AI Governance Market by Component (Solutions (Platforms And Software Tools) and Services), Deployment Mode, Organization Size, Vertical (BFSI, Healthcare and Life Sciences, Government and Defense, and Automotive), and Region - Global Forecast to 2026

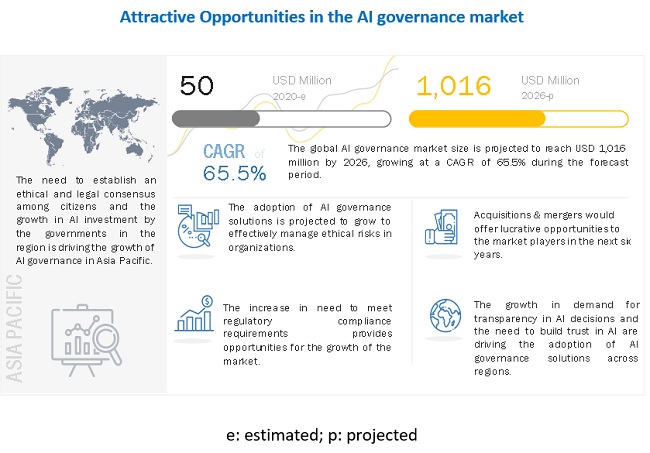

The global AI Governance Market size was worth $50 million in 2020. It is expected to grow at a compound annual growth rate (CAGR) of 65.5% during the forecast period. Various factors such as increase in government initiatives to leverage the AI technology, rise in need for building trust in AI systems and growth in demand for transparency in AI decisions, and growth in regulatory compliances around the technology are expected to drive the adoption of the AI governance solutions and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact Analysis

Managing and monitoring credit, market, liquidity, and operational risk across financial markets was hard enough with ongoing geopolitical tensions, international trade wars, and the occasional hurricanes and earthquakes. The current pandemic situation has forced chief risk officers and their teams to recalibrate old assumptions and models used to manage and monitor risk. COVID-19’s global impact has shown that interconnectedness plays an important role in international cooperation and how outdated technologies are obstacles to effective policymaking. As a result, many governments started rushing towards identifying, evaluating, and procuring reliable solutions powered by AI. Healthcare facilities globally have been turning toward AI systems to identify infections through people’s voices or chest x-rays. Various governments have proposed tracking tools to monitor the virus’ spread person-to-person. From Asia to Europe, several public sector entities have collaborated with the private sector to utilize AI-based services to monitor the spread of the virus. COVID-19 has accelerated the need to operationalize Ethical AI principles. In order to help practitioners, navigate these challenges, the World Economic Forum’s AI and ML platform created the Procurement in a Box package, which aims to unlock public sector adoption of AI through government procurement.

AI Governance Market Dynamics

Driver: Increase in government initiatives to leverage the AI technology

With the growing advantages of AI, organizations and governments across the globe are taking various initiatives to adopt AI and ML technologies and to register as leaders in the global market. Therefore, government organizations from numerous countries are taking various initiatives to adopt AI governance solutions through establishing councils, developing new standards and guidelines, and designing frameworks. The major objective of governments behind adopting AI governance solutions is to protect privacy and civil liberties and build trust and confidence in AI technology among people. Therefore, many companies have formed committees to identify risk factors for AI technology in collaboration with AI solution providers, universities, and research labs.

Restraint: Establishment of comprehensive ethical principles for AI

The exponential growth in AI technology is driven by high computing power and increased growth in the volume of data. Organizations are increasingly investing their time, money, and intelligence to identify the enormous potential of AI and convert technology into tangible benefits, which can help organizations enhance their business productivity, build advanced products and services, and gain competitive advantages. However, AI outcomes may not be trustworthy owing to the black box problem, which leads to difficulties in maintaining transparency while using AI for most critical tasks, such as dealing with the customer’s personal data, financial data, and patient diagnosis. Therefore, to build a responsible and explainable AI system, many government agencies, research labs, and AI solution providers are conducting in-depth researches to build comprehensive ethical principles for AI technology.

Since 2017, many sets of principles and guidelines have been laid down by different government authorities, professional bodies, regulatory systems, and AI companies, which provide a basic stage to show the path for building strong AI regulations and help in identifying major ethical issues that need to be addressed. However, even after the proliferation of these principles, there are no guidelines that are comprehensive. For instance, if principles are protecting 1 important value and regulations are built to protect that value, another value is neglected, which may harm social ethics. Hence, establishing comprehensive ethical principles for AI, which covers all ethical values, can be a restraining factor for the current scenario of AI governance solutions.

Opportunity: Reduction in gender bias and discrimination through the use of AI

AI technology has transformed the current era with its ML and cognitive thinking abilities. It has made a positive impact on society through various use cases. However, there are some negative cases where AI provides a biased and discriminating output. Currently, AI technology is in the development stage, which learns from various types of data patterns and provides an output that is negative or positive. With the use of AI governance solutions, developers would be able to develop and monitor the ML algorithm, and train it through relevant data to avoid unwanted outcomes. The use of an AI governance solution is the only option for AI solution providers to prevent the reputational, financial, and data-related losses caused by unexplainable AI. Moreover, the use of ethical AI can help prevent the increasing gender gap and discrimination issues caused by black-box AI across various areas, such as recruitment processes and facial recognition.

Challenge: Inadequate AI expertise and skills

AI technology is used to transform traditional business approaches and redefine them to enhance the organization’s productivity and profit margins. However, organizations lack the AI skills and understanding that can help them design algorithms to govern the AI system. This is due to the complexity of neural networks and ML algorithms in the AI system and the unestablished regulatory environment for AI governance. In order to build critical ML models, it is better for an organization to have its skilled workforce. However, it is very difficult for organizations to hire or train AI-skilled employees. According to the Artificial Intelligence and Digital Talent Survey conducted by Willis Towers Watson, currently, there are 22,000 AI-trained professionals in the world. Organizations around the world are challenged by retention and increased attrition rate of skilled employees. Hence, inadequate AI expertise and skills pose a major challenge among organizations, which might reduce in the near future.

The integration services segment to grow at a higher CAGR during the forecast period

The consulting services segment is expected to account for the largest market size, while the integration services segment is projected to have the highest CAGR during the forecast period. The technicalities involved in implementing AI governance solutions and the need to integrate them into their client’s IT infrastructure would boost the growth of integration services.

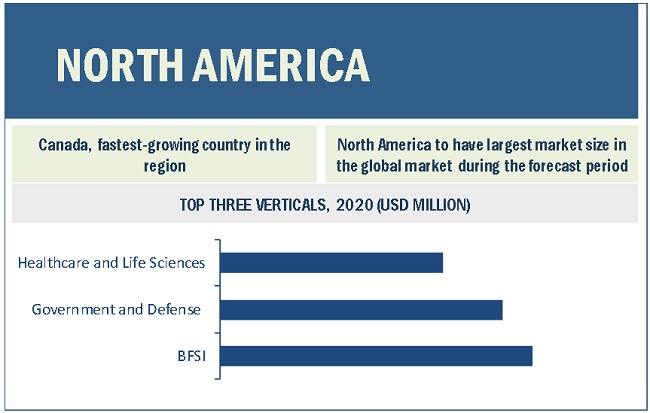

North America to account for largest market size during the forecast period

The organizations in North America, especially the US, have leveraged the benefits of AI, ML, and deep learning technologies to stay ahead in the market. The region has well-established economies, which enable AI governance vendors to invest in new technologies. Furthermore, it is regarded as the center of innovation where major IT players are rolling out intelligent devices and collaborating with other companies in the AI governance market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major vendors in the global AI governance market include Alphabet Inc. (US), Microsoft Corporation (US), IBM Corporation (US), SAP SE (Germany), Salesforce.com, Inc. (Salesforce), Amazon Web Services, Inc. (US), QlikTech International AB (US), TIBCO Software Inc. (US), SAS Institute Inc. (US), Facebook, Inc. (US), FICO (US), Zest AI (US), Pymetrics Inc. (US), H2O.ai, Inc. (US), Informatica LLC (US), Ataccama Corporation (Canada), DataRobot, Inc. (US), Dataiku (US), Kyndi, Inc. (US), SparkCognition, Inc. (US), Fiddler Labs, Inc. (US), DarwinAI (Canada), Truera (US), Genie AI Ltd. (UK), MindsDB Inc. (US), integrate.ai Inc. (Canada), Untangle AI Pte Ltd (Singapore), AnotherBrain (France), Diveplane Corporation (US), and 2021.AI (Denmark).

The AI governance vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The study includes an in-depth competitive analysis of these key players in the AI governance market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size value in 2020 |

USD 50 million |

|

Revenue forecast for 2026 |

USD 1,016 million |

|

Growth Rate |

65.5% CAGR |

|

Forecast units |

USD Million |

|

Segments covered |

Component, Deployment Mode, Organization Size, Vertical, And Region |

|

Geographies covered |

North America, Europe, APAC, Rest of the World (Latin America and MEA) |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Companies covered |

Alphabet Inc. (US), Microsoft Corporation (US), IBM Corporation (US), Amazon Web Services, Inc. (US), QlikTech International AB (US), TIBCO Software Inc. (US), SAS Institute Inc. (US), Facebook, Inc. (US), and many more. |

This research report categorizes the AI governance market based on components, deployment mode, organization size, vertical, and regions.

By Component:

-

Solution

- Software Tools

- Platform

-

Services

- Consulting

- Integration

- Support and Maintenance

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large enterprises

- Small and medium-sized enterprises (SMEs)

By Vertical:

- BFSI

- Government and Defense

- Healthcare and Life Sciences

- Media and Entertainment

- Retail

- IT and Telecom

- Automotive

- Other Verticals (education, travel and tourism, energy and utilities, and manufacturing).

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Singapore

- Rest of APAC

-

Restof the World

- MEA

- Latin America

Recent Developments:

- In December 2020, AWS announced nine new Amazon SageMaker capabilities. The new capabilities include faster data preparation, a purpose-built repository for prepared data, workflow automation, greater transparency into training data to mitigate bias and explain predictions, distributed training capabilities to train large models up to two times faster, and model monitoring on edge devices.

- In October 2020, H2O.ai brought AutoML with Driverless AI to Equifax Ignite. The platform would enable Equifax Ignite users to easily build and deploy ML models.

- In June 2020, IBM updated AI Fairness 360 (AIF360) toolkit and added two functionalities in AI Fairness 360 toolkit: compatibility with sci-kit-learn and R. AIF360 can be used to detect fairness issues at training time from Watson Studio and use Watson OpenScale to detect fairness at runtime.

- In June 2020, Informatica announced an update for the Intelligent Data Platform. The platform was designed to be powered by Informatica’s AI-powered CLAIRE engine.

- In March 2019, Zest AI launched the ZAML Fair AI tool to reduce bias from the ML algorithm, by applying it to existing models.

- In October 2018, IBM launched AI OpenScale, a data governance platform, which would help organizations build AI-based applications that provide a fair and unbiased outcome.

- In September 2018, Google launched ML technology-based What-If Tool, a feature of the TensorBoard web application.

- In May 2018, Pymetrics launched Audit AI tool that can audit a variety of algorithms, including those made to predict whether a person will pay back a loan or to assign a credit score to people with no banking history.

- In May 2018, Facebook launched a new product, the Fairness Flow tool, to reduce bias and discriminated outcomes during the case of job recommendation or while identifying fake social media accounts.

Frequently Asked Questions (FAQ):

How big is the AI governance market?

What is growth rate of the AI governance market?

Who are the key players in AI governance market?

Who will be the leading hub for AI governance market?

What are the opportunities in AI governance market?

What is the AI governance market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS & EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 PERIODIZATION CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 6 AI GOVERNANCE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 RESEARCH METHODOLOGY: APPROACH

FIGURE 9 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF THE AI GOVERNANCE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF AI GOVERNANCE VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATION OF COMPANY’S AI GOVERNANCE REVENUE ESTIMATION I

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 14 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 BOTTOM-UP (DEMAND SIDE): SHARE OF AI GOVERNANCE THROUGH OVERALL AI GOVERNANCE SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 15 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 4 AI GOVERNANCE MARKET SIZE AND GROWTH RATE, 2020–2026 (USD MILLION, Y-O-Y%)

FIGURE 16 AI GOVERNANCE SOLUTIONS TO BE A LARGER MARKET IN 2020 (USD MILLION)

FIGURE 17 AI GOVERNANCE PLATFORMS TO ACCOUNT FOR THE LARGER MARKET SIZE IN 2020 (USD MILLION)

FIGURE 18 CONSULTING SERVICES TO DOMINATE THE MARKET IN 2020 (USD MILLION)

FIGURE 19 THE CLOUD SEGMENT TO ACCOUNT FOR THE LARGER MARKET SIZE IN 2020 (USD MILLION)

FIGURE 20 LARGE ENTERPRISES TO BE THE LARGER MARKET IN 2020 (VALUE)

FIGURE 21 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO ACCOUNT FOR THE LARGEST MARKET SIZE IN 2020 (USD MILLION)

FIGURE 22 EUROPE TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN THE AI GOVERNANCE MARKET

FIGURE 23 RISE IN DEMAND FOR TRANSPARENCY IN AI DECISIONS AND NEED TO BUILD TRUST IN AI TO BOOST THE MARKET GROWTH

4.2 MARKET, BY VERTICAL

FIGURE 24 HEALTHCARE AND LIFESCIENCES VERTICALS TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 25 NORTH AMERICA TO HOLD THE HIGHEST MARKET SHARE IN 2026

4.4 MARKET, BY SERVICE AND VERTICAL

FIGURE 26 CONSULTING SERVICES SEGMENT AND BFSI VERTICAL TO ACCOUNT FOR THE LARGEST SHARES IN NORTH AMERICA IN 2020

5 MARKET OVERVIEW (Page No. - 52)

5.1 MARKET DYNAMICS

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: AI GOVERNANCE MARKET

5.1.1 DRIVERS

5.1.1.1 Increase in government initiatives to leverage the AI technology

5.1.1.2 Rise in need for building trust in AI systems and growth in demand for transparency in AI decisions

5.1.1.3 Growth in regulatory compliances around the technology

5.1.2 RESTRAINTS

5.1.2.1 Establishment of comprehensive ethical principles for AI

5.1.3 OPPORTUNITIES

5.1.3.1 Reduction in gender bias and discrimination through the use of AI

5.1.4 CHALLENGES

5.1.4.1 Inadequate AI expertise and skills

5.1.4.2 Clean and relevant data required to train ML algorithms

5.2 EVOLUTION

FIGURE 28 EVOLUTION OF AI GOVERNANCE

5.3 COMMON AI GOVERNANCE PRINCIPLES

FIGURE 29 AI GOVERNANCE PRINCIPALS

5.4 AI GOVERNANCE MARKET: COVID-19 IMPACT

FIGURE 30 MARKET TO DECLINE BETWEEN 2020 AND 2021

5.5 CASE STUDY ANALYSIS

5.5.1 USE CASE 1: FICO ANALYTICS WORKBENCH HELPS BANKS TO IMPROVE CREDIT RISK DECISIONS

5.5.2 USE CASE 2: DARWINAI USES OPENVINO TOOLKIT TO DELIVER EXPLAINABLE AI

5.5.3 USE CASE 3: CLOSEDLOOP.AI USES AI AND ML TO HELP USERS IDENTIFY AND PREDICT HIGH-RISK POPULATIONS

5.5.4 USE CASE 4: FINANCIAL SERVICE INDUSTRY USE AI SOLUTIONS OF ELULA TO IMPROVE ITS CUSTOMER RETENTION

5.5.5 USE CASE 5: SPARKCOGNITION’S AI SOLUTION HELPS TO PREDICT RARE FAILURES IN HYDRO TURBINES

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 31 SUPPLY CHAIN ANALYSIS

TABLE 5 AI GOVERNANCE MARKET: SUPPLY CHAIN

5.7 TECHNOLOGY ANALYSIS

5.7.1 AI GOVERNANCE AND MACHINE LEARNING (ML)

5.7.2 AI GOVERNANCE AND DEEP LEARNING

5.7.3 AI GOVERNANCE AND LOCAL INTERPRETABLE MODEL-AGNOSTIC EXPLANATION (LIME)

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 AI GOVERNANCE MARKET: PORTER FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 PATENT ANALYSIS

5.9.1 INNOVATION AND PATENT REGISTRATIONS

TABLE 7 IMPORTANT INNOVATION AND PATENT REGISTRATIONS, 2018-2020

5.10 PRICING ANALYSIS

5.11 REGULATORY IMPLICATIONS

5.11.1 INTRODUCTION

5.11.2 GENERAL DATA PROTECTION REGULATION

5.11.3 GOVERNANCE, RISK, AND COMPLIANCE STANDARDS

5.11.4 HEALTH INFORMATION TECHNOLOGY FOR ECONOMIC AND CLINICAL HEALTH

5.11.5 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.11.6 FEDERAL TRADE COMMISSION

5.11.7 FEDERAL COMMUNICATIONS COMMISSION

5.11.8 SECURITIES FINANCING TRANSACTIONS REGULATION

6 AI GOVERNANCE MARKET, BY COMPONENT (Page No. - 67)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 32 THE SERVICES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 8 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

6.2 SOLUTIONS

FIGURE 33 SOFTWARE TOOLS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 9 AI GOVERNANCE SOLUTIONS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 10 AI GOVERNANCE MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

6.2.1 SOFTWARE TOOLS

TABLE 11 AI GOVERNANCE SOFTWARE TOOLS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.2 PLATFORM

TABLE 12 AI GOVERNANCE PLATFORM MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SERVICES

FIGURE 34 INTEGRATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 13 AI GOVERNANCE SERVICES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 14 AI GOVERNANCE MARKET SIZE, BY SERVICES, 2020–2026 (USD MILLION)

6.3.1 CONSULTING

TABLE 15 AI GOVERNANCE CONSULTING MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.2 INTEGRATION

TABLE 16 AI GOVERNANCE INTEGRATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.3 SUPPORT AND MAINTENANCE

TABLE 17 AI GOVERNANCE SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 AI GOVERNANCE MARKET, BY DEPLOYMENT MODE (Page No. - 74)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODE: MARKET DRIVERS

7.1.2 DEPLOYMENT MODE: COVID-19 IMPACT

FIGURE 35 THE ON-PREMISES SEGMENT TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 18 MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

7.2 ON-PREMISES

TABLE 19 ON-PREMISES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 CLOUD

TABLE 20 CLOUD-BASED MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 AI GOVERNANCE MARKET, BY ORGANIZATION SIZE (Page No. - 78)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 36 SMALL AND MEDIUM-SIZED ENTERPRISES TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 21 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 22 MARKET SIZE IN LARGE ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

8.3 SMALL- AND MEDIUM-SIZED ENTERPRISES

TABLE 23 MARKET SIZE IN SMALL AND MEDIUM-SIZED ENTERPRISES, BY REGION, 2020–2026 (USD MILLION)

9 AI GOVERNANCE MARKET, BY VERTICAL (Page No. - 82)

9.1 INTRODUCTION

9.1.1 VERTICAL: MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

9.2 AI GOVERNANCE: ENTERPRISE USE CASES

FIGURE 37 AUTOMOTIVE VERTICAL TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 24 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

9.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 25 BANKING, FINANCIAL SERVICES, AND INSURANCE: USE CASES

TABLE 26 MARKET SIZE IN BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2020–2026 (USD MILLION)

9.4 GOVERNMENT AND DEFENSE

TABLE 27 GOVERNMENT AND DEFENSE: USE CASES

TABLE 28 MARKET SIZE IN GOVERNMENT AND DEFENSE, BY REGION, 2020–2026 (USD MILLION)

9.5 HEALTHCARE AND LIFE SCIENCES

TABLE 29 HEALTHCARE AND LIFE SCIENCES: USE CASES

TABLE 30 AI GOVERNANCE MARKET SIZE IN HEALTHCARE AND LIFE SCIENCES, BY REGION, 2020–2026 (USD MILLION)

9.6 MEDIA AND ENTERTAINMENT

TABLE 31 MEDIA AND ENTERTAINMENT: USE CASES

TABLE 32 MARKET SIZE IN MEDIA AND ENTERTAINMENT, BY REGION, 2020–2026 (USD MILLION)

9.7 RETAIL

TABLE 33 RETAIL: USE CASES

TABLE 34 MARKET SIZE IN RETAIL, BY REGION, 2020–2026 (USD MILLION)

9.8 IT AND TELECOM

TABLE 35 IT AND TELECOM: USE CASES

TABLE 36 MARKET SIZE IN IT AND TELECOM, BY REGION, 2020–2026 (USD MILLION)

9.9 AUTOMOTIVE

TABLE 37 AUTOMOTIVE: USE CASES

TABLE 38 MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020–2026 (USD MILLION)

9.10 OTHER VERTICALS

TABLE 39 OTHER VERTICALS: USE CASES

TABLE 40 MARKET SIZE IN OTHER VERTICALS, BY REGION, 2020–2026 (USD MILLION)

10 AI GOVERNANCE MARKET, BY REGION (Page No. - 96)

10.1 INTRODUCTION

FIGURE 38 SINGAPORE TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 39 EUROPE TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 41 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATIONS

10.2.3.1 The Personal Information Protection and Electronic Documents Act (PIPEDA)

10.2.3.2 California Consumer Privacy Act

FIGURE 40 NORTH AMERICA: MARKET SNAPSHOT

TABLE 42 NORTH AMERICA: AI GOVERNANCE MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.4 US

10.2.5 CANADA

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATIONS

10.3.3.1 General Data Protection Regulation

10.3.3.2 European Committee for Standardization

10.3.3.3 EU Data Governance Act

FIGURE 41 EUROPE: MARKET SNAPSHOT

TABLE 49 EUROPE: AI GOVERNANCE MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 53 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 54 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 55 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.4 UK

10.3.5 GERMANY

10.3.6 FRANCE

10.3.7 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATIONS

10.4.3.1 Personal Data Protection Act

10.4.3.2 Singapore’s Model AI Governance Framework

TABLE 56 ASIA PACIFIC: AI GOVERNANCE MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.4 CHINA

10.4.5 JAPAN

10.4.6 INDIA

10.4.7 SINGAPORE

10.4.8 REST OF ASIA PACIFIC

10.5 REST OF THE WORLD

10.5.1 ROW: AI GOVERNANCE MARKET DRIVERS

10.5.2 ROW: COVID-19 IMPACT

10.5.3 ROW: REGULATIONS

10.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

10.5.3.2 GDPR Applicability in KSA

10.5.3.3 Protection of Personal Information Act

10.5.3.4 TRA’s IoT Regulatory Policy

10.5.3.5 Brazil Data Protection Law

10.5.3.6 Argentina Personal Data Protection Law No. 25.326

TABLE 63 ROW: AI GOVERNANCE MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 64 ROW: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 65 ROW: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 66 ROW: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 67 ROW: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 68 ROW: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 69 ROW: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.5.4 MIDDLE EAST & AFRICA

10.5.5 LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 122)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS

TABLE 70 AI GOVERNANCE MARKET: DEGREE OF COMPETITION

11.3 COMPANY EVALUATION QUADRANT

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE PLAYERS

11.3.4 PARTICIPANTS

FIGURE 42 KEY AI GOVERNANCE MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2020

11.4 MARKET SHARE/RANK

FIGURE 43 RANKING OF KEY PLAYERS, 2020

11.4.1 PRODUCT FOOTPRINT

TABLE 71 COMPANY PRODUCT FOOTPRINT

TABLE 72 COMPANY INDUSTRY FOOTPRINT

TABLE 73 COMPANY REGION FOOTPRINT

11.5 STARTUP/SME EVALUATION QUADRANT

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 44 STARTUP/SME AI GOVERNANCE MARKET EVALUATION MATRIX, 2020

11.5.5 PRODUCT FOOTPRINT

TABLE 74 STARTUPS/SMES PRODUCT FOOTPRINT

TABLE 75 STARTUPS/SMES INDUSTRY FOOTPRINT

TABLE 76 STARTUPS/SMES REGION FOOTPRINT

11.6 COMPETITIVE SCENARIO

11.6.1 PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 77 PRODUCT LAUNCHES, 2018–2021

11.6.2 DEALS

TABLE 78 DEALS, 2018–2021

11.6.3 OTHERS

TABLE 79 OTHERS, 2018–2021

12 COMPANY PROFILES (Page No. - 137)

12.1 INTRODUCTION

(Business and Financial overview, Products offered, Recent developments & MnM View)*

12.2 KEY PLAYERS

12.2.1 MICROSOFT

TABLE 80 MICROSOFT: BUSINESS OVERVIEW

FIGURE 45 MICROSOFT: COMPANY SNAPSHOT

TABLE 81 MICROSOFT: PRODUCTS OFFERED

12.2.2 IBM

TABLE 82 IBM: BUSINESS OVERVIEW

FIGURE 46 IBM: COMPANY SNAPSHOT

TABLE 83 IBM: PRODUCTS OFFERED

12.2.3 GOOGLE

TABLE 84 GOOGLE: BUSINESS OVERVIEW

FIGURE 47 GOOGLE: COMPANY SNAPSHOT

TABLE 85 GOOGLE: PRODUCT OFFERED

12.2.4 SALESFORCE

TABLE 86 SALESFORCE: BUSINESS OVERVIEW

FIGURE 48 SALESFORCE: COMPANY SNAPSHOT

TABLE 87 SALESFORCE: PRODUCT OFFERED

12.2.5 SAP

TABLE 88 SAP: BUSINESS OVERVIEW

FIGURE 49 SAP: COMPANY SNAPSHOT

TABLE 89 SAP: PRODUCT OFFERED

12.2.6 AWS

TABLE 90 AWS: BUSINESS OVERVIEW

FIGURE 50 AWS: COMPANY SNAPSHOT

TABLE 91 AWS: PRODUCT OFFERED

12.2.7 SAS INSTITUTE

TABLE 92 SAS INSTITUTE: BUSINESS OVERVIEW

FIGURE 51 SAS INSTITUTE: COMPANY SNAPSHOT

TABLE 93 SAS INSTITUTE: PRODUCT OFFERED

12.2.8 FAIR ISAAC CORPORATION

TABLE 94 FICO: BUSINESS OVERVIEW

FIGURE 52 FICO: COMPANY SNAPSHOT

TABLE 95 FICO: PRODUCT OFFERED

12.2.9 FACEBOOK

TABLE 96 FACEBOOK: BUSINESS OVERVIEW

FIGURE 53 FACEBOOK: COMPANY SNAPSHOT

TABLE 97 FACEBOOK: PRODUCT OFFERED

12.2.10 TIBCO SOFTWARE

TABLE 98 TIBCO SOFTWARE: BUSINESS OVERVIEW

TABLE 99 TIBCO SOFTWARE: PRODUCT OFFERED

12.2.11 ZEST AI

TABLE 100 ZEST AI: BUSINESS OVERVIEW

TABLE 101 ZEST AI: PRODUCT OFFERED

12.2.12 PYMETRICS

TABLE 102 PYMETRICS: BUSINESS OVERVIEW

TABLE 103 PYMETRICS: PRODUCT OFFERED

12.2.13 QLIK

TABLE 104 QLIK: BUSINESS OVERVIEW

TABLE 105 QLIK: PRODUCT OFFERED

12.2.14 H2O.AI

TABLE 106 H2O.AI: BUSINESS OVERVIEW

TABLE 107 H20.AI: PRODUCT OFFERED

12.2.15 INFORMATICA

TABLE 108 INFORMATICA: BUSINESS OVERVIEW

TABLE 109 INFORMATICA: PRODUCT OFFERED

12.2.16 ATACCAMA

12.2.17 DATAROBOT

12.2.18 DATAIKU

12.2.19 KYNDI

12.2.20 SPARKCOGNITION

12.3 START-UP/SME PLAYERS

12.3.1 FIDDLER LABS

12.3.2 DARWINAI

12.3.3 UNTANGLE AI

12.3.4 2021.AI

12.3.5 INTEGRATE.AI

12.3.6 TRUERA

12.3.7 GENIE AI

12.3.8 MINDSDB

12.3.9 ANOTHERBRAIN

12.3.10 DIVEPLANE

*Details on Business and Financial overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 199)

13.1 INTRODUCTION

13.2 DATA GOVERNANCE MARKET—GLOBAL FORECAST TO 2025

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.2.1 Data governance market, by application

TABLE 110 DATA GOVERNANCE MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 111 DATA GOVERNANCE MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

13.2.2.2 Data governance market, by component

TABLE 112 DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 113 DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

13.2.2.3 Data governance market, by deployment mode

TABLE 114 DATA GOVERNANCE MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 115 DATA GOVERNANCE MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

13.2.2.4 Data governance market, by organization size

TABLE 116 DATA GOVERNANCE MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 117 DATA GOVERNANCE MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

13.2.2.5 Data governance market, by vertical

TABLE 118 DATA GOVERNANCE MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 119 DATA GOVERNANCE MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

13.2.2.6 Data governance market, by region

TABLE 120 DATA GOVERNANCE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 121 DATA GOVERNANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 122 NORTH AMERICA: DATA GOVERNANCE MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 123 NORTH AMERICA: DATA GOVERNANCE MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 124 EUROPE: DATA GOVERNANCE MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 125 EUROPE: DATA GOVERNANCE MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 126 ASIA PACIFIC: DATA GOVERNANCE MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 127 ASIA PACIFIC: DATA GOVERNANCE MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.3 CONVERSATIONAL AI MARKET—GLOBAL FORECAST TO 2025

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.2.1 Conversational AI market, by component

TABLE 128 CONVERSATIONAL AI MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 129 CONVERSATIONAL AI MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

13.3.2.2 Conversational AI market, by type

TABLE 130 CONVERSATIONAL AI MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

13.3.2.3 Conversational AI market, by technology

TABLE 131 CONVERSATIONAL AI MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

13.3.2.4 Conversational AI market, by deployment mode

TABLE 132 CONVERSATIONAL AI MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

13.3.2.5 Conversational AI market, by application

TABLE 133 CONVERSATIONAL AI MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

13.3.2.6 Conversational AI market, by vertical

TABLE 134 CONVERSATIONAL AI MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

13.3.2.7 Conversational AI market, by region

TABLE 135 CONVERSATIONAL AI MARKET SIZE, BY REGION, 2019–2025(USD MILLION)

TABLE 136 NORTH AMERICA: CONVERSATIONAL AI MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 137 EUROPE: CONVERSATIONAL AI MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 138 ASIA PACIFIC: CONVERSATIONAL AI MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: CONVERSATIONAL AI MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 140 LATIN AMERICA: CONVERSATIONAL AI MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

14 APPENDIX (Page No. - 213)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

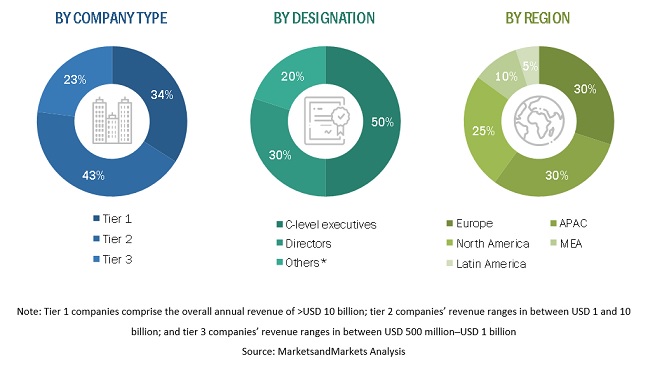

The study involved four major activities in estimating the current market size of the AI governance market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the AI governance market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from AI governance solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AI governance market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the AI governance market. The bottom-up approach was used to arrive at the overall market size of the global AI governance market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the AI governance market by component (platforms, software tools, and services), services (training and consulting, system integration and testing, and support and maintenance), deployment mode, organization size, vertical, and region

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the AI governance market

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the AI governance market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To profile the key players of the AI governance market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as new product launches, mergers & acquisitions, and partnerships, agreements, and collaborations in the AI governance market

- To analyze the impact of the COVID-19 pandemic on the AI governance market.

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American AI governance market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in AI Governance Market