of interest of major companies operating with 3D printing technology, in particular fashion and fabric development.

In addition to the list above, I am interested in information about the 3d printing services market, bureaus sales and competition, service bureaus challenges for getting clients, opportunities for providing services etc.

We provides prototyping, 3D printing, and manufacturing services for its PCB design and 3D modeling. We are interested in this report on 3D printing and would like to get more information about the same.

Is it possible to have a sample of the 3D printing report to see if it is suitable for us?

I have an interest to know the said , hence send me necessary details for me to commence with the requirements. Will it cost more than $ 5000 ? Request details of all type of printing by 3 D system.

I am specifically interested in 3D/FDM substrate markets by polymer type and converter or producer of filament.

I'm writing my bachelor thesis about the impact of 3D-Printing on the existing supply chains and I would like to ask if I can get a free copy of the report "3D Printing Market by Offering (Printer, Material, Software, Service), Process (Binder Jetting, Direct Energy Deposition, Material Extrusion, Material Jetting, Powder Bed Fusion), Application, Vertical, Technology, and Geography - Global Forecast to 2024". If you need any further information don't hesitate to contact me.

We are opening a new line of 3d printing and additive manufacturing in the Middle East especially in Lebanon. Can I get a free sample of this report?

I am interested in 3D printing market data concerning thermoplastics material use. More concretely, I am interested in polyolefin (polypropylene, polyethylene). Do you have any market data that breaks down the thermoplastics used? In addition, do you have information about further trends in this regard?

I am interested in the following - 1. Scalability with Additive Manufacturing 2. Durability of materials as far as industrial-grade fasteners are concerned 3. Supply side considerations.

We are about to carry out a market scouting 2019 for additional 3D manufacturers and service providers both for metallic and non-metallic. A market scouting was already carried out in 2016 and we want to get an update.

We have 3D printers which make sand moldings to produce metal castings in short lead time. I would like to have the market size and volume for prototyping parts in industrial and energy industries.

Is it possible to purchase just the following tables from the report? Table 69 Market, By Service, 2014–2022 (USD Million) Table 70 3D Printing Services Market, By Technology, 2014–2022 (USD Million) Table 71 3D Printing Services Market, By Vertical, 2014–2022 (USD Million) Table 72 3D Printing Services Market, By Application, 2014–2022 (USD Million) Table 73 3D Printing Services Market, By Region, 2014-2022

I'm looking for the biggest players in the 3D consumer printing materials market because I may be interested in selling 3D consumer printing materials.

I am a PHD student and my topic of research is related to 3D printing. Do you provide a free sample of this report?

As a board member of a start-up company I would like to get a high-level overview about the 3D printing market, in particular about the North America and Europe regions.

Wanting to find some statistics for projected growth of the 3D printing market, both in general and with regards to specific technologies, as well as key growth industries.

We are interested to continue with your support for our research on 3D-printing. Our institute is entitled with well furnished "RESEARCH AND DEVELOPMENT CENTER" . We are expecting a sample of 'PLA, Aluminum filament from you. If it gives better result than the earlier one's, we are ready to get all the filaments from your company.

We are interested to step forward with your support to do our research on 3D-printing, our institute is entitled with well furnished "RESEARCH AND DEVELOPMENT CENTER" we are expecting a sample of 'CARBON FIBER OR Aluminum filament from you. If it gives better result than the earlier one's, we are ready to get all the filaments from your company.

We are interested to step forward with your support to do our research on 3D-printing, our institute is entitled with well furnished "RESEARCH AND DEVELOPMENT CENTER" we are expecting a sample of 'CARBON FIBER OR Aluminum filament from you. If it gives better result than the earlier one's, we are ready to get all the filaments from your company.

kindly provide some sales strategy for 3d printer sales

Looking to start a business in the 3D printing market and need information about the market as a whole to determine whether or not the business plan is viable.

I am a graduate student working on a marketing plan for an additive manufacturing company. Do you provide free samples of reports?

Searching for detailed information on the additive manufacturing market to assess the viability of a new market entrant. Having access to your extensive research as soon as possible would be extremely helpful.

I want to explore the 3D printing Market, different technology, different applications, limitations of process machines and materials. Also, I want to know the global forecast especially Indian market. Economics of 3D printing.

Do you provide only country specific data for 3D printing report?

I am involved in development of polymers for SLA, DLP, Polymer Solutions, create new application Areas and optimize characteristics of 3D printed object towards longer lifetime and stability/reliability. Please provide a sample for this report.

I want to know the potential for 3d Printing and services in Colombia, South America. I am looking for partnerships.

We have task in university course to write short article about market share of 3D printing. Can you share some information?

I'm currently studying the market of 3D printing in Puerto Rico and the United States and I want to know the number of people uses 3D Printing for hobby or home use.

I oversee the world's first additive manufacturing & design graduate program and teach 3D printing/additive manufacturing courses. I want to make sure that our courses and graduates are aligned to meet the demands that you (and others) are forecasting. Can I get a sample of the report?

I want to know more about 3D printing technology and latest technological developments in the 3D printing market.