AIoT Platforms Market by Offering (Solutions (Device Management, Application Management, Connectivity Management) and Services), Vertical (Manufacturing, Healthcare, Retail) and Region - Global Forecast to 2028

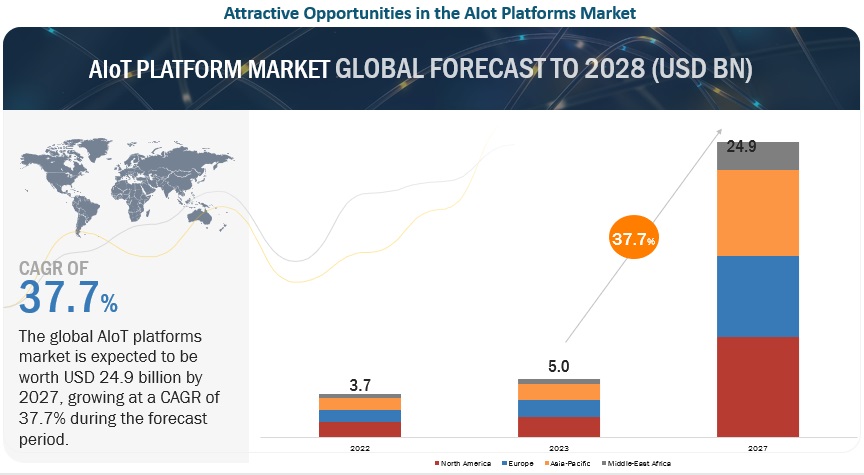

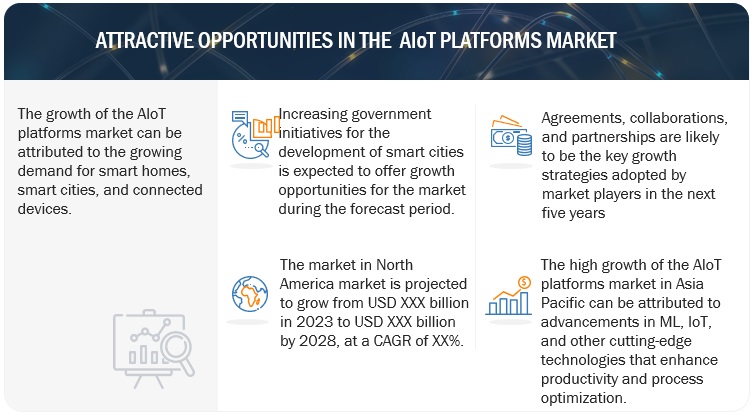

The AIoT Platforms Market size is projected to expand at a CAGR of 37.7% during the forecast period to reach USD 24.9 billion by 2028, size was valued USD 5.0 billion in 2023. The primary factor driving the growth of AIoT platforms is the increasing government spending and initiatives to establish AIoT platforms developments. Also the increasing demand for effective management of data generated from IoT devices to gain valuable insights, streamline the production process, and reduce downtime is to drive the growth of the AIoT platforms market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

AIoT Platforms Market Dynamics

Driver: Edge-Computing-Powered Artificial Intelligence of Things

The idea of edge computing encourages the development of distributed system architectures with on-device data processing that are extremely effective, scalable, reliable, and well suited for low-latency use cases. Due to the enormous computing resources needed to conduct ML tasks, machine learning and deep learning were first restricted to the cloud platform. Emerging computationally demanding and resource-intensive AIoT applications can be effectively supported at the network edge by utilizing the innovative paradigm of edge intelligence. To achieve quick processing speed and low latency needed for intelligent IoT applications, edge computing is crucial.

Restraint: Security and compatibility issues

Security is a serious problem, since AIoT platforms require integration and exchange of data across numerous devices and networks. Every vulnerability or breach can have serious repercussions, including data loss, identity theft, and monetary losses. AIoT platforms make use of a range of hardware, software, and standards. This may result in compatibility problems that make it challenging to combine various systems. It may be challenging for enterprises to connect various systems together due to the absence of common standards for AI and IoT technology. This may prevent companies reluctant to invest in non-standard technology from adopting AIoT platforms.

Opportunity: Real-time operational decision-making

IoT devices collect significant amounts of data. AIoT technologies use this data for real-time decision-making. A simple example of this is a security camera system integrated with an alarm. A typical IoT camera would stream video data to a center where security personnel would watch the recording. An AIoT camera can detect trespassers and automatically activate a noise alarm to notify the security team. Thus, AIoT technology moves decision-making from human security personnel to the IoT device, enabling labor savings and improved compliance. For example, an automated system is better than security professionals who could fall asleep in front of the screen.

Challenge: Maintenance and update issues

Enterprises are adopting AI-based IoT solutions for predictive maintenance and enhanced customer experience. The vendors in the market must develop AI in IoT systems considering two important factors, namely maintenance and updates. An AI-based IoT system needs to be updated and maintained as per the changing business requirements to implement technological upgrades. As new components are added, the software also needs to be upgraded. The new system must be integrated with the existing as well as additional software. With an increase in the number of systems, the maintenance cost also increases. Maintaining and upgrading AI-based IoT systems is going to be a challenging task for companies offering solutions without any interruption.

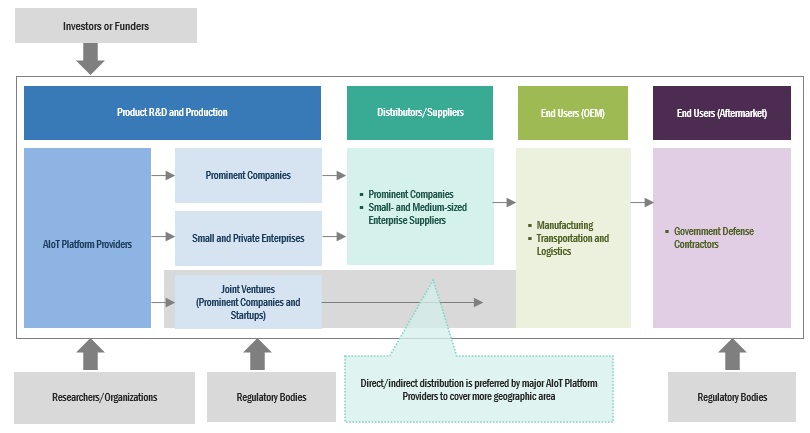

AIoT Platforms Market Ecosystem

Prominent companies in this market include well-established, financially stable provider of AIoT platforms solutions and services. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks.

By professional services, Deployment and integration to hold the largest market size during the forecast period

Deployment and integration services are one of the major services as the data generated by AI-enhanced IoT devices needs to be merged with the current systems, necessitating the usage of the appropriate level of connectors and back-end integration abilities. Deployment and integration services begin with collecting customer requirements, and then deploying, integrating, testing, and rolling out the solutions. Many organizations have already deployed various AI-based solutions to manage their workflows and provide ease to their customers and employees. Deployment and integration service providers help these organizations develop a connected environment by integrating IoT devices and AI-based solutions with their existing IT infrastructure. Companies such as OSIsoft and PTC offer deployment and integrations services to organizations in the AIoT market.

By offering, the services segment is expected to register the fastest growth rate during the forecast period.

Factors such as increasing adoption of connected devices across organizations and evolution of high speed networking technologies have encouraged organizations in every industry sector to adopt AIoT solutions. However, the integration of new services and AI-based solutions into a company’s contemporary functioning system or infrastructure forces it to be acquainted with comprehensive detailed insights about services. Additionally, organizations need to have in-depth knowledge about the benefits that the new services would offer to their customers and employees. This knowledge is provided through a specific set of channelized services, offered by AIoT service providers.

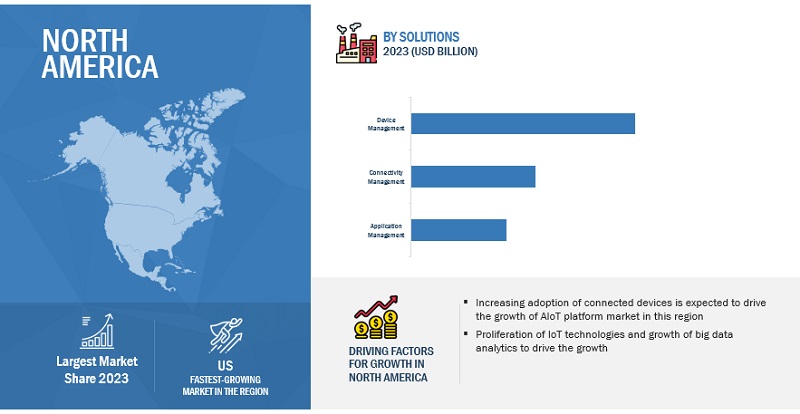

North America is expected to hold the largest market size during the forecast period.

North America being one of the most technologically advanced regions, has frequently set the pace for IoT growth globally. Regarding IoT, the region excels at innovation and developing fresh approaches to common issues. Due to the increasing adoption of AIoT by the manufacturing and automotive industries and the presence of significant solution providers in this region, North America is anticipated to dominate the growth of the global artificial intelligence of things (AIoT) market.

Market Players:

The major players in the AIoT platforms market are IBM (US), Sharp Global (Japan), Google (US), AWS (US), Microsoft (US), Oracle (US), HPE (US), Cisco (US), Intel (US), Tencent Cloud (China), NXP (Netherlands), SAS (US), Hitachi (Japan), SAP (Germany), AxiomTek (Taiwan), Autoplant Systems India Pvt. Ltd. (India), Williot (Israel), Cognosos (US), Relayr (US), Terminus Group (China), Semifive (South Korea), Uptake (Chicago), Falkonry (US), and Sightmachine (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the AIoT platforms market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments covered |

Offering (Solutions and Services), Verical and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

IBM (US), Sharp Global (Japan), Google (US), AWS (US), Microsoft (US), Oracle (US), HPE (US), Cisco (US), Intel (US), Tencent Cloud (China), NXP (Netherlands), SAS (US), Hitachi (Japan), SAP (Germany), AxiomTek (Taiwan), Autoplant Systems India Pvt. Ltd. (India), Williot (Israel), Cognosos (US), Relayr (US), Terminus Group (China), Semifive (South Korea), Uptake (Chicago), Falkonry (US), and Sightmachine (US). |

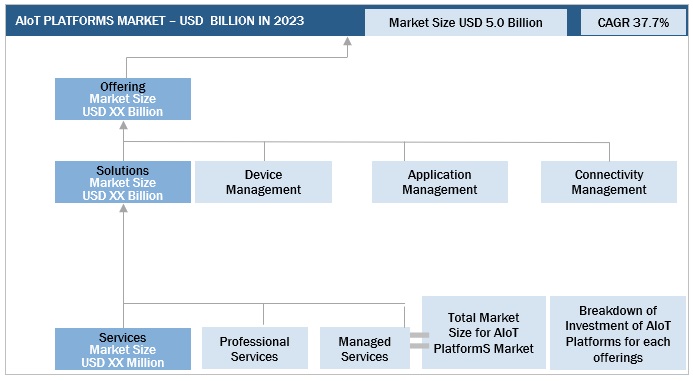

This research report categorizes the AIoT platforms market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

-

Solutions

- Device Management

- Application Managemnet

- Connectivity Management

-

Services

-

Professional Services

- Deployment and Integration

- Support and Maintenance

- Training and Consulting

- Managed Services

-

Professional Services

Based on Vertical:

- BFSI

- Manufacturing

- Healthcare

- Energy & Utilties

- Retail

- Transportation & Logistics

- Other Verticals

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

-

Middle East

- KSA

- UAE

- Rest of Middle East

-

Africa

- South Africa

- Egypt

- Nigeria

- Rest of Africa

-

Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In March 2022, Cisco Meraki expanded its IoT portfolio by launching a smart automation button, MT30; a new indoor air quality sensor, MT14; and new MV analytics capabilities. Cisco Meraki addresses smart workspace requirements and the future needs of enterprises to protect places, people, and things.

- In June 2022, Intel collaborated with Vingroup to develop smart city solutions. Intel would explore opportunities for 5G-enabled smart city and smart building solutions, which could be applied to Vinhomes’ smart city projects, and deploy smart factory IoT solutions for VinES batteries manufacturing and VinFast EV manufacturing.

- In July 2021, IBM and Siemens announced a collaboration to integrate Siemens’ MindSphere IoT platform with IBM's Watson AI and Edge computing technologies. The collaboration is aimed at helping businesses improve their industrial operations and make better use of IoT data.

Frequently Asked Questions (FAQ):

What is the definition of AIoT platforms market?

An AIoT platform is a fusion of Artificial Intelligence (AI) technologies and the Internet of Things (IoT) infrastructure. Its purpose is to optimize IoT operations, enhance interactions between humans and machines, and elevate data management and analytics for improved efficiency.

AI is crucial for extracting meaningful insights from the massive amount of data collected by IoT devices. An AIoT platform plays a pivotal role in reducing the data that needs to be transmitted to the cloud and enabling real-time decision-making. By integrating AI and IoT, an AIoT platform enhances the effectiveness and efficiency of both systems, allowing them to work synergistically.

What is the market size of the AIoT platforms market?

The AIoT platforms market is estimated at USD 5.0 billion in 2023 and is projected to reach USD 24.9 billion by 2028, at a CAGR of 37.7% from 2023 to 2028.

What are the major drivers in the AIoT platforms market?

The major drivers in AIoT platforms market are edge-computing-powered artificial intelligence of things, integration of ai-based solutions in iot projects, reduced maintenance cost and downtime

Who are the key players operating in the AIoT platforms market?

The key market players profiled in the AIoT platforms market are A IBM (US), Sharp Global (Japan), Google (US), AWS (US), Microsoft (US), Oracle (US), HPE (US), Cisco (US), Intel (US), Tencent Cloud (China), NXP (Netherlands), SAS (US), Hitachi (Japan), SAP (Germany), AxiomTek (Taiwan), Autoplant Systems India Pvt. Ltd. (India), Williot (Israel), Cognosos (US), Relayr (US), Terminus Group (China), Semifive (South Korea), Uptake (Chicago), Falkonry (US), and Sightmachine (US).

Which are the key technology trends prevailing in AIoT platforms market?

The AIoT platform is heavily reliant on AI. Without AI, the Internet of Things would just be a collection of internet-connected devices that were collecting data. But, artificial intelligence is able to interpret all of this data and transform it into insightful knowledge.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

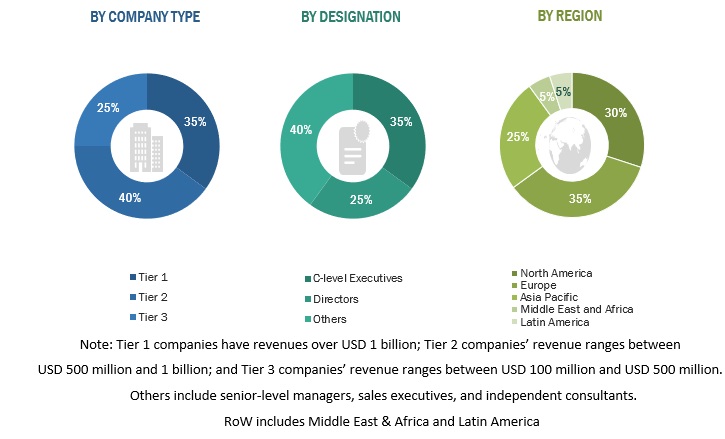

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for this technical, market-oriented, and commercial study of the global AIoT platforms market. The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, Service Providers (SPs), technology developers, alliances, and organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as assess prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. These included annual reports, press releases, and investor presentations of companies, and white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations were also referred. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the AIoT platforms market. The primary sources from the demand side included network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the AIoT platforms market. The first approach involves estimating the market size by summating companies’ revenue generated through AIoT platforms solutions and services. In this approach for market estimation, we identified the key companies offering AIoT platforms solutions and services by offerings: solutions and services.

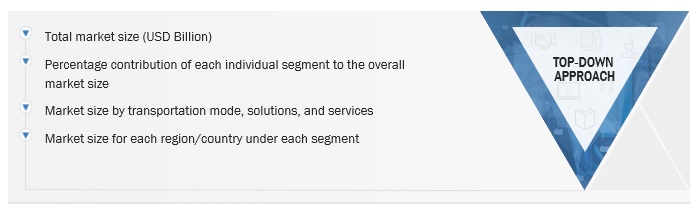

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AIoT platforms market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

AIoT platforms Market Size: Botton Up Approach

AIoT platforms Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size, the overall AIoT platforms market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

An AIoT platform is a fusion of Artificial Intelligence (AI) technologies and the Internet of Things (IoT) infrastructure. Its purpose is to optimize IoT operations, enhance interactions between humans and machines, and elevate data management and analytics for improved efficiency.

AI is crucial for extracting meaningful insights from the massive amount of data collected by IoT devices. An AIoT platform plays a pivotal role in reducing the data that needs to be transmitted to the cloud and enabling real-time decision-making. By integrating AI and IoT, an AIoT platform enhances the effectiveness and efficiency of both systems, allowing them to work synergistically.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- R&D Department

- IT Department

Report Objectives

- To determine and forecast the global AIoT platforms market by offering (solutions and services), vertical, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the AIoT platforms market.

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market.

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in AIoT Platforms Market