AIOps Platform Market by Offering (Platforms (Domain-centric, Domain-agnostic), Services (Professional, Managed)), Application (Infrastructure Management, ITSM, Security & Event Management), Deployment Mode, Vertical and Region - Global Forecast to 2028

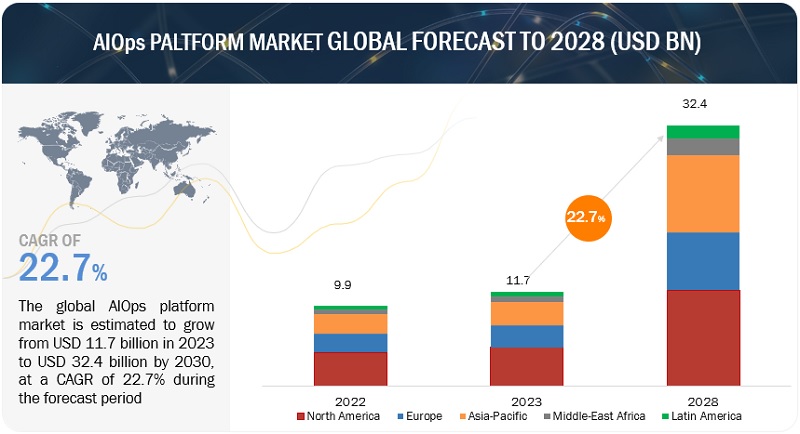

[347 Pages Report] The global market for AIOps Platform is projected to grow from USD 11.7 billion in 2023 to USD 32.4 billion by 2028, at a CAGR of 22.7% during the forecast period. The rapid digital transformation in global business organizations has led to increasingly complex datasets, requiring significant time, cost, and effort for data processing. As IT operations are also undergoing this transformation, IT teams face the challenge of managing intricate datasets to sustain business operations. Additionally, the distributed architecture and dynamic nature of modern business applications and services have resulted in a considerable increase in data loads over recent years. To address the growing demand for IT agility, the AIOps platform has emerged as a solution for IT operations teams. This AI-powered platform combines human intelligence with automated algorithms, providing full visibility into IT system performance.

Technology Roadmap of AIOps Platform till 2030

The AIOps Paltform market report covers technology roadmap till 2030, with insights around short-term, mid-term, and long-term developments.

Short-term roadmap (2023-2025)

- The focus is on improving the integration of diverse data sources into the AIOps platform.

- The AIOps platform enables real-time analysis of streaming data to provide instantaneous insights and proactive monitoring.

- Focus on improving the interpretability and explainability of AI models used in the AIOps platform.

- The AIOps platform incorporates self-learning capabilities to adapt and improve over time.

Mid-term roadmap (2025-2028)

- The AIOps platform expands its integration capabilities to include emerging data sources such as IoT devices and edge computing systems.

- Strengthens capabilities for processing and analyzing high-velocity, real-time data streams.

- Advanced techniques, such as rule-based approaches, causal AI, and counterfactual explanations, are explored to provide deeper insights into the reasoning behind AI-driven decisions.

- Development of self-adaptive systems to dynamically adjust algorithms and models based on evolving IT landscapes.

Long-term roadmap (2028-2030)

- Advanced techniques, such as data virtualization and federated learning, enable the platform to handle distributed data sources and perform real-time data fusion.

- Development of advanced streaming analytics techniques that enable real-time decision-making and automated actions.

- Ethical considerations, including bias mitigation, privacy preservation, and algorithmic transparency, are integrated into the design and implementation of the AIOps platform.

- Developing intelligent systems capable of self-healing, self-optimizing, and self-configuring.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Streamlining IT operation for digital transformation through AI and automation

AIOps plays a pivotal role in driving digital transformation by streamlining IT operations and meeting the evolving customer demands in the digital age. It enables businesses to deliver seamless digital experiences by transforming the backend operations. With AIOps, the management of complex environments becomes simpler as it orchestrates infrastructure, applications, and services across hybrid cloud ecosystems, ensuring optimal efficiency and customer satisfaction. Enterprises worldwide are embarking on digital transformation journeys, driven by the need to modernize and adapt in the post-pandemic era of remote work and digital collaboration. However, the success rate of these initiatives remains challenging, with many projects falling short of their goals due to the complexities of implementing new technologies throughout the organization. To overcome these challenges, organizations can harness the power of AI and automation, specifically through the adoption of AIOps platforms. These solutions leverage machine learning to connect and contextualize operational data, enabling informed decision-making and automated issue resolution. By simplifying and streamlining the transformation process, AIOps platforms prove to be a game-changer, particularly as businesses scale up their operations.

By embracing AIOps platforms, enterprises empower their digital transformation initiatives, leveraging the capabilities of AI and automation to drive success, enhance operational efficiency, and effectively navigate the complexities of the modern business landscape.

Restraint: Addressing data quality and availability in AIOps implementation

Data quality and availability pose significant challenges in the implementation of AIOps platforms. AIOps relies on a diverse range of data sources, including system logs, metrics, historical performance data, real-time operations events, and incident-related information. However, the data required for AIOps often suffers from issues such as incompleteness, inconsistency, and being stored in disparate silos across the organization's infrastructure. Insufficient or poor-quality data adversely impacts the accuracy and reliability of AIOps algorithms, resulting in misleading insights and erroneous technology decisions. To overcome these restraints, organizations must focus on data governance practices, data integration techniques, and data quality assurance processes. This includes implementing robust data pipelines, data cleansing procedures, and data normalization techniques to ensure the data used by AIOps platforms is accurate, reliable, and readily available. Furthermore, organizations need to break down data silos, establish data standards, and enforce data quality controls to enhance the overall effectiveness and trustworthiness of AIOps platforms.

Opportunity: Growing demand for increased security threats mitigation and compliance requirements

The rising demand for increased security threats mitigation and compliance requirements presents a significant opportunity for AIOps platforms. With the growing complexity of IT environments and the evolving threat landscape, organizations face challenges in effectively detecting and responding to security incidents while meeting regulatory compliance standards. AIOps platforms leverage advanced analytics and machine learning algorithms to enhance security operations. By analyzing vast amounts of security-related data, including logs, events, and network traffic, these platforms identify patterns, anomalies, and potential security breaches in real-time. This proactive approach enables early threat detection and faster incident response, reducing the risk of data breaches and minimizing the impact of security incidents.

Moreover, AIOps platforms aid organizations in achieving compliance requirements by automating the collection, analysis, and reporting of security-related data. It provide continuous monitoring, audit trail generation, and assist in maintaining adherence to industry-specific regulations. By leveraging the power of AI and automation, AIOps platforms empower organizations to strengthen their security posture, mitigate security threats, and streamline compliance processes. It enable IT teams to efficiently manage security incidents, enhance visibility into security operations, and ensure the protection of critical assets and sensitive data.

Challenge: Lack of transparency and explainability

The lack of transparency and explainability in AIOps algorithms poses a significant issue that hampers the comprehension and articulation of the decision-making process. This lack of transparency and explainability leads to trust issues, especially in regulated industries where human judgment holds paramount importance. The complexity inherent in AIOps algorithms presents challenges in understanding and validating the outcomes they generate. This becomes particularly critical in highly regulated sectors such as finance and healthcare, where accountability and compliance are of utmost significance. Being able to elucidate AI-driven decisions becomes crucial in such environments. To tackle this challenge, it is imperative to enhance the explainability of AIOps algorithms through the development of interpretability techniques. These techniques aim to provide transparent insights into the inner workings and decision-making process of AIOps platforms. By incorporating explainability features, organizations build trust, ensure compliance with regulations, and gain a deeper understanding of the rationale behind the recommendations and actions of AIOps platforms. Effectively addressing this challenge requires striking a balance between algorithmic complexity and interpretability, enabling stakeholders to comprehend and trust the decisions made by AIOps systems with confidence. Achieving explainability is instrumental in the successful adoption and acceptance of AIOps platforms, particularly in regulated industries where transparency and accountability are integral.

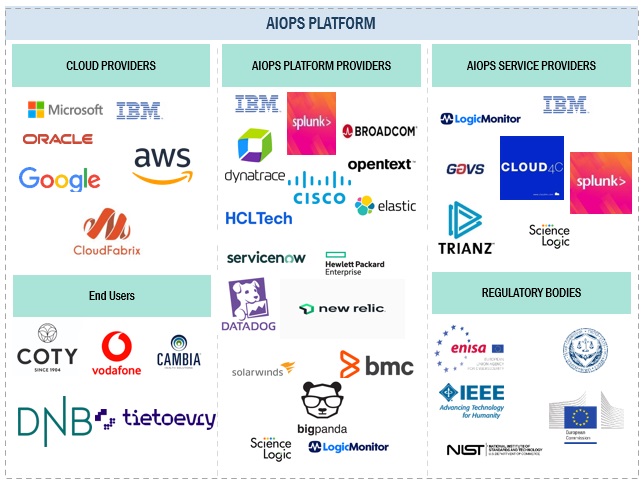

AIOps Platform Market Ecosystem

By application, infrastructure management to account for the largest market size during the forecast period

Infrastructure management is adopting AIOps platforms to optimize and streamline IT operations. AIOps leverages AI and ML algorithms to analyze vast amounts of infrastructure data in real-time, enabling proactive monitoring, predictive insights, and intelligent automation. By detecting anomalies, predicting potential issues, and automating routine tasks, AIOps improves resource allocation, reduces downtime, and enhances overall infrastructure performance. This adoption of AIOps empowers IT teams to efficiently manage complex and dynamic infrastructures, ensuring better system reliability and meeting the demands of modern business operations.

By deployment, cloud to account for the largest market size during the forecast period

Cloud environments are increasingly adopting AIOps platforms to address the challenges posed by the dynamic and complex nature of cloud-based infrastructures. AIOps leverages AI and ML technologies to analyze data from various cloud sources, such as logs, metrics, and monitoring tools, in real-time. This enables cloud providers and users to gain deep insights into the performance, security, and resource utilization of cloud services. AIOps platforms help optimize cloud resource allocation, automate incident management, and detect potential issues proactively. By embracing AIOps, cloud environments enhance efficiency, improve service reliability, and provide better user experiences for organizations and end-users leveraging cloud services.

By offering, platform to account for the largest market size during the forecast period

AIOps technology is being adopted across various platforms to enhance IT operations. Domain-centric AIOps focuses on specific IT domains, offering tailored insights and automation. Monitoring-centric AIOps uses real-time data from monitoring tools to detect anomalies and improve system performance. ITSM-centric AIOps integrates with IT Service Management processes for efficient incident and problem resolution. Data lake-centric AIOps leverages data repositories for advanced analytics, enabling proactive operations. Domain-agnostic AIOps provides a unified view of the entire IT environment, using data integration for comprehensive analytics.

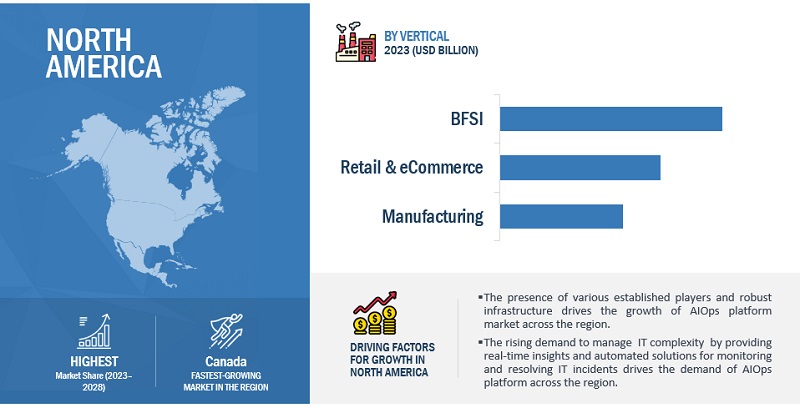

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in AIOps Platform market. AIOps Platform is making a significant impact on North America, driving innovation and transforming industries across the region. North America's leadership in AIOps platforms is driven by early adoption, a vibrant tech innovation ecosystem, and a skilled workforce. The region's focus on digital transformation, collaborations, and significant investments in AIOps drive its competitiveness. A thriving startup ecosystem introduces disruptive solutions, keeping North America at the forefront of AIOps technology. These factors collectively enable the region to leverage cutting-edge AIOps platforms and gain a competitive edge in the evolving market.

Key Market Players

The AIOps Platform vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market for AIOps Platform IBM (US), Splunk (US), Broadcom (US), OpenText (Canada), Dynatrace (US), Cisco (US), HCL Technologies (India), Elastic (US), ServiceNow (US), HPE (US), Datadog (US), New Relic (US), SolarWinds (US), BMC Software (US), ScienceLogic (US), BigPanda (US), LogicMonitor (US), Sumo Logic (US), Moogsoft (US), Resolve Systems (US), AIMS Innovation (Norway), Interlink Software (UK), CloudFabrix (US), PagerDuty (US), Aisera (US), ManageEngine (US), Digitate (US), ZIF.ai (US), Autointelli (India), UST (US), Freshworks (US), Everbridge (US), StackState (US), Logz.io (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Billion |

|

Segments covered |

Offering, Services, Deployment Mode, Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Splunk (US), Broadcom (US), OpenText (Canada), Dynatrace (US), Cisco (US), HCL Technologies (India), Elastic (US), ServiceNow (US), HPE (US), Datadog (US), New Relic (US), SolarWinds (US), BMC Software (US), ScienceLogic (US), BigPanda (US), LogicMonitor (US), Sumo Logic (US), Moogsoft (US), Resolve Systems (US), AIMS Innovation (Norway), Interlink Software (UK), CloudFabrix (US), PagerDuty (US), Aisera (US), ManageEngine (US), Digitate (US), ZIF.ai (US), Autointelli (India), UST (US), Freshworks (US), Everbridge (US), StackState (US), Logz.io (US) |

This research report categorizes the AIOps Platform market based on Offering, Services, Deployment Mode, Application, Vertical, and Region.

By Offering:

- Platform

-

Domain-Centric

- Monitoring-centric AIOps

- ITSM centric-AIOps

- Data-Lake centric-AIOps

- Domain-Agnostic

- Services

By Services:

-

Professional Services

- Implementation Services

- Licenses and Maintenance Services

- Training & Education Services

- Consulting Services

-

Managed Services

- Managed Network Servicecs

- Managed Cloud Services

- Managed Security Services

- Manged Automation Servcies

By Deployment Mode:

- On-Premises

-

Cloud

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application:

-

Infrastructure Mangement

- Anomaly Detection and Root Cause Analysis

- Automated Incident Management

- Capacity Planning and Optimization

- Performance Monitoring and Optimization

- Server Monitoring and Management

- Storage Monitoring and Management

- Application Performance Monitoring

- Network Monitoring

-

ITSM

- Service Level Management

- Configuration Management

- Actionable Intelligence

- IT Asset Management

- Service Desk Automation (Chatbot)

- Security & Event Management

- Security Incident and Event Management (SIEM)

- Threat Intelligence and Detection

- Security Automation and Orchestration

- Security Event Correlation

- User and Entity Behavior Analytics

- Vulnerability Management

By Vertical:

- BFSI

- Retail & eCommerce

- Transportation and Logistics

- Government & Defense

- Healthcare & Life Sciences

- Telecom

- Energy & Utilities

- Manufacturing

- IT/ITeS

- Media & Entertainment

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- South Korea

- ANZ

- Japan

- ASEAN

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- Israel

- Egypt

- UAE

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In June 2023, IBM announced the acquisition of Apptio to accelerate the advancement of IBM's IT automation capabilities and enable enterprise leaders to deliver enhanced business value across technology investments.

- In February 2023, OpenText announced the acquisition of Micro Focus to help enterprise professionals secure their operations, gain more insight into their information, and better manage an increasingly hybrid and complex digital fabric.

- In January 2023, Interlink Software partnered with Cisco and integrated its AIOps platform with AppDynamics. By leveraging this integration, IT teams mitigate the risk of unnecessary IT outages and enhance service availability, optimizing overall operational performance.

- In April 2022, Meliá Hotels International collaborated with Dynatrace to fuels its digital transformation by migrating its critical applications. Using Dynatrace's observability and advanced AIOps capabilities, Meliá ensures that their digital services match the quality of in-person interactions with hotel staff.

- In December 2021, Broadcom announced the acquisition of AppNeta. The acquisition of AppNeta by Broadcom allows for the integration of AppNeta's scalable end-to-end visibility solution with Broadcom's infrastructure and AIOps capabilities.

Frequently Asked Questions (FAQ):

What is AIOps Platform?

AIOps (Artificial Intelligence for IT Operations) is a technology platform that uses AI and ML algorithms to automate IT operations tasks, analyze data for real-time insights, and enhance IT system efficiency, reliability, and scalability. It aims to optimize IT infrastructure and improve service delivery for a better user experience.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Spain, and Italy in the European region.

Which are key verticals adopting AIOps Platform software and services?

Key verticals adopting AIOps Platform and services include BFSI, Retail & eCommerce,

Which are the key drivers supporting the market growth for AIOps Platform?

The key drivers supporting the market growth for AIOps Platform include Rising complexity and hybridization of IT environments, Streamlining IT operation for digital transformation through AI and automation, Growing demand for real-time monitoring, proactive incident response, and predictive analytic.

Who are the key vendors in the market for AIOps Platform?

The key vendors in the global AIOps Platform market include IBM (US), Splunk (US), Broadcom (US), OpenText (Canada), Dynatrace (US), Cisco (US), HCL Technologies (India), Elastic (US), ServiceNow (US), HPE (US), Datadog (US), New Relic (US), SolarWinds (US), BMC Software (US), ScienceLogic (US), BigPanda (US), LogicMonitor (US), Sumo Logic (US), Moogsoft (US), Resolve Systems (US), AIMS Innovation (Norway), Interlink Software (UK), CloudFabrix (US), PagerDuty (US), Aisera (US), ManageEngine (US), Digitate (US), ZIF.ai (US), Autointelli (India), UST (US), Freshworks (US), Everbridge (US), StackState (US), Logz.io (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

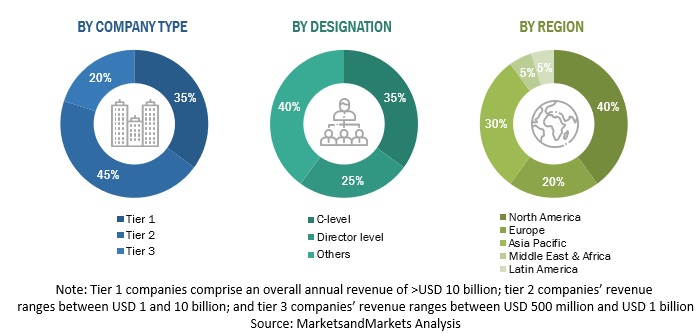

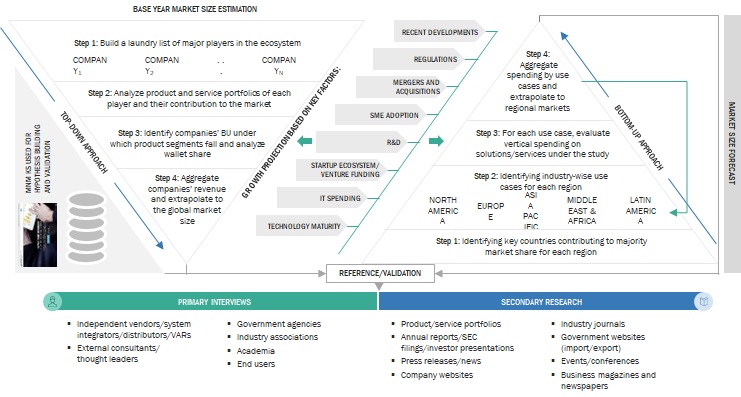

The research methodology for the global AIOps Platform market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including key opinion leaders, subject matter experts, high-level executives of multiple companies offering AIOps Platform offerings, and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources.

The secondary research was used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides of the AIOps Platform market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing AIOps Platform offerings; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify and validate the segmentation types; industry trends; key players; the market's competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the AIOps Platform market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global AIOps Platform market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

The top-down approach prepared an exhaustive list of all the vendors offering AIOps Platform. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of solution and service offerings, cloud types, organization sizes, and verticals. The aggregate of all the companies' revenues was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of AIOps Platform solutions and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of AIOps Platform solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on AIOps Platform solutions based on some of the key use cases. These factors for the AIOps Platform tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Size Estimation: Top Down And Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Definition

According to Sumo Logic, AIOps involves using AI and machine learning to automate tasks traditionally performed manually by IT operators. AIOps implementations employ mathematical models that analyze data to trigger response algorithms based on predefined criteria.

MoogSoft defines AIOps as the application of AI, machine learning, and NLP to IT Ops activities. AIOps aids IT Ops, DevOps, and SRE teams in working more efficiently, detecting issues earlier, and resolving them promptly to prevent business disruptions and customer impact.

Key Stakeholders

- Analytics solution vendors

- Artificial intelligence (AI) service providers

- Value-added resellers

- Security and intelligence service providers

- MSPs

- Cloud service providers

- Network and system integrators

- IT operations tool and solution providers

Report Objectives

- To define, describe, and predict the AIOps platform market by offering (platform and services), services, applications, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the AIOps platform market

- To analyze the impact of the recession in the AIOps platform market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market for AIOps Platform

- Further breakup of the European market for AIOps Platform

- Further breakup of the Asia Pacific market for AIOps Platform

- Further breakup of the Latin American market for AIOps Platform

- Further breakup of the Middle East & Africa market for AIOps Platform

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in AIOps Platform Market