Activated Carbon Filters Market by Type (Stainless Steel Shell, Carbon Steel Shell, Others), Application (Industrial Water Pollution Treatment, Drinking Water Purification, Food & Beverage, Pharmaceutical, Others), and Region - Global Forecast to 2025

Updated on : April 17, 2024

Activated Carbon Filters Market

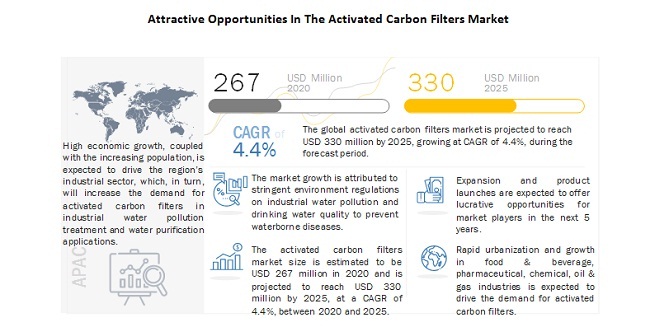

Activated Carbon Filters Market was valued at USD 267 million in 2020 and is projected to reach USD 330 million by 2025, growing at 4.4% cagr from 2020 to 2025. The growth in the activated caron filters demand is increasing due to stringent governmental regulations on water purification and regulations implemented by environmental agencies on industrial discharge.

To know about the assumptions considered Request for Free Sample Report

Stainless steel shell is the fastest-growing segment of activated carbon filters market.

Stainless steel shell was the largest segment of the activated carbon filters market globally in 2019 in terms of value. Stainless steel shell is anticipated to account for the biggest share of the overall activated carbon filters market during the forecast period. The growth of stainless steel shell activated carbon filters is attributed to its durability and less-corrosive properties. Carbon steel shell activated carbon filters are less durable because of its corrosive nature.

Industrial water pollution treatment is the largest application of activated carbon filters market

The industrial water pollution treatment application is expected to be the largest, and drinking water purification application is expected to be the fastest-growing segment in the overall market. The global activated carbon filters market is mainly driven by the implementation of stringent regulations by regional governments and environmental agencies to control water pollution. Also, activated carbon filters are used to treat industrial discharge to re-use it in the manufacturing rocess again. Re-use of industrial discharge water and water pollution control are the two major making industrial water pollution treatment the largest application in the market.

To know about the assumptions considered for the study, download the pdf brochure

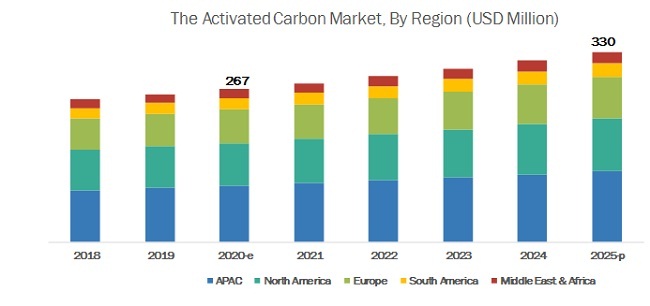

e-estimated, p-projected

APAC is projected to be the largest activated carbon filters market.

APAC is estimated to be the largest activated carbon filters market during the forecast period. Of China, Japan, India, Malaysia, Indonesia and Rest of APAC. China was the largest consumer of activated carbon filterss in the region as of 2019 in terms of value. China is estimated to be the largest market in APAC region in 2019.

Key Market Players

The key companies profiled in this report on the activated caron filters market include TIGG LLC (US), Puragen Activated Carbons (US), Cabot Corporation (US), Westech Engineering (US), Kuraray Co. Ltd. (Japan), Lenntech B.V. (The Netherlands), Donau Carbon Corporation (Germany), General Carbon Corporation (US), Sereco S.R.L. (Italy), Carbtrol Corp (US).

These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence and meet the growing demand for activated carbon filters from emerging economies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

|

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD) |

|

Segments |

Type, Application, and Region |

|

Regions |

APAC, Europe, North America, the Middle East & Africa, and South America |

|

Companies |

TIGG LLC (US), Puragen Activated Carbons (US), Cabot Corporation (US), WesTech Engineering Inc.(US), Kuraray Co., Ltd (Japan), Lenntech B.V. (The Netherlands), Donau Carbon Gmbh (Germany), General Carbon Corporation (US), Sereco S.R.L (Italy), Carbtrol Corp.(US), and others. |

This research report categorizes the activated carbon filters market based on type, application, and region.

The activated carbon filters Market, By Type:

- Stainless steel shell

- Carbon steel shell

- Others

The activated carbon filters Market, By Application:

- Industrial water pollution treatment

- Drinking water purification

- Food & beverage

- Pharmaceutical

- Others

The activated carbon filters Market, By Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2020, Kuraray expanded its Mississippi (US) activated carbon plant, which will increase the capacity of the plant by 50 million pounds of granular activated carbon (GAC) annually. GAC is used as filter media in activated carbon filters. This expansion will help the company to cater to the growing needs of activated carbon filters in the North American region.

- In April 2020, Cabot Corporation acquired Shenzhen Sanshun Nano New Materials Co., Ltd (SUSN) (China). This acquisition will help the company to strengthen its market position in the APAC region.

- In November 2019, Cabot Corporation has expanded its carbon black production facility at Cilegon, Indonesia, by adding 80,000 metric tons of additional annual production capacity. This expansion is aimed at the company’s global expansion strategy to increase its global footprint.

- In October 2019, Newterra Ltd. (US), a leading supplier of water solutions to industrial, municipal, and environmental remediation sector, acquired TIGG LLC (US). TIGG LLC will cater to its customers by offering a broad range of filtration solutions and extend its distribution network in the North American region with this acquisition.

- In September 2018, Kuraray acquired Calgon Carbons Corporation (US). The company strengthened its position in North America and the global activated carbon filters market with this acquisition.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the activated carbon filters market?

Stringent government regulation on water purification to increase the demand for activated carbon filters and strict regulation on industrial discharge by environmental agencies are major factors influencing the growth of activated carbon filters market.

What are the market dynamics for the different types of activated carbon filters?

On the basis of type, the activated carbon filters market is divided into three categories, namely, stainless steel shell, carbon steel shell, and others. The others segment include fiber-reinforced plastic (FRP), mild steel epoxy coating (MSEP), mild steel rubber lined (MSRL), and acrylonitrile butadiene styrene (ABS) plastic. Stainless steel shell activated carbon filters are expected to be the largest and fastest-growing segment in the overall market.

What are the market dynamics for competitive rivalry in the activated carbon filters market?

The intensity of competitive rivalry in the activated carbon filters market is moderate. The market seems to be scattered and unorganized, owing to a large number of suppliers and buyers across the globe. As per the current market scenario, the market demand is shifting toward cost-effective and durable carbon filters.

What are the market dynamics for different applications of activated carbon filters?

On the basis of application, the activated carbon filter is divided into five segments, namely, industrial water pollution treatment, drinking water purification, food & beverage, pharmaceutical, and others (metal, chemical, oil & gas, refinery, and municipality sewage water treatment). The industrial water pollution treatment application is expected to be the largest, and drinking water purification application is expected to be the fastest-growing segment in the overall market.

Who are the major manufacturers of activated carbon filters?

TIGG LLC (US), Puragen Activated Carbons (US), Cabot Corporation (US), WesTech Engineering Inc.(US), Kuraray Co., Ltd (Japan), Lenntech B.V. (The Netherlands), Donau Carbon Gmbh (Germany), General Carbon Corporation (US), Sereco S.R.L (Italy), Carbtrol Corp.(US), and others are major manufacturers of activated carbon filters.

What are the major restraint factors which will impact market growth during the forecast period?

In activated carbon filters, the activated carbon bed, which adsorbs contamination dissolved in the incoming stream, provides a damp environment, which is ideal for the growth and proliferation of bacteria. This causes problems in various applications, especially the medical application, or while using carbon as pretreatment to reverse osmosis. In drinking water purification, food & beverage, and pharmaceutical applications, this can cause health problems to the end consumers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH 1

2.2.2 SUPPLY-SIDE APPROACH 2

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN THE ACTIVATED CARBON FILTERS MARKET

4.2 ACTIVATED CARBON FILTERS MARKET GROWTH, BY TYPE

4.3 ACTIVATED CARBON FILTERS MARKET SHARE, BY APPLICATION AND REGION, 2019

4.4 ACTIVATED CARBON FILTERS MARKET, BY COUNTRY

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Stringent governmental regulations on water purification to increase the demand for activated carbon filters

5.2.1.2 Regulations by environmental agencies on industrial discharge

5.2.2 RESTRAINTS

5.2.2.1 Damp environment leads to the growth of bacteria

5.2.3 OPPORTUNITIES

5.2.3.1 Gas separation is an emerging application of activated carbon filters

5.2.4 CHALLENGES

5.2.4.1 Weak economic growth and reduced investment potential in various industries due to COVID-19

5.2.5 PORTER'S FIVE FORCES ANALYSIS

5.2.6 BARGAINING POWER OF SUPPLIERS

5.2.7 THREAT OF NEW ENTRANTS

5.2.8 THREAT OF SUBSTITUTES

5.2.9 BARGAINING POWER OF BUYERS

5.2.10 INTENSITY OF COMPETITIVE RIVALRY

6 ACTIVATED CARBON FILTERS MARKET, BY TYPE

6.1 INTRODUCTION

6.2 STAINLESS STEEL SHELL

6.3 CARBON STEEL SHELL

6.4 OTHERS

7 ACTIVATED CARBON FILTERS MARKET, BY APPLICATION

7.1 INTRODUCTION

7.2 INDUSTRIAL WATER POLLUTION TREATMENT

7.3 DRINKING WATER PURIFICATION

7.4 FOOD & BEVERAGE

7.5 PHARMACEUTICAL

7.6 OTHERS

8 ACTIVATED CARBON FILTERS MARKET, BY REGION

8.1 INTRODUCTION

8.2 APAC

8.2.1 CHINA

8.2.1.1 High demand for various water treatment activities to drive the market

8.2.2 INDIA

8.2.2.1 Rising demand for air purification and gas separation activities fueling growth

8.2.3 JAPAN

8.2.3.1 Increasing demand witnessed from flue gas cleaning and water treatment applications

8.2.4 INDONESIA

8.2.4.1 Demand from industrial water pollution treatment to drive the demand for activated carbon filters

8.2.5 MALAYSIA

8.2.5.1 Malaysia experiencing increased industrial water pollution treatment activities

8.2.6 REST OF APAC

8.3 NORTH AMERICA

8.3.1 US

8.3.1.1 Demand for activated carbon is propelled by increased industrial water treatment and municipal water treatment activities

8.3.2 CANADA

8.3.2.1 Activated carbon filters market is propelled by the growth of the growth of industrial sector

8.3.3 MEXICO

8.3.3.1 Activated carbon filters market is propelled by industrial water treatment and drinking water purification

8.4 EUROPE

8.4.1 GERMANY

8.4.1.1 Stringent regulations on industrial discharge to drive the market

8.4.2 FRANCE

8.4.2.1 Industrial growth to fuel demand for activated carbon filters

8.4.3 UK

8.4.3.1 Stringent governmental regulations on emissions and industrial discharge to drive the demand

8.4.4 ITALY

8.4.4.1 Italy witnessing growing demand for activated carbon filters in automobile industry

8.4.5 SPAIN

8.4.5.1 Growing demand for industrial water pollution treatment & drinking water purification fueling the market growth

8.4.6 RUSSIA

8.4.6.1 Growing demand from domestic water purification to drive the market

8.4.7 TURKEY

8.4.7.1 Stainless steel shell to be largest and fastest-growing segment in Turkey

8.4.8 REST OF EUROPE

8.5 SOUTH AMERICA

8.5.1 BRAZIL

8.5.1.1 The demand for activated carbon filters in brazil is driven by water treatment application

8.5.2 ARGENTINA

8.5.2.1 Activated carbon filters market is fueled by growth of metal, oil & gas, chemical, and food & beverage industries

8.5.3 REST OF SOUTH AMERICA

8.6 MIDDLE EAST & AFRICA

8.6.1 SAUDI ARABIA

8.6.1.1 Industrial development is expected to drive the activated carbon filters market

8.6.2 UAE

8.6.2.1 Activated carbon filters market is propelled by industrial, drinking water purification, and municipal wastewater applications

8.6.3 REST OF MIDDLE EAST & AFRICA

9 IMPACT OF COVID-19 PANDEMIC ON ACTIVATED CARBON FILTERS MARKET

10 COMPETITIVE LANDSCAPE

10.1 OVERVIEW

10.2 MARKET RANKING ANALYSIS

10.3 COMPETITIVE SCENARIO

10.3.1 EXPANSION

10.3.2 ACQUISITION

10.3.3 AGREEMENT & JOINT VENTURE

11 COMPANY PROFILES

11.1 TIGG LLC

11.1.1 BUSINESS OVERVIEW

11.1.2 PRODUCTS OFFERED

11.1.3 RECENT DEVELOPMENTS

11.1.4 SWOT ANALYSIS

11.1.5 WINNING IMPERATIVES

11.1.6 CURRENT FOCUS AND STRATEGIES

11.1.7 THREAT FROM COMPETITION

11.1.8 RIGHT TO WIN

11.2 PURAGEN ACTIVATED CARBONS

11.2.1 BUSINESS OVERVIEW

11.2.2 PRODUCTS OFFERED

11.2.3 RECENT DEVELOPMENTS

11.2.4 SWOT ANALYSIS

11.2.5 WINNING IMPERATIVES

11.2.6 CURRENT FOCUS AND STRATEGIES

11.2.7 THREAT FROM COMPETITION

11.2.8 RIGHT TO WIN

11.3 CABOT CORPORATION

11.3.1 BUSINESS OVERVIEW

11.3.2 PRODUCTS OFFERED

11.3.3 RECENT DEVELOPMENTS

11.3.4 SWOT ANALYSIS

11.3.5 WINNING IMPERATIVES

11.3.6 CURRENT FOCUS AND STRATEGIES

11.3.7 THREAT FROM COMPETITION

11.3.8 RIGHT TO WIN

11.4 WESTECH ENGINEERING

11.4.1 BUSINESS OVERVIEW

11.4.2 PRODUCT OFFERED

11.4.3 RECENT DEVELOPMENT

11.4.4 SWOT ANALYSIS

11.4.5 WINNING IMPERATIVES

11.4.6 CURRENT FOCUS AND STRATEGIES

11.4.7 THREAT FROM COMPETITION

11.4.8 RIGHT TO WIN

11.5 KURARAY CO. LTD.

11.5.1 BUSINESS OVERVIEW

11.5.2 PRODUCTS OFFERED

11.5.3 RECENT DEVELOPMENTS

11.5.4 SWOT ANALYSIS

11.5.5 WINNING IMPERATIVES

11.5.6 CURRENT FOCUS AND STRATEGIES

11.5.7 THREAT FROM COMPETITION

11.5.8 RIGHT TO WIN

11.6 LENNTECH B.V.

11.6.1 BUSINESS OVERVIEW

11.6.2 PRODUCT OFFERED

11.7 DONAU CARBON GMBH

11.7.1 BUSINESS OVERVIEW

11.7.2 PRODUCTS OFFERED

11.8 GENERAL CARBON CORPORATION

11.8.1 BUSINESS OVERVIEW

11.8.2 PRODUCTS OFFERED

11.9 SERECO S.R.L

11.9.1 BUSINESS OVERVIEW

11.9.2 PRODUCT OFFERED

11.1 CARBTROL CORP

11.10.1 BUSINESS OVERVIEW

11.10.2 PRODUCT OFFERED

11.11 ADDITIONAL COMOPANY PROFILES

11.11.1 PROMINENT SYSTEMS INC.

11.11.2 SILCARBON AKTIVKOHLE GMBH

11.11.3 VEOLIA WATER TECHNOLOGIES

11.11.4 WOLFTECHNIK FILTER SYSTEM

11.11.5 SUEZ WATER TECHNOLOGIES & SOLUTIONS

11.11.6 BIONICS CONSORTIUM PVT. LTD.

11.11.7 ECOLOGIX ENVIRONMENTAL SYSTEMS

11.11.8 WATER PROFESSIONALS

11.11.9 COCARB SOLUTION

11.11.10 CONDORCHEM ENVITECH

12 APPENDIX

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (75 Tables)

TABLE 1 ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 2 STAINLESS STEEL SHELL ACTIVATED CARBON FILTERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 3 CARBON STEEL SHELL ACTIVATED CARBON FILTERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 4 OTHER ACTIVATED CARBON FILTERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 5 ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 6 ACTIVATED CARBON FILTERS MARKET SIZE IN INDUSTRIAL WATER POLLUTION TREATMENT, 2018-2025 (USD MILLION)

TABLE 7 ACTIVATED CARBON FILTERS MARKET SIZE IN DRINKING WATER PURIFICATION, 2018-2025 (USD MILLION)

TABLE 8 ACTIVATED CARBON FILTERS MARKET SIZE IN FOOD & BEVERAGE, 2018-2025 (USD MILLION)

TABLE 9 ACTIVATED CARBON FILTERS MARKET SIZE IN PHARMACEUTICAL, 2020-2025 (USD MILLION)

TABLE 10 ACTIVATED CARBON FILTERS MARKET SIZE IN OTHER APPLICATIONS, 2018-2025 (USD MILLION)

TABLE 11 ACTIVATED CARBON FILTERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 12 APAC: ACTIVATED CARBON FILTERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 13 APAC: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 14 APAC: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 15 CHINA: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 16 CHINA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 17 INDIA: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 18 INDIA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 19 JAPAN: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 20 JAPAN: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 21 INDONESIA: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 22 INDONESIA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 23 MALAYSIA: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 24 MALAYSIA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 25 REST OF APAC: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 26 REST OF APAC: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 27 NORTH AMERICA: ACTIVATED CARBON FILTERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 28 NORTH AMERICA: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 29 NORTH AMERICA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 30 US: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 31 US: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 32 CANADA: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 33 CANADA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 34 MEXICO: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 35 MEXICO: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 36 EUROPE: ACTIVATED CARBON FILTERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 37 EUROPE: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 38 EUROPE: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 39 GERMANY: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 40 GERMANY: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 41 FRANCE: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 42 FRANCE: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 43 UK: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 44 UK: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 45 ITALY: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 46 ITALY: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 47 SPAIN: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 48 SPAIN: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 49 RUSSIA: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 50 RUSSIA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 51 TURKEY: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 52 TURKEY: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 53 REST OF EUROPE: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 54 REST OF EUROPE: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 55 SOUTH AMERICA: ACTIVATED CARBON FILTERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 56 SOUTH AMERICA: ACTIVATED CARBON MARKET FILTERS SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 57 SOUTH AMERICA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 58 BRAZIL: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2020 (USD MILLION)

TABLE 59 BRAZIL: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 60 ARGENTINA: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 61 ARGENTINA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 62 REST OF SOUTH AMERICA: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 63 REST OF SOUTH AMERICA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA: ACTIVATED CARBON FILTERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION , 2018-2025 (USD MILLION)

TABLE 67 SAUDI ARABIA: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 68 SAUDI ARABIA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 69 UAE: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 70 UAE: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 71 REST OF MIDDLE EAST & AFRICA: ACTIVATED CARBON FILTERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 72 REST OF MIDDLE EAST & AFRICA: ACTIVATED CARBON FILTERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 73 EXPANSIONS, 2016-2020

TABLE 74 ACQUISITIONS, 2016-2020

TABLE 75 AGREEMENTS & JOINT VENTURES, 2016-2020

LIST OF FIGURES (41 Figures)

FIGURE 1 ACTIVATED CARBON FILTERS MARKET: MARKET SEGMENTATION

FIGURE 2 ACTIVATED CARBON FILTERS MARKET: RESEARCH DESIGN

FIGURE 3 INDUSTRIAL WATER POLLUTION TREATMENT TO BE THE LARGEST APPLICATION IN THE ACTIVATED CARBON FILTERS MARKET

FIGURE 4 STAINLESS STEEL SHELL TO BE THE LARGEST AND FASTEST-GROWING TYPE IN THE MARKET

FIGURE 5 APAC DOMINATED THE ACTIVATED CARBON FILTERS MARKET IN 2019

FIGURE 6 ACTIVATED CARBON FILTERS MARKET TO WITNESS GROWTH DURING FORECAST PERIOD

FIGURE 7 STAINLESS STEEL SHELL TO BE THE FASTEST-GROWING TYPE SEGMENT

FIGURE 8 INDUSTRIAL WATER POLLUTION TREATMENT WAS THE LARGEST APPLICATION AND APAC WAS THE LARGEST REGION IN 2019

FIGURE 9 CANADA TO REGISTER HIGHEST GROWTH IN THE MARKET FROM 2020 TO 2025

FIGURE 10 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES, IN THE ACTIVATED CARBON FILTERS MARKET

FIGURE 11 ACTIVATED CARBON FILTERS MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 12 STAINLESS STEEL SHELL DOMINATES ACTIVATED CARBON FILTERS MARKET

FIGURE 13 APAC IS LARGEST MARKET FOR STAINLESS STEEL SHELL ACTIVATED CARBON FILTERS

FIGURE 14 APAC DOMINATES CARBON STEEL SHELL ACTIVATED CARBON FILTERS MARKET

FIGURE 15 APAC IS FASTEST-GROWING MARKET IN OTHERS SEGMENT

FIGURE 16 INDUSTRIAL WATER POLLUTION TREATMENT EXPECTED TO DOMINATE THE ACTIVATED CARBON FILTERS MARKET

FIGURE 17 APAC ESTIMATED TO BE LARGEST MARKET IN INDUSTRIAL WATER POLLUTION TREATMENT

FIGURE 18 APAC TO BE FASTEST-GROWING MARKET IN DRINKING WATER PURIFICATION

FIGURE 19 APAC DOMINATES ACTIVATED CARBON FILTER IN FOOD & BEVERAGES

FIGURE 20 APAC TO WITNESS HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 21 APAC ESTIMATED TO BE LARGEST MARKET IN OTHERS APPLICATION SEGMENT

FIGURE 22 REGIONAL SNAPSHOT: ACTIVATED CARBON FILTERS MARKET, 2020-2025

FIGURE 23 APAC SNAPSHOT: CHINA TO BE LARGEST MARKET FOR ACTIVATED CARBON FILTERS

FIGURE 24 NORTH AMERICA MARKET SNAPSHOT: US IS LARGEST MARKET

FIGURE 25 EUROPE: ACTIVATED CARBON FILTERS MARKET SNAPSHOT

FIGURE 26 SOUTH AMERICA MARKET SNAPSHOT: BRAZIL IS LARGEST AND FASTEST-GROWING MARKET

FIGURE 27 MIDDLE EAST & AFRICA MARKET SNAPSHOT: SAUDI ARABIA IS FASTEST-GROWING MARKET, 2020-2025

FIGURE 28 COMPANIES PRIMARILY ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY BETWEEN 2016 AND 2020

FIGURE 29 ACTIVATED CARBON FILTERS MARKET RANKING, 2019

FIGURE 30 TIGG LLC: SWOT ANALYSIS

FIGURE 31 TIGG LLC: WINNING IMPERATIVES

FIGURE 32 PURAGEN ACTIVATED CARBONS: SWOT ANALYSIS

FIGURE 33 PURAGEN ACTIVATED CARBONS: WINNING IMPERATIVES

FIGURE 34 CABOT CORPORATION: COMPANY SNAPSHOT

FIGURE 35 CABOT CORPORATION: SWOT ANALYSIS

FIGURE 36 CABOT CORPORATION: WINNING IMPERATIVES

FIGURE 37 WESTECH ENGINEERING INC.: SWOT ANALYSIS

FIGURE 38 WESTECH ENGINEERING INC.: WINNING IMPERATIVES

FIGURE 39 KURARAY CO. LTD.: COMPANY SNAPSHOT

FIGURE 40 KURARAY CO. LTD.: SWOT ANALYSIS

FIGURE 41 KURARAY CO. LTD.: WINNING IMPERATIVES

The study involved four major activities in estimating the current market size for activated carbon filters. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

The activated carbon filters market comprises of several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by developments of activated carbon filters application in industrial water pollution treatment, drinking water purification, food & beverage, pharmaceutical, and others. The supply side is characterized by market consolidation activities undertaken by raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents -

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the activated carbon filters market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study:

- To define, describe, and forecast the global activated carbon filters market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the activated carbon filters market based on type, application, and region

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, collaboration, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the activated carbon filters market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Activated Carbon Filters Market