5G in Healthcare Market by Component (Hardware, Connectivity, Services), Application (Remote Patient Monitoring, Connected Medical Devices, AR/VR, Connected Ambulance, Asset Tracking), End User (Healthcare Providers, Payers) & Region - Global Forecast to 2026

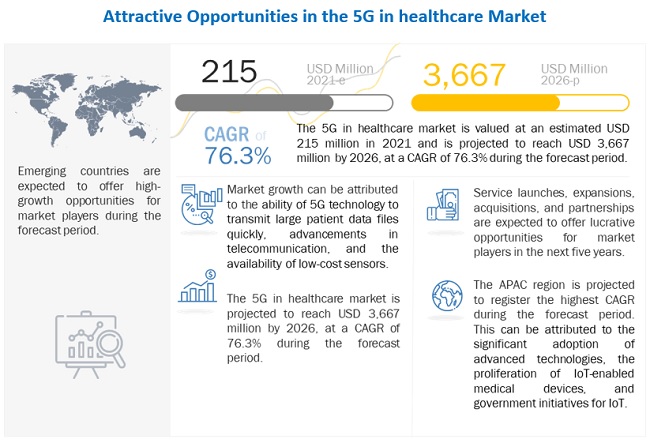

The global 5G in healthcare market in terms of revenue was estimated to be worth $215 million in 2021 and is poised to reach $3,667 million by 2026, growing at a CAGR of 76.3% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The increasing adoption of telehealth and robotic surgery and the rising adoption of 5G-enabled wearable medical devices for real-time remote patient monitoring are key factors driving the growth of this market. The ability of 5G technology to transmit large patient data files quickly, advancements in telecommunication, and the availability of low-cost sensors are other major factors that are driving the growth of this market. However, the high cost of deployment of the 5G network is expected to restrain the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

5G in Healthcare Market Dynamics

Driver: Increasing adoption of telehealth and robotics surgery

The increasing adoption of telehealth and robotic surgery is a key driver of growth in the market. Telehealth and robotic surgery allow for more efficient and precise diagnosis and treatment of patients. These technologies also enable remote monitoring of patients, which increases patient safety and convenience. The use of 5G will enable faster and more reliable communication between doctors and patients, providing more efficient healthcare services. Additionally, advances in 5G technology will enable remote surgeries, which will reduce the need for expensive and time-consuming in-person surgeries. This will reduce healthcare costs and improve patient access to care.

Restraint: High cost of deployment of the 5G network

5G in the healthcare market provides a number of advantages, such as faster data exchange, improved data security, and improved connectivity. However, one of the major restraints for 5G in the healthcare market is the high cost of deployment of the 5G network. The cost of deploying a 5G network is significantly higher than its predecessors, such as 4G and 3G networks, due to the need for new infrastructure and hardware. Additionally, the cost of the 5G-enabled devices is also higher than that of those used with older networks. This high cost of deployment and hardware can act as a major restraint on the growth of 5G in the healthcare market.

Opportunity: Role of AI in 5G healthcare

5G technology has revolutionized the healthcare sector with its higher speed, low latency, and improved data accuracy. It has enabled healthcare providers to access and analyze patient information quickly and accurately. The combination of 5G technology and AI can bring about massive improvements in the healthcare sector. AI can be used to automate mundane tasks, allowing healthcare providers to focus on providing better care. AI can be used to create personalized healthcare plans for patients, analyze data to detect anomalies and disease outbreaks, and help healthcare providers make informed decisions. AI can also be used to analyze medical images and identify potential health issues quickly and accurately. By leveraging 5G and AI together, healthcare providers can provide higher-quality care at a lower cost.

Challenge: Data breach and security concerns

The increasing use of 5G technology in the healthcare industry has brought with it a number of challenges related to data breaches and security. As 5G technology allows for greater data storage, transmission, and retrieval, it also opens up the possibility of data breaches and cyberattacks. The healthcare industry is particularly vulnerable to such threats, as medical data is highly sensitive and can put patients at risk. Therefore, it is essential for healthcare organizations to invest in strong security protocols and encryption technologies to ensure the safety of their data. Additionally, healthcare organizations must ensure that all of their connected devices are secure and regularly updated with the latest security patches.

The hardware segment accounted for the largest share of the 5G in healthcare industry.

Based on component, the 5G in healthcare market is segmented into hardware, services, and connectivity. The hardware segment accounted for the largest share of the market. This segment is projected to reach USD 1,871.7 million by 2026, at a CAGR of 76.0% during the forecast period. The large share of this segment can primarily be attributed to the need for frequent upgradation or replacement to make optimal use of the latest software available in the market.

The Connected Medical Devices segment accounted for the largest share of 5G in healthcare industry.

Based on application, the 5G in healthcare market is segmented into remote patient monitoring, connected ambulances, connected medical devices, asset tracking for medical devices, and AR/VR. The connected medical devices segment accounted for the largest share of the market. This application segment is projected to reach USD 1,405.3 million by 2026 from USD 94.5 million in 2021, at a CAGR of 71.6% during the forecast period. The large share of this segment can be attributed to the growth of the telehealth market and the growing inclination towards home healthcare. The high burden of COVID-19, increasing healthcare costs, strong government support and initiatives, and the growing focus on quality of care and patient safety are further driving the market for connected medical devices in the global market.

The healthcare providers segment accounted for the largest share of the 5G in healthcare industry.

Based on end users, the 5G in healthcare market is segmented into healthcare providers, healthcare payers, and other end users. The healthcare providers segment accounted for the largest share of the market. This end-user segment is projected to reach USD 3,011.1 million by 2026 from USD 170.4 million in 2021, at a CAGR of 77.6% during the forecast period. The large share of this segment can be attributed to the rising need for an efficient healthcare system, growing patient volume, increasing number of hospitals and ambulatory care centers, growth in telehealth, rising adoption of 5G-enabled wearable medical devices, and the rising demand for better technologies that help in the easy transfer of large data files.

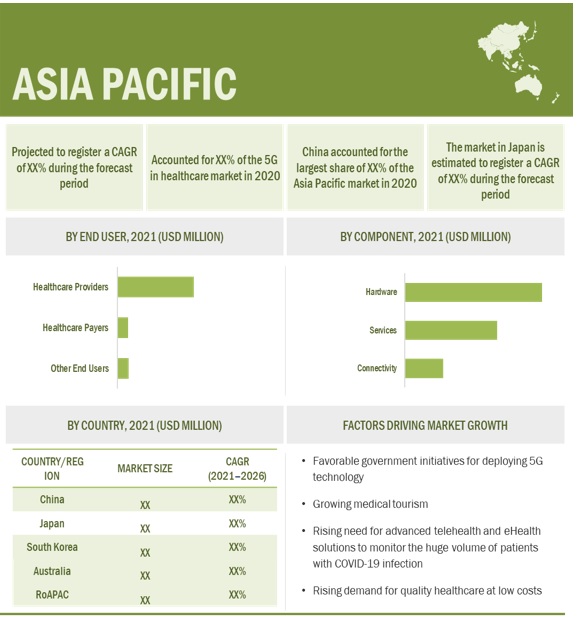

Asia Pacific was the largest regional market for 5G in healthcare industry.

The 5G in healthcare market is segmented into five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific accounted for the largest share of the global market, at 33.8%. This growth can be attributed to the significant adoption of advanced technologies, the increasing number of IoT-enabled medical devices, continuously enhancing network connectivity, and government initiatives for IoT.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in the 5G in healthcare market include AT&T (US), Verizon (US), China Mobile Limited (China), T-Mobile (US), Ericsson (Sweden), Telit (Poland), Telus (Canada), Vodafone (UK), Nokia (Finland), Samsung (South Korea), Deutsche Telekom AG (Germany), Orange S.A. (France), SK Telecom Co., Ltd. (South Korea), BT Group (UK), NTT DOCOMO (UK), NEC Corporation (Japan), Telefónica (Spain), Airtel (India), Huawei Technologies Co., Ltd. (China), Cisco (US), Sierra Wireless (Canada), Swisscom (Switzerland), Qualcomm (US), Fibocom Wireless Inc. (China), Quectel (China), and Sequans (France).

Scope of the 5G in Healthcare Industry

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$215 million |

|

Projected Revenue by 2026 |

$3,667 million |

|

Revenue Rate |

Poised to grow at a CAGR of 76.3% |

|

Market Driver |

Increasing adoption of telehealth and robotics surgery |

|

Market Opportunity |

Role of AI in 5G healthcare |

The study categorizes the 5G in healthcare market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Hardware

- Services

- Connectivity

By Application

- Connected Medical Devices

- Remote Patient Monitoring

- AR/VR

- Asset tracking for medical devices

- Connected Ambulance

By End Users

- Healthcare Providers

- Healthcare Payers

- Other End Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments of 5G in Healthcare Industry

- Cisco and Accedian: In February 2022, Cisco announced its acquisition of Accedian, a Montreal-based provider of 5G network performance solutions for the healthcare industry. The acquisition will strengthen Cisco’s 5G network portfolio and help healthcare customers optimize network performance, security, and reliability.

- AT&T and Aira: AT&T announced in October 2022 its acquisition of Aira, a San Diego-based provider of 5G-enabled remote healthcare solutions. The acquisition will help AT&T expand its 5G capabilities in the healthcare industry and enable Aira to offer more comprehensive remote healthcare solutions to healthcare providers.

- Nokia and Vodafone: Nokia announced its acquisition of Vodafone’s 5G and IoT business in February 2023. The acquisition will strengthen Nokia’s 5G capabilities and help Vodafone create a more comprehensive 5G offering for healthcare customers.

- Qualcomm and Xilinx: Qualcomm announced in March 2023 its acquisition of Xilinx, a San Jose-based provider of 5G technologies for the healthcare industry. The acquisition will strengthen Qualcomm’s 5G portfolio and help healthcare customers optimize their networks for better performance and reliability.

- Ericsson and Cisco: Ericsson announced its acquisition of Cisco’s 5G and IoT business in May 2023. The acquisition will expand Ericsson’s 5G capabilities and help Cisco’s healthcare customers leverage 5G technology to improve patient care.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the 5G in healthcare market?

The 5G in healthcare market boasts a total revenue value of $3,667 million by 2026.

What is the estimated growth rate (CAGR) of the 5G in healthcare market?

The global 5G in healthcare market has an estimated compound annual growth rate (CAGR) of 76.3% and a revenue size in the region of $215 million in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 5G IN HEALTHCARE INDUSTRY DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKETS COVERED

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.4 LIMITATIONS

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Insights from primary experts

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION: 5G IN HEALTHCARE MARKET

FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE FROM 5G IOT VENDORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE): DEMAND-SIDE MARKET ESTIMATIONS THROUGH APPLICATION/USE CASES

FIGURE 8 CAGR PROJECTIONS: OVERALL GLOBAL 5G IN HEALTHCARE MARKET

2.2.1 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET RANKING ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: GLOBAL 5G IN HEALTHCARE MARKET

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 10 5G IN HEALTHCARE MARKET, BY COMPONENT, 2021 VS. 2026 (USD MILLION)

FIGURE 11 GLOBAL 5G IN HEALTHCARE INDUSTRY, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 12 GLOBAL MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL 5G IN HEALTHCARE INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 MARKET OVERVIEW

FIGURE 14 RISING ADOPTION OF 5G-ENABLED WEARABLE MEDICAL DEVICES FOR REAL-TIME REMOTE PATIENT MONITORING TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: 5G IN HEALTHCARE INDUSTRY, BY END USER AND COUNTRY (2020)

FIGURE 15 HEALTHCARE PROVIDERS ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2020

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 JAPAN TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4.4 REGIONAL MIX: GLOBAL 5G IN HEALTHCARE MARKET (2019−2026)

FIGURE 17 ASIA PACIFIC WILL DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

4.5 GLOBAL 5G IN HEALTHCARE MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 18 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

TABLE 3 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Increasing adoption of telehealth and robotics surgery due to COVID-19

5.2.1.2 Rising adoption of 5G-enabled wearable medical devices for real-time remote patient monitoring

FIGURE 19 SMARTPHONE USERS AND PENETRATION WORLDWIDE, 2016–2021

5.2.1.3 Ability of 5G technology to transmit large patient data files quickly

5.2.1.4 Advancements in telecommunication

5.2.1.5 Availability of low-cost sensors

5.2.2 RESTRAINTS

5.2.2.1 High cost of deployment of the 5G network

5.2.3 OPPORTUNITIES

5.2.3.1 Role of AI in 5G healthcare

5.2.3.2 High reliability and low latency 5G networks to accelerate a new wave of healthcare applications

5.2.4 CHALLENGES

5.2.4.1 Delay in spectrum harmonization across geographies

5.2.4.2 Data breach and security concerns

FIGURE 20 US: NUMBER OF DATA BREACHES (2005–2020)

6 INDUSTRY INSIGHTS (Page No. - 58)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 RISING DEMAND FOR 5G TECHNOLOGY ACROSS THE HEALTHCARE CONTINUUM

FIGURE 21 TELECOM OPERATOR REVENUE POTENTIAL IN ADDRESSING HEALTHCARE INDUSTRY DIGITALIZATION WITH 5G IN 2026

6.2.2 5G-ENABLED INTERNET OF MEDICAL THINGS (IMOT)

FIGURE 22 5G HEALTHCARE USE CASES

6.2.3 5G-ENABLED HEALTHCARE TRAINING AND THERAPEUTIC & REHABILITATIVE USES FOR AR/VR

6.2.4 PRIVATE 5G NETWORKS

6.3 TECHNOLOGY ANALYSIS

6.3.1 INTRODUCTION

FIGURE 23 COMPARISON OF 5G TECHNOLOGY SPECIFICATIONS TO OTHER WIRELESS PROTOCOLS

6.3.2 WI-FI

6.3.3 WIMAX

6.3.4 NETWORK SLICING IN RADIO ACCESS NETWORK

6.3.5 NETWORK SLICING IN CORE NETWORK

6.3.6 NETWORK SLICING IN TRANSPORT NETWORK

6.3.7 SMALL CELL NETWORKS

6.3.8 LONG-TERM EVOLUTION NETWORKS

6.3.9 CITIZENS BROADBAND RADIO SERVICES

6.3.10 MULTEFIRE

6.4 REGULATORY IMPLICATIONS

6.4.1 GENERAL DATA PROTECTION REGULATION

6.4.2 CALIFORNIA CONSUMER PRIVACY ACT

6.4.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

6.4.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

6.4.5 DIGITAL IMAGING AND COMMUNICATIONS IN MEDICINE

6.4.6 HEALTH LEVEL SEVEN

6.4.7 GRAMM-LEACH-BLILEY ACT

6.4.8 SARBANES-OXLEY ACT

6.4.9 SOC 2

6.4.10 COMMUNICATIONS DECENCY ACT

6.4.11 DIGITAL MILLENNIUM COPYRIGHT ACT

6.4.12 ANTI-CYBERSQUATTING CONSUMER PROTECTION ACT

6.4.13 LANHAM ACT

6.5 PRICING ANALYSIS

TABLE 4 GLOBAL MARKET: PRICING ANALYSIS

6.6 CASE STUDY ANALYSIS

6.6.1 CHINA MOBILE LIMITED

6.6.2 AT&T

6.7 ECOSYSTEM ANALYSIS

TABLE 5 GLOBAL MARKET: ECOSYSTEM MAPPING

FIGURE 24 GLOBAL MARKET: ECOSYSTEM MARKET MAP

6.7.1 5G TELECOM OPERATORS

6.7.2 5G MOBILE SENSOR/CHIPSET TECHNOLOGY PROVIDERS

6.7.3 5G MOBILE DEVICE MANUFACTURERS

6.7.4 END USER/APPLICATION/USE CASES

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 PORTER’S FIVE FORCES ANALYSIS

6.8.1 INTENSITY OF COMPETITIVE RIVALRY

6.9 COVID-19 IMPACT ON THE GLOBAL MARKET

6.10 PATENT ANALYSIS

TABLE 7 PATENTS IN GLOBAL MARKET

FIGURE 25 TOTAL NO. OF PATENTS FILED BY PLAYERS

FIGURE 26 FILING TREND

7 5G IN HEALTHCARE MARKET, BY COMPONENT (Page No. - 78)

7.1 INTRODUCTION

TABLE 8 GLOBAL 5G IN HEALTHCARE INDUSTRY, BY COMPONENT, 2019–2026 (USD MILLION)

7.2 HARDWARE

7.2.1 HARDWARE IS THE LARGEST COMPONENT SEGMENT OF THE GLOBAL MARKET

TABLE 9 GLOBAL MARKET FOR HARDWARE, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 SERVICES

7.3.1 SERVICES HELP END USERS EFFECTIVELY DESIGN AND OPERATE NETWORK INFRASTRUCTURE TO GAIN DESIRABLE BUSINESS OUTCOMES

7.3.2 PROFESSIONAL SERVICES

7.3.3 MANAGED SERVICES

TABLE 10 GLOBAL MARKET FOR SERVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 CONNECTIVITY

7.4.1 5G CONNECTIVITY TO BRING STRONG FOUNDATION FOR INTERNET OF THINGS USE CASES

TABLE 11 GLOBAL 5G IN HEALTHCARE INDUSTRY FOR CONNECTIVITY, BY COUNTRY, 2019–2026 (USD MILLION)

8 5G IN HEALTHCARE MARKET, BY APPLICATION (Page No. - 84)

8.1 INTRODUCTION

TABLE 12 GLOBAL 5G IN HEALTHCARE MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 CONNECTED MEDICAL DEVICES

8.2.1 CONNECTED MEDICAL DEVICES IS THE LARGEST APPLICATION SEGMENT OF THE GLOBAL MARKET

TABLE 13 GLOBAL MARKET FOR CONNECTED MEDICAL DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 REMOTE PATIENT MONITORING

8.3.1 PATIENT READMISSION RATE HAS BEEN REDUCING DUE TO THE AVAILABILITY OF PATIENT MONITORING KITS AT HIGH-SPEED 5G CONNECTIVITY

TABLE 14 GLOBAL MARKET FOR REMOTE PATIENT MONITORING, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 ASSET TRACKING FOR MEDICAL DEVICES

8.4.1 5G IOT ENABLES HEALTHCARE COMPANIES TO DEPLOY EFFICIENT IOT APPLICATIONS, WHICH HELPS THEM TRACK THEIR ASSETS IN REAL-TIME

TABLE 15 GLOBAL MARKET FOR ASSET TRACKING FOR MEDICAL DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 AR/VR

8.5.1 5G-POWERED AR AND VR ENABLES HEALTHCARE PROVIDERS TO VISUALIZE PROCEDURES IN AN ENGAGING, LEARNING-BY-DOING PRACTICE THAT WILL ENHANCE THEIR MEDICAL EDUCATION

TABLE 16 GLOBAL MARKET FOR AR/VR, BY COUNTRY, 2019–2026 (USD MILLION)

8.6 CONNECTED AMBULANCE

8.6.1 CONNECTED AMBULANCE IS EMPOWERED BY 5G’S HIGH BANDWIDTH, LOW LATENCY, AND ULTRA-RELIABLE CONNECTIVITY

TABLE 17 GLOBAL MARKET FOR CONNECTED AMBULANCE, BY COUNTRY, 2019–2026 (USD MILLION)

9 5G IN HEALTHCARE MARKET, BY END USER (Page No. - 92)

9.1 INTRODUCTION

TABLE 18 GLOBAL 5G IN HEALTHCARE INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.2 HEALTHCARE PROVIDERS

9.2.1 RISING NEED TO IMPROVE THE PROFITABILITY OF HEALTHCARE OPERATIONS TO BOOST THE USE OF 5G IN HEALTHCARE

TABLE 19 GLOBAL MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 HEALTHCARE PAYERS

9.3.1 INCREASED FOCUS ON OUTCOME-BASED PAYMENT MODELS TO DRIVE THE DEMAND FOR 5G IN HEALTHCARE

TABLE 20 GLOBAL MARKET FOR HEALTHCARE PAYERS, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 OTHER END USERS

TABLE 21 GLOBAL MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

10 5G IN HEALTHCARE MARKET, BY REGION (Page No. - 97)

10.1 INTRODUCTION

TABLE 22 GLOBAL 5G IN HEALTHCARE MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 23 APAC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 24 APAC: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 25 APAC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 26 APAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.1 CHINA

10.2.1.1 China dominates the APAC market

TABLE 27 CHINA: MACROECONOMIC INDICATORS

TABLE 28 CHINA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 29 CHINA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 30 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.2 JAPAN

10.2.2.1 Japan has a strong base of technologically advanced healthcare verticals that offer multiple opportunities for the growth of the 5G network

TABLE 31 JAPAN: MACROECONOMIC INDICATORS

TABLE 32 JAPAN: 5G IN HEALTHCARE MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 33 JAPAN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 34 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.3 SOUTH KOREA

10.2.3.1 Increased spending on geriatric health and coverage for major chronic diseases to support market growth in South Korea

TABLE 35 SOUTH KOREA: MACROECONOMIC INDICATORS

TABLE 36 SOUTH KOREA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 37 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 38 SOUTH KOREA: 5G IN HEALTHCARE INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.2.4 AUSTRALIA

10.2.4.1 Favorable R&D tax benefits offered in the country to drive market growth

TABLE 39 AUSTRALIA: MACROECONOMIC INDICATORS

TABLE 40 AUSTRALIA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 41 AUSTRALIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 42 AUSTRALIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.5 REST OF ASIA PACIFIC

TABLE 43 ROAPAC: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 44 ROAPAC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 45 ROAPAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 28 NORTH AMERICA: 5G IN HEALTHCARE MARKET SNAPSHOT

TABLE 46 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: 5G IN HEALTHCARE INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.3.1 US

10.3.1.1 The US dominates the North American market

TABLE 50 US: MACROECONOMIC INDICATORS

TABLE 51 US: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 52 US: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 53 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Deployment of digital services to drive market growth

TABLE 54 CANADA: MACROECONOMIC INDICATORS

TABLE 55 CANADA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 56 CANADA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 57 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4 EUROPE

TABLE 58 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 59 EUROPE: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 60 EUROPE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 61 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 Germany accounted for the largest share of the European 5G in healthcare market in 2020

TABLE 62 GERMANY: MACROECONOMIC INDICATORS

TABLE 63 GERMANY: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 64 GERMANY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 65 GERMANY: 5G IN HEALTHCARE INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.4.2 UK

10.4.2.1 Government initiatives favoring the adoption of digitalization to drive market growth

TABLE 66 UK: MACROECONOMIC INDICATORS

TABLE 67 UK: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 68 UK: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 69 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.3 REST OF EUROPE

TABLE 70 ROE: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 71 ROE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 72 ROE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 MARKET IN LATIN AMERICA IS IN THE NASCENT PHASE AND IS EXPECTED TO GROW AT A STEADY RATE IN THE FORECAST PERIOD

TABLE 73 LATIN AMERICA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 74 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 75 LATIN AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 RISING DEMAND FOR BETTER TECHNOLOGY-ENABLED MEDICAL DEVICES TO SUPPORT MARKET GROWTH

TABLE 76 MIDDLE EAST & AFRICA: 5G IN HEALTHCARE MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA: 5G IN HEALTHCARE INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 132)

11.1 INTRODUCTION

FIGURE 29 KEY DEVELOPMENTS BY MAJOR PLAYERS BETWEEN JANUARY 2018 AND AUGUST 2021

11.2 COMPETITIVE BENCHMARKING

11.2.1 COMPONENT FOOTPRINT OF COMPANIES

11.2.2 REGIONAL FOOTPRINT OF COMPANIES

11.3 5G IN HEALTHCARE MARKET: R&D EXPENDITURE

FIGURE 30 R&D EXPENDITURE OF KEY PLAYERS IN THE GLOBAL MARKET (2019 VS. 2020)

11.4 REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 31 GLOBAL 5G IN HEALTHCARE INDUSTRY: REVENUE ANALYSIS OF KEY MARKET PLAYERS (2020)

11.5 COMPETITIVE LEADERSHIP MAPPING

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 32 COMPETITIVE LEADERSHIP MAPPING: GLOBAL MARKET, 2020

11.6 MARKET RANKING ANALYSIS

FIGURE 33 GLOBAL MARKET RANKING ANALYSIS, BY KEY PLAYER, 2020

11.7 COMPETITIVE SITUATION AND TRENDS

11.7.1 COMPONENT LAUNCHES

11.7.2 DEALS

11.7.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 142)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 AT&T

TABLE 79 AT&T: BUSINESS OVERVIEW

FIGURE 34 AT&T: COMPANY SNAPSHOT (2020)

12.1.2 VERIZON

TABLE 80 VERIZON: BUSINESS OVERVIEW

FIGURE 35 VERIZON: COMPANY SNAPSHOT (2020)

12.1.3 ERICSSON

TABLE 81 ERICSSON: BUSINESS OVERVIEW

FIGURE 36 ERICSSON: COMPANY SNAPSHOT (2020)

12.1.4 T-MOBILE

TABLE 82 T-MOBILE: BUSINESS OVERVIEW

FIGURE 37 T-MOBILE: COMPANY SNAPSHOT (2020)

12.1.5 CHINA MOBILE LIMITED

TABLE 83 CHINA MOBILE LIMITED: BUSINESS OVERVIEW

FIGURE 38 CHINA MOBILE LIMITED: COMPANY SNAPSHOT (2020)

12.1.6 CISCO

TABLE 84 CISCO: BUSINESS OVERVIEW

FIGURE 39 CISCO: COMPANY SNAPSHOT (2020)

12.1.7 TELUS

TABLE 85 TELUS: BUSINESS OVERVIEW

FIGURE 40 TELUS: COMPANY SNAPSHOT (2020)

12.1.8 HUAWEI TECHNOLOGIES CO., LTD.

TABLE 86 HUAWEI TECHNOLOGIES CO., LTD.: BUSINESS OVERVIEW

FIGURE 41 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT (2020)

12.1.9 TELIT

TABLE 87 TELIT: BUSINESS OVERVIEW

FIGURE 42 TELIT: COMPANY SNAPSHOT (2020)

12.1.10 ORANGE S.A.

TABLE 88 ORANGE S.A.: BUSINESS OVERVIEW

FIGURE 43 ORANGE S.A.: COMPANY SNAPSHOT (2020)

12.1.11 TELEFÓNICA

TABLE 89 TELEFÓNICA: BUSINESS OVERVIEW

FIGURE 44 TELEFÓNICA: COMPANY SNAPSHOT (2020)

12.1.12 SK TELECOM CO., LTD.

TABLE 90 SK TELECOM CO., LTD.: BUSINESS OVERVIEW

FIGURE 45 SK TELEKOM CO., LTD.: COMPANY SNAPSHOT (2020)

12.1.13 SAMSUNG

TABLE 91 SAMSUNG: BUSINESS OVERVIEW

FIGURE 46 SAMSUNG: COMPANY SNAPSHOT (2020)

12.1.14 BT GROUP

TABLE 92 BT GROUP: BUSINESS OVERVIEW

FIGURE 47 BT GROUP: COMPANY SNAPSHOT (2020)

12.1.15 DEUTSCHE TELEKOM

TABLE 93 DEUTSCHE TELEKOM AG: BUSINESS OVERVIEW

FIGURE 48 DEUTSCHE TELEKOM AG: COMPANY SNAPSHOT (2020)

12.1.16 VODAFONE

TABLE 94 VODAFONE: BUSINESS OVERVIEW

FIGURE 49 VODAFONE: COMPANY SNAPSHOT (2020)

12.1.17 NOKIA

TABLE 95 NOKIA: BUSINESS OVERVIEW

FIGURE 50 NOKIA: COMPANY SNAPSHOT (2020)

12.1.18 NEC CORPORATION

TABLE 96 NEC CORPORATION: BUSINESS OVERVIEW

FIGURE 51 NEC CORPORATION: COMPANY SNAPSHOT (2020)

12.1.19 QUALCOMM

TABLE 97 QUALCOMM: BUSINESS OVERVIEW

FIGURE 52 QUALCOMM: COMPANY SNAPSHOT (2020)

12.1.20 NTT DOCOMO

TABLE 98 NTT DOCOMO: BUSINESS OVERVIEW

FIGURE 53 NTT DOCOMO: COMPANY SNAPSHOT (2020)

12.2 OTHER PLAYERS

12.2.1 SIERRA WIRELESS

12.2.2 QUECTEL

12.2.3 FIBOCOM

12.2.4 SWISSCOM

12.2.5 SEQUANS

12.2.6 AIRTEL

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 204)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

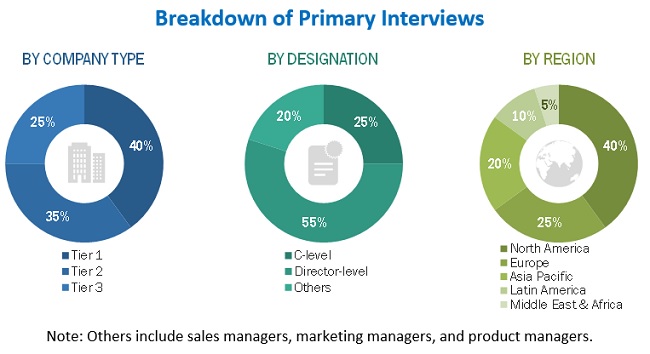

This study involved four major activities for estimating the current size of the 5G in healthcare market. Exhaustive secondary research was conducted to collect information on the market as well as its peer and parent markets. The next step focused on validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Revenue Share Analysis, bottom-up and top-down approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to identify and collect information for this study. These secondary sources include annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, and databases.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies operating in the real-world evidence solutions market. Primary sources from the demand side include experts from pharma and biopharma companies, experts from food industry and research centers. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on the key industry trends and key market dynamics, such as market drivers, restraints, challenges, and opportunities.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the real-world evidence solutions market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the 5G in healthcare market

The size of the global market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the global 5G in healthcare market based on component, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to the individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa (along with the major countries in these regions)

- To profile the key market players and comprehensively analyze their market shares and core competencies in the global market

- To track and analyze competitive developments such as business expansions, partnerships, agreements, collaborations, acquisitions, and product/service launches in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the RoAPAC market into India, New Zealand, Hong Kong, Singapore, and other countries

- Further breakdown of the RoE market into France, Italy, Russia, the Netherlands, Nordic countries, and other countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G in Healthcare Market