TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2020–2022

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.6.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 AGRICULTURE ANALYTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

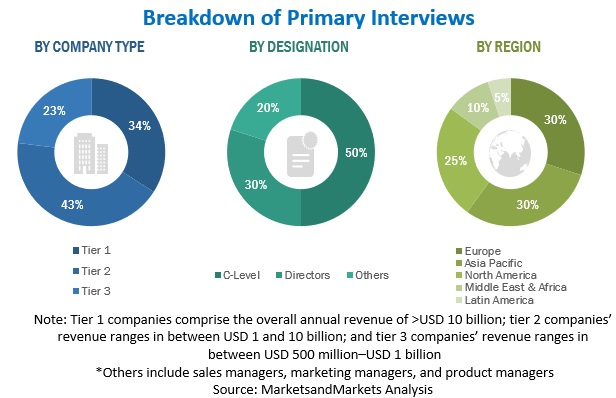

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 AGRICULTURE ANALYTICS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF AGRICULTURE ANALYTICS MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF AGRICULTURE ANALYTICS MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (DEMAND-SIDE): SHARE OF AGRICULTURE ANALYTICS THROUGH OVERALL AGRICULTURE ANALYTICS SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.6 LIMITATIONS

2.7 IMPLICATIONS OF RECESSION ON AGRICULTURE ANALYTICS MARKET

3 EXECUTIVE SUMMARY (Page No. - 47)

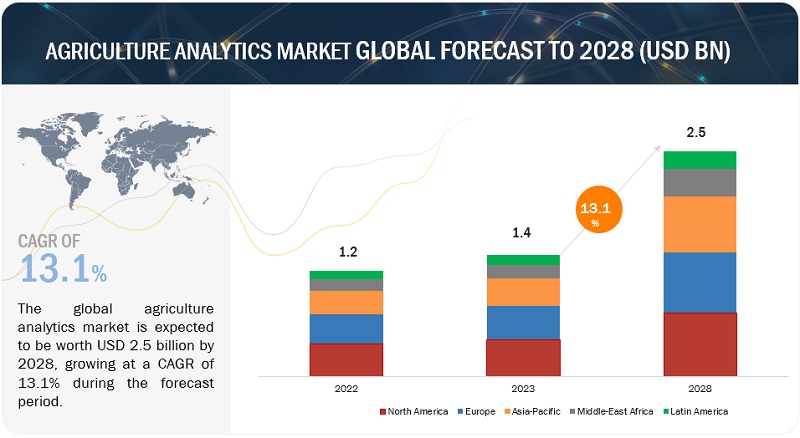

TABLE 4 AGRICULTURE ANALYTICS MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y %)

TABLE 5 AGRICULTURE ANALYTICS MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

FIGURE 7 SOLUTIONS SEGMENT TO SECURE HIGHER MARKET SHARE IN 2023

FIGURE 8 PROFESSIONAL SEGMENT TO DOMINATE MARKET IN 2023

FIGURE 9 TRAINING AND CONSULTING SERVICES TO CLAIM LARGER MARKET SHARE IN 2023

FIGURE 10 LARGE FARMS SEGMENT TO LEAD MARKET IN 2023

FIGURE 11 REMOTE SENSING AND SATELLITE IMAGERY SEGMENT TO CLAIM LARGER MARKET SHARE IN 2023

FIGURE 12 PRECISION FARMING SEGMENT TO DOMINATE MARKET IN 2023

FIGURE 13 FARMERS SEGMENT TO SECURE LARGER MARKET SHARE IN 2023

FIGURE 14 AGRICULTURE ANALYTICS MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 52)

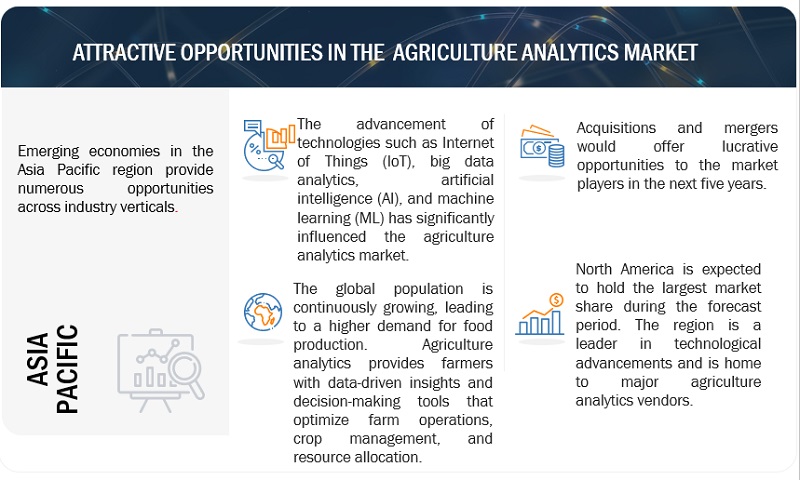

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AGRICULTURE ANALYTICS MARKET

FIGURE 15 RISING NEED FOR RISK ASSESSMENT IN FARMING TO DRIVE ADOPTION OF AGRICULTURE ANALYTICS

4.2 OVERVIEW OF RECESSION IN GLOBAL AGRICULTURE ANALYTICS MARKET

FIGURE 16 AGRICULTURE ANALYTICS MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH IN 2023

4.3 AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE

FIGURE 17 PRECISION FARMING SEGMENT TO HOLD HIGHEST MARKET SHARE DURING FORECAST PERIOD

4.4 AGRICULTURE ANALYTICS MARKET, BY REGION

FIGURE 18 NORTH AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARE IN 2023

4.5 AGRICULTURE ANALYTICS MARKET IN NORTH AMERICA, BY AGRICULTURE TYPE AND END USERS

FIGURE 19 PRECISION FARMING AND FARMERS SEGMENTS ESTIMATED TO SECURE MAXIMUM MARKET SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 AGRICULTURE ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing size and complexity of farms

5.2.1.2 Rising need for optimal resource utilization

5.2.1.3 Enhancing sustainability and reducing environmental impact

5.2.1.4 Applying Big Data in farming

5.2.2 RESTRAINTS

5.2.2.1 High costs associated with data collection and analysis

5.2.2.2 Data privacy and security concerns

5.2.3 OPPORTUNITIES

5.2.3.1 Technological advancements such as IoT, AI, and ML

5.2.3.2 Prospect of public-private collaborations to advance use of agriculture analytics

5.2.4 CHALLENGES

5.2.4.1 Lack of technological literacy and skills gap

5.2.4.2 Data transfer and storage

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: BETTER WINE PRODUCTION AT E. & J. GALLO WINERY WITH IBM SOLUTION

5.3.2 CASE STUDY 2: BUNGE RUNS SOPHISTICATED ANALYSIS TO IMPROVE ACTIVITIES USING IBM GIS MAPPING SOFTWARE

5.3.3 CASE STUDY 3: DELAVAL HELPS ABIS DAIRY FARM TO IMPROVE ANIMAL WELFARE AND WORK EFFICIENCY

5.3.4 CASE STUDY 4: NESTLÉ USES AGRIVI 360 AGRICULTURE SUPPLY CHAIN PLATFORM FOR COMPLETE TRACEABILITY THROUGHOUT CHAIN

5.3.5 CASE STUDY 5: VEGGITECH AND AGRIVI BRINGS AGRONOMY INTO MODERN WORLD

5.3.6 CASE STUDY 6: WYMAN INCREASES PRODUCTIVITY WITH CONSERVIS

5.3.7 CASE STUDY 7: SPROULE FARMS INCREASES EFFICIENCY AND PROFITABILITY WITH CONSERVIS

5.3.8 CASE STUDY 8: AGROPECUÁRIA CANOA MIRIM S/A IMPROVES PROFITABILITY AND PRODUCTIVITY BY OPTIMIZING FERTILIZER USE

5.3.9 CASE STUDY 9: MFA STREAMLINES STANDARDIZATION ACROSS ORGANIZATION BY IMPLEMENTING PROAGRICA’S SOLUTIONS

5.3.10 CASE STUDY 10: ONESOIL YIELD ASSISTS SMART FARMING IN IMPROVING PERFORMANCE

5.3.11 CASE STUDY 11: WOODHALL GROWERS ACHIEVES ACCURACY AND FLEXIBILITY WITH AG LEADER’S SOLUTION

5.3.12 CASE STUDY 12: DE BORTOLI WINES SAVES 15–20% ON INPUT COSTS WITH AGWORLD’S SOLUTIONS

5.4 BRIEF HISTORY OF AGRICULTURE ANALYTICS

FIGURE 21 BRIEF HISTORY OF AGRICULTURE ANALYTICS

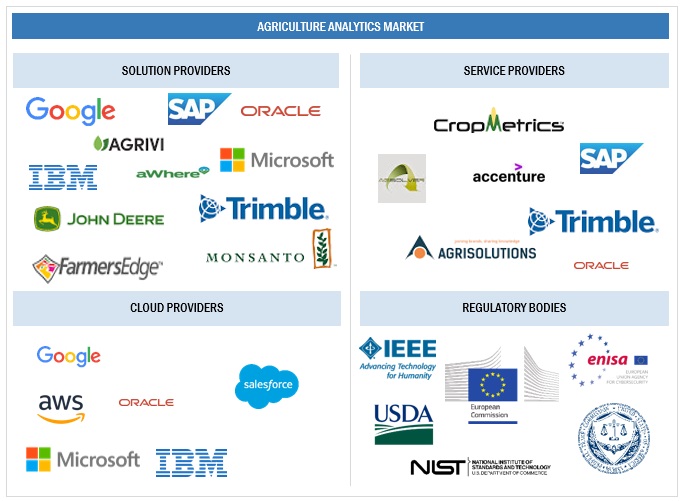

5.5 AGRICULTURE ANALYTICS MARKET: ECOSYSTEM

FIGURE 22 AGRICULTURE ANALYTICS MARKET: ECOSYSTEM

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 23 SUPPLY CHAIN ANALYSIS: AGRICULTURE ANALYTICS MARKET

5.7 PRICING MODEL ANALYSIS

TABLE 6 AVERAGE SELLING PRICE ANALYSIS, 2023

5.8 PATENT ANALYSIS

5.8.1 METHODOLOGY

5.8.2 DOCUMENT TYPE

TABLE 7 PATENTS FILED, 2013–2023

5.8.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED, JANUARY 2013– APRIL 2023

5.8.3.1 Top applicants

FIGURE 25 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS, 2013–2023

FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013–2023

TABLE 8 TOP 10 PATENT OWNERS IN AGRICULTURE ANALYTICS MARKET, 2013–2023

TABLE 9 LIST OF PATENTS IN AGRICULTURE ANALYTICS MARKET, 2021–2023

5.9 TECHNOLOGY ANALYSIS

5.9.1 RELATED TECHNOLOGY

5.9.1.1 GIS-based agriculture

5.9.1.2 Sensor technology

5.9.2 ALLIED TECHNOLOGY

5.9.2.1 Blockchain

5.9.2.2 Sky-drones

5.9.2.3 Robotics and automation technology

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 KEY CONFERENCES & EVENTS

TABLE 11 AGRICULTURE ANALYTICS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

5.12 REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.2 REGULATIONS, BY REGION

5.12.2.1 North America

5.12.2.2 Europe

5.12.2.3 Asia Pacific

5.12.2.4 Middle East & Africa

5.12.2.5 Latin America

5.12.3 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

5.12.3.1 General Data Protection Regulation

5.12.3.2 Securities and Exchange Commission Rule 17a-4

5.12.3.3 International Organization for Standardization/International Electrotechnical Commission 27001

5.12.3.4 System and Organization Controls 2 Type II Compliance

5.12.3.5 Financial Industry Regulatory Authority

5.12.3.6 Freedom of Information Act

5.12.3.7 Health Insurance Portability and Accountability Act

5.13 KEY COMPONENTS OF AGRICULTURE ANALYTICS ARCHITECTURE

5.13.1 DATA COLLECTION

5.13.2 DATA MANAGEMENT

5.13.3 DATA ANALYSIS

5.13.4 PREDICTIVE MODELING

5.13.5 DECISION SUPPORT SYSTEMS

5.14 TYPE OF AGRICULTURE ANALYTICS

5.14.1 FARMING ANALYTICS

5.14.2 LIVESTOCK ANALYTICS

5.14.3 AQUACULTURE ANALYTICS

5.15 KEY STAKEHOLDERS & BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE AGRICULTURE TYPE

TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE AGRICULTURE TYPE

5.15.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE AGRICULTURE TYPE

TABLE 18 KEY BUYING CRITERIA FOR TOP THREE AGRICULTURE TYPE

5.16 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN AGRICULTURE ANALYTICS MARKET

FIGURE 30 AGRICULTURE ANALYTICS MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.17 TECHNOLOGY ROADMAP OF AGRICULTURE ANALYTICS MARKET

TABLE 19 SHORT-TERM ROADMAP, 2023–2025

TABLE 20 MID-TERM ROADMAP, 2026–2028

TABLE 21 LONG-TERM ROADMAP, 2029–2030

5.18 BUSINESS MODELS OF AGRICULTURE ANALYTICS

5.19 PRACTICES IN AGRICULTURE ANALYTICS MARKET

5.19.1 AGRI-EDUCATION AND TRAINING

5.19.2 AGRI-MARKET FORECASTING AND PRICE ANALYSIS

5.19.3 SAFETY AND HEALTH

5.19.4 CROP SELECTION AND DIVERSITY

5.19.5 WATER CONSERVATION

6 AGRICULTURE ANALYTICS MARKET, BY OFFERING (Page No. - 97)

6.1 INTRODUCTION

6.1.1 OFFERING: AGRICULTURE ANALYTICS MARKET DRIVERS

FIGURE 31 SERVICES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 22 AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 23 AGRICULTURE ANALYTICS MARKET SIZE, BY OFFERING, 2023–2028 (USD MILLION)

6.2 SOLUTIONS

TABLE 24 SOLUTIONS: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 25 SOLUTIONS: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3 SERVICES

FIGURE 32 MANAGED SERVICES SEGMENT TO EXHIBIT HIGHER CAGR IN AGRICULTURE ANALYTICS MARKET DURING FORECAST PERIOD

TABLE 26 AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2017–2022 (USD MILLION)

TABLE 27 AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2023–2028 (USD MILLION)

TABLE 28 SERVICES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 29 SERVICES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 33 SYSTEM INTEGRATION AND IMPLEMENTATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 30 PROFESSIONAL SERVICES: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2017–2022 (USD MILLION)

TABLE 31 PROFESSIONAL SERVICES: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2023–2028 (USD MILLION)

TABLE 32 PROFESSIONAL SERVICES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 33 PROFESSIONAL SERVICES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.1.1 Training and Consulting

6.3.1.1.1 Plays vital role in managing operations and technology updates

TABLE 34 TRAINING AND CONSULTING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 35 TRAINING AND CONSULTING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.1.2 System Integration and Implementation

6.3.1.2.1 Rising need to ensure effective system communication to augment segment growth

TABLE 36 SYSTEM INTEGRATION AND IMPLEMENTATION: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 37 SYSTEM INTEGRATION AND IMPLEMENTATION: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.1.3 Support and Maintenance

6.3.1.3.1 Rising agriculture analytics deployment to enhance segment growth

TABLE 38 SUPPORT AND MAINTENANCE: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 39 SUPPORT AND MAINTENANCE: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.2 MANAGED SERVICES

FIGURE 34 DATA SERVICES SUB-SEGMENT TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

TABLE 40 MANAGED SERVICES: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2017–2022 (USD MILLION)

TABLE 41 MANAGED SERVICES: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2023–2028 (USD MILLION)

TABLE 42 MANAGED SERVICES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 43 MANAGED SERVICES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.2.1 Farm operation services

6.3.2.1.1 Generates records and integrates unstructured data into single, easy-to-use cloud-based or on-premises system

TABLE 44 FARM OPERATION SERVICES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 45 FARM OPERATION SERVICES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.2.2 Data services

6.3.2.2.1 Provides real-time information and intelligence capabilities

TABLE 46 DATA SERVICES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 47 DATA SERVICES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.2.3 Analytics Services

6.3.2.3.1 Rising demand for mobile technologies to boost segment growth

TABLE 48 ANALYTICS SERVICES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 49 ANALYTICS SERVICES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

7 AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE (Page No. - 113)

7.1 INTRODUCTION

7.1.1 AGRICULTURE TYPE: AGRICULTURE ANALYTICS MARKET DRIVERS

FIGURE 35 LIVESTOCK FARMING TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 50 AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2017–2022 (USD MILLION)

TABLE 51 AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2023–2028 (USD MILLION)

7.2 PRECISION FARMING

7.2.1 INCREASED EFFICIENCY AND REDUCED LABOR COSTS

TABLE 52 PRECISION FARMING: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

TABLE 53 PRECISION FARMING: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

TABLE 54 PRECISION FARMING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 55 PRECISION FARMING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

7.2.2 YIELD MONITORING AND PREDICTION

7.2.3 VARIABLE RATE TECHNOLOGY

7.2.4 FARM LABOR MANAGEMENT

7.2.5 DECISION SUPPORT SYSTEMS

7.2.6 SOIL HEALTH ANALYSIS

7.2.7 IRRIGATION AND WATER MANAGEMENT

7.2.8 WEATHER TRACKING & FORECASTING

7.2.9 FINANCIAL AND RISK MANAGEMENT

7.2.10 SUPPLY CHAIN MANAGEMENT

7.2.10.1 Order Delivery and Invoice Management

7.2.10.2 Shipping Management

7.2.10.3 Inventory Management

7.2.11 OTHER PRECISION FARMING

7.3 LIVESTOCK FARMING

7.3.1 OPTIMIZES PRODUCTION PROCESSES AND ENHANCES PRODUCTIVITY

TABLE 56 LIVESTOCK FARMING: AGRICULTURE ANALYTICS MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

TABLE 57 LIVESTOCK FARMING: AGRICULTURE ANALYTICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 58 LIVESTOCK FARMING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 59 LIVESTOCK FARMING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

7.3.2 FEEDING MANAGEMENT

7.3.3 HEAT STRESS MANAGEMENT

7.3.4 MILK HARVESTING

7.3.5 BREEDING MANAGEMENT

7.3.6 BEHAVIOR MONITORING AND MANAGEMENT

7.3.7 REAL-TIME MONITORING

7.3.8 CALF MANAGEMENT

7.3.9 SUPPLY CHAIN MANAGEMENT

7.3.9.1 Order Delivery and Invoice Management

7.3.9.2 Shipping Management

7.3.9.3 Inventory Management

7.3.10 OTHER LIVESTOCK FARMING

7.4 AQUACULTURE FARMING

7.4.1 ADOPTION OF DATA-DRIVEN DECISION-MAKING PROCESSES BOOSTS SEGMENTAL GROWTH

TABLE 60 AQUACULTURE FARMING: AGRICULTURE ANALYTICS MARKET, BY TYPE, 2017–2022 (USD MILLION)

TABLE 61 AQUACULTURE FARMING: AGRICULTURE ANALYTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 62 AQUACULTURE FARMING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 63 AQUACULTURE FARMING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

7.4.2 FISH TRACKING AND FLEET NAVIGATION

7.4.3 FEEDING MANAGEMENT

7.4.4 WATER QUALITY MANAGEMENT

7.4.5 QUALITY CONTROL AND TRACEABILITY

7.4.6 PEST AND DISEASE MANAGEMENT

7.4.7 FOOD PRODUCTION

7.4.8 AERATION SYSTEMS

7.4.9 SUPPLY CHAIN MANAGEMENT

7.4.9.1 Order Delivery and Invoice Management

7.4.9.2 Shipping Management

7.4.9.3 Inventory Management

7.4.10 OTHER AQUACULTURE FARMING

7.5 VERTICAL FARMING

7.5.1 OFFERS SOLUTION BY MAXIMIZING CROP YIELD IN LIMITED SPACES

TABLE 64 AGRICULTURE ANALYTICS MARKET, BY VERTICAL FARMING TYPE, 2017–2022 (USD MILLION)

TABLE 65 AGRICULTURE ANALYTICS MARKET, BY VERTICAL FARMING TYPE, 2023–2028 (USD MILLION)

TABLE 66 VERTICAL FARMING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 67 VERTICAL FARMING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

7.5.2 SUSTAINABILITY AND ENVIRONMENTAL MONITORING

7.5.3 ENERGY OPTIMIZATION

7.5.4 NUTRIENT MANAGEMENT

7.5.5 RESOURCE PLANNING AND OPTIMIZATION

7.5.6 GRADING AND MARKETING

7.5.7 PLANTING AND SEEDING

7.5.8 SUPPLY CHAIN MANAGEMENT

7.5.8.1 Order Delivery and Invoice Management

7.5.8.2 Shipping Management

7.5.8.3 Inventory Management

7.5.9 OTHER VERTICAL FARMING

7.6 OTHER AGRICULTURE TYPE

8 AGRICULTURE ANALYTICS MARKET, BY FARM SIZE (Page No. - 138)

8.1 INTRODUCTION

8.1.1 FARM SIZE: AGRICULTURE ANALYTICS MARKET DRIVERS

FIGURE 36 SMALL AND MEDIUM FARMS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 68 AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 69 AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED FARMS

8.2.1 MEDIUM-SIZED FARMS TO DOMINATE AGRICULTURE ANALYTICS MARKET

TABLE 70 SMALL AND MEDIUM-SIZED FARMS: AGRICULTURE ANALYTICS MARKET SIZE, BY REGION, 2017–2022 (USD MILLION)

TABLE 71 SMALL AND MEDIUM-SIZED FARMS: AGRICULTURE ANALYTICS MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

8.3 LARGE FARMS

8.3.1 OWNERS ADOPT ADVANCED TECHNOLOGIES TO ATTAIN GRANULAR DATA POINTS ON SOIL CONDITIONS AND OTHER VITAL DETAILS

TABLE 72 LARGE FARMS: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 73 LARGE FARMS: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

9 AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY (Page No. - 143)

9.1 INTRODUCTION

9.1.1 TECHNOLOGY: AGRICULTURE ANALYTICS MARKET DRIVERS

FIGURE 37 VISUALIZATION AND REPORTING SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 74 TECHNOLOGY: AGRICULTURE ANALYTICS MARKET, 2017–2022, (USD MILLION)

TABLE 75 TECHNOLOGY: AGRICULTURE ANALYTICS MARKET, 2023–2028 (USD MILLION)

9.2 REMOTE SENSING AND SATELLITE IMAGERY

9.2.1 INCREASING PRODUCTIVITY AND PROMOTING ENVIRONMENTAL STEWARDSHIP

TABLE 76 REMOTE SENSING AND SATELLITE IMAGERY: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 77 REMOTE SENSING AND SATELLITE IMAGERY: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3 GEOGRAPHIC INFORMATION SYSTEM

9.3.1 IMPROVED CROP MANAGEMENT AND ENVIRONMENTALLY SUSTAINABLE FARMING PRACTICES

TABLE 78 GEOGRAPHIC INFORMATION SYSTEM: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 79 GEOGRAPHIC INFORMATION SYSTEM: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.4 ROBOTICS AND AUTOMATION

9.4.1 ANALYZES AGRICULTURAL DATA TO OPTIMIZE FARMING PRACTICES

TABLE 80 ROBOTICS AND AUTOMATION: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 81 ROBOTICS AND AUTOMATION: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.5 BIG DATA AND CLOUD COMPUTING

9.5.1 EXTRACTS VALUABLE INSIGHTS FROM COMPLEX AGRICULTURAL DATA

TABLE 82 BIG DATA AND CLOUD COMPUTING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 83 BIG DATA AND CLOUD COMPUTING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.6 VISUALIZATION AND REPORTING

9.6.1 TRANSFORMING COMPLEX INFORMATION INTO VISUALLY INTUITIVE REPRESENTATIONS

TABLE 84 VISUALIZATION AND REPORTING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 85 VISUALIZATION AND REPORTING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.7 BLOCKCHAIN TECHNOLOGY

9.7.1 PROVIDES SECURE DATA MANAGEMENT, TRACEABILITY, AND INTEGRATION OF DIVERSE DATA SOURCES

TABLE 86 BLOCKCHAIN TECHNOLOGY: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 87 BLOCKCHAIN TECHNOLOGY: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.8 OTHER TECHNOLOGY

10 AGRICULTURE ANALYTICS MARKET, BY END USERS (Page No. - 154)

10.1 INTRODUCTION

10.1.1 END USERS: AGRICULTURE ANALYTICS MARKET DRIVERS

FIGURE 38 AGRONOMISTS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 88 AGRICULTURE ANALYTICS MARKET, BY END USERS, 2017–2022 (USD MILLION)

TABLE 89 AGRICULTURE ANALYTICS MARKET, BY END USERS, 2023–2028 (USD MILLION)

10.2 FARMERS

10.2.1 ADOPTION OF INNOVATIVE SOLUTIONS TO ENHANCE PRODUCTIVITY AND SUSTAINABILITY

TABLE 90 FARMERS: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 91 FARMERS: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

10.3 AGRONOMISTS

10.3.1 IMPROVED CROP MANAGEMENT AND ENVIRONMENTALLY SUSTAINABLE FARMING PRACTICES

TABLE 92 AGRONOMISTS: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 93 AGRONOMISTS: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

10.4 AGRIBUSINESSES

10.4.1 DRIVES PROFITABILITY, SUSTAINABILITY, AND INNOVATION IN EVER-EVOLVING AGRICULTURE INDUSTRY

TABLE 94 AGRIBUSINESSES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 95 AGRIBUSINESSES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

10.5 AGRICULTURAL RESEARCHERS

10.5.1 ENSURES SECURE AND RESILIENT FOOD SUPPLY

TABLE 96 AGRICULTURAL RESEARCHERS: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 97 AGRICULTURAL RESEARCHERS: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

10.6 GOVERNMENT AGENCIES

10.6.1 GATHER, ANALYZE, AND DISTRIBUTE DATA FOR POLICY FORMULATION

TABLE 98 GOVERNMENT AGENCIES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 99 GOVERNMENT AGENCIES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

10.7 OTHER END USERS

11 AGRICULTURE ANALYTICS MARKET, BY REGION (Page No. - 163)

11.1 INTRODUCTION

FIGURE 39 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 40 INDIA TO ATTAIN FASTEST GROWTH DURING FORECAST PERIOD

TABLE 100 AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 101 AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

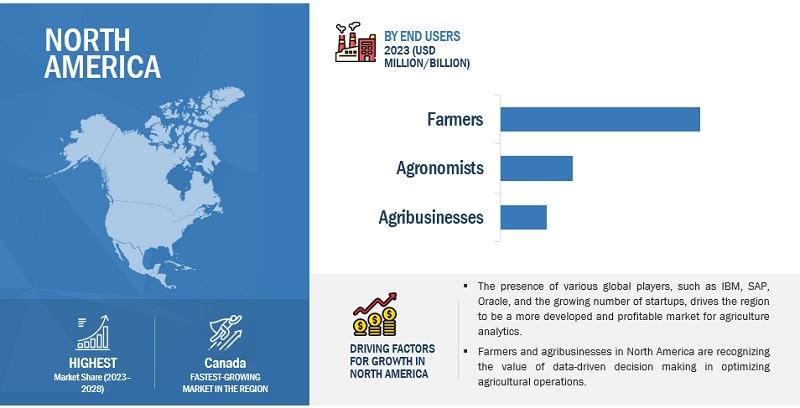

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET DRIVERS

11.2.2 NORTH AMERICA: IMPACT OF RECESSION

FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

TABLE 102 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 103 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 104 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2017–2022 (USD MILLION)

TABLE 105 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2023–2028 (USD MILLION)

TABLE 106 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2017–2022 (USD MILLION)

TABLE 107 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

TABLE 108 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY MANAGED SERVICES, 2017–2022 (USD MILLION)

TABLE 109 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY MANAGED SERVICES, 2023–2028 (USD MILLION)

TABLE 110 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2017–2022 (USD MILLION)

TABLE 111 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2023–2028 (USD MILLION)

TABLE 112 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 113 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

TABLE 114 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

TABLE 115 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

TABLE 116 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY END USERS, 2017–2022 (USD MILLION)

TABLE 117 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY END USERS, 2023–2028 (USD MILLION)

TABLE 118 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

TABLE 119 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

11.2.3 US

11.2.3.1 Increasing application of artificial intelligence in agriculture

TABLE 120 US: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 121 US: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 122 US: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 123 US: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.2.4 CANADA

11.2.4.1 Growing research on predictive analysis and machine learning

TABLE 124 CANADA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 125 CANADA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 126 CANADA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 127 CANADA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: AGRICULTURE ANALYTICS MARKET DRIVERS

11.3.2 EUROPE: IMPACT OF RECESSION

TABLE 128 EUROPE: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 129 EUROPE: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 130 EUROPE: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2017–2022 (USD MILLION)

TABLE 131 EUROPE: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2023–2028 (USD MILLION)

TABLE 132 EUROPE: AGRICULTURE ANALYTICS MARKET, BY PROFESSIONAL SERVICES: 2017–2022 (USD MILLION)

TABLE 133 EUROPE: AGRICULTURE ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

TABLE 134 EUROPE: AGRICULTURE ANALYTICS MARKET, BY MANAGED SERVICES, 2017–2022 (USD MILLION)

TABLE 135 EUROPE: AGRICULTURE ANALYTICS MARKET, BY MANAGED SERVICES, 2023–2028 (USD MILLION)

TABLE 136 EUROPE: AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2017–2022 (USD MILLION)

TABLE 137 EUROPE: AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2023–2028 (USD MILLION)

TABLE 138 EUROPE: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 139 EUROPE: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

TABLE 140 EUROPE: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

TABLE 141 EUROPE: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

TABLE 142 EUROPE: AGRICULTURE ANALYTICS MARKET, BY END USERS, 2017–2022 (USD MILLION)

TABLE 143 EUROPE: AGRICULTURE ANALYTICS MARKET, BY END USERS, 2023–2028 (USD MILLION)

TABLE 144 EUROPE: AGRICULTURE ANALYTICS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

TABLE 145 EUROPE: AGRICULTURE ANALYTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

11.3.3 UK

11.3.3.1 Several government initiatives and laws in favor of agriculture analytics to boost market growth

TABLE 146 UK: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 147 UK: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 148 UK: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 149 UK: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.3.4 GERMANY

11.3.4.1 Farming 4.0 and increased funding from established players to expand market size

TABLE 150 GERMANY: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 151 GERMANY: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 152 GERMANY: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 153 GERMANY: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.3.5 FRANCE

11.3.5.1 Growing application of GIS in agriculture analytics

TABLE 154 FRANCE: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 155 FRANCE: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 156 FRANCE: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 157 FRANCE: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.3.6 ITALY

11.3.6.1 Shift to AI-based farming to promote market growth

TABLE 158 ITALY: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 159 ITALY: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 160 ITALY: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 161 ITALY: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.3.7 NETHERLANDS

11.3.7.1 Increased usage of advanced agricultural practices to favor market expansion

TABLE 162 NETHERLANDS: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 163 NETHERLANDS: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 164 NETHERLANDS: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 165 NETHERLANDS: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.3.8 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET DRIVERS

11.4.2 ASIA PACIFIC: IMPACT OF RECESSION

FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 166 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 167 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 168 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2017–2022 (USD MILLION)

TABLE 169 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2023–2028 (USD MILLION)

TABLE 170 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY PROFESSIONAL SERVICES: 2017–2022 (USD MILLION)

TABLE 171 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

TABLE 172 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY MANAGED SERVICES, 2017–2022 (USD MILLION)

TABLE 173 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY MANAGED SERVICES, 2023–2028 (USD MILLION)

TABLE 174 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2017–2022 (USD MILLION)

TABLE 175 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2023–2028 (USD MILLION)

TABLE 176 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 177 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

TABLE 178 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

TABLE 179 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

TABLE 180 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY END USERS, 2017–2022 (USD MILLION)

TABLE 181 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY END USERS, 2023–2028 (USD MILLION)

TABLE 182 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

TABLE 183 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

11.4.3 CHINA

11.4.3.1 Implementation of “Digital Village” to enhance market growth

TABLE 184 CHINA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 185 CHINA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 186 CHINA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 187 CHINA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Rise of innovative technologies and government initiatives to drive use of analytics technologies

TABLE 188 JAPAN: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 189 JAPAN: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 190 JAPAN: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 191 JAPAN: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.4.5 INDIA

11.4.5.1 Digital transformation of Indian agriculture sector to provide opportunities to AI technology providers

TABLE 192 INDIA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 193 INDIA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 194 INDIA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 195 INDIA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.4.6 SOUTH KOREA

11.4.6.1 Increasing investments in aquaculture industry to create lucrative opportunities

TABLE 196 SOUTH KOREA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 197 SOUTH KOREA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 198 SOUTH KOREA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 199 SOUTH KOREA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.4.7 ANZ

11.4.7.1 Growing adoption of agriculture robots in farming to strengthen market

TABLE 200 ANZ: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 201 ANZ: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 202 ANZ: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 203 ANZ: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.4.8 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: IMPACT OF RECESSION

TABLE 204 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 205 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 206 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2017–2022 (USD MILLION)

TABLE 207 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2023–2028 (USD MILLION)

TABLE 208 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY PROFESSIONAL SERVICES: 2017–2022 (USD MILLION)

TABLE 209 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

TABLE 210 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY MANAGED SERVICES, 2017–2022 (USD MILLION)

TABLE 211 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY MANAGED SERVICES, 2023–2028 (USD MILLION)

TABLE 212 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2017–2022 (USD MILLION)

TABLE 213 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2023–2028 (USD MILLION)

TABLE 214 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 215 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

TABLE 216 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

TABLE 217 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

TABLE 218 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY END USERS, 2017–2022 (USD MILLION)

TABLE 219 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY END USERS, 2023–2028 (USD MILLION)

TABLE 220 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

TABLE 221 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

11.5.3 SAUDI ARABIA

11.5.3.1 Disburses subsidies and grants interest-free loans to farmers

TABLE 222 SAUDI ARABIA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 223 SAUDI ARABIA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 224 SAUDI ARABIA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 225 SAUDI ARABIA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.5.4 UAE

11.5.4.1 Advancement and adoption of AI and ML technologies to boost market

TABLE 226 UAE: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 227 UAE: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 228 UAE: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 229 UAE: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.5.5 ISRAEL

11.5.5.1 Employment of advanced analytics tools to favor market growth

TABLE 230 ISRAEL: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 231 ISRAEL: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 232 ISRAEL: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 233 ISRAEL: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.5.6 SOUTH AFRICA

11.5.6.1 Government initiatives to boost market

TABLE 234 SOUTH AFRICA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 235 SOUTH AFRICA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 236 SOUTH AFRICA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 237 SOUTH AFRICA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.5.7 REST OF MIDDLE EAST & AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET DRIVERS

11.6.2 LATIN AMERICA: IMPACT OF RECESSION

TABLE 238 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 239 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 240 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2017–2022 (USD MILLION)

TABLE 241 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY SERVICES, 2023–2028 (USD MILLION)

TABLE 242 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY PROFESSIONAL SERVICES: 2017–2022 (USD MILLION)

TABLE 243 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

TABLE 244 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY MANAGED SERVICES, 2017–2022 (USD MILLION)

TABLE 245 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY MANAGED SERVICES, 2023–2028 (USD MILLION)

TABLE 246 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2017–2022 (USD MILLION)

TABLE 247 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2023–2028 (USD MILLION)

TABLE 248 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 249 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

TABLE 250 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

TABLE 251 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

TABLE 252 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY END USERS, 2017–2022 (USD MILLION)

TABLE 253 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY END USERS, 2023–2028 (USD MILLION)

TABLE 254 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

TABLE 255 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

11.6.3 BRAZIL

11.6.3.1 Growing initiatives to digitize agriculture sector to strengthen market expansion

TABLE 256 BRAZIL: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 257 BRAZIL: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 258 BRAZIL: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 259 BRAZIL: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.6.4 MEXICO

11.6.4.1 Increasing initiatives to develop smart farming technologies to support market growth

TABLE 260 MEXICO: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 261 MEXICO: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 262 MEXICO: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 263 MEXICO: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.6.5 ARGENTINA

11.6.5.1 Application of satellite imagery, remote sensing, and data analytics to augment market size

TABLE 264 ARGENTINA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 265 ARGENTINA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 266 ARGENTINA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

TABLE 267 ARGENTINA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 227)

12.1 OVERVIEW

12.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 268 OVERVIEW OF STRATEGIES ADOPTED BY KEY AGRICULTURE ANALYTICS VENDORS

12.3 REVENUE ANALYSIS

FIGURE 43 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2020–2022

12.4 MARKET SHARE ANALYSIS

FIGURE 44 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2022

TABLE 269 AGRICULTURE ANALYTICS MARKET: DEGREE OF COMPETITION

12.5 COMPANY EVALUATION MATRIX

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE COMPANIES

12.5.4 PARTICIPANTS

FIGURE 45 KEY COMPANY EVALUATION MATRIX, 2022

12.5.5 COMPETITIVE BENCHMARKING

TABLE 270 AGRICULTURE ANALYTICS MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

TABLE 271 AGRICULTURE ANALYTICS MARKET: PRODUCT FOOTPRINT ANALYSIS OF OTHER PLAYERS, 2022

12.6 STARTUP/SME EVALUATION MATRIX

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 46 STARTUPS/SME EVALUATION MATRIX, 2022

12.6.5 STARTUPS/SMES COMPETITIVE BENCHMARKING

TABLE 272 AGRICULTURE ANALYTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

12.7 COMPETITIVE SCENARIOS AND TRENDS

12.7.1 PRODUCT LAUNCHES

TABLE 273 PRODUCT LAUNCHES, 2020–2023

12.7.2 DEALS

TABLE 274 DEALS, 2020–2023

13 COMPANY PROFILES (Page No. - 245)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.2.1 IBM

TABLE 275 IBM: BUSINESS OVERVIEW

FIGURE 47 IBM: COMPANY SNAPSHOT

TABLE 276 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 277 IBM: PRODUCT LAUNCHES

TABLE 278 IBM: DEALS

13.2.2 DEERE & COMPANY

TABLE 279 DEERE & COMPANY: BUSINESS OVERVIEW

FIGURE 48 DEERE & COMPANY: COMPANY SNAPSHOT

TABLE 280 DEERE & COMPANY: PRODUCTS/SOLUTIONS SERVICES OFFERED

TABLE 281 DEERE & COMPANY: DEALS

13.2.3 BAYER AG

TABLE 282 BAYER AG: BUSINESS OVERVIEW

FIGURE 49 BAYER AG: COMPANY SNAPSHOT

TABLE 283 BAYER AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 284 BAYER AG: PRODUCT LAUNCHES

TABLE 285 BAYER AG: DEALS

13.2.4 SAP

TABLE 286 SAP: BUSINESS OVERVIEW

FIGURE 50 SAP: COMPANY SNAPSHOT

TABLE 287 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 288 SAP: PRODUCT LAUNCHES

TABLE 289 SAP: DEALS

13.2.5 TRIMBLE INC

TABLE 290 TRIMBLE INC: BUSINESS OVERVIEW

FIGURE 51 TRIMBLE INC: COMPANY SNAPSHOT

TABLE 291 TRIMBLE INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 292 TRIMBLE INC: PRODUCT LAUNCHES

TABLE 293 TRIMBLE INC: DEALS

13.2.6 ACCENTURE

TABLE 294 ACCENTURE: BUSINESS OVERVIEW

FIGURE 52 ACCENTURE: COMPANY SNAPSHOT

TABLE 295 ACCENTURE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 296 ACCENTURE: DEALS

13.2.7 ABACO GROUP

TABLE 297 ABACO GROUP: BUSINESS OVERVIEW

TABLE 298 ABACO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 299 ABACO GROUP: DEALS

13.2.8 DELAVAL

TABLE 300 DELAVAL: BUSINESS OVERVIEW

FIGURE 53 DELAVAL: COMPANY SNAPSHOT

TABLE 301 DELAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 302 DELAVAL: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 303 DELAVAL: DEALS

13.2.9 ORACLE

TABLE 304 ORACLE: BUSINESS OVERVIEW

FIGURE 54 ORACLE: COMPANY SNAPSHOT

TABLE 305 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 306 ORACLE: DEALS

13.2.10 DTN

TABLE 307 DTN: BUSINESS OVERVIEW

TABLE 308 DTN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 309 DTN: DEALS

13.2.11 FARMERS EDGE

TABLE 310 FARMERS EDGE: BUSINESS OVERVIEW

TABLE 311 FARMERS EDGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 312 FARMERS EDGE: DEALS

13.2.12 SAS INSTITUTE

TABLE 313 SAS INSTITUTE: BUSINESS OVERVIEW

TABLE 314 SAS INSTITUTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 315 SAS INSTITUTE: DEALS

13.3 OTHER KEY PLAYERS

13.3.1 ITERIS

13.3.2 PRECISIONHAWK

13.3.3 CONSERVIS

13.3.4 STESALIT SYSTEMS

13.3.5 AGRIBOTIX

13.3.6 AGRIVI

13.3.7 GRANULAR

13.3.8 FBN

13.3.9 GRO INTELLIGENCE

13.3.10 RESSON

13.4 STARTUPS

13.4.1 AGVUE TECHNOLOGIES

13.4.2 TARANIS

13.4.3 CROPX

13.4.4 TRACE GENOMICS

13.4.5 FASAL

13.4.6 AGEYE TECHNOLOGIES

13.4.7 HELIOPAS AI

13.4.8 ONESOIL

13.4.9 ROOT AI

13.4.10 AGSHIFT

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 299)

14.1 INTRODUCTION

14.2 PRECISION FARMING MARKET – GLOBAL FORECAST TO 2030

14.2.1 MARKET DEFINITION

14.2.2 MARKET SEGMENT

14.2.2.1 By Offering

TABLE 316 PRECISION FARMING MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 317 PRECISION FARMING MARKET, BY OFFERING, 2022–2030 (USD MILLION)

14.2.2.1.1 By hardware

TABLE 318 PRECISION FARMING MARKET, BY HARDWARE, 2018–2021 (USD MILLION)

TABLE 319 PRECISION FARMING MARKET, BY HARDWARE, 2022–2030 (USD MILLION)

14.2.2.1.2 By software

TABLE 320 SOFTWARE: PRECISION FARMING MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

TABLE 321 SOFTWARE: PRECISION FARMING MARKET, BY DEPLOYMENT TYPE, 2022–2030 (USD MILLION)

14.2.2.1.3 By service

TABLE 322 PRECISION FARMING MARKET FOR SERVICES, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 323 PRECISION FARMING MARKET FOR SERVICES, BY SERVICE TYPE, 2022–2030 (USD MILLION)

14.2.2.2 By Technology

TABLE 324 PRECISION FARMING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 325 PRECISION FARMING MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

14.2.2.3 By Application

TABLE 326 PRECISION FARMING MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

14.2.2.4 By Region

14.2.2.4.1 Introduction

TABLE 327 PRECISION FARMING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 328 PRECISION FARMING MARKET, BY REGION, 2022–2030 (USD MILLION)

14.3 AI IN AGRICULTURE MARKET – GLOBAL FORECAST TO 2028

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.2.1 By Technology

TABLE 329 AI IN AGRICULTURE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

TABLE 330 AI IN AGRICULTURE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

14.3.2.2 By Offering

TABLE 331 AI IN AGRICULTURE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

TABLE 332 AI IN AGRICULTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

14.3.2.2.1 By hardware

TABLE 333 HARDWARE: AI IN AGRICULTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

TABLE 334 HARDWARE: AI IN AGRICULTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

14.3.2.2.2 By software

TABLE 335 SOFTWARE: AI IN AGRICULTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

TABLE 336 SOFTWARE: AI IN AGRICULTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

14.3.2.2.3 By service

TABLE 337 SERVICE: AI IN AGRICULTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

TABLE 338 SERVICE: AI IN AGRICULTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

14.3.2.3 By Application

TABLE 339 AI IN AGRICULTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 340 AI IN AGRICULTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

14.3.2.4 By Region

TABLE 341 AI IN AGRICULTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

TABLE 342 AI IN AGRICULTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

15 APPENDIX (Page No. - 310)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agriculture Analytics Market

Who are the top players in APAC region for Agriculture Analytics Market