Agricultural Micronutrients Market by Type (Zinc, Boron, Iron, Manganese, Molybdenum, Copper), Mode of Application (Soil, Foliar and Fertigation), Form (Chelated and Non-Chelated Micronutrients), Crop Type and Region - Global Forecast to 2028

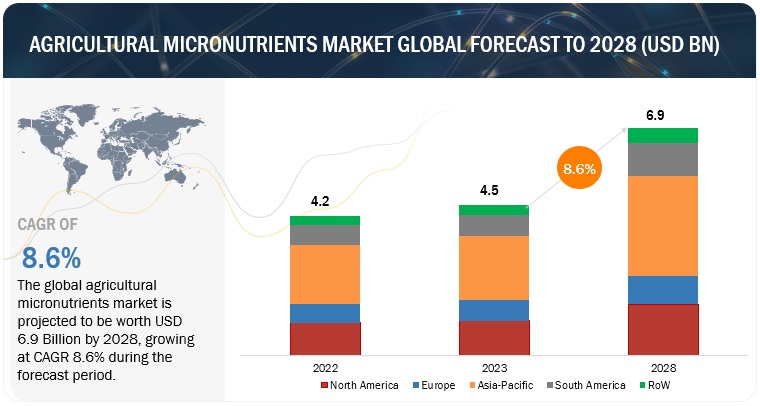

[314 Pages Report] The global agricultural micronutrients market is estimated to be valued at USD 4.5 billion in 2023 and is projected to reach USD 6.9 billion by 2028, at a CAGR of 8.6% from 2023 to 2028.

The agricultural micronutrients market has gained significant traction, primarily driven by the relentless pursuit of improved crop efficiency in the agriculture sectors. Effective government policies play a pivotal role in supporting the growth of agricultural micronutrients. These policies are essential for addressing soil imbalances and deficiencies of micronutrients, which can significantly impact crop yields. Government initiatives can include promoting soil testing, providing subsidies or incentives for micronutrient application, and offering educational programs to farmers. By doing so, governments help ensure that agricultural practices are aligned with the principles of balanced nutrient management, sustainable agriculture, and improved food security. The integration of micronutrient-focused policies into broader agricultural and economic development strategies is crucial in enhancing soil health and agricultural productivity. These policies are vital drivers in safeguarding the long-term viability of agriculture while meeting the nutritional needs of growing populations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Rise in awareness about crop production and quality

The increasing emphasis on crop production and the quality of agricultural produce has spurred the growth of agricultural micronutrients. As the global population continues to rise, the demand for food also escalates. To meet this growing demand, there is a heightened focus on improving crop yields and the nutritional quality of crops. Agricultural micronutrients, such as zinc, iron, manganese, and others, play a crucial role in enhancing plant growth, nutrient uptake, and overall crop quality. Farmers and agricultural experts recognize the significance of these micronutrients in achieving higher yields and better nutritional content in crops. Consequently, the use of micronutrient fertilizers and soil amendments has become a common practice to address deficiencies and imbalances in soil nutrients, thereby supporting the production of healthier, more abundant crops. This shift towards quality-driven agriculture is a driving force behind the increasing attention to agricultural micronutrients.

Restraints: Bioaccumulation of biodegradable chelates

The bioaccumulation of biodegradable chelates can indeed pose a challenge to the growth of agricultural micronutrients. While biodegradable chelates are designed to break down in the environment, their persistence in aquatic systems can lead to bioaccumulation in plants and organisms. As a result, these chelates may inadvertently inhibit the bioavailability of essential micronutrients in agricultural soils. This unintended consequence can restrict the efficient uptake of micronutrients by crops, potentially leading to nutrient deficiencies and reduced crop yields. It is crucial to strike a balance between the use of biodegradable chelates and their potential environmental impact, as their accumulation can disrupt the delicate nutrient balance required for optimal plant growth. Sustainable and responsible practices in the application of biodegradable chelates are essential to ensure they support, rather than hinder, the growth of agricultural micronutrients.

Opportunities: Innovation in biodegradable chelates

The use of biodegradable chelates in agricultural micronutrients presents significant opportunities for sustainable agriculture. Biodegradable chelates are eco-friendly and can enhance the bioavailability and uptake of essential micronutrients by crops. This can result in improved crop yields and quality while reducing the environmental impact associated with conventional chelates. Additionally, these biodegradable chelates can address concerns about the persistence of non-biodegradable chelates in aquatic systems, which can lead to environmental contamination. By using biodegradable chelates, agricultural practices can become more environmentally responsible and aligned with the principles of circular agriculture. This shift towards sustainable micronutrient management not only benefits crop production but also contributes to the broader goal of reducing the ecological footprint of agriculture.

Challenges: Sustainable sourcing of raw materials

Sustainably sourcing agricultural micronutrients presents a range of challenges. One significant challenge is ensuring a consistent and reliable supply of these micronutrients. The production and availability of micronutrient sources can be affected by factors like climate change, resource limitations, and geopolitical issues, which can disrupt the supply chain. Additionally, the environmental impact of micronutrient extraction and production is a concern, as it can contribute to pollution and resource depletion. Balancing the need for micronutrients with sustainability goals, such as reducing carbon emissions and minimizing habitat disruption, can be complex. Moreover, the cost-effectiveness of sustainable sourcing methods can be a challenge, as more environmentally friendly approaches may be more expensive. Addressing these challenges requires innovative and sustainable practices, such as recycling and repurposing waste materials to extract micronutrients, as well as considering regional and crop-specific needs to minimize environmental and economic impact.

Agricultural Micronutrients Market: Value Chain Analysis

Ecosystem Analysis

The market ecosystem for agricultural micronutrients encompasses various stakeholders and components involved in the production, distribution, and end users of agricultural micronutrients products. Various regulatory bodies are also involved in this market, and they are one of the significant stakeholders.

Ecosystem Map

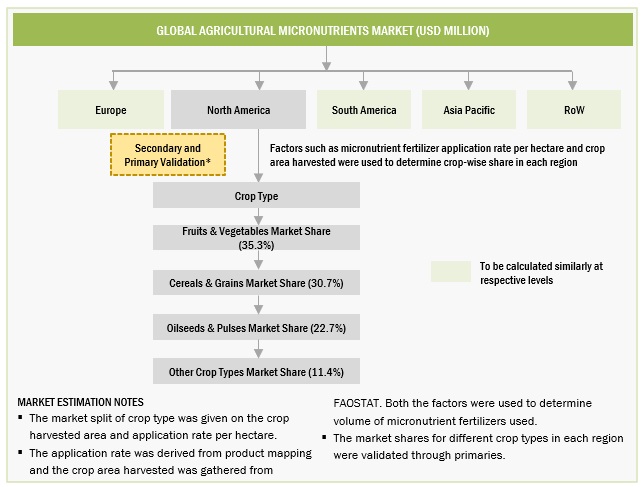

Based on crop type, the fruit and vegetable segment is estimated to account for the largest market share of the agricultural micronutrients market.

Fruits and vegetables hold the largest market share by crop type in the agricultural micronutrients market. This dominance is attributed to their essential role in human nutrition and the increasing demand for nutrient-rich produce. Micronutrients, including vitamins and minerals, play a crucial role in enhancing the yield and quality of these crops. They serve as co-factors for various enzymatic reactions involved in plant growth and development. For instance, micronutrients like iron, zinc, and manganese are vital for photosynthesis, hormone synthesis, and the prevention of various nutrient-related disorders in plants. Improving micronutrient availability in fruits and vegetables not only enhances their nutritional content but also extends their post-harvest shelf life. This contributes to reduced food wastage and increased access to nutrient-dense produce. Additionally, advancements in micronutrient application methods, such as precision agriculture and foliar spraying, have allowed for more efficient and targeted nutrient delivery to these crops, leading to improved overall crop health and productivity.

Based on the mode of application, the foliar segment is anticipated to dominate the agricultural micronutrients market.

Foliar application is a dominant method in the agricultural micronutrients market, holding a significant market share. Foliar application ensures that plants quickly receive the necessary micronutrients, which can be especially crucial during critical growth stages. It enables precise and targeted nutrient delivery, addressing specific deficiencies in crops. Foliar application enhances nutrient uptake, leading to improved crop health and yield. By minimizing excess runoff and waste, this method is more environmentally friendly. It can be easily combined with other agricultural practices, such as pest and disease management. Continuous research and development have led to more effective micronutrient formulations, ensuring optimal plant utilization. Foliar applications benefit crops by preventing and correcting nutrient deficiencies, enhancing photosynthesis, and improving overall plant health. These benefits contribute to increased yields, better crop quality, and sustainable agricultural practices.

By form, the chelated segment is estimated to dominate as well as grow at the highest CAGR in the agricultural micronutrients market.

Chelated micronutrients have experienced substantial growth in the agricultural micronutrients market, primarily due to their multiple advantages. These micronutrients are readily absorbed by plants, fostering healthier growth and development. Moreover, their efficient utilization translates into increased crop yields, making them a valuable choice for farmers seeking higher productivity. Chelation enhances the stability and availability of micronutrients, mitigating the risk of nutrient deficiencies in crops, thereby ensuring the overall health of plants. Importantly, chelated micronutrients contribute to plant resistance against pests and diseases, bolstering crop protection. Their environmentally friendly characteristics, allowing for reduced application quantities, further emphasize their sustainability in modern farming. Chelates offer versatility in application methods, including foliar sprays, seed treatments, and soil applications, catering to diverse farming needs. Continuous research and development efforts have led to improved formulations, ensuring their consistent and enhanced performance. In summary, chelated micronutrients play a pivotal role in contemporary agriculture by addressing nutrient deficiencies, promoting sustainable farming practices, and ultimately boosting crop yields.

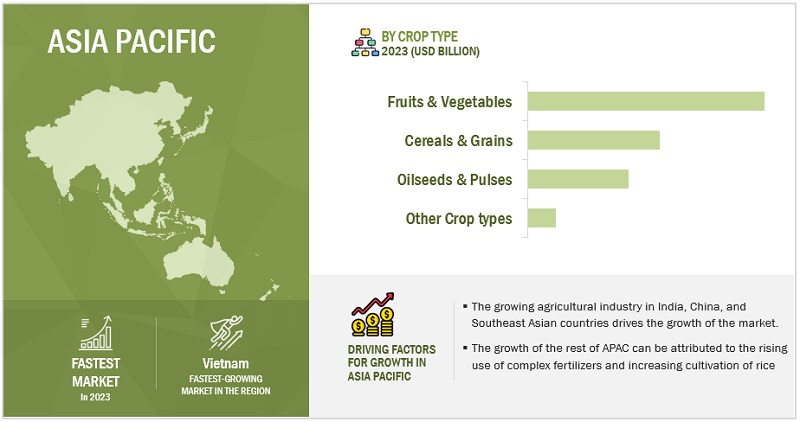

Asia Pacific is estimated to grow at the highest CAGR in the global agricultural micronutrients market.

The region's burgeoning population, coupled with rising income levels, has led to an increased demand for meat and dairy products. As a result, the livestock industry is experiencing unprecedented growth, creating a parallel surge in the need for efficient animal nutrition, driving the demand for agricultural micronutrients.

Moreover, Asia Pacific boasts a diverse agricultural landscape, with countries like China and India emerging as significant players in livestock production. The adoption of modern farming practices and a growing awareness of the importance of animal health and nutrition have further fueled the demand for agricultural micronutrients. Additionally, the presence of a large number of feed manufacturers and a rapidly expanding aquaculture sector in countries like Indonesia and Vietnam contribute to the region's dominance.

Key Market Players

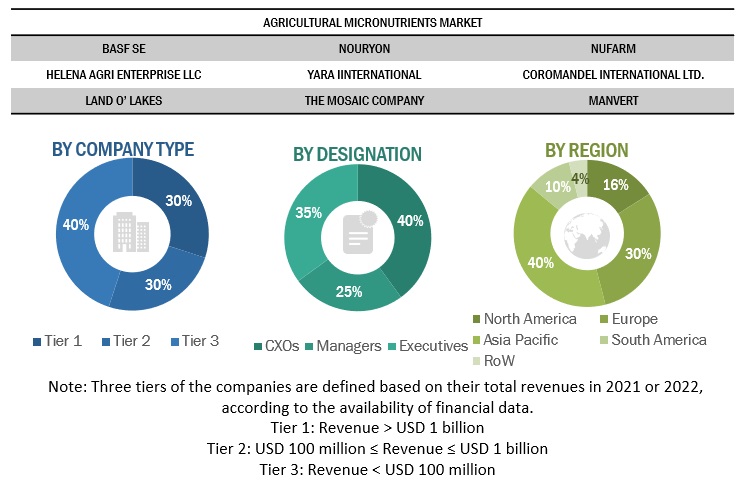

Basf SE (Germany), Nouryon (Netherlands), Nufarm (Australia), Yara International ASA (Norway), Coromandel International Limited (India), Land O’lakes, Inc. (US), Helena Agri-Enterprises, LLC (US), The Mosaic Company (US), and Haifa Negev Technologies Ltd (Israel) are among the key players in the global agricultural micronutrients market. To increase their company's revenues and market shares, companies are focusing on launching new products, developing partnerships, and expanding their production facilities. The key strategies used by companies in the agricultural micronutrients market include geographical expansion to tap the potential of emerging economies, strategic acquisitions to gain a foothold over the extensive supply chain, and new product launches as a result of extensive research and development (R&D) initiatives.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments Covered |

By Type, By Form, By Crop type, By Mode of Application, and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

|

Agricultural Micronutrients Market:

By Type

- Zinc

- Boron

- Iron

- Molybdenum

- Copper

- Manganese

- Other Types

By Crop Type

- Fruits & Vegetables

- Cereals & Grains

- Oilseeds & Pulses

- Other Crop Types

By Form

- Chelated

- Non-Chelated

By Mode of Application

- Soil

- Foliar

- Fertigation

- Other Mode of Applications

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

RoW includes the Middle East & Africa.

Recent Developments

- In February 2023, Andersons Inc. introduced MicroMark DG, a new brand of granular micronutrients using dispersion granule (DG) technology. The new technique enables uniform spherical granules for easy blending, spreading, and greater efficacy. MicroMark DG Blitz, a calcium, boron, manganese, and zinc blend, and MicroMark DG Humic, a calcium, sulfur, manganese, zinc, and humic acid blend, will be the first to be released.

- In February 2022, The Mosaic Company acquired Plant Response, an industry consolidator of leading biological-based solutions. With this acquisition, Mosaic renamed the company to Mosaic Biosciences, through which the company intends to support crops and their natural biology.

- In February 2019, Haifa Group launched NutriNet, a new online service for growers and agronomy experts, aiming to enhance the process of creating customized fertilization programs. This tool helps integrate the data regarding crops, soil type, water analysis, irrigation system setup, and other preferences of growers, which support the decision-making of farmers.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share of the agricultural micronutrients market?

The Asia Pacific region accounted for the largest share, in terms of value, of USD 1.7 billion, of the global agricultural micronutrients market in 2022 and is expected to grow at a CAGR of 9.4%.

What is the current size of the global agricultural micronutrients market?

The agricultural micronutrients market is estimated at USD 4.5 billion in 2023 and is projected to reach USD 6.9 billion by 2028, at a CAGR of 8.6% from 2023 to 2028.

What are the key players in the market?

The key players in this market include BASF SE (Germany), Yara International ASA (Norway), Coromandel International Ltd (India), and Land’O’Lakes (US).

What are the factors driving the agricultural micronutrients market?

Increase in demand and consumption of high quality crops.

Which segment by crop type accounted for the largest agricultural micronutrients market share?

The fruit & vegetable segment dominated the market for agricultural micronutrients market and was valued at USD 1.5 billion in 2022. This is due to its widespread consumption, high production volumes, and the demand for its health benefits.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the agricultural micronutrient market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, such as the Food and Agriculture Organization (FAO), International Fertilizer Association (IFA), Micronutrient Manufacturers Association (MMA), the ministries of the agricultural department in various countries, corporate filings (such as annual reports, press releases, investor presentations, and financial statements), and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research and manufacturers' annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The agricultural micronutrients market comprises multiple stakeholders, including raw material suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce to the manufacturers, and importers & exporters of agricultural micronutrients from the demand side including distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

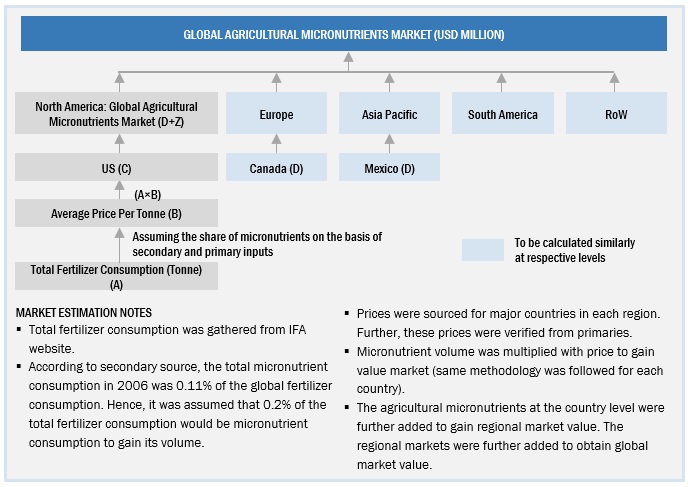

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the agricultural micronutrients market. These approaches were also used extensively to estimate the size of various dependent submarkets.

The following figure represents the overall market size estimation process employed for the purpose of this study.

Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Through the bottom-up approach, the data extracted from secondary research was utilized to validate the market segment sizes obtained. The approach was employed to arrive at the overall size of the agricultural micronutrients market in particular regions, and its share in the market was validated through primary interviews conducted with fungicide manufacturers, suppliers, dealers, and distributors.

With the data triangulation procedure and validation of data through primaries, the overall size of the parent market and each segmental market were determined.

Top-Down Approach

For the estimation of the agricultural micronutrients market, the size of the most appropriate immediate parent market was considered to implement the top-down approach. For the agricultural micronutrients market, the specialty fertilizers market was considered as the parent market to arrive at the market size, which was again used to estimate the size of individual markets (mentioned in the market segmentation) through percentage shares arrived from secondary and primary research.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall agricultural micronutrient market and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

Agricultural micronutrients can be defined as nutrients required in small amounts, which are necessary for plant growth. Due to their requirement in limited quantities, micronutrients are also known as trace elements. These micronutrients, also known as trace elements, play a crucial role in various physiological processes within plants, including enzyme activation, photosynthesis, and nutrient uptake. The primary agricultural micronutrients include iron (Fe), manganese (Mn), zinc (Zn), copper (Cu), molybdenum (Mo), and boron (B).

Stakeholders

- Agricultural micronutrient manufacturers, formulators, and blenders

- Fertilizer traders, suppliers, distributors, importers, and exporters

- Raw material suppliers and technology providers to agricultural micronutrient manufacturers

- Agricultural co-operative societies

- Fertilizer associations and industry bodies:

- Food and Agriculture Organization (FAO)

- International Fertilizer Association (IFA)

- Micronutrient Manufacturers Association (MMA)

- The Fertilizer Institute (TFI)

- Government agricultural departments and regulatory bodies:

- US Environmental Protection Agency (EPA)

- Association of American Plant Food Control Officials (AAFCO)

- European Commission

- Ministry of Agriculture (MOA), China

- Department of Agriculture, Forestry, and Fisheries (DAFF), South Africa

- US Department of Agriculture (USDA)

Report Objectives

Market Intelligence

Determining and projecting the size of the agricultural micronutrients market, based on type, form, crop type, mode of application, and regional markets, over a five-year period, ranging from 2023 to 2028

Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

Analyzing the demand-side factors based on the following:

- Impact of macro- and microeconomic factors on the market

- Shift in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key players in the agricultural micronutrientss market.

- Determining the share of key players operating in the agricultural micronutrients market

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products across the key regions and their impact on the prominent market players.

- Analyzing the market dynamics, competitive situations, and trends across the regions, and their impact on prominent market players.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the rest of the Asia Pacific agricultural micronutrients market into the Philippines, Vietnam, South Korea, Malaysia, and Australia & New Zealand.

- Further breakdown of the rest of Europe's agricultural micronutrients market into Netherlands, Poland, other EU, and non-EU countries.

- Further breakdown of the rest of South America's agricultural micronutrients market into Peru, Chile, and Venezuela.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agricultural Micronutrients Market