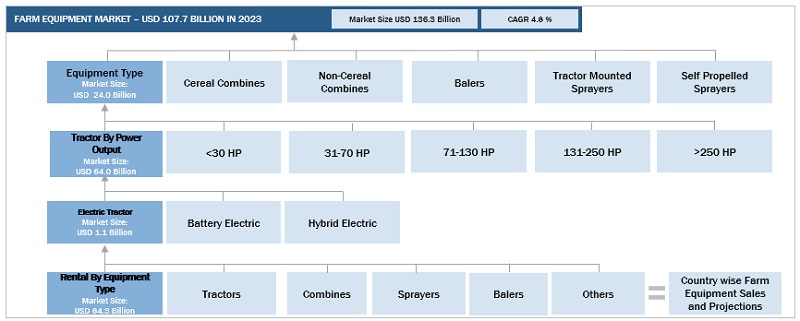

Farm Equipment Market by Tractor Power Output (<30, 31-70, 71-130, 131-250, >250HP), Type (Tractors, Balers, Sprayers), Tractor Drive Type, Electric Tractor by Type & Propulsion, Implement by Function, Rental & Region - Global Forecast to 2028

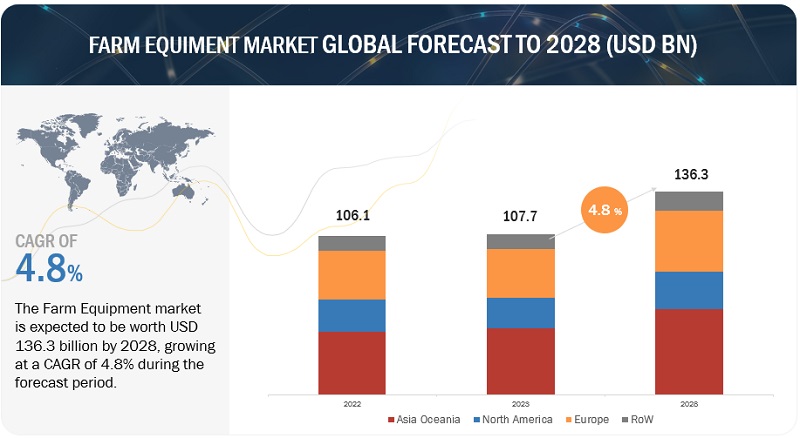

[379 Pages Report] The global farm equipment market is projected to grow from USD 107.7 billion in 2023 to USD 136.3 billion by 2028, at a CAGR of 4.8% during the forecast period. Farm mechanization has shown significant growth recently, and top OEMs are investing in the same, which would further drive the demand for agriculture equipment. Though the demand for farm equipment is growing in Europe and North America, Asia Oceania remains the key market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Government support with farm loan waivers/ credit finance

Farm loan waiver programs serve as incentives for farmers to invest in agricultural equipment. Governments worldwide have introduced these schemes to alleviate farmers from debt burdens and promote the adoption of mechanized farming methods. According to the 2019 Agricultural Policy Monitoring and Evaluation report by the Organization for Economic Co-operation and Development (OECD), farm policies in 54 countries, including OECD and EU nations, along with 12 key emerging economies, provided an average of USD 817 billion per year in direct support to farmers from 2019 to 2021. This represents a 13% increase compared to the period from 2018 to 2020. EU For instance, In India, the Ministry of Agriculture and Farmers’ Welfare has allocated Rs 1,25,036 crore (USD 15.14 Billion) in 2023-24, 5% more than the revised estimates for 2022-23. Rashtriya Krishi Vikas Yojana (RKVY) scheme was restructured under the 2022-23 budget to subsume other schemes such as the Pradhan Mantri Krishi Sinchai Yojna-Per Drop More Crop, Paramparagat Krishi Vikas Yojna, National Project on Soil and Health Fertility, Rainfed Area Development and Climate Change, Sub-Mission on Agriculture Mechanization including Management of Crop Residue.

Government subsidies have a crucial impact on a country's agricultural sector. For instance, the US Farm Service Agency (FSA) offers secured and direct loans for farm ownership and operations to small family farmers who struggle to secure commercial credit from banks, farm credit institutions, or other lenders. Additionally, FSA loans can be utilized for acquiring land, livestock, equipment, feed, seed, and supplies. For instance, in the Inflation Reduction Act, specifically outlined in Section 22006, allocates USD 3.1 billion to the USDA. This funding aims to support struggling borrowers who hold specific farm loans through the Farm Service Agency (FSA), both direct and guaranteed.

Additionally, the act seeks to fast-track aid for individuals whose agricultural enterprises face financial jeopardy. The US Department of Agriculture has introduced multiple loan initiatives, including a program for direct farm ownership down payments. Notably, the maximum loan amount has been raised from USD 250,000 to USD 300,000, and the guaranteed portion on conservation loans has increased from 75% to 80%. These adjustments have played a pivotal role in driving substantial growth within the farm equipment market.

RESTRAINT: Growth of the rental market

Investing in farm equipment like tractors and harvesters constitutes a substantial financial commitment in agricultural operations and holds the largest portion of the global rental market. The entire process of creating, manufacturing, and distributing this equipment demands significant financial resources, which is evident in the pricing of the machinery accessible to farmers. Limited investment capabilities among small-scale farmers contribute to the low adoption of farm equipment in emerging nations.

Farmers choose to rent agricultural machinery as it boosts productivity and speed, thereby enhancing business efficiency and profitability. Renting equipment is a cost-effective alternative to acquiring it through traditional loans. Consequently, the global shortage of farm labor and rising wages have propelled the demand for farm equipment rental services. The growing incorporation of advanced technologies in rental agricultural machinery plays a pivotal role in elevating operational efficiency and profitability. This trend is particularly valuable for small-scale farmers, allowing them to utilize high-value equipment for enhanced crop production in a shorter timeframe.

Ongoing research and development have led to the creation of advanced products with versatile capabilities. These modern machines incorporate intricate mechatronic systems, necessitating specialized manufacturing and assembly procedures. The entire process of designing, producing, and distributing such equipment involves substantial investments, which is mirrored in the machinery's cost made accessible to farmers. Farm equipment manufacturers opt for mobile applications and rent the equipment through dealers. For instance, in February 2022, Sonalika Group provided farm machinery and equipment for rent through the Sonalika Agro Solutions App, through which farmers can rent the available advanced agricultural machinery according to their needs. MacAllister Rentals, known as The CAT Rental Store, provides a wide range of premium equipment from Caterpillar and 50+ other manufacturers. As part of Indiana’s MacAllister Machinery, a family-owned business, they have a strong legacy of offering contractors excellent service, technical knowledge, and quality gear. KhetiGaadi, an agriculture equipment rental and agro e-commerce startup in India, launched its agro advisory services for farmers in Pune in May 2022. The company provides farmers with access to a variety of farm equipment, as well as advice on how to use it. etHekwini Municipality in South Africa acquired tractors to rent for free to the farmers in March 2022. The municipality’s Agro-Ecology Unit managed the free tractor-hiring initiative. In August 2021, Farmkart launched the farm machinery rentals platform rent4farm, which helps farmers rent high-quality machinery and equipment at competitive rates. The limited financial capacity of small farmers is a key factor contributing to the lower adoption of farm equipment in developing nations. In emerging economies like Asia-Oceania, farmers are hesitant to invest in costly machinery. However, the adoption rate is higher in North America and Europe due to labor scarcity and high labor costs. Agricultural equipment manufacturers must consistently upgrade their products to meet changing emission standards, which drives up equipment costs. Consequently, the elevated prices of agricultural machinery such as high horsepower tractors, combines, balers, and sprayers hinder sales and consequently slow down the growth of the farm equipment market, particularly in emerging economies.

OPPORTUNITY: Precision agriculture

As per the Economic Survey findings, the relationship between farm mechanization and crop productivity is direct. Mechanization offers time and labor savings, diminishes laborious tasks, cuts production expenses, minimizes postharvest losses, and elevates crop yield and farm revenue over the long term. The agricultural sector faces ongoing pressure to meet the demands of a growing population, compelling farmers to prioritize efficiency and productivity for business expansion. Precision farming has become commonplace, particularly for farmers seeking heightened output with limited resources. This approach effectively addresses the global food demand challenge. Additionally, it enhances operational efficiency, bolsters production, and reduces the gap between agricultural supply and consumption. Employing agricultural machinery optimally enhances productivity, enables timely farm operations, and facilitates swift crop rotation on the same land. Precision farming technology optimizes water, seed, land, fertilizer, and equipment use, ultimately enhancing yield quantity and quality.

The increasing R&D activities and several companies' launches of hybrid & electric tractors are expected to create growth opportunities for the agriculture sector. In August 2021, Solectrac launched the e70N tractor with 70 HP, 60 kWh electric tractor for USD 75,000. In 2022, CNH Industrial has developed a prototype electric tractor with autonomous features. The tractor has sensors, cameras, and control units to navigate fields and perform tasks such as planting and harvesting without human intervention.

Italian motorcycle manufacturer Energica, through Energica Inside, is collaborating with American electric tractor company Solectrac to develop advanced electric tractors using motorcycle technology. Energica Inside will aid in battery pack and VCU development to enhance tractor run-time and performance.

John Deere also plans to introduce electric equipment in its turf and utility lines by 2026, including an autonomous electric tractor. The company sees this shift as a significant opportunity driven by customer needs, battery advancements, and cost reductions.

CHALLENGE: Rapidly changing emission norms and mandates

CNH Industrial, John Deere, and AGCO have voiced apprehensions regarding emission regulations across various global regions. The enforcement of these norms has the potential to curb the sales of both construction and agricultural machinery. Adapting to altered emission regulations necessitates substantial Research and Development investments. Each market's specific regulations add complexity, particularly in the design of components, particularly engines.

India introduced emission standards for off-road vehicles in 1999, with the latest TREM Stage-IV implemented on January 1, 2023. TREM Stage-V, with even stricter pollution limits, is anticipated to come into effect in April 2024, underscoring the government’s commitment to reducing emissions from new diesel non-road equipment. The new standards require more advanced emission control technologies, which can be expensive. However, the agricultural industry is committed to reducing its environmental impact and is investing in new technologies to meet the new emission standards. Thus, changing emission regulations to comply with government regulations may challenge the sale of tractors. Furthermore, it is expected that stricter emission norms for farm equipment that conform to Euro Stage IV may result in prices of this equipment being increased by 10-15%.

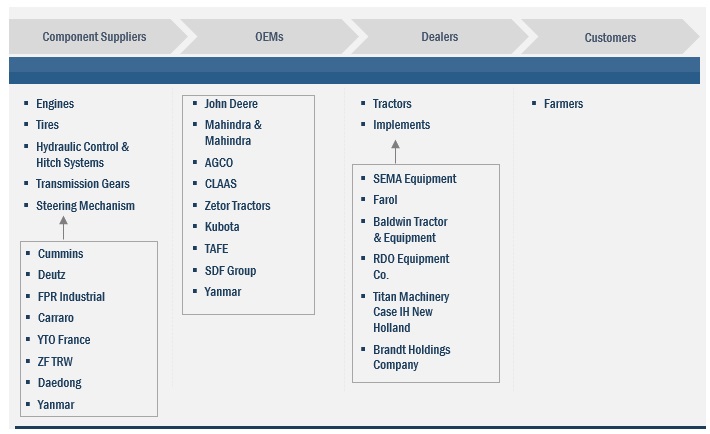

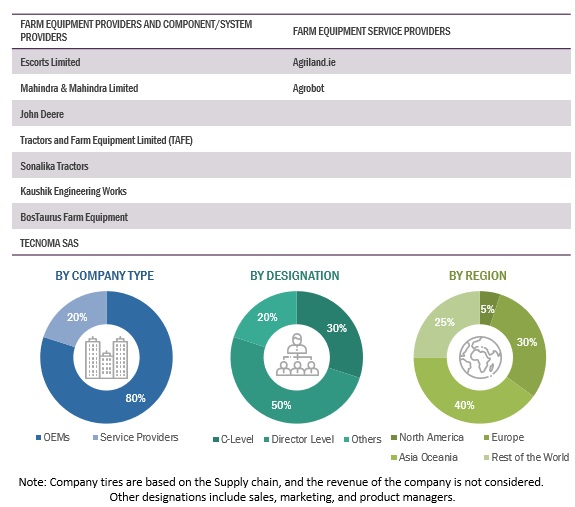

Farm Equipment market Ecosystem

The ecosystem analysis highlights farm equipment market players, primarily represented by component manufacturers, manufacturers, and dealers.

Light Duty electric tractor segment is estimated to be the fastest growing market

The light-duty electric tractors are quiet and emission-free, making them a good choice for farmers looking to reduce their environmental impact. The increasing emphasis on sustainable agriculture and advancements in tractor technology drives the demand for light-duty tractors. Their versatility and adaptability to smaller plots of land are significant drivers. However, the higher cost of electric tractors than diesel ones can discourage their adoption. However, a ten-year cost analysis suggests that the overall cost difference is relatively small despite initial high purchase expenses. This cost competitiveness could be enhanced with incentives. For instance, India introduced the Faster Adoption and Manufacturing of Electric and Hybrid Vehicles (FAME) scheme in 2015, extended in 2019 to promote electric vehicles and reduce fossil fuel reliance. The current subsidy offers around INR 15,000 per kWh battery or up to 40% of the total vehicle cost. India’s history of subsidizing agricultural electricity and states offering discounted power rates, especially for irrigation, could further decrease the operating costs of electric tractors. TAFE, a leading tractor manufacturer, supported around 64,000 small farmers in Tamil Nadu through its "Free Tractor Rental Scheme" (FTRS) under the JFarm service. TAFE enabled farming across 1.03 lakh acres. Within 60 days of the FTRS launch, they offered over 1.55 lakh hours of free tractor and farm implement rental services, benefiting the farming community significantly.

31–70 HP segment is estimated to be the largest market during the forecast period

The farm equipment market is projected to see the highest demand in the 31—70 HP segment. This trend is fueled by the growing adoption of farm mechanization, particularly in emerging nations, largely prompted by government initiatives like loan waivers and schemes. Within this range, the 31-70 HP tractors are anticipated to make up approximately 34.6% of total tractor sales in the year 2023. These tractors are powerful enough to handle various tasks, such as tillage, planting, and harvesting, but they are also not too large or bulky to maneuver in small fields or orchards. 30-70 HP tractors are typically more fuel-efficient than larger tractors, which can save farmers money on fuel costs, and are easy to maintain, saving farmers time and money. Also, the farm size in emerging countries is small to medium and requires less power tractors than high-power tractors, and the cost of manual labor or draught animals is the same when renting the low to medium-power tractor. Smallholder farms mostly prefer these tractors, and 84% of the world’s 570 million farms are smallholdings, less than two hectares in size. This drives the growing demand for tractors with moderate power output like 30-70 HP. A shift towards small-scale farming can be a dominating factor in leading the 31-70 HP tractor market growth. The market is anticipated to experience growth due to enhanced farm mechanization in emerging economies, a momentum propelled by government initiatives. Furthermore, a surge in the desire for high-performance tractors and the expansion of well-connected dealer networks supported by effective marketing strategies are projected to elevate the global market. The increasing demand for agricultural mechanization is also one of the primary drivers of the growth of the 31-70 HP tractor market. This is due to the rising labor costs and the need to increase crop yields.

Four-wheel drive segment to grow at the fastest CAGR from 2023 to 2028

The demand for four-wheel drive tractors is expected to grow with the changing requirements in farming activities such as covering a larger acre of land or pulling large implements. The availability of low-powered tractors with four-wheel drive is expected to be a significant factor in their growing demand. Four-wheel drive tractors provide better traction than 2-wheel drive tractors, which is important for operating in rugged terrain like mud, snow, or hills. John Deere Model 5050 D is a low-powered tractor that delivers 50 HP and is available in four-wheel drive. John Deere 5060E 4WD, Mahindra Yuvo 575 DI 4WD, New Holland 3630 TX Plus 4WD, Escort Agri Machinery Farmtrac 6055 T20 4WD, Kubota MU4501 4WD, etc. are some of the models with four-wheel drive type in India.

In 2021, Sonalika Tractors (India) made a significant move by unveiling the Tiger DI 75 four-wheel drive tractor, incorporating cutting-edge CRDs (Common Rail Diesel System) technology. Moreover, Sonalika introduced the Tiger DI 65 four-wheel drive tractor, which offers a customized combination of 65 HP power and the efficiency of a 55 HP model. These new tractor variants are accessible in both 4-wheel and 2-wheel drive configurations. The growing trend of agricultural mechanization is further propelling the expansion of the market for four-wheel-drive tractors. Rising agricultural mechanization is also boosting the four-wheel-drive tractors market. These tractors offer enhanced traction, pulling power, fuel efficiency, extended service intervals, and power distribution to all wheels as needed.

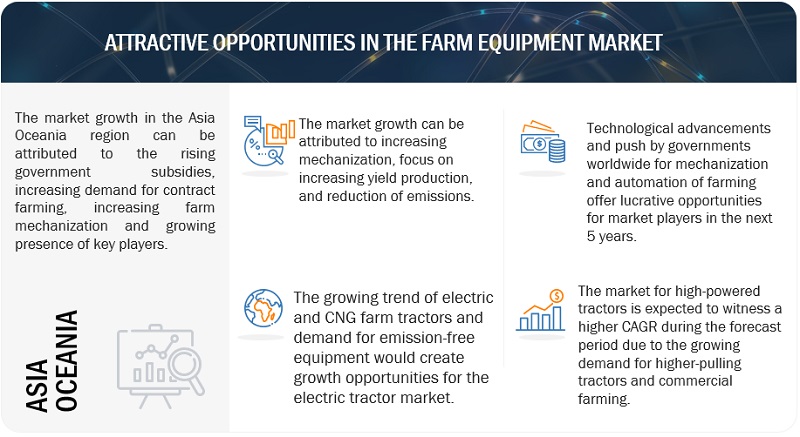

Asia Oceania is projected to be the highest-growing regional market

For the market analysis, the Asia Oceania region includes Japan, China, India, South Korea, Australia, and the Rest of Asia Oceania. The increasing farm mechanization driven by subsidies/loan waivers and government efforts is expected to drive farm tractor sales in India. Electric farm tractors are gaining traction in China due to various factors. The government’s push for cleaner transportation and financial incentives has spurred adoption. Rising awareness of sustainable agriculture’s importance has further driven demand, given the environmental impact of traditional methods. Indian government provides a capital subsidy of up to 40% of the cost of an electric tractor. This subsidy is available to farmers who purchase electric tractors from approved manufacturers. Precision agriculture is gaining recognition in India and China as a sustainable and environmentally friendly approach to crop farming, yielding improved agricultural outcomes. As precision agriculture offers the potential to increase yields, reduce waste, and improve overall farm profitability, farmers often require more advanced and capable equipment to implement these practices effectively. Tractors, a fundamental tool in modern farming, are crucial in precision agriculture operations.

Apart from the expansion of containerized transportation, various other factors are contributing to opportunities in the farming industry. These include the growth of Gross Domestic Product (GDP), increased investments in infrastructure, rising per capita income, a growing preference for mechanization, and government efforts to attract foreign direct investment (FDI). Consequently, these developments are propelling the farm tractor market in the Asia-Oceania region.

Key Market Players

The farm equipment market is led by established players, such as John Deere (US), AGCO Corporation (US), CNH Industrial (Netherlands), Kubota Corporation (Japan), and CLAAS KGAA (Germany). These companies have adopted several strategies to gain traction in the market. They have expanded in various geographical locations through mergers & acquisitions and expansions and entered joint ventures/collaborations with other industry players to sustain their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attribute |

Details |

|

Base year for estimation |

2022 |

|

Forecast period |

2023 - 2028 |

|

Market Growth forecast |

USD 136.3 billion by 2028 from USD 107.7 billion at 4.8 % CAGR |

|

Farm Tractor Market By Power Output |

<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP |

|

Farm Tractor Market By Drive Type |

Two-Wheel and Four-Wheel |

|

Farm Equipment Market, By Equipment Type |

Cereal Combines, Non-Cereal Combines, Balers, Tractor-Mounted Sprayers, and Self-Propelled Sprayers |

|

Implements Market, By Function |

Plowing & Cultivating, Harvesting & Threshing, Sowing & Planting, Plant Protection & Fertilizing, and Others |

|

Farm Tractor Rental Market, By Equipment Type |

Tractors, Combines, Balers, Sprayers, Other Equipment |

|

Farm Tractor Rental Market, By Power Output |

<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP |

|

Electric Tractor Market, By Type |

Light-Duty Tractors, Medium-Duty Tractors, Heavy-Duty Tractors |

|

Electric Tractor Market, By Propulsion |

Battery Electric and Hybrid Electric |

|

By Region |

Asia Pacific, North America, Europe, Rest of the World |

|

Top Players |

John Deere (US), CNH Industrial (Netherlands), Kubota Corporation (Japan), AGCO Corporation (US), and CLAAS KGAA (Germany) |

The study segments the farm equipment market :

Farm Tractor Market, By Power Output:

- <30 HP

- 31–70 HP

- 71–130 HP

- 131–250 HP

- >250 HP

Farm Tractor Market, By Drive Type

- Two-wheel

- Four-wheel

Farm Implements Market, By Function

- Plowing & Cultivating

- Sowing & Planting

- Plant Protection & Fertilizing

- Harvesting & Threshing

- Others

Farm Equipment Market, By Equipment Type

- Cereal Combines

- Non-Cereal Combines

- Balers

- Tractor-mounted Sprayers

- Self-propelled Sprayers

Farm Equipment Rental Market, By Equipment Type

- Tractors

- Combines

- Sprayers

- Balers

- Others

Farm Tractor Rental Market, By Power Output

- <30 HP

- 31–70 HP

- 71–130 HP

- 131–250 HP

- >250 HP

Electric Tractor Market, By Type

- Light-duty tractors

- Medium-duty tractors

- Heavy-duty tractors

Electric Tractor Market, By Propulsion

- Battery Electric

- Hybrid Electric

By Region

- Asia Oceania

- North America

- Europe

- Rest of the World [RoW]

Recent Developments

- In July 2023, John Deere launched a new See & Spray premium performance upgrade kit for John Deere self-propelled sprayers, the next addition to the See & Spray line. This kit uses an AI-powered vision system that can help farmers profit and combat herbicide resistance with precise application by spraying only weeds, not the entire field. This technology helps stabilize the spray arm when mounted cameras are needed to capture clear field images. Within milliseconds, a machine learning model uses multiple camera images to distinguish weeds from plants.

- In January 2023, Mahindra launched the SP PLUS series of tractors that offer more power and mileage. These powerful tractors are designed to improve your agricultural and transportation productivity. The SP PLUS tractor series has the advanced ELS-DI (Extra Long Stroke) engine. It has beneficial features such as a dual-clutch with reverse PTO, high lift hydraulics, easy shift transmission, and wet brakes.

- In December 2022, CNH Industrial launched the New Holland T4 electric power – the industry’s first all-electric light utility tractor prototype with autonomous features. Production is expected to begin at the end of 2023 with a broader product offering.

- In March 2023, AGCO Corporation introduced the innovative Fendt 200 Vario series solutions at the 2023 Commodity Classic in Orlando. As Fendt’s smallest tractor, the 200 Vario Series combines a compact design with high performance in three models ranging from 94 to 114 hp.

- In January 2022, John Deere introduced an autonomous 8R tractor. This new tractor comes equipped with several advanced features like a TruSet-enabled chisel plow, a GPS guidance system, and cutting-edge technology. It has six pairs of stereo cameras that help it detect obstacles all around it and quickly calculate their distance. Additionally, it uses a deep neural network to analyze every pixel in images within 100 milliseconds. This tractor represents a significant leap in modern farming technology.

- In July 2023, CLAAS KGAA expanded its product range in the compact tractor segment with three new series. The tractors have many different technical features in terms of performance, power transmission, comfort, and load capacity to suit additional customer requirements and fields of application. From a fully mechanical 4-speed manual transmission with a maximum output of 75 to 103 horsepower to a 5-speed powershift transmission with REVERSHIFT and TWINSHIFT.

Frequently Asked Questions (FAQ):

What is the current size of the global Farm Equipment market?

The global Farm Equipment market is projected to grow from USD 107.7 Billion in 2023 to USD 136.3 Billion by 2028, at a CAGR of 4.8%, with Asia Oceania dominating the market.

Which application is currently leading the Farm Equipment market?

Farm Tractor is the leading in the Farm Equipment market.

Many companies are operating in the Farm Equipment market space across the globe. Do you know who the front leaders are, and what strategies they have adopted?

The farm equipment market is led by established players, such as John Deere (US), AGCO Corporation (US), CNH Industrial (Netherlands), Kubota Corporation (Japan), and CLAAS KGAA (Germany). These companies adopted new product launches, acquisitions, and joint venture strategies to gain traction in the Farm Equipment market.

How is the demand for Farm Equipment vary by region?

Asia Oceania is estimated to be the largest market for Farm Equipment in the forecast period. The growth of the Farm Equipment market in Asia Oceania is mainly attributed to the higher demand for Farm Equipment from China and India due to the increasing farm mechanization and higher population.

What are the growth opportunities for the Farm Equipment supplier?

The demand for Four-wheel drive and electric tractors would create growth opportunities for the Farm Equipment market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The research study involved various secondary sources, such as company annual reports/presentations, industry association publications, farm equipment magazine articles, directories, technical handbooks, world economic outlook, trade websites, technical articles, and databases, which were used to identify and collect information for an extensive study of the Farm Equipment market. Primary sources—experts from related industries, automobile OEMs, and suppliers—were interviewed to obtain and verify critical information and assess prospects and market estimations.

Secondary Research

In the secondary research process, various secondary sources, such as the Association of Equipment Manufacturers (AEM), corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and farm equipment associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from the primaries. This and the in-house subject matter experts’ opinions have led to the findings described in this report's remainder.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A bottom-up approach was used to estimate and validate the size of the farm tractor market. The farm equipment market size by power output, in terms of volume, was derived by multiplying the region-level breakup for each type with region-level farm tractor sales. The farm tractor market size by power output, in terms of volume, was derived by multiplying the region-level breakup for each power output (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP) with region-level farm tractor sales. The region-level farm equipment market by power output, by volume, was multiplied with the region-level average selling price (ASP) for each application to get the farm tractor market for each application by value. The summation of the region-level market would give the global farm tractor market, by power output. The total value of each region was then summed up to derive the total value of the farm tractor market by power output.

Farm Equipment Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

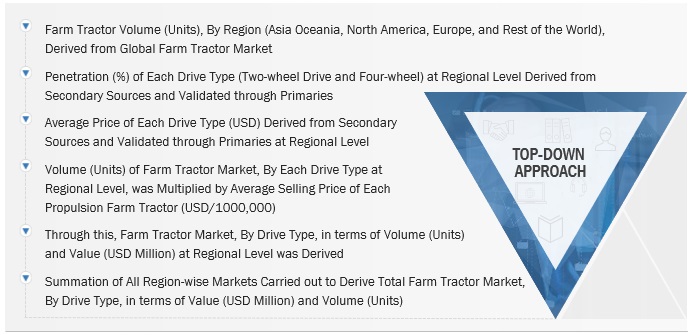

Farm Equipment Market: Top-Down Approach

A top-down approach was used to estimate and validate the market by drive type in terms of volume and value. The farm tractor market value (USD million) by region (Asia Oceania, North America, Europe, and RoW) was derived from the global farm tractor market. The penetration of each drive type (two-wheel drive and four-wheel drive) at the regional level was derived from secondary sources and validated through primaries. The penetration of each drive type was multiplied by the regional farm tractor market to get the farm tractor market value (USD million) for each region. A summation of all region-wise markets was carried out to derive the total farm tractor market value (USD million) by drive type. The top-down approach was followed by the farm equipment market by equipment type, farm implements market, by function, etc.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by the primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Market Definition

The farm equipment market includes a diverse array of machinery such as tractors, plows, seeders, combines, sprayers, irrigation systems, and other specialized tools tailored to different aspects of farming. Farm equipment are machines used on farmlands to perform various agricultural activities. These machines help enhance efficiency and productivity. Farm equipment aims to enhance agricultural efficiency, productivity, and sustainability by mechanizing various labor-intensive processes, optimizing resource use, and integrating modern technologies. The market's growth is driven by factors like technological advancements, changing agricultural practices, labor dynamics, environmental concerns, government policies, and the demand for increased food production to meet global needs.

Key Stakeholders

- Farm Equipment manufacturers

- Farm Equipment component manufacturers

- Farm Equipment distributors and retailers

- Raw Material Suppliers of farm equipment components

- Traders, Distributers and Suppliers of farm equipment components

- Government agencies and policymakers

- Associations, forums, and alliances related to farm equipment and their components

Report Objectives

-

To define, describe, and forecast the farm equipment market in terms of volume

(’000 units) and value (USD million) -

To define, describe, and forecast the farm tractors market, by value and volume, based on

- Power output (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP) at country and regional levels

- Drive type (two-wheel and four-wheel) at the regional level

- Region [Asia Oceania, Europe, North America, and the Rest of the World (RoW)], along with key countries in each of these regions

- To define, describe, and forecast the farm equipment market, by value, based on equipment type (cereal combines, non-cereal combines, balers, self-propelled sprayers, and tractor-mounted sprayers)

- To define, describe, and forecast the implements market, by value, based on function (plowing & cultivating, sowing & planting, plant protection & fertilizing, harvesting & threshing, and others) at the regional level

- To define, describe, and forecast the farm equipment rental market (Tractors, Combines, Balers, Sprayers, Other Equipment) at the regional level

- To define, describe, and forecast the farm tractor rental market, by value, based on Power output (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP) at the regional level

- To define, describe, and forecast the electric market, by value and volume, based on type (Light-Duty Tractors, Medium-Duty Tractors, Heavy-Duty Tractors) at the regional level

- To define, describe, and forecast the electric tractor market, by value and volume, based on propulsion (battery electric and hybrid electric) at the regional level

-

To understand the market dynamics (drivers, restraints, opportunities, and challenges) of

the farm equipment market - To analyze the impact of recession on the market

- To analyze the market share of the key players in the farm equipment market

- To strategically analyze the market with supply chain analysis, market ecosystem, trade analysis, case studies, ASP analysis, patent analysis, trends/disruptions impacting buyers, technology trendss, regulatory analysis, and the recession impact

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Farm Equipment MARKET, by Application & Country

-

Asia Oceania

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Oceania

-

Europe

- Germany

- France

- UK

- Spain

- Russia

- Italy

- Poland

- Turkey

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

RoW

- Brazil

- Argentina

- Others

Farm Equipment MARKET, by Type & country

-

Asia Oceania

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Oceania

-

Europe

- Germany

- France

- UK

- Spain

- Russia

- Italy

- Poland

- Turkey

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

RoW

- Brazil

- Argentina

- Others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Farm Equipment Market

What are the Farm Equipment Market government efforts in emerging countries to increase farm mechanization?

MarketsandMarkets report in Farm Equipment was updated in Jan 2022, and it covers the market trends and growth factors with respect to Farm Equipment Market. It also covered the Market estimations of Farm Equipment’s in terms of Value (USD Million)and Volume (‘000 Units) by Tractor Power Output/ Tractor Drive Type/ Autonomous Tractor/ Electric Tractor/ Farm Equipment/ Implement/ Rental at regional and country level for the period 2016-2027. The report also covers the detail competitive landscape with key players Market Share Analysis, Developments of Key Market Players Like There Contracts & Agreements, Investments & Expansions, Joint Venture, Partnerships, And Collaborations and their Business Overview, Products/solutions/services Offered, Recent Developments, SWOT Analysis. Our report is primarily a demand-based coverage that states the Historic, Current and Future revenues at a regional and country level for which we had contacted several primary respondents from supply and demand side of the business to obtain the qualitative and quantitative information. We have forecasted the market size both in terms of Volume (Units) and Value (USD Million) till year 2027, which is broken down by Farm tractor market by Power Output, Farm tractor market by Drive Type, Farm equipment market, by equipment type, Implements market, by function, Farm equipment Rental market, Farm equipment market by region, Farm equipment Rental market by region.Farm Equipment Market report for your kind evaluation. Based on our conversation, I understood your company Quality Tractor Parts Ltd. being the Ireland's leading national and international tractor parts supplier and the importer & distributor for new and replacement parts for agricultural tractors you are currently looking to understand available total addressable market for these equipment’s globally, which is precisely covered in our report with profiles of the top leading Farm Equipment Manufacturer and Component Manufacturers.

How emerging markets offering revenue expansion opportunities in Farm Equipment Market?

I want to understand the current and future Global market/business potential of Farm Equipments - Tractor attachments

we are looking for No. of Tractor Engines manufactured /forecasted in the coming years for the Tractor segment in India. We are supplying some components for Engine Assly.