5G Enterprise Market by Network Type (Hybrid Network, Private Network), Operator Model, Infrastructure, Spectrum, Frequency Band, Organization Size, Application, Vertical, Region (2021-2027)

The 5G enterprise market size is expected to reach USD 10.9 billion by 2027, at a CAGR of 31.8% during the forecast period.

A few major factors driving the growth of this market are the emergence of Industry 4.0 paving the way for mMTC, the development of smart infrastructure, and the delivery of differentiated 5G services using network slicing technique. The critical challenge faced by the market players is the requirement of the high spending capability of carriers to set up a 5G infrastructure. Similarly, the adoption of Wi-Fi communication technology by enterprises and security concerns in the 5G core network are the major factors hindering the market growth. Low latency connectivity with uRLLC and increasing demand for private networks from various enterprises and government organizations for mission-critical applications. Despite the market being in the infancy stage, a lot of research is being conducted in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Emergence of Industry 4.0 paving way for mMTC

Along with IoT, Industry 4.0 provides manufacturing companies with the ability to store and analyze large volumes of data, based on which manufacturers can set actions using several technologies, such as robotics, artificial intelligence, connected sensors, IoT, and cloud computing. Thus, Industry 4.0 aims to improve production process efficiency and flexibility by deploying automation technology.

Development of smart infrastructure

Infrastructural initiatives, such as smart cities and smart buildings, are conceptual model, designed to deliver a set of cutting-edge services and infrastructure. A smart city has Information and Communication Technology (ICT) infrastructure to improve the quality of life and augment the efficiency of urban operations and services. An existing city can be considered smart only if it adheres to the following components: smart transportation, smart buildings, smart utilities, and smart citizen services. Therefore, the successful implementation of smart city projects heavily depends on several technologies—data communications, cloud, mobility, and sensors—that collectively form the IoT. Due to the huge demand for rapid connectivity and faster communication, 5G standalone (SA) services can see huge opportunities in the future.

Delivery of differentiated 5G services using network slicing

5G introduced new business models across various enterprises that are focused on meeting the ever-changing requirements of customers from different verticals. Network slicing is one of the crucial techniques that enable service providers to expand their business by offering innovative services. The end-to-end network slicing includes the RAN, core network, and transport functions. With this technique, network services can be offered with high security and flexibility. It also helps service providers to earn better returns on their investments by managing their network resources effectively and providing differentiated services to a larger scale.

Network resources can be dedicated per slice, enabling end-to-end service differentiation. Both vertical and horizontal slicing can be specified within the same service slice, enabling different slices per tenant and fulfilling different service-level agreements (SLAs). For example, a dedicated slice can be allocated to separate use cases or services, such as utilities, healthcare, and automotive. Then, the CSP can slice in the same vertical by the tenant, for instance, in the automotive slice, between different manufacturers, each having its SLA.

Restraints: Stability Adoption of Wi-Fi communication technology by enterprises

Wi-Fi communication is currently considered to be the de-facto connectivity technology among organizations for offering on site mobility for employees, connected devices, visitors, and contract-based employees. Advancements and developments in wireless technologies and devices have increased the working efficiency of organizations. The use of Wi-Fi–enabled tablets and smart devices by employees has increased business productivity. Workers and technicians in manufacturing enterprises have witnessed an increase in their work productivity according to Intel’s white paper published in 2016.

Increasing number of enterprises are dependent on Wi-Fi products to manage their daily business operations. The wide range of Wi-Fi coverage helps employees to always stay connected from any part of office premises or building. With wireless products and smart devices deployed in organizations, operating expense is lowered and a high return on investments is achieved. Considering many features of Wi-Fi technology and widespread adoption among enterprises, it acts as a major restraint for the anticipated growth of the 5G enterprise industry.

Security concerns in 5G core network

Chief information officers (CIOs) are largely concerned with a network that can lead to a huge loss for businesses and service providers. The 5G network infrastructure has been designed with the help of SDN, NFV, and cloud-native architecture. Network functions are disaggregated from underline infrastructure and located across local, regional, and central data centers. In a cloud-based 5G network, most network functions are deployed over the public and private cloud infrastructure.

Based on network type, private networks are projected to witness a higher CAGR as these networks enable enterprises to reduce their dependence on service providers because when they opt for private networks, they can have full control over operating methods. It also allows separate data processing and storage. Additionally, enterprises can customize the network the way they want.

Based on operator model, communication service providers (CSPs) held a larger market share in 2020. They are keen on utilizing their fully virtualized network architecture, having increasing agility, flexibility, visibility, and cost-efficiency.

Based on infrastructure, core network technology is projected to witness a higher CAGR in the 5G enterprise market during 2021–2027 owing to enhanced end user experience (UX), simplified network operations, increased service creation agility, and improved network capabilities.

Based on spectrum, the licensed spectrum is likely to hold a major share of the market owing to network control and critical use cases for maintaining service quality, especially for end users from the defense and government organizations.

Based on frequency, mmWave would record a higher growth rate in the coming years owing to several advantages offered by this frequency band, such as high bandwidth (for higher data transfer rate), high resolution, low interference (systems with high immunity to cramming), small component sizes, and increased security and cost-efficacy.

Based on organization size, large enterprises are expected to dominate the 5G enterprise market in 2020 as they are anticipated to deploy 5G networks to increase data transmission speed, ensure higher device capacity and spectrum band, and adopt IIoT.

Based on application, AR/VR will be one of the fastest-growing applications in the coming years. Several companies are investing in AR/VR technology, fueling 5G adoption. One of the key factors driving adoption of AR/VR will be gaming sector. For instance, HTC Vive has already begun testing VR through 5G technology.

Based on vertical, manufacturing is attributed to holding a major share of the market in the coming years as leading manufacturers, such as Gabler, are already deploying AR and VR technologies in equipment maintenance and training applications. AR/VR in HD resolution requires more than 100 Mbps for a smooth experience, while technically, the bandwidth requirement can be fulfilled by fiber or Wi-Fi networks; however, some remote sites/factories are not covered by fiber. Issues outside the corporate network can be resolved with 5G technology for AR/VR in manufacturing.

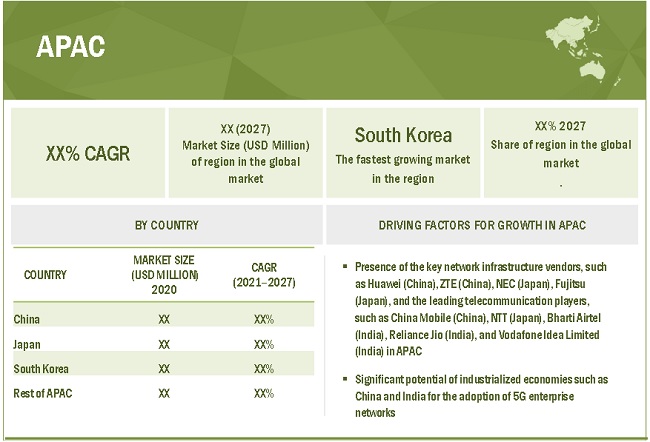

APAC is transforming dynamically with regard to the adoption of new technologies by organizations functioning across various sectors. The region has become the center of attraction for major investments and business expansion opportunities. Companies such as ZTE (China) and Huawei (China) are heavily investing in full-scale 5G enterprise deployment and upcoming 5G technology and are initiating field trials with a few leading mobile service carriers, such as AT&T (US), China Mobile (China), SoftBank (Japan), and China Unicom (China). These companies are entering into partnerships and collaborations with other players to remain dominant in the market.

To know about the assumptions considered for the study, download the pdf brochure

Top Key Players in 5G Enterprise Companies:

-

Huawei (China),

-

Ericsson (Sweden),

-

Nokia Neworks(Finland),

-

Samsung (South Korea),

-

ZTE (China).

Huawei (China)

Huawei Technologies is a leading global provider of networking products, servers, storage solutions, and telecommunications and information and communications technology (ICT) solutions. The company also provides different services such as network integration, business consulting, learning, assurance, managed and global delivery services to stakeholders, including telecom operators, data center security service providers, network service providers worldwide.

- In February 2021, China Mobile and Huawei deployed the world's first 4.9 GHz commercial LampSite network in Shanghai, China. This is the first time an aggregate bandwidth of 200 MHz on the 2.6 and 4.9 GHz bands and distributed Massive MIMO have been simultaneously implemented in digital indoor networks.

- In February 2021, Haier, China Mobile, and Huawei unveiled their 5G MEC Joint Innovation Base at the Haier Institute of Industrial Intelligence. 5G is the ideal choice for building private networks for industries. Its greatest potential is unleashed when it is allied to MEC, a powerful enabler for a blend of connectivity, computing, and application.

5G Enterprise Market Report Scope

|

Report Metric |

Details |

| Estimated Value | USD 2.1 Billion |

| Expected Value | USD 10.9 Billion |

| Growth Rate | CAGR of 31.8% |

|

Market Size Available for Years |

2020–2027 |

|

Forecast Period |

2021–2027 |

|

On Demand Data Available |

2030 |

|

Segments Covered |

Network type, Operator model, Infrastructure, Spectrum, Frequency band, Organization size, Application, and Vertical |

|

Base Year |

2020 |

| Market Leaders | Huawei (China), Ericsson (Sweden), Nokia Networks (Finland), Samsung (South Korea), and ZTE (China) |

| Key Market Driver | Emergence of Industry 4.0 paving way for mMTC |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Hybrid Network Segment |

| Highest CAGR Segment | Small and Medium-sized Enterprises |

| Largest Application Market Share | Communication Applications |

This report categorizes the 5G enterprise market based on network type, operator model, infrastructure, spectrum, frequency band, organization size, application, and vertical.

5G Enterprise Market, By Network Type

- Hybrid Networks

- Private Networks

- Enterprise Network

- CSP Network

5G Enterprise Market, By Operator Model

- Communication service provider

- Private Enterprises

5G Enterprise Market, By Infrastructure

- Access Equipment

- Small Cells

- E-RAN Equipment (Service Node)

- Core Network

- SDN

- NFV

5G Enterprise Market, By Spectrum

- Licensed

- Unlicensed/Shared

5G Enterprise market, by Frequency Band

- Sub-6GHz

- mmWave

5G Enterprise market, by Organization size

- Small and medium-sized enterprises (SMEs)

- Large enterprises

Market, by Application

- Mobile robots (AGV)

- Video analytics

- Drones

- AR/VR

- Communication

- Others

Market, by Vertical

- BFSI

- Manufacturing

- Energy & utilities

- Retail

- Healthcare

- Government and public safety

- Transportation and logistics

- Aerospace & defense

- Media & entertainment

- Office Buildings

5G enterprise market, by Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- South Korea

- Rest of APAC (RoAPAC)

-

Rest of the World (RoW)

- South America

- Middle East & Africa

Frequently Asked Questions (FAQ):

Which are the major applications of the 5G enterprise market? How big is the opportunity for their growth in the developing economies in the coming years?

The major application of 5G enterprise market includes AR/VR. It is expected to boost the demand for 5G enterprise in this industry leading to USD 10.9 billion opportunity till 2027.

Which are the major companies in the 5G enterprise market? What are their major strategies to strengthen their market presence?

The 5G enterprise market was dominated by Huawei (China), Ericsson (Sweden), Nokia (Finland), Samsung (South Korea), and ZTE (China). The major strategies adopted by the top 5 players in the 5G enerprise market included product launches and developments, partnerships and expansions.

Which are the leading countries in the 5G enterprise market?

5G enterprise market is expected to grow at the highest CAGR in APAC region during the forecast period. The countries in APAC such as China, Japan, and South Korea are expected to exhibit large-scale development owing to rising investments by governments of these countries.

Which type of network is expected to witness significant demand for 5G enterprise in the coming years?

The private segment is expected to witness the highest growth in the 5G enterprise market in the coming years as these networks enable enterprises to reduce their dependence on service providers because when they opt for private networks, they can have full control over operating methods. It also allows separate data processing and storage. Additionally, enterprises can customize the network the way they want.

How will COVID-19 impact on the penetration of 5G enterprise market?

The impact of COVID-19 on 5G enerprise vendors will be high in 2020. In China, six big 5G projects, including an industrial internet project in the Guangdong province, a hospital-related project in the Jiangxi province, and a police-related project in the Gansu province, have been postponed since January 2020. This is expected to slow down the deployment of the 5G infrastructure as projected earlier. Currently, the demand for 5G is low; however, 5G has witnessed potential applications during the COVID-19 outbreak in China. The Chinese government is using 5G for diagnosis and telemedicine, along with the implementation of AI and machine learning, to control the further spread of the outbreak. For instance, in Wuhan, the epicenter of the outbreak, Huawei Technologies has built a 5G network at the Wuhan Huoshenshan Hospital, which played a crucial role in treating the patients affected by COVID-19. The network included the installation of small cells as the hospital is in a remote area. Also, China is using 5G-enabled robots for telemedicine and control medical equipment in distant healthcare centers.

Supply chain members and government authorities are expected to work in collaboration to exploit the potential applications of 5G. This will accelerate 5G investment plans and generate significant demand for 5G equipment. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 5G ENTERPRISE MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 5G ENTERPRISE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Breakdown of primaries

2.1.3.4 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH METHODOLOGY: APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size by top-down analysis (supply side)

FIGURE 6 5G ENTERPRISE MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RISK ASSESSMENT

TABLE 1 RISK FACTORS ANALYSIS

2.5 FORECASTING ASSUMPTIONS

2.6 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 8 5G ENTERPRISE MARKET: HOLISTIC VIEW

FIGURE 9 MARKET: GROWTH TREND

3.1 MARKET SCENARIO

FIGURE 10 MARKET SCENARIO: OPTIMISTIC, REALISTIC,AND PESSIMISTIC

TABLE 2 MARKET SCENARIO

FIGURE 11 HYBRID NETWORK CAPTURED LARGER MARKET SHARE IN 2020

FIGURE 12 PRIVATE ENTERPRISES TO WITNESS HIGHER CAGR IN MARKET FROM 2021 TO 2027

FIGURE 13 ACCESS EQUIPMENT HELD MAJOR MARKET SIZE IN 2020

FIGURE 14 UNLICENSED/SHARED SPECTRUM TO WITNESS HIGHER CAGR THAN LICENSED SPECTRUM IN MARKET FROM 2021 TO 2027

FIGURE 15 MMWAVE SEGMENT TO DOMINATE MARKET IN COMING YEARS

FIGURE 16 LARGE ENTERPRISES TO ACCOUNT FOR LARGER SIZE OF ARKET IN 2027

FIGURE 17 COMMUNICATION APPLICATION HELD MAJOR MARKET SIZE IN 2020

FIGURE 18 MANUFACTURING VERTICAL ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

FIGURE 19 APAC IS PROJECTED TO WITNESS HIGHEST GROWTH RATE IN MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN 5G ENTERPRISE MARKET

FIGURE 20 RISING DEMAND FOR HIGH-SPEED AND IMPROVED NETWORK COVERAGE TO PROPEL MARKET GROWTH FROM 2021 TO 2027

4.2 MARKET, BY NETWORK TYPE

FIGURE 21 PRIVATE NETWORK TO REGISTER HIGHER CAGR THAN HYBRID NETWORK IN MARKET DURING FORECAST PERIOD

4.3 MARKET, BY OPERATOR MODEL

FIGURE 22 COMMUNICATION SERVICE PROVIDERS TO HOLD LARGER SHARE OF MARKET IN 2027

4.4 MARKET, BY INFRASTRUCTURE

FIGURE 23 CORE NETWORK TECHNOLOGY TO EXHIBIT HIGHER CAGR IN MARKET DURING FORECAST PERIOD

4.5 MARKET, BY SPECTRUM

FIGURE 24 LICENSED SPECTRUM TO CAPTURE LARGER SIZE OF MARKET IN 2027

4.6 5G ENTERPRISE MARKET, BY ORGANIZATION SIZE

FIGURE 25 SMALL AND MEDIUM-SIZED ENTERPRISES TO REGISTER HIGHEST CAGR IN MARKET DURING 2021–2026

4.7 MARKET IN APAC, BY COUNTRY AND FREQUENCY BAND

FIGURE 26 MMWAVE 5G ENTERPRISE NETWORKS TO HOLD LARGER MARKET SHARE IN APAC IN 2027

4.8 MARKET, BY APPLICATION

FIGURE 27 COMMUNICATION APPLICATION TO HOLD SIGNIFICANTLY LARGER SIZE OF MARKET IN 2027

4.9 MARKET, BY VERTICAL

FIGURE 28 MANUFACTURING VERTICAL TO HOLD LARGEST MARKET SIZE IN MARKET FROM 2021 TO 2027

4.10 5G ENTERPRISE MARKET, BY REGION (USD MILLION)

FIGURE 29 APAC TO RECORD HIGHEST CAGR IN 5G ENTERPRISE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 30 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: 5G ENTERPRISE MARKET

5.2.1 DRIVERS

FIGURE 31 MARKET DRIVERS AND THEIR IMPACT

5.2.1.1 Emergence of Industry 4.0 paving way for mMTC

FIGURE 32 GLOBAL INTERNET OF THINGS CONNECTIONS (BILLION)

5.2.1.2 Development of smart infrastructure

5.2.1.3 Delivery of differentiated 5G services using network slicing technique

5.2.2 RESTRAINTS

FIGURE 33 MARKET RESTRAINTS AND THEIR IMPACT

5.2.2.1 Adoption of Wi-Fi communication technology by enterprises

5.2.2.2 Security concerns in 5G core network

FIGURE 34 5G SECURITY THREAT LANDSCAPE

5.2.3 OPPORTUNITIES

FIGURE 35 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Low latency connectivity with uRLLC

FIGURE 36 REVENUE STREAMS FOR 5G SOLUTIONS

5.2.3.2 Increasing demand for private 5G networks from various enterprises and government organizations for mission-critical applications

FIGURE 37 KEY FUNCTIONAL AREAS TO DEPLOY PRIVATE WIRELESS NETWORKS IN MANUFACTURING

5.2.4 CHALLENGES

FIGURE 38 MARKET CHALLENGES AND THEIR IMPACT

5.2.4.1 Requirement for high spending capability of carriers to set up 5G infrastructure

5.3 REVENUE SHIFT AND NEW REVENUE POCKETS FOR 5G INFRASTRUCTURE MARKET

FIGURE 39 REVENUE SHIFT IN 5G INFRASTRUCTURE MARKET

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 40 5G ENTERPRISE MARKET: SUPPLY CHAIN ANALYSIS

5.4.1 TELECOM ORIGINAL EQUIPMENT MANUFACTURERS

5.4.2 5G RADIO HARDWARE PROVIDERS

5.4.3 5G CORE NETWORK COMPONENT PROVIDERS

5.4.4 5G TRANSPORT NETWORK PROVIDERS

5.4.5 NFV/SDN/CLOUD SERVICE PROVIDERS

5.4.6 SYSTEM INTEGRATORS/MANAGED SERVICE PROVIDERS

5.4.7 END USERS

5.5 ECOSYSTEM

FIGURE 41 5G TECHNOLOGY ECOSYSTEM

TABLE 3 5G ENTERPRISE MARKET: ECOSYSTEM

5.6 PATENT ANALYSIS

FIGURE 42 PATENT ANALYSIS

TABLE 4 NOTICEABLE 5G RELATED PATENTS

5.7 TECHNOLOGY ANALYSIS

5.7.1 INTRODUCTION

5.7.2 CLOUD VIRTUAL & AUGMENTED REALITY (AR/VR)

5.7.3 CONNECTED AUTOMOTIVE

5.7.4 SMART MANUFACTURING

5.7.5 SMART GRID

5.7.6 SMART HEALTH

5.7.7 CONNECTED DRONES

5.7.8 SMART CITIES

5.7.9 CBRS

FIGURE 43 THREE-TIER MODEL FOR CBRS SPECTRUM ACCESS

5.7.10 MULTEFIRE

5.8 COVID-19 MARKET OUTLOOK FOR 5G ENTERPRISES

5.8.1 EMERGING 5G APPLICATIONS

5.8.2 RISING DIGITALIZATION

5.8.3 SUPPLY CHAIN DISRUPTION

5.8.4 DELAY IN RELEASE OF 5G SPECIFICATIONS

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 5G ENTERPRISE MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 44 5G ENTERPRISE: PORTER’S FIVE FORCES ANALYSIS

5.9.1 COMPETITIVE RIVALRY

FIGURE 45 HIGH FIXED COST WOULD HAVE MAJOR IMPACT ON MARKET

5.9.2 THREAT OF NEW ENTRANTS

FIGURE 46 STRINGENT GOVERNMENT REGULATIONS HINDER NEW ENTRANTS TO ENTER 5G ENTERPRISE MARKET

5.9.3 THREAT OF SUBSTITUTES

FIGURE 47 SUBSTITUTE COST HAS MAJOR IMPACT ON MARKET

5.9.4 BARGAINING POWER OF BUYERS

FIGURE 48 ROLE OF BRAND IMPACTS LARGELY ON BARGAINING POWER OF BUYERS

5.9.5 BARGAINING POWER OF SUPPLIERS

FIGURE 49 NUMBER OF BUYERS MAXIMIZES BARGAINING POWER OF SUPPLIERS IN MARKET

5.10 PRICING ANALYSIS

FIGURE 50 AVERAGE SELLING PRICE ANALYSIS

TABLE 6 AVERAGE SELLING PRICE OF SMALL CELLS AND E-RAN SOLUTIONS, 2020–2027

5.11 TRADE ANALYSIS

TABLE 7 IMPORT DATA OF UNITS FOR BASE STATIONS OF APPARATUS FOR TRANSMISSION OR RECEPTION OF VOICE, IMAGES, OR OTHER DATA, BY COUNTRY, 2016–2019 (USD MILLION)

FIGURE 51 IMPORT DATA FOR HS CODE 851761 FOR TOP FIVE COUNTRIES IN MARKET, 2016-2019 (USD MILLION)

TABLE 8 EXPORT DATA OF UNITS FOR BASE STATIONS OF APPARATUS FOR TRANSMISSION OR RECEPTION OF VOICE, IMAGES, OR OTHER DATA, BY COUNTRY, 2016–2019 (USD MILLION)

FIGURE 52 EXPORT DATA FOR HS CODE 851761 FOR TOP FIVE COUNTRIES IN 5G ENTERPRISE MARKET, 2016–2019 (USD MILLION)

5.12 TARIFF AND REGULATORY LANDSCAPE

6 INDUSTRY TRENDS IN 5G ENTERPRISE MARKET (Page No. - 90)

6.1 PRIVATE 5G NETWORK INDUSTRY TRENDS

6.1.1 INDUSTRY TRENDS

6.1.1.1 Ultra-reliable low-latency communication (uRLLC)

6.1.1.2 Massive machine-type communication (mMTC)

6.1.1.3 Enhanced mobile broadband (eMBB)

6.2 USE CASES

6.2.1 AIRPORTS

6.2.2 SEAPORTS

6.2.3 TELEMEDICINE

6.2.4 INDUSTRY 4.0

6.2.5 OIL & GAS

6.2.6 MINING

6.3 MARKET DRIVERS FOR PRIVATE 5G NETWORKS

6.3.1 PRIVATE 5G NETWORK DRIVERS

6.3.1.1 Network range

6.3.1.2 Network capacity

6.3.1.3 High QoS

6.3.1.4 Developed ecosystem

6.3.1.5 Device support

6.3.1.6 Security

6.3.1.7 Frequency spectrum

6.4 SPECTRUM OPPORTUNITY

6.4.1 NORTH AMERICA

6.4.1.1 US

6.4.1.2 Canada

6.4.1.3 Mexico

6.4.2 EUROPE

6.4.2.1 UK

6.4.2.2 Germany

6.4.2.3 Rest of Europe

6.4.3 APAC

6.4.3.1 China

6.4.3.2 Japan

6.4.3.3 Australia

6.4.3.4 South Korea

6.4.4 REST OF THE WORLD

6.4.4.1 Middle East and Africa

6.4.4.2 South America

6.5 INVESTMENTS

6.5.1 US

6.5.2 CANADA

6.5.3 UK

6.5.4 GERMANY

6.5.5 CHINA

6.5.6 JAPAN

6.5.7 AUSTRALIA

6.5.8 SOUTH KOREA

6.5.9 REST OF THE WORLD

6.6 PRIVATE NETWORK DEPLOYMENT MODELS

FIGURE 53 DEPLOYMENT MODELS FOR PRIVATE NETWORKS

6.7 3GPP INITIATIVES SUPPORTING PRIVATE 5G NETWORKS FOR IIOT

TABLE 9 SUMMARY OF 3GPP INITIATIVES SUPPORTING PRIVATE 5G NETWORKS FOR IIOT

7 5G ENTERPRISE MARKET, BY NETWORK TYPE (Page No. - 109)

7.1 INTRODUCTION

FIGURE 54 PRIVATE NETWORK SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2021 TO 2027

TABLE 10 MARKET, BY NETWORK TYPE, 2021–2027 (USD MILLION)

7.2 HYBRID NETWORK

7.2.1 HYBRID MODEL SUPPORTS PUBLIC AND PRIVATE NETWORKS PROVIDED BY COMMUNICATION SERVICE PROVIDERS

7.3 PRIVATE NETWORK

7.3.1 PRIVATE NETWORK ARE EXPECTED TO EXHIBIT HIGHER CAGR IN MARKET DURING FORECAST PERIOD

TABLE 11 MARKET FOR PRIVATE NETWORK, BY TYPE, 2021–2027 (USD MILLION)

7.3.2 ENTERPRISE NETWORK

7.3.2.1 Enterprises are undergoing digital transformation across different verticals, thereby creating need for dedicated connected networks

TABLE 12 POTENTIAL INDUSTRIAL SITES FOR PRIVATE WIRELESS NETWORKS

7.3.3 COMMUNICATION SERVICE PROVIDER NETWORK

7.3.3.1 CSPs worldwide are developing 5G SA network to provide high-speed connectivity to consumers

8 5G ENTERPRISE MARKET, BY OPERATOR MODEL (Page No. - 114)

8.1 INTRODUCTION

FIGURE 55 COMMUNICATION SERVICE PROVIDERS TO CAPTURE LARGER SIZE OF MARKET IN 2021

TABLE 13 MARKET, BY OPERATOR MODEL, 2021–2027 (USD MILLION)

8.2 COMMUNICATION SERVICE PROVIDERS

8.2.1 TELECOMMUNICATIONS INDUSTRY STANDS ON BRINK OF PIVOTAL NEW ERA OF CONNECTIVITY

TABLE 14 COMMUNICATION SERVICE PROVIDER (CSP): CAPITAL EXPENDITURE, 2017–2019 (USD MILLION)

8.3 PRIVATE ENTERPRISES

8.3.1 PRIVATE NETWORKS UTILIZE NETWORK ISOLATION, DATA PROTECTION, AND DEVICE/USER AUTHENTICATION TO PROTECT KEY ASSETS

TABLE 15 SHARED SPECTRUM FOR PRIVATE ENTERPRISE NETWORKS

9 5G ENTERPRISE MARKET, BY INFRASTRUCTURE (Page No. - 120)

9.1 INTRODUCTION

FIGURE 56 CORE NETWORK TECHNOLOGY TO REGISTER HIGHER CAGR IN MARKET DURING FORECAST PERIOD

TABLE 16 MARKET, BY INFRASTRUCTURE, 2021–2027 (USD MILLION)

9.2 ACCESS EQUIPMENT

TABLE 17 MARKET, BY ACCESS EQUIPMENT, 2021–2027 (USD MILLION)

TABLE 18 MARKET, BY ACCESS EQUIPMENT, 2021–2027 (THOUSAND UNITS)

TABLE 19 MARKET FOR ACCESS EQUIPMENT, BY REGION, 2021–2027 (USD MILLION)

9.2.1 SMALL CELLS

9.2.1.1 Network operators deploy small cells to provide faster data speeds and more reliable services

9.2.2 E-RAN SOLUTIONS

9.2.2.1 E-RAN is advanced cellular network architecture for 5G enterprises

9.3 CORE NETWORK TECHNOLOGY

TABLE 20 MARKET, BY CORE NETWORK TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 21 MARKET FOR CORE NETWORK TECHNOLOGY, BY REGION, 2021–2027 (USD MILLION)

9.3.1 SOFTWARE-DEFINED NETWORKING (SDN)

9.3.1.1 SDN is dynamic and cost-effective technology that helps operators to make quick changes in network according to business requirements

9.3.2 NETWORK FUNCTIONS VIRTUALIZATION (NFV)

9.3.2.1 NFV assists network operators in implementing different network functions via software solutions

10 5G ENTERPRISE MARKET, BY SPECTRUM (Page No. - 127)

10.1 INTRODUCTION

FIGURE 57 LICENSED SPECTRUM TO HOLD SIGNIFICANT SIZE OF MARKET THROUGHOUT FORECAST PERIOD

TABLE 22 MARKET, BY SPECTRUM, 2021–2027 (USD MILLION)

10.2 LICENSED

10.2.1 LICENSED SPECTRUM IS EXPECTED TO REMAIN AS CORE 5G SPECTRUM MANAGEMENT APPROACH

10.3 UNLICENSED/SHARED

10.3.1 SPECTRUM SHARING AND UNLICENSED BANDS ALLOW 5G OPERATORS TO IMPROVE USER EXPERIENCE

11 5G ENTERPRISE MARKET, BY FREQUENCY BAND (Page No. - 130)

11.1 INTRODUCTION

FIGURE 58 MMWAVE TO LEAD MARKET IN COMING YEARS

TABLE 23 MARKET, BY FREQUENCY BAND, 2021–2027 (USD MILLION)

11.2 SUB-6 GHZ

11.2.1 SUB-6 GHZ OFFERS AMALGAMATION OF COVERAGE AND CAPACITY BENEFITS

TABLE 24 MARKET FOR SUB-6 GHZ, BY REGION, 2021–2027 (USD MILLION)

11.3 MMWAVE

11.3.1 MILLIMETER WAVE FREQUENCY BAND RANGES FROM 30 TO 300 GHZ

TABLE 25 MARKET FOR MMWAVE, BY REGION, 2021–2027 (USD MILLION)

12 5G ENTERPRISE MARKET, BY ORGANIZATION SIZE (Page No. - 134)

12.1 INTRODUCTION

FIGURE 59 LARGE ENTERPRISES TO HOLD MAJOR MARKET SIZE IN 2021

TABLE 26 MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

12.2 SMALL AND MEDIUM-SIZED ENTERPRISES

12.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES ADOPT 5G ENTERPRISE NETWORK TO REDUCE CAPEX

TABLE 27 MARKET FOR SMALL AND MEDIUM-SIZED ENTERPRISES, BY REGION, 2021–2027 (USD MILLION)

TABLE 28 MARKET FOR SMALL AND MEDIUM-SIZED ENTERPRISES IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 29 MARKET FOR SMALL AND MEDIUM-SIZED ENTERPRISES IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 30 MARKET FOR SMALL AND MEDIUM-SIZED ENTERPRISES IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 31 MARKET FOR SMALL AND MEDIUM-SIZED ENTERPRISES IN ROW, BY REGION, 2021–2027 (USD MILLION)

12.3 LARGE ENTERPRISES

12.3.1 LARGE ENTERPRISES REQUIRE WIRELESS, AFFORDABLE, AND SWIFT 5G ENTERPRISE NETWORK SOLUTIONS

TABLE 32 MARKET FOR LARGE ENTERPRISES, BY REGION, 2021–2027 (USD MILLION)

TABLE 33 MARKET FOR LARGE ENTERPRISES IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 34 MARKET FOR LARGE ENTERPRISES IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 35 MARKET FOR LARGE ENTERPRISES IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 36 MARKET FOR LARGE ENTERPRISES IN ROW, BY REGION, 2021–2027 (USD MILLION)

13 5G ENTERPRISE MARKET, BY APPLICATION (Page No. - 141)

13.1 INTRODUCTION

FIGURE 60 AR/VR WILL BE FASTEST-GROWING APPLICATION IN MARKET FROM 2021 TO 2027

TABLE 37 MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

13.1.1 MOBILE ROBOTS OR AUTOMATED GUIDED VEHICLES

13.1.1.1 5G-enabled AGVs ensure industrial connectivity and optimize manufacturing process

13.1.2 VIDEO ANALYTICS

13.1.2.1 5G plays crucial role in making cities smarter and more secure through video analytics technique

13.1.3 AR/VR

13.1.3.1 5G mobile networks can accelerate adoption of AR/VR

13.1.4 DRONES

13.1.4.1 Drones with 5G connectivity play pivotal role in remote manufacturing, industrial application and control, and smart agriculture applications

13.1.5 COMMUNICATION

13.1.5.1 5G network is designed to connect everything virtually together

13.1.6 OTHERS

14 5G ENTERPRISE MARKET, BY VERTICAL (Page No. - 146)

14.1 INTRODUCTION

FIGURE 61 MANUFACTURING SECTOR TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 38 MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

14.2 BFSI

14.2.1 BFSI ENTERPRISES REQUIRE RELIABLE NETWORK INFRASTRUCTURE FOR HANDLING NUMEROUS CALLS AND VOLUMINOUS DATA

TABLE 39 MARKET FOR BFSI, BY REGION, 2021–2027 (USD MILLION)

14.3 MANUFACTURING

14.3.1 HIGH-SPEED DATA TRANSFER AND LOW LATENCY MAKE 5G PREFERRED CHOICE FOR MACHINE-TYPE COMMUNICATION (MTC)

TABLE 40 MARKET FOR MANUFACTURING, BY REGION,2021–2027 (USD MILLION)

14.4 ENERGY & UTILITIES

14.4.1 5G CAN EMPOWER UTILITIES TO SUPPORT DIGITIZATION OF SEVERAL UTILITY-DRIVEN FIELDWORKS

TABLE 41 MARKET FOR ENERGY & UTILITIES, BY REGION, 2021–2027 (USD MILLION)

14.5 RETAIL

14.5.1 RETAIL INDUSTRY TO ADOPT NEXT LEVEL OF AUTOMATION IN WAREHOUSE MANAGEMENT AND RELATED SERVICES

TABLE 42 5G ENTERPRISE MARKET FOR RETAIL, BY REGION,2021–2027 (USD MILLION)

14.6 HEALTHCARE

14.6.1 5G NETWORK INFRASTRUCTURE FACILITATES HD VIDEO CALLS AND IMAGES FOR HEALTHCARE APPLICATIONS

TABLE 43 MARKET FOR HEALTHCARE, BY REGION,2021–2027 (USD MILLION)

14.7 GOVERNMENT AND PUBLIC SAFETY

14.7.1 5G CONNECTIVITY WILL PROVIDE FASTER AND MORE ROBUST NETWORK NECESSARY FOR SURVEILLANCE SYSTEMS

TABLE 44 MARKET FOR GOVERNMENT AND PUBLIC SAFETY,BY REGION, 2021–2027 (USD MILLION)

14.8 TRANSPORTATION AND LOGISTICS

14.8.1 BROADBAND CONNECTIVITY IS LIKELY TO BECOME OPERATIONAL REQUIREMENT IN NEAR FUTURE

TABLE 45 MARKET FOR TRANSPORTATION AND LOGISTICS,BY REGION, 2021–2027 (USD MILLION)

14.9 AEROSPACE & DEFENSE

14.9.1 5G CAN OFFER HIGH DATA TRANSFER SPEEDS AND RELIABLE CONNECTIVITY TO AEROSPACE & DEFENSE VERTICAL

TABLE 46 MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2021–2027 (USD MILLION)

14.10 MEDIA & ENTERTAINMENT

14.10.1 OTT PLATFORMS WOULD ADOPT 5G TECHNOLOGY TO ENABLE USERS TO WATCH MORE CONTENT AT HIGHER QUALITY AND WITHOUT BUFFERING

TABLE 47 MARKET FOR MEDIA & ENTERTAINMENT, BY REGION, 2021–2027 (USD MILLION)

14.11 OFFICE BUILDINGS

14.11.1 5G HAS POTENTIAL TO BRING ULTRA-SMART OFFICE BUILDINGS IN REALITY

TABLE 48 5G ENTERPRISE MARKET FOR OFFICE BUILDINGS, BY REGION, 2021–2027 (USD MILLION)

15 GEOGRAPHIC ANALYSIS (Page No. - 158)

15.1 INTRODUCTION

FIGURE 62 MARKET IN SOUTH KOREA TO GROW AT HIGHEST CAGR FROM 2021 TO 2027

TABLE 49 MARKET, BY REGION, 2020–2027 (USD MILLION)

15.2 NORTH AMERICA

15.2.1 NORTH AMERICA: COVID-19 IMPACT

FIGURE 63 SNAPSHOT: 5G ENTERPRISE MARKET IN NORTH AMERICA

TABLE 50 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 51 MARKET IN NORTH AMERICA, BY FREQUENCY BAND, 2020–2027 (USD MILLION)

TABLE 52 MARKET IN NORTH AMERICA, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 53 MARKET IN NORTH AMERICA, BY VERTICAL, 2020–2027 (USD MILLION)

15.2.2 US

15.2.2.1 Plan of National Security Council to develop its own 5G wireless network in US would accelerate market growth

TABLE 54 MARKET IN US, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 55 MARKET IN US, BY VERTICAL, 2020–2027 (USD MILLION)

15.2.3 CANADA

15.2.3.1 Adoption of radio nodes and proliferation of IoT technology would foster Canadian market growth from 2021 to 2027

TABLE 56 MARKET IN CANADA, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 57 MARKET IN CANADA, BY VERTICAL, 2020–2027 (USD MILLION)

15.2.4 MEXICO

15.2.4.1 Adoption of emerging telecommunication and digital commerce technologies by Mexican mobile operators would boost demand for 5G enterprise network

TABLE 58 5G ENTERPRISE MARKET IN MEXICO, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 59 MARKET IN MEXICO, BY VERTICAL, 2020–2027 (USD MILLION)

15.3 EUROPE

15.3.1 EUROPE: COVID-19 IMPACT

FIGURE 64 SNAPSHOT: 5G ENTERPRISE MARKET IN EUROPE

TABLE 60 MARKET IN EUROPE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 61 MARKET IN EUROPE, BY FREQUENCY BAND, 2020–2027 (USD MILLION)

TABLE 62 MARKET IN EUROPE, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 63 MARKET IN EUROPE, BY VERTICAL, 2020–2027 (USD MILLION)

15.3.2 UK

15.3.2.1 Smart city transformation program in UK to stimulate demand for foster Canadian market growth from 2021 to 2027

TABLE 64 MARKET IN UK, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 65 MARKET IN UK, BY VERTICAL, 2020–2027 (USD MILLION)

15.3.3 GERMANY

15.3.3.1 Smart grid projects, along with adoption of smart city technologies, to propel market growth in country

TABLE 66 MARKET IN GERMANY, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 67 MARKET IN GERMANY, BY VERTICAL, 2020–2027 (USD MILLION)

15.3.4 FRANCE

15.3.4.1 Adoption of IoT to catalyze growth of market in France

TABLE 68 5G ENTERPRISE MARKET IN FRANCE, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 69 MARKET IN FRANCE, BY VERTICAL, 2020–2027 (USD MILLION)

15.3.5 REST OF EUROPE

TABLE 70 MARKET IN REST OF EUROPE, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 71 MARKET IN REST OF EUROPE, BY VERTICAL, 2020–2027 (USD MILLION)

15.4 APAC

15.4.1 APAC: COVID-19 IMPACT

FIGURE 65 SNAPSHOT: 5G ENTERPRISE MARKET IN APAC

TABLE 72 MARKET IN APAC, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 73 MARKET IN APAC, BY FREQUENCY BAND, 2020–2027 (USD MILLION)

TABLE 74 MARKET IN APAC, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 75 MARKET IN APAC, BY VERTICAL, 2020–2027 (USD MILLION)

15.4.2 CHINA

15.4.2.1 Deployment of advanced manufacturing technologies such as IoT and robotics to bolster market growth in China

TABLE 76 MARKET IN CHINA, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 77 MARKET IN CHINA, BY VERTICAL, 2020–2027 (USD MILLION)

15.4.3 JAPAN

15.4.3.1 Participation of government in rapid development and deployment of 5G networks to augment market growth in Japan

TABLE 78 MARKET IN JAPAN, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 79 MARKET IN JAPAN, BY VERTICAL, 2020–2027 (USD MILLION)

15.4.4 SOUTH KOREA

15.4.4.1 Investment by telecom operators in South Korean in building 5G base stations to spur market growth

TABLE 80 5G ENTERPRISE MARKET IN SOUTH KOREA, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 81 MARKET IN SOUTH KOREA, BY VERTICAL, 2020–2027 (USD MILLION)

15.4.5 REST OF APAC

TABLE 82 MARKET IN REST OF APAC, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 83 MARKET IN REST OF APAC, BY VERTICAL, 2020–2027 (USD MILLION)

15.5 ROW

FIGURE 66 SNAPSHOT: 5G ENTERPRISE MARKET IN ROW

TABLE 84 MARKET IN ROW, BY REGION, 2020–2027 (USD MILLION)

TABLE 85 MARKET IN ROW, BY FREQUENCY BAND, 2020–2027 (USD MILLION)

TABLE 86 MARKET IN ROW, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 87 MARKET IN ROW, BY VERTICAL, 2020–2027 (USD MILLION)

15.5.1 SOUTH AMERICA

15.5.1.1 Formulation of new telecommunication policies and adoption of IoT to encourage demand for 5G enterprise networks

TABLE 88 MARKET IN SOUTH AMERICA, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 89 MARKET IN SOUTH AMERICA, BY VERTICAL, 2020–2027 (USD MILLION)

15.5.2 MIDDLE EAST AND AFRICA

15.5.2.1 Growth in mobile subscribers, along with flexible government regulations for telecom operators, to provide growth opportunity for 5G network development

TABLE 90 MARKET IN MIDDLE EAST AND AFRICA, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 91 MARKET IN MIDDLE EAST AND AFRICA, BY VERTICAL, 2020–2027 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 193)

16.1 INTRODUCTION

FIGURE 67 COMPANIES ADOPTED PRODUCT LAUNCHES AND DEVELOPMENTS, PARTNERSHIPS, AND EXPANSIONS AS KEY GROWTH STRATEGIES FROM JANUARY 2019 TO MARCH 2021

16.2 MARKET EVALUATION FRAMEWORK

TABLE 92 OVERVIEW OF STRATEGIES DEPLOYED BY KEY 5G ENTERPRISE SOLUTION PROVIDERS

16.2.1 PRODUCT PORTFOLIO

16.2.2 REGIONAL FOCUS

16.2.3 MANUFACTURING FOOTPRINT

16.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

16.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 68 REVENUE OF TOP FIVE PLAYERS IN MARKET, 2015–2019

16.4 MARKET SHARE ANALYSIS, 2020

FIGURE 69 SHARE RANGE OF KEY COMPANIES IN MARKET, 2020

TABLE 93 5G ENTERPRISE MARKET: DEGREE OF COMPETITION

16.5 RANKING ANALYSIS OF KEY PLAYERS IN MARKET

FIGURE 70 MARKET RANKING, 2020

16.6 COMPANY EVALUATION QUADRANT

TABLE 94 COMPANY INDUSTRY FOOTPRINT

TABLE 95 COMPANY APPLICATION FOOTPRINT

TABLE 96 COMPANY REGION FOOTPRINT

TABLE 97 COMPANY FOOTPRINT

16.6.1 5G ENTERPRISE MARKET

16.6.1.1 Star

16.6.1.2 Emerging leader

16.6.1.3 Pervasive

16.6.1.4 Participant

FIGURE 71 MARKET: COMPANY EVALUATION QUADRANT, 2020

16.7 STARTUP/SME EVALUATION MATRIX

16.7.1 PROGRESSIVE COMPANIES

16.7.2 RESPONSIVE COMPANIES

16.7.3 DYNAMIC COMPANIES

16.7.4 STARTING BLOCKS

FIGURE 72 5G ENTERPRISE MARKET: STARTUP/SME EVALUATION MATRIX, 2020

16.8 COMPETITIVE SCENARIO

FIGURE 73 MARKET EVALUATION FRAMEWORK: PRODUCT LAUNCHES, PARTNERSHIPS, AND EXPANSIONS & COLLABORATIONS HAVE BEEN KEY GROWTH STRATEGIES ADOPTED BY MARKET PLAYERS FROM JANUARY 2019 TO MARCH 2021

16.9 COMPETITIVE SITUATIONS AND TRENDS

16.9.1 PRODUCT LAUNCHES

TABLE 98 5G ENTERPRISE MARKET: PRODUCT LAUNCHES, JANUARY 2019 TO MARCH 2021

16.9.2 PARTNERSHIPS

TABLE 99 MARKET: PARTNERSHIPS, JANUARY 2019 TO MARCH 2021

16.9.3 EXPANSIONS

TABLE 100 MARKET: EXPANSIONS, JANUARY 2019 TO MARCH 2021

16.9.4 DEALS

TABLE 101 MARKET: DEALS, JANUARY 2019 TO MARCH 2021

17 COMPANY PROFILES (Page No. - 211)

17.1 KEY PLAYERS

(Business overview, Products/services/solutions offered, Recent Developments, MNM view)*

17.1.1 HUAWEI TECHNOLOGIES

TABLE 102 HUAWEI TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 74 HUAWEI TECHNOLOGIES: COMPANY SNAPSHOT

17.1.2 ERICSSON

TABLE 103 ERICSSON: BUSINESS OVERVIEW

FIGURE 75 ERICSSON: COMPANY SNAPSHOT

17.1.3 NOKIA NETWORKS

TABLE 104 NOKIA NETWORKS: BUSINESS OVERVIEW

FIGURE 76 NOKIA NETWORKS: COMPANY SNAPSHOT

17.1.4 SAMSUNG

TABLE 105 SAMSUNG: BUSINESS OVERVIEW

FIGURE 77 SAMSUNG: COMPANY SNAPSHOT

17.1.5 ZTE

TABLE 106 ZTE: BUSINESS OVERVIEW

FIGURE 78 ZTE: COMPANY SNAPSHOT

17.1.6 NEC

TABLE 107 NEC: BUSINESS OVERVIEW

FIGURE 79 NEC: COMPANY SNAPSHOT

17.1.7 ORACLE

TABLE 108 ORACLE: BUSINESS OVERVIEW

FIGURE 80 ORACLE: COMPANY SNAPSHOT

17.1.8 CISCO

TABLE 109 CISCO: BUSINESS OVERVIEW

FIGURE 81 CISCO: COMPANY SNAPSHOT

17.1.9 CIENA

TABLE 110 CIENA: BUSINESS OVERVIEW

FIGURE 82 CIENA: COMPANY SNAPSHOT

17.1.10 JUNIPER NETWORKS

TABLE 111 JUNIPER NETWORKS: BUSINESS OVERVIEW

FIGURE 83 JUNIPER NETWORKS: COMPANY SNAPSHOT

17.1.11 HEWLETT PACKARD ENTERPRISE

TABLE 112 HEWLETT PACKARD ENTERPRISE: BUSINESS OVERVIEW

FIGURE 84 HEWLETT PACKARD ENTERPRISE: COMPANY SNAPSHOT

17.1.12 AFFIRMED NETWORKS (MICROSOFT)

TABLE 113 AFFIRMED NETWORKS (MICROSOFT): BUSINESS OVERVIEW

FIGURE 85 AFFIRMED NETWORKS (MICROSOFT): COMPANY SNAPSHOT

17.1.13 MAVENIR

TABLE 114 MAVENIR: BUSINESS OVERVIEW

17.1.14 CELONA

TABLE 115 CELONA: BUSINESS OVERVIEW

17.1.15 AIRSPAN NETWORKS

TABLE 116 AIRSPAN NETWORKS: BUSINESS OVERVIEW

17.2 OTHER PLAYERS

17.2.1 COMMSCOPE

17.2.2 VMWARE

17.2.3 EXTREME NETWORKS

17.2.4 COMBA TELECOM SYSTEMS

17.2.5 AMERICAN TOWER

17.2.6 FUJITSU

17.2.7 VERIZON COMMUNICATIONS

17.2.8 AT&T

17.2.9 SK TELECOM

17.2.10 T-MOBILE

*Details on Business overview, Products/services/solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

18 APPENDIX (Page No. - 264)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATIONS

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

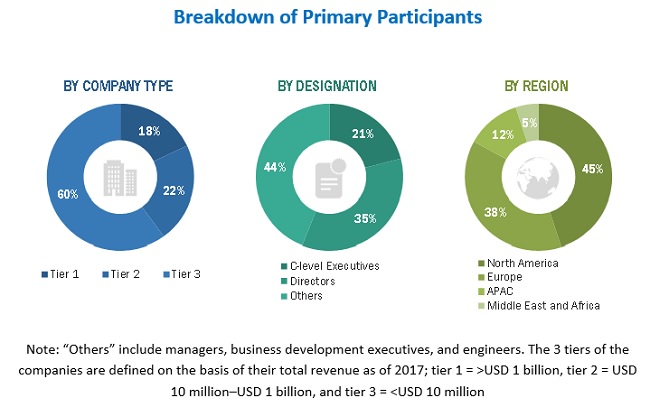

The study involved 4 major activities in estimating the current size of the 5G enterprise market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the 5G enterprise market begins with capturing the data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for the technical and commercial study of the 5G enterprise market. Secondary sources also include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, market’s value chain, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the 5G enterprise market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the 5G enterprise market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the 5G enterprise market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the 5G enterprise market, by network type, operator model, infrastructure, spectrum, frequency band, organization size, application, and vertical, in terms of value

- To describe and forecast the market size for various segments with regard to 4 main regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To describe the 5G enterprise supply chain, ecosystem, Porter’s five forces, trade data analysis, pricing analysis, patent analysis, tariff, and regulatory landscape

- To provide a detailed impact of COVID-19 on the 5G enterprise market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the 5G enterprise market and describe the competitive landscape of the market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies

- To analyze competitive developments such as product launches/ developments, partnerships, and expansions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G Enterprise Market

As a test probe and service vendor, we are looking for new opportunity regadring private 5G. We suppose there are new test/monitor demands for deploying mission critical application ulitilzing new radio technology and KPI (such as URLLC). We also want to know supply chain of private 5G products consisting of not only base station device/software but also test/monitring srevice. Thank you very much.