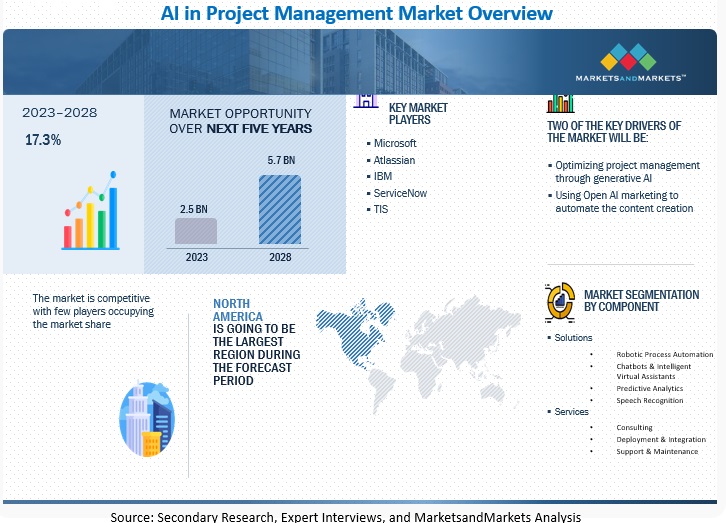

AI in Project Management Market by Component (Solution (Robotic Process Automation, Chatbots & Intelligent Virtual Assistants, Others), Service), Application, Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2028

The global AI in Project Management Market is projected to grow from USD 2.5 billion in 2023 to USD 5.7 billion by 2028, at a CAGR of 17.3% during the forecast period. Platforms utilizing AI and machine learning have the ability to increase the commercial visibility of projects throughout. Project management teams may take speedier action before hazards threaten project completion because of AI’s ability to recognize and anticipate issues far sooner. For better, quicker decision-making, AI in project management employs machine learning and predictive data analytics to deliver more accurate insights into potential outcomes.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increase in need to enhance the success rate of projects

Project management software and methodologies such as critical path analysis, Gantt charts, and risk management techniques have been used in organizations for centuries. These tools and techniques have been refined over time and have proven to be effective in managing projects across businesses. However, according to project management experts, only 35% of projects hit production and were completed successfully within time, budget, and planning. Major reasons for project failure are inadequate resources, poor project planning and management, lack of stakeholder engagement & communication, and changing project requirements. Organizations can implement AI-based solutions for effective project management that automates routine tasks. The use of AI in project management has the potential to significantly improve project outcomes, reduce costs, increase efficiency, and reduce costs.

Restraint: Increase in concerns over data privacy and security

Data is often regarded as the most crucial organisational asset, necessitating cyber threat defence. Businesses that adopt new, cutting-edge digital technology expose their corporate data to risk. An organisation will always struggle to defeat these dangers, regardless of how well-prepared it is to cope with cybercrimes. Every innovation that promises to enhance company processes also increases the access points for hackers and thieves into IT systems. This is the main obstacle preventing businesses from adopting solutions for project management that are based on Al. Small and medium-sized businesses can readily utilise the affordable public cloud services (SMEs). These services, however, are more vulnerable to cyberattacks and security issues, whilst small businesses cannot afford a private cloud owing to financial restrictions. Also, the accessibility of project management tools on mobile devices makes them more vulnerable to data leaks and cyberattacks. Thus, it may be concluded that businesses in highly regulated industries are reluctant to embrace cutting-edge Al-based project management systems because to financial limitations or information security concerns.

Opportunity: Cost optimization

In today’s competitive business landscape, cost optimization has become a critical focus for organizations looking to improve their bottom line. One area where businesses can find significant opportunities to optimize costs is project management. Using AI-based project management tools, organizations can identify cost-saving opportunities and improve overall project efficiency. AI-based project management tools can help organizations optimize costs by analyzing historical project data to identify areas where they can reduce spending. AI can analyze data on resource utilization, procurement, and project schedules to identify inefficiencies and cost-saving opportunities. This can help businesses allocate resources more effectively, streamline procurement processes, and reduce project delays, all of which can lead to significant cost savings. In addition to cost optimization, AI-based project management tools can also improve overall project efficiency. By automating routine tasks, such as data entry and reporting, project teams can focus on more value-added activities that can drive better project outcomes. Additionally, AI can provide predictive analytics that helps organizations make data-driven decisions, which can lead to more accurate project forecasting and better overall project outcomes.

Challenge: Selecting the right solutions that align with the organizations’ business needs

As there is no one-size-fits-all PPM solution, it can be quite difficult for project-intensive firms to choose the appropriate solution among the options available to suit their unique business objectives in order to remain competitive and afloat in an environment that is becoming more volatile and more competitive. Furthermore, there is no established method for evaluating a PPM solution's capabilities or service standards. Giving control of business data is a crucial issue that still needs to be addressed even after choosing the solution. Companies working on complicated projects in a regulated environment are highly wary about their data because a data loss might cost the company millions of dollars and damage its reputation. Also, if the adopted solution doesn't take into account any of the factors, it will have an effect on businesses' everyday operations and lower worker productivity, which could lead to financial losses. 73% of firms do not have enough resources to satisfy demand, and 55% report that their projects and resources are not well-aligned with business objectives, according to Planview's 2017 Project and Portfolio Management Study.

By application, risk management to register at the highest CAGR among applications during the forecast period

The market for AI in project management by application is segmented into project scheduling & budgeting; data analytics, reporting, and visualization; project support & administration; project data management; risk management; resource allocation, planning, and forecasting; project task management, automation, and prioritization; project monitoring; and others (performance tracking and KPI management). The risk management application is projected to grow at the highest CAGR during the forecast period. The activity of detecting, assessing, and preventing or minimizing risks to a project that have the potential to affect the desired outcomes is known as risk management in project management. Typically, project managers are in charge of supervising the risk management procedure throughout the whole course of a certain project. Project managers need a comprehensive grasp of their goals in order to spot any potential obstacles that can limit the team’s capacity to achieve outcomes. This is necessary for successful risk management.

By solution, predictive analytics segments to projected to be the largest market size during the forecast period

Predictive analytics is being used by a greater number of sectors to boost their profitability and competitiveness. Organizations may use predictive analytics to assess variance and variation, regularly improve predictions, and monitor projections alongside past performance. Service teams are given the information they require when needed by making this forecasting data visible and accessible. This strategy can assist businesses in overcoming several obstacles. This involves maintaining the projects within their allotted scope, money, and time.

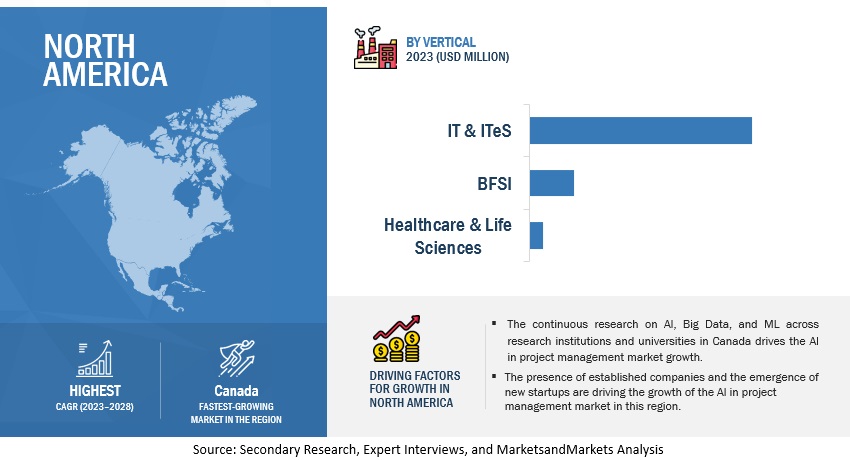

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in AI in project management. Project managers are among the roles that artificial intelligence (AI) is beginning to take over in more conventional commercial contexts to supplement or help. Artificial intelligence (AI) has the unique capacity to swiftly evaluate huge volumes of business data, identify patterns, make conclusions from them, and make predictions. AI in project management is essential for organizations due to its ability to estimate project outcomes and monitor particular patterns quickly and correctly.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The AI in project management vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market for AI in project management IBM (US), Oracle (US), Hitachi (Japan), Adobe (US), Microsoft (US), TIS (Japan), ServiceNow (US), Atlassian (Australia), Alice Technologies (US), Aitheon (US), PMaspire (Singapore), Forecast (UK), ClickUp (US), Zoho (India), ProofHub (US), Azeendo (France), Bubblz (France), Lili.ai (France), RationalPlan (Romania), ClearStrategy (Ireland), Saviom (Australia), CodeComplete (Japan), monday.com (Israel), ImageGrafix (UAE), Orangescrum (US), Smartsheet (US), PSOhub (Netherlands), Bitrix24 (US), Asana (US), and Wrike (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Billion |

|

Segments covered |

Component, Application, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Oracle (US), Hitachi (Japan), Adobe (US), Microsoft (US), TIS (Japan), ServiceNow (US), Atlassian (Australia), Alice Technologies (US), Aitheon (US), PMaspire (Singapore), Forecast (UK), ClickUp (US), Zoho (India), ProofHub (US), Azeendo (France), Bubblz (France), Lili.ai (France), RationalPlan (Romania), ClearStrategy (Ireland), Saviom (Australia), CodeComplete (Japan), monday.com (Israel), ImageGrafix (UAE), Orangescrum (US), Smartsheet (US), PSOhub (Netherlands), Bitrix24 (US), Asana (US), and Wrike (US). |

This research report categorizes the AI in project management market based on component, application, deployment mode, organization size, vertical, and region.

By Component:

-

Solutions

- Robotic process automation

- Chatbots & intelligent virtual assistants

- Predictive analytics

- Speech recognition

-

Services

- Consulting

- Deployment & integration

- Support & maintenance services

By Application:

-

- Project scheduling & budgeting

- Data analytics, reporting, and visualization

- Project support & administration

- Project data management

- Risk management

- Resource allocation, planning, and forecasting

- Project task management, automation, and prioritization

- Project monitoring

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large enterprises

- SMEs

By Vertical:

- Banking, financial services, and insurance

- Retail & eCommerce

- Healthcare & life sciences

- Government & defense

- IT & ITeS

- Energy & utilities

- Telecommunications

- Manufacturing

- Construction & engineering

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- Israel

- Turkey

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2023, Hitachi launched the next-generation TXpert Hub to digitalize the transformers. The TXpert Hub enables monitoring by aggregating, storing, and analyzing the information received from the transformer’s digital sensors.

- In January 2023, TIS Inc. announced a capital and business alliance with Vector Consulting Group. Vector would provide its clients with value-added consulting services to build innovative models that enhance the long-term competitive advantage of clients.

- In December 2022, IBM announced an agreement to acquire Octo, a US-based IT modernization and digital transformation services provider exclusively serving the US federal government, including defense, health, and civilian agencies.

- In November 2022, Oracle NetSuite announced updates to NetSuite Analytics Warehouse. The latest updates enhanced the first and only prebuilt data warehouse and analytics solution for NetSuite customers by making it easier for customers to blend relevant data sets and introducing new prebuilt visualization capabilities.

- In October 2022, Microsoft launched Microsoft Syntex, a content AI integrated into the flow of work. It put people at the center, with content seamlessly integrated into collaboration and workflows, turning content from a cost into an advantage. Syntex would automatically read, tag, and index high volumes of content and connect it where needed—in search, in applications, and as reusable knowledge.

Frequently Asked Questions (FAQ):

What is AI in project management?

AI in project management refers to the deployment of AI-based software tools, platforms, and solutions that enable project managers to automate repetitive activities, such as project communications and interactions, project scheduling and budgeting, data management and analysis from current and historical data, scheduling and sending reminders, and project task and resource management, among others. AI-based software solutions minimize manual errors, enhance planning, and allocation of resources, thereby increasing productivity and efficiency and improving decision-making capability across project management offices.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Spain, and Italy in the European region.

Which are key verticals adopting AI in project management software and services?

Key verticals adopting AI in project management and services include BFSI, health care & life sciences, government & defense, retail & eCommerce, energy & utilities, telecommunications, IT & ITeS, manufacturing, and construction & engineering.

Which are the key drivers supporting the market growth for AI in project management?

The key drivers supporting the market growth for AI in project management include the increasing need to enhance the success rate of projects, improve operational performance to gain competitive benefits in the market and focus on agile project management methodologies.

Who are the key vendors in the market for AI in project management?

The key vendors in the global AI in project management market include IBM (US), Oracle (US), Hitachi (Japan), Adobe (US), Microsoft (US), TIS (Japan), ServiceNow (US), Atlassian (Australia), Alice Technologies (US), Aitheon (US), PMaspire (Singapore), Forecast (UK), ClickUp (US), Zoho (India), ProofHub (US), Azeendo (France), Bubblz (France), Lili.ai (France), RationalPlan (Romania), ClearStrategy (Ireland), Saviom (Australia), CodeComplete (Japan), monday.com (Israel), ImageGrafix (UAE), Orangescrum (US), Smartsheet (US), PSOhub (Netherlands), Bitrix24 (US), Asana (US), and Wrike (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

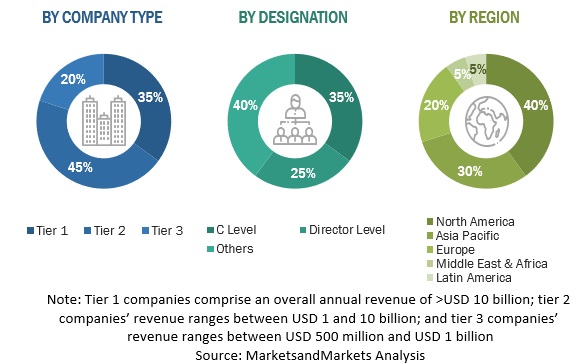

The research methodology for the global AI in project management market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including the key opinion leaders, subject matter experts, high-level executives of various companies offering AI in project management software and services, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

The secondary research was mainly used to obtain the key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the market for AI in the project management ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing AI in project management software, and solutions; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the key information/insights throughout the report.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting for AI in project management and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market for AI in project management, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the market for AI in project management was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of solution and service components, deployment modes, organization size, and verticals. The aggregate of all the revenues of the companies was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of AI in project management solutions and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of AI in project management solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on AI in project management solutions based on some of the key use cases. These factors for the AI in the project management tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

AI in project management refers to the deployment of AI-based software tools, platforms, and solutions that enable project managers to automate repetitive activities, such as project communications and interactions, project scheduling and budgeting, data management and analysis from current and historical data, scheduling and sending reminders, and project task and resource management, among others. AI-based software solutions minimize manual errors, enhance planning, and allocation of resources, thereby increasing productivity and efficiency and improving decision-making capability across project management offices.

AI-based tools also assist project managers in handling different tasks during each phase of the project planning process. It enables project managers to process complex project data and uncover patterns that may affect project delivery. AI also automates most redundant tasks, thereby enhancing employee engagement and productivity.

Key Stakeholders

- Research organizations

- Third-party service providers

- Technology providers

- AI consulting companies

- Independent software vendors (ISVs)

- Service providers and distributors

- Application development vendors

- System integrators

- Consultants/consultancy/advisory firms

- Training and education service providers

- Support and maintenance service providers

- Managed service providers

Report Objectives

- To define, describe, and forecast market for AI in project management based on component, application, technology, deployment mode, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide the competitive landscape of the market.

- To forecast the revenue of the market segments with respect to all the five major regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze the recent developments and their positioning related to the market for AI in project management

- To analyze competitive developments, such as mergers & acquisitions, product developments, and research & development (R&D) activities, in the market

- To analyze the impact of recession across all the regions across the market for AI in project management

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market for AI in project management

- Further breakup of the European market for AI in project management

- Further breakup of the Asia Pacific market for AI in project management

- Further breakup of the Latin American market for AI in project management

- Further breakup of the Middle East & Africa market for AI in project management

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in AI in Project Management Market