5G IoT Market by Component (Hardware, Platform, Connectivity, and Services), Network Type (5G Standalone and 5G Non-Standalone), Organization Size, Type (Short-range IoT Devices, Wide-range IoT Devices), End Users and Region - Global Forecast to 2028

Updated on : June 26, 2023

Market Overview

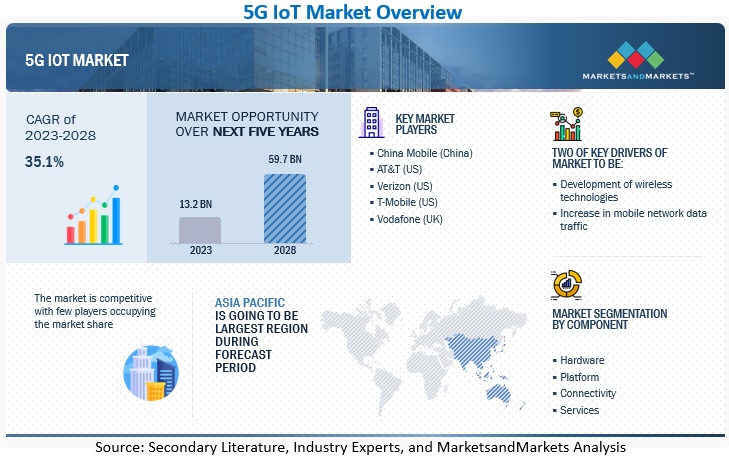

The size of the worldwide 5G IoT market is expected to increase from $13.2 billion in 2023 to $59.7 billion by 2028. This represents a growth rate of 35.1% over the forecast period. Increasing mobile network data traffic is driving 5G IoT market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

5G IoT Market Dynamics

Driver: Unleashing massive 5G IoT ecosystem and critical communication services

The growing popularity of IoT use cases in various sectors relying on connectivity spanning large areas and the increasing need to handle many connections have driven the demand for massive IoT technologies. Today, massive IoT is emerging as a new focal point for IoT connectivity technologies. It is an attractive opportunity for 5G, but telcos still rely on the current cellular IoT standards, such as the Narrowband Internet of Things (NB-IoT) in the early 5G era. 5G networks are expected to support the massive rollout of intelligent IoT nodes for a multitude of scenarios. They would also provide a competent platform to support the widespread adoption of critical communications services. Massive Machine Type Communication (mMTC) is developed as a part of the 3rd Generation Partnership Project (3GPP) Release 13/14 Low Power Wide Area Network (LPWAN) technologies, which include NB-IoT. These technologies are expected to meet most 5G mMTC requirements. The widespread adoption of IoT and continuous advancements in Machine-to-Machine (M2M) communication networks are transforming various verticals by connecting all types of devices, appliances, systems, and services.

Restraint: Lack of standardization in IoT protocols

As a diverse range of devices needs to be connected, the need to coordinate with these different devices has increased. Various devices use different hardware, run over different platforms, and are manufactured by different vendors. This incompatibility among devices, sensors, and even interfaces of remote servers causes the interoperability challenge in the IoT space. IoT involves every aspect of human life, and the challenge lies in unifying these standards so that M2M communication becomes user-friendly and flexible. Several associations and organizations are working toward resolving this issue. The existing interoperability standards, such as MTConnect, Ethernet for Control Automation Technology (EtherCAT), MCS-DCS Interface Standardization (MDIS), Master Control System (MCS), Distributed Control System (DCS), and Interface Standardization, promote data interchange across heterogeneous domains and industries. Companies currently use custom Application Programming Interfaces (APIs) and solutions for every IoT project. A common protocol and communication standard is required to enable communication among IoT-enabled devices to share data or form an intelligent network.

Opportunity: Development of smart infrastructure

Infrastructural initiatives, such as smart cities and smart buildings, are conceptual models designed to deliver a set of cutting-edge services and infrastructure. A smart city can be defined as a city that efficiently deploys its ICT infrastructure to improve the quality of life and augment the efficiency of urban operations and services. The city can be considered smart if it adheres to the following components: smart transportation, smart buildings, smart utilities, and smart citizen services. Therefore, the successful implementation of smart city projects heavily depends on the technologies—data communications, cloud, mobility, and sensors—which collectively form IoT. Due to a huge demand for rapid connectivity and fast communication, 5G services can see huge opportunities in the future.

Challenge: Risk of uncertainty in terms of RoIs

Enterprises consider 5G as an enabler of their evolving IoT agendas. IoT improves the effectiveness of enterprise operations and ensures proper asset usage, extends equipment service life, and improves reliability and return on assets. However, IoT deployments in various industries incur several huge initial investments, such as spending on hardware (sensors and gateways), connectivity, cloud storage, administrative labor, and technical support. There is uncertainty related to Return on Investments (RoIs). Thus, businesses have to consider how quickly they can introduce new solutions and how fast it would take for a solution to start generating revenue. Therefore, in various countries, SMEs do not get easily ready to incur such huge initial costs of IoT deployment, which can hinder market growth. 5G networks can provide advantages, such as Control and User Plane Separation (CUPS) and network slicing. Operators need end-to-end 5G networks to be expansible and flexible to efficiently deliver extensive services to users, which finally brings competitive advantages to operators.

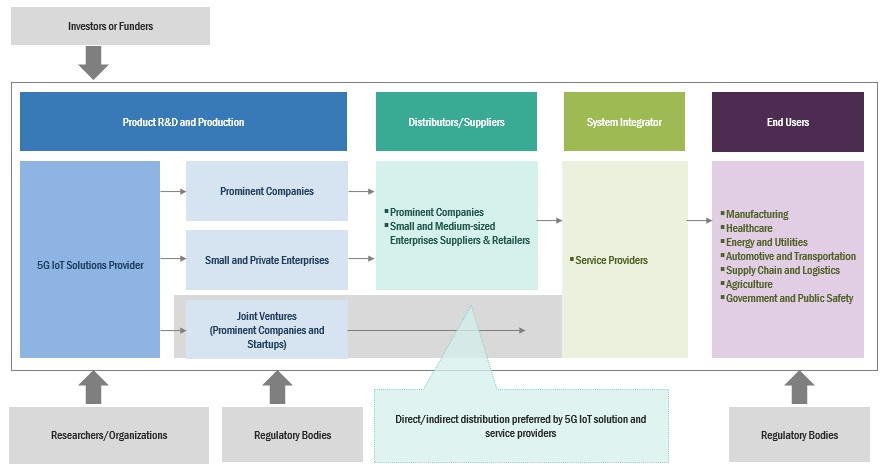

5G IoT Market Ecosystem

Prominent companies in this market include a well-established, financially stable provider of 5G IoT solutions and services. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include China Mobile (China), AT&T (US), Verizon (US), T-Mobile US, INC. (US), Vodafone Group plc (UK), Orange SA (France), Telefónica S.A. (Spain), SK Telecom Co., Ltd (South Korea), Deutsche Telekom AG (Germany), Ericsson (Sweden), Huawei Technologies Co., Ltd. (US), Nokia Corporation (Finland), Samsung Electronics (South Korea), Cisco Systems (US), NEC Corporation (Japan).

To know about the assumptions considered for the study, download the pdf brochure

Wide-range IoT devices segment to grow at higher growth rate during forecast period

Several wireless standards are limited by their range, which is challenging for a number of useful applications that require much longer paths. To overcome the challenge, a collection of newer, longer-range wireless technologies has developed Low-Power Wide-Area Networks (LPWANs). These can overcome challenges between traditional short-range technologies and the more costly M2M alternatives. The features offered by LoRa devices are long-range, low power consumption, and secure data transmission for IoT applications. It provides a greater range than cellular networks. It can be used by public, private, or hybrid networks. The technology can easily plug into current infrastructure and enables low-cost battery-operated IoT applications.

Manufacturing segment to account for largest market share during forecast period

With Industry 4.0 underway, the introduction of 5G has accelerated the development of Intelligent factories of the future with its high capacity, wireless flexibility, and low-latency performance capabilities. Manufacturers are embracing digitalization to curb costs and improve ROI, and 5G IoT assures new process efficiencies and cutting-edge technological advancements, thereby increasing profitability and shop floor productivity. Industry 4.0 is expected to be fueled by cyber-physical systems and IoT, which would require the support of 5G networks. This would enable efficient, connected, and flexible factories of the future.

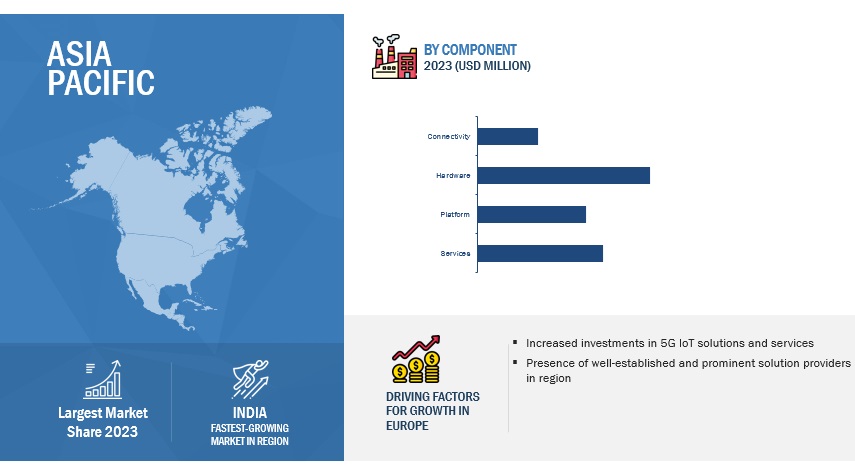

Asia Pacific to account for largest market share during forecast period

Asia Pacific to witness largest market share during the forecast period. This can be attributed to the significant adoption of advanced technologies, the proliferation of IoT-enabled devices, continuously enhancing network connectivity, and government initiatives for IoT. Asia Pacific is one of the biggest markets for connected devices. The region is a strong adopter of IoT-based devices due to its unique combination of government advocacy, manufacturing roots, and R&D know-how.

Top Companies in 5G IoT Market

The market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global 5G IoT market are China Mobile (China), AT&T (US), Verizon (US), T-Mobile US, INC. (US), Vodafone Group plc (UK), Orange SA (France), Telefónica S.A. (Spain), SK Telecom Co., Ltd (South Korea), Deutsche Telekom AG (Germany), Ericsson (Sweden), Huawei Technologies Co., Ltd. (US), Nokia Corporation (Finland), Samsung Electronics (South Korea), Cisco Systems (US), NEC Corporation (Japan), Semtech Corporation (US), Telit Cinterion (US), Quectel Wireless Solutions Co., Ltd (China), GosuncnWelink Corporation (China), Neoway Technology Co. Ltd. (China), Fibocom Wireless Inc. (China), u-blox AG (Switzerland), Sunsea AIOT Technology Co. Ltd. (China), Omniflow (Portugal), Tri Cascade Inc. (US), Celona (US), and Sequans Communications (France). The study includes an in-depth competitive analysis of these key players in the market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By component, network type, organization size, type, end user, and region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

China Mobile (China), AT&T (US), Verizon (US), T-Mobile US, INC. (US), Vodafone Group plc (UK), Orange SA (France), Telefónica S.A. (Spain), SK Telecom Co., Ltd (South Korea), Deutsche Telekom AG (Germany), Ericsson (Sweden), Huawei Technologies Co., Ltd. (US), Nokia Corporation (Finland), Samsung Electronics (South Korea), Cisco Systems (US), NEC Corporation (Japan), Semtech Corporation (US), Telit Cinterion (US), Quectel Wireless Solutions Co., Ltd (China), GosuncnWelink Corporation (China), Neoway Technology Co. Ltd. (China), Fibocom Wireless Inc. (China), u-blox AG (Switzerland), Sunsea AIOT Technology Co. Ltd. (China), Omniflow (Portugal), Tri Cascade Inc. (US), Celona (US), and Sequans Communications (France) |

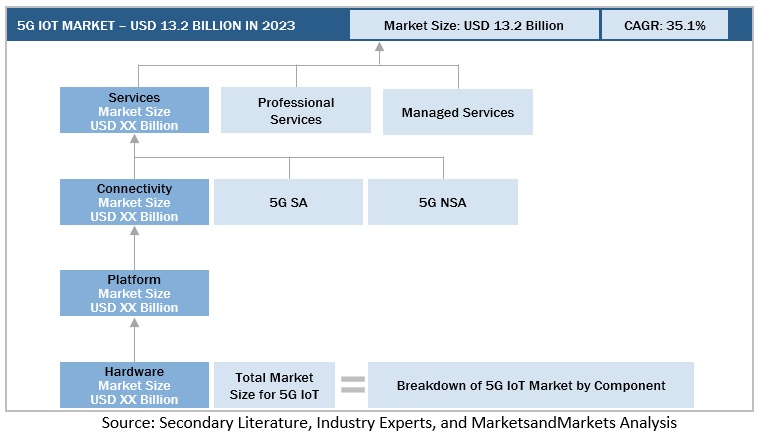

This research report categorizes the 5G IoT market to forecast revenues and analyze trends in each of the following subsegments:

By Component

- Hardware

- Platform

- Connectivity

-

Services

- Consulting Services

- Deployment and Integration Services

- Support and Maintenance Services

By Network Type

- 5G Standalone

- 5G Non-standalone

By Organization Size

- Large Enterprises

- SMEs

By Type

- Short-range IoT Devices

- Wide-range IoT Devices

By End User

-

Manufacturing

- Industrial Automation

- Predictive Maintenance

- Asset Monitoring

-

Healthcare

- Remote Patient Monitoring

- Connected Ambulance

- Asset Tracking for Medical Devices

- Connected Medical Devices

-

Energy and Utilities

- Smart Grid

- Smart Meter

- Pipeline Management

-

Automotive and Transportation

- Fleet Management/Telematics

- Connected Car

- Autonomous Vehicle

-

Supply Chain and Logistics

- Asset Tracking

- Inventory Management

- Logistics and Warehouse Automation

-

Agriculture

- Precision farming

- Livestock Monitoring

- Asset Tracking

-

Government and Public Safety

- Smart Parking

- Smart Street Lighting

- Autonomous vehicle

- Water and Waste Management

- Public Safety and Surveillance

- Environment Monitoring

-

Other End Users

-

Retail

- Digital Signage

- Smart Vending and Kiosks

-

Smart Building

- Security and Surveillance

- Facility Management

- Building Automation

-

Education

- Connected Classroom

-

Retail

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Nordic Region

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East & Africa

-

Middle East

- UAE

- KSA

- Rest of Middle East

- Africa

-

Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In October 2022, T Mobile, Cradlepoint, and Bosch, collaborated to enable advanced IoT connectivity solutions, such as autonomous vehicles, robotics, and AR/VR, using 5G Wireless WAN technology.

- In January 2022, Verizon and Atos partnered to power intelligent IoT solutions with private 5G multi-access edge computing for consumers. The 5G edge solution will alter how companies influence predictive analytics. The solution will let them enhance operational efficiency, mitigate risk and increase revenue.

- In August 2021, InVideo acquired the website KIZOA. InVideo bought the website KIZOA, a 13-year-old video editing software platform with 18 million registered accounts to the web service worldwide. InVideo’s purchase of Kizoa increased its market share in the online video editor sector.

Frequently Asked Questions (FAQ):

What is the projected market value of the global 5G IoT market?

The global market of 5G IoT is projected to reach $59.7 billion.

What is the estimated growth rate (CAGR) of the global 5G IoT market for the next five years?

The global 5G IoT market is projected to grow at a Compound Annual Growth Rate (CAGR) of 35.1% from 2023 to 2028.

What are the major revenue pockets in the 5G IoT market currently?

Asia Pacific to witness largest market share during the forecast period. This can be attributed to the significant adoption of advanced technologies, the proliferation of IoT-enabled devices, continuously enhancing network connectivity, and government initiatives for IoT. Asia Pacific is one of the biggest markets for connected devices. The region is a strong adopter of IoT-based devices due to its unique combination of government advocacy, manufacturing roots, and R&D know-how.

Who are the key vendors in the 5G IoT market?

The key vendors operating in the 5G IoT market include China Mobile (China), AT&T (US), Verizon (US), T-Mobile US, INC. (US), Vodafone Group plc (UK), Orange SA (France), Telefónica S.A. (Spain), SK Telecom Co., Ltd (South Korea), Deutsche Telekom AG (Germany), Ericsson (Sweden), Huawei Technologies Co., Ltd. (US), Nokia Corporation (Finland), Samsung Electronics (South Korea), Cisco Systems (US), NEC Corporation (Japan), Semtech Corporation (US), Telit Cinterion (US), Quectel Wireless Solutions Co., Ltd (China), GosuncnWelink Corporation (China), Neoway Technology Co. Ltd. (China), Fibocom Wireless Inc. (China), u-blox AG (Switzerland), Sunsea AIOT Technology Co. Ltd. (China), Omniflow (Portugal), Tri Cascade Inc. (US), Celona (US), and Sequans Communications (France).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

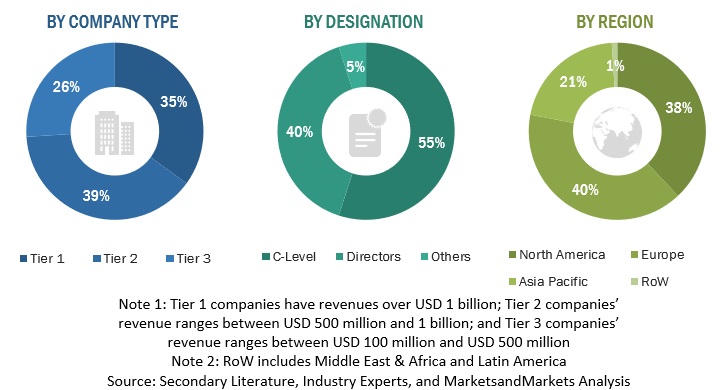

The 5G IoT market study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. Other market-related sources, such as journals and white papers from industry associations, were also considered while conducting the secondary research. Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents to obtain and verify critical qualitative and quantitative information and assess the market’s prospects. These respondents included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals such as the International Journal of Computer Science and Information Technology and Security (IJCSITS), ScienceDirect, ResearchGate, Academic Journals, Scientific.Net, and various telecom and 5G IoT associations/forums, Citizens Broadband Radio Service (CBRS) Alliance, MulteFire Alliance, and 3GPP were also referred. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the 5G IoT market. The primary sources from the demand side included 5G IoT network end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

After the complete market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both top-down and bottom-up approaches and several data triangulation methods were used to perform the market estimation and forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Breakdown of Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

T-Mobile |

IoT Enterprise Manager |

|

NEC Corporation |

Senior Project Manager |

|

China Mobile |

Project Manager |

|

Telefónica |

5G and IoT Solutions Manager |

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the 5G IoT market. The first approach involves the estimation of market size by summing up the revenue generated by companies through the sale of 5G IoT components, such as hardware, platform, connectivity, and services.

5G IoT Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

5G IoT Market: Top-Down Approach

Data Triangulation

In the top-down approach, the overall market size was used to estimate the size of the individual market segments through percentage splits obtained from secondary and primary research.

The most appropriate immediate parent market size was used to implement the top-down approach to calculate specific market segments. The bottom-up approach was implemented for the data obtained from secondary research to validate the market size of various segments.

The market share of each company was obtained to verify the revenue share used in the bottom-up approach. Through data triangulation and validation of data with the help of primary research, the overall parent market size and each market segment size were determined.

Market Definition

The 5G IoT market refers to the usage of 5G technology for connecting Internet of Things (IoT) devices in a short and wide range, coupled with extraordinary bandwidth, wider network capacity and coverage, low latency, greater security, and higher power efficiency. The market comprises hardware, platform, connectivity, and services enabling 5G IoT connectivity for billions of IoT devices with the right speed, power, security, and latency combination.

Key Stakeholders

- Network Infrastructure Enablers

- Technology Vendors

- Mobile Network Operators (MNOs)

- Independent Software Vendors (ISVs)

- Communication Service Providers (CSPs)

- System Integrators (SIs)

- Neutral Host Operators

- Resellers

- Value-added Resellers (VARs)

- Managed Service Providers (MSPs)

- Compliance Regulatory Authorities

- Government Authorities

- Investment Firms

- Cloud Service Providers

- 5G Iot Alliances/Groups

- Original Design Manufacturers (ODMs)

- Original Equipment Manufacturers (OEMs)

- Enterprises/Businesses

Report Objectives

- To determine, segment, and forecast the global 5G IoT market by component, network type, organization size, type, end user, and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the 5G IoT market

- To study the complete value chain and related industry segments and perform a value chain analysis of the 5G IoT market landscape

- To strategically analyze macro and micromarkets with respect to individual growth trends, prospects, and contributions to the total 5G IoT market

- To analyze industry trends, pricing data, and patents and innovations related to the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, collaborations, business expansions, and Research and Development (R&D) activities

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Further breakdown of South Korean 5G IoT market

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G IoT Market