Advanced Ceramics Market by Material (Alumina, Zirconia, Titanate, Silicon Carbide), Application, End-Use Industry (Electrical & Electronics, Transportation, Medical, Defense & Security, Environmental, Chemical) and Region - Global Forecast to 2028

Advanced Ceramics Market

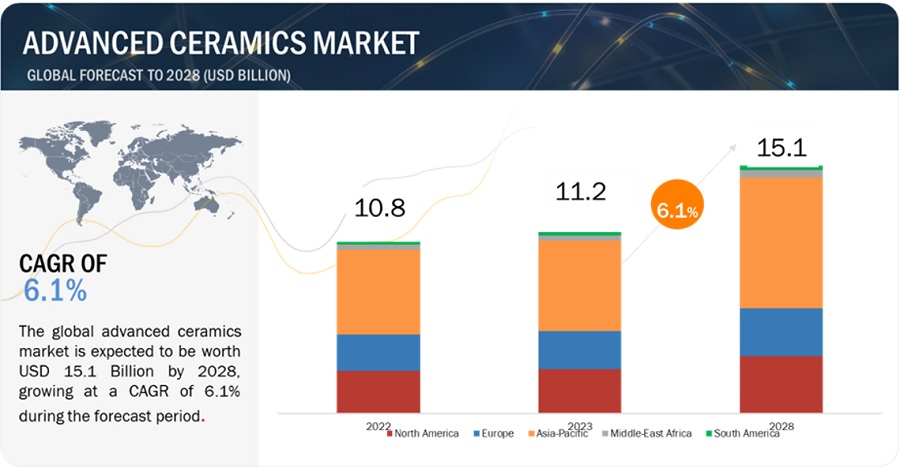

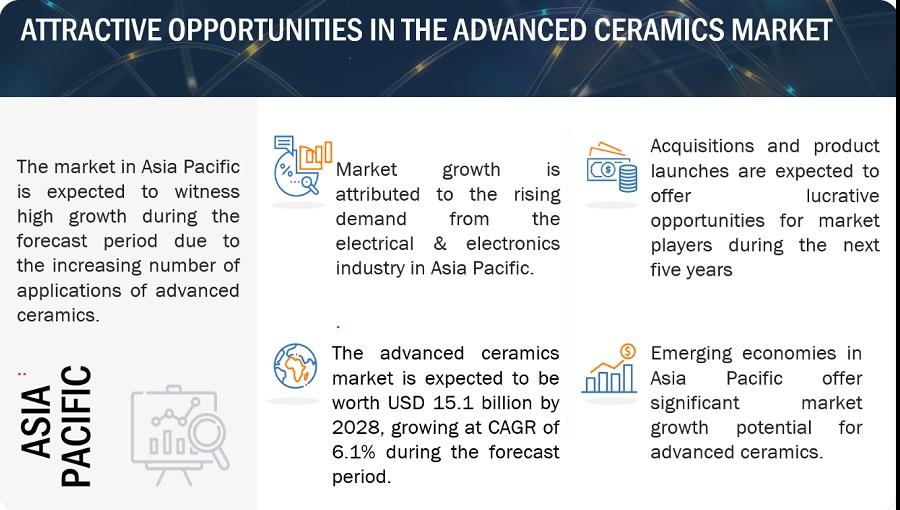

The global advanced ceramics market size was valued at USD 11.2 billion in 2023 and is projected to reach USD 15.1 billion by 2028, growing at a cagr 6.1% from 2023 to 2028. Advanced ceramics are eco-friendly alternatives to traditional materials due to their low environmental impact, longer lifespan, and recyclability. As industries strive to reduce their carbon footprint and adopt sustainable practices, advanced ceramics are being favored for their potential to contribute to a greener and more sustainable future.

Opportunities in the Advanced Ceramics Market

To know about the assumptions considered for the study, Request for Free Sample Report

Recession Impact

Recessions can cause companies to postpone investments in research and development, as well as capital expenditures. This can slow down the pace of innovation and technological advancements in the field of advanced ceramics. Companies may focus more on cost-cutting measures and short-term survival strategies rather than long-term investments. Recessions might bring about shifts in consumer preferences and market demands. Certain industries that are less affected by the recession or experience increased demand, such as healthcare or renewable energy, may continue to drive the demand for advanced ceramics. Manufacturers may need to adapt and pivot their focus to these sectors to mitigate the impact of the recession.

Advanced Ceramics Market Dynamics

Driver: Rising demand from medical & electronics sectors

Advanced ceramics are used in a wide range of medical devices such as implants, medical sensors, hip and knee joints, pacemakers and heart pumps, and drug delivery devices. These ceramics mainly find applications in joint implantation and dental procedures in the medical industry. They also find applications in artificial hip, shoulder, and knee replacements. The demand for advanced ceramics is rapidly increasing in this industry as they help reduce damage to equipment from exposure to conflagration or mordant atmospheres owing to their resistance to high temperature and chemical stability. The medical industry is growing moderately, which in turn, is contributing to the growth of the market globally.

Advanced ceramics are preferred in the joint replacement process as they are not likely to be attacked by the body’s immune system owing to their chemical inertness. In dental applications, these ceramics are preferred for their opalescence. Dentists and prosthetic laboratories have been using advanced ceramics for restoration veneers for many years. The advanced ceramics (also known as engineering ceramics, fine ceramics, high-performance ceramics, high-tech ceramics, technical ceramics) market players are expanding their product offerings for medical applications.

Restrain: Brittle nature of advanced ceramics

Advanced ceramics, such as alumina, zirconia, and silicon carbide, are inherently brittle materials. They have limited tensile strength and are susceptible to cracking and fracturing under certain conditions. This brittleness can pose challenges in applications that require high impact resistance or in situations where components may experience mechanical stress or vibration.

Opportunity: Increasing use in nanotechnology

The growth of advanced ceramics in nanotechnology has been significant, with nanoscale ceramics playing a crucial role in various applications. Nanotechnology involves the manipulation and control of materials at the nanoscale level, typically at dimensions of less than 100 nanometers. Advanced ceramics, with their unique properties, have found extensive use in nanotechnology, enabling advancements in multiple fields. Another significant application of advanced ceramics in nanotechnology is in nanocomposites. Nanoceramic particles are incorporated into polymers or metals to create nanocomposite materials with enhanced mechanical, thermal, and electrical properties. The dispersion of ceramic nanoparticles in a matrix material at the nanoscale level improves the overall material performance and enables the development of lightweight, high-strength materials suitable for aerospace, automotive, and structural applications.

Challenge: High production cost of advanced ceramics

Advanced ceramics are often more expensive to produce compared to conventional materials. The complex manufacturing processes, specialized equipment, and high-quality raw materials contribute to higher production costs. The cost factor can limit their adoption in price-sensitive industries or applications where cost is a significant consideration. Finding cost-effective manufacturing methods and alternative raw materials is a challenge in advancing the cost competitiveness of advanced ceramics.

Advanced Ceramics Market Ecosystem

Zirconia Ceramics is the second-fastest growing material in the advanced ceramics market during the forecast period.

Zirconia Ceramics is the second-fastest growing material in the advanced ceramics market between 2023 to 2028, owing to high strength, fracture toughness, and thermal shock resistance, making them ideal for structural applications. They are used in industries such as aerospace, automotive, and chemical processing, where high-performance materials are required. Zirconia-based components are used in valves, bearings, cutting tools, and wear-resistant parts that operate in extreme conditions.

Ceramic filters are the fastest growing application in the advanced ceramics market during the forecast period.

Ceramic filters are the fastest growing application, this is attributed to the rising demand from industrial application. Advanced ceramics are widely employed in various industrial filtration processes. The exceptional chemical resistance and high-temperature stability of ceramics make them suitable for filtering aggressive chemicals, corrosive liquids, and hot gases. Ceramic filters are used in applications such as oil and gas filtration, chemical processing, pharmaceutical manufacturing, and metal refining. They help remove solid impurities, catalyst fines, and particulate matter from process streams, ensuring product quality and equipment protection.

Medical is estimated to be the fastest growing end use industry advanced ceramics consuming end-use industry in 2022.

By end-use industry, Medical is the fastest growing end-use industry in terms of value in 2022. Advanced ceramics are useful for medical engineering devices as well as orthopedic and dental implants. They have gained importance in medical applications owing to their properties such as biocompatibility, non-toxicity, hardness, high compressive strength, low friction coefficient, and wear & chemical resistance, which enable doctors to provide patients with optimum care. They are used in diverse applications, ranging from drug delivery devices to artificial joints, stimulators, and electronic sensors.

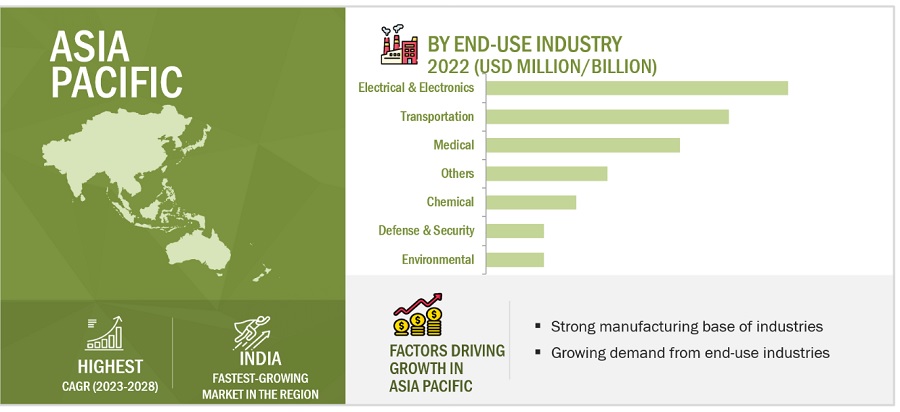

Based on region, Asia Pacific is projected to grow fastest in the advanced ceramics market during the forecast period.

Asia Pacific is projected to be the fastest-growing region in terms of value between 2023-2028. This is attributed to the rising population, increasing electrification, growth in disposable income, rapid industrialization, increased technological advancements, and increased urbanization are driving the Asia Pacific advanced ceramics market. China is the largest advanced ceramics market in the region. Apart from China, Japan, Australia, India, Malaysia, Indonesia, and South Korea are projected to grow at a fast pace during the forecast period.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Advanced Ceramics Market Players

Kyocera Corporation (Japan), Coors Tek (US), CeramTec (US), Morgan Advanced Materials (UK), Saint-Gobain Ceramic Materials (US) and 3M (US). These players have established a strong foothold in the market by adopting strategies, such as new product launches, expansions, joint ventures, and mergers & acquisitions.

Advanced Ceramics Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 11.2 billion |

|

Revenue Forecast in 2028 |

USD 15.1 billion |

|

CAGR |

6.1% |

|

Years considered for the study |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Kiloton) and Value (USD) |

|

Segments |

Material, Application, End-use Industry, and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies |

Kyocera Corporation (Japan), CeramTec (US), CoorsTek (US), Saint-Gobain Ceramic Materials (US), Morgan Advanced Materials (UK), and 3M (US) |

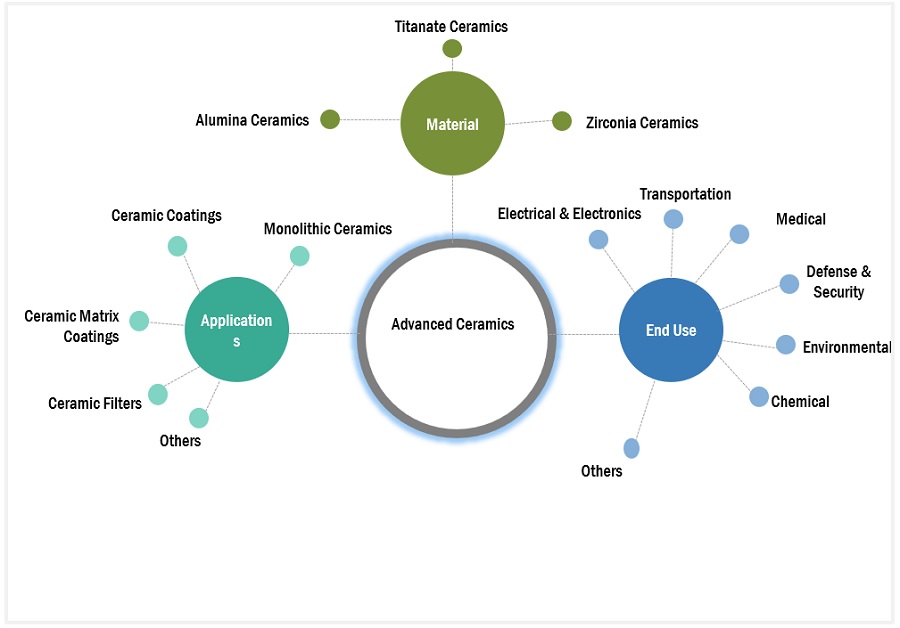

The study categorizes the advanced ceramics market based on material, application, end-use industry, and region.

By Material:

- Alumina Ceramics

- Titanate Ceramics

- Zirconia Ceramics

- Silicon Carbide Ceramics

- Others

By Application:

- Monolithic Ceramics

- Ceramic Coatings

- Ceramic Matrix Composites

- Ceramic Filters

- Others

By End-use Industry

- Electrical & Electronics

- Transportation

- Medical

- Defence & Security

- Environmental

- Chemical

- Others

By Region:

- North America

- Asia Paific

- Europe

- Middle East & Africa

- South America

Recent Developments

- In April 2022, Kyocera reached an agreement to acquire about 37 acres of land for a new smart factory at the Minami Shaaya Industrial Park in Ishayu City, Nagasaki Prefecture. Kyocera is designing this new factory for fine ceramic components production, set to start operating in 2026, in order to meet the growing demand in the electronics industry and advanced semiconductor technology.

- In May 2022, Ceram Tec developed a new product under the name AlN HP. It is a high-performance substrate made of aluminum nitride. The newly launched AlN HP substrate offers 40 percent more flexural strength than the previous generation of AlN substrates.

- In March 2022, Ceram Tec expanded its non-oxide ceramic portfolio by launching LKT 100 ceramic. The newly developed material offers high efficiency, excellent wear resistance, and high notch sensitivity.

- In October 2021, Kyocera Corporation announced an investment of USD 97 million to build two additional production facilities at its Kokubu Plant Campus in Kagoshima, Japan. The area of one factory will be 5,174 m2, and another will be 6,996m2.

Frequently Asked Questions (FAQ):

What is the current size of the global advanced ceramics market?

Global advanced ceramics market size is estimated to reach USD 15.1 billion by 2027 from USD 11.2 billion in 2022, at a CAGR of 6.1% during the forecast period.

Are there any regulations for advanced ceramics?

Several countries in Europe and North America have introduced regulations for this market. For e.g., in the European Union, agencies such as the European Environment Agency (EEA), the European Council for an Energy Efficient Economy, the Council of European Energy Regulators (CEER), and others are involved in mandating adopting regulations, updating policies, and implementation efforts of these regulations in the respective sectors.

Who are the winners in the global advanced ceramics market?

Kyocera Corporation, Saint Gobain, CeramTec, CoorsTek and Morgan Advanced Materials fall under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What is the recession on advanced ceramics manufacturers?

Companies may focus more on cost-cutting measures and short-term survival strategies rather than long-term investments. Recessions might bring about shifts in consumer preferences and market demands.

What are some of the drivers in the market?

Rising demand from medical & electronics sectors are some of the factors driving advanced ceramics market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

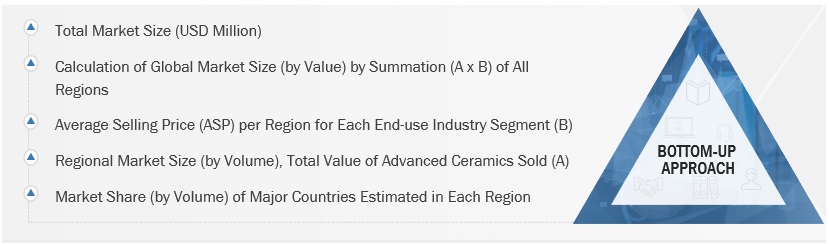

The study involved four major activities in estimating the current market size for advanced ceramics. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary sources referred to for this research study include ceramic industry organizations such as the European Ceramic Industry Association (OICA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and ceramic associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

Advanced Ceramics market involves a variety of stakeholders across the value chain, including raw material suppliers, manufacturers, and end-users. For this study, both the supply and demand sides of the market were interviewed to gather qualitative and quantitative information. Key opinion leaders from various end-use sectors were interviewed from the demand side, while manufacturers, associations, and institutions involved in the thermal management solutions industry were interviewed from the supply side.

Primary interviews helped to gather insights on market statistics, revenue data, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped to identify trends related to grade, application, end-use industries, and region. C-level executives from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand their perspective on suppliers, products, component providers, and their current and future usage of thermal management solutions, which will affect the overall market.

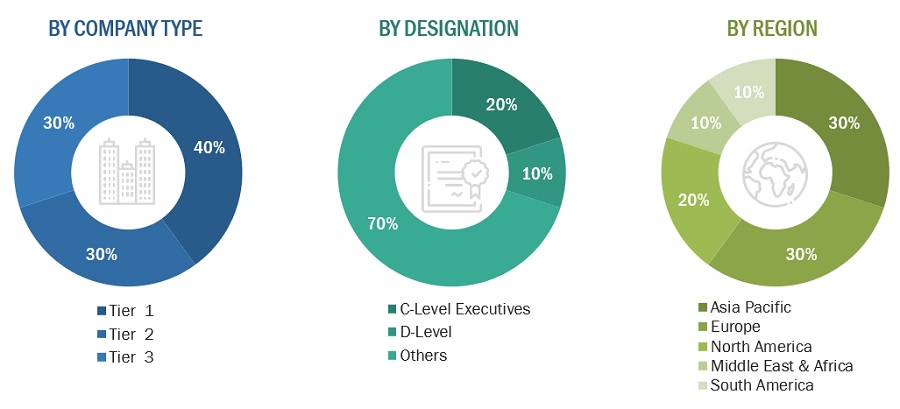

Breakdown of primary interviews

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Kyocera |

Sales Manager |

|

Ceram Tek |

Sales Manager |

|

Coors |

Technical Sales Manager |

|

Saint Gobain |

Marketing Manager |

|

AGC |

R&D Manager |

Market Size Estimation

- The top-down approach was used to estimate and validate the size of various submarkets for advanced ceramics for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on grade, application, end-use industry, and country were determined using secondary sources and verified through primary sources.

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Advanced Ceramics Market: Bottum-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Advanced Ceramics Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of advanced ceramics and their applications.

Market Definition

Advanced ceramics are highly developed inorganic and non-metallic ceramics with excellent high-temperature stability, hardness, low thermal expansion, and various electrical properties ranging from insulation to dielectric properties to high conductivity. Advanced ceramics are mainly used in electrical & electronics, transportation, medical, defense & security, and environmental, among other end-use industries.

Key Stakeholders

- Manufacturers of advanced ceramics market

- Feedstock Suppliers

- Manufacturers In End-use Industries

- Traders, Distributors, and Suppliers

- Regional Manufacturers’ Associations

- Government & Regional Agencies and Research Organizations

Objectives of the Study:

- To analyze and forecast the size of the advanced ceramics market in terms of value and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market

- To analyze and forecast the market by type/material, application, end-use industry, and region.

- To forecast the size of the market with respect to five regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders.

- To analyze competitive developments in the market, such as investment & expansion, joint venture, partnership, and merger & acquisition

- To strategically profile key players and comprehensively analyze their market shares and core competencies2.

- Notes: Micromarkets1 are the sub-segments of the Advanced ceramics market included in the report.

- Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report.

- Additional country-level analysis of advanced ceramics market

- Profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Advanced Ceramics Market